Protect Capital First, Trade SecondIn the world of trading, mastering technical analysis or finding winning strategies is only part of the equation. One of the most overlooked but essential skills is money management. Even the best trading strategy can fail without a solid risk management plan.

Here’s a simple but powerful money management framework that helps you stay disciplined, protect your capital, and survive long enough to grow.

✅1. Risk Only 2% Per Trade

The 2% rule means you risk no more than 2% of your total capital on a single trade.

-Example: If your trading account has $10,000, your maximum loss per trade should not exceed $200.

-This protects you from large losses and gives you enough room to survive a losing streak without major damage.

A disciplined approach to risk keeps your emotions under control and prevents you from blowing your account.

✅2. Limit to 5 Trades at a Time

Keeping your number of open trades under control is essential to avoid overexposure and panic management.

-A maximum of 5 open trades allows you to monitor each position carefully.

-It also keeps your total account risk within acceptable limits (2% × 5 trades = 10% total exposure).

-This rule encourages you to be selective, focusing only on the highest quality setups.

Less is more. Focus on better trades, not more trades.

✅3. Use Minimum 1:2 or 1:3 Risk-Reward Ratio

Every trade must be worth the risk. The Risk-Reward Ratio (RRR) defines how much you stand to gain compared to how much you’re willing to lose.

-Minimum RRR: 1:2 or 1:3

Risk $100 to make $200 or $300

-This allows you to be profitable even with a win rate below 50%.

Example:

If you take 10 trades risking $100 per trade:

4 wins at $300 = $1,200

6 losses at $100 = $600

→ Net profit = $600, even with only 40% accuracy.

A poor RRR forces you to win frequently just to break even. A strong RRR gives you room for error and long-term consistency.

✅4. Stop and Review After 30% Drawdown

Drawdowns are a part of trading, but a 30% drawdown from your account's peak is a red alert.

When you hit this level:

-Stop trading immediately.

-Conduct a full review of your past trades:

-Were your losses due to poor strategy or poor execution?

-Did you follow your stop-loss and risk rules?

-Were there changes in the market that invalidated your setups?

You must identify the problem before you continue trading. Without review, you risk repeating the same mistakes and losing more.

This is not failure; it’s a checkpoint to reset and rebuild your edge.

Final Thoughts: Survive First, Thrive Later

In trading, capital protection is the first priority. Profits come after you've mastered control over risk. No trader wins all the time, but the ones who respect risk management survive the longest.

Here’s your survival framework:

📉 Risk max 2% per trade

🧠 Limit to 5 trades

⚖️ Maintain minimum 1:2 or 1:3 RRR

🛑 Pause and review after 30% drawdown

🧘 Avoid revenge trading and burnout

Follow these principles and you won't just trade, you'll trade with discipline, confidence, and longevity.

Cheers

Hexa

Educationalpost

Feed Your Ego or Feed Your Account- Your Choise🧭 From Rookie to Realization

I’ve been trading since 2002. That’s nearly a quarter of a century in the markets.

I’ve lived through it all:

• The early days, when the internet was slow and information was scarce

• The forums, the books, the overanalyzing

• The obsession with finding “the perfect system”

• And later… the dangerous phase: needing to be right, because I have a few years of experience and I KNOW

At one point, I thought that being a good trader meant calling the market in advance — proving I was smarter than the rest.

But the truth is: the market doesn't pay for being right. It pays for managing risk, always adapting and executing cleanly.

________________________________________

😤 The Psychological Trap Most Traders Fall Into

There’s one thing I’ve seen consistently over the last 25 years:

Most traders don’t trade to make money.

They trade to feel right.

And this need — this psychological craving to validate an opinion — is exactly what keeps them from growing.

You’ve seen it too:

• The guy who’s been screaming “altcoin season” for 2 years

• Who first called it when EGLD was at 80, TIA, and others that kept dropping

• But now that something finally moves, he says:

“See? I was right all along, altcoin season is here”

He’s not trading.

He’s rehearsing an ego story, ignoring every failed call, every drawdown, every frozen position.

He doesn’t remember the trades that didn’t work — only the one that eventually did.

This is not strategy.

It’s delusion dressed up as conviction.

________________________________________

📉 The Market Doesn’t Care What You Think

Here’s the reality:

You can be right in your analysis — and still lose money.

You can be wrong — and still come out profitable.

Because the market doesn’t reward your opinion.

It rewards how well you manage risk, entries, exits, expectations, and flexibility

I’ve seen traders who were “right” on direction but blew their accounts by overleveraging.

And I’ve seen others who were wrong on their first two trades — but adjusted quickly, cut losses, and ended green overall in the end.

This is what separates pros from opinionated amateurs.

________________________________________

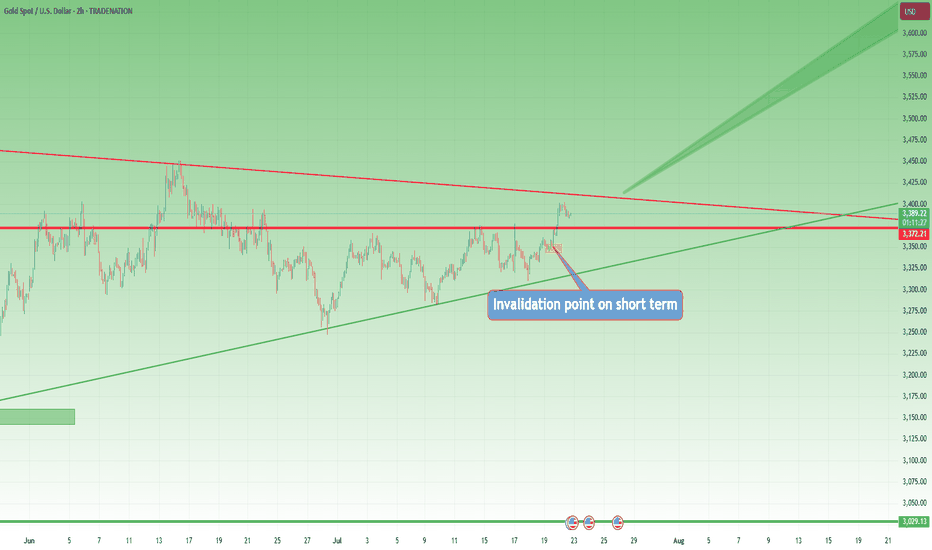

📍 A Real Example: Today’s Gold Analysis

Let’s take a real, current example — my own Gold analysis from this morning.

I said:

• Short-term, Gold could go to 3450

• Long-term, the breakout from the weekly triangle could take us to 3800

Sounds “right,” right? But let’s dissect it:

Short-term:

✅ I identified 3370 as support

If I buy there, I also have a clear invalidation level (below 3350)

If it breaks that and hits my stop?

👉 I reassess — because being “right” means nothing if the trade setup is invalidated

And no, it doesn’t help my PnL if Gold eventually reaches 3450 after taking me out.

Long-term:

✅ The weekly chart shows a symmetrical triangle

Yes — if we break above, the measured move targets 3800

But…

If Gold goes below 3300, that long-term scenario is invalidated too.

And even worse — if Gold trades sideways between 3000 and 3500 for the next 5 years and finally hits 3800 in 2030, that “correct call” is worth nothing.

You can't build a career on "eventually I was right."

You need precision, timing, risk management, and the ability to say:

“This setup is no longer valid. I’m out.”

________________________________________

💡 The Shift That Changed Everything

It took me years to realize this.

The day I stopped needing to be right was the day I started making consistent money.

I stopped arguing with the market.

I stopped holding losers out of pride.

I stopped needing to "prove" anything to anyone — especially not myself.

Now, my job is simple:

• Protect capital

• Execute with discipline

• Let the edge do its job

• And never fall in love with my opinion

________________________________________

✅ Final Thought – Let Go of Being Right

If you’re still stuck in the “I knew it” mindset — let it go.

It’s not helping you. It’s costing you.

The best traders lose small, admit mistakes fast, and stay emotionally neutral.

The worst traders hold on to “being right” while their account burns.

The market doesn’t owe you respect.

It doesn’t care if you called the top, bottom, or middle.

It pays the ones who trade objectively, flexibly, and without ego.

After almost 25 years, this is the one thing I wish I had learned sooner:

Don’t try to win an argument with the market.

Just get paid.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

The Dangers of Holding Onto Losing Positions...One of the most common — and costly — mistakes in trading is holding onto a losing position for too long. Whether it's driven by hope, ego, or fear, this behavior can damage your portfolio, drain your capital, and block future opportunities. Successful trading requires discipline, objectivity, and the willingness to accept when a trade isn’t working. Understanding the risks behind this behavior is essential to protecting your capital and evolving as a trader.

-- Why Traders Hold Onto Losing Trades --

It’s not always poor strategy or lack of experience that keeps traders locked in losing positions — it’s often psychology. Several cognitive biases are at play:

1. Loss Aversion

Loss aversion refers to our instinctive desire to avoid losses, often stronger than the desire to realize gains. Traders may hold onto a losing position simply to avoid the emotional pain of admitting the loss, hoping the market will eventually turn in their favor.

2. Overconfidence

When traders are overly confident in their analysis or trading thesis, they can become blind to changing market conditions. This conviction may cause them to ignore red flags and hold on out of sheer stubbornness or pride.

3. The Sunk Cost Fallacy

This is the belief that since you’ve already invested money, time, or effort into a trade, you need to keep going to “get your investment back.” The reality? Past investments are gone — and continuing the position often compounds the loss.

These mental traps can distort decision-making and trap traders in unproductive or damaging positions. Being aware of them is the first step toward better judgment.

-- The True Cost of Holding Losing Positions --

Holding onto a bad trade costs more than just the money it loses. It impacts your entire trading strategy and limits your growth. Here’s how:

1. Opportunity Cost

Capital tied up in a losing trade is capital that can’t be used elsewhere. If you keep $8,000 in a stock that’s fallen from $10,000 — hoping it rebounds — you're missing out on placing that money in higher-performing opportunities. Inactive capital is wasted capital.

2. Deeper Compounding Losses

A 20% loss doesn’t sound catastrophic until it becomes 30%… then 40%. The deeper the loss, the harder it becomes to break even. Holding out for a recovery often makes things worse — especially in markets with high volatility or downtrends.

3. Reduced Liquidity

Successful traders rely on flexibility. When your funds are tied up in a losing position, you limit your ability to respond to new opportunities. In fast-moving markets, this can be the difference between success and stagnation.

Recognizing these costs reframes the decision from “holding on until it turns around” to “preserving capital and maximizing potential.”

Consider this simple XAUUSD (Gold) weekly chart example. If you base a trading strategy solely on the Stochastic oscillator (or any single indicator) without backtesting and ignoring the overall trend, focusing solely on overbought signals for reversals, you'll quickly see the oscillator's frequent inaccuracies. This approach will likely lead to substantial and prolonged losses while waiting for a reversal that may never occur.

-- Signs It’s Time to Exit a Losing Trade --

The hardest part of trading isn’t opening a position — it’s closing a bad one. But if you know what to look for, you’ll know when it’s time to let go:

1. Emotional Attachment

If you find yourself feeling “married” to a trade, it’s a warning sign. Traders often assign meaning or identity to a position. But trading should be based on data and strategy, not sentiment.

2. Ignoring or Adjusting Your Stop Loss

Stop Loss orders exist for a reason: to protect your capital. If you habitually move your stop further to avoid triggering it, you’re letting hope override risk management.

3. Rationalizing Losses

Statements like “It’ll bounce back” or “This company always recovers” can signal denial. Hope is not a strategy. When you catch yourself justifying a bad position without objective reasoning, it’s time to reevaluate.

Consider also reading this article:

-- How to Cut Losses and Move Forward --

Cutting a loss isn’t a failure — it’s a skill. Here are proven techniques that help you exit with discipline and confidence:

1. Use Stop Losses — and Respect Them

Set a Stop Loss at the moment you enter a trade — and stick to it. It takes the emotion out of the exit and protects your downside. Moving the stop is the fastest path to deeper losses.

2. Trade With a Plan

Every trade should be part of a bigger strategy that includes risk tolerance, entry/exit points, and profit targets. If a position hits your predetermined loss threshold, exit. Trust your system.

3. Apply Position Sizing and Diversification

Never risk more than a small percentage of your capital on a single trade. Keep your portfolio diversified across different instruments or sectors to avoid one position derailing your progress.

4. Review and Reflect

Post-trade analysis is vital. Review both wins and losses to learn what worked — and what didn’t. This practice sharpens your strategy and builds emotional resilience over time.

-- Why Cutting Losses Strengthens Your Portfolio --

There’s long-term power in letting go. Here’s what cutting losses early can do for you:

1. Preserve Capital

The faster you cut a losing trade, the more capital you retain — and the more opportunities you can pursue. Capital preservation is the foundation of longevity in trading.

2. Reduce Emotional Stress

Sitting in a losing trade weighs heavily on your mindset. The stress can cloud your judgment, increase risk-taking, or cause hesitation. Exiting early reduces this emotional drag and keeps you clear-headed.

3. Reallocate to Better Setups

Exiting losing trades frees up both capital and mental energy for higher-probability opportunities. This proactive approach builds momentum and reinforces the idea that it’s okay to be wrong — as long as you act decisively.

Consider also reading this article:

-- Final Thoughts: Discipline Over Denial --

Holding onto losing trades may feel like you're showing patience or commitment — but in reality, it's often denial wrapped in hope. Trading is about probabilities, not guarantees. The most successful traders aren’t the ones who win every trade — they’re the ones who manage losses with discipline.

Letting go of a bad trade is a show of strength, not weakness. It’s a deliberate choice to protect your capital, stay agile, and refocus on trades that serve your goals. The market doesn’t owe you a comeback — but with a clear head and disciplined approach, you can always find your next opportunity.

✅ Please share your thoughts about this article in the comments section below and HIT LIKE if you appreciate my post. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Japanese Candlestick Cheat Sheet – Part OneSingle-Candle Formations That Speak

Before you dream of profits, learn the one language that never lies: price.

Indicators are just subtitles — price is the voice.

Japanese candlesticks are more than just red and green bars — they reflect emotion, pressure, and intention within the market.

This series will walk you through the real psychology behind candlestick patterns — starting here, with the most essential:

🕯️ Single-candle formations — the quiet signals that often appear before big moves happen.

If you can’t read a doji, you’re not ready to understand the market’s hesitation.

If you ignore a hammer, you’ll miss the moment sentiment shifts.

Let’s start simple. Let’s start strong.

This is Part One of a five-part series designed to build your candlestick fluency from the ground up.

1. DOJI

Bias: Neutral

What is the Doji pattern?

The Doji candlestick pattern forms when a candle’s open and close prices are nearly identical, resulting in a small or nonexistent body with wicks on both sides. This pattern reflects market equilibrium, where neither buyers nor sellers dominate. Dojis often appear at trend ends, signaling potential reversals or pauses.

As a fundamental tool in technical analysis, Dojis help traders gauge the psychological battle between buyers and sellers. Proper interpretation requires context and experience, especially for spotting trend shifts.

Meaning:

Indicates market indecision or balance. Found during trends and may signal a reversal or continuation based on context.

LONG-LEGGED DOJI

Bias: Neutral

What is the Long-Legged Doji pattern?

The Long-Legged Doji captures a moment of intense uncertainty and volatility in the market. Its long wicks represent significant movement on both sides, suggesting that neither buyers nor sellers have control. This back-and-forth reflects the psychology of market participants wrestling for control, which often foreshadows a shift in sentiment. When traders see a Long-Legged Doji, it highlights the need to monitor for potential changes in direction.

They can appear within trends, at potential reversal points, or at consolidation zones. When they form at the end of an uptrend or downtrend, they often signal that the current trend may be losing momentum.

Meaning:

The prominent wicks indicate volatility. Buyers and sellers pushed prices in opposite directions throughout the session, ultimately reaching an indecisive close.

SPINNING TOP

Bias: Neutral

What is the Spinning Top pattern?

A Spinning Top is a candlestick with a small body and long upper and lower wicks, indicating that the market has fluctuated significantly but ultimately closed near its opening price. This pattern often points to a moment of indecision, where both buyers and sellers are active but neither dominates. Spinning Tops are commonly found within both uptrends and downtrends and can suggest that a trend is losing momentum.

For traders, a Spinning Top provides a valuable insight into market psychology, as it hints that the prevailing sentiment may be weakening. While Spinning Tops alone aren’t always definitive, they can serve as a precursor to larger moves if the following candles confirm a shift in sentiment.

Meaning:

Shows indecision between buyers and sellers. Common in both up and downtrends; signals potential reversal or pause.

HAMMER

Bias: Bullish

What is the Hammer pattern?

A Hammer candlestick appears at the end of a downtrend, with a small body and a long lower wick. This shape reflects a moment when sellers pushed prices lower, but buyers managed to absorb the selling pressure and drive prices back up before the close. This pattern is particularly important for spotting potential reversals, as it indicates that buyers are beginning to reassert control.

Hammers reveal the underlying psychology of a market where buying confidence is emerging, even if sellers have dominated for a while. To successfully trade this pattern, it’s essential to confirm the reversal with subsequent candles.

Meaning:

Showing rejection of lower prices. Signals potential bullish reversal, especially if followed by strong buying candles.

INVERTED HAMMER

Bias: Bullish

What is the Inverted Hammer pattern?

The Inverted Hammer forms at the bottom of a downtrend, with a small body and long upper wick. This pattern shows that buyers attempted to push prices higher, but sellers ultimately brought them back down by the close. The Inverted Hammer is an early sign of buyer interest, hinting that a trend reversal may be underway if subsequent candles confirm the shift.

Interpreting the Inverted Hammer helps traders understand where sentiment may be shifting from bearish to bullish, often marking the beginning of a recovery. Recognizing these patterns takes practice and familiarity with market conditions.

Meaning:

Showing rejection of higher prices. Can signal bullish reversal if confirmed by subsequent buying pressure.

DRAGONFLY DOJI

Bias: Bullish

What is the Dragonfly Doji pattern?

The Dragonfly Doji has a long lower wick and no upper wick, forming in downtrends to signal potential bullish reversal. This pattern reveals that sellers were initially in control, pushing prices lower, but buyers stepped in to push prices back up to the opening level. The Dragonfly Doji’s unique shape signifies that strong buying support exists at the lower price level, hinting at an impending reversal.

Recognizing the psychology behind a Dragonfly Doji can enhance a trader’s ability to anticipate trend changes, especially in markets where support levels are being tested.

Meaning:

Found in downtrends; suggests possible bullish reversal if confirmed by a strong upward move.

BULLISH MARUBOZU

Bias: Bullish

What is the Bullish Marubozu pattern?

The Bullish Marubozu is a large, solid candle with no wicks, indicating that buyers were in complete control throughout the session. This pattern appears in uptrends, where it signals strong buying momentum and often foreshadows continued upward movement. The absence of wicks reveals that prices consistently moved higher, with little resistance from sellers.

For traders, the Bullish Marubozu offers a glimpse into market psychology, highlighting moments when buyer sentiment is particularly strong. Learning to identify these periods of intense momentum is crucial for trading success.

Meaning:

Showing complete buying control. Found in uptrends or at reversal points; indicates strong buying pressure and likely continuation of the trend.

SHOOTING STAR

Bias: Bearish

What is the Shooting Star pattern?

The Shooting Star appears at the top of an uptrend, characterized by a small body and a long upper wick, indicating a potential bearish reversal. Buyers initially drove prices higher, but sellers took over, bringing prices back down near the open. This shift suggests that buyers may be losing control, and a reversal could be imminent.

Interpreting the Shooting Star gives traders valuable insights into moments when optimism begins to fade, providing clues about a potential trend shift.

Meaning:

Indicating rejection of higher prices. Signals a potential bearish reversal if followed by selling pressure.

HANGING MAN

Bias: Bearish

W hat is the Hanging Man pattern?

The Hanging Man candle forms at the top of an uptrend, with a small body and long lower wick. This pattern suggests that sellers attempted to drive prices down, but buyers regained control. However, the presence of a long lower shadow hints that sellers may be gaining strength, potentially signaling a bearish reversal.

The Hanging Man pattern reflects market psychology where buyers might be overextended, making it a valuable tool for identifying potential tops in trends.

Meaning:

Signals potential bearish reversal if confirmed by selling candles afterward.

GRAVESTONE DOJI

Bias: Bearish

What is the Gravestone Doji pattern?

With a long upper wick and no lower wick, the Gravestone Doji reveals that buyers pushed prices up, but sellers eventually regained control. Found in uptrends, it suggests that a bearish reversal could be near, as the upper shadow indicates buyer exhaustion. The Gravestone Doji often appears at market tops, making it a valuable indicator for those looking to anticipate shifts.

Understanding the psychology behind this pattern helps traders make informed decisions, especially in markets prone to overbought conditions.

Meaning:

Showing rejection of higher prices. Found in uptrends; signals potential bearish reversal if followed by selling activity.

BEARISH MARUBOZU

Bias: Bearish

What is the Bearish Marubozu pattern?

The Bearish Marubozu is a large, solid bearish candle without wicks, showing that sellers held control throughout the session. Found in downtrends, it signals strong bearish sentiment and suggests that the trend is likely to continue. The lack of wicks reflects consistent downward momentum without significant buyer support.

This pattern speaks about market psychology, offering traders insights into moments of intense selling pressure. Recognizing the Bearish Marubozu can help you align with prevailing trends and avoid buying into weakening markets

Meaning:

Showing strong selling pressure. Found in downtrends; signals continuation of the bearish trend or an intensifying sell-off.

👉 Up next: Double-candle formations – where price meets reaction.

Why Swing Trading and Scalping Are Opposite Worlds"It's not about the strategy. It's about who you are when the market puts pressure on you."

Most traders fail not because they don’t learn “strategies” — but because they pick a style that doesn't match their temperament.

And nothing creates more damage than confusing swing trading with scalping/intraday trading.

Let’s break them down. For real...

________________________________________

🔵 1. Swing Trader – Chasing Direction, Not Noise

A swing trader does not touch choppy markets.

He’s not here for the sideways grind. He wants momentum.

If there’s no clear trend, he doesn’t trade.

He shifts between assets depending on where real movement is.

• USD weakens → he buys EUR/USD and waits

• Gold breaks → he enters and lets the move develop

Swing trading means positioning with the macro flow, not chasing bottoms and tops.

✅ He trades based on H4/Daily or even Weekly charts

✅ He holds for hundreds of pips.

✅ He accepts contrarian candles in the process.

________________________________________

🔴 2. Scalper/Intraday Trader – The Asset Specialist

A true scalper doesn’t chase trends.

He hunts inefficiencies — quick spikes, fakeouts, liquidity grabs.

✅ Loves range conditions

✅ Lives inside M5–M15

✅ Often trades only one asset he knows like the back of his hand

He doesn’t care what EUR/USD will do this week.

He cares what it does in the next 30 minutes after a breakout.

Scalping is not chaos. It's cold execution with a sniper mindset.

📡 He reacts to news in real time.

He doesn’t predict — he exploits.

________________________________________

🧾 Key Differences – Swing Trader vs. Scalper

________________________________________

🎯 Primary Objective

• Swing Trader: Captures large directional moves over several days.

• Scalper/Intraday: Exploits short-term volatility, aiming for quick, small gains.

________________________________________

🧭 Market Conditions Preference

• Swing Trader: Needs clean, trending markets with clear momentum.

• Scalper/Intraday: Feels comfortable in ranging markets with liquidity spikes and noise.

________________________________________

🔍 Number of Instruments Traded

• Swing Trader: Monitors and rotates through multiple assets (e.g. XAUUSD, EURUSD, indices, BTC, he's going where the money is).

• Scalper/Intraday: Specializes in 1–2 instruments only, knows their behavior in every session.

________________________________________

⏰ Time Spent in Front of the Charts

• Swing Trader: Waits for clean setups, may hold positions for days or weeks.

• Scalper/Intraday: Constant screen time, executes and manages trades actively.

________________________________________

📰 Reaction to News

• Swing Trader: Interprets the macro/fundamental impact and positions accordingly.

• Scalper/Intraday: Reacts live to data releases, wicks, and intraday volatility.

________________________________________

📉 When They Struggle

• Swing Trader: Fails in choppy or directionless markets.

• Scalper/Intraday: Loses edge when the market trends explosively.

________________________________________

🧠 Psychological Requirements

• Swing Trader: Needs patience, confidence in the big picture, and acceptance of drawdown.

• Scalper/Intraday: Needs absolute discipline, emotional detachment, and razor-sharp focus.

________________________________________

✅ Bottom line: They are two different games.

Don’t try to play both on the same chart with the same mindset.

________________________________________

✅ Final Thoughts – Your Edge Is in Alignment, Not Imitation

You don’t pick a trading style because it “sounds cool.”

You pick it because it aligns with:

• Your schedule

• Your attention span

• Your tolerance for uncertainty

If you hate watching candles all day – go swing.

If you hate waiting for days – go intraday.

If you keep switching between both – go journal your pain and come back later.

P.S. Recent Example:

I'm a swing trader. And this week, Gold has been stuck in a range.

What do I do? I wait. No rush, no overtrading. Just patience.

Once the range breaks, I’m ready — in either direction.

But I don’t close after a quick 50–100 pip move. That’s not my game.

I aim for 700+ pips whether it breaks up or down,because on both sides we have major support and resistance levels that matter.

That’s swing trading:

📍 Enter with structure, hold with confidence, exit at significance.

Not every move is worth trading — but the big ones are worth waiting for.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

In trading, the long way is the shortcut⚠️ The Shortcut Is an Illusion — And It Will Cost You

In trading, everyone wants to arrive without traveling.

They want the profits, the freedom, and the Instagram lifestyle — even if it’s fake.

What they don’t want is the process that actually gets you there.

So they chase shortcuts:

• Copy signals without understanding the reason behind them

• Over-leverage on “the perfect setup”

• Buy indicators they don’t know how to use

• Skip journaling and backtesting

• Trade real money without trading psychology

And then they wonder…

Why is my account bleeding?

Why does this feel like a cycle I can't break?

Because:

Every shortcut in trading is just a fast track to disaster.

You will lose. You will restart. And it will take even longer than if you just did it right the first time.

🤡 The TikTok Fantasy: “1-Minute Strategy That Will Make You Millions in 2025”

This is the new wave:

A 60-second video showing you a magical indicator combo.

No context. No testing. No risk management.

Just fake PnL screenshots and promises of millionaire status before next summer.

“This 1-minute scalping strategy made me $12,000 today!”

And people fall for it… because it’s easier to believe in shortcuts than to accept that real trading is boring, repetitive, and hard-earned.

If it fits in a TikTok video, it’s not a strategy. It’s clickbait.

________________________________________

❓ Looking for a System Without Knowing the Basics

Here’s the paradox:

Most people are desperate to find a “profitable strategy” — but they haven’t even mastered the basic math of trading.

• They don’t know how pip value is calculated

• They don’t understand how leverage works

• They confuse margin with risk

• They size positions emotionally, not based on their account

• They can’t define what 1% risk per trade actually means in dollars

But they’re out here, loading indicators, watching YouTube “hacks,” and flipping accounts with 1:500 leverage.

Imagine trying to perform surgery before learning anatomy.

That’s what trying to trade a strategy without knowing pip cost looks like.

________________________________________

🛠️ The Long Way Is the Fastest Way

You want the real shortcut?

Here it is:

• Learn price structure deeply

• Backtest like a scientist

• Journal like a professional

• Risk small while you're learning

• Stay on demo until your edge is proven

• Master basic math: leverage, margin, pip value, position sizing

This is the long way.

But it’s the only way that doesn’t end in regret.

________________________________________

⏳ Most Traders Waste 2–5 Years Looking for a Shortcut

And in the end?

They crawl back to the long path.

Broke, humbled, and wishing they had just started there from the beginning.

The shortcut is a scam.

The long way is the only path that leads to consistency.

You either take it now… or take it later — after your account pays the price.

________________________________________

✅ Final Thought

Don’t ask how fast you can get profitable.

Ask how solid you can build your foundation.

Because in trading:

❌ The shortcut costs you everything

✅ The long way gives you everything

And the longer you avoid it, the longer it takes.

Most Traders React to Markets. The Best Anticipate Them.Most Traders React to Markets. The Best Anticipate Them.

Hard truth:

You're always one step behind because you trade reactively.

You can’t win a race if you're always responding to moves already made.

Here's how reactive trading burns your edge:

- You chase breakouts after they've happened, entering at the peak.

- You panic-sell into downturns because you didn't anticipate.

- You miss major moves because you're looking backward, not forward.

🎯 The fix?

Develop anticipatory trading habits. Identify scenarios in advance, set clear triggers, and act decisively when probabilities align - not after the market confirms.

TrendGo provides structure for anticipation - not reaction.

🔍 Stop responding, start anticipating. Your account will thank you.

Guide: How to Read the Smart Farmer SystemDear Reader , Thank you for tuning in to my first video publication.

This video explains the 3-step signal validation process—helping you quickly and precisely anticipate market intent and liquidity dynamics before taking action.

We do not react to noise; we respond with structured execution because we understand the market’s true game.

Listen to the market— this guide is here to sharpen your journey.

Correction Notice (16:58 timestamp): A slight clarification on the statement regarding signal validation :

SELL signals: The trading price must close BELOW the Price of Control (POC) and Value Average Pricing (VAP) without invalidation occurring in both the confirmation candle and progress candle.

BUY signals: The trading price must close ABOVE the Price of Control (POC) and Value Average Pricing (VAP) without invalidation occurring in both the confirmation candle and progress candle.

Multiple signals indicate liquidity games are actively unfolding, including accumulation, control, distribution, and offloading.

Trading Without an Edge Is Like Gambling Without the FunAt least in Vegas, you get free drinks.

Let’s cut the fluff.

You want to make money trading.

But here’s the problem no one wants to admit:

Most traders don’t have an edge. And they trade anyway.

Which means they’re not traders.

They’re just expensive gamblers in denial.

🎰 W elcome to the Casino Called “Charts”

In Vegas, the odds are clearly displayed.

You know the house has the advantage.

But in trading? You convince yourself you are the house.

You say things like:

-“This setup worked for someone on YouTube.”

- “Price is oversold, so it has to bounce.”

- “I just have a feeling it’ll go up.”

That’s not a strategy. That’s astrology.

If you can’t define your edge in one sentence, you don’t have one.

And if your edge isn’t tested over at least 100 trades — it’s fantasy.

🧠 What Is an Edge, Anyway?

An edge is not a pattern. It’s not always your gut.

It’s a repeatable, testable advantage in the market.

It could be:

- A statistical tendency in price behavior

- A setup with positive risk-to-reward over time

- A timing structure that aligns with volume or volatility

- Even psychological edge (you stay calm when others panic)

But here’s the key:

An edge is something that works often enough, with controlled risk, and consistent execution.

☠️ What Happens When You Don’t Have One

Let’s break it down.

Trading without an edge leads to:

- Random outcomes that feel emotional

- Overtrading because you’re chasing the next “feel good” moment

- Misplaced confidence after a few lucky wins

- Explosive losses when luck runs out

And worst of all?

You think you’re improving…

But in reality, you’re just getting better at losing slower.

🍹 At Least Vegas Gives You Something Back

Here’s the irony:

In Vegas, the drinks are free.

You get a show. You laugh. You know it’s a gamble.

In trading?

- You pay for your losses

- You pay for your education

- You pay for your psychology coach

- And nobody even gives you a free mojito.

If you're going to lose money without an edge, you might as well enjoy the music.

🎯 So How Do You Actually Get an Edge?

1. Backtest.

Find a setup that repeats. Track it. Chart it. Obsess over it.

2. Track your stats.

Your win rate, average R, time in trade. Know thyself.

3. Simplify.

An edge isn’t 12 indicators. It’s one thing done well.

4. Survive first, thrive later.

If you’re not around after 100 trades, your edge won’t matter anyway.

5. Learn from pain, not just profit.

Your losers have more to teach than your winners.

🧘 Final Thought – Stop Playing Pretend

If you wouldn’t go to a casino and bet $1000 on 25 without knowing the odds…

Why are you doing that in the markets?

Don’t call it trading if it’s actually coping.

Don’t call it strategy if it’s actually guessing.

Most Traders Want Certainty. The Best Ones Want Probability.Hard truth:

You’re trying to trade like an engineer in a casino.

You want certainty in an environment that only rewards probabilistic thinking.

Here’s how that kills your edge:

You wait for “confirmation” — and enter too late.

By the time it feels safe, the market has moved.

You fear losses — but they’re the cost of data.

Good traders don’t fear being wrong. They fear not knowing why.

You need to think in bets, not absolutes.

Outcomes don’t equal decisions. Losing on a great setup is still a good trade.

🎯 Fix it with better framing.

That’s exactly what we designed TrendGo f or — to help you see trend strength and structure without delusions of certainty.

Not perfect calls. Just cleaner probabilities.

🔍 Train your brain for the game you’re playing — or you’ll keep losing by default.

In Theory, You’re a Great Trader — In Practice, You’re Human🧠 10 Ways Trading Theory Falls Apart in Real Practice

Because in theory, you're rich. In practice, you panic-sold at support.

“In theory, there is no difference between theory and practice. In practice, there is.”

— Yogi Berra

Welcome to trading — where you read about patience and discipline, and then blow up your account chasing a breakout at 3AM.

Let’s explore the top 10 ways trading theory gets wrecked by real-world execution, complete with painful honesty and maybe a laugh or two (because crying is for after market close).

________________________________________

1. 🎯 In theory: You always follow your trading plan.

In practice:

You make a new plan after every trade.

That loss wasn’t part of “the plan,” so obviously the plan was wrong. Let’s fix it — during the trade — in real-time — while it bleeds. Genius.

________________________________________

2. 🧘♂️ In theory: You manage risk carefully.

In practice:

"Let me just move the stop... just this once... just 10 more pips..."

Before you know it, your stop loss is in the next timezone, and your trade is now a long-term investment.

________________________________________

3. 📊 In theory: Backtesting proves the strategy works.

I n practice:

Backtest = you, alone, with no emotions, clicking replay in TradingView.

Live trading = markets screaming, Twitter panicking, and you entering on the 1-minute chart because “it felt right.”

________________________________________

4. 💻 In theory: You’ll be objective.

In practice:

You saw one green candle and whispered:

“This is it. The reversal. I feel it.”

You weren’t objective. You were in a situationship with your trade.

________________________________________

5. 💰 In theory: R:R 2:1 minimum.

In practice:

You close at +0.3R “just to be safe” — and then it hits target 10 minutes later while you re-enter worse, and get stopped.

________________________________________

6. 🕒 In theory: You wait for confirmation.

In practice:

You anticipate confirmation. You hope for confirmation.

Spoiler: hope is not a strategy. But hey, at least you learned… again.

________________________________________

7. 🤖 In theory: You’re a rules-based, emotionless trader.

In practice:

You meditate, breathe deeply, journal, and then buy Gold after CPI with no stop loss and max leverage.

So much for being the Terminator.

________________________________________

8. 📚 In theory: More knowledge = better performance.

I n practice:

You read five books, memorized all candlestick names, and still entered long into resistance because it “looked bullish.”

Trading isn’t trivia night. It’s controlled decision-making under fire.

________________________________________

9. 😤 In theory: You’ll accept losses calmly.

In practice:

First you rage-quit. Then you revenge trade. Then you open ChatGPT and ask:

“Should I hedge this 80% drawdown?”

________________________________________

10. 📆 In theory: You’ll be consistent.

In practice:

You traded London Open on Monday, Asian Session on Tuesday, and New York close on Friday.

Consistency? You don’t even use the same time frame twice in a row.

________________________________________

🚧 So… how do you bridge the gap?

1. Journal your trades — honestly. Especially the emotional mess-ups.

2. Create rules you can actually follow — not Instagram-quote rules.

3. Simulate real conditions — including drawdowns, boredom, and fakeouts.

4. Accept that mistakes are part of the job — and build for resilience, not perfection.

5. Trade small enough that you don’t care much — so you can learn while surviving.

________________________________________

🎯 Final word:

Trading theory is like a clean whiteboard.

But the market? It’s a chaotic toddler with crayons and no rules.

If you can operate inside that chaos — with clarity and emotional control — that’s when the theory starts working.

Trading Gold? Know the Difference Between XAU/USD and Futures🔎 Let’s address a question I get very often:

“Should I trade spot gold (XAU/USD) or Gold futures?”

It might sound like a technical decision, but it’s actually about how you approach the market, your risk profile, and your experience level.

So let’s break it down 👇

________________________________________

🟡 Two ways to trade the same asset

Both spot and futures allow you to speculate on the price of Gold. But they’re two very different beasts when it comes to execution, capital, and strategy.

________________________________________

1️⃣ Spot gold (XAU/USD)

• Traded mostly via Forex brokers or CFD platforms

• No expiration — you can hold the position as long as you want

• Often used by retail traders for day trading or swing setups

• You can open small trades (even 0.01 lots)

• Costs include spread, swap fees if you hold overnight

• Leverage is usually high — up to 1:100 or more

• Margin is required, but typically lower than in futures

💡 Spot is flexible and accessible, but you pay the price through overnight holding costs, wider spreads during volatility, and slippage. On some brokers, especially during high-impact news, your platform might even freeze or delay execution — and that’s a serious risk if you’re not prepared.

________________________________________

2️⃣ Gold futures (GC)

• Traded on major futures exchanges like CME

• Contracts have a fixed size (usually 100 oz)

• They expire monthly, so you need to manage rollovers

• Common among hedge funds and experienced traders

• You pay commissions and exchange fees, but no swaps

• Margin is required here too — but it's much higher

💡 Futures are structured and professional — but they demand more capital, stricter execution discipline, and higher margin requirements. Just like in spot trading, margin is a collateral deposit, not a cost — but with futures, the bar is set higher.

________________________________________

⚖️ So, which one is for you?

If you're using MetaTrader or any platform offered by a Forex/CFD broker, and you're a scalper, intraday, or swing trader working with flexible position sizes...

→ You're probably better off with spot gold (XAU/USD).

If you're trading big volume, managing diversified portfolios, or involved in hedging large exposure...

→ You should consider futures — but expect to level up your game, capital requirements, and discipline.

________________________________________

🧠 Mindset:

Don’t confuse accessibility with simplicity.

Just because spot Gold is easier to open doesn’t mean it’s always the best choice.

Just because futures look “pro-level” doesn’t mean they’re always worth it for a retail trader.

Understand your tools. Pick the one that aligns with your structure. That’s how you stay in the game. 🎯

________________________________________

📚 Hope this cleared it up. If you want me to cover execution setups for each one, let me know in the comments.

Buy Fear, Not Euphoria: The Trader's EdgeWhen you look back at the greatest trading opportunities in history, they all seem to share a common element: fear. Yet, when you're in the moment, it feels almost impossible to pull the trigger. Why? Because fear paralyzes, while euphoria seduces. If you want to truly evolve as a trader, you need to master this fundamental shift: buy fear, not euphoria.

Let's break it down together.

________________________________________

What Fear and Euphoria Really Mean in Markets

In simple terms, fear shows up when prices are falling sharply, when bad news dominates the headlines, and when people around you are saying "it's all over."

Euphoria, on the other hand, is everywhere when prices are skyrocketing, when everyone on social media is celebrating, and when it feels like "this can only go higher."

In those moments:

• Fear tells you to run away.

• Euphoria tells you to throw caution to the wind.

Both emotions are signals. But they are inverted signals. When fear is extreme, value appears. When euphoria is extreme, danger hides.

________________________________________

Why Buying Fear Works

Markets are pricing machines. They constantly adjust prices based on emotions, news, and expectations. When fear hits, selling pressure often goes beyond what is rational. People dump assets for emotional reasons, not fundamental ones.

Here’s why buying fear works:

• Overreaction: Bad news usually causes exaggerated moves.

• Liquidity Vacuums: Everyone sells, no one buys, creating sharp discounts.

• Reversion to Mean: Extreme moves tend to revert once emotions stabilize.

Buying into fear is not about being reckless. It’s about recognizing that the best deals are available when others are too scared to see them.

________________________________________

Why Chasing Euphoria Fails

At the peak of euphoria, risks are often invisible to the crowd. Valuations are stretched. Expectations are unrealistic. Everyone "knows" it's going higher — which ironically means there's no one left to buy.

Chasing euphoria often leads to:

• Buying high, selling low.

• Getting trapped at tops.

• Emotional regret and revenge trading.

You’re not just buying an asset — you're buying into a mass illusion.

________________________________________

How to Train Yourself to Buy Fear

It's not enough to "know" this. In the heat of the moment, you will still feel the fear. Here's how you build the right habit:

1. Pre-plan your entries: Before panic strikes, have a plan. Know where you want to buy.

2. Focus on strong assets: Not everything that falls is worth buying. Choose assets with strong fundamentals or clear technical setups.

3. Scale in: Don’t try to catch the bottom perfectly. Build positions gradually as fear peaks.

4. Use alerts, not emotions: Set price alerts. When they trigger, act mechanically.

5. Remember past patterns: Study previous fear-driven crashes. See how they recovered over time.

Trading is a game of memory. The more you internalize past patterns, the easier it is to act when everyone else panics.

________________________________________

A Recent Example: April 2025 Tariff Panic

Very recently, at the start of April, Trump’s new tariff announcements sent shockwaves through the market. Panic took over. Headlines screamed. Social media was flooded with fear.

But if you looked beyond the noise, charts like SP500 and US30 told a different story: the drops took price right into strong support zones.

At the time, I even posted this : support zones were being tested under emotional pressure.

If you had price alerts set and reacted mechanically, not emotionally , you could have bought into that fear — and potentially benefited from the rebound that followed just days later.

This is the essence of buying fear.

________________________________________

Final Thoughts

In trading, you are paid for doing the hard things. Buying when it feels terrible. Selling when it feels amazing.

Remember:

Fear offers you discounts. Euphoria offers you traps.

The next time the market feels like it's crashing, ask yourself:

• Is this fear real, or exaggerated?

• Is this an opportunity hiding under an emotional fog?

If you can answer that with clarity, you're already ahead of 90% of traders.

Stay rational. Stay prepared. And above all: buy fear, not euphoria.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Trading Psychology Trap: The Dark Side of Hedging a Bad Trade⚡ Important Clarification Before We Begin

In professional trading, real hedging involves sophisticated strategies using derivatives like options, futures, or other financial instruments.

Banks, funds, and major institutions hedge to manage portfolio risk, based on calculated models and complex scenarios.

This article is not about that.

We are talking about the kind of "hedging" retail traders do — opening an opposite position at the broker to "protect" a losing trade.

It may feel smart in the moment, but psychologically, it can be a hidden trap that damages your trading discipline.

Let’s dive into why emotional hedging rarely works for independent traders.

________________________________________

In trading, there’s a moment of panic that every trader has faced:

"My short position is in the red… maybe I’ll just open a long to balance it out."

It feels logical. You’re hedging. Protecting yourself. But in reality, you might be stepping into one of the most deceptive psychological traps in trading.

Let’s unpack why emotional hedging is rarely a good idea—and how it quietly sabotages your progress.

________________________________________

🧠 1. Emotional Relief ≠ Strategic Thinking

Hedging often arises not from a solid strategy, but from emotional discomfort.

You don’t hedge because you’ve analyzed the market. You hedge because you can’t stand the pain of a losing position.

This is not trading.

This is emotional anesthesia.

You’re trying to feel better—not trade better.

________________________________________

🎭 2. The Illusion of Control

Opening a hedge feels like taking back control.

In reality, you’re multiplying complexity without clarity.

You now have:

• Two opposing positions

• No clear directional bias

• An unclear exit strategy

You’ve replaced one problem (a loss) with two: mental conflict and strategic confusion.

________________________________________

🎢 3. Emotional Volatility Rises Sharply

With two positions open in opposite directions:

• You root for both sides at once.

• You feel relief when one wins, and stress when the other loses.

• Your mind becomes a battleground, not a trading desk.

This emotional volatility leads to irrational decisions, fatigue, and trading paralysis.

________________________________________

🔄 4. You Delay the Inevitable

When you hedge a losing position, you don’t fix the mistake.

You prolong it.

Eventually, you’ll have to:

• Close one side

• Add to one side

• Or exit both at the wrong moment

Hedging here is just postponed decision-making—and it gets harder the longer you wait.

________________________________________

🧪 5. You Build a Dangerous Habit

Hedging out of fear creates a reflex:

"Every time I’m losing, I’ll hedge."

You’re not learning to cut losses or reassess your strategy.

You’re learning to panic-protect.

And over time, you start to rely on hedging as a crutch—rather than developing real confidence and discipline.

________________________________________

✅ The Healthier Alternative

What should you do instead?

• Cut the loss.

• Review the trade.

• Wait for a fresh setup that aligns with your plan.

Accepting a losing trade is hard. But it’s a sign of maturity, not weakness.

Hedging may feel clever in the moment, but long-term consistency comes from clarity, not complication.

________________________________________

🎯 Final Thought

Emotional hedging isn’t about strategy.

It’s about fear.

The best traders don’t hedge to escape a loss.

They manage risk before the trade starts —and have the courage to close what’s not working.

Don’t fall into the illusion of safety.

Master the art of decisive action. That’s where real edge lives. 🚀

Why I Deal With Losses Before They Even Appear📉 Mastering the mindset that most traders avoid

There’s a moment that happens in every trader’s journey — not during a win, but during a loss.

A frozen moment where your mind screams, “It shouldn’t have gone this way!”

You look at the screen, your stop is hit, your equity drops, and your brain starts the negotiation:

“What if I held a bit longer?”

“Maybe the stop was too tight.”

“I need to make this back. Now.”

But the problem didn’t start with that loss.

It started long before you placed the trade.

________________________________________

💡 The Biggest Lie in Trading: “I’ll Deal With It When It Happens”

Too many traders operate from a place of reactivity.

They focus on the chart, the breakout, the “R:R,” the indicator... but they forget the only thing that actually matters:

❗️ What if this trade fails — and how will I handle it?

That’s not a pessimistic question.

It’s the most professional one you can ask.

If you only accept the possibility of a loss after the loss happens, it’s too late.

You’ve already sabotaged yourself emotionally — and probably financially, too.

So here's the core principle I apply every single day:

________________________________________

🔒 I Accept the Loss Before I Enter

Before I click "Buy" or "Sell," I already know:

✅ What my stop is.

✅ How much that stop means in money.

✅ That I am 100% okay losing that amount.

If any of those don’t align, the trade is dead before it begins.

This is not negotiable.

________________________________________

🚫 Don’t Touch the Stop. Touch the Volume.

One of the biggest mistakes I see — and I’ve done it too, early on — is this:

You find a clean technical setup. Let’s say the proper stop is 120 pips away.

You feel it’s too wide. You want to tighten it to 40. Why?

Not because the market structure says so — but because your ego can’t handle the potential loss.

❌ That’s not trading. That’s emotional budgeting.

Instead, keep the stop where it technically makes sense.

Then reduce the volume until the potential loss — in money, not pips — is emotionally tolerable.

We trade capital, not distance.

________________________________________

🧠 This Is the Only Risk Model That Makes Sense

Your strategy doesn’t need to win every time.

It just needs to keep you in the game long enough to let the edge play out.

If your risk is too big for your mental tolerance, it’s not sustainable.

And if it’s not sustainable, it’s not professional trading.

The goal isn’t to be right. The goal is to survive long enough to be consistent.

________________________________________

📋 My Framework: How I Deal with Losses Before They Show Up

Here’s my mental checklist for every trade:

1. Accept the loss before entering.

If I’m not okay losing X, I reduce the volume or skip the trade.

2. Set the stop based on structure, not comfort.

If the setup needs a 150-pip stop, so be it. It’s not about feelings.

3. Adjust volume to match my comfort zone.

I never trade “big” just because a setup looks “great.” Ego has no place here.

4. View trades as part of a series.

I expect losses. I expect drawdowns. One trade means nothing.

5. Be willing to exit early if the story changes.

If price invalidates the idea before the stop is hit (or the target), I’m gone.

________________________________________

🧘♂️ If You Can’t Sleep With the Trade, You’re Doing It Wrong

Peace of mind is underrated.

If a trade is making you anxious — not because it’s near SL, but because it’s threatening your sense of control — something is off.

And that something is usually your risk size.

Professional trading isn’t built on adrenaline.

It’s built on calm decisions, repeated for years.

________________________________________

🏁 Final Thoughts: Profit is Optional. Loss Management is Mandatory.

If you want to become consistent, start every trade with a simple, brutally honest question:

“Can I lose this money and still feel calm, focused, and in control?”

If the answer is no, you’re not ready for the trade — no matter how good the chart looks.

Profit is a possibility.

Loss is a certainty.

Master the certainty. The rest will follow.

🚀 Keep learning, keep growing.

Best of luck!

Mihai Iacob

Why All You Need Is the Chart: Let the Market Speak FirstYou missed the news? Doesn’t matter. The chart already heard it for you.

________________________________________

1. The Myth of Being “Informed”

Modern traders feel pressured to be constantly plugged in:

• Twitter alerts

• Trump’s latest outburst

• CNBC headlines

It feels like you’re missing out if you’re not watching everything.

But here’s the truth:

By the time you read the news, the market already priced it in.

Being "informed" doesn’t make you early . It usually makes you late .

________________________________________

2. The Chart Already Knows

Imagine a bullish surprise in the economy. You didn’t catch it live.

But when you open your chart, you see this:

📈 A bullish engulfing candle bouncing cleanly off major support.

That’s all you need. That’s your trade. You don’t need to know why it happened.

The chart speaks last. And the chart speaks loudest.

________________________________________

3. Price Is the Final Judge

All the noise — opinions, reports, breaking headlines — flows into a single output: price.

• Economic collapse? The chart shows a break.

• Political turmoil? Price still rejects resistance.

Price is truth.

Instead of asking: " What happened? ", start asking: " What is price doing? "

________________________________________

4. Real-Life Analogy

You don’t need to read the newspaper to know it’s raining. Just look out the window. 🌧️

Same with trading. Just look at the chart.

The price is your weather forecast. React to that. Not to noise.

________________________________________

5. What to Do Instead of Watching News:

• Draw clean support/resistance levels

• Wait for real confirmation (engulfings, breakouts, rejections)

• Manage risk — always

• Be patient. Let the market show its hand

________________________________________

Final Thought:

If something important happened, you’ll see it on the chart. You don’t need 10 sources. You don’t need speed. You need clarity.

Let the chart speak. It knows more than the news ever will.

Dealing with Stress in Trading: The Silent Killer of PerformanceTrading is hard. But not just technically or economically — emotionally, it's one of the most demanding things you can do.

Charts, indicators, news, setups — they’re all part of the job. But behind every click, there’s a person reacting to fear, frustration, regret, and pressure.

And that’s where stress creeps in.

In this article, we’ll explore:

• Why trading stress hits harder than most think

• How it manifests (and sabotages) your decisions

• Practical ways to reduce and manage stress

• The mindset shift that changes everything

________________________________________

🔥 Why Trading Is Uniquely Stressful

Most jobs reward consistency. Trading, ironically, punishes it at times.

You can do everything “right” and still lose money. You can follow your plan, manage risk, and still watch a red candle wipe your equity.

The problem?

Our brains aren’t built for that kind of randomness. We crave cause-effect logic — but markets aren't and most of all don’t care.

This disconnect creates cognitive dissonance . The result? Stress builds up.

________________________________________

🧠 How Stress Sabotages Traders (Without Them Realizing)

Stress doesn’t always show up as panic. More often, it shows up as:

• Overtrading (trying to ‘fix’ bad trades emotionally)

• Freezing (not taking good setups out of fear)

• Revenge trading (turning a bad trade into a disaster)

• Inconsistency (changing strategy mid-week, mid-trade, mid-breath)

• Physical symptoms (fatigue, headaches, insomnia — yes, it's real)

Left unchecked, stress creates a loop:

Stress → bad trades → more stress → worse decisions.

________________________________________

🛠️ Practical Techniques to Manage Trading Stress

Here’s what actually helps — not the Instagram-fluff, but what real traders use:

1. Create Pre-Defined Trade Plans

Stress loves uncertainty. But when you enter a trade with exact entries, stops, and targets, you leave less room for panic-based decisions.

✅ Pro tip: Write your trade plan down. Don’t trade from memory.

________________________________________

2. Use the 3-Strike Rule

If you take 3 consecutive losses or bad trades — stop for the day, or if you are a swing trader, stop for the week, come back on Monday. It’s not about revenge. It’s about protecting mental capital.

“When in doubt, protect your focus. You can’t trade well without it.”

________________________________________

3. Build a Trading Routine (Like a Ritual)

Start each session the same way. Same coffee, same chart review, same breathing.

Why? It anchors your brain. Predictability in your environment reduces the emotional chaos inside your head.

________________________________________

4. Step Away from the Screen (Yes, Physically)

After a tough trade, move. Walk. Stretch. Get outside. Go to gym, ride your bike(these I do most often). Reset your nervous system. Trading is mental, but stress is physical too.

You’re not a robot. Don't act like one.

________________________________________

5. Track Your Emotional State (Not Just P&L)

Keep a trading journal where you note how you felt before/after trades.

You’ll find patterns like:

• “I lose when I’m bored and looking for action”

• “My best trades happen when I feel calm and centered”

Awareness = control.

________________________________________

🧭 The Mindset Shift: From Outcome to Process

This might be the most important thing I’ll ever tell you:

Detach from results. Fall in love with process.

Your goal isn’t to win every trade.

Your goal is to execute your plan with discipline.

Every time you do that — even on a losing trade — you’re winning the real game.

That’s how stress stops being the master and becomes the servant.

________________________________________

🧘 Final Thought: Stress Will Never Go Away — and That’s Okay

You’ll always feel something. But the goal isn’t to be emotionless — it’s to be aware and in control.

Trading is like martial arts: the best fighters aren’t calm because they feel nothing. They’re calm because they’ve trained their response.

So train yours.

________________________________________

💬 Remember, consistency in mindset creates consistency in results.

Trading is a business

The masses have the wrong ideas about Trading. It is a business and just like others it involves risk. We grow, we learn, earn and scale up. Crafting a plan is essential to success and character also play a key role here.

In this business, risk is an inherent part of the equation. Just like any other enterprise, trading exposes you to challenges and setbacks, but it's how you manage these risks that can differentiate a thriving business from one that falters. Careful risk management—whether through proper position sizing, stop-loss strategies, or diversification—is the foundation that helps protect your capital while you grow your business over time.

Crafting a trading plan is essential. This plan should not only outline your entry and exit strategies based on rigorous analysis but also incorporate a framework to evaluate your performance critically. A well-crafted plan serves as a roadmap, guiding your decisions in both favorable and challenging market conditions. Moreover, it creates a discipline that protects you from emotional reactions that can often lead to impulsive decisions—a common pitfall in trading.

Character plays a crucial role as well. In trading, psychological fortitude, resilience in the face of losses, and the humility to learn from mistakes are qualities that separate the successful from the rest. Many people mistakenly believe that a few big wins can offset a series of missteps; however, it is the consistent, calculated, and disciplined approach that leads to sustainable growth. This business mindset—acknowledging that each trade is a learning opportunity and a step in scaling up your efforts—is what ultimately propels traders to long-term success.

In essence, re-framing trading as a business fosters a mindset where every decision is taken seriously, every mistake is analyzed for improvement, and every trade is seen as a building block for growth. This approach not only minimizes unnecessary risks but also enables you to scale up with confidence.

I'm curious—what elements of your trading plan do you find most effective at keeping your business mindset in check, and are there aspects you'd like to refine further?

12 Tips Every New Forex Trader Should Know!New to Forex? These 12 tips will save you months of frustration.

Forex trading can be overwhelming in the beginning, but it doesn’t have to be. Whether you're just starting out or still finding your feet, these tips are designed to help you avoid common mistakes and fast-track your learning curve.

✅ Save this post

✅ Follow for more Forex insights

✅ Drop a comment with your biggest struggle as a beginner, I might turn it into the next tip!

Let’s grow together. 📈💪

Why I Only Buy Dips / Sell Rallies When I Trade GoldWhen it comes to trading Gold (XAUUSD), I’ve learned one key truth: breakouts lie, but dips/rallies tell the truth.

That’s why I stick to one rule that has kept me consistently profitable:

I only buy dips in an uptrend and only sell rallies in a downtrend.

Let me explain exactly why this approach works so well—especially on Gold, a notoriously tricky market.

________________________________________

1. 🔥 Gold is famous for fake breakouts

Breakouts on Gold often look amazing… until they trap you.

You enter just as price breaks a key level—then suddenly it reverses and stops you out.

This happens because Gold loves to tease liquidity. It breaks highs or lows just enough to activate stop losses or attract breakout traders, only to reverse.

Buying dips or selling rallies protects you from these traps by entering from value, not hype.

________________________________________

2. ✅ I get better stop-loss placement and risk:reward

When I buy a dip, I can place my stop below a strong level (like a support zone or swing low).

That gives me tight risk and allows for big reward potential—often 1:2, 1:3 or more.

Breakout trades, on the other hand, often require wider stops or result in poor entries due to emotional execution.

________________________________________

3. ⏳ I get time to assess the market

False breakouts happen fast. But dips usually form more gradually.

That gives me time to analyze price action, spot confirmation signals, and even scratch the trade at breakeven if it starts to fail.

This reduces emotional decisions and increases my accuracy.

________________________________________

4. 🎯 Gold respects key levels more than it respects momentum

Even in strong trends, Gold often retraces deeply and retests zones before continuing.

That means entries near key levels—on a dip or rally—are more reliable than chasing price.

I’d rather wait for the zone than jump in mid-air.

________________________________________

5. 🔁 Even in aggressive trends, Gold often reverts to the mean

Lately, Gold has been trending hard—no doubt.

But even during explosive moves, it frequently pulls back to key moving averages or demand zones.

That’s why mean reversion entries on dips or rallies continue to offer excellent setups, even in fast-moving markets.

________________________________________

6. 🧠 I benefit from retail trader mistakes

Most traders get excited on breakouts.

But what usually happens? The breakout fails, and the price returns to structure.

By waiting for the dip/rally (when others are panicking or taking losses), I can enter at a discount and ride the move in the right direction.

________________________________________

7. 🧘♂️ This strategy forces patience and discipline

Waiting for dips or rallies requires patience.

You don’t jump in randomly. You plan your entry, your stop, your take profit—calmly.

That mental discipline is a trading edge on its own.

________________________________________

8. 📊 I align myself with probability, not emotion

In an uptrend, buying a dip is logical.

In a downtrend, selling a rally is natural.

Trying to “chase the breakout” is emotional—trying to get in on the action, fearing you'll miss the move.

I trade with the trend, from the right zone, and with a clear plan.

________________________________________

9. 🕒 I can use pending limit orders and walk away

One of the most underrated benefits of trading dips and rallies?

I don’t need to chase the market or be glued to the screen.

When I see a clean level forming, I simply place a buy limit (or sell limit) with my stop and target predefined.

This saves time, reduces overtrading, and keeps my emotions in check.

It’s a set-and-forget approach that fits perfectly with Gold’s tendency to return to key zones—even during high volatility.

________________________________________

🔚 Final thoughts

There’s no perfect trading strategy. But when it comes to Gold, buying dips and selling rallies consistently keeps me on the right side of probability.

I avoid the emotional traps. I get better entries. And most importantly, I protect my capital while maximizing reward.

Next time you see Gold breaking out, ask yourself:

“Is this real… or should I just wait for the dip/rally?”

That question might save you a lot of pain.

There's a Time to Trade and a Time to Watch Lately, the market has been in chaos – indices are dropping like there’s no tomorrow, and when it comes to Gold, what used to be a normal fluctuation of 100 pips has now turned into a 500-pip swing. In such a volatile environment, many traders feel compelled to be constantly active, believing that more trades mean more profit. But the truth is, there’s a time to trade and a time to watch.

Conservation of Capital is Essential 💰

The best traders understand that their capital is their lifeline. It’s not about making trades; it’s about making the right trades.

The market doesn’t reward effort; it rewards patience and precision.

Instead of jumping into mediocre setups, learn to appreciate the value of patience .

Every time you enter a trade that doesn’t meet your criteria, you risk your capital unnecessarily. And every loss chips away at your ability to capitalize on the real opportunities when they come. Capital preservation should be your priority.

Focus Only on A+ Signals 📌

Not every setup is worth your time and money. The goal should be to only enter positions that offer a clear edge – signals that you’ve identified as high-probability opportunities through your experience and strategy.

A + setups are those that offer:

• A clear technical pattern or setup you've mastered.

• A favorable risk-to-reward ratio, ideally 3:1 or better.

• Alignment with your overall strategy and market context.

If these criteria aren't met, it’s often better to do nothing. Waiting for the right setup and market conditions is part of the game.

The Power of Doing Nothing 🤫

Inaction is a skill. It requires discipline to avoid the urge to "force" trades. But the market will always be there tomorrow , and so will the opportunities.

By learning to watch rather than trade during uncertain or suboptimal conditions, you avoid unnecessary losses and conserve your capital for when the market truly presents an edge.

Conclusion 🚀

Trading is about quality, not quantity. Respect your capital and recognize that sometimes, the smartest move is to wait. Let the market be clear.

Remember, there’s a time to trade and a time to watch. Master this balance, and you’ll be miles ahead of most traders.

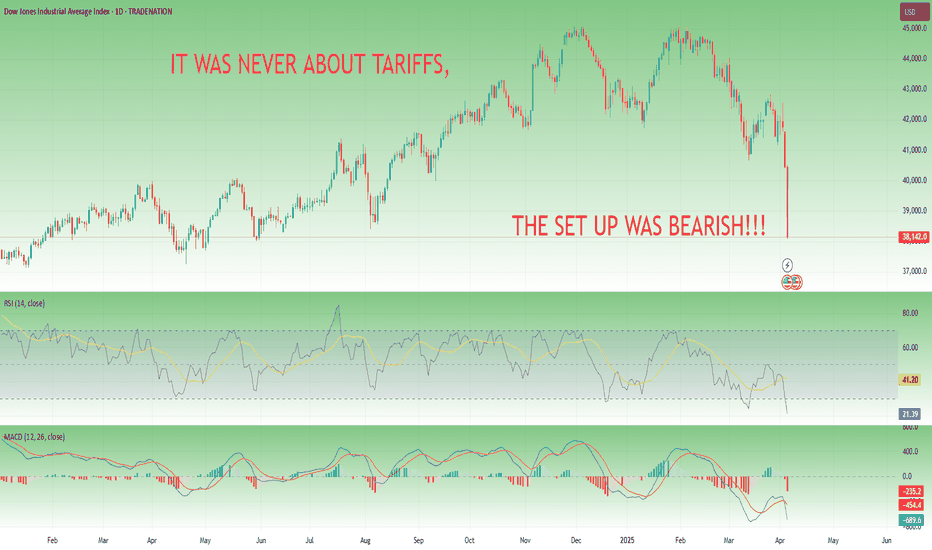

Tariffs Didn’t Cause the Correction — It Was Coming Anyway🚩 Intro: Markets Correct — They Don’t Need Permission

Every time the market drops hard, the headlines rush in to explain it. This time, it was President Trump’s dramatic tariff announcement on April 2nd. The media called it a shock.

I didn’t.

I’ve been calling for S&P 500 to drop to 5,200, and NASDAQ-100 to 17,500, since early January.

Not because I predicted tariffs. But because the charts told the story.

The market didn’t fall because of politics — it fell because it had to.

________________________________________

🔥 The Spark: Trump’s “Liberation Day” Tariffs

On April 2, 2025, Trump rolled out an aggressive trade agenda:

• 10% blanket tariff on all imports

• Up to 54% tariffs on Chinese goods

• 25% tariffs on imported cars and parts

• With limited exemptions for USMCA-aligned countries

Markets reacted instantly:

• S&P 500 dropped 4.8% — worst day since 2020

• NASDAQ-100 plunged over 6%

• Tech mega caps lost 5–14% in a day

Sounds like cause and effect, right?

Wrong.

________________________________________

🧠 The Real Cause: A Market That Was Ready to Fall

Let’s talk technicals:

• S&P 500 had printed a textbook double top at the 6100–6150 zone

• NASDAQ-100 had formed a rising wedge, with volume divergence and momentum fading

• RSI divergence was in place since February

• MACD had crossed bearish and also deverging

• Breadth was weakening while indices were still pushing highs

• Sentiment was euphoric, volatility crushed — a classic setup

You didn’t need to guess the news. The structure was screaming reversal.

SP500 CHART:

NASDAQ CHART:

________________________________________

🧩 Why Tariffs Made a Convenient Narrative

Markets love clean stories. And Trump’s tariffs offered everything:

• Emotional trigger

• Economic fear factor

• Political drama

• Global implications

But smart traders know better: markets correct based on positioning, not politics.