LCIDUSDT Ending Diagonal Near Strong DemandLucid Group continues its broader bearish move but now approaches a critical juncture with a well defined ending diagonal formation, often signaling trend exhaustion. Price action is nearing a historically strong demand zone, increasing the probability of a sharp reaction.

The trading plan is clear

Key facts today

Lucid Group expects a notable rise in Q2 revenue from increased luxury electric vehicle deliveries, with traders focused on tariff updates and supply chain localization strategies.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−1.22 USD

−2.71 B USD

807.83 M USD

1.24 B

About Lucid Group, Inc.

Sector

Industry

CEO

Marc Winterhoff

Website

Headquarters

Newark

Founded

2007

FIGI

BBG00W7F99V5

Lucid Group, Inc. manufactures electric vehicles. It designs, develops, and builds energy storage systems for electric vehicles and supplies automakers with the battery pack system needed to power hybrid, plug-in, and electric vehicles. The company was founded in December 2007 and is headquartered in Newark, CA.

Related stocks

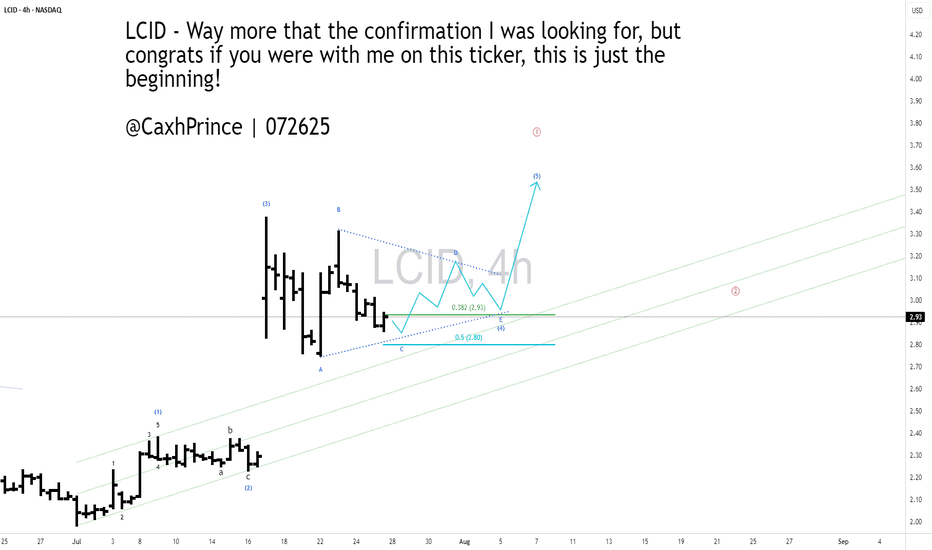

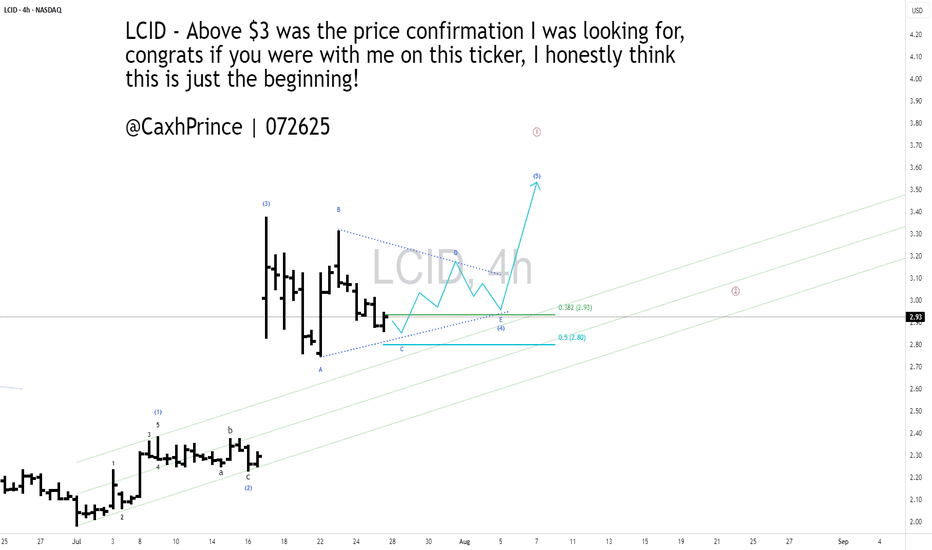

A 4HR Bullish view on #Lucid Motors ($LCID)Lucid blasted off last week with the collaboration of Uber and Robo-taxis. I think that blast infused more investors to the stock and I think it may never come back to take out its lows. If it does, I would load up more on it. I like their designs and the fact that they are now compatible with TESLA

#LCID - 4HR [ A potential bullish view]Lucid blasted off last week with the collaboration of Uber and Robo-taxis. I think that blast infused more investors to the stock and I think it may never come back to take out its lows. If it does, I would load up more on it. I like their designs and the fact that they are now compatible with TESLA

My thoughts on LCID-4HRLucid blasted off last week with the collaboration of Uber and Robo-taxis. I think that blast infused more investors to the stock and I think it may never come back to take out its lows. If it does, I would load up more on it. I like their designs and the fact that they are now compatible with TESLA

Time for Lucid Group Inc. (LCID) – Short-Term Bullish --3.50 USDLucid Group Inc. (LCID) on the 4-hour chart is showing a moderately bullish structure, suggesting potential for continued short-term upside. After a period of consolidation and base-building, the price has broken above key moving averages (MA5, MA10, and MA30), which are now turning upward and begin

LUCID going to benefit from recent policy changes Lucid is positioned to enjoy a short-term uplift from the policy change due to its EV-only model and lower volume compared to peers. However, its longer-term success depends on execution—scaling manufacturing, launching key new models, and moving toward profitability in a future without subsidies.

High probability bullish setup #lcidMultiple confluences are suggesting a potential bullish reversal:

A- Price is forming lower highs, while MACD is showing higher lows → bullish divergence

B- MACD crossover is forming, indicating strengthening momentum

C- Bollinger Bands are narrowing, suggesting a potential breakout

D- Support

Buy Idea for Lucid Group (LCID) • Current Price: $2.15

• Support level: $1.99

• Resistance level: $2.42 / $2.85

• Indicators:

• Bollinger Bands show a potential reversal from the lower band.

• MACD and momentum indicators are still weak but may show signs of convergence soon.

• Volume is picking up, which may support a shor

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US549498AA1

LUCID GROUP 21/26 CVYield to maturity

8.23%

Maturity date

Dec 15, 2026

US549498AC7

LUCID GROUP 25/30 CVYield to maturity

4.95%

Maturity date

Apr 1, 2030

See all LCID bonds

Curated watchlists where LCID is featured.

Frequently Asked Questions

The current price of LCID is 2.41 USD — it has decreased by −0.41% in the past 24 hours. Watch Lucid Group, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Lucid Group, Inc. stocks are traded under the ticker LCID.

LCID stock has fallen by −18.03% compared to the previous week, the month change is a 16.43% rise, over the last year Lucid Group, Inc. has showed a −22.76% decrease.

We've gathered analysts' opinions on Lucid Group, Inc. future price: according to them, LCID price has a max estimate of 7.00 USD and a min estimate of 1.00 USD. Watch LCID chart and read a more detailed Lucid Group, Inc. stock forecast: see what analysts think of Lucid Group, Inc. and suggest that you do with its stocks.

LCID reached its all-time high on Feb 18, 2021 with the price of 64.86 USD, and its all-time low was 1.93 USD and was reached on Nov 15, 2024. View more price dynamics on LCID chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

LCID stock is 3.97% volatile and has beta coefficient of 1.27. Track Lucid Group, Inc. stock price on the chart and check out the list of the most volatile stocks — is Lucid Group, Inc. there?

Today Lucid Group, Inc. has the market capitalization of 7.40 B, it has decreased by −1.72% over the last week.

Yes, you can track Lucid Group, Inc. financials in yearly and quarterly reports right on TradingView.

Lucid Group, Inc. is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

LCID earnings for the last quarter are −0.24 USD per share, whereas the estimation was −0.22 USD resulting in a −6.90% surprise. The estimated earnings for the next quarter are −0.21 USD per share. See more details about Lucid Group, Inc. earnings.

Lucid Group, Inc. revenue for the last quarter amounts to 235.05 M USD, despite the estimated figure of 247.55 M USD. In the next quarter, revenue is expected to reach 261.26 M USD.

LCID net income for the last quarter is −366.17 M USD, while the quarter before that showed −397.22 M USD of net income which accounts for 7.82% change. Track more Lucid Group, Inc. financial stats to get the full picture.

No, LCID doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 5, 2025, the company has 6.8 K employees. See our rating of the largest employees — is Lucid Group, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Lucid Group, Inc. EBITDA is −2.64 B USD, and current EBITDA margin is −334.87%. See more stats in Lucid Group, Inc. financial statements.

Like other stocks, LCID shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Lucid Group, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Lucid Group, Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Lucid Group, Inc. stock shows the sell signal. See more of Lucid Group, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.