Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.26 EUR

3.02 B EUR

19.76 B EUR

549.77 M

About Fiserv, Inc.

Sector

CEO

Michael P. Lyons

Website

Headquarters

Milwaukee

Founded

1984

FIGI

BBG01K3X0K21

Fiserv, Inc. engages in the provision of financial services technology. It operates through the Merchant and Financial segments. The Merchant segment offers commerce-enabling products and services including merchant acquiring and digital commerce and mobile payment services, and security and fraud protection, stored-value, and pay-by-bank solutions to companies of all sizes. The Financial segment provides products and services such as processing of customer loan and deposit accounts, digital payments, and card transactions to financial institutions and corporate and public sector clients. The company was founded by Leslie M. Muma and George D. Dalton on July 31, 1984 and is headquartered in Milwaukee, WI.

FI uptrend start possible from this week.The fundamentals of Fiserv is really good. It is growing the figures quite nicely.

In terms of TA, I have observed huge red candlestick being present, but the volume is on increasing basis, that means some group of traders/investor have been buying up taking the advantage of many red candlesticks.

FiservInsiders have sold $239 Million shares on MAY 29TH. We expect price to rally from these lows to visit the 50% Fib levels. This is a contrarian play as 4,024 Puts are in play which means more Bears are betting on a drop. This means a lot of Stop Loss orders are prime above the $170 level. This will b

$FI bounce coming off 30% ATH drawdown $170 targetHello, NYSE:FI Fiserv evidently got hammered to the downside the last month and last few months the name is down 30% from it's all time high from March 2025 and last month and change it is down 25% or so after downgrades. I have been watching the name the last week or so and I was looking for a dr

DCA into $FI- NYSE:FI is big recognizable brand in Point of Sales. You might have seen clover handheld machines.

- I believe fundamentals on this blue chip company is getting cheap. I'm not going all in but have started DCA into this name.

- If it falls further 20-30 or even 40% I will be happy to DCA furt

5/15/25 - $fi - Stock a buy here5/15/25 :: VROCKSTAR :: NYSE:FI

Stock a buy here

- industry POS leader

- CEO chat at JPM conf not helpful for px action, but ahead of opex tmr, this chad should be a bit more heads up. then again, most mgmt have no idea how stonk mkt works.

- at sub 20x PE this thing is objectively a buy, nearly

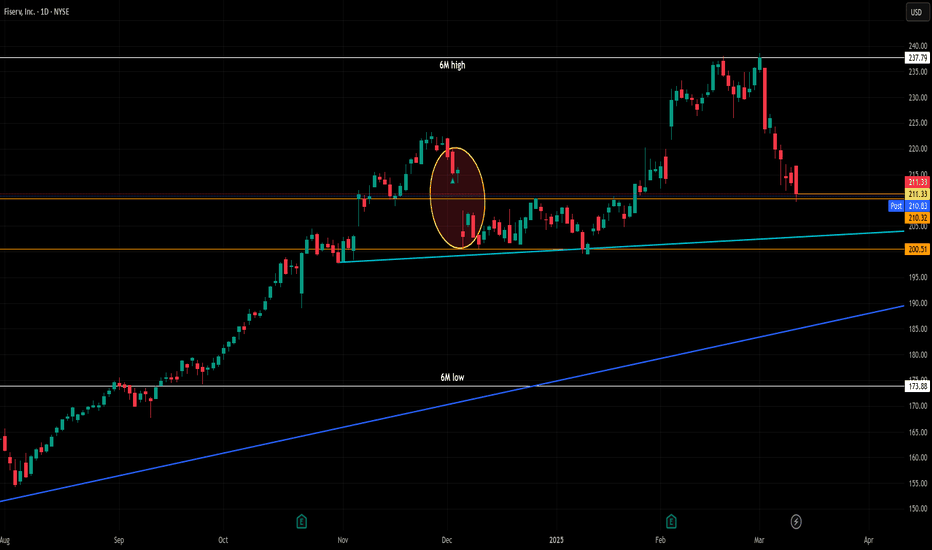

Fiserv (take 2) at 211.19As some of you may remember from back in early December, this is not my first idea for $FI. At the time, I hyped it up as a top performer for me, only to make a measly 0.27% on the trade in one day (which is still about 6x the avg daily return of the market). I was disappointed in the return, but

FI | FiservScreener Buy Idea

Fiserv, Inc. engages in the provision of financial services technology. It operates through the following segments: Merchant Acceptance, Financial Technology, and Payments and Network. The Merchant Acceptance segment provides commerce enabling solutions and serves merchants of all

Long Fiserv @ 215.38 - You do NOT want to miss this one!C'mon, look at that chart. It's the chart equivalent of a cute puppy.

How could you not love it? It has a little something for everyone. The chartists will love how the close today sits right at the confluence of both recent support and the trend line. It's not volatile, it's beautiful.

And fo

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

FISV4845279

Fiserv, Inc. 4.4% 01-JUL-2049Yield to maturity

6.53%

Maturity date

Jul 1, 2049

FIVF

FISERV 19/25Yield to maturity

6.24%

Maturity date

Jul 1, 2025

FISV5864177

Fiserv, Inc. 5.15% 12-AUG-2034Yield to maturity

5.37%

Maturity date

Aug 12, 2034

FISV5761679

Fiserv, Inc. 5.45% 15-MAR-2034Yield to maturity

5.32%

Maturity date

Mar 15, 2034

FIVG

FISERV 19/31Yield to maturity

5.27%

Maturity date

Jul 1, 2031

FISV5634796

Fiserv, Inc. 5.625% 21-AUG-2033Yield to maturity

5.19%

Maturity date

Aug 21, 2033

FISV5548631

Fiserv, Inc. 5.6% 02-MAR-2033Yield to maturity

5.16%

Maturity date

Mar 2, 2033

FISV4986756

Fiserv, Inc. 2.65% 01-JUN-2030Yield to maturity

5.04%

Maturity date

Jun 1, 2030

FISV4845278

Fiserv, Inc. 3.5% 01-JUL-2029Yield to maturity

4.87%

Maturity date

Jul 1, 2029

FISV5761678

Fiserv, Inc. 5.35% 15-MAR-2031Yield to maturity

4.84%

Maturity date

Mar 15, 2031

FISV4702958

Fiserv, Inc. 4.2% 01-OCT-2028Yield to maturity

4.60%

Maturity date

Oct 1, 2028

See all 1FISV bonds

Curated watchlists where 1FISV is featured.

Related stocks

Frequently Asked Questions

The current price of 1FISV is 142.86 EUR — it has decreased by −1.07% in the past 24 hours. Watch FISERV stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange FISERV stocks are traded under the ticker 1FISV.

1FISV stock has fallen by −1.87% compared to the previous week, the month change is a −15.73% fall, over the last year FISERV has showed a 3.79% increase.

We've gathered analysts' opinions on FISERV future price: according to them, 1FISV price has a max estimate of 235.22 EUR and a min estimate of 127.27 EUR. Watch 1FISV chart and read a more detailed FISERV stock forecast: see what analysts think of FISERV and suggest that you do with its stocks.

1FISV reached its all-time high on Feb 27, 2025 with the price of 254.66 EUR, and its all-time low was 101.00 EUR and was reached on Mar 22, 2024. View more price dynamics on 1FISV chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1FISV stock is 4.31% volatile and has beta coefficient of 0.35. Track FISERV stock price on the chart and check out the list of the most volatile stocks — is FISERV there?

Today FISERV has the market capitalization of 78.01 B, it has increased by 0.12% over the last week.

Yes, you can track FISERV financials in yearly and quarterly reports right on TradingView.

FISERV is going to release the next earnings report on Jul 29, 2025. Keep track of upcoming events with our Earnings Calendar.

1FISV earnings for the last quarter are 1.98 EUR per share, whereas the estimation was 1.92 EUR resulting in a 3.12% surprise. The estimated earnings for the next quarter are 2.10 EUR per share. See more details about FISERV earnings.

FISERV revenue for the last quarter amounts to 4.43 B EUR, despite the estimated figure of 4.47 B EUR. In the next quarter, revenue is expected to reach 4.49 B EUR.

1FISV net income for the last quarter is 786.62 M EUR, while the quarter before that showed 906.09 M EUR of net income which accounts for −13.19% change. Track more FISERV financial stats to get the full picture.

No, 1FISV doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jun 15, 2025, the company has 38 K employees. See our rating of the largest employees — is FISERV on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. FISERV EBITDA is 8.46 B EUR, and current EBITDA margin is 43.86%. See more stats in FISERV financial statements.

Like other stocks, 1FISV shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade FISERV stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So FISERV technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating FISERV stock shows the sell signal. See more of FISERV technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.