Apple (AAPL) Shares Jump Following Earnings ReportApple (AAPL) Shares Jump Following Earnings Report

Yesterday, after the close of the regular trading session, Apple released its earnings report, which surpassed analysts’ expectations:

→ Earnings per share: actual = $1.57, forecast = $1.43;

→ Revenue: actual = $94.04 billion, forecast = $89.35

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

214.9 THB

3.04 T THB

12.68 T THB

14.92 B

About Apple Inc

Sector

Industry

CEO

Timothy Donald Cook

Website

Headquarters

Cupertino

Founded

1976

ISIN

TH0809121500

FIGI

BBG01TZGJ1V4

Apple, Inc. engages in the design, manufacture, and sale of smartphones, personal computers, tablets, wearables and accessories, and other varieties of related services. It operates through the following geographical segments: Americas, Europe, Greater China, Japan, and Rest of Asia Pacific. The Americas segment includes North and South America. The Europe segment consists of European countries, as well as India, the Middle East, and Africa. The Greater China segment comprises China, Hong Kong, and Taiwan. The Rest of Asia Pacific segment includes Australia and Asian countries. Its products and services include iPhone, Mac, iPad, AirPods, Apple TV, Apple Watch, Beats products, AppleCare, iCloud, digital content stores, streaming, and licensing services. The company was founded by Steven Paul Jobs, Ronald Gerald Wayne, and Stephen G. Wozniak in April 1976 and is headquartered in Cupertino, CA.

Related stocks

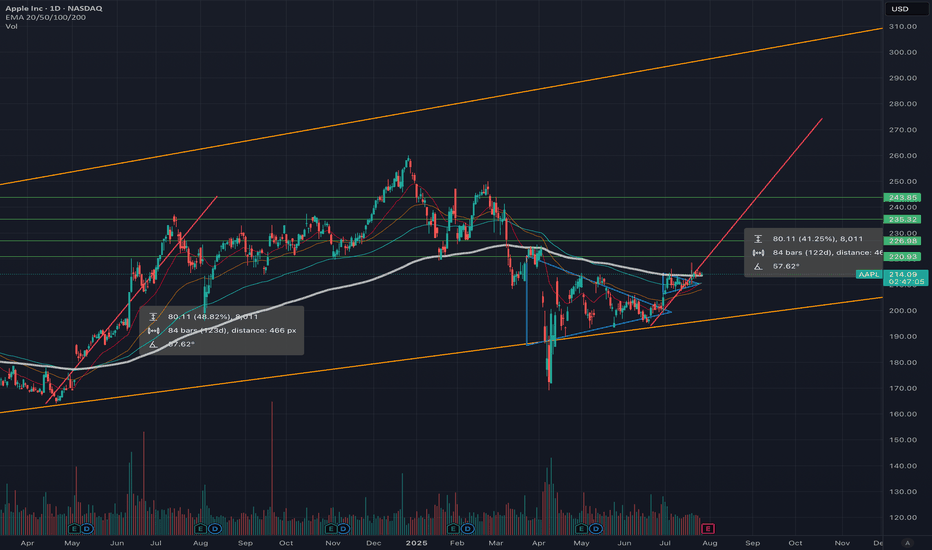

Why Apple Could Be Entering a Structural Correction🍎📉 Why Apple Could Be Entering a Structural Correction ⚠️🔍

After scanning major tech names today, one stock stood out— for all the wrong reasons : NASDAQ:AAPL .

Technically, Apple has broken below long-standing trendline support , and my chart now assigns a 70% probability(roughly guys...rough

Time to buy? Too much negative press. Buy in Fear- Updated 28/7Apple has been making steady gains since April 8th. Trading volume has been consistently strong, increasing intermittently, with sell pressure exhausted at the 200 USD mark. The price point is now sitting above the 200 daily EMA support, which indicates strong potential for continued upward movement

AAPL BUY 1st target $223AAPL is forming a wedge and been lagging for 2 years. I was expecting $182 but we never saw that level, after weeks of $200 range consolidation it's clear this is basing, first target of resistance is $223 then we could be off to the races. I would expect to see this as soon as next week provided

Apple - The next major push higher!🍎Apple ( NASDAQ:AAPL ) will head for new highs:

🔎Analysis summary :

Apple has been underperforming markets for a couple of months lately. However technicals still remain very bullish, indicating an inherent and substantial move higher soon. All we need now is bullish confirmation and proper ri

Apple Is Down YTD Ahead of Earnings. What Does Its Chart Say?Apple NASDAQ:AAPL will report earnings Thursday at a time when the tech giant has been struggling more than most other "Magnificent Seven" stocks or higher-end, AI-focused companies. What does fundamental and technical analysis say about AAPL heading into the report?

Let's see:

Apple's Fundamen

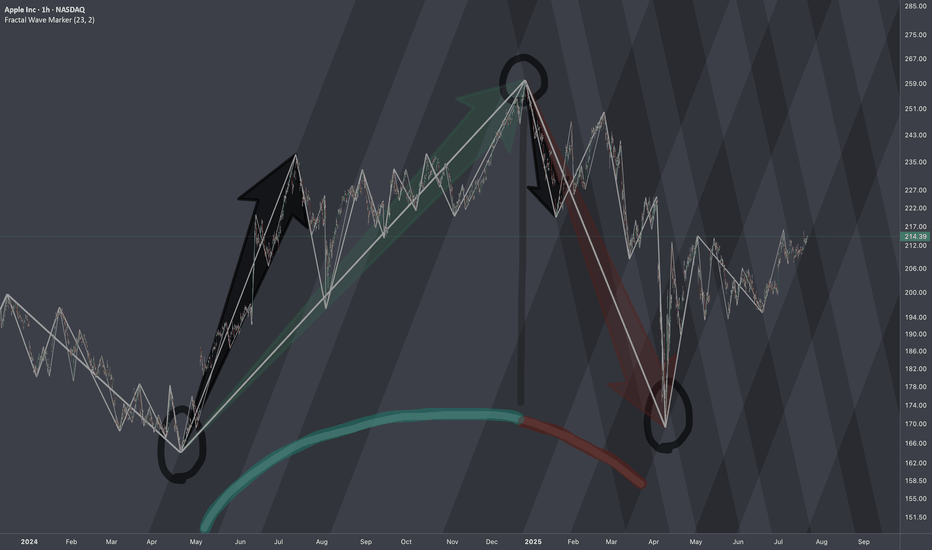

$AAPL: Structure SurgeryResearch Notes

Original Structure:

Altering structure for experimental purposes

Angle of fib channels that rises from cycle low, has been pushed into the past to the top of first major reaction. blue area resembles the change

Reason

The the angle of Fibonacci channels which cover th

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

US37833DZ0

APPLE 20/50Yield to maturity

6.88%

Maturity date

Aug 20, 2050

US37833EF3

APPLE 21/51Yield to maturity

6.81%

Maturity date

Feb 8, 2051

US37833EG1

APPLE 21/61Yield to maturity

6.81%

Maturity date

Feb 8, 2061

US37833EL0

APPLE 21/61Yield to maturity

6.77%

Maturity date

Aug 5, 2061

US37833DW7

APPLE 20/50Yield to maturity

6.77%

Maturity date

May 11, 2050

US37833EK2

APPLE 21/51Yield to maturity

6.75%

Maturity date

Aug 5, 2051

US37833EA4

APPLE 20/60Yield to maturity

6.66%

Maturity date

Aug 20, 2060

US37833DQ0

APPLE 19/49Yield to maturity

6.52%

Maturity date

Sep 11, 2049

US37833EE6

APPLE 21/41Yield to maturity

6.18%

Maturity date

Feb 8, 2041

US37833DD9

APPLE 17/47Yield to maturity

5.95%

Maturity date

Sep 12, 2047

US37833BA7

APPLE 15/45Yield to maturity

5.94%

Maturity date

Feb 9, 2045

See all AAPL01 bonds

Curated watchlists where AAPL01 is featured.