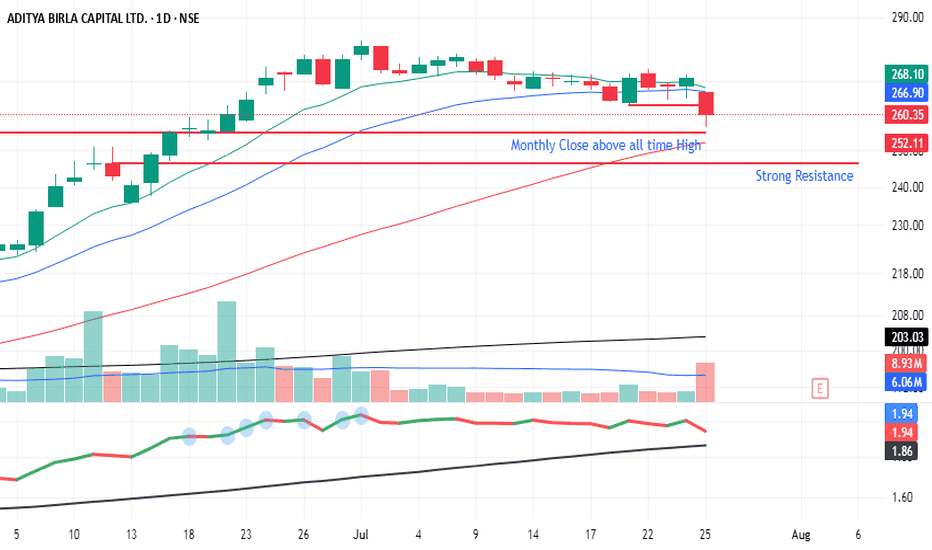

AB Capital - Closed above all time high and consolidationAB Capital

After closing above-time high of Rs. 255 in June 2025, the stock has entered a consolidation phase over the past month.

Key observations:

Support Zone: The 246-255 range is expected to provide strong support.

Trading Plan: Look for buying opportunities near the support zone (246-250) wit

0.16 USD

394.14 M USD

4.86 B USD

About ADITYA BIRLA CAPITAL LTD.

Sector

Industry

CEO

Vishakha Vivek Mulye

Website

Headquarters

Mumbai

Founded

2007

FIGI

BBG00HY9LB89

Aditya Birla Capital Ltd. engages in the provision of financial services. It operates through the following segments: NBFC, Housing Finance, Life Insurance, Asset Management, General Insurance Broking, Stock and Securities Broking, Health Insurance, and Other Financial Services. The company was founded on October 15, 2007 and is headquartered in Mumbai, India.

Related stocks

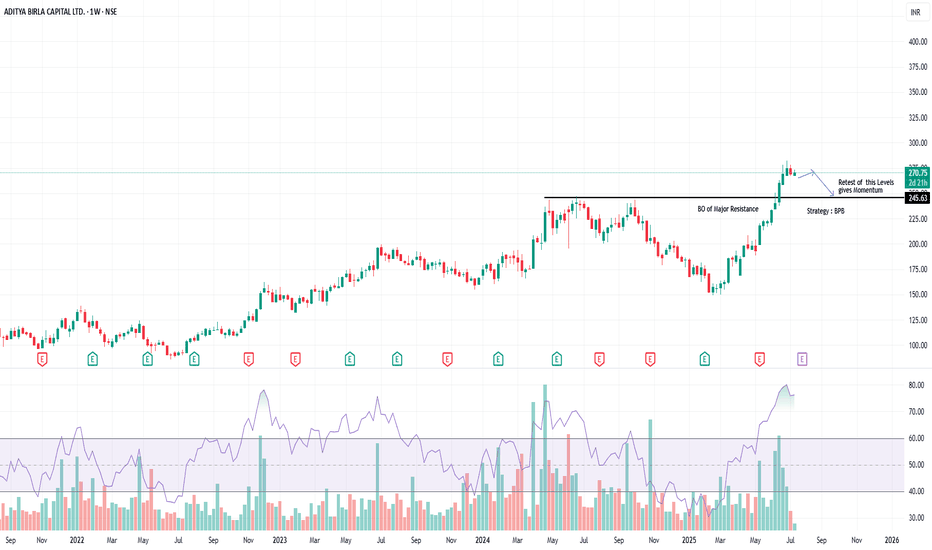

AB Capital – Clean Breakout of Multi-Year Resistance | BPB SetupTimeframe: Weekly | Strategy: Breakout–Pullback (BPB)

Technical Highlights:

========================

✅ BO (Breakout) of a major resistance zone around ₹250–₹255, which was acting as a multi-year supply zone.

📈 Strong bullish momentum seen with expanding volumes and wide-range candles.

🔄 BPB Strateg

ADITYA BIRLA CAPITAL LTD – Trend Reversal Breakout Trade🧠 Technical Highlights:

Downtrend Channel Breakout: Clear breakout from a falling channel pattern

Resistance Break: Strong breakout above supply zone of ₹204–₹210

Volume: Massive volume spike validates bullish strength

RSI: Above 70, indicating strong momentum but not overbought yet

🟢 Buy Setup

Analysis and Summary of the ADITYA BIRLA CAPITAL LTD. (NSE: ABCA🔍 Technical Overview:

Current Price: ₹200.25

Recent Price Action: Price is attempting a bounce after forming a higher low near ₹187.83.

📈 Key Technical Levels:

Fibonacci Levels:

0.0 (Support): ₹187.83

0.5 (Mid-Resistance): ₹204.67

0.618 (Golden Ratio): ₹208.64

1.0 (Previous High): ₹221.51

1.61

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.