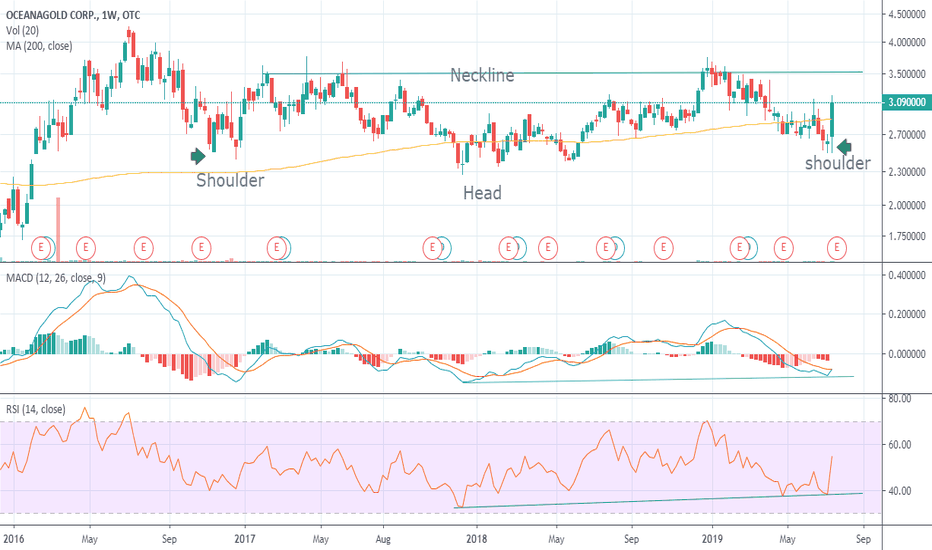

BUY AND ENJOY 24% tARGET @2.58Support *1 - CAD 1.78

Support *2 - CAD 1. 68

Resistance *1 - CAD 2.46

Resistance *2 - CAD 2.59

**Disclaimer - not financial advice, please trade with caution and DYOR. This prediction Based on My Dreams. I am new to this trade and would appreciate your feedback on my analysis.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.74 CAD

256.73 M CAD

1.77 B CAD

229.91 M

About OCEANAGOLD CORPORATION

Sector

Industry

CEO

Gerard Michael Bond

Website

Headquarters

Vancouver

Founded

2003

FIGI

BBG000RG1Q23

OceanaGold Corp. is an intermediate gold and copper producer. The company has a portfolio of four operating mines: the Haile Gold Mine in the United States of America; the Didipio Mine in the Philippines; and the Macraes and Waihi operations in New Zealand. The firm's gold, copper, and silver are essential to the renewable energy and transport sectors, life-saving medical devices, and technology that connects communities around the world. The company was founded in 2003 and is headquartered in Vancouver, Canada.

Related stocks

Gold stocks showing strengthQuite a few gold stocks are showing strength.

All of them have seen-

1. A spike in volume

2. Greater price range for the day

3. New 3-month highs

These indicate a bullish run from Gold stocks, possibly testing previous highs.

Is the fact that gold is a safe haven in bearish markets causing t

OGC Reversal after a long downtrend, great buying opportunityThe last few trading days show that this is a good buying opportunity and stock has probably reversed.

Stochastic shows it climbing up from an oversold position and MACD histograms show that the market is trending positively.

I believe OGC could rise up to its previously long held position of $3.45

OGCA new Zealand Gold mining company. New Zealand's Dollar and Stock market are very strong and this gold mining company has some of the best profit margins of any in the world. If gold markets continue to rally this year like I predict, this could be one of the best companies to hold. Sadly I canno

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of OGC is 19.68 CAD — it has decreased by −0.30% in the past 24 hours. Watch OCEANAGOLD CORPORATION stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on TSX exchange OCEANAGOLD CORPORATION stocks are traded under the ticker OGC.

OGC stock has risen by 3.85% compared to the previous week, the month change is a 2.88% rise, over the last year OCEANAGOLD CORPORATION has showed a 84.79% increase.

We've gathered analysts' opinions on OCEANAGOLD CORPORATION future price: according to them, OGC price has a max estimate of 29.85 CAD and a min estimate of 21.83 CAD. Watch OGC chart and read a more detailed OCEANAGOLD CORPORATION stock forecast: see what analysts think of OCEANAGOLD CORPORATION and suggest that you do with its stocks.

OGC stock is 2.22% volatile and has beta coefficient of 1.62. Track OCEANAGOLD CORPORATION stock price on the chart and check out the list of the most volatile stocks — is OCEANAGOLD CORPORATION there?

Today OCEANAGOLD CORPORATION has the market capitalization of 4.54 B, it has decreased by −1.86% over the last week.

Yes, you can track OCEANAGOLD CORPORATION financials in yearly and quarterly reports right on TradingView.

OCEANAGOLD CORPORATION is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

OGC earnings for the last quarter are 0.60 CAD per share, whereas the estimation was 0.38 CAD resulting in a 59.09% surprise. The estimated earnings for the next quarter are 0.56 CAD per share. See more details about OCEANAGOLD CORPORATION earnings.

OCEANAGOLD CORPORATION revenue for the last quarter amounts to 517.96 M CAD, despite the estimated figure of 498.19 M CAD. In the next quarter, revenue is expected to reach 495.90 M CAD.

OGC net income for the last quarter is 143.05 M CAD, while the quarter before that showed 142.78 M CAD of net income which accounts for 0.19% change. Track more OCEANAGOLD CORPORATION financial stats to get the full picture.

Yes, OGC dividends are paid quarterly. The last dividend per share was 0.01 CAD. As of today, Dividend Yield (TTM)% is 0.64%. Tracking OCEANAGOLD CORPORATION dividends might help you take more informed decisions.

OCEANAGOLD CORPORATION dividend yield was 0.70% in 2024, and payout ratio reached 7.70%. The year before the numbers were 1.07% and 17.06% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 26, 2025, the company has 4.64 K employees. See our rating of the largest employees — is OCEANAGOLD CORPORATION on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. OCEANAGOLD CORPORATION EBITDA is 991.94 M CAD, and current EBITDA margin is 46.03%. See more stats in OCEANAGOLD CORPORATION financial statements.

Like other stocks, OGC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade OCEANAGOLD CORPORATION stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So OCEANAGOLD CORPORATION technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating OCEANAGOLD CORPORATION stock shows the buy signal. See more of OCEANAGOLD CORPORATION technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.