Key facts today

Amazon's warehouse bonds are falling, with $2.7 billion in Affinius Capital securities trading at 81 cents on the dollar due to refinancing worries and high interest rates.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.78 EUR

57.23 B EUR

616.25 B EUR

9.59 B

About Amazon.com

Sector

Industry

CEO

Andrew R. Jassy

Website

Headquarters

Seattle

Founded

1994

FIGI

BBG000BWBBZ1

Amazon.com, Inc. is a multinational technology company, which engages in the provision of online retail shopping services. It operates through the following segments: North America, International, and Amazon Web Services (AWS). The North America segment offers retail sale of consumer products, including from sellers, advertising, and subscriptions services through North America-focused online and physical stores. The International segment focuses on retail sale of consumer products, including from sellers, advertising, and subscription services through internationally-focused online stores. The AWS segment is composed of global sales of compute, storage, database, and other services for start-ups, enterprises, government agencies, and academic institutions. The company was founded by Jeffrey P. Bezos in July 1994 and is headquartered in Seattle, WA.

Related stocks

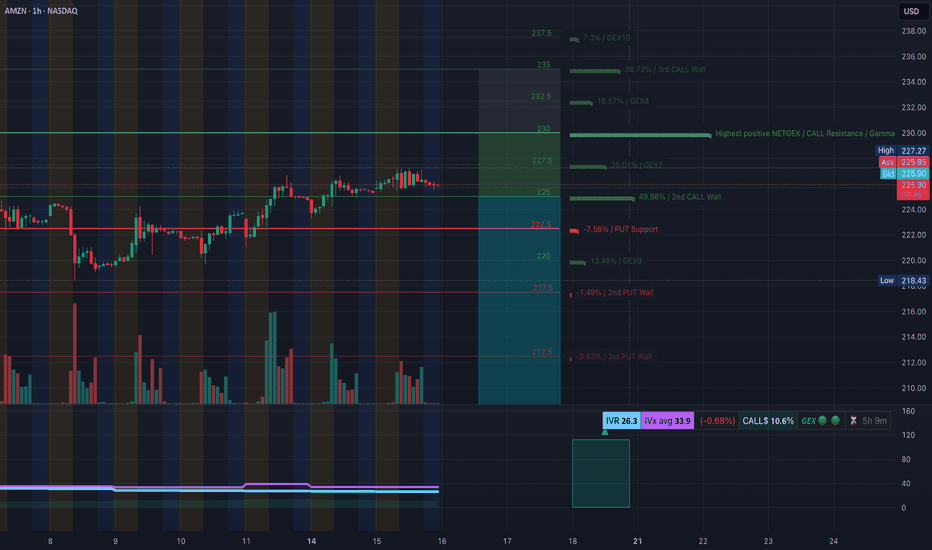

AMZN at a Crossroad! TA for July 16Options & Intraday Trading Setups to Watch This Week 🔍

🧠 GEX Analysis & Options Sentiment (Tanuki)

* GEX Sentiment: Mildly Bullish

* CALLs Volume: 10.6% → Neutral-to-Weak Bullish

* IV Rank (IVR): 26.3 → Low implied volatility rank

* IVx Avg: 33.9 → Neutral options environment

Gamma Walls / Levels t

AMZN Sitting on a Key Launchpad – What’s Next? for July 14🧠 GEX Analysis & Option Strategy:

* Gamma Wall / Resistance: $225

* Next Major Call Walls: $227.5 → $230 → $235

* Call Side Dominance: 13.3% Calls, low IVR at 27.4, IVx avg 38.9

* Put Support: $217.5 / $213.5

* GEX Bias: Mildly bullish bias above $225 — price is floating at Gamma Wall.

🟢 Bullish Opt

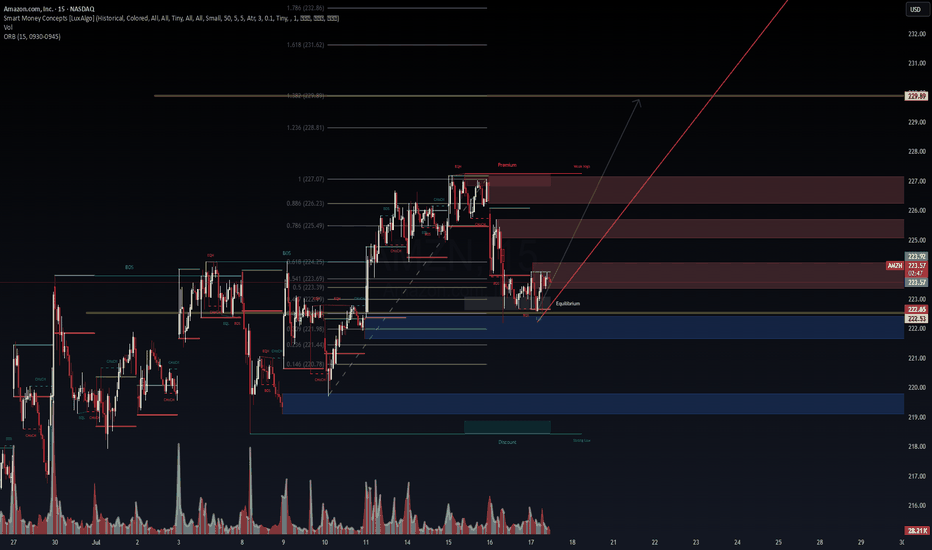

AMZN 15m – Institutional Demand Reclaim in Progress | VolanX Pro📈 AMZN 15m – Institutional Demand Reclaim in Progress | VolanX Protocol Alert

Amazon (AMZN) is staging a potential bullish reversal from a deep discount zone following a strong rejection near the 0.146–0.236 Fibonacci confluence at ~$220.78–221.44. We are now consolidating near the equilibrium zone

Amazon I Strong Bullish Outlook Welcome back! Let me know your thoughts in the comments!

** Amazon Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow

AMZN Near Critical Pivot AMZN Near Critical Pivot – Option Traders, Watch These GEX Levels Carefully!

🧠 GEX Analysis for Options Trading:

Amazon is sitting right below its Gamma Wall at $225, which aligns with the highest positive NETGEX, suggesting a significant resistance zone. There's a clear call wall stack at $227.5 a

AMZN Coiled at Key Gamma Level! Trade Setup Inside📊 GEX (Options Sentiment) Analysis – AMZN

* Current Price: $223.20

* Gamma Wall (Call Resistance): $225 – Highest Net GEX, significant resistance zone.

* CALL Walls: Stack from $225 → $230 → $232.5 → $235

→ Suggests upside resistance builds fast; option sellers may try to cap the rally here.

* PUT W

AMAZON STRONG UPTREND|LONG|

✅AMAZON is going up

Now and the stock made a bullish

Breakout of the key horizontal

Level of 220$ and the breakout

Is confirmed so we are bullish

Biased and we will be expecting

A further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nat

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where AMZ is featured.

Frequently Asked Questions

The current price of AMZ is 194.70 EUR — it has increased by 0.76% in the past 24 hours. Watch AMAZON.COM INC. DL-,01 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange AMAZON.COM INC. DL-,01 stocks are traded under the ticker AMZ.

AMZ stock has risen by 2.03% compared to the previous week, the month change is a 4.14% rise, over the last year AMAZON.COM INC. DL-,01 has showed a 12.37% increase.

We've gathered analysts' opinions on AMAZON.COM INC. DL-,01 future price: according to them, AMZ price has a max estimate of 258.70 EUR and a min estimate of 168.16 EUR. Watch AMZ chart and read a more detailed AMAZON.COM INC. DL-,01 stock forecast: see what analysts think of AMAZON.COM INC. DL-,01 and suggest that you do with its stocks.

AMZ stock is 1.45% volatile and has beta coefficient of 1.36. Track AMAZON.COM INC. DL-,01 stock price on the chart and check out the list of the most volatile stocks — is AMAZON.COM INC. DL-,01 there?

Today AMAZON.COM INC. DL-,01 has the market capitalization of 2.07 T, it has increased by 0.27% over the last week.

Yes, you can track AMAZON.COM INC. DL-,01 financials in yearly and quarterly reports right on TradingView.

AMAZON.COM INC. DL-,01 is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

AMZ earnings for the last quarter are 1.47 EUR per share, whereas the estimation was 1.26 EUR resulting in a 16.38% surprise. The estimated earnings for the next quarter are 1.12 EUR per share. See more details about AMAZON.COM INC. DL-,01 earnings.

AMAZON.COM INC. DL-,01 revenue for the last quarter amounts to 143.89 B EUR, despite the estimated figure of 143.41 B EUR. In the next quarter, revenue is expected to reach 137.56 B EUR.

AMZ net income for the last quarter is 15.83 B EUR, while the quarter before that showed 19.32 B EUR of net income which accounts for −18.07% change. Track more AMAZON.COM INC. DL-,01 financial stats to get the full picture.

No, AMZ doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 19, 2025, the company has 1.56 M employees. See our rating of the largest employees — is AMAZON.COM INC. DL-,01 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. AMAZON.COM INC. DL-,01 EBITDA is 118.23 B EUR, and current EBITDA margin is 19.15%. See more stats in AMAZON.COM INC. DL-,01 financial statements.

Like other stocks, AMZ shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AMAZON.COM INC. DL-,01 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So AMAZON.COM INC. DL-,01 technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating AMAZON.COM INC. DL-,01 stock shows the buy signal. See more of AMAZON.COM INC. DL-,01 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.