BTCUSD – Let's see first sellers how much power they still haveWelcome to our Academy. We’re here to help you achieve what you have been looking for.

Use our free analysis where you have everything you need for potencial trade ideas and profit.

BTCUSD – Let's see first sellers how much power they still have

Trend: Buy/ Neutral

At the moment: Sell/ Neutral

Price now: 8642.55

Support/Resistance:

R2: 10307.74

R1: 9106.68

S1: 8001.05

S2: 7593.96

S3: 7266.36

S4: 6555.78

S5: 5771.10

Price action:

For this potencial trade idea it is better to wait for more data then we have now. Bitcoin price is stucked between overall bullish perioud and recently sell, which presents more neutral chart then potencial trade idea for now.

Price broke the Channel and bounced from it. If the price will break 9106.68 resistance level and hold above, then we can follow next bullish target to 10307.74 level.

If the price will go down below Bitcoin channel, then we have to see Bearish retracement at deeper buyers support. First Bitcoin buyers support is at 7593.96 level and second at 7266.36 level. If buyers will not show performance at these levels, then sellers has open era to first target at 6555.78 and second target at 5771.10 level.

BTCUSD Potencial trade idea:

Bulls targets:

T1: 8200

T2: 9106.68

T3: 10307.74

Bears targets:

T1: 6555.78

T2: 5771.10

NOTE – We are trading BTCUSD via the preferred trading setups by EliteFxAcademy

Disclaimer: Martin’s views on the Chart analysis is ment as a trading advice for education terms; Education terms include: trading consistency to everyone who is reading this blog; for every advance student and for every Elite student who is using this analysis for managing his equity by Elite strategy and custom indicator. This analysis is understandable and transparent for all Elite students. This is a free content which is based from Academy in term of transparency to support and following progress to everyone. We know that there is always possible way that market can pull you out even when you follow our analysis blog and advice for a trade. We don’t publish where you have to have your risk management – Stop Loss, because, it would not be fair to Elite members, who learned this techniques in our Elite course.

Keywords:

Elite strategy, Custom Indicator, Fundamental Analysis , Tehnical analysis, Price action, Advanced strategies, Trading Education

Good trading!

Elitefxacademy

USD (US Dollar)

How brokers provide zero commission trading? You've probably heard of many zero commission trading platforms being established.

Robinhood is probably the most well known one, actually.

Historically, brokers have made their money by facilitating trades in the market between buyers and sellers and collected a fee for their extremely hard work...

Since markets have become larger, with greater trading volume and more participants, commissions per trade have fallen drastically, and the industry has had to change for your poor broker to earn a living.

With the rise of the smartphone, this has led to brokers being able to target a new type of trader...

This trader tends to be less informed than a professional...

Trading off a phone...

A lack of experience...

And more of a gambling mentality rather than understanding what is truly driving markets.

Firms have realised that.

'Commission free' is a marketing tool, and a very good one.

See, what is happening now is that market makers and dealers - and by extension, exchanges - are willing to pay brokers for their uninformed clients' order flow.

High frequency trading firms, such as Citadel, Apex, Renaissance, Virtu and DRW conduct market making on extremely low timeframes, providing liquidity to exchanges - that's their primary goal - and exchanges pay them rebates based on volume for doing so - note the chart of the CME Group above.

Their share price has increased massively since high frequency trading (market making) has driven 'liquidity' to the exchange.

Since their business is focused around volume, they welcome HFTs providing liquidity and therefore do not mind paying them volume based rebates - HFTs are kind of like introducing brokers.

But what's a market maker?

Market makers are delta neutral.

They do not necessarily care about the direction of a market, they simply want to sell higher at the bid and buy at a lower offer, thus capturing the 'spread' (the difference between the bid and the offer).

By paying brokers for the uninformed flow, this means that they believe they can capture asset misvaluations, and therefore turn a profit.

And it's very lucrative business.

Robinhood recently got fined for not routing orders adequately to allow for best execution for clients.

The adverse selection that they committed is an example of how a client can be at detriment.

However, it isn't necessarily bad to trade with a zero commission broker, since your explicit costs can be low (although implicit - the costs you don't see - could be higher and likely are).

What matters massively is their execution policy and whether you are being filled at the bid or offer that the market will allow you, or if you're receiving the price that the broker wishes you to get as part of their routing relationships with market makers.

The former is good, the latter is bad!

I hope that's cleared up a bit for you...

USDMXN - HOW TO TRADE WEEKLY SIGNALS WITHOUT BREAKING THE BANKThe weekly trade signals are very powerful to trade but the weekly stop losses are so large it makes you trade very small size positions.

It takes a long time for a weekly entry to hit it's first target.

This technique takes that built up explosive energy in a huge weekly pattern.

But to trade a size that will make it worth while and to get in and out of the trade more quickly.

The weekly chart shows the week of Dec. 9th is the candle that triggered the trade.

It closed on Dec 13th at an ATR of .3457.

This pair moves a hugh amount of pips every day.

Weekly ATR = .3457

Weekly candle close entry @ 19.00

Weekly SL is 1.5 x ATR (.3457) = .5186 pip SL or SL @ 19.5156

Weekly 1st TP is 1 x ATR = .3457 pip TP or TP @ 18.65

Use the free trade size calculator at our TSG website under free tools.

Demo Acct Size $10,000 Risk Percentage 1% (open two positions of 1% each) & SL of 5186 pips =

You can trade 3.62 Micro Lots or 3 micro lot trade size.

You still watch weekly chart for breakout setup but use 1st Daily chart for SL & TP.

Your alternative option is to use the Daily SL & TP for the daily breakout candle close.

Dec. 9th Daily Close breakout candle.

Daily ATR = .1361.

Daily candle close entry @ 19.24.

Daily SL is 1.5 x ATR (.1361) = .2041 pip SL or SL @ 19.44.

Daily 1st TP is 1 x ATR = .1361 pip TP or TP @ 19.1039.

Free Trade Size Calculator - Demo Acct Size $10,000 Risk 1% with SL of .2041

You can trade 9.59 Micro Lots or 9 Micro lots.

Your Daily 1st TP is closer now also at 19.1039 which your are trading with 9 miro lots.

1st TP was hit on 4th day.

USDMXN 1W trade was tied up for 5 weeks with 6 micro lots without hitting 1st TP.

Use Weekly Chart Pattern Trade set.

But use 1st Day Candle Breakout Close for Trade Management data.

No reason to use full week numbers on a weekly trade signal.

This applies to all markets that you trade.

We often see big patterns on indexes and metals where you can use this technique to shorten your trades.

This also allows you to use a bigger size.

Much better to see your TP hit in a day or two.

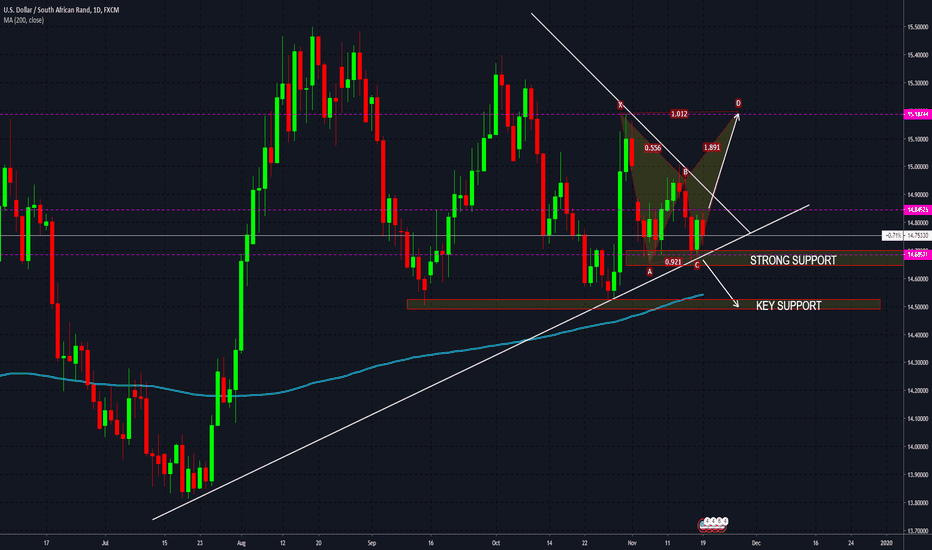

USD/ZAR Price Action Study - Read Contents - Do Not PresumeThis study is for demonstration and educational purposes, and study of this will start with the related idea which is linked below. As you recall, I suggested to long term buyers to beware. A few points I would like to make:

1. We are still in a bearish trend, until price breaches the trendline as noted in this tutorial. The bullish price action we have seen thus far could be very well corrective, and not a reversal of the trend.

2. Price is currently sitting at a key level in the market, at the 61.8% fib level from the latest swing points.

3. Price action will tell us if we will see more action to the upside or downside. Watch price action at the key zones as noted, and use other confluences for your entry.

Given this, do not presume on the market but we must study price action as it relates to the zones as noted. For more in depth study on this and how to determine zones and key levels I invite you to join my new subscription service.

I am now offering a subscription service for concentrated study of this and other pairs. Please visit www.celestefrederick.com to subscribe to this service for less than $10 per week.

My subscription service will include access to:

Group Chat, where we will discuss charts, education, and fundamentals

Exclusive Webinars

Trade Ideas with Entry and Exit Suggestions

I am also having a free charting webinar on this Saturday, January 18, 2020 at 11:00 am. Visit www.celestefrederick.com to register.

You can also follow me on Instagram and Facebook.

USDCAD ACTIVE SELL TRADE [SYSTEM EDUCATION]we use a very unique trading style, a system we completely created from scratch, its a pretty simple system yet its very effective!

This video explains what we are doing with our active sell trade and showcase what we plan to do, we also go over a summary of why we are selling this pair!

USDZAR Key Zone Study - With Video Analysis - Read WithinWe had a great time this past Friday studying USD/ZAR and key zones/levels pertaining to this pair.. To Watch the replay of ForexNChill visit the YouTube video at www.youtube.com

This idea is being posted as an educational post, following the study from the ForexNChill, where I share how I study this pair. A few things to note as we study:

1. Note price has rejected key levels in the market with a few failed attempts to rally to higher prices.

2. Price has fallen beneath the 200 MA on the daily timeframe; given so, we are open for further movement to the downside as a possibility.

3. The short term 9 EMA and 50 EMAs have crossed to the downside. This could mean that we will see lower prices.

5. The 50 EMA has crossed beneath the 200 MA which could signal a death cross, with further movement to the downside.

Given this, my inclination is that we have a bit more room to the downside to go; we could see a pullback or a retracement before seeing a continuation of price further down. HOWEVER, It is also not out of the question that we will see a strong bounce around key levels as noted and movement towards the upside. Watching price action at the key zones as noted is key to analysis. There are a few possible scenarios that could happen. Hence the various directions noted. However, again, my overall inclination is that unless we see a notable reversal or strong bullish momentum building, I think we have more room to the downside to go.

For now, study, watch and observe price action around these key levels. As price approaches these levels study candlestick analysis. Time will tell and the market will tell us in time what it wants to do. Never presume on the market, but allow price action to show you along the way.

To see the study on this pair and how to use market structure and price action to study this pair visit www.youtube.com

To receive personal mentorship or join the educational platform to which I belong visit www.celestefrederick.com

Visit the Contact Me page on my website and type in FREE RESOURCES to get free resources to help you learn how to study price action.

Always use proper risk management and use your confluences before entering.

CHRISTMAS BONUS!!! $25,000 IN 48 HOURS!!!

$1,000,000.00 a year is only $2730 a day.

$2730 a day is only $110 per hour if you earn money 24 hours a day.

If you're only working 8 hours a day, how do you make money in the other 16 hours?

You need a business that pays you whilst you sleep. Simple!

There is nothing wrong with having a job to pay the bills, but a job rarely sets you financially free. You need a business that pays you 24 hours a day, 365 days a year that you can build in the pockets of your time.

Crypto currencies and forex investments opportunities can do that for you.

GOLD, How do you like it?!))Look at the local lines on the chart!

Each of them should be considered separately.

It can be an intraday trading strategy:

after a few taps on one side, touch the other and make some move.

Push like if you think this is a useful idea!

Before to trade my ideas make your own analyze.

Write your comments and questions here!

Thanks for your support!

USD/ZAR - Anticipation of a Breakout But Which Direction?USD/ZAR is experiencing what I would call a choppy market at the present time. In times of choppy markets my suggestion is always to look at other opportunities in the market. Why? In choppy markets, we see a lot of indecision. Its actually likely that you will LOSE money or try to chase the market to no avail. What we want to trade is a trending market..A trending market is where we can see clear buy and sell opportunities and we see CLEAR continuous higher highs (buy opportunity) or lower lows (sell opportunity)

As a backdrop in terms of fundamentals there is a lot of uncertainty in the markets as it relates to emerging market currencies. The China trade war is playing heavily into this uncertainty. In light of the fundamentals, we know that we keep the fundamentals in mind as we trade the technicals. The technicals are what make up make up the market structure. It gives a picture of the forex pair over the course of time, which includes the fundamentals (news). This is why I always say to keep the fundamentals in mind. However, we should give a lot of credence to the technicals more than the fundamentals. Given this lets look at the technicals and what do we see?

- We see price is sitting on a very strong level of support, and is currently trading within a range On a lower timeframe you will see the choppiness to which I refer..

- We see price is still sitting above the 200 MA and the 200 MA which tells us that for now price is holding ground above the very next key level of support.

- We see price is trading and consolidating on a higher timeframe within a pennant (note trendlines)

- We know that the longer the consolidation within a pennant on a higher timeframe especially, we can expect there to be a massive breakout. In which direction though? Only time will tell.

- As we continue to study this pair, we could possibly have two scenarios:

1. If price breaks out to the upside, given the previous consolidation, I would expect a massive breakout to the upside to higher highs as noted (remember the massive breakout a couple of weeks ago? Perhaps just like that..not definite but perhaps).

2. If price pushes beyond support to the downside, given the previous consolidation, I would expect a breakout to the downside towards the next key support as noted.

For now I say, watch, study and be ready to take advantage of the breakout when it happens, as it breaks out of the pennant or for conservative, you can watch for the break and re-test.

Please refer to my previous studies on price action, key zones, and how to study the markets using price action study.

I now offer one-on-one mentoring sessions where we will together study the markets and you will learn how to trade price action and understand market structure. If interested please inbox me for information. Spaces are limited; For individual sessions, I have space just for a few more students, as I like to take the on-on-one time to spend with each individual. Group sessions are also available, if you would like to get a small group of students (3 to 5), and you can take advantage of lesser group rate. I really enjoy studying the market and sharing with others. As we study I will share certain e-books and educational material that I have as we learn this market together.

Thanks for studying along! Always use proper risk management, use your confluences, and wait for confirmation before entering any trade. Conserving capital is very key.

GBP/USD Bullish bias!We prefer buy over sell, but will see on smaller time frame for possible entries for long or short. For buy setup wait on breakout on daily time frame and for short setup wait that price came back in sellers territory, thats below 1.29160.

Keep it simple and do not complicate with hundreds of indicators because pure price action shows you everything.

GOOD LUCK, Elitefxacademy

[b]USDJPY – USD potenicial buy[/b]USDJPY – USD potenicial buy

Trend: Strong Buy

Support/Resistance:

R3: 111.068

R2: 110.240

R1: 109.718

S1: 108.969

S2: 108.647

S3: 108.325

Price action:

We've been same in this trade from previous week because of buyers good momentum. The end of week end up at great position for potencial buy side. If something will change then follow risk management rules from elite strategy lessons.

Potencial trade idea:

Bulls targets:

T1 = 109.718

T2 = 110.240

T3 = 111.068

Bears targets:

108.325

NOTE – We are trading USDJPY via the preferred trading setups

Disclamer1: We have to wait for a currency pair to trade after news are reliased. This might be a short correction, or price will give us moving dirrection after news are reliased.

Disclaimer2: Martin's views on the Chart analysis is ment as a trading advice for education terms; Education terms include: trading consistency to everyone who is reading this blog; for every advance student and for every Elite student who is using this analysis for managing his equity by Elite strategy and custom indicator. This analysis is understandable and transparent for all Elite students. This is a free content which is based from Academy in term of transparency to support and following progress to everyone. We know that there is always possible way that market can pull you out even when you follow our analysis blog and advice for a trade. We don't publish where you have to have your risk management – Stop Loss, because, it would not be fair to Elite members, who learned this techniques in our Elite course.

ELITEFXACADEMY

USDZAR Educational PostHappy Wednesday! As we continue our study of this pair USD/ZAR we see price is at a very key point in the market. The market opened on Sunday with a gap. Price continued it's descent and pulled back to the 38% key fib level, which is also right at the market open gap point. Will price trade above Sunday market open, which will lead us to higher price, or will price continue down after the pullback (rhetorical question). For now it's a good watch or perhaps a scalp. This is a study for demonstration and educational purposes only. Thanks for studying. We should visit back and play forward to see how price reacted, which helps us to build knowledge for future trade ideas. Sometimes the best trade to make is no trade at all, while we study price action. Please note, the arrows are not pointing towards a particular take profit area, but I am showing that price COULD reach these points. How do we know for sure? WE DON'T. We must continue to study price action along the way to gain better insight. Price action and market structure is EVERYTHING when studying for trade ideas. Price doesn't have to reach particular points. We see what the market is doing and REACT accordingly. Protection of capital is key. Please study progression of my previous ideas below to aid in your study. Study is most important versus taking signals. You build knowledge to call your own trades, independent of others traders ideas which are all speculation as well. We can only speculate, not dictate the markets. Feel free to offer your comments as well as we study the markets.

USDZAR Truly For Study Purposes ONLY - READ CONTENTSNow before I share this idea, let me tell you THIS IS FOR STUDY PURPOSES. This is what we do as traders STUDY. This idea is a tutorialL for now because I want you to read the contents and understand my profile. Let me preface before I begin a few points:

1. My trade ideas are for STUDY and EDUCATIONAL PURPOSES.

2. My goal in sharing with YOU is NOT to be RIGHT. The market doesn't give a hoot if I or you are right or wrong for that matter. Heck, I don't give a hoot if my analysis is wrong. Price action and Market movement is dynamic. It's subject to change at any notice. Just one news event can change a perfectly good set up. So know being wrong is not my biggest fear, which is why I can share freely. What is important is how we REACT to price action. A WRONG IDEA IS ONLY WRONG IF YOU ENTER UNWISELY AND LOSE YOUR CAPITAL. If I share an idea and it is not right..there is no shame in that..as that is not my goal to be right, but to help you to STUDY.

3. I DO NOT give signals..let me repeat. I DO NOT GIVE SIGNALS

4. When I share trade ideas, they are not for SIGNAL TAKERS. I repeat. MY IDEAS ARE NOT FOR SIGNAL TAKERS.

5. My ideas are for STUDENTS OF THE MARKET. I repeat. If you are a signals taker, this may not sit well with you.

6. The purpose of my profile is to EDUCATE. Meaning we STUDY the markets, watch price action and confluences to consider an entry. IF YOU DO NOT KNOW HOW TO STUDY, JOIN MY TEAM WHERE YOU WILL LEARN. INBOX ME.

7. I WILL VERY VERY RARELY TELL YOU WHEN TO EXECUTE. WHY? Again, my ideas are to EDUCATE YOU and not to tell you when to get in the market. YOU are responsible for your own entries. MY IDEAS ARE FOR STUDY PURPOSES. We should all want to be students of the market and depend on our own analysis. Take the time to learn this skill.

8. I DO NOT GIVE SIGNALS

9. If you take this idea and run with it, without exercising proper study and risk management, it is your own responsibility and fault, not mine, if your trade fails and you lose capital.

Now that we got that out of the way, THIS IS FOR STUDY PURPOSES. How do we improve our winnings in the market? We do this by way of study, sharing ideas (NOT SIGNALS). If you want signals, join my team for my precise entries.

For the study

On a lower time frame we have the possible makings of an inverse head and shoulders. What does this mean for the future? we could possibly see the creation of a right shoulder . Is it definite? No. It's possible. We know we also see on a lower timeframe what may be the makings of a reversal for another bullish run up. Is it definite? No. It's possible. How do you determine which way price will go? Answer is WE REALLY DON'T KNOW. However, we can STUDY PRICE ACTION, CONFLUENCES, STUDY AGAIN, EXERCISE PROPER RISK MANAGEMENT and enter trades based upon our study and wise judgement.

Please refer to the linked idea below, which will show you what I believe based on where we are now, what is the direction of the market. Keep in mind, the market does not move in a straight line, and it WILL have a series of bull runs and pullbacks, even sell opportunities until we make it there. My ideas are overall market outlook only

What I am doing is studying price action and will see how price responds to certain areas in the market. This will determine if I enter the trade. This should determine if you enter the trade. You enter at your own risk and are responsible for your own trades and outcomes. I would love to help you learn to study; please inbox me to join my team. If not, there are a plethora of resources to help you learn the skill of trading.

Thanks for following.. Feel free to leave comments if you like, follow me on Instagram and Facebook. I am here to educate and share!