Is Samsung's Chip Bet Paying Off?Samsung Electronics is navigating a complex global landscape, marked by intense technological competition and shifting geopolitical alliances. A recent $16.5 billion deal to supply advanced chips to Tesla, confirmed by Elon Musk, signals a potential turning point. This contract, set to run until lat

Key facts today

Samsung Electronics' shares rose nearly 1% as South Korean markets mirrored Wall Street's record highs, driven by soft U.S. inflation data boosting hopes for a Federal Reserve rate cut.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.29 USD

22.63 B USD

202.49 B USD

4.67 B

About SAMSUNG ELECTRONICS

Sector

Industry

CEO

Young-Hyun Jun

Website

Headquarters

Suwon-si

Founded

1969

ISIN

KR7005930003

FIGI

BBG000BT2LD0

Samsung Electronics Co., Ltd. engages in the manufacturing and selling of electronics and computer peripherals. The company operates through following business divisions: Device Experience (DX), Device Solutions (DS), Samsung Display (SDC), and Harman. The DX division offers televisions, monitors, refrigerators, washing machines, air conditioners, smartphones, network systems, and computers. The DS division deals with semiconductor components including DRAM, NAND Flash, and mobile APs. The SDC division provides OLED panels for smartphones. The Harman division consists of digital cockpits, car audio, and portable speakers. The company was founded on January 13, 1969 and is headquartered in Suwon-si, South Korea.

Related stocks

The key is whether it can rise above 61800

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(Samsung Electronics 1D chart)

HA-Low indicator and HA-High indicator have begun to converge.

Accordingly, a trend is expected to occur soon.

Since the pri

Good time to buy Samsung stocksIt went down a lot, and checked the floor.

It gave a fake rebound and fell back.

So, now it's ready for a go.

What do I mean?

Many individual investors entered thinking the price will go up, and they are losing hopes seeing a little minus %.

They will give up, and only after that process the price

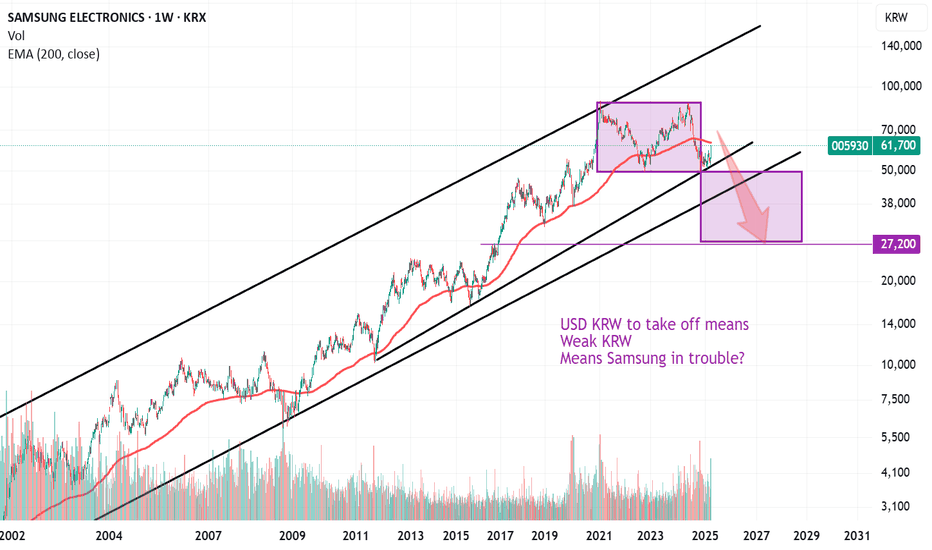

SAMSUNG ELECTRONICS - KRXSAMSUNG ELECTRONICS - KRX

Est-ce le meilleur moment pour un achat ?

Mon analyse :

*Sur un graphique hebdo (W1)

- SAMSUNG ELECTRO est dans une tendance haussière depuis 2016

- Une zone résistante qui limite le mouvement haussier et une zone de soutient qui limite le mouvement baissier

*Sur u

Samsung Galaxy S25 Series to Adopt Snapdragon ExclusivelySamsung is poised to make a strategic shift with its upcoming Galaxy S25 series by exclusively integrating Qualcomm's Snapdragon 8 Gen 4 SoC. This move marks a departure from earlier plans to use Samsung's Exynos chips across all models.

Key Points:

1. Snapdragon 8 Gen 4 Dominance:

- The G

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where SSNLF is featured.

Frequently Asked Questions

The current price of SSNLF is 42.33 USD — it has increased by 9.01% in the past 24 hours. Watch Samsung Electronics Co., Ltd. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange Samsung Electronics Co., Ltd. stocks are traded under the ticker SSNLF.

We've gathered analysts' opinions on Samsung Electronics Co., Ltd. future price: according to them, SSNLF price has a max estimate of 71.60 USD and a min estimate of 38.66 USD. Watch SSNLF chart and read a more detailed Samsung Electronics Co., Ltd. stock forecast: see what analysts think of Samsung Electronics Co., Ltd. and suggest that you do with its stocks.

SSNLF reached its all-time high on Oct 13, 2021 with the price of 2,000.00 USD, and its all-time low was 38.83 USD and was reached on Apr 16, 2025. View more price dynamics on SSNLF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SSNLF stock is 8.26% volatile and has beta coefficient of 1.11. Track Samsung Electronics Co., Ltd. stock price on the chart and check out the list of the most volatile stocks — is Samsung Electronics Co., Ltd. there?

Today Samsung Electronics Co., Ltd. has the market capitalization of 341.00 B, it has increased by 3.59% over the last week.

Yes, you can track Samsung Electronics Co., Ltd. financials in yearly and quarterly reports right on TradingView.

Samsung Electronics Co., Ltd. is going to release the next earnings report on Oct 30, 2025. Keep track of upcoming events with our Earnings Calendar.

SSNLF earnings for the last quarter are 0.54 USD per share, whereas the estimation was 0.63 USD resulting in a −13.59% surprise. The estimated earnings for the next quarter are 0.88 USD per share. See more details about Samsung Electronics Co., Ltd. earnings.

Samsung Electronics Co., Ltd. revenue for the last quarter amounts to 54.76 B USD, despite the estimated figure of 54.65 B USD. In the next quarter, revenue is expected to reach 59.48 B USD.

SSNLF net income for the last quarter is 3.76 B USD, while the quarter before that showed 5.42 B USD of net income which accounts for −30.70% change. Track more Samsung Electronics Co., Ltd. financial stats to get the full picture.

Yes, SSNLF dividends are paid quarterly. The last dividend per share was 0.27 USD. As of today, Dividend Yield (TTM)% is 2.05%. Tracking Samsung Electronics Co., Ltd. dividends might help you take more informed decisions.

Samsung Electronics Co., Ltd. dividend yield was 2.72% in 2024, and payout ratio reached 29.07%. The year before the numbers were 1.84% and 67.77% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 13, 2025, the company has 129.48 K employees. See our rating of the largest employees — is Samsung Electronics Co., Ltd. on this list?

Like other stocks, SSNLF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Samsung Electronics Co., Ltd. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Samsung Electronics Co., Ltd. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Samsung Electronics Co., Ltd. stock shows the sell signal. See more of Samsung Electronics Co., Ltd. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.