TradeTheIndex

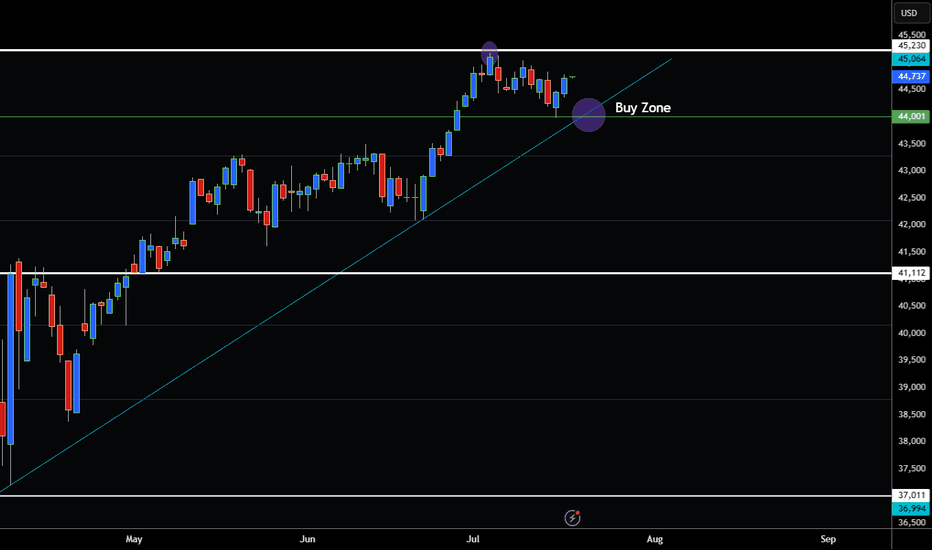

EssentialHey Traders so today was looking at the DOW and it is showing strong uptrend as Stock Indices normally move in tandem. So now that the Nasdaq and S&P500 have broken all time high I believe it only makes sense for the DOW to do so also. However seems to be lagging behind for the moment. So therefore I think it's a good buy the dip if market can pullback to the...

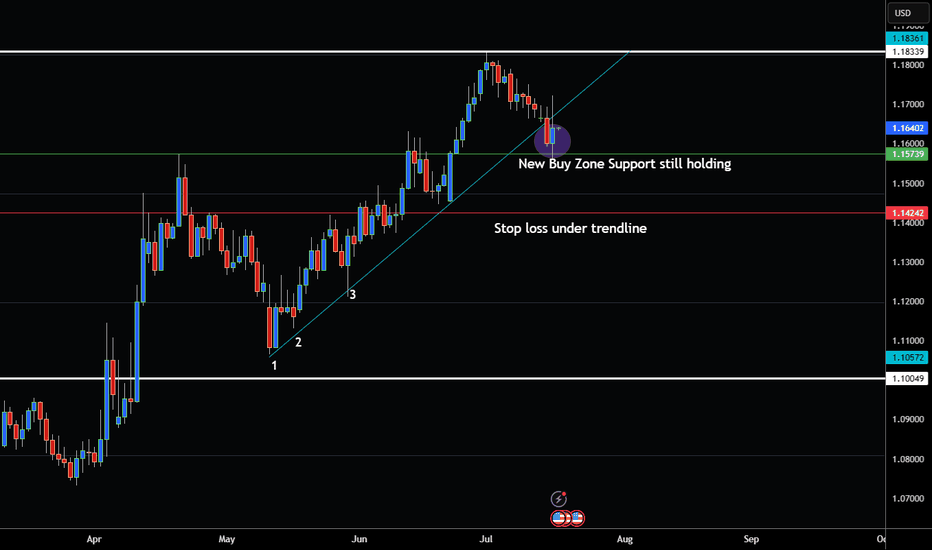

Hey Traders so looking at Euro still looks bullish but again markets can change on a dime so always be cautious because we need to be good at defense just as much as offense in this game of trading. Some say US Dollar may bottomed some say it's still going to weaken regardless of what do news says what can the charts show us? I see a support level of 1.1573...

Hey Traders wow just a few week ago I was watching to see if it was going to pullback instead smashes above all time high. Thats how quick these markets can change in the blink of an eye! Lesson here (Always Expect the Unexpected in the Markets!) 😁 Ok so now we have channel breakout above resistance at 112,100. About 70% of the time market will retest this level...

Hey Traders so looking at Gold right now seems like we are consolidating at 3310 looking for direction. However I think the trend is still up because if you look close at support levels 3240 it has rejected that level twice. Of course markets can flip on a dime when something unpredictable happens in this tariff driven environment so we still need to be...

Hey Traders taking a look at the S&P500 this week it is clear that we are in a strong bull market. Notice that we broke above 6300 on the ES Futures Contract last week on July 3. This level is extremely important because it was the all time high from Feburary 2025. So now that the market has closed above this level buying opportunities can be considered at the...

Hey Traders so today we are looking at Bitcoin currently trading in narrow sideways channel. But looking like strong support at 100,431 notice how on June 22 could not close below it. Also notice on May 8 that was the same area for strong rally. So I think a good place to get back in this market would be half the daily candle on June 23 or a price of 103,150 or...

Hey Traders so today in part 2 wanted to go over more about how to read the report, and what it means when you see changes in positioning. Enjoy! Hope This Helps Your Trading 😃 Clifford

Hey Traders so today watching S&P500 and looks like strong resistance at 6300. Market can do 1 of 3 things like before. Pause, Reverse, or Breakthrough so if your long watch for reversals. If not watch for pullback to new support level around 6135. Can be a nice area to enter new long positions in the buy zone. Place stops under trendline around 6040. Remember...

Hey traders so continuing to watch the Euro. Don't you just love it when a trade plan comes together and everything goes as you expect? Don't get too excited normally we only get our forecasts right around 50% of the time! However this one is working out well so far so now where to from here? The Trend is your Friend until it bends or breaks. Same plan wait...

Hey Traders so looking today at the Nasdaq 100 it's looking really bullish confirmed with 3 bar trendline. However we are now approaching resistance of this all time high at 22,820 after bounce off support at around 21,500. So I believe it's a good place to buy on pullback to trendline at around 21,900. This level is 50% of the last big candle with is showing...

Hey Traders so looking at Gold as we can see it has now pulled back to the trendline and is testing support at $3300 level. So if bullish now is the time to buy it with a stop loss under support at 3237 or even maybe even 3200. Also Seasonally Gold normally bottoms in the Summer around July or August. Imo a wide stop is need to let the market breathe we don't...

Hey Traders so here we can see that it's building support levels and holding. So imo this is a bullish sign if Nasdaq 100 continues to rise I think it should push Russell higher as Nasdaq normally leads the market. So if you are bullish make sure you put your stop below a good support level. If bearish I would wait until market breaks serious support like 2030...

Hey traders so today we are going to look at the Austrailian Dollar which is now in chart pattern called a Symetrical Triangle. So how do we know which way to trade the market right now? We don't so why guess when instead we can wait for the market to confirm which way it wants to go. These are normally known as a consolidation patterns, and normally they...

Looking very bullish Plus bounced off support recently at 1.457. However watch out for resistance at 1.158 it could pause, reverse or break through. Of course daily close above resistance would be a very strong bullish trend continuation sign. Always use Risk Management! (Just in case your wrong in your analysis most experts recommend never to risk more than...

Hey Traders so today I wanted to start a 3 part series on how to use the Commitment of Traders report to help you in your trading. Enjoy! Hope This Helps Your Trading 😃 Clifford

Hey Traders so today continuing previous chart on Russell 2000 so as you can see markets always do eventually pull back most of the time. So what now? Well support at 2127 seems to want to hold. FED meeting tommorow of course could change that. Always expect the unxepected in trading! I am bullish Russell and the other Indexes also Nasdaq 100 seems to be...

Hey Traders today was checking out the Russell 2000 again and it's bullish momentum is increasing fast. But it's looking a little overbought now and so are the other indexes it's been an nice leg up so far and Im not saying it can't continue but remember what goes up must come down eventually. In the stock market it's called a correction for those who may be...

Hey Traders so today was watching Euro it is in strong uptrend confirmed with my favorite 3 bar trendline. So normally best way to trade the trend is buy when it pulls back to the trendline. I like to use a candle that might hold support around 1.1457 but we also have strong high at 1.576 So aggressive entry would be to buy at that pullback 1.1457-1.1475 wide...