Gann

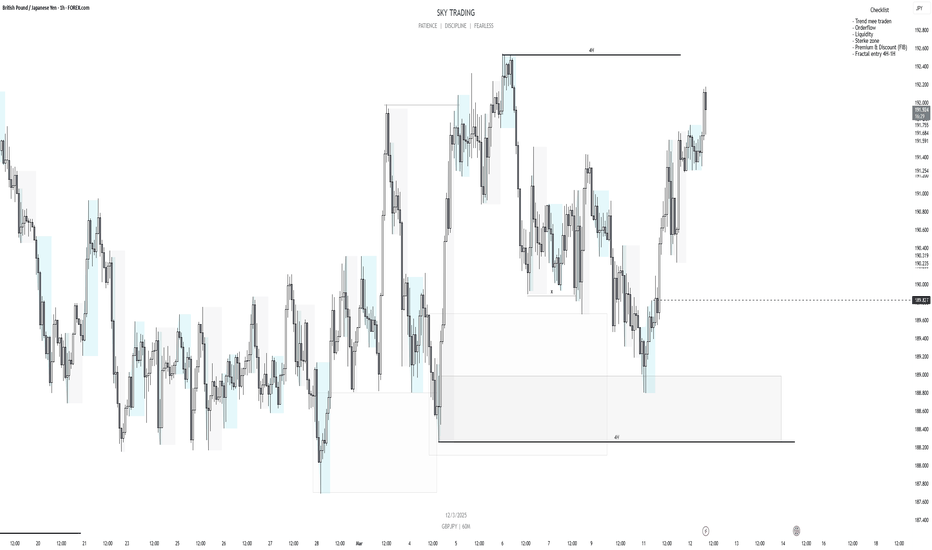

Price moved up as I said. Now it's about it's next courseThere are more than one potential configurations of this market structure

This next move should help guide us as to how the Highs and Lows of this market structure is set to be

What matters is that price went up, so we are in profit. Now it's about whether we close or hold...keep in mind that most traders are not profitable, we decide how profitable we want to be

Gann Astro Trading Strategy with 92% Win Rate !Gann Astro Trading Strategy with 92% Win Rate !

Unlocking Gann's Secrets: Time Cycles, Square of 9, and Planetary Influence

In this video, we will dive deep into Gann’s trading methods, uncovering how time cycles, Square of 9 calculations, and planetary influences — especially the Mars-Jupiter cycle and lunar cycles — shape market movements. We’ll explore how numerology shifts and square roots reveal hidden support and resistance levels, plus how planetary declinations influence both price action and market psychology. Whether you’re a seasoned trader or just discovering Gann’s techniques, this breakdown will give you powerful insights to time the markets more effectively.

What You’ll Learn in This Video:

- How to apply Gann’s Square of 9 to track market highs and lows.

- The power of Mars-Jupiter cycles in driving momentum and expansion.

- How lunar cycles and faster planets like Mercury influence short-term moves.

- Using numerology shifts and square roots to uncover hidden support and resistance levels.

- The role of planetary declinations in shaping market psychology and major trend reversals.

Why This Video is Essential for Traders:

- Understand how Gann’s time cycles predict market turning points.

- Gain an edge with astrological market analysis — beyond traditional technical methods.

- Learn to combine fast and slow planets to time entries and exits more precisely.

- Decode historic market moves like the 2008 crash through planetary geometry.

Unlock the power of Gann’s time cycles, Square of 9, Gann Wheel, Gann angles, and Gann Fan to forecast market moves with precision. Discover how the Mars-Jupiter cycle, lunar phases, Gann Master Time Factor, Gann Emblem, and planetary declinations impact price action and trend shifts. Learn how Gann’s Law of Vibration, numerology shifts, square roots, price-time squaring, and hidden vibrational levels reveal key support and resistance zones. Whether it’s tracking historic market crashes, price-time balance, or Gann’s astro-numerology, this strategy will refine your entry-exit timing for maximum profitability.

Gann Trading Strategy: Understanding Gann Price CyclesGann Trading Strategy: Understanding Gann Price Cycles.

Gann Trading Strategy with a deep dive into Gann Price Cycles and candle range averaging to forecast upcoming highs and lows. Learn how to apply Gann's time and price principles, predict market turning points, and enhance your trading accuracy.

Gann Price Cycles: Understanding Market Movements with Precision

- Gann Price Cycles are a fundamental concept in W.D. Gann's trading methodology, used to predict market highs and lows based on historical price movements and time cycles. Gann believed that markets move in predictable cycles, influenced by both price and time relationships. By studying these cycles, traders can anticipate future turning points with greater accuracy.

Key Principles of Gann Price Cycles:

1. Repeating Market Patterns – Price movements follow specific cyclical patterns that repeat over time. Identifying these patterns helps traders forecast future price swings.

2. Time and Price Symmetry – Gann emphasized that time and price must be in balance. When a market completes a significant time cycle, it often results in a reversal or acceleration of trend.

3. Natural Market Rhythms – Just like planetary cycles, financial markets move through predictable 360-degree price cycles, based on Gann’s Square of Nine and Gann Angles.

4. Averaging Price Ranges – By analyzing historical price ranges and averaging them, traders can estimate the next high or low in the market.

Gann Trading Strategy | Predict Market Highs & Lows with Gann.Gann Trading Strategy | Predict Market Highs & Lows with Gann Trading Strategy

In this video we will unlock historical secrets of Sacred Geometry and how they apply to financial markets through W.D. Gann's Time & Price concepts. This video explores the deep connection between natural mathematical principles, the Golden Ratio (0.618), Fibonacci levels, and market structure—all rooted in ancient sacred geometry used in art, architecture, and astronomy.

Markets are not random; they follow universal laws found in nature, human anatomy, and celestial movements. Gann discovered that time and price cycles repeat in predictable patterns, allowing traders to anticipate reversals with precision. This video will guide you through how to use these ancient principles in modern trading.

What You'll Learn in This Video:

✅ Understanding Gann’s Time & Price Geometry – The foundation of market movements

✅ Golden Ratio & Fibonacci Trading – How 0.618, 0.786, and 1.618 shape market trends

✅ The ABCD Pattern in Trading – How to use structured price action setups.

Discover the hidden connections between Sacred Geometry, W.D. Gann’s Time & Price principles, and financial markets in this powerful Gann trading lesson. Markets are not random; they move according to natural laws, mathematical ratios, and planetary cycles—the same principles found in ancient architecture, astronomy, and human biology. Gann’s work revealed that time and price must synchronize for major market reversals, and by understanding these patterns, traders can anticipate key turning points with accuracy. This lesson will dive deep into Gann’s geometric approach, the Golden Ratio (0.618), Fibonacci levels, and structured price action setups, all of which play a crucial role in market movements.

live bitcoin trade Trend Analysis: The broader trend appears to be downward, with Bitcoin forming a potential falling wedge on the daily chart. Falling wedges are generally considered bullish reversal patterns, but confirmation is needed.

Support and Resistance:

Support: $82,500 is a critical short-term support. Below this, $79,000 and the stronger zone around $76,100–$73,600 are key supports.

Resistance: $85,100–$85,300 is the immediate resistance. If BTC breaks this zone with a strong daily close, it could lead to a significant upward move.

Volume: The volume seems relatively low, indicating possible indecision in the market. A volume spike could confirm a breakout or breakdown.

Gann Astro Trading Course | Gann Trading StrategyGann Astro Trading Course | Free Lesson. Gann Astro Trading | Gann Time Cycles | Gann Financial Astrology. Gann Trading Strategy - Gann Trading Course

TOPIC OF THIS VIDEO - Gann Astro Trading Course | Free Lesson

🎯 Unlock the Market’s Hidden Code with W.D. Gann’s Strategies!

What if market movements weren’t random — but followed a precise, predictable blueprint? In this powerful breakdown, we dive into the groundbreaking methods of W.D. Gann, revealing how price, time, and planetary positions create a hidden pattern behind market highs and lows.

Gann’s revolutionary idea was that time and price vibrate together — making them interchangeable. By converting prices into planetary longitudes, tracking time cycles, and applying market geometry, you can uncover the market’s natural rhythm and predict turning points with remarkable accuracy. This video unveils the core of Gann’s strategy, giving you the tools to anticipate price moves before they happen.

---------------------------------------------------------------------------------------------------------------------

📌 What You’ll Learn in This Video:

✅Gann Square of 9 Explained – Understand how this iconic tool aligns price and time with planetary degrees to identify key turning points.

✅Price to Longitude Conversion – Learn how to convert market prices into planetary longitudes to uncover hidden reversal points.

✅ Time and Price Interchangeability – Discover how Gann’s theory of time-price equality helps predict trend shifts.

✅ The 10% Decimal Shift Rule – A powerful trick to reveal harmonic price levels by shifting the decimal point.

✅ Market Geometry: The Blueprint of Price Movements – Explore Gann’s geometric approach using circles, squares, and hexagons to map market pivots.

✅ Planetary Cycles and Longitudes – See how planetary movements — like Saturn’s retrograde and Mars' heliocentric positions — influence price action.

✅ Harmonic Degrees and Price Reactions – Find out why 10, 15, and other degree increments often mark critical spike reversal areas.

✅ Equilibrium Principle – Learn how Gann's "squared out" price and time cycles lead to powerful reversal setups.

✅ Real Case Studies: Tesla & IBM Analysis – Watch Gann’s techniques in action as we analyze historical charts to uncover price pivots and reversal dates.

market geometry and harmonic degrees.