Key facts today

Alphabet (GOOG) exceeded second-quarter earnings expectations, but worries remain about its search market share due to the rise of large language models impacting traditional ad revenue.

The U.S. General Services Administration has named Google an official AI vendor, allowing federal agencies to use AI tools like Gemini under pre-negotiated terms to improve procurement efficiency.

Zoomcar Holdings Inc. has partnered with Google Cloud to incorporate generative AI into its services, aiming to improve the experience for users.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

8.04 EUR

96.71 B EUR

337.91 B EUR

5.80 B

About Alphabet Inc (Google) Class C

Sector

Industry

CEO

Sundar Pichai

Website

Headquarters

Mountain View

Founded

2015

FIGI

BBG00J7BJ2M7

Alphabet, Inc. is a holding company, which engages in software, health care, transportation, and other technologies. It operates through the following segments: Google Services, Google Cloud, and Other Bets. The Google Services segment includes products and services, such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. The Google Cloud segment refers to infrastructure and platform services, collaboration tools, and other services for enterprise customers. The Other Bets segment relates to the sale of healthcare-related services and internet services. The company was founded by Lawrence E. Page and Sergey Mikhaylovich Brin on October 2, 2015 and is headquartered in Mountain View, CA.

Related stocks

GOOG | Long | Breakout After Ranging Base | (Aug 2025)GOOG | Long | Breakout After Ranging Base | (Aug 2025)

1️⃣ Short Insight Summary:

GOOG has been ranging for nearly a year between ~$125–$185, forming a strong accumulation base. If it successfully retests the $181–182 zone, I’m looking for a breakout entry with a long-term upside.

2️⃣ Trade Parame

GOOGL Poised for a Breakout! Aug. 5GOOGL Poised for a Breakout! Key Gamma Levels Driving the Next Move 🚀

Technical Analysis & GEX Insights

GOOGL has been grinding higher after finding support around the 185–186 zone and holding the bullish recovery trend. Price is now consolidating just under 195, setting the stage for a potential b

Big Money is Buying GOOGL Calls — Are You In?

## 🚨 GOOGL WEEKLY TRADE IDEA (Aug 4–8)

**Institutional CALL Buying Surges — \$197.50 CALL Setup Triggered**

---

### 📊 Model Consensus Breakdown:

* **🔁 Call/Put Ratio**: **3.33** — strong bullish options bias

* **📉 RSI**: Weak Daily & Weekly = ⚠️ caution zone

* **💰 Volume**: Institutional call f

GOOGL Forecast – Dual AI Model Confirmation📊 GOOGL Forecast – Dual AI Model Confirmation

🔹 Posted by WaverVanir | VolanX Protocol

NASDAQ:GOOGL is showing strong bullish structure backed by both Smart Money Concepts (SMC) and AI model consensus.

🧠 VolanX AI Protocol Forecast (30-Day)

🎯 Target: $223.08 (+13.3%)

📈 Accuracy: 98.2%

📉 Drawdown

$GOOG Eyes Breakout Above $198Currently at $197.12, NASDAQ:GOOG is trading above both its 50-period SMA (~$196.00) and 200-period SMA (~$192.50) on the 30-minute chart. The trend remains bullish with support holding firm at $192.50, and bulls are watching closely as the price flirts with resistance near $198.75. This steady gr

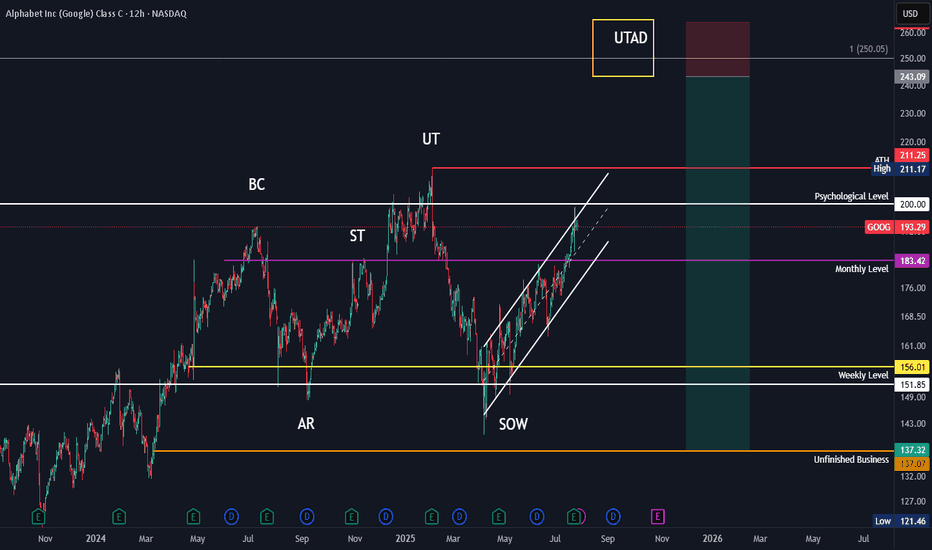

Alphabet (GOOGL) Stock Chart Analysis Following Earnings ReleaseAlphabet (GOOGL) Stock Chart Analysis Following Earnings Release

Earlier this week, we highlighted the prevailing bullish sentiment in the market ahead of Alphabet’s (GOOGL) earnings report, noting that:

→ an ascending channel had formed;

→ the psychological resistance level at $200 was of particu

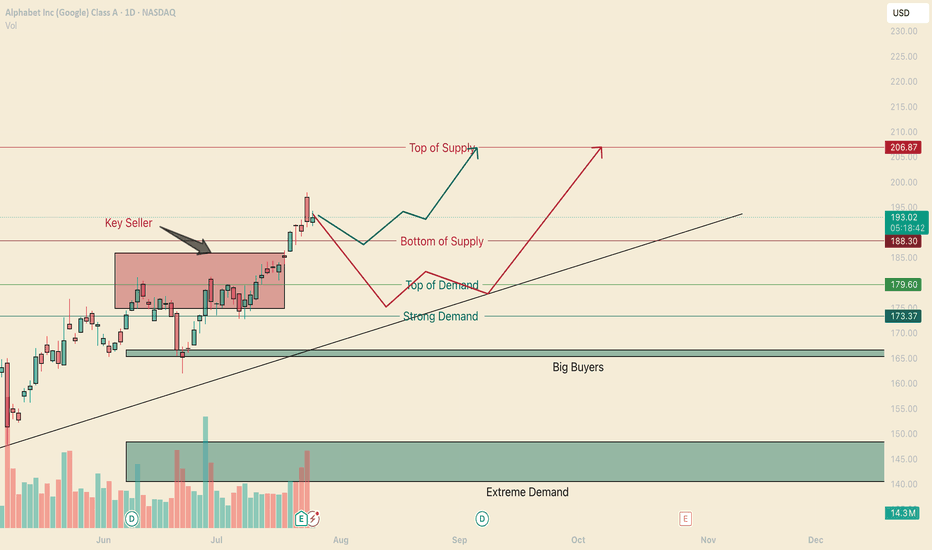

Google Buyers Entered Seller Territory.Hello, I am the Cafe Trader.

To finish off our series of the MAG 7 we have GOOGL up next.

If you have been keeping up, I will offer insight into Long term and short term interest. Google has taken out a key sellers on July 21st, and also closed inside the supply zone. This is very bullish, bulls

Waiting for a buy trigger.Google stock is at a good spot where it could make a strong upward move. At this price level, we see multiple confluences both in terms of trend and from the perspective of indicators and oscillators. So, if it manages to break through this level, the price could move nicely.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

GOOG5025299

Alphabet Inc. 0.45% 15-AUG-2025Yield to maturity

11.02%

Maturity date

Aug 15, 2025

US2079KAF4

ALPHABET 20/50Yield to maturity

6.88%

Maturity date

Aug 15, 2050

US2079KAG2

ALPHABET 20/60Yield to maturity

6.72%

Maturity date

Aug 15, 2060

US2079KAE7

ALPHABET 20/40Yield to maturity

6.07%

Maturity date

Aug 15, 2040

GOOG6065579

Alphabet Inc. 5.3% 15-MAY-2065Yield to maturity

5.42%

Maturity date

May 15, 2065

GOOG6065578

Alphabet Inc. 5.25% 15-MAY-2055Yield to maturity

5.34%

Maturity date

May 15, 2055

GOOG6065581

Alphabet Inc. 4.5% 15-MAY-2035Yield to maturity

4.64%

Maturity date

May 15, 2035

US2079KAD9

ALPHABET 20/30Yield to maturity

4.28%

Maturity date

Aug 15, 2030

US2079KAC1

ALPHABET 16/26Yield to maturity

4.19%

Maturity date

Aug 15, 2026

XS306443038

ALPHABET 25/54Yield to maturity

4.10%

Maturity date

May 6, 2054

US2079KAJ6

ALPHABET 20/27Yield to maturity

3.95%

Maturity date

Aug 15, 2027

See all 1GOOGL bonds

Curated watchlists where 1GOOGL is featured.

Frequently Asked Questions

The current price of 1GOOGL is 167.60 EUR — it has increased by 1.07% in the past 24 hours. Watch ALPHABET CLASSE A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange ALPHABET CLASSE A stocks are traded under the ticker 1GOOGL.

1GOOGL stock has risen by 1.36% compared to the previous week, the month change is a 10.70% rise, over the last year ALPHABET CLASSE A has showed a 13.40% increase.

We've gathered analysts' opinions on ALPHABET CLASSE A future price: according to them, 1GOOGL price has a max estimate of 216.12 EUR and a min estimate of 155.61 EUR. Watch 1GOOGL chart and read a more detailed ALPHABET CLASSE A stock forecast: see what analysts think of ALPHABET CLASSE A and suggest that you do with its stocks.

1GOOGL reached its all-time high on Feb 4, 2025 with the price of 199.14 EUR, and its all-time low was 40.26 EUR and was reached on Mar 28, 2018. View more price dynamics on 1GOOGL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1GOOGL stock is 1.37% volatile and has beta coefficient of 0.95. Track ALPHABET CLASSE A stock price on the chart and check out the list of the most volatile stocks — is ALPHABET CLASSE A there?

Today ALPHABET CLASSE A has the market capitalization of 2.04 T, it has increased by 3.60% over the last week.

Yes, you can track ALPHABET CLASSE A financials in yearly and quarterly reports right on TradingView.

ALPHABET CLASSE A is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

1GOOGL earnings for the last quarter are 1.96 EUR per share, whereas the estimation was 1.85 EUR resulting in a 5.83% surprise. The estimated earnings for the next quarter are 2.01 EUR per share. See more details about ALPHABET CLASSE A earnings.

ALPHABET CLASSE A revenue for the last quarter amounts to 81.86 B EUR, despite the estimated figure of 79.83 B EUR. In the next quarter, revenue is expected to reach 85.98 B EUR.

1GOOGL net income for the last quarter is 23.94 B EUR, while the quarter before that showed 31.93 B EUR of net income which accounts for −25.03% change. Track more ALPHABET CLASSE A financial stats to get the full picture.

Yes, 1GOOGL dividends are paid quarterly. The last dividend per share was 0.18 EUR. As of today, Dividend Yield (TTM)% is 0.42%. Tracking ALPHABET CLASSE A dividends might help you take more informed decisions.

ALPHABET CLASSE A dividend yield was 0.32% in 2024, and payout ratio reached 7.46%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 6, 2025, the company has 183.32 K employees. See our rating of the largest employees — is ALPHABET CLASSE A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ALPHABET CLASSE A EBITDA is 117.88 B EUR, and current EBITDA margin is 36.45%. See more stats in ALPHABET CLASSE A financial statements.

Like other stocks, 1GOOGL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ALPHABET CLASSE A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ALPHABET CLASSE A technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ALPHABET CLASSE A stock shows the buy signal. See more of ALPHABET CLASSE A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.