Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−30.14 USD

−1.81 B USD

901.46 M USD

57.73 M

About SolarEdge Technologies, Inc.

Sector

Industry

CEO

Shuki Nir

Website

Headquarters

Herzliya

Founded

2006

FIGI

BBG0084BBZY6

SolarEdge Technologies, Inc. engages in the development of energy technology, which provides inverter solutions. The firm operates through the following segments: Solar and All Other. The Solar segment includes the design, development, manufacturing, and sales of an inverter solution designed to maximize power generation. The All Other segment includes the design, development, manufacturing and sales of UPS products, energy storage products, e-Mobility products, and automated machines. Its products and services include photovoltaic inverters, power optimizers, photovoltaic monitoring, software tools, and electric vehicle chargers. The company was founded by Guy Sella, Lior Handelsman, Yoav Galin, Meir Adest, and Amir Fishelov in 2006 and is headquartered in Herzliya, Israel.

Related stocks

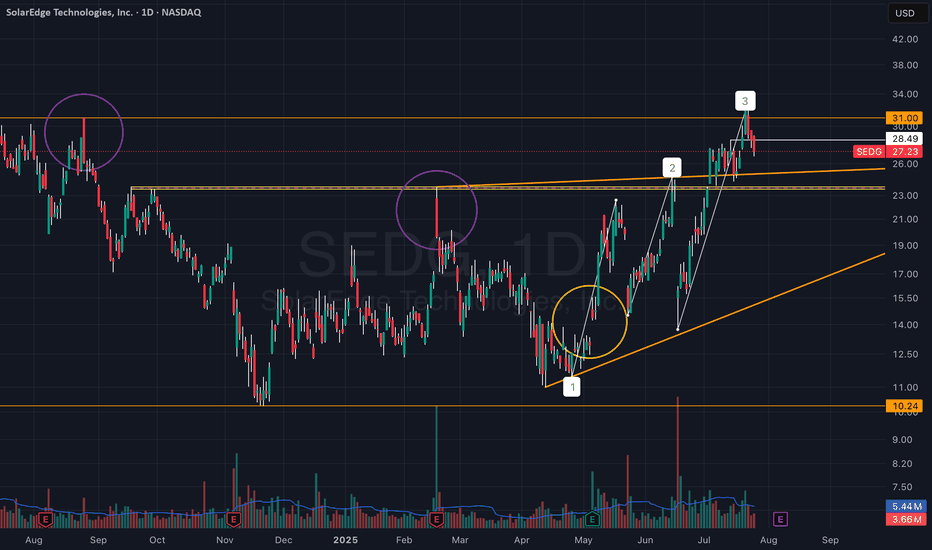

Are We Witnessing a Trend Reversal in SEDG?Something I’ve been watching closely these past few days — SEDG (SolarEdge):

There’s a setup unfolding that I think could benefit from a few more eyes on it:

• The two purple circles mark large vector candles that initiated sharp downward moves.

• The yellow circle highlights the quarterly earnin

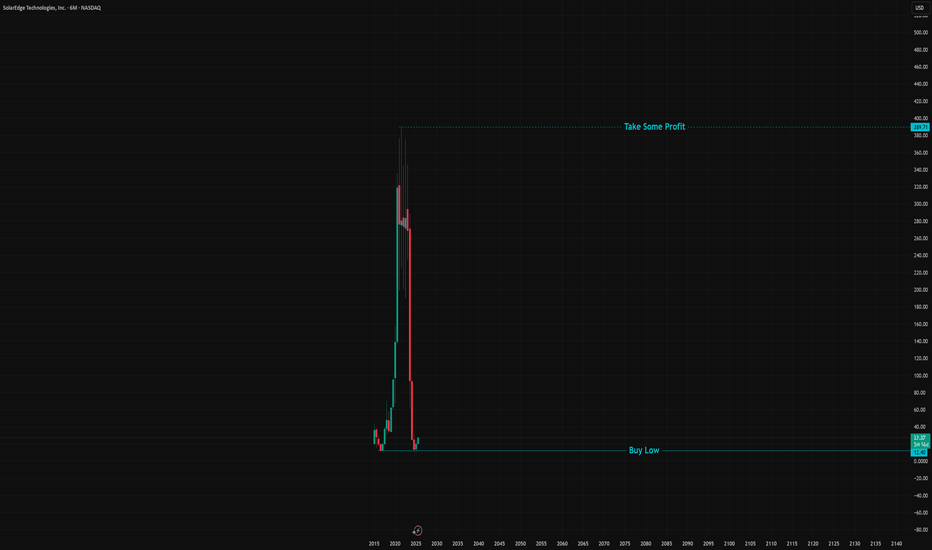

Solaredge!! Ready for a rebound?Solar stocks have taken quite a hit. There are several reasons for that, the biggest is high interest rates. Solar companies (installers) often sell solar by having the end-customer finance the up front cost of the system. When interest rates sky-rocketed post-covid, that made it a lot harder to sel

Are you ready for a short squeeze?39.47% short interest while 98.8% of shares held by institutions sounds like pure madness of the short sellers when the stock is down 97%.

RenTech (The Famous Quantitative Hedge Fund by Jim Simons) increased its position in the last F13 by 79%.

I opened my position at 10.76 and closed 47% at 23! I

$SEDG BEATS + and No Worries! Confessions from the DeskConfessions from the Desk: 10X, Black Coffee, and No Worries

SolarEdge is up 20%, and my Feb 21, 2025, $20 strike call has officially 10X’d. That’s right—after weeks of my portfolio looking like a crime scene, I’ve finally hit a clean, beautiful, 10X multiplier.

And today? I’m sipping my black co

SEDG SolarEdge Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DKNG DraftKings prior to the earnings report this week,

I would consider purchasing the 16usd strike price Calls with

an expiration date of 2025-2-28,

for a premium of approximately $1.76.

If these options prove to be profitable prior to the earn

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SEDG5270493

SolarEdge Technologies Inc. 0.0% 15-SEP-2025Yield to maturity

36.25%

Maturity date

Sep 15, 2025

US83417MAF1

SOLAREDGE T. 24/29 CVYield to maturity

11.26%

Maturity date

Jul 1, 2029

See all SEDG bonds

Curated watchlists where SEDG is featured.

Frequently Asked Questions

The current price of SEDG is 27.23 USD — it has decreased by −4.36% in the past 24 hours. Watch SolarEdge Technologies, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange SolarEdge Technologies, Inc. stocks are traded under the ticker SEDG.

SEDG stock has risen by 6.55% compared to the previous week, the month change is a 42.68% rise, over the last year SolarEdge Technologies, Inc. has showed a 8.62% increase.

We've gathered analysts' opinions on SolarEdge Technologies, Inc. future price: according to them, SEDG price has a max estimate of 29.00 USD and a min estimate of 5.00 USD. Watch SEDG chart and read a more detailed SolarEdge Technologies, Inc. stock forecast: see what analysts think of SolarEdge Technologies, Inc. and suggest that you do with its stocks.

SEDG reached its all-time high on Nov 22, 2021 with the price of 389.71 USD, and its all-time low was 10.24 USD and was reached on Nov 20, 2024. View more price dynamics on SEDG chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SEDG stock is 8.50% volatile and has beta coefficient of 1.15. Track SolarEdge Technologies, Inc. stock price on the chart and check out the list of the most volatile stocks — is SolarEdge Technologies, Inc. there?

Today SolarEdge Technologies, Inc. has the market capitalization of 1.61 B, it has decreased by −9.47% over the last week.

Yes, you can track SolarEdge Technologies, Inc. financials in yearly and quarterly reports right on TradingView.

SolarEdge Technologies, Inc. is going to release the next earnings report on Aug 7, 2025. Keep track of upcoming events with our Earnings Calendar.

SEDG earnings for the last quarter are −1.14 USD per share, whereas the estimation was −1.16 USD resulting in a 1.67% surprise. The estimated earnings for the next quarter are −0.88 USD per share. See more details about SolarEdge Technologies, Inc. earnings.

SolarEdge Technologies, Inc. revenue for the last quarter amounts to 219.48 M USD, despite the estimated figure of 204.10 M USD. In the next quarter, revenue is expected to reach 274.24 M USD.

SEDG net income for the last quarter is −98.52 M USD, while the quarter before that showed −287.44 M USD of net income which accounts for 65.72% change. Track more SolarEdge Technologies, Inc. financial stats to get the full picture.

No, SEDG doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 27, 2025, the company has 5.63 K employees. See our rating of the largest employees — is SolarEdge Technologies, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SolarEdge Technologies, Inc. EBITDA is −1.26 B USD, and current EBITDA margin is −149.16%. See more stats in SolarEdge Technologies, Inc. financial statements.

Like other stocks, SEDG shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SolarEdge Technologies, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SolarEdge Technologies, Inc. technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SolarEdge Technologies, Inc. stock shows the sell signal. See more of SolarEdge Technologies, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.