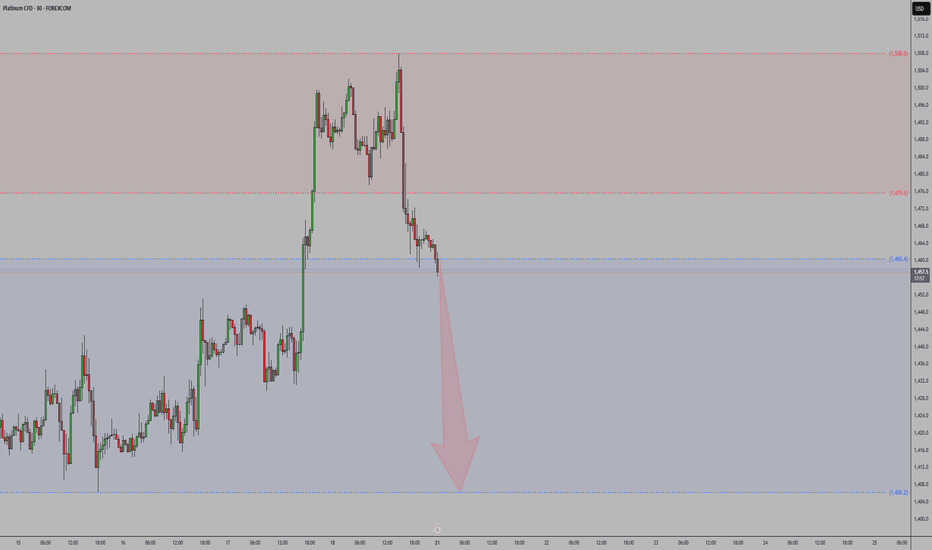

XPTUSD Platinum will hit 1370 - Long TradeOANDA:XPTUSD Long trade, with my back testing of this strategy, XPTUSD need to touch 1370

This is good trade

Don't overload your risk like Greedy gambler,

Be Disciplined Trader, what what you can afford.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

About CFDs on Platinum (US$ / OZ)

Platinum as an investment has a much shorter history in the financial sector than does either gold or silver, which were known to ancient civilizations. Experts posit that platinum is about 15-20 times scarcer than gold, on the basis of annual mine production. Because of this fact, platinum has nearly always tended to sell at a significant price premium to gold. More than 75% of global platinum is mined in South Africa.

The price of platinum changes along with its supply and demand; during periods of sustained economic stability and growth, the price of platinum tends to be as much as twice the price of gold; whereas, during periods of economic uncertainty, the price of platinum tends to decrease because of reduced demand, falling below the price of gold, partly due to increased gold prices.

The price of platinum changes along with its supply and demand; during periods of sustained economic stability and growth, the price of platinum tends to be as much as twice the price of gold; whereas, during periods of economic uncertainty, the price of platinum tends to decrease because of reduced demand, falling below the price of gold, partly due to increased gold prices.

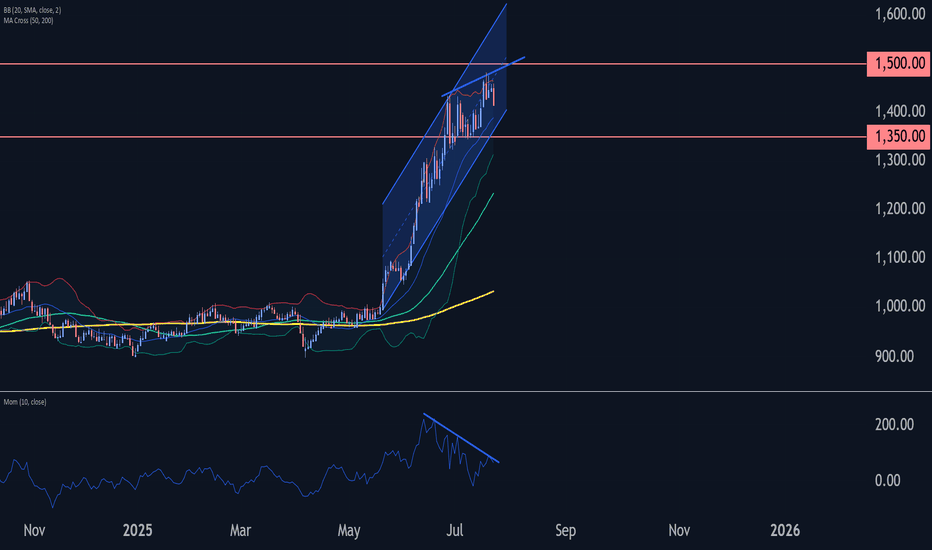

⤷ XPT/USD Metals Alert | Breakout Heist Mode Engaged ⤶🔐💎 XPT/USD “The Platinum Heist” — MA Breakout Bullish Robbery Plan! 💰🚀

💼 Asset: XPT/USD "The Platinum"

📊 Market Plan: BULLISH

🕵️♂️ Thief Entry: Breakout of MA 🔓 (Above 1350.00)

🛑 Stop Loss: Hidden Vault 🔐 (1300.00)

🎯 Target: Getaway Car 🚗💨 (1420.00)

🎯 Style: Layered entries using thief-style limit

XPTPlatinum Price Analysis Idea:

It appears that platinum has the potential for further upside. On the 4H , we are seeing price pullbacks from previous resistance levels, which now seem to be acting as support. Additionally, the price is forming higher lows, suggesting the beginning of a possible uptr

Platinum Still Has Room to RunJust like with silver, the potential for further growth in gold remains, despite the setbacks of recent days.

It seems the precious metals market didn’t mourn the Fed’s decision and subsequent press release for long.

The uptrend remains intact, and the previously supportive factors are still in p

Platinum Breakout Stalk: Thief Entry Only After Confirmed🧠 Thief's Heist Plan Activated!

Asset: XTI/USD (PLATINUM) 💎

Strategy: Bullish Pullback + Breakout Play 💥

🔍 We stalking platinum's neutral zone… waiting for that clean breakout!

No early entries, no premature SLs. Discipline = Profits. 🎯

🎯 Entry: After breakout confirmed. Use multiple DCA limit ord

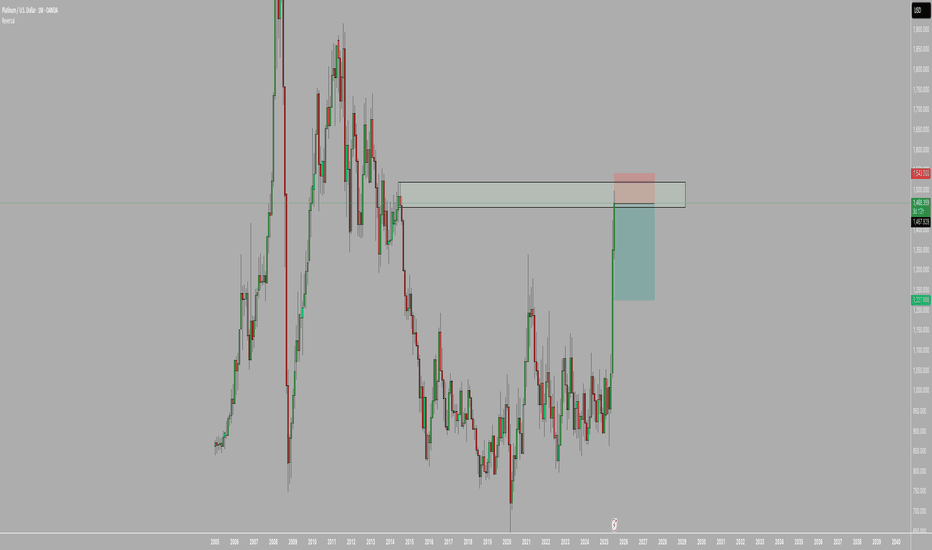

Platinum Wave Analysis – 31 July 2025- Platinum broke support zone

- Likely to fall to support level 1200.00

Platinum recently broke the support zone located between the key support level 1340.00 (low of the previous minor correction iv) and the support trendline of the daily up channel from May.

The breakout of this support zone acc

Platinum Wave Analysis – 23 July 2025- Platinum reversed from resistance zone

- Likely to fall to support level 1350.00

Platinum recently reversed down from the resistance zone located between the round resistance level 1500.00, upper daily Bollinger Band and the resistance trendline of the daily up channel from May.

The downward rev

Platinum SellI'm taking this sell trade on platinum because, after a strong three-month rally, the price has now reached a key resistance zone that has historically seen significant selling pressure—most notably back in August 2014. Given the extended bullish move and the fact that we're approaching a major supp

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.