If you put $1000 into Bitcoin last year, you would now have...Sorry for pooperino sounderino :(

If you put $1000 in Bit-con 1 year ago you would now have 170$ :)

Happy anniversary ATH Bitcoin ponzi.

How normal markets behave:

How a ponzi behaves:

So unlike normal markets here we have:

* Negative sum (FX null sum stocks positive sum)

* The whole system depends on miners which either: A) Get paid in crypto for running the system, that they sell and drop the price. B) Get paid in crypto for running the system, which they hold greedily until they have a fat stack that could single handedly crash the entire system.

* 99% of crypto existance is based on exchanges. Bitcoin was nothing before MtGox. People go to crypto exhanges to buy and sell. Unlike normal markets, these exchanges ar enot neutral. At all. Arthur Hayes is a crypto early investor and "believer" for crying out loud. They hold bags and have a 100% full clear conflict of interest. Also, if this ponzi collapses, their businesses likely die (unless theystart diversifying quick but all these names... like they can all make the transition to Forex or something else). The people running the show are dependent on it not crashing, or as slowly as possible. They are not regulated too. It is in their interest to keep this alive as long as possible.

WHAT COULD POSSIBLY GO WRONG? :D

Leprous - Contaminate me. Coldplay - Fix you.

BTC-M

Bitcoin Whales And Their Bots Controlling The MarketA few days ago i said i would make an educational analysis about that pattern i saw a few days, something i have seen many MANY times this year. Especially since May until September this year. What do we see here:

After breakouts like we had a few days, where we see a squeeze up happen within 1 or 2 minutes, then we see a dump happen just as fast and usually around 50% of the up move. The most important factor, is the speed of the push down. These are bots in action because nobody can react that fast AND feel so confident to push the price down during a squeeze up, unless you know you have unlimited funds and volume to play with. The only time i know they failed, was in July, when the 6800 broke and we squeezed up to the 7.500. If you remember, i mentioned that several times, because since that moment, it took a while until they showed up again. There were around 200 mil contracts liquidated that day :)

After the push down has been made, we usually see a small bear flag forming, like they are getting a feel of the buying pressure of the market before they start to make their second push down. A few days ago, the buy volume was probably still too strong to we tested the high again, something that didn't happen earlier this year. So there is a slight change in that pattern.

Today's move, which i warned for yesterday was only a 30/40 point move up. But the push down fits the profile i described. And since we are at lower prices now, it might be fair to assume they are at it again.

What and why do they do it.

Why? They play games with over leveraged traders. We always get these obvious resistance or support levels. If it's a bull or bear flag or trend line breakouts. So many traders who are breakout traders go long at these highs while THEY have their short orders already in the book ready to get filled. Then they push the price down just as fast, putting these bulls under immediate pressure. They wait and see a bit how the rest of the market reacts, if they see buying volume dropping, they start to push the price down even more.

Because they trapped these breakout traders, they use THEIR volume as their own, because as soon as these over leveraged traders start to get in a loosing position, they will cut their losses and start to sell as well (or get liquidated which has the same result). So creating volume (fuel) for these whales. And if the market is not strong enough to catch the volume of both of these sellers, we start to see those Bart moves and the market starts to drop again.

You probably remember this chart i showed a week ago, before that move up happened and dropped again. This is a bigger version and a different pattern but it's the same tactic. In case you wondered how the hell did i know it would move like that, well know you have your answer :). Of course it is an assumption upfront and it's not that easy, but it does increase your odds in trading when your aware of these kind of things.

If i get a big support for this educational analysis through likes, i will make a part 2 and will show you examples of these patterns. It takes me many hours to make these kind of educational posts, so i will only continue when i see enough people find it interesting.

I also still have that long term (with log trend lines ) educational post, i am half way but still needs a lot to complete it. I might post that one as well in the near future. Maybe some will finally see and understand the false preferences most TA analysts tell you. Not on purpose, they simply don't know any better. Now i don't need to prove my right with this and i won't even try, it's up to you to make your own conclusion. But i think the fact 90% of retail traders looses money in the financial markets says more than enough. The chart is here below, probably finished but i might still adjust it a bit

I can see only 1 solution for this manipulation, that is combining the volume of all exchanges in 1 order book. Because then they would much more volume to push the price around. Now they only need 1,2 or 3 exchanges and the rest will follow since there are so many bots reacting automatically. Combining all the volume , would make it MUCH more difficult to control. Not impossible, because the same manipulation happens on the normal markets as well.

So in other words, the decentralization of crypto is actually biting it in it's own ass when you think about it. Very unfortunate, but it's the hard truth.

Please don't forget to like if you appreciate this :)

Previous educational analysis:

If this is a perfect system .............. if blockchain will keep getting those eliptical moves in long term , we can see a final last down move so the story can move to higher targets.

Just saying .. if Bitcoin will keep in this eliptical pattern in up overall , we could see some very highs in 2020 when this next spike coincide with bitcoin next halving reward year ...

PS : Expect for a quick and nasty final move in which bitcoin will kill other alts and start regain dominance and FOMO into his ass :)

#bitcoin trend or end of trend using MACDStudy MACD 2018 (Only when signal lines < zero) Mark: all 1st 3 pinks in Histo white; all 1st dys up in Signal Line brown; all 1st dys up & down in MACD blue Take 1st brown vertical after white & box volatility between candle before & after in orange Close breakout can signal trend or near end Not advice DYOR. Could try and refine using MACD blue verticals and including other brown verticals. Have edited them out to keep it simple.

WHY THE MEDIA SILENCE ? I'm going to publish & be dammed. Cool.Mon 17 Dec 2018 is one year since bitcoin peak 17 Dec 2017. Not a single media reporter or journalist appears to have referred to it in media yet. No analyst or analysis available yet. Is that good or bad news? Bullish or bearish. A good or bad time to buy?

Three simple charts showing what happened in previous years from high Dec 2013

Pattern test based on Bulkowski's Chart PatternsJust an idea, want to see if it'll be accurate at all.

Comes from this page: thepatternsite.com *

I used to use Bulkowski's site as a reference for chart patterns, I guess this could be a good test for his descending triangle calculation. I think he claims to base the percentages on statistical analysis of historical chart patterns. I never really use them myself, so this is just for fun.

* I am not Thomas Bulkowski

Exclusive Update, Bitcoin And Solving The Bart Move Puzzle As promised i would explain my view on why i assumed today's bear flag was NOT a Bart move.

There is more to is than just these 2 moves, the bigger picture also plays a part, but i won't get into those details because it would make things too complicated.

1: The spread between high and low

2: A drop and quick move above the previous high

3: Difference in buying volume

4: Bull flag and follow through, on the right a failed one

5: Similar move also similar volume

6: What is the difference here?

7: Left is a triangle shape, right is a bear flag shape

1: First of all, number 1 was the most obvious from the start. Don't mean it already said it would not be another Bart move, but it was an obvious difference, as i also mentioned in my

Bitcoin' analysis. On the left it's 150 points and on the right it's 70 points. The one on the left is enough to create liquidations or stops getting hit on a leveraged exchange like

Bitmex' which creates fuel to do what they want.

2: A second big clue is number 2, a quick drop and a big move up just as fast and went even above the high of the previous few candles.

3: The high buying volume on number 2, most probably even just bots who are programmed to buy within a certain price range. The high volume shows the order book was filled with

sell orders, so perfect opportunity to get a big amount of long positions in.

4: During this drop and bounce up, we can see a small bull flag on the left with follow through reaching the target of that bull flag. First though would be, hmmmm this is a bullish

sign. That is true as well, but look at the one on the right, what do you see? We see similar buying volume but no follow through in price? This i want you to answer yourself in the

comment section.

5: Explained at point 4

6: Here is where we continued to drop today and bounced up again at the Bart move on the left. This one is not easy to judge, there is a difference in volume here but not significant.

On the right it obviously just continued to drop while on the left there was support at that low.

7: The whole pattern on the left has the shape of a triangle while on the right it was simply a bear flag.

The orange part was an extra bonus, does not have much to do with the Bart pattern.

Now who ever these people are, if it's on entity or simply just several traders who use the similar bots, i don't know. But to make it easy, i always look at the market as if it's me against one big whale. Now the blue circles, you have to see those as if the bots are eating up all the sell orders on the way until a maximum level. Now if their bags or not filled up enough, they simply stop the price there with sell orders or simply just sell walls, unless the rest of the market pushes the price down. So they try to eat up all the sell orders as fast as they can before someone else does it and hit the break at a certain point. Just think of it in that way, makes it easier to comprehend/visualize.

Please don't forget to give a like if you appreciate this :)

Current Bitcoin analysis:

#bitcoin MACD to confirm nearest to low like last time maybeConstruction: Only used signal line in Histogram format. The last time confirmed low was shortly after price hit bottom the signal line dropped into the box (light blue) which is the gap between the last lower low in the signal line. Note that I've picked lower lows in the signal line which did not return above zero in between

NOTE: The low in this example of $166.5 was later beaten by $162 set 18 August of same year.

Gaps in the volume profileJust a example to show how gaps in the Volume Profile caused during fast falls or rises in price are filled at a later date.

The gap between 4200 down to 3800 during the drop on 24th November was filled just over 24 hours later.

The left window shows the volume profile prior to the drop and up to the bottom of the drop.

The right window shows the volume profile from the start of the rise back up to 4000.

I have displayed the volume profiles back to back to make it easier to visualise.

The range of the gap in the volume profile has been marked with a box extending across both sides.

There are some other boxes in the chart that mark previous volume areas from last year.

This was created on my working chart and I didn't want to spend the time hiding them or opening a new chart for this example.

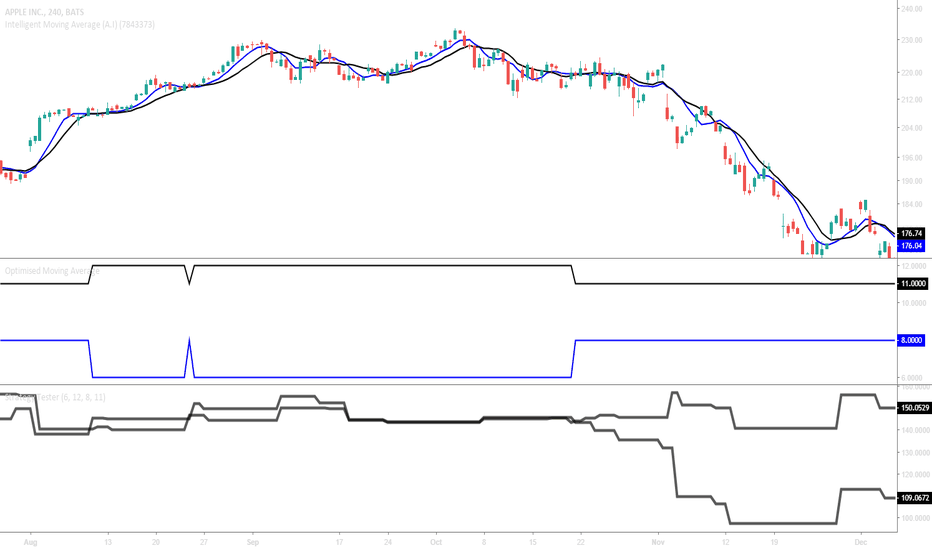

3 trading methods with my indicator. :)it's mainly for swing trading, i use the 3 day / 15 day / monthly charts with it and it works perfectly,

it works good for stocks and cryptocurrency.

you will use heiken ashi chart style and turn on the EMA DOTS indicator.

once the indicator is on you will hide the heiken ashi so you only see the dots.

when a green dot -0.57% -7.44% appears you buy, if a green dot -0.57% -7.44% appears after that green dot -0.57% -7.44% you hold your investment.

if a red dot appears you sell your position. easy as that.

the standard dots setting will be set to 10 - use this for any chart above 3 days

change the dots setting to 6 for 3day charts and below

shorter time frames will be choppy.

larger time frames will be smooth.

*Daytrading smaller timeframes is possible but not recommended.

#bitcoin bounce odds 3-1 or doubts about future dominance maybeLoads of predictions and time to try and make it simple maybe using roughly same principles as when bitcoin first hit $6000 low back in February 2018. I think if bitcoin goes lower then there may be serious doubts about its future dominance and likely institutional portfolio weighting going forward into 2019.