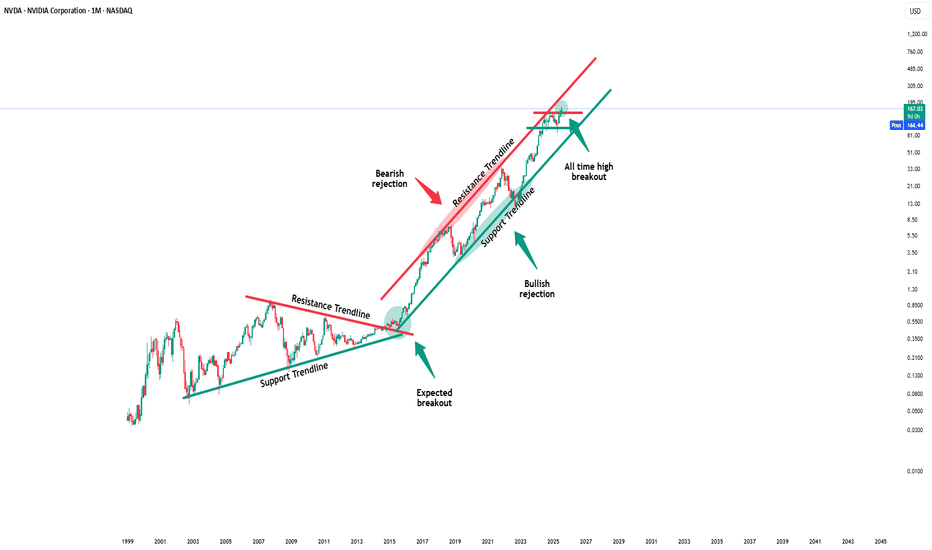

Nvidia - This is clearly not the end!📐Nvidia ( NASDAQ:NVDA ) will simply rally more:

🔎Analysis summary:

Yes, over the past couple of months, Nvidia has been rallying another +100%. But looking at the higher timeframe, this is still not the end of the unbelievable bullrun. Following the rising channel pattern, Nvidia can rally an

Key facts today

Wells Fargo raised Nvidia's price target from $185 to $220, citing strong demand for AI chips and solid order visibility ahead of quarterly results, anticipating ongoing revenue growth.

Nvidia is in talks with President Trump to resume H20 chip exports to China, proposing a 15% sales cut to the U.S. government and a 20% cut on sales to China.

Bernstein analysts estimate Nvidia could earn $3 billion from its new China-focused H20 chips, with overall revenue expected to surpass $200 billion this fiscal year.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.59 CHF

66.44 B CHF

118.96 B CHF

23.41 B

About NVIDIA

Sector

Industry

CEO

Jen Hsun Huang

Website

Headquarters

Santa Clara

Founded

1993

FIGI

BBG006TLSPX6

NVIDIA Corp engages in the design and manufacture of computer graphics processors, chipsets, and related multimedia software. It operates through the following segments: Graphics Processing Unit (GPU), Tegra Processor, and All Other. The GPU segment comprises of product brands, which aims specialized markets including GeForce for gamers; Quadro for designers; Tesla and DGX for AI data scientists and big data researchers; and GRID for cloud-based visual computing users. The Tegra Processor segment integrates an entire computer onto a single chip, and incorporates GPUs and multi-core CPUs to drive supercomputing for autonomous robots, drones, and cars, as well as for consoles and mobile gaming and entertainment devices. The All Other segment refers to the stock-based compensation expense, corporate infrastructure and support costs, acquisition-related costs, legal settlement costs, and other non-recurring charges. The company was founded by Jen Hsun Huang, Chris A. Malachowsky, and Curtis R. Priem in January 1993 and is headquartered in Santa Clara, CA.

Related stocks

Nvidia - This is clearly not the end!📐Nvidia ( NASDAQ:NVDA ) will confirm the breakout:

🔎Analysis summary:

Over the past couple of months, Nvidia managed to rally about +100%, reaching top 1 of total market cap. Most of the time such bullish momentum just continues and new all time highs will follow. But in order for that to hap

NVDA Approaching Premium Supply – Breakout or Double Top?📊 Market Breakdown

NVDA is trading at $182.70 and pressing into the Premium/Supply Zone ($184.36). The stock is riding a strong ascending wedge pattern, but with RSI at 69.70 (near overbought) and price stretched from the equilibrium, we’re at a critical decision point.

Trend: Strong uptrend from t

NVDA: Bullish Channels and Momentum CheckWe're seeing a compelling case for continued upward momentum in NVDA, but it's crucial to understand the different layers of the trend and key resistance levels.

Macro Trend: The Expanding Bullish Channel

On the weekly timeframe, a larger expanding bullish channel has been forming. The price is c

Proprietary SupportIn this slowly but continuously updating idea I will be posting an interesting way to analyze charts. It is something old but also new, like duality.

We all know that the stock market continuously grows.

But it doesn't always grow.

For markets lie between worlds.

The reasonable and the unreas

NVIDIA at the Crossroads: Will This Breakout Hold or Fake? Aug 7🧠 Technical Analysis – 1H + 15M Chart

NVDA is testing the upper bound of a symmetrical triangle on the 1-hour chart — a critical spot that could either break for continuation or reject back into the wedge.

* Trendline resistance from previous highs is pressing NVDA around 180.80–181.50.

* Stochastic

NVDA NVIDIA Price Target by Year-EndNVIDIA Corporation (NVDA) remains a dominant force in the AI and semiconductor markets, with its forward price-to-earnings (P/E) ratio currently at 19.37—a reasonable valuation considering its growth trajectory and market position.

NVIDIA’s leadership in the AI sector, particularly through its cutt

$NVDA: Tracking Formations🏛️ Research Notes

Frames of Reference

Interconnection of 3rd degree points fractal hierarchy

Multi-scale Interconnection

Merging into probabilistic layout

Market movement reflects proportional relationships inherent to its own scale. Fibonacci ratios, appear not by accident but as s

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

NVDA4971918

NVIDIA Corporation 3.5% 01-APR-2050Yield to maturity

5.99%

Maturity date

Apr 1, 2050

NVDA4971919

NVIDIA Corporation 3.7% 01-APR-2060Yield to maturity

5.93%

Maturity date

Apr 1, 2060

NVDA4971917

NVIDIA Corporation 3.5% 01-APR-2040Yield to maturity

5.40%

Maturity date

Apr 1, 2040

US67066GAN4

NVIDIA 21/31Yield to maturity

4.46%

Maturity date

Jun 15, 2031

US67066GAE4

NVIDIA 2026Yield to maturity

4.28%

Maturity date

Sep 16, 2026

NVDA4971916

NVIDIA Corporation 2.85% 01-APR-2030Yield to maturity

4.12%

Maturity date

Apr 1, 2030

NVDA5203204

NVIDIA Corporation 1.55% 15-JUN-2028Yield to maturity

3.98%

Maturity date

Jun 15, 2028

See all NVDA bonds

Curated watchlists where NVDA is featured.

Frequently Asked Questions

The current price of NVDA is 15.90 CHF — it hasn't changed in the past 24 hours. Watch NVIDIA stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SIX exchange NVIDIA stocks are traded under the ticker NVDA.

We've gathered analysts' opinions on NVIDIA future price: according to them, NVDA price has a max estimate of 203.47 CHF and a min estimate of 81.39 CHF. Watch NVDA chart and read a more detailed NVIDIA stock forecast: see what analysts think of NVIDIA and suggest that you do with its stocks.

NVDA reached its all-time high on Jan 19, 2024 with the price of 15.90 CHF, and its all-time low was 0.47 CHF and was reached on Nov 13, 2014. View more price dynamics on NVDA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

NVDA stock is 0.00% volatile and has beta coefficient of 2.23. Track NVIDIA stock price on the chart and check out the list of the most volatile stocks — is NVIDIA there?

Today NVIDIA has the market capitalization of 3.62 T, it has increased by 6.27% over the last week.

Yes, you can track NVIDIA financials in yearly and quarterly reports right on TradingView.

NVIDIA is going to release the next earnings report on Aug 27, 2025. Keep track of upcoming events with our Earnings Calendar.

NVDA earnings for the last quarter are 0.67 CHF per share, whereas the estimation was 0.61 CHF resulting in a 9.89% surprise. The estimated earnings for the next quarter are 0.82 CHF per share. See more details about NVIDIA earnings.

NVIDIA revenue for the last quarter amounts to 36.47 B CHF, despite the estimated figure of 35.87 B CHF. In the next quarter, revenue is expected to reach 37.30 B CHF.

NVDA net income for the last quarter is 15.54 B CHF, while the quarter before that showed 20.14 B CHF of net income which accounts for −22.83% change. Track more NVIDIA financial stats to get the full picture.

Yes, NVDA dividends are paid quarterly. The last dividend per share was 0.01 CHF. As of today, Dividend Yield (TTM)% is 0.02%. Tracking NVIDIA dividends might help you take more informed decisions.

NVIDIA dividend yield was 0.03% in 2024, and payout ratio reached 1.16%. The year before the numbers were 0.03% and 1.34% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 12, 2025, the company has 36 K employees. See our rating of the largest employees — is NVIDIA on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. NVIDIA EBITDA is 73.05 B CHF, and current EBITDA margin is 63.85%. See more stats in NVIDIA financial statements.

Like other stocks, NVDA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade NVIDIA stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So NVIDIA technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating NVIDIA stock shows the buy signal. See more of NVIDIA technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.