Where fundamentals outshine TA, XRP and AlibabaIt is still the early days for many coins!

Over time we will see many coins die off as cryptocurrencies with stronger fundamentals and larger market caps live on. Comparable to the dotcom bubble in 2000.

I acknowledge there will be a period of time between this where it will be 'stormy' where the overall cryptocurrency market cap will increase. This is the best time to capitalize on projects that you dont see holding longevity.

I highly doubt this will be a completely alt coin friendly world.

XRP is an example of a coin with strong fundamentals (integration with banks, developed network) yet weak TA (not much to analyze)

Often you will see coins showing TA that promises huge potential (massive bull flags, huge falling wedges), yet will have weak fundamentals. This i see as bait.

Choose your cryptocurrencies wisely.

I am long XRP.

Bix

J-xrp

XRP/USD Swing StrategyHi guys, here is a simple Swing Trading strategy for Ripple BINANCE:XRPUSDT

To trade this strategy manually you will need the SuperTrend indicator, paired with a 25 bars EMA as trend filter.

Set the ATR multiplier to 2 and the lookback to 3 bars.

Filter trades whose ADX on the 1 Day timeframe is below 12.

Backtest results below.

Configuration:

To get the indicator and automate the strategy, use the link below, thanks.

TRADING PSYCHOLOGY: xrp holders and the denial"the trendline xrp holders refuse to see"

Here is a little psychology lesson:

Denialism is a person's choice to deny reality as a way to avoid a psychologically uncomfortable truth. Denialism is an essentially IRRATIONAL action that withholds the validation of a historical experience or event, when a person refuses to accept an empirically verifiable reality. The motivations and causes of denialism include religion, self-interest (economic, political, or financial), and defence mechanisms meant to protect the psyche of the denialist against mentally disturbing facts and ideas.

Denialism starts when a trader abandons his rules (or worse yet has none), and trades whatever feels or looks right whenever it feels or looks right. Once the trade is entered, denialism begins to spread like a cancer looking for its next body part to attack. The disease grows in stages, with each successive stage sucking more life out of its victim.

STAGE ONE DENIAL (UNSTRUCTURED ABANDON): Rules are worthless in a random environment such as the crypto market; therefore, we do not need to make any rules. Rules make sense, the market does not, so why make rules? Rules are for boneheads, children, students, mathematicians, and sports pros but not for self-employed traders, we reason. But the market’s randomness and our freedom together can make for a disastrous combination. If there is any place that needs structure it is in our approach to an unstructured market. If there is any place where we can practice true freedom it is in the market…where we have the freedom to choose the rules we will follow. Structured freedom keeps unstructured abandon from rearing its ugly head and can help keep the trader from advancing to stage 2.

STAGE TWO DENIAL (PLANNED IGNORANCE): Traders are hard pressed to plead ignorance but when given the option are likely to make plans to do so. The trade is not working because we forgot about support or resistance, a shorter or longer time frame, or Elliot wave, or the bollinger bands, or the retracement level, or earnings, or this or that, BLAH, BLAH, BLAH. We need to study more patterns and strategies and indicators; we need to sign up for more newsletters; we need to read more stock trading books, we need more monitors, etc. not realizing that the more we search the more ignorant we become. The market has no rules of its own so we impose cute little rules of our own asking the market not to break them. The rules are not for the market but for ourselves. They are designed to protect us against ourselves, not against the market. The market just is; we are. Since we began with no structure (STAGE ONE) we now plead ignorance when the market does not conform to our way of thinking. We convince ourselves that we did not take all the factors into consideration. How could we? We were ignorant! We deny the fact that there is more to the market than patterns; we deny that there are other traders taking opposite positions; we deny the random nature of markets; we deny our inability to ever know everything there is to know about market behavior. Unless we are able to read the collective minds of every one who is trading a particular market during a particular time frame we will never know everything there is to know about the market. We either accept this fact, plan for it, and manage it (planned awareness) or we deny it and micro-manage it. Micro management in stock trading is simply another word for over analyzing and over analyzing will lead to frustration and stage 3.

STAGE THREE DENIAL (FRUSTRATED BLINDNESS): Have you ever been so frustrated about something that you were blind to your surroundings? You know, like losing your cool in a crowded room unaware that all eyes are on you as you make a fool of yourself? Or, your frustration at not being able to find your car keys is directed toward everyone in the house, including the dog, until you realize the keys were in your pocket the whole time? Frustration is a result of unrealized expectations while missing out on what might have been. We expect someone to understand what we are saying until they don’t. We expect to find our car keys where we last left them until we don’t. We are blind to the obvious when we deny the obvious. Traders expect each trade to work when it is expected to work, thus fooling or bullshitting themselves. When it does not we can become frustrated and deny the fact that the trade is not working, while missing other higher probability opportunities, thus leading to greater frustration. Once a trader gets to this stage where missing opportunities is a result of unrealized expectations from a previous trade, frustrated blindness results. Let’s think about this for a minute. If a trader denies the obvious (that a trade is not working) and denies himself the opportunity to make money on another trade (because he is blind to it), not only is he losing money on a loser but he is missing obvious opportunities that could become big winners. If this continues for too long, this trader will either learn to manage his expectations or his frustrated blindness will lead to ultimate destruction. And a once promising trader succumbs to a trader’s death.

Denialism is a disease best treated, better yet prevented, with structured freedom, planned awareness, and managed expectations. If not, you may be asking, “Is there a doctor in the house?”

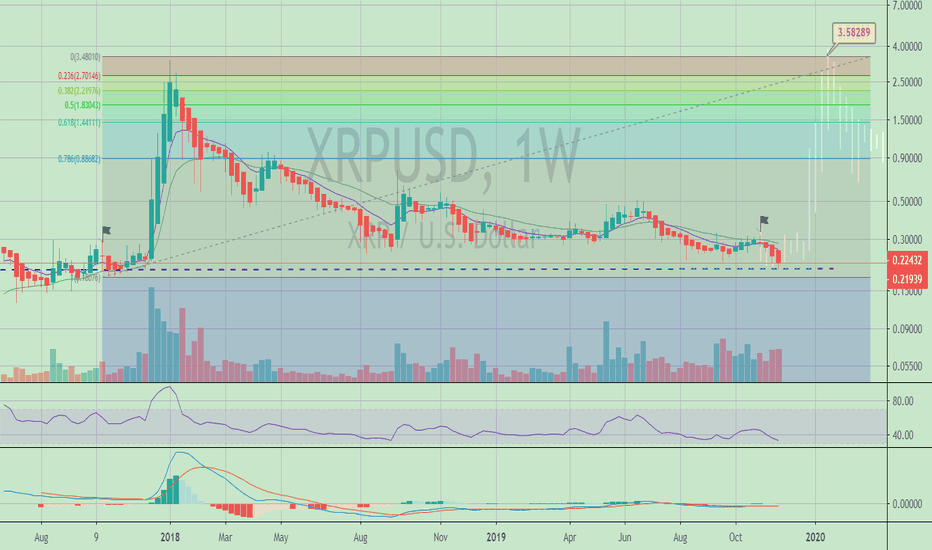

Ripple | Holding the Bottom Support ..!!XRP/USD (Update)

Ripple price is still struggling to gain momentum and declining below $0.1920 against the US dollar.

In Bigger TF Chart, XRPUSD Is Forming Wedge Pattern & Holding Bottom Support As well.

Recently, Ripple (XRP) Hits 27-Month Low & Now holding the Bottom Support.!!

Ripple’s price action in 2020 will largely depend on the movement in Bitcoin’s market.

For instance, the 2020 Bitcoin halving event is expected to drive the price to highs above $20000. The correlation between the assets will impact XRPUSD into a bullish rally and could pull the price to levels above $1.0.

However, I still believe 0.9$ is a very conservative price for XRP.After Wedge Breakout.

Ripple Regulation..!!

Ripple has particularly struggled with regulation for its XRP cryptocurrency, especially in the United States.

The Securities and Exchange Commission (SEC) is torn between categorizing XRP as a security token or leave it to ride along as crypto.

However, XRP has gained traction in the United Kingdom, which recently referred to it as crypto, just like Ethereum.

Many experts and enthusiasts believe that unclear regulations for the industry are stifling innovation.

Ripple Future and Growth

Ripple is often regarded as the future of cryptocurrencies in terms of technology infrastructure as well as mainstream adoption.

Armed with its flagship products: RippleNet and xRapid the network is set to be the bridge between cryptocurrencies and the traditional banking system.

More importantly, Ripple believes that it will soon overtake SWIFT to become the preferred cross-border money transfer platform.

SWIFT has its own share of struggles that are dealing with including long processing time and unreliability.

On the other hand, Ripple as mentioned above already has signed partnerships with more than 200 banking institutions.

Besides, this number is expected to grow with the current expansion to the Middle East and the Asian regions.

Ripple’s XRP demand in the future will mainly come from banks as adoption increases supported by the need to send money across the border faster, reliably and a low cost.

Please like, subscribe and share your ideas and charts with the community!

Example of cryptocurrency market infancyWe are currently still in the infancy of the cryptocurrency market, as the market matures more coins will die off, fundamentals will become more prominent during evaluation and new trends within culture will emerge, including cryptocurrency. Often this infancy is compared to the dot com bubble which it is very much alike. This infancy is a direct contributor to the volatility and unpredictable nature of many coins, and most of the time this volatility is dependent on speculation. Once VERY clear leaders emerge (bitcoin, Eth, XRP at the current time) volatility will slow, and more growth will be seen as more confident investors enter the space.

Leave comments below I would love to hear your feedback, (what else I could have included).

Who can make money in this market?The market still has no direction, so no effort to prejudge what point entry, I see is the right signal, break through ma18 again, otherwise wait for macd to form a long trend.

Talking about some of the logic of trading today, which I've repeatedly stressed before, analysis and trading are two levels of things. A lot of people always say they want to make money, but what they do is make themselves analysts.

For example, in business, do you have a special course to study to make money? The so-called money making, is a very broad concept, he is low buy high selling.

No matter what profession you study, what industry you are engaged in, your education, your age, we are all equal in terms of making money, and the threshold is as high. So if you want to make money, not to study that profession, but to understand the logic of making money.

Similarly, when we do financial market trading, don't people who don't know technical analysis make money? On the contrary, many people analyze very well, but they don't make any money. I'm a very good example myself (sneaking).

What you need as an analyst is rationality and rigour. As comprehensive as possible analysis of the market, away from the market can remain sober, not involved in trading to maintain reason.

A person can have both trading and analysis skills, is a real master, but such a rare, Soros, Williams is a top master, but there are a few people think you can match them?

So we look at the big institutions, but also the research team and the trading team separate, is to play their strengths.

In terms of trading alone, it is not difficult. As the martial arts novel says: if you are very fast, you can beat the world invincible.

Trading is the faster decision-making when the market changes, and if you think more, you lose the opportunity.

But before trading, you need to understand the trend, know the trading strategy, set a take profit stop. Whose job is these? Analysts!

So a team, an analyst and a trader all have to have it. But as a small investor, it's hard to build your own team.

If you want to make money, see if you're a highly executive person. If not, advise you not to mix in this "head tied to the waist of the pants" market, it is better to find a safer way to manage money.

If you have the potential of a trader, then the next step is to find a good analyst and keep tracking. Find your own rhythm and trading patterns and take analyst analysis to complete your own trades.

Of course, this is only a theoretical analysis. In the real world, due to our cognitive barriers, we often misposition ourselves. Isn't it? How many people feel they are not a good trader?

PRICE TARGETS LIST WEN HYPERINFLATION HITSSomewhere around 2020-2025

BITCOIN - 1 Quadrillion MCAP

ETHEREUM - 300 Trillion MCAP

XRP - 100 Trillion MCAP

Litecoin - 50 Trillion MCAP

WHICH MEANS ROUGHLY ROUNDED NUMBERS.....

Bitcoin - $80Million/coin

ETH - $1Million/coin

XRP - $2000/coin

Litecoin - $500,000/coin

Enjoy.

ITS CALLED HYPERINFLATION LADIES AND GENTS. THERE IS NO LIMIT TO THE DIGITS THAT CAN BE PRINTED ON YOUR FIAT SYSTEMS.

The Art Of Missing Out (XRP and Crypto)Many people loves to buy high and sell low.

Many people pretends to know how market works.

But they have no clue how market works. They pretend that somehow analyzing one chart on a nanoesecond timeframe can give them advantages and high probabilities of succeeding against market manipulation and whales action.

If you want to be successful in financial markets, you need to throw away all the things that you have learnt.

As Richard Wyckoff stated, you need to look at the market from the perspective and lens of "Composite Man".

Composite Man are the one who "operates" the market, they have the ability to control and move the market.

How they do it and who they are are NOT RELEVANT.

The point is, as long as humans have emotions, as long as humans are greedy, then Composite Man will exist and market manipulation WILL EXIST.

So, the only way to CONSISTENTLY make money from markets are to UNDERSTAND how they OPERATE and do their work.

I am not these people, so I don't know how they operate. I can only learn from what I heard from some people who have experiences dealing with market manipulators. Obviously its a shady and illegal business and I don't want to be part of that.

Telling the truth is not an endorsement. It will be better to know that this thing exist so that we can adjust our trading and investing strategies.

So, go ahead, just know that they will always do the unexpected thing.

It will be FOOLISH to assume that CRYPTO is DEAD and it is foolish to ASSUME that Crypto is not here for the LONG TERM.

Everything is set up perfectly.

It doesn't matter if you HATE it, if you think it is USELESS, if you think that it is SHITCOIN SQUARED.

It doesn't matter. The incentives are always there for the market manipulators to manipulate and profit greatly from the stupid and idiot retailers.

Stop listening to people who claims to know everything about the market, they don't know.

I don't like XRP, but XRP is here to stay and the "intention" of the Whales are clear as hell.

You can make some money trading it and it is up to you. I don't have time to argue about philosophy and ethics.

The whales are inside and we are about to see resurgences in alt coins. Good luck and all the best.

XRP vs Gold - The real moveWhat if I told you the dollar will be backed by XRP and XRP will be backed by BTC and BTC backed by gold?

would you call me insane? Would you say I should walk away from this space now before I go too far down the rabbit hole?

Well its just a conspiracy theory. And that is where it will sit but its kinda not too far-fetched of an idea when you see how this entire space is developing.

I have a gut feeling that once the feds are done pumping money into the dollar as well as other currencies; printing will slow down dramatically beginning 2020. From here fiat currency will tank forever in a bearish market while digital assets and country by country stable coins begin to take over. These are called CBDC's. Central Bank Digital Currencies. Here is the link for anyone who has not done their research: 2018 publication

www.imf.org

It will be possible to still use fiat currency but it will be like going to the store and using a $2 dollar bill come 2045-50. It'll be rare to even need paper money in 10 years from now in America.

Today, paper money is in my wallet for a short amount of time -- if ever at all. For years now I never use paper money unless I had to withdraw cash to give to someone, but even then, I have paypal and other systems I can use now that have no fees for me to transfer (such as Zelle on PNC which PNC is apart of the Trump executive order for a new global fintech system which also uses Ripple's network indirectly.

Source : home.treasury.gov

Well I think that we will get this kind of announcement in the next decade or towards the end of 2028. XRP will be a driving force like blood in the veins of this entire network supporting bitcoin with oxygen and value diversification at near instant speeds. It is what will pump economic value inside the bitcoin system and all connected protocols that survive the full regulatory rodeo show we have been in since Jan 2018.

In a perfect digital asset / world here is what I would like to see form.

1. New assets for growth to swallow inflationary costs and over valued stocks / commodities / and other investment vehicles....this would put other markets into a corrective state while digital assets grow.

2. XRP would become the universal token for transferring money globally and not just for international payment transfers (that was just the beginning). It will become a "valuable" storage container to secure payments on, save money, make it fast, etc etc...and if the majority of money around the world is constantly pumped through the inter-ledger system it will constantly slowly grow in its value beyond $1 and it would become a perfect fit as a new $100 dollar digital asset liquidity coin/token whatever you wanna call it. I like to say investment vehicle because it acts just like that.

100 billion dollar supply is pennies compared to trillions of dollars. Anyone who thinks that supply matters here with this asset does not fully appreciate/understand the way XRP is destined to work. By design, theoretically, XRP can very well have a 10T dollar market cap and be worth $100 bucks or more if you want to believe that (id love that too), sit in 1st place, but be worth less than BTC forever.

3. XRP supports fiat money transfer but supports the basket of CBDC's that are being used as a vehicle as well for on-boarding and off-boarding value through multiple networks.

4. BTC becomes the official universal digital gold in support of gold usage since its a widely used conductor and in much of our technology it only makes sense to merge these two assets or make them co-exist as a foundation of support / LTC ends up backing or acting like silver and every invention you can think about with silver.

5. ETH begins to act like the S&P500 with hundreds of businesses supporting its value growth.

6. Other things as well but this post is becoming too long so im going to cut it here.

Overall, I thought this was a neat idea to share. Alongside I am posting a historical pic in the comment below of Gold because XRP is looking quite similar in development.

There is so much that can happen in the next 10 years I just can't fathom BTC, ETH, or XRP ever going away anytime soon. That being said....enjoy the waves of the market and be a proud individual to be able to live in a life where we can create opportunity out of thin air that can give us a prosperous financial portfolio.

My goal is to obtain over 100,000 followers so we can all support each other on an invite only scale social network of knowledge, trade, and donation to leverage each other up.

Something like this takes time and this is something I will reach and achieve by 2030.

100,000 people supporting each other over the next decade. Get at me, bring a battle buddy cuz we are going into new trade wars and id rather go into this next decade with an army of people beside me, not behind me, not in front of me.....beside me...taking on the next 10 years together for our families, friends, and ourselves. Because at the end of the day.....we deserve to life a happy life with less debt and more options for wealth and growth. Im sure there are many of you out there sick and tired of being tired down to credit cards, debt, always fighting for good income but being taxed like crazy, have little support or knowledge to grow on... well im here to tell you I am 1 of a few in this world ...a rare breed with enough knowledge to share that'll help many in this world.

If there is one thing I hate growing up knowing...it was the fact my government's system failed my parents and failed me and it was failed on purpose because its a faulty designed system to begin with and has been well known by the banks and federal government since the YEAR OF MY BIRTH. I was born 2 months before the 1987 Stock market crash. What is known as Black Monday...the impact it had on my family took away our opportunity for our family to be fruitful. We started over in 1987 and had little to begin with even then...

The picture is much bigger than just crypto currencies everyone...and I hope this post helps those who cannot see that ...begin to see....

Your network is your net-worth. Build it wisely...and always respect each other.... much love everyone

..as always stay safe out there. Manage your risk....and grow many avenues of investments in your life because there is time for you to do it now but you have to take action and stop telling yourself you will get to it. As my buddy told me yesterday...GET OUT OF YOUR HEAD AND ON YOUR FEET! Actions speak louder than words. Thoughts are just thoughts until they're written on paper and designed into a plan. We all know this but we all don't always live by it!

Make goals. Plan them from A to Z. Live by them like your life depended on it and encourage those around you to help guide you and your plans of life success (not just financially but def included lol).

Peace. Love. Trade.

XRP planting another root.A dollar a year is what I tell those who FEAR! We begin to take our first steps in 2020...get ready..I know I am. Try to find the best choice of when to buy based on how the corridors open for XRP by solving cross-border payment problems. It is the best choice for banks because they will be able to ripple "xrp" to help their liquidity problems.

I am going heavy in on XRP. Call me crazy all you want. I have a gut feeling to do so and will sell off once we tap $1.00 or more & I will buy back in at .80 cents unless we have a strong push back to .75 - .50 --I will begin a new portfolio for some others but for now I am transferring everything into XRP for a possible run to 1.00 before the end of the year.

Buy orders set:

.42 / .33 / .245 / .22 / .19 / .17 /.11

I have decided that I want to focus heavily on Ripple and the XRP protocol growth as well as IOHK Cardano because I believe these are going to be a diamond in the rough that will pay nicely in the future to come...Id like to find some DA trading network partners who focus heavily on other assets so we can develop strong focal points in this market as it grows into a mainstream market.

If my focus is XRP & ADA

I would like a network who can focus on 1 or 2 others heavily throughout the years as well...

Since I also trade FX and I am an entrepreneur I am trying to manage my time more appropriately so that I can eventually become a full-time trader and part time entrepreneur helping people financially and building businesses.

For anyone who has had success since Feb following these ideas you are more than welcome to donate or tip me some XRP. I will use all proceeds towards helping others learn to follow the new market as it blooms. Honestly I thought I would see a crash happen but I don't and I don't believe America is in any kind of recession as much as the news keeps talking about it. Well you all know how that goes..lol...CNBC says one thing .. ILL DO THE OPPOSITE LOL.

India to ramp up XRP...wait for it ;) lots of business in India..

www.youtube.com

For those of you who wish to help encourage my growth wallet address and TAG is below. As always, do not forget the tag.

Wallet address

rw2ciyaNshpHe7bCHo4bRWq6pqqynnWKQg

XRP Tag

636515678

XRP ~ Deep Dive 8/20/19I focus on providing live education and support to those interested in trading, Cryptocurrencies, and Blockchain technology. You will learn charting techniques, technical analysis, and the most popular cryptocurrencies for trading. My content is ideally suited for beginner to intermediate level traders.

Gold is in a bubble - only traces inflation due to 'Reflexivity'Do not follow the financial advice of dinosaur gold shills, who are mostly over the age of 65 years and have weakened IQs and memory retention. Please study George Soros' Theory of Reflexivity (inb4 "Soros is evil, Qanon blah blah blah"). Gold only traces inflation because people 'believe' it should trace inflation. Gold has little to no utility in manufacturing especially given the discovery of synthetic substitutes ionised from copper particles. Gold is a great luxury asset used in the production of Jewellery which the world has an over abundance of already, that can easily be recycled. Like all asset bubbles such as real estate, stocks, bonds, etc Gold is also in a bubble. Gold has no future in a digital economy. The world has experienced the greatest reduction in poverty since the abolishment of the gold standard. This is due to the velocity of money, where the faster the exchange of value is in any given economy the more growth said economy experiences.

The world will never return to a 'gold standard' because the negotiation of trade and the rules of exchange can be much more efficiently coordinated and managed using computer networks and high tech communication systems. Gold is a barbarous relic, and has no inherent/intrinsic value since all words and perceptions of value are subjective and change rapidly over time. If value is subjective, and we live in a highly complicated matrix society that has vast computing resources at it's disposal then what purpose does gold actually have? Cryptocurrencies are in a bear market and due to the Theory of Reflexivity their value is underestimated by society at large. However their utility in terms of the velocity of money, where value can be exchanged in seconds, where consensus is regulated by a large distributed network, where security is guaranteed through various cryptographic algorithms such as SHA256, and where productive capacity is maintained by decentralised autonomous communities (which are virtually impossible to compete with) makes certain cryptocurrencies far greater investments than Gold and precious metals.

Do some research on XRP and Ripple. Do no fall for the doomsday fear porn that drives the sales of precious metals. Look to countries such as Turkey, Venezuela, Argentina etc and realise that cryptocurrencies best facilitate trade during periods of economic downturn. Those countries aren't turning to gold to facilitate trade, especially since Gold is extremely difficult to maintain security over. Will gold always have a place in society? Yes, of course it will. Will gold ever shift the paradigm of civilisation as we know it? Hell no. I'm not saying you shouldn't maintain holdings of precious metals, but you should reduce your exposure to them, since cryptocurrencies will dramatically shift the perception of value that we currently place on gold going into the future.

XRPBTC Consolidation - Breaking UP or DOWN?? Been observing this ticker for a few days now, notice on how the trendlines are drawn:

- From higher high to lower high to lower high

- From lower low to higher low to higher low

The two trendlines looks like they are converging to a single point.

This is a consolidation pattern of price action and price is about to break out from the pattern. On a Daily Time Frame, some of you may be able to identify the "Inside Bars". At this moment, market watchers will be asking this Golden Question - Is it breaking UP or breaking DOWN?

One group of traders I know, we call them the breakout traders. They will place their Buy/Sell Stop Orders a certain price outside the two trendlines and anticipate to get in to catch the move, either up or down it doesn't matter to them.

There are another group of traders who are directional, they do their analysis and "place their bet" on buying or selling the market according to their market bias. They get the best entry price but at the same time, they are exposing to the risks that are far more worst if the market goes against them.

What I prefer is to wait and anticipate where price is heading and identify its turning points. Using methods such as Harmonics Patterns and Supply Demand, I am able to mark out the price area that price is likely going to turn, and it is at these areas that I am interested to take my trades to protect myself as i have a good risk management.

Which are the best methods? There is no right or wrong answer, I recommend to choose the right strategy that suits your personality and your lifestyle.

Do like, share and follow me for more analysis like this. We believe in sharing and build a conducive environment for all traders.