Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

12.87 INR

131.35 B INR

890.88 B INR

2.78 B

About WIPRO LTD

Sector

Industry

CEO

Srinivas Pallia

Website

Headquarters

Bengaluru

Founded

1945

ISIN

INE075A01022

FIGI

BBG000D27Z87

Wipro Ltd. is a global information technology, consulting and outsourcing company, which engages in the development and integration of solutions. It operates through the following segments: Information Technology Services, India State Run Enterprise Services, and Information Technology Products. The Information Technology Services segment provides digital strategy advisory, customer-centric design, technology consulting, IT consulting, custom application design, development, re-engineering and maintenance, systems integration, package implementation, global infrastructure services, analytics services, business process services, research and development, and hardware and software design to enterprises worldwide. The Information Technology Products segment offers a range of third-party IT products. The company was founded on December 29, 1945 and is headquartered in Bengaluru, India.

Related stocks

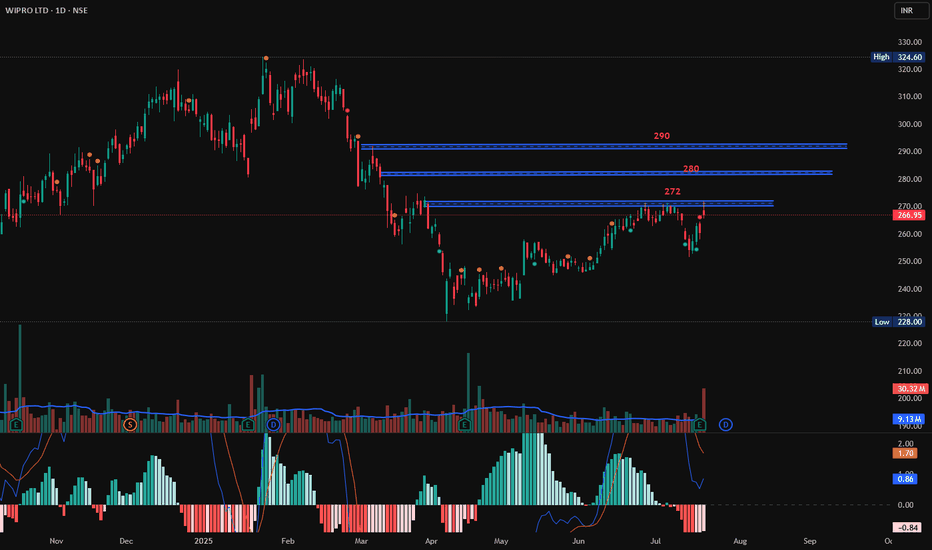

Wipro at Resistance, Long, 1DWipro has shown huge volume traded today however it has not broken a resistance which is at 272. If it breaks 272 with Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or Bullish Harami, then enter at 27

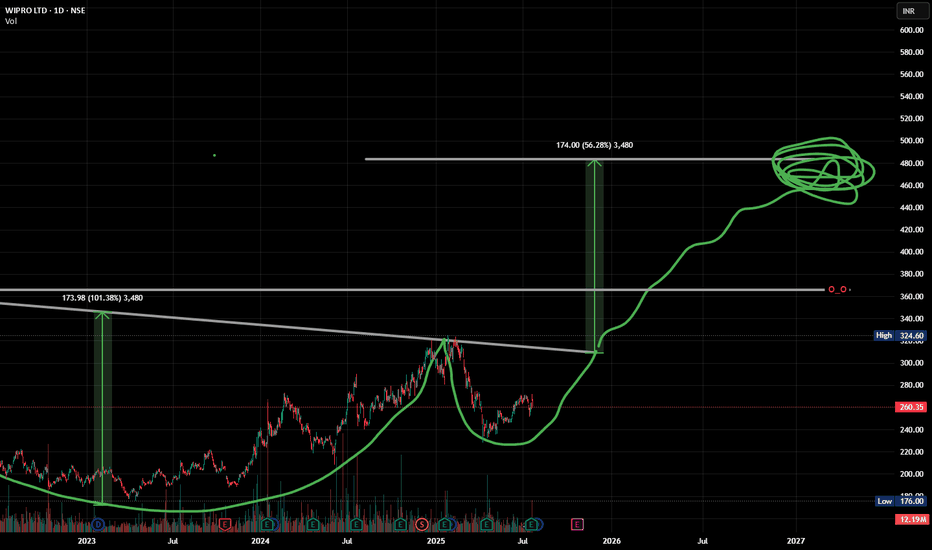

WIPRO & the Squiggle Prophecy Drew this green curve a year ago just for vibes… and WIPRO said “bet.”

Now it’s casually forming a monstrous cup, heading toward the ₹320 neckline.

If that breaks, we might see ₹370+, and maaaybe ₹480-ish… ish. Idk. Don’t ask me. Ask the squiggle.

Hopefully the squiggle squiggle prophecy holds tru

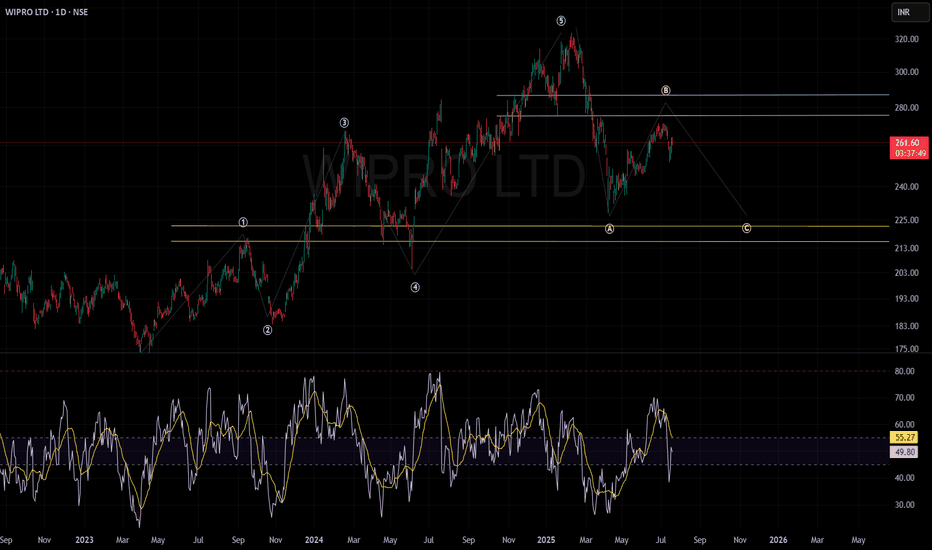

WIPRO CAN STILL FACE SOME PRESSUREWIPRO LTD.

Wave Structure:

The chart depicts a well-defined Elliott Wave pattern, illustrating a completed five-wave impulse sequence succeeded by a classic ABC corrective phase.

Wave B retracement appears to be underway, with resistance anticipated around the ₹275–₹285 zone.

Support & Resistanc

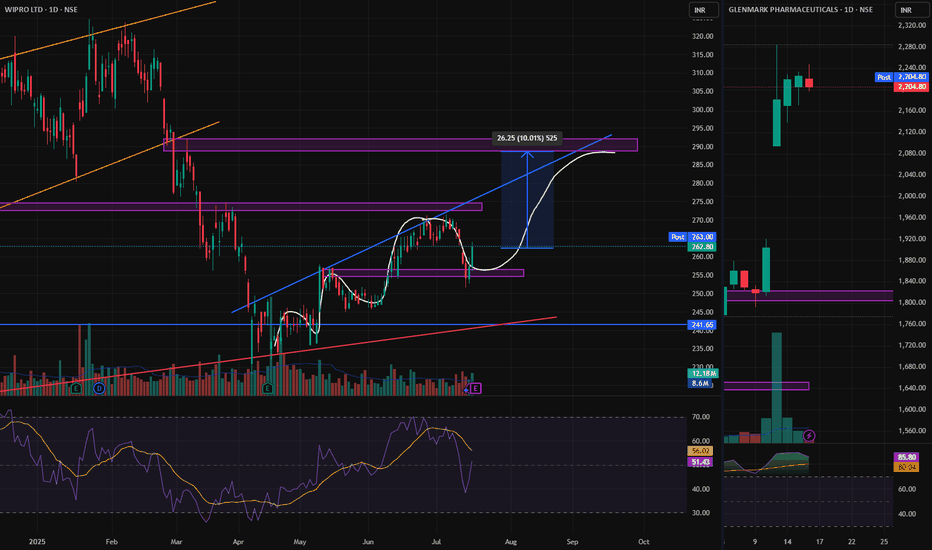

Wipro AT Best Support Zone These are two daily timeframe charts of Wipro .

In the first chart : Wipro is trading within an ascending parallel channel, with the lower boundary positioned around the ₹251–₹254 zone.

Wipro has previously respected the Fibonacci golden zone, and the stock is once again approaching this key retra

WIPRO at Best Support !!This is the 4 hour chart of Wipro ltd.

WIPRO has a strong support zone in the 245–248 range.

WIPRO is forming a symmetrical triangle pattern, with a potential target of 268, which also aligns with the channel's resistance zone at 268-270."

If this level is sustain , we may see higher prices in Wi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where WIPRO is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of WIPRO is 245.91 INR — it has increased by 1.36% in the past 24 hours. Watch WIPRO LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange WIPRO LTD stocks are traded under the ticker WIPRO.

WIPRO stock has fallen by −3.13% compared to the previous week, the month change is a −8.29% fall, over the last year WIPRO LTD has showed a 0.37% increase.

We've gathered analysts' opinions on WIPRO LTD future price: according to them, WIPRO price has a max estimate of 320.00 INR and a min estimate of 200.00 INR. Watch WIPRO chart and read a more detailed WIPRO LTD stock forecast: see what analysts think of WIPRO LTD and suggest that you do with its stocks.

WIPRO reached its all-time high on Oct 14, 2021 with the price of 369.92 INR, and its all-time low was 0.37 INR and was reached on Dec 31, 1996. View more price dynamics on WIPRO chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

WIPRO stock is 0.99% volatile and has beta coefficient of 0.67. Track WIPRO LTD stock price on the chart and check out the list of the most volatile stocks — is WIPRO LTD there?

Today WIPRO LTD has the market capitalization of 2.58 T, it has decreased by −0.90% over the last week.

Yes, you can track WIPRO LTD financials in yearly and quarterly reports right on TradingView.

WIPRO LTD is going to release the next earnings report on Oct 21, 2025. Keep track of upcoming events with our Earnings Calendar.

WIPRO earnings for the last quarter are 3.20 INR per share, whereas the estimation was 3.08 INR resulting in a 3.80% surprise. The estimated earnings for the next quarter are 3.15 INR per share. See more details about WIPRO LTD earnings.

WIPRO LTD revenue for the last quarter amounts to 221.35 B INR, despite the estimated figure of 221.13 B INR. In the next quarter, revenue is expected to reach 225.35 B INR.

WIPRO net income for the last quarter is 33.30 B INR, while the quarter before that showed 35.70 B INR of net income which accounts for −6.70% change. Track more WIPRO LTD financial stats to get the full picture.

WIPRO LTD dividend yield was 2.29% in 2024, and payout ratio reached 47.76%. The year before the numbers were 0.21% and 4.79% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 5, 2025, the company has 230 K employees. See our rating of the largest employees — is WIPRO LTD on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. WIPRO LTD EBITDA is 179.65 B INR, and current EBITDA margin is 20.23%. See more stats in WIPRO LTD financial statements.

Like other stocks, WIPRO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade WIPRO LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So WIPRO LTD technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating WIPRO LTD stock shows the neutral signal. See more of WIPRO LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.