0.17 CAD

−33.58 M CAD

14.39 K CAD

About SPROTT ASSET MANAGEMENT LP

Sector

Industry

CEO

John Anthony Ciampaglia

Website

Headquarters

Toronto

Founded

2011

FIGI

BBG00JR6CQX8

Sprott Physical Platinum & Palladium Trust is a closed-end investment trust, which engages in the investment in physical platinum and palladium bullion. Its objective is to provide a convenient and exchange-traded investment alternative for investors interested in holding physical platinum and palladium bullion without the inconvenience that is typical of a direct investment in physical platinum and palladium bullion. The company was founded on December 23, 2011 and is headquartered in Toronto, Canada.

Related stocks

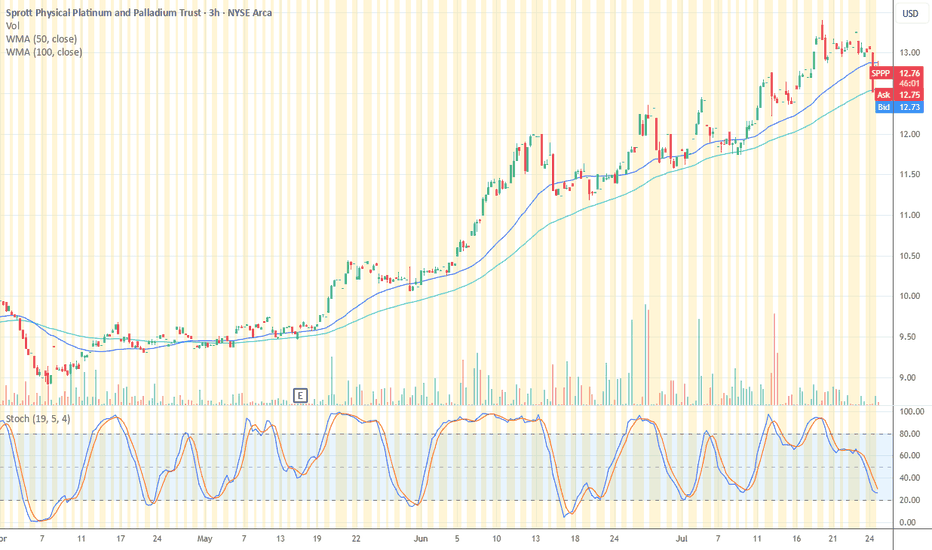

SPPP bottoming for multi year retrace

Several fundamental drivers backing the physical market of platinum and palladium such as institutional positioning, supply constraints, new deposit discoveries declining and misunderstood demand drivers across industrial market. Technicala offer a fairly simple setup based on a multi-year trendl

Platinum having a new bull run?I have been buying SPPP for several years now and have been cost averaging down. Platinum has been in a down trend for years. Finally, it looks like Platinum has bottomed and is in a new uptrend. SPPP has broken a long time downtrend line, popped above it and is now retesting. With gold, silver,

SPPP-SPROTT PHYSICAL PALLADIUM AND PLATINUM PROFITSI made good profits with this in a short time swing trading this etf. I loved it. Why mess with bitcoin crypto or even gold when I can make money with this.. Anyway. Now its in a bear trend and looking to get back into this etf if it shows some promise. As you know the prices for Palladium and Plati

SPPP boom on the horizon? Here's a potential catalyst...Thesis: Russia/Ukraine tensions threaten to disrupt the global supply of Palladium- a precious metal used to produce semiconductor chips. Small chip producers, particularly in smaller countries like Taiwan, companies may not be able to get their hands on enough supply. Palladium prices may increase

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.