CVX: Chevron stock slidingPresident Trump policies to support oil companies aiming to increase oil supply in the market and hence to reduce oil prices not to increase it, which mean lower margins for oil companies.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

Key facts today

Chevron is set to resume its supply deal with Valero Energy for Venezuelan crude oil, following a new U.S. license. Shipments of 50,000 barrels per day are expected to start this month.

Chevron's stock rose 0.8% as crude prices bounced back from a five-week low, influenced by U.S. tariff threats on India's Russian crude imports and a significant drop in U.S. crude inventories.

Chevron's acquisition of Hess has led to Hess's removal from the S&P 500, highlighting Chevron's influence in the energy sector and its growth through acquisitions.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.60 EUR

17.06 B EUR

186.89 B EUR

2.04 B

About Chevron Corporation

Sector

Industry

CEO

Michael K. Wirth

Website

Headquarters

Houston

Founded

1879

FIGI

BBG00GQ6S109

Chevron Corp. engages in the provision of administrative, financial management, and technology support for energy and chemical operations. It operates through the Upstream and Downstream segments. The Upstream segment consists of the exploration, development, and production of crude oil and natural gas, the liquefaction, transportation, and regasification associated with liquefied natural gas, the transporting of crude oil by major international oil export pipelines, the processing, transporting, storage, and marketing of natural gas, and a gas-to-liquids plant. The Downstream segment consists of the refining of crude oil into petroleum products, the marketing of crude oil and refined products, the transporting of crude oil and refined products by pipeline, marine vessel, motor equipment, and rail car, and the manufacturing and marketing of commodity petrochemicals and plastics for industrial uses and fuel & lubricant additives. The company was founded on September 10, 1879 and is headquartered in Houston, TX.

Related stocks

CVX Earnings Trade Setup — August 1, 2025

## 🚨 CVX Earnings Trade Setup — August 1, 2025 🚨

🔍 **Chevron (CVX) Earnings Analysis | High Conviction Call Play**

### 🧠 Model Consensus (Multi-LLM Blend)

* 📉 **Revenue Trend:** -1.0% TTM growth, margin pressure from falling oil

* 📈 **Analyst EPS Expectation:** \$11.04 with 26.2% YoY growth est

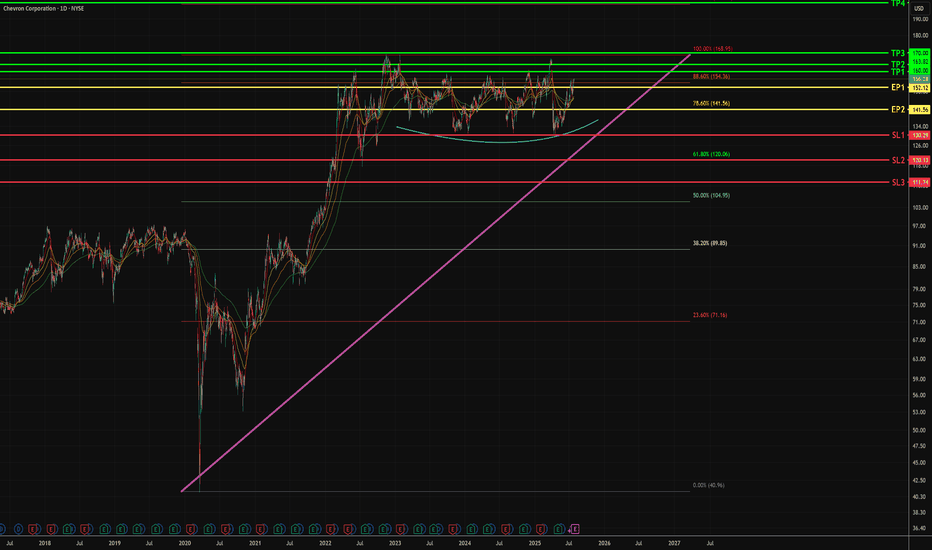

CVX - Potential Swing Upside - Mid TermTimeline - now to 3 months

1. Bullish flag pattern sustained, form during Oct 2021.

2. Rounding bottom above 1D resistance at $130

- Last close is above Fib 88.6% - $154.36

- In the 2 days, weak selling pressure is noticed.

3. More attempts to break 88.6% Fib level opposed to $130 support line

CVX Trade Setup — Catch the Bounce + Dividend PlayChevron ( NYSE:CVX ) is setting up for a potential bounce from strong support around $134.96 (S2 level). The trade aligns with both technical and fundamental tailwinds:

🟢 Technical Setup:

Holding just above S2, showing signs of base formation.

Clear risk/reward box:

Entry: ~$135

Target: $150.05 →

CVX – Waiting for Pullback to 0.382 Before Targeting Gap FillsChevron (CVX) recently broke structure to the upside after holding a 1D demand zone near $136.

I'm now watching for a pullback toward the 0.382 retracement (~$141.80) of the recent impulse. This level aligns with the breakout area and offers a potential continuation setup.

🎯 Trade Setup:

Bias: Lon

Bullish Outlook: Key Levels Signal Upside PotentialTargets:

- T1 = $140.50

- T2 = $144.00

Stop Levels:

- S1 = $134.50

- S2 = $133.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where CVX is featured.

Big Oil: Integrated energy companies

10 No. of Symbols

Oil stocks: Liquid black gold

6 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of CVX is 132.18 EUR — it has increased by 0.21% in the past 24 hours. Watch CHEVRON CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on VIE exchange CHEVRON CORP stocks are traded under the ticker CVX.

CVX stock has fallen by −3.10% compared to the previous week, the month change is a 4.22% rise, over the last year CHEVRON CORP has showed a −1.03% decrease.

We've gathered analysts' opinions on CHEVRON CORP future price: according to them, CVX price has a max estimate of 160.71 EUR and a min estimate of 107.14 EUR. Watch CVX chart and read a more detailed CHEVRON CORP stock forecast: see what analysts think of CHEVRON CORP and suggest that you do with its stocks.

CVX stock is 1.77% volatile and has beta coefficient of 0.55. Track CHEVRON CORP stock price on the chart and check out the list of the most volatile stocks — is CHEVRON CORP there?

Today CHEVRON CORP has the market capitalization of 270.73 B, it has decreased by −2.19% over the last week.

Yes, you can track CHEVRON CORP financials in yearly and quarterly reports right on TradingView.

CHEVRON CORP is going to release the next earnings report on Oct 24, 2025. Keep track of upcoming events with our Earnings Calendar.

CVX earnings for the last quarter are 1.50 EUR per share, whereas the estimation was 1.47 EUR resulting in a 2.07% surprise. The estimated earnings for the next quarter are 1.69 EUR per share. See more details about CHEVRON CORP earnings.

CHEVRON CORP revenue for the last quarter amounts to 38.05 B EUR, despite the estimated figure of 37.24 B EUR. In the next quarter, revenue is expected to reach 40.34 B EUR.

CVX net income for the last quarter is 2.11 B EUR, while the quarter before that showed 3.24 B EUR of net income which accounts for −34.66% change. Track more CHEVRON CORP financial stats to get the full picture.

Yes, CVX dividends are paid quarterly. The last dividend per share was 1.52 EUR. As of today, Dividend Yield (TTM)% is 4.36%. Tracking CHEVRON CORP dividends might help you take more informed decisions.

CHEVRON CORP dividend yield was 4.50% in 2024, and payout ratio reached 67.08%. The year before the numbers were 4.05% and 53.14% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 6, 2025, the company has 45.3 K employees. See our rating of the largest employees — is CHEVRON CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. CHEVRON CORP EBITDA is 28.42 B EUR, and current EBITDA margin is 18.85%. See more stats in CHEVRON CORP financial statements.

Like other stocks, CVX shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade CHEVRON CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So CHEVRON CORP technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating CHEVRON CORP stock shows the sell signal. See more of CHEVRON CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.