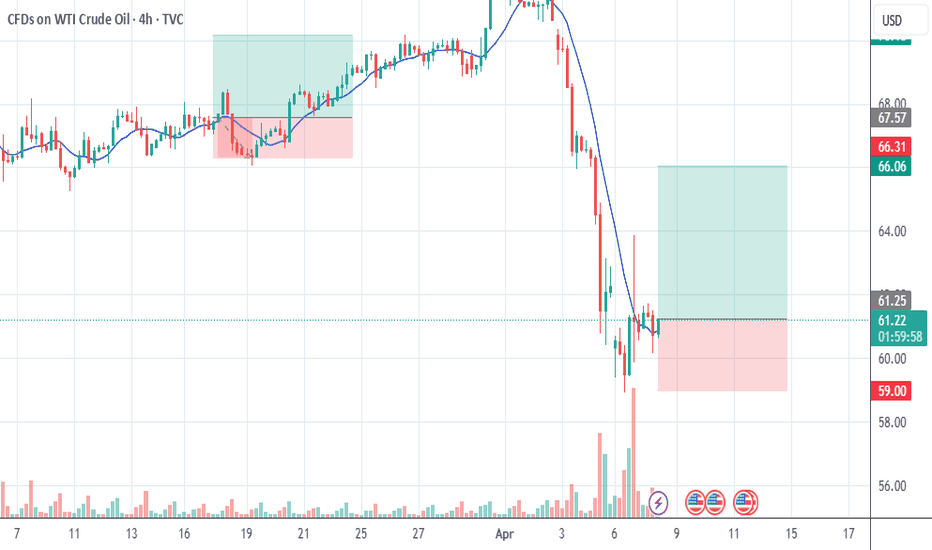

Buy oil! Target 63-65!Crude oil is currently in a short position overall, and the rebound momentum is relatively weak. However, in the short-term structure, oil has shown obvious signs of stopping the decline, and the support of the 60-59 area below is still valid.

After hitting the low point of 58.9, oil began to rebound, and the rebound low gradually shifted upward. At present, oil holds the support near 60, and is expected to build a W-bottom structure in the short-term structure, which is conducive to further rebound of oil prices.

Therefore, in terms of short-term trading, you can try to go long on crude oil in the 60.5-59.5 area, and the rebound target will first look at 63, followed by 65

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

USCRUDEOILCFD trade ideas

Plotted by TrumpI’ve been telling people that this is just a panic sell that people are doing, just keep your position no matter which price it goes to. 55,50,45,40. Its okay because ive advised to buy crude without leverage for investing. Its time to buy more actually!

I got some more positions yesterday, and might get another if it falls to 55. 👌

Keep it up because our trades will be profitable😁

WTI CRUDE OIL: Potential bottom and massive rebound to 71.00.WTI Crude Oil got oversold on its 1D technical outlook (RSI = 31.096, MACD = -1.620, ADX = 38.232) but is recovering its 1W candle now as it hit the bottom (LL) of the 1 year Channel Down. If the 1W candle makes a green closing, we will consider this a bottom, as the 1W RSI is also on its LL trendline) and go for a long aimed as the previous one at the 0.618 Fibonacci (TP = 71.00).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

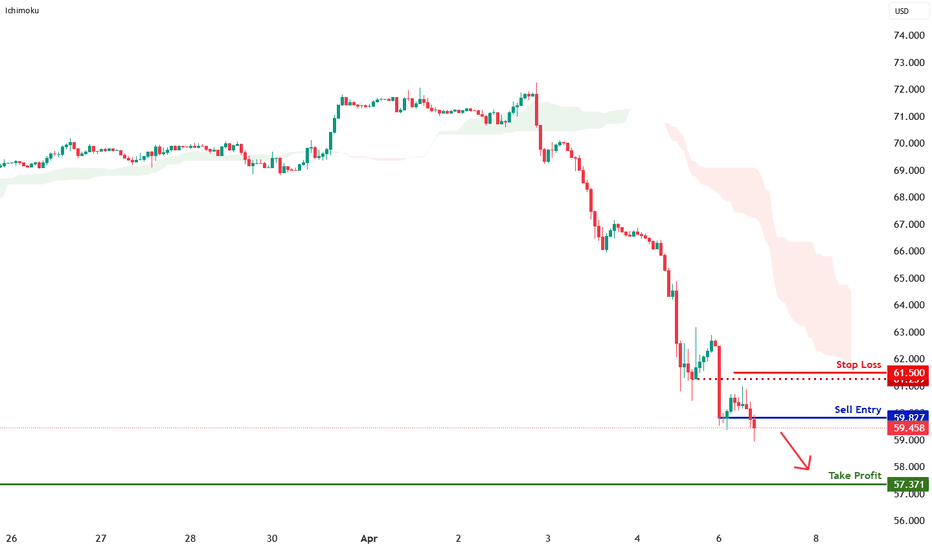

WTI Oil H1 | Bearish downtrend to extend further?WTI oil (USOIL) could rise towards a pullback resistance and potentially reverse off this level to drop lower.

Sell entry is at 59.52 which is a pullback resistance.

Stop loss is at 61.50 which is a level that sits above a pullback resistance.

Take profit is at 57.37 which is a swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Trump Goes "The Peacemaker", as Crude Oil Turns Gradually LowerThe notion that crude oil prices might decrease due to an abatement of the Ukraine's war not seems to be counterintuitive, as the conflict has historically led to increased oil prices due to supply disruptions and geopolitical tensions.

There are several factors that could contribute to a decrease in oil prices if tensions were to ease.

Factors Contributing to Decreased Oil Prices:

Easing of Sanctions on Russia: If tensions between the U.S. and Ukraine were to ease, it might lead to a relaxation of sanctions on Russia, potentially allowing more Russian oil to enter the global market. This increase in supply could help reduce prices.

Market Perception of Reduced Conflict: The market might perceive a decrease in conflict as a sign of reduced risk to global oil supplies, leading to lower prices. This perception could be influenced by expectations of increased oil availability from Russia and other regions.

OPEC Production Increases: If OPEC decides to increase production, as it has recently done, this could add more oil to the market, further pressuring prices downward.

Global Economic Concerns: Economic slowdowns or concerns about global growth can reduce demand for oil, leading to lower prices. The Ukraine conflict has contributed to economic uncertainty, and its abatement might not necessarily increase demand if global economic concerns persist.

Fundamental considerations

Well, in early March 2025, oil prices fell due to a combination of factors, including tensions between the U.S. and Ukraine and OPEC's decision to gradually increase output. Brent crude fell to around $71.08 per barrel, and WTI to about $68.01 per barrel.

Impact of Sanctions: Despite sanctions not directly targeting Russian oil, they have affected its exports by limiting financing and causing some buyers to avoid Russian crude. Easing these sanctions could increase Russian oil exports, potentially lowering global prices.

Market Dynamics: The war in Ukraine initially caused oil prices to surge due to supply concerns. However, if the conflict were to abate, market dynamics could shift, leading to decreased prices as supply risks diminish and global economic factors come into play.

Post war challenge

Crude oil and gasoline prices today are moderately lower, but crude oil tends to breakthrough a long-term 3 - to - 4 years low.

Crude oil prices are under pressure as US tariff uncertainty weighs on the outlook for energy demand.

Also, ramped-up Russian oil exports boost global supplies and are negative for prices.

In addition, crude prices have some negative carryover from Wednesday when weekly EIA crude inventories rose more than expected to a 7-month high.

Conclusion

In summary, while the Ukrainian war has historically driven oil prices up due to supply disruptions and geopolitical tensions, an easing of tensions could lead to decreased prices through increased supply, reduced market risk, and global economic factors.

--

Best 'Peacemaking' wishes,

@PandorraResearch Team 😎

WTI Breaks Flat Support – Eyes on $58.45WTI has completed a textbook flat continuation pattern with a bearish engulfing candle slicing below $65.40 support.

Price is now hovering near $60, with downside momentum targeting $58.45 and $56.50 next.

RSI remains deeply oversold near 26, hinting at potential for a relief bounce. However, as long as price stays below the 50 EMA ($69.05), bearish bias remains intact.

Market Analysis: WTI Crude Oil Crashes As Trade War EscalatesMarket Analysis: WTI Crude Oil Crashes As Trade War Escalates

WTI Crude oil is down over 10% and remains at risk of more losses.

Important Takeaways for WTI Crude Oil Prices Analysis Today

- WTI Crude oil prices extended downsides below the $65.00 support zone.

- A major bearish trend line is forming with resistance near $60.70 on the hourly chart of XTI/USD at FXOpen.

WTI Crude Oil Price Technical Analysis

On the hourly chart of WTI Crude Oil at FXOpen, the price struggled to continue higher above $72.00 against the US Dollar. The price formed a short-term top and started a fresh decline below $70.00.

There was a steady decline below the $65.60 pivot level. The bears even pushed the price below $62.20 and the 50-hour simple moving average. Finally, the price tested the $59.20 zone. The recent swing low was formed near $59.21, and the price is now consolidating losses.

There was a minor move above the $60.00 level. On the upside, immediate resistance is near the $60.70 level. There is also a major bearish trend line forming with resistance near $60.70.

The next resistance is near the $62.20 level and the 23.6% Fib retracement level of the downward move from the $71.97 swing high to the $59.21 low. The main resistance is near a trend line at $65.60.

The 50% Fib retracement level of the downward move from the $71.97 swing high to the $59.21 low is also near $65.60. A clear move above the $65.60 zone could send the price toward $68.70. The next key resistance is near $71.85. If the price climbs further higher, it could face resistance near $72.20. Any more gains might send the price toward the $75.00 level.

Immediate support is near the $59.20 level. The next major support on the WTI crude oil chart is near $58.00. If there is a downside break, the price might decline toward $55.00. Any more losses may perhaps open the doors for a move toward the $52.00 support zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USOIL - ANALYSIS👀 Observation:

Hello, everyone! I hope you're doing well. I’d like to share my analysis of WTI Crude Oil (U.S. Oil) with you.

Looking at the WTI Crude Oil chart, we are currently in a 6-month price range, and right now, we're at the lower boundary of this range. I have two scenarios for oil:

Bullish Scenario: We might see a price increase from here towards 85.30 on the higher timeframes.

Bearish Scenario: If we close below 61.70 on the monthly timeframe, I expect a significant decline in price towards 41.62.

📉 Expectation:

Bullish Scenario: Price may rise to 85.30.

Bearish Scenario: If price closes below 61.70, expect a decline to 41.62.

💡 Key Levels to Watch:

Support: 61.70

Resistance: 85.30

💬 What are your thoughts on WTI Crude Oil this week? Let me know in the comments!

Trade safe

Crude Oil: A Major Breakdown in the Making?Last Friday, April 4th, 2025, crude oil decisively broke below a key long-term support level that had held strong since late November 2021.

This significant downside breakout, if confirmed, could mark a major shift in the oil market structure — potentially opening the door for a deeper decline.

Based on Elliott Wave analysis, it appears that wave B has been completed in the form of a contracting triangle, and we are now likely entering wave C. According to Fibonacci projections, wave C could extend down toward the $41–$44 range, which represents roughly a 28% drop from current levels.

From a chart pattern perspective, price action has also broken down from a descending triangle — a classic bearish pattern — with a projected target that aligns closely with the Elliott Wave count around $44.

Moreover, this entire bearish move, which began in early June 2022, fits neatly within a descending channel — further validating the confluence of technical signals.

Breaking below such a well-established support zone alone could be a strong bearish signal. But when this is backed by Elliott Wave structure, pattern projection, and broader macroeconomic concerns, it suggests a high-probability short opportunity in crude oil.

USOIL: Long Trade with Entry/SL/TP

USOIL

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy USOIL

Entry Level - 62.27

Sl - 60.60

Tp - 65.58

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

WTI Crude Oil AnalysisHello traders,

After analyzing the current price action, I believe WTI remains bearish in the mid-to-long term. However, in the short term (next few sessions), we might see a temporary bullish correction, as the RSI is signaling oversold conditions.

Since late September 2023, WTI has been in a steady downtrend—clearly visible through the purple trendline—and recently hit its lowest level since early 2023. I'm watching the $66–$67 zone closely: if price reaches but fails to break above it, the downtrend is likely to resume. However, a clean breakout above that range could indicate a potential bullish reversal heading into next week.

This view is based on RSI and key support/resistance zones.

📉 Bearish bias mid/long term

📈 Short-term bounce likely

📍 Key zone to watch: $66–$67

Let me know your thoughts in the comments — are you bullish or bearish on WTI?

Not financial advice — just sharing my personal analysis.

WTI Breakout LowerWTI shed nearly 10% last week and tested levels not seen since early 2021. As a result, the downside move punctured the lower boundary of a descending triangle formation on the weekly chart, extended from a high of US$95.01 and a low of US$64.34. Technically, this opens the door to possible bearish scenarios in the weeks to come toward a decision point zone at US$51.38-US$53.92. With that in mind, if you drill down to the H1 timeframe, you will note a bearish decision point zone formed at the lower boundary of the weekly chart’s descending triangle at US$64.90-US$64.24. This could be a location that traders look to fade from in the event of a pullback-retest play unfolding this week.

Written by FP Markets Chief Market Analyst Aaron Hill

Crude OIL CRASH - OPEC & Trump - Recession Catalyst#Recession is here, Markets are bleeding.

Crude #Oil is the kicker.

I shorted TVC:USOIL on Friday.

Hunting on this trade for a while now.

Very #Bearish outlook on #WTI.

MARKETSCOM:OIL Weekly

#FundamentalAnalysis

- #OPEC+ Output Hike (411K bpd)

- #Trump #Tariffs & #TradeWar

I'm looking at a #CrudeOIL #MarketCrash, similar to the #Covid era, when NYMEX:CL1! went in minus on #Nymex #Futures.

TVC:USOIL & my BIG SHORT

#Trading EASYMARKETS:OILUSD via CFDs with #Leverage.

Executed my #Sell Position on #WTI at $64.

* DYOR before, it's not a financial advice, I just share.

#TechnicalAnalysis

- #ElliottWave Impulse Cycle a (white)

- #Correction in Primary ABC (red)

- #LeadingDiagonal in Primary A (red)

- #Descending Triangle in Primary B (red)

Why will BLACKBULL:WTI Crash?

#Bearish Primary C (red) has started.

#Break-out below the Triangle Flat Line.

Important Note:

The #Bearish #Impulse will continue lower.

After the short-lived pull-back, Sellers will dominate.

$63-64 Range is the Entry.

MARKETSCOM:OIL Daily

TVC:USOIL #Short #TradeSignal

- Entry @ $63-64 Range

- SL @ $73

- TP1 @ $40

- TP2 @ $30

- TP3 @ $20

Stay in the green and many pips ahead!

Richard (Wave Jedi)