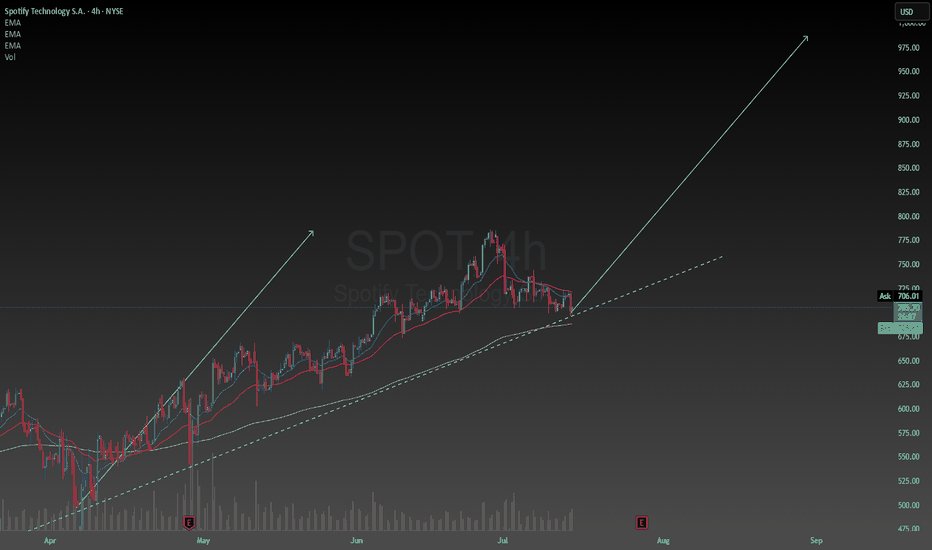

SPOT: Rebounding Off the 150 SMA -- Upper Channel Next?SPOT (Spotify) has been trading within a well-defined ascending parallel channel since late 2022. The recent dip brought price action close to the lower boundary of the channel, right at the 150-day moving average, which acted as support several times in the past.

This confluence between trendline

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.24 USD

1.23 B USD

16.95 B USD

146.84 M

About Spotify Technology S.A.

Sector

Industry

CEO

Daniel Ek

Website

Headquarters

Luxembourg

Founded

2006

ISIN

LU1778762911

FIGI

BBG003T4VFC2

Spotify Technology SA is a digital music service offering music fans instant access to a world of music. The company operates through the following segments: Premium and Ad-Supported. The Premium segment provides subscribers with unlimited online and offline high-quality streaming access of music and podcasts on computers, tablets, and mobile devices, users can connect through speakers, receivers, televisions, cars, game consoles, and smart watches. It also offers a music listening experience without commercial breaks. The Ad-Supported segment provides users with limited on-demand online access of music and unlimited online access of podcasts on their computers, tablets, and compatible mobile devices. It also serves both premium subscriber acquisition channel and a robust option for users who are unable or unwilling to pay a monthly subscription fee but still want to enjoy access to a wide variety of high-quality audio content. The company was founded by Daniel Ek and Martin Lorentzon in April, 2006 and is headquartered in Luxembourg.

Related stocks

When to buy the dip of Spotify?

Prices are at strong support, coinciding also with a 50% retracement level

A slight rise in RSI is a bullish sign

The convergence of the 50 and 20 day EMAs could be a source of resistance

Conclusion: let prices break above the 50 and 20 EMAs and wait for a retracement before buying

SPOTIFY-Turn the Music Up!NYSE:SPOT

Why did profit drop?

Spotify reported an operating loss of $75M — at first glance, that looks bad. But there’s logic behind it:

• Increased spending on marketing and podcast development (long-term investment)

• Higher royalty payments — short-term pressure

• Expansion of features and

ShortifyI don't post all my trade ideas ahead of time but I will share another short position that I executed before posting, this time in Spotify.

Short entered at $770, stop lost at $790.

Added to my position when we lost the monthly level of support.

The end of the 5 Wave Supercycle.

Trailing stop loss,

SPOT Reversing at VWAP Support – Signs of Seller ExhaustionAfter a sharp drop, SPOT is showing early signs of reversal at a key anchored VWAP support zone. The intraday bounce occurred on low volume, which may indicate seller exhaustion rather than aggressive dip-buying.

Price is holding near the blue VWAP anchored from the April low, a level that previous

Raising the bar for SpotifySpotify has been my favorite stock so far this year. Primarily because resilience in uncertain economies. Subscription-based services, especially freemium models, are seen as defensive. Spotify is the number one music streaming service in the world and unless that changes people will keep using it e

Spotify's Valuation Is Red-Lining (Rating Downgrade)📈 Spotify's Remarkable Comeback

Spotify NYSE:SPOT has transformed itself from a money-losing audio platform into a disciplined, profit-generating tech firm. Through smarter podcast investments, layoffs, and better monetization strategies, the company recently swung from red ink to positive free c

Bullish Strength candle close above Bollinger Band midline.Nice price cross over and close above the midline of the Bollinger Band. Long entry at open on 7/7/25. Expecting volume to follow thru with average or even better above average on green candle. Target is upper BB line and then $785. This could happen fairly quickly in the bull market.

As always, be

Take a bullish position as price action shows momentumCurrent Price: $772.60

Direction: LONG

Targets:

- T1 = $795.00

- T2 = $810.00

Stop Levels:

- S1 = $755.00

- S2 = $735.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to ide

Spotify is the most beautiful chart of the yearI made chat GPT write this because i was too lazy;

ps. (The intrinsic value for the stock right now is between $400 and $2900)

Q. Why is Spotify stock doing so good this year.

A.

1. First-ever full-year profit in 2024

Spotify swung to a €1.1 billion net profit in 2024—its first annual profit—on

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where SPOT is featured.

Frequently Asked Questions

The current price of SPOT is 705.89 USD — it has increased by 2.79% in the past 24 hours. Watch Spotify Technology S.A. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Spotify Technology S.A. stocks are traded under the ticker SPOT.

SPOT stock has risen by 13.49% compared to the previous week, the month change is a −2.29% fall, over the last year Spotify Technology S.A. has showed a 115.08% increase.

We've gathered analysts' opinions on Spotify Technology S.A. future price: according to them, SPOT price has a max estimate of 911.06 USD and a min estimate of 488.59 USD. Watch SPOT chart and read a more detailed Spotify Technology S.A. stock forecast: see what analysts think of Spotify Technology S.A. and suggest that you do with its stocks.

SPOT reached its all-time high on Jun 27, 2025 with the price of 785.00 USD, and its all-time low was 69.29 USD and was reached on Nov 4, 2022. View more price dynamics on SPOT chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SPOT stock is 4.42% volatile and has beta coefficient of 1.02. Track Spotify Technology S.A. stock price on the chart and check out the list of the most volatile stocks — is Spotify Technology S.A. there?

Today Spotify Technology S.A. has the market capitalization of 143.35 B, it has decreased by −0.62% over the last week.

Yes, you can track Spotify Technology S.A. financials in yearly and quarterly reports right on TradingView.

Spotify Technology S.A. is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

SPOT earnings for the last quarter are −0.49 USD per share, whereas the estimation was 2.30 USD resulting in a −121.50% surprise. The estimated earnings for the next quarter are 2.27 USD per share. See more details about Spotify Technology S.A. earnings.

Spotify Technology S.A. revenue for the last quarter amounts to 4.94 B USD, despite the estimated figure of 5.02 B USD. In the next quarter, revenue is expected to reach 4.96 B USD.

SPOT net income for the last quarter is −97.55 M USD, while the quarter before that showed 236.80 M USD of net income which accounts for −141.20% change. Track more Spotify Technology S.A. financial stats to get the full picture.

No, SPOT doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Spotify Technology S.A. EBITDA is 2.13 B USD, and current EBITDA margin is 9.76%. See more stats in Spotify Technology S.A. financial statements.

Like other stocks, SPOT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Spotify Technology S.A. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Spotify Technology S.A. technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Spotify Technology S.A. stock shows the buy signal. See more of Spotify Technology S.A. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.