Related commodities

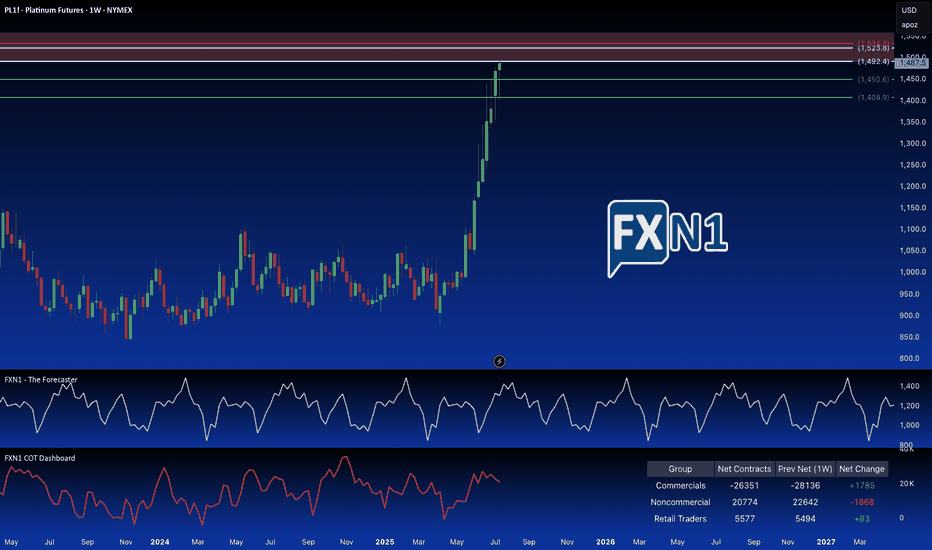

Platinum: Breaking the Supply Barrier?I'm adding a second Platinum position. Price has hit a strong weekly supply area, also a significant monthly supply zone. I'm anticipating a reversal here, as non-commercial holdings are decreasing, and seasonal patterns suggest a potential trend change. To further capitalize on potential upside,

From Sweep to Slaughter, Bear Setup EngagedOk a little late but I saw this and thought I'd share. Price has swept liquidity above the prior range high and failed to close strong. Structure is now rejecting under micro trend EMAs, breaking the local trend line and forming a short-term bearish momentum bias into the IFV zone. This is a short-

How much higher for Platinum futures In this video I look at the current price of platinum on a higher tf and forecast where I believe the cool down to this rally might begin.

Using tools like the fib extension, volume profile and speed fan we are able to highlight a major reaction zone ahead at $1600 region .

Set alerts at these

PL to 1200 Platinum has made a massive upwards move in the last 2 weeks. It has not tested my original $1400 price target but got pretty close. The large upwards move has formed a beautiful trend line with more than 3 touch points which has now been broken. I am looking for price to fall back to $1200 price le

Platinum Market Alert: One-Day Reversal in Play On Friday, the platinum market printed a key day reversal — a classic signal that a short-term correction may be underway.

🔍 In our analysis posted Thursday, we highlighted the 55-hour moving average as good place to place a stop level in a runaway market. Fast forward to now: that level has been de

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for Platinum Futures (Apr 2025) is Apr 28, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Platinum Futures (Apr 2025) before Apr 28, 2025.