ST Engineering Break $4 - Is it a Good Buy?ST Engineering's share price finally breaks $4, records a 52-week high at $4.04 today.

From what I saw on Moomoo forum. The break out signals has captured investor attention excited them for a trading opportunity.

In fundamental speaking, ST Engineering has demonstrated robust performance. Its an

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.23 SGD

702.26 M SGD

11.28 B SGD

1.52 B

About ST ENGINEERING

Sector

Industry

CEO

Sy Feng Chong

Website

Headquarters

Singapore

Founded

1967

ISIN

SG1F60858221

FIGI

BBG000BX7RG0

Singapore Technologies Engineering Ltd. is an investment holding company, which engages providing solutions and services in the aerospace, electronics, land systems, and marine sectors. It operates through the following business segments: Commercial Aerospace, Urban Solutions and Satcom, and Defence and Public Security. The Commercial Aerospace segment refers to the airframe, engines, and components maintenance. The Urban Solutions and Satcom segment relate to smart mobility, smart utilities, and infrastructure. The Defence and Public Security segment is involved in defence, public safety and security, critical information infrastructure solutions, and others. The company was founded in 1967 and is headquartered in Singapore.

Related stocks

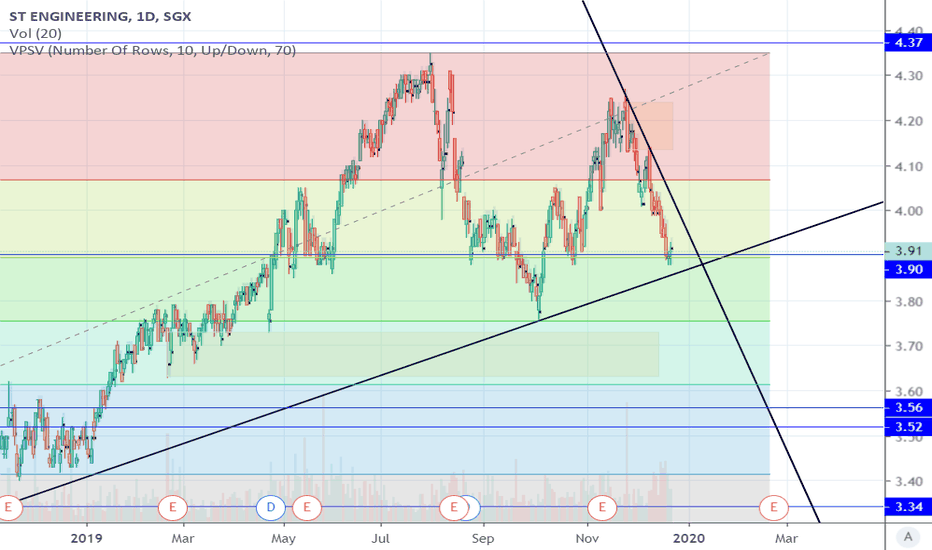

S63 - new trend formation - possible bullish biasTarget as shown - with stop loss indication.

Feel free to share your thoughts comments box. Note: This is not financial or investment advise. It will be good to always understand the risks involve in trading. Always trade with stop loss in place. Thumbs up if u like the analysis :)

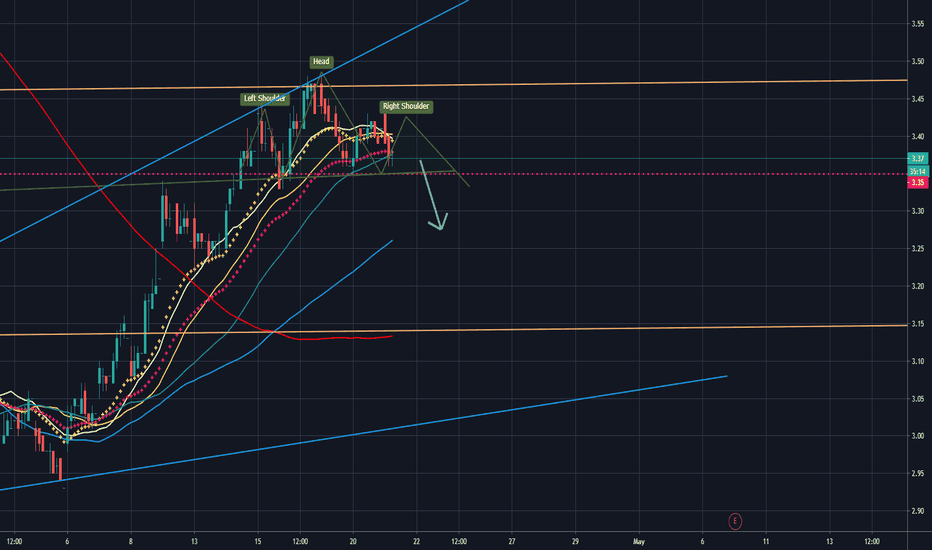

S63 - Is it possible in formation of Head & Shoulder?With the current oil crisis, market is in sort of jitters right now... this counter seems to follow the down trend (possibly) as well. Will the head & shoulder formation plays out in short term duration? or will it break out of the current formation and become bullish?

Feel free to share your thou

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

TMJC5405185

STE TransCore Holdings, Inc. 3.75% 05-MAY-2032Yield to maturity

4.73%

Maturity date

May 5, 2032

SEUS5596916

STE TransCore Holdings, Inc. 4.125% 23-MAY-2026Yield to maturity

4.46%

Maturity date

May 23, 2026

TMJC6073261

ST Engineering RHQ Ltd. 4.25% 08-MAY-2030Yield to maturity

4.34%

Maturity date

May 8, 2030

TMJC5405183

STE TransCore Holdings, Inc. 3.375% 05-MAY-2027Yield to maturity

4.29%

Maturity date

May 5, 2027

See all S63 bonds

Frequently Asked Questions

The current price of S63 is 7.82 SGD — it has decreased by −1.01% in the past 24 hours. Watch ST ENGINEERING stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SGX exchange ST ENGINEERING stocks are traded under the ticker S63.

S63 stock has fallen by −1.01% compared to the previous week, the month change is a 4.10% rise, over the last year ST ENGINEERING has showed a 86.63% increase.

We've gathered analysts' opinions on ST ENGINEERING future price: according to them, S63 price has a max estimate of 9.00 SGD and a min estimate of 6.60 SGD. Watch S63 chart and read a more detailed ST ENGINEERING stock forecast: see what analysts think of ST ENGINEERING and suggest that you do with its stocks.

S63 stock is 1.15% volatile and has beta coefficient of 0.66. Track ST ENGINEERING stock price on the chart and check out the list of the most volatile stocks — is ST ENGINEERING there?

Today ST ENGINEERING has the market capitalization of 24.76 B, it has decreased by −1.01% over the last week.

Yes, you can track ST ENGINEERING financials in yearly and quarterly reports right on TradingView.

ST ENGINEERING is going to release the next earnings report on Aug 13, 2025. Keep track of upcoming events with our Earnings Calendar.

S63 net income for the last half-year is 365.73 M SGD, while the previous report showed 336.53 M SGD of net income which accounts for 8.68% change. Track more ST ENGINEERING financial stats to get the full picture.

ST ENGINEERING dividend yield was 3.65% in 2024, and payout ratio reached 75.45%. The year before the numbers were 4.11% and 85.02% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ST ENGINEERING EBITDA is 1.71 B SGD, and current EBITDA margin is 14.64%. See more stats in ST ENGINEERING financial statements.

Like other stocks, S63 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ST ENGINEERING stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ST ENGINEERING technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ST ENGINEERING stock shows the buy signal. See more of ST ENGINEERING technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.