2] How to use Traders Dynamic Index and Complementary OverlayWe here learn to observe the higher time frame 360, and analyse 1D that RSIPL are crossed down parallel. So lower than daily time frame= 540, 360 allows for trend entry at a 360 RSIPL and 'TSL initial cross down for max profit.

On 180 as on 360 allowed for entry using the RSIPL/TSL crosses down. Also observing Phaser very near price as it 'pushed' priced down until price could breakout Phaser which had much importance.

Price breakout of black Midline meant clear reversal and price retraced to it for support with target being HighPhaser or Fibonacci retracement tool for extension target. Entry for this retracement was possible by means of the countertrendline cross.

__________

Promoting free and highly useful Indicators:

KK_Traders Dynamic Index_Bar Highlighting

Traders Dynamic Index Overlay

"Price Action Channel Master by JustUncleL Restored"

Volatility

1] How to use Traders Dynamic Index and Complementary OverlayTraders Dynamic Index serves for crossover signals and are essential for trade entries and most beneficial when identified on over 30-minute Time Frames as on hourly time frames.

I have made the options available of the oversold (green) 32 level line overlay which is useful in identifying potential buy zones/price.

In KK_Traders Dynamic Index_Bar Highlighting it is also good to note that in uptrends : RSI ranges between Upper Volatility Band, Lower Volatility Band and/or relatively "within" 68 and 50 level lines as it has been doing on hourly time frames on Bitcoin.

Direction and deviation of MBL overlay or Phaser from price is strong indicator of trend direction and price level/zone useful for those who are confused in knowing where price will have to average into.

Promoting free and highly useful Indicators:

KK_Traders Dynamic Index_Bar Highlighting

Traders Dynamic Index Overlay

"Price Action Channel Master by JustUncleL Restored"

_______________

I had not used these guides recently which I have currently published.

If anything (I ever do publish) varies contrary to these indicated guides and the coming guides to be published, the likelihood of failed forecast is augmented.

Comparison of Volatility Indices (Daily)This chart shows the most current values of Volatility Indices for the mostly used Future Underlyings: ES, B6, E6, ZL, ZN, ZC, ZW, Russell etc.

Using Multiple Timeframes to Enter a TradeHello Traders!

As many of you know, I use the Stoch RSI as my main cycle indicator. As an indicator of an indicator, it normalizes the RSI indicator itself and provides excellent guidance on the price cycles of Gold. And while I base my daily analysis on the Daily time frame, I use 2 shorter time frames to enter my positions. These time frames are 30 minutes and 60 minutes.

Let me give you a real life example from yesterday of how I added to an existing short position.

Last week ended with a beautiful down candle on the daily chart. Long upper wick and a full body that closed just a few points above the bottom of our wedge. With plenty of room left on the Stoch RSI before it crossed the 20 line, I wanted to add another position to my existing short. But I new that I didn't want to jump in at Friday's closing price. So how could I gauge any potential pullback and set an entry price?

The first thing I did was to look at the 30 and 60 min charts, specifically to find where price was on those charts in relation to the overall down cycle.

Here is the 30 min chart on Sunday night at 11 pm PST. It's clear from the Stoch RSI that price was at the bottom of it's cycle. Not an ideal time to enter a trade. And the same was true on the 60 min chart (bottom chart). Therefore, I wanted the Stoch RSI to cycle up to get the best possible entry price. Looking at the BB, I placed a limit order at the inner BB (1.0 Std. Dev) @ 1321, thinking that would give both Stoch RSIs enough time to complete an up cycle. Turns out that was pretty close to the high of the day!

I have had the best entries when I wait for the cycle indicators across multiple time frames to get in sync. Waiting for harmony across multiple time frames is a great way to create a repeatable system for entries and really helps to remove emotions from your trading.

I would love to hear if this technique is helpful!

Safe Trading and Protect Your Profits!

#Fif Favorites indicators Friday. Parabolic Sar explained.The parabolic SAR is a popular indicator that is mainly used by traders to determine the future short-term momentum of a given asset.

A dot is placed below the price when the trend of the asset is upward.

A dot is placed above the price when the trend is downward.

As you can see from the chart, transaction signals are generated when the position of the dots reverses direction and is placed on the opposite side of the price as it was earlier.

Español:

El Parabolic Sar es un indicador popular el cual es usualmente usado para determinar el momentun a corto plazo de un activo en especifico.

Un punto es colocado debajo del precio cuando el activo tiene tendencia al alza.

Un punto es colocado por encima del precio cuando el activo tiene tendencia a la baja.

Como puedes observar en la gráfica, ocurren señales de transacción cuando la posición de los puntos se reversa de dirección y se colocan en el lado opuesto del precio como se encontraba anteriormente.

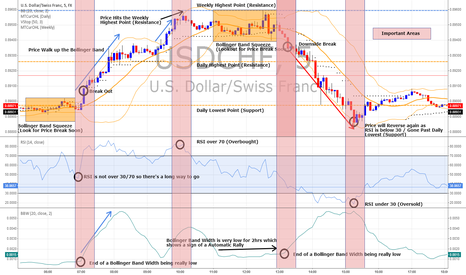

Maximize your Profits with Bollinger BandsBollinger Band Strategy is One of the Most Profitable Strategy Used by the Trades who earn lots of Money!!!

You can't just use Bollinger Bands to Trade and Earn Money as you need to confirm the Break Out Signal that you get after a Bollinger Band Squeeze.

Here are some tips how to confirm that:

1. Always looks for Bollinger Band Squeezes as you will find Price Break Outs most of the times

2. Use RSI to confirm the Price Break Out

3. Make sure RSI is not Overbought/Oversold to have a Major Price Break Out

4. Look for Bollinger Band Width to see whether its Rising as well

5. When there's a Major Price Break out it will go on for 1 -3hrs so you can take multiple entry points to Maximize your profits

6. Always check the Support/Resistance levels as there's possibility of the Price reversing the other way

7. I would also recommend to check the investing.com and look for Strong Buy/Sell Signal before you enter your Trade

8. There will be fake break outs where the price go the otherway

9. You can have stop losses and enter the Trades on the otherway if there's a fake breakout

Few other Tips to Enhance the above:

1. Use default MACD to reconfirm the Trend Direction (Thanks for the Idea from HamzaLeith)

2. Check the Direction of the Upper/Lower Bands.

For Bullish reversal's and continuations (opposite is true for bearish reversals or continuations)

1.) Price approaches the Buy Zone and the upper and lower bands remain flat. Reversal - Likely a sharp reversal to the lower band. Because both bands are flat this will likely be short lived.

2.) Price approaches the Buy Zone and the upper band goes up and the lower band is flat or moving up slightly. Continuation - Price will likely continue up slowly for a time.

3.) Price approaches the Buy Zone and the upper band goes up and the lower band goes down. Continuation - Price will likely move up fast and furious. This is the best continuation pattern for the bands. This is a rapid expansion of volatility. You will experience "fake out's" sometimes but most of the time this set-up will produce some good profits when executed properly.

4.) Price approaches the Buy Zone and the upper and lower bands both go down. - Reversal - This is likely to result in a reversal

Source: www.eezybooks.com

Summary: Use RSI / Bollinger Band Width & MACD Indicators to Confirm the Signal

Hope this Helps Anyone who like to maximize the profits