DraftKings & Evolution: Riding the Wave of Gambling GrowthNASDAQ:DKNG OMXSTO:EVO

The North American online gambling sector is experiencing a surge, with companies like DraftKings and Evolution emerging as standout performers. In the past month, Evolution’s stock rose an impressive 15%, while DraftKings continues to show strong potential in the sports b

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.82 USD

−507.29 M USD

4.77 B USD

477.81 M

About DraftKings Inc.

Sector

Industry

CEO

Jason D. Robins

Website

Headquarters

Boston

Founded

2011

FIGI

BBG0134WCM78

DraftKings, Inc. is a digital sports entertainment and gaming company, which engages in the provision of online sports betting, online casino, daily fantasy sports product offerings, DraftKings Marketplace, retail sportsbook, media, and other consumer product offerings. The company was founded by Jason D. Robins, Matthew Kalish, and Paul Liberman on December 31, 2011 and is headquartered in Boston, MA.

Related stocks

SniperYos INTC 5/19 Weekly OutlookNASDAQ:INTC - Falling Wedge Breakout Setup Intel (INTC) has broken out of a falling wedge pattern, reclaiming key Fibonacci levels with rising volume and bullish EMA alignment. A strong bounce from support signals a potential move higher.

Key Levels Resistance: $21.50 → $23.00 → $24.15 → $25.25 →

DKNG DraftKings Options Ahead of EarningsIf you haven`t bought DKNG before the rally:

Now analyzing the options chain and the chart patterns of DKNG DraftKings prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2025-7-18,

for a premium of approximately $1.43.

If the

Draftkings Stock Chart Fibonacci Analysis 050725Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 33/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E

Strong Upside PotentialOn the 4-hour chart, price action remains bullish: buyers continue to step in at progressively higher levels, and the 10, 20 and 50-period EMAs are all aligned upwards, confirming positive momentum within an established uptrend. A discounted cash-flow valuation also suggests the shares are currently

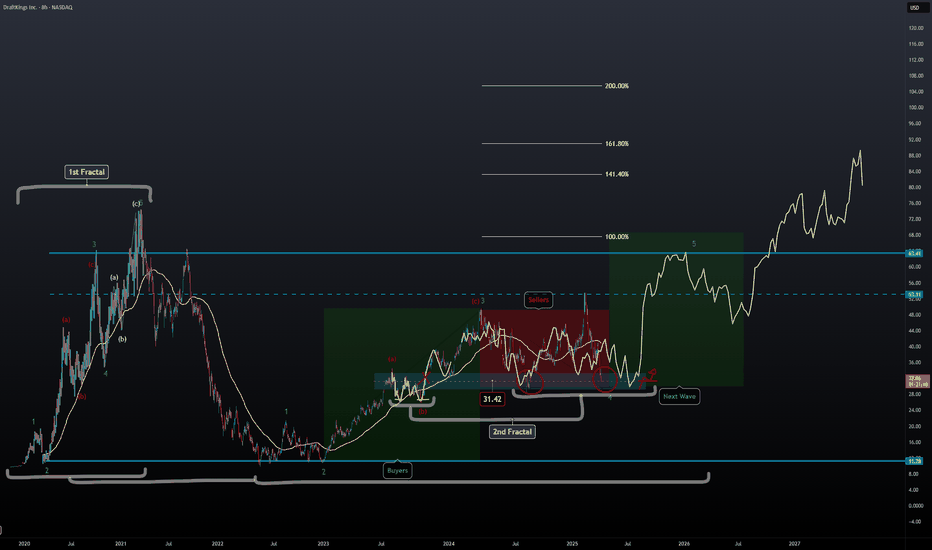

DKNG Update | Second Fractal | Extended TargetsPrice action looks very similar to the '23 Q3 play where we saw a double bottom move taking off from $26 - $49 which is also the ABC move that carried the 3rd impulse wave of the original fractal.

We're still in correction wave 4 and are about to start wave 5 shortly from now to July.

It's possibl

DKNG 1W – Technical and Fundamental AnalysisDKNG shares have broken a rising wedge on the weekly chart, reinforcing a bearish signal. The price is testing the $35.29 level after failing to hold above $36.88. A breakdown below $31.74 could accelerate a decline toward $28.67 and $14.89. RSI indicates weakening bullish momentum, MACD shows a bea

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where DKNG is featured.

Frequently Asked Questions

The current price of DKNG is 42.34 USD — it has decreased by −0.47% in the past 24 hours. Watch DraftKings Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange DraftKings Inc. stocks are traded under the ticker DKNG.

DKNG stock has fallen by −5.96% compared to the previous week, the month change is a 18.31% rise, over the last year DraftKings Inc. has showed a 13.88% increase.

We've gathered analysts' opinions on DraftKings Inc. future price: according to them, DKNG price has a max estimate of 74.00 USD and a min estimate of 36.00 USD. Watch DKNG chart and read a more detailed DraftKings Inc. stock forecast: see what analysts think of DraftKings Inc. and suggest that you do with its stocks.

DKNG reached its all-time high on Mar 22, 2021 with the price of 74.38 USD, and its all-time low was 9.76 USD and was reached on Aug 7, 2019. View more price dynamics on DKNG chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

DKNG stock is 5.15% volatile and has beta coefficient of 1.46. Track DraftKings Inc. stock price on the chart and check out the list of the most volatile stocks — is DraftKings Inc. there?

Today DraftKings Inc. has the market capitalization of 20.14 B, it has increased by 7.00% over the last week.

Yes, you can track DraftKings Inc. financials in yearly and quarterly reports right on TradingView.

DraftKings Inc. is going to release the next earnings report on Aug 1, 2025. Keep track of upcoming events with our Earnings Calendar.

DKNG earnings for the last quarter are −0.07 USD per share, whereas the estimation was −0.08 USD resulting in a 9.70% surprise. The estimated earnings for the next quarter are 0.12 USD per share. See more details about DraftKings Inc. earnings.

DraftKings Inc. revenue for the last quarter amounts to 1.41 B USD, despite the estimated figure of 1.43 B USD. In the next quarter, revenue is expected to reach 1.39 B USD.

DKNG net income for the last quarter is −33.86 M USD, while the quarter before that showed −134.85 M USD of net income which accounts for 74.89% change. Track more DraftKings Inc. financial stats to get the full picture.

No, DKNG doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 9, 2025, the company has 5.1 K employees. See our rating of the largest employees — is DraftKings Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. DraftKings Inc. EBITDA is −185.97 M USD, and current EBITDA margin is −4.83%. See more stats in DraftKings Inc. financial statements.

Like other stocks, DKNG shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade DraftKings Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So DraftKings Inc. technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating DraftKings Inc. stock shows the buy signal. See more of DraftKings Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.