GBP (British Pound)

ORBEX: GBPCHF & EURJPY Follow Identical Pattern (hint: bullish)!In today’s #marketinsights video recording, I talk about #fxminors #EURJPY and #GBPCHF as they both seem to be moving within an identical pattern.

Despite the added uncertainty amid the latest delay drama of phase-1 of a potential trade deal between US and China, safe-havens #yen and #franc seemed unaffected by at least this type of flows.

That suggests that participants are now shifting to more exciting events, expected to trade trade war flows when a more significant and certain development comes on the surface.

Until then, #euro and #pound inflows could push the aforementioned pairs higher, with the latter hanging on today's #BoE meeting.

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice

ORBEX: GBPCHF, AUDJPY - Tradetalk & Brexit Signals Mixed! In today's #marketinsights video recording I analyse #gbpchf and #audjpy minors!

Both pairs are showing an identical pattern and are indeed influenced by:

AUDJPY

- Tradewar tensions but latest from positive developments on the back of a potential partial deal Chinese are willing to do

- Positive Home Loans in AU and negative BoJ Corporate Goods Price Index figures

GBPCHF

- Blury Brexit developments with the risk of an election following an extension increasing

- UK-EU talks not looking good despite EU announcing otherwise

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice

ORBEX: EURJPY, GBPCHF - US-EU Tradewar Begins, BoJo Submits PlanIn today's #marketinsights video recording I analyse #EURJPY and #GBPCHF

#EURJPY looking bullish on:

- Expectations of further BoJ easing

- Poor JP consumer confidence

- Soft BoJ monetary base

- Good German PMIs and EA Inflation

#GBPCHF looking bearish on:

- Expectations of a strong franc

- Poor UK construction PMI

- Fresh BoJo proposal sentiment

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice

GBP Update - Temporary exhaustion? Quick update on GBP pairs.

It's rallied into some key resistance levels on my charts. This could potentially signify exhaustion and lead to speculative selling/profit-taking in the very short term.

Keep a watch on the formation of this daily candle, if it posts some kind of inverted hammer or outside day, then I may look to sell some GBP pairs next week in anticipation of a correction.

There are political risks to trading GBP as we edge closer to the Brexit deadline. The rhetoric seems to be improving, although there has been no breakthrough in discussions just yet.

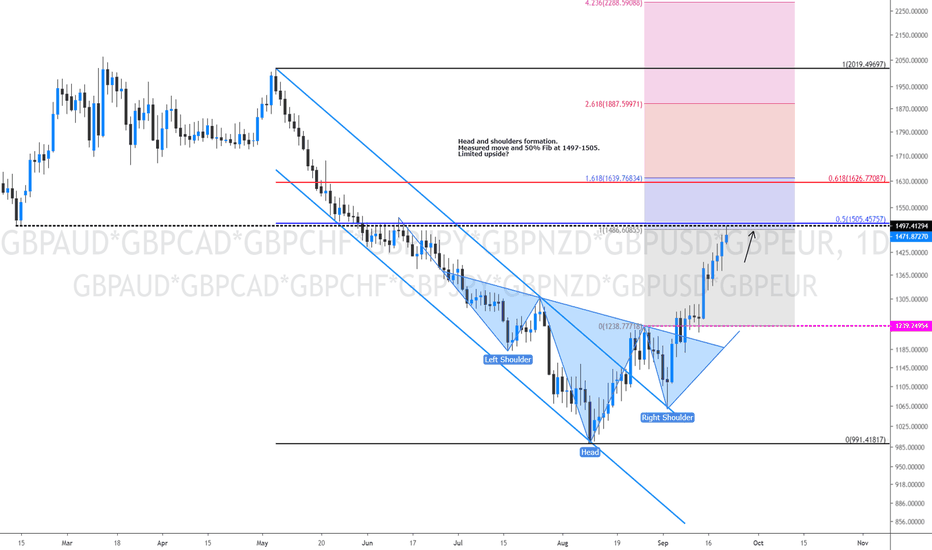

Overview of GBPUSD - VideoA quick overview of my current position on GBPUSD.

Looking at GBP on the whole, I think there is the possibility for more upside and continued momentum.

(Here is the code for the basket I use GBPAUD*GBPCAD*GBPCHF*GBPJPY*GBPNZD*GBPUSD*GBPEUR)

GBPUSD still looks good to me but it looks like we are about to see a consolidation/correction in the very short term.

Watching for now, but will be looking to buy on dips.

Forex basket : 10:15 04-Sep-19.LOG

Forex basket : 10:15 04-Sep-19

For most new traders, the biggest challenge is getting a profitable strategy that works

for the long term. Usually, trend-following systems are favored because they tend to have

a very good risk-to-reward ratio. Trading the currency market is essentially a numbers

game, basically traders look for strategies or systems that have a positive overall

yield. The profit factor of any strategy is also very essential, because a profitable

strategy should make more money or pips, than it loses. After some extensive research,

I have discovered one of such systems. This strategy is built on one of the oldest

trading adages around; “cut your losses early and let your profits run”

and “the trend is your friend”.

Basket trading involves opening a series of correlated or uncorrelated trades, and after

an adequate amount of time, closing the trades when the overall sum of the trades

is positive i.e. when the net value of all open trades is positive or close to our

targeted profit-value.

It is not 100% guarantee.

The Trading setup

The truth behind the Forex market is that currencies trend. This means that currencies have a tendency to keep gaining or diminishing over a long period of time. There are a lot of concepts about trading cycles and swings, but in reality if we were to zoom out of our charts we would notice a very obvious and unmistakable trend direction. Basket trading involves gauging the potential strength or weakness of a pair, and placing several trades that align with that analysis.

Key Reports/Factors that Move FX Markets

Any world events /news

Financial crises and elections create financial uncertainty and, in turn, impact value

of a country’s currency

Central Bank monetary policy announcements Will affect size/growth rate of a

nation’s money supply and, in turn, interest rates; can include key interest rate

changes, buying/selling government bonds, reserve requirements changes

FOMC (Federal Open Markets Committee)

Meets 8 times a year to set U.S. monetary policy and key interest rate changes;

impacts value of U.S. dollar, world’s reserve currency

U.S. Dollar Index

Measures the value of U.S. dollar relative to a basket of currencies for the

U.S.’s most significant trading partners

09:57 04-Sep-19

Forex basket : 09:57 04-Sep-19.LOG

Forex basket : 09:57 04-Sep-19

For most new traders, the biggest challenge is getting a profitable strategy that works

for the long term. Usually, trend-following systems are favored because they tend to have

a very good risk-to-reward ratio. Trading the currency market is essentially a numbers

game, basically traders look for strategies or systems that have a positive overall

yield. The profit factor of any strategy is also very essential, because a profitable

strategy should make more money or pips, than it loses. After some extensive research,

I have discovered one of such systems. This strategy is built on one of the oldest

trading adages around; “cut your losses early and let your profits run”

and “the trend is your friend”.

Basket trading involves opening a series of correlated or uncorrelated trades, and after

an adequate amount of time, closing the trades when the overall sum of the trades

is positive i.e. when the net value of all open trades is positive or close to our

targeted profit-value.

It is not 100% guarantee.

The Trading setup

The truth behind the Forex market is that currencies trend. This means that currencies have a tendency to keep gaining or diminishing over a long period of time. There are a lot of concepts about trading cycles and swings, but in reality if we were to zoom out of our charts we would notice a very obvious and unmistakable trend direction. Basket trading involves gauging the potential strength or weakness of a pair, and placing several trades that align with that analysis.

Key Reports/Factors that Move FX Markets

Any world events /news

Financial crises and elections create financial uncertainty and, in turn, impact value

of a country’s currency

Central Bank monetary policy announcements Will affect size/growth rate of a

nation’s money supply and, in turn, interest rates; can include key interest rate

changes, buying/selling government bonds, reserve requirements changes

FOMC (Federal Open Markets Committee)

Meets 8 times a year to set U.S. monetary policy and key interest rate changes;

impacts value of U.S. dollar, world’s reserve currency

U.S. Dollar Index

Measures the value of U.S. dollar relative to a basket of currencies for the

U.S.’s most significant trading partners

09:57 04-Sep-19

Forex basket : 09:36 04-Sep-19 CAD Interest Rate Decision 10.30.LOG

Forex basket : 09:36 04-Sep-19

For most new traders, the biggest challenge is getting a profitable strategy that works

for the long term. Usually, trend-following systems are favored because they tend to have

a very good risk-to-reward ratio. Trading the currency market is essentially a numbers

game, basically traders look for strategies or systems that have a positive overall

yield. The profit factor of any strategy is also very essential, because a profitable

strategy should make more money or pips, than it loses. After some extensive research,

I have discovered one of such systems. This strategy is built on one of the oldest

trading adages around; “cut your losses early and let your profits run”

and “the trend is your friend”.

Basket trading involves opening a series of correlated or uncorrelated trades, and after

an adequate amount of time, closing the trades when the overall sum of the trades

is positive i.e. when the net value of all open trades is positive or close to our

targeted profit-value.

It is not 100% guarantee.

The Trading setup

The truth behind the Forex market is that currencies trend. This means that currencies have a tendency to keep gaining or diminishing over a long period of time. There are a lot of concepts about trading cycles and swings, but in reality if we were to zoom out of our charts we would notice a very obvious and unmistakable trend direction. Basket trading involves gauging the potential strength or weakness of a pair, and placing several trades that align with that analysis.

Key Reports/Factors that Move FX Markets

Any world events /news

Financial crises and elections create financial uncertainty and, in turn, impact value

of a country’s currency

Central Bank monetary policy announcements Will affect size/growth rate of a

nation’s money supply and, in turn, interest rates; can include key interest rate

changes, buying/selling government bonds, reserve requirements changes

FOMC (Federal Open Markets Committee)

Meets 8 times a year to set U.S. monetary policy and key interest rate changes;

impacts value of U.S. dollar, world’s reserve currency

U.S. Dollar Index

Measures the value of U.S. dollar relative to a basket of currencies for the

U.S.’s most significant trading partners

Forex basket : 08:36 04-Sep-19.LOG

For most new traders, the biggest challenge is getting a profitable strategy that works

for the long term. Usually, trend-following systems are favored because they tend to have

a very good risk-to-reward ratio. Trading the currency market is essentially a numbers

game, basically traders look for strategies or systems that have a positive overall

yield. The profit factor of any strategy is also very essential, because a profitable

strategy should make more money or pips, than it loses. After some extensive research,

I have discovered one of such systems. This strategy is built on one of the oldest

trading adages around; “cut your losses early and let your profits run”

and “the trend is your friend”.

Basket trading involves opening a series of correlated or uncorrelated trades, and after

an adequate amount of time, closing the trades when the overall sum of the trades

is positive i.e. when the net value of all open trades is positive or close to our

targeted profit-value.

It is not 100% guarantee.

The Trading setup

The truth behind the Forex market is that currencies trend. This means that currencies have a tendency to keep gaining or diminishing over a long period of time. There are a lot of concepts about trading cycles and swings, but in reality if we were to zoom out of our charts we would notice a very obvious and unmistakable trend direction. Basket trading involves gauging the potential strength or weakness of a pair, and placing several trades that align with that analysis.

Key Reports/Factors that Move FX Markets

Any world events /news

Financial crises and elections create financial uncertainty and, in turn, impact value

of a country’s currency

Central Bank monetary policy announcements Will affect size/growth rate of a

nation’s money supply and, in turn, interest rates; can include key interest rate

changes, buying/selling government bonds, reserve requirements changes

FOMC (Federal Open Markets Committee)

Meets 8 times a year to set U.S. monetary policy and key interest rate changes;

impacts value of U.S. dollar, world’s reserve currency

U.S. Dollar Index

Measures the value of U.S. dollar relative to a basket of currencies for the

U.S.’s most significant trading partners

Forex basket : 08:20 04-Sep-19.LOG

For most new traders, the biggest challenge is getting a profitable strategy that works

for the long term. Usually, trend-following systems are favored because they tend to have

a very good risk-to-reward ratio. Trading the currency market is essentially a numbers

game, basically traders look for strategies or systems that have a positive overall

yield. The profit factor of any strategy is also very essential, because a profitable

strategy should make more money or pips, than it loses. After some extensive research,

I have discovered one of such systems. This strategy is built on one of the oldest

trading adages around; “cut your losses early and let your profits run”

and “the trend is your friend”.

Basket trading involves opening a series of correlated or uncorrelated trades, and after

an adequate amount of time, closing the trades when the overall sum of the trades

is positive i.e. when the net value of all open trades is positive or close to our

targeted profit-value.

It is not 100% guarantee.

The Trading setup

The truth behind the Forex market is that currencies trend. This means that currencies have a tendency to keep gaining or diminishing over a long period of time. There are a lot of concepts about trading cycles and swings, but in reality if we were to zoom out of our charts we would notice a very obvious and unmistakable trend direction. Basket trading involves gauging the potential strength or weakness of a pair, and placing several trades that align with that analysis.

Key Reports/Factors that Move FX Markets

Any world events /news

Financial crises and elections create financial uncertainty and, in turn, impact value

of a country’s currency

Central Bank monetary policy announcements Will affect size/growth rate of a

nation’s money supply and, in turn, interest rates; can include key interest rate

changes, buying/selling government bonds, reserve requirements changes

FOMC (Federal Open Markets Committee)

Meets 8 times a year to set U.S. monetary policy and key interest rate changes;

impacts value of U.S. dollar, world’s reserve currency

U.S. Dollar Index

Measures the value of U.S. dollar relative to a basket of currencies for the

U.S.’s most significant trading partners

09:46 03-Sep-19

Forex basket : 09:46 03-Sep-19.LOG

For most new traders, the biggest challenge is getting a profitable strategy that works

for the long term. Usually, trend-following systems are favored because they tend to have

a very good risk-to-reward ratio. Trading the currency market is essentially a numbers

game, basically traders look for strategies or systems that have a positive overall

yield. The profit factor of any strategy is also very essential, because a profitable

strategy should make more money or pips, than it loses. After some extensive research,

I have discovered one of such systems. This strategy is built on one of the oldest

trading adages around; “cut your losses early and let your profits run”

and “the trend is your friend”.

Basket trading involves opening a series of correlated or uncorrelated trades, and after

an adequate amount of time, closing the trades when the overall sum of the trades

is positive i.e. when the net value of all open trades is positive or close to our

targeted profit-value.

It is not 100% guarantee.

The Trading setup

The truth behind the Forex market is that currencies trend. This means that currencies have a tendency to keep gaining or diminishing over a long period of time. There are a lot of concepts about trading cycles and swings, but in reality if we were to zoom out of our charts we would notice a very obvious and unmistakable trend direction. Basket trading involves gauging the potential strength or weakness of a pair, and placing several trades that align with that analysis.

Key Reports/Factors that Move FX Markets

Any world events /news

Financial crises and elections create financial uncertainty and, in turn, impact value

of a country’s currency

Central Bank monetary policy announcements Will affect size/growth rate of a

nation’s money supply and, in turn, interest rates; can include key interest rate

changes, buying/selling government bonds, reserve requirements changes

FOMC (Federal Open Markets Committee)

Meets 8 times a year to set U.S. monetary policy and key interest rate changes;

impacts value of U.S. dollar, world’s reserve currency

U.S. Dollar Index

Measures the value of U.S. dollar relative to a basket of currencies for the

U.S.’s most significant trading partners

09:46 03-Sep-19

Forex basket : 08:58 03-Sep-19.LOG

Forex basket : 08:58 03-Sep-19

For most new traders, the biggest challenge is getting a profitable strategy that works

for the long term. Usually, trend-following systems are favored because they tend to have

a very good risk-to-reward ratio. Trading the currency market is essentially a numbers

game, basically traders look for strategies or systems that have a positive overall

yield. The profit factor of any strategy is also very essential, because a profitable

strategy should make more money or pips, than it loses. After some extensive research,

I have discovered one of such systems. This strategy is built on one of the oldest

trading adages around; “cut your losses early and let your profits run”

and “the trend is your friend”.

Basket trading involves opening a series of correlated or uncorrelated trades, and after

an adequate amount of time, closing the trades when the overall sum of the trades

is positive i.e. when the net value of all open trades is positive or close to our

targeted profit-value.

It is not 100% guarantee.

The Trading setup

The truth behind the Forex market is that currencies trend. This means that currencies have a tendency to keep gaining or diminishing over a long period of time. There are a lot of concepts about trading cycles and swings, but in reality if we were to zoom out of our charts we would notice a very obvious and unmistakable trend direction. Basket trading involves gauging the potential strength or weakness of a pair, and placing several trades that align with that analysis.

Key Reports/Factors that Move FX Markets

Any world events /news

Financial crises and elections create financial uncertainty and, in turn, impact value

of a country’s currency

Central Bank monetary policy announcements Will affect size/growth rate of a

nation’s money supply and, in turn, interest rates; can include key interest rate

changes, buying/selling government bonds, reserve requirements changes

FOMC (Federal Open Markets Committee)

Meets 8 times a year to set U.S. monetary policy and key interest rate changes;

impacts value of U.S. dollar, world’s reserve currency

U.S. Dollar Index

Measures the value of U.S. dollar relative to a basket of currencies for the

U.S.’s most significant trading partners