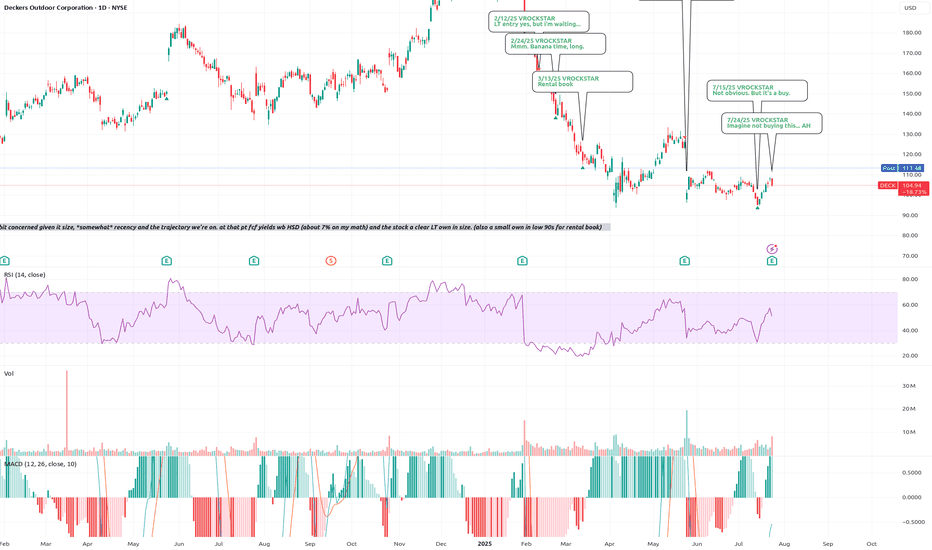

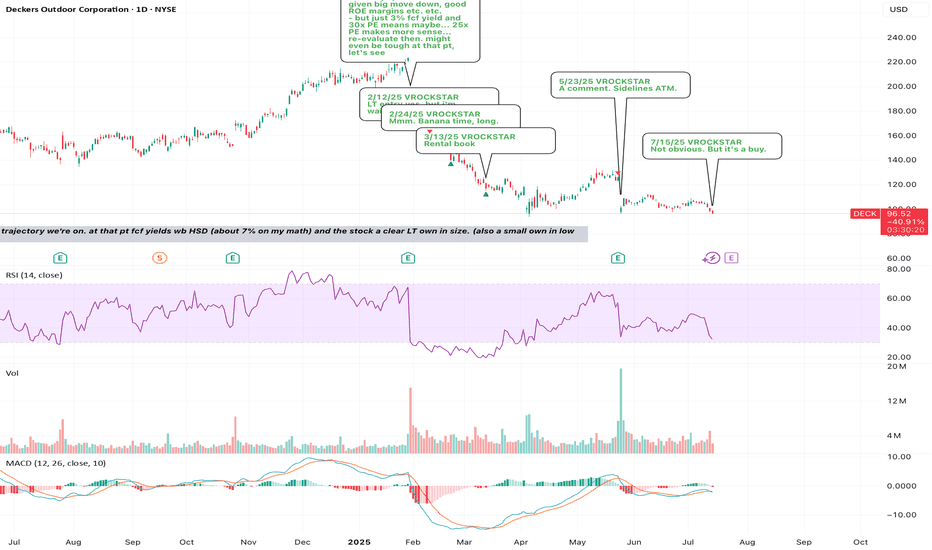

8/1/25 - $deck - 50% position8/1/25 :: VROCKSTAR :: NYSE:DECK

50% position

- if you have followed long enough, you know that when i write this sort of thing, it's maybe 5-10x a year, at most

- i still think anything can happen here in the mkt, so there are a lot of arrangements i've made in my portfolio to account for furth

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.54 EUR

893.00 M EUR

4.61 B EUR

145.80 M

About Deckers Outdoor Corporation

Sector

Industry

CEO

Stefano Caroti

Website

Headquarters

Goleta

Founded

1973

FIGI

BBG01T4QR4P8

Deckers Outdoor Corp. engages in the business of designing, marketing, and distributing footwear, apparel, and accessories developed for both everyday casual lifestyle use and high performance activities. It operates through the following segments: UGG Brand, HOKA Brand, Teva Brand, Sanuk Brand, Other Brands, and Direct-to-Consumer. The UGG Brand segment offers a line of premium footwear, apparel, and accessories. The HOKA Brand segment sells footwear and apparel that offers enhanced cushioning and inherent stability with minimal weight, originally designed for ultra-runners. The Teva Brand segment focuses on the sport sandal and modern outdoor lifestyle category, such as sandals, shoes, and boots. The Sanuk Brand segment originated in Southern California surf culture and has emerged into a lifestyle brand with a presence in the relaxed casual shoe and sandal categories. The Other Brands segment includes the Koolaburra by UGG brand. The Direct-to-Consumer segment consists of retail stores and e-commerce websites. The company was founded by Douglas B. Otto in 1973 and is headquartered in Goleta, CA.

Related stocks

8/8/25 - $deck - Don't fud yo hoka8/8/25 :: VROCKSTAR :: NYSE:DECK

Don't fud yo hoka

- idk why 7+% fcf yield, buybacks, 35%+ ROICs, growth in 2H (worst behind us) and growing HSD++ is unattractive in this tape

- but i'll take the over here

- here's the deal... NASDAQ:CROX result was pretty bad. but honestly even that thing's a

7/30/25 - $deck - Degen time.7/30/25 :: VROCKSTAR :: NYSE:DECK

Degen time.

- look at the last NYSE:ANF report... and tell me you're not noticing the exact same pattern. massive rip. massive gap fill retrace.

- do we re-test pre-report levels mid to low $100s?

- that's what keeps me buying ITM leaps here, but going quite la

7/28/25 - $deck - De risked, a few ways to play7/28/25 :: VROCKSTAR :: NYSE:DECK

De risked, a few ways to play

- mid teens PE

- 2 brands hitting on all strides (pun intended)

- great result, everyone offsides

- the action you're seeing here is MM re-adjusting post pop

- can buy spot/ sell covered calls for healthy mid 40s IV and roll

- my sen

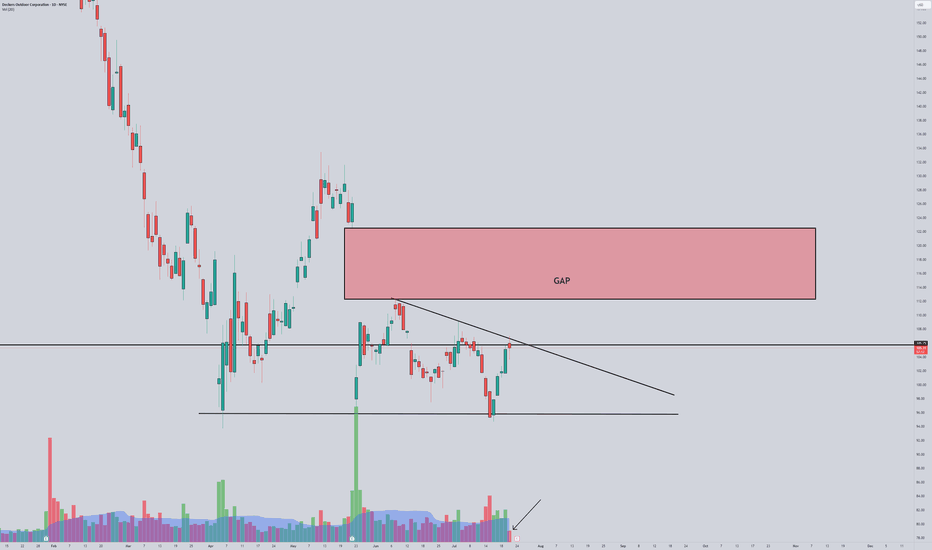

DECK - Is the GAP fill inevitable?📰 Deckers Outdoor (DECK) — Technical & Macro Update

Ticker: DECK | Chart Timeframe: 30‑minute | Current Price: ~$117

Sector: Footwear & Apparel

Date: July 26, 2025

⚡ Market Recap

Deckers made waves this week with a strong mix of earnings momentum and analyst reactions:

👟 Blowout Q1 Earnings: Reven

7/24/25 - $deck - Imagine not buying this... AH7/24/25 :: VROCKSTAR :: NYSE:DECK

Imagine not buying this... AH

- amazing to listen to the mental degradation of "sell side analysts".

- the quarterly ritual when real shareholders must endure management answering the room temperature IQ questions from these "research" providers is a circus

- r

Long $DECK - NYSE:DECK is the only growth story I'm comfortable buying. This was wall street darling for many years. I believe sell off was overdone.

- It has lot of room to run. It is getting traction and NYSE:NKE because of law of large number is not growing much in %age.

- However, NYSE:DECK has l

7/15/25 - $deck - Not obvious. But it's a buy.7/15/25 :: VROCKSTAR :: NYSE:DECK

Not obvious. But it's a buy.

- will reiterate that i'm not on tape so closely this week, but will revert w any comment replies by next week; nevertheless i'm checking in here on the tape

- see what T did today on NVDA/ China?

- you think it's easier or harder to

BUY Deck!!!This is a good opportunity to look out for. We can see that market structure is clearly inducing early buyers to perhaps wipe them out with another bearish leg down to our major demand level.

Looking to set some buy orders at our next major zone to ride this stock up to previous all time highs.

G

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Curated watchlists where DECK is featured.

Frequently Asked Questions

The current price of DECK is 86.36 EUR — it has decreased by −1.08% in the past 24 hours. Watch DECKERS OUTDOOR CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on VIE exchange DECKERS OUTDOOR CORP stocks are traded under the ticker DECK.

DECK stock has fallen by −6.72% compared to the previous week, the month change is a −3.85% fall, over the last year DECKERS OUTDOOR CORP has showed a −18.18% decrease.

We've gathered analysts' opinions on DECKERS OUTDOOR CORP future price: according to them, DECK price has a max estimate of 135.54 EUR and a min estimate of 83.21 EUR. Watch DECK chart and read a more detailed DECKERS OUTDOOR CORP stock forecast: see what analysts think of DECKERS OUTDOOR CORP and suggest that you do with its stocks.

DECK reached its all-time high on May 12, 2025 with the price of 117.56 EUR, and its all-time low was 81.44 EUR and was reached on Jul 16, 2025. View more price dynamics on DECK chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

DECK stock is 1.92% volatile and has beta coefficient of 1.52. Track DECKERS OUTDOOR CORP stock price on the chart and check out the list of the most volatile stocks — is DECKERS OUTDOOR CORP there?

Today DECKERS OUTDOOR CORP has the market capitalization of 12.93 B, it has decreased by −2.10% over the last week.

Yes, you can track DECKERS OUTDOOR CORP financials in yearly and quarterly reports right on TradingView.

DECKERS OUTDOOR CORP is going to release the next earnings report on Oct 23, 2025. Keep track of upcoming events with our Earnings Calendar.

DECK earnings for the last quarter are 0.79 EUR per share, whereas the estimation was 0.58 EUR resulting in a 36.11% surprise. The estimated earnings for the next quarter are 1.35 EUR per share. See more details about DECKERS OUTDOOR CORP earnings.

DECKERS OUTDOOR CORP revenue for the last quarter amounts to 818.80 M EUR, despite the estimated figure of 764.34 M EUR. In the next quarter, revenue is expected to reach 1.21 B EUR.

DECK net income for the last quarter is 118.17 M EUR, while the quarter before that showed 139.96 M EUR of net income which accounts for −15.57% change. Track more DECKERS OUTDOOR CORP financial stats to get the full picture.

No, DECK doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 10, 2025, the company has 5.5 K employees. See our rating of the largest employees — is DECKERS OUTDOOR CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. DECKERS OUTDOOR CORP EBITDA is 1.09 B EUR, and current EBITDA margin is 25.21%. See more stats in DECKERS OUTDOOR CORP financial statements.

Like other stocks, DECK shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade DECKERS OUTDOOR CORP stock right from TradingView charts — choose your broker and connect to your account.