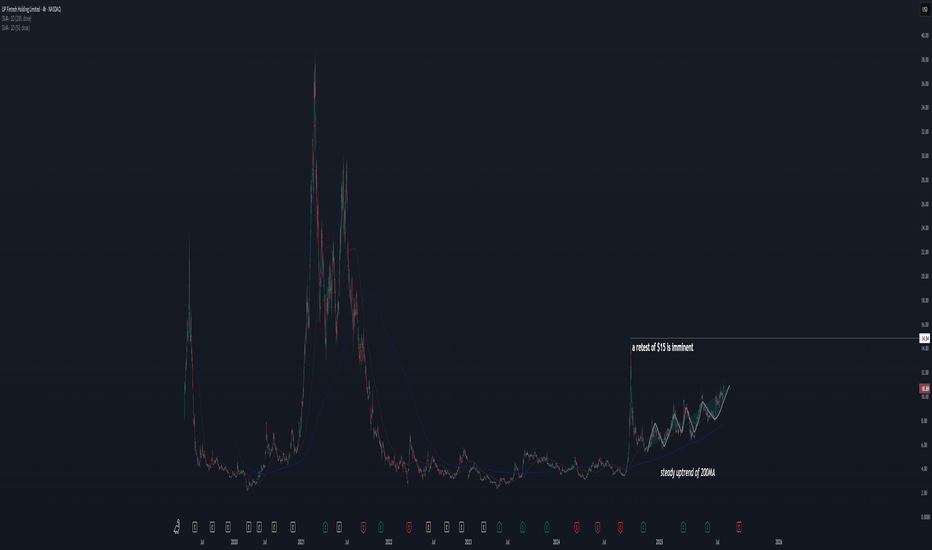

Next Robinhood? TIGR, a hidden gem.We all know the story about retail going crazy on $HOOD. But what about its SEA counterpart, TIGR? Will our SEA friends follow the same trend?

With more and more retail traders rushing to the stock market, TIGR is a safe grab to get on the retail frenzy.

This is also supported from a technical si

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.47 USD

60.73 M USD

391.54 M USD

169.99 M

About UP Fintech Holding Limited

Sector

Industry

CEO

Tian Hua Wu

Website

Headquarters

Singapore

Founded

2014

FIGI

BBG00NG4GW96

UP Fintech Holding Ltd. is an online brokerage firm that focuses on global investors. It provides an online trading platform that enables investors to trade in equities and other financial instruments on multiple exchanges around the world. The firm offers products and services, as well as a user experience to customers through its mobile first strategy. The company was founded by Tian Hua Wu in June 2014 and is headquartered in Singapore.

Related stocks

UP Fintech Holding Ltd. (TIGR) – Fintech Expansion in MotionCompany Snapshot:

NASDAQ:TIGR is a digital-first brokerage gaining global traction by combining smart technology, cost efficiency, and a user-friendly experience that appeals to both retail and institutional investors.

Key Catalysts:

User Growth Acceleration 🚀

In Q2 2025, TIGR added 60,900 new

UP Fintech Holding Ltd (TIGR) Gains With Tiger TradeUP Fintech Holding Limited (TIGR) is a leading online brokerage firm, offering trading services for U.S., Hong Kong, and global stocks, options, and ETFs through its popular Tiger Trade platform. Known for low fees and easy-to-use tools, TIGR attracts young, tech-savvy investors. The company’s growt

TIGR UP Fintech Holding Limited Options Ahead of EarningsIf you haven`t bought TIGR before the previous earnings:

Now analyzing the options chain and the chart patterns of TIGR UP Fintech Holding Limited prior to the earnings report this week,

I would consider purchasing the 8usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of

Long TIGR (Maybe Double Up)

NASDAQ:TIGR is a fintech company incorporated in Singapore and headquartered in Beijing. Think HOOD for asian markets, and having direct access to those equities. From the chart you can see they clearly align with the China trade and do get a huge boost if we see China's market pick up.

Cur

New Setup: TIGRDivergence Play

TIGR: I have a setup signal(green dot).I'm looking to enter long near the close of the day if the stock can manage to CLOSE above the last candle highs(white line). If triggered, I will then place a stop-loss below(SL) and a price target above it(TP 100%).

********

Note: The above se

TIGR UP Fintech Holding Limited Options Ahead of EarningsIf you haven`t bought TIGR before the previous earnings:

Now analyzing the options chain and the chart patterns of TIGR UP Fintech Holding Limited prior to the earnings report this week,

I would consider purchasing the 4usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of

TIGR | InformativeNASDAQ:TIGR

Trend and Key Levels:

Downtrend: The stock is in a long-term downtrend, indicated by the descending trendline.

Support Levels: $4.03 to $4.25

Resistance area: $4.91 to $5.01.

Candlestick and Volume Patterns:

Recent Activity: Mixed sentiment with the latest candle being bearish,

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.