Multi timeframes RSI Screener & indicator by noop42Since my previous x4 multi timeframes Stochastic RSI script seems to have been appreciated, I decided to make a 2nd version of this tool which focuses on the RSI indicator only.

Default parameters

RSI length : 14

Timeframes: 5, 15, 60, 240

OB/OS zones : 70 & 30

Repaint mode: enabled

Display lines: enabled

Display screener: enabled

Convergence warnings: timeframes 1, 2 & 3

Details

Repaint mode : Disabling it makes the indicator wait for the current candle to close before to change its value

Display lines: Allows you to disable RSI lines drawings, in order to move the screener on your main chart for example.

Display screener: Allows you to disable the screener, in order to use RSI lines only

OB/OS convergences warnings : Allows you to select which timeframe(s) must be taken into consideration for convergence signals (Selected timeframes can be distinguished in the screener, followed by a * char in the timeframes column)

Note The Stochastic RSI version of this tool is available here

Mtf

MTF StochRSI indicator by noop42Here is a custom x3 timeframes Stochastic RSI indicator.

Main Features (can be disabled)

Average mode : for each timeframe, a single line corresponding to the average value between K and D is printed

Repaint mode : if enabled: values are updated in live, if disabled: values are updated once the concerned candle is closed

Default parameters

Timeframes: 1, 5, 15

Mode : Average value

Repaint mode: enabled

MTF C Strategy A

The Pearson coefficient is a type of correlation coefficient that represents the relationship between two variables that are measured on the same interval or ratio scale. It's a measure of the strength of the association between two continuous variables.

This script allows you to choose one or more sources as a curve, if several sources are chosen, their average is taken into account in an EMA or SMA of your choice. It is possible to have the average of all the curves and to add one or more other curves for an influence on the calculated average.

Then, on the basis of this curve a correlation is calculated from 8 time ranges which give 4 curves, it is on this basis that the conditions of entries in the trade and / or exits are based with the possibility of adding an RSI condition.

For some entries, it is possible to try the symmetrically opposite condition, ie the one that is used in shorts.

To make entry short work, you must activate an exit short option.

However, exit conditions are more flexible than entry conditions because they allow the inverse entry condition used and / or to use statistical indices such as CCI / RSI / ROC / BB as exit condition independently or combined way.

It should be noted that if a condition among those chosen is executed substantially first, it will predominate over the others (same for long / short entries).

In addition, it is possible to choose a stop loss as an exit condition, however, it is not possible to combine the other exit conditions with the stoploss at the same time. Credits to adolgov for the base of the stoploss script part.

You can combine several curves, just as it is possible to combine several types of trade entries / exits.

The strategy uses 100% of equity, it has not been configured in such a way that there is an order pyramid and the closings are done on a total equity basis.

You can configure a daily session interval, a limit of the number of daily trades, a limit of drawdown.

You can add comments for each execution of an opening / closing order respectively to the direction (long or short).

Each step of the configuration has a tip, a button that must be hovered over in order to have the information relating to the configuration.

William %R MTF [DM]Greeting Colleagues

Today I share The Wlliams %R

Extras=

- 5 diferent length

- 1 extra signal with the technique used in the ultimate oscillator

- Fibo Leves based on ob os leves "width it's automatic"

- Colored bars bassed en average strength

- The indicator that is modified now has the same range as the ultimate oscillator.

Enjoy

Hx MTF Sorted MAs Panel with Freeze WarningThis script displays the close price and 4 sorted moving averages of your choice in a small repositionable panel and, when used on a higher timeframe, warns you when values may be different from actual values in the higher timeframe, inciting you to double check the actual values of the moving averages in the higher timeframe the panel is supposed to reflect.

The 4 moving averages and close are sorted together, providing you with a bird’s-eye view of their relative positions, the same way moving averages and last price values are displayed on the right scale.

The black header reminds of:

(1) the timeframe (resolution) used in the panel

(2) the remaining time before a new bar is created in the panel timeframe. Note that this remaining time is different from the one on the right scale, since it is only updated when a new transaction occurs.

Below, price and moving averages are sorted, color coded and followed by:

(1) a trend indicator ↗ or ↘ meaning that last change is up or down

(2) the number of bars since the moving average is above or below close (0 means current bar). This is obviously not displayed after the close price line (white background color).

Use

This panel was basically developed to display higher timeframe data but it can also be used with the same timeframe as chart for example if you do not want to plot moving averages on your chart but are still interested in their trends and relative positions vs price.

If you see something strange (like header is not black and displays NaN), it just means you requested moving averages that are not available in the panel timeframe. This may happen with newly introduced cryptos and “long” MA timeframes.

Different Timeframe

If you choose to use the panel on a different timeframe than the current one, be aware that you should only use timeframes higher than the current one, as per Tradingview recommendations.

If you select a lower timeframe than the current one, the panel timeframe header cell will turn to the alert color you set (fuchsia by default).

After tinkering for a while with the security function, I noticed that sometimes indicator values “freeze” (i.e. stop udating) and I have found no workaround.

What I mean is that when you look at a sma on a 5 minutes timeframe (the reference) and look at this same sma on a 5 minutes timeframe but from a lower timeframe through the security function set with a timeframe of 5 minutes, values returned by the security function are not always up to date and “freeze”. That’s the bad news.

Freeze warning

The better news is that this unexpected behaviour seems to be predictable, at least on minutes timeframes and I implemented an indicator that endeavors to detecting such situations. When the panel believes data may be frozen, the ‘Remaining Time’ header cell will turn to the alert color.

This feature is only implemented on minutes timeframes and can be switched on or off.

Other points of interest in this script

If you code, this function may also interest you:

sortWithIndexes (arrayToSort) returns a tuple (sortedArray, sortedIndexes) and therefore allows multi-dimensional arrays sorting without actually implementing a sorting algorithm 😉.

Default Settings

The default settings provide an example of commonly used moving averages with associated colors ranked from Hot (more nervous) to Cold (less nervous).

These settings are just an example and are NOT meant to be used as a trading system! DYOR!

Hope it will be useful.

Does the Freeze warning work for you? What do you think of my pseudo sorting algorithm?

Enjoy and please let me know what you think in the comments.

MACD Divergence + MTF EMA Reversal by @DaviddTechMACD Divergence + MTF Indicator / EMA by @DaviddTech

Long :

* Find Divergence in the MACD line

* Multi Time Frame EMA 50 15 minutes above Multi Time Frame EMA 50 60 minutes

* MACD and Signal line are below the 0 line

* MACD crosses above the Signal line

Short :

* Find Divergence in the MACD line

* Multi Time Frame EMA 50 15 minutes below Multi Time Frame EMA 50 60 minutes

* MACD and Signal line are above the 0 line

* MACD crosses below the Signal line

EMA usages instead.

* I found that as a strategy this could work better with the 200 EMA line.

* Trends reversals also gave good results.

Trend Reversals :

* Price is below EMA 200 - Take LONG on divergence.

* Price is above EMA 200 - Take SHORT on divergence.

** You may need to turn off MTF ema when using the Simple EMA 200

WARNING:

- For purpose educate only - My mission is to debunk fake strategies with code to find THE ONE.

- Plots EMAs and other values on chart.

- This script to change bars colors.

MTF WatchList Charts [Anan]█ OVERVIEW

I am happy to present this script with a nice idea!

You can now customize a watchlist with your preferred time frame and any symbol from any market.

The main purpose is to be aware of any moves and watch a brief overview of the chart.

█ FEATURES

- 8 customizable symbols with the option to show/hide anyone

- Multi time frame support

- 3 Types of charts (Candles / Heikin Ashi / Line)

- Displaying up to 10 candles for every chart

- Customizable chart colors

- Option to Show/hide Price

- Option to Show/hide Price Line

- Option to change Labels and Text Size

- Show Symbol name and used time frame

- Option to change gaps between charts

- Hover over on the top of any candle to see (Open/High/Low/Close) Prices

█ SCREENSHOTS

-----------------------------------------------

Special thanks to @dgtrd for inspiration and for the amazing framework used here ( HTF Candles by DGT )

Special thanks to Pine Chat @fareidzulkifli @Bjorgum @JohnBaron @fpainchaud

Coppock Curve Correlation between MTF & SlopesMy first tool !

1. The waves shows the slope of the curve. The front one = 3 periods, back one = 2 periods, difference = white area.

2. The moving lines shows the curve correlation between 2x 2 time frames (adjustable on the settings) on 2 periods lookback.

2.1 Theres few regions of high correlation, lines are at (absolute values) 0.5, 0.75, 1

3. On the top there's the Coppock curve -> if falling since 1 period = red, else green.

4. Diamonds shows : if correlation is in the strong correlation area and slope is falling or rising : red or green diamond.

This tool could be interesting to have an idea if there's strong correlation between timeframes instead of watching 4-5 different timeframes !

MTF Key Levels - Support and ResistanceThis indicator shows how to Multi Time Frame (MTF) interpret levels:

Watch how price acts around these levels and how they can act as support/resistance and can be used as great confluence levels for your technical analysis.

This indicator displays:

VWAP Levels

Daily / Weekly / Monthly / Yearly

Within the chart above I have marked out how displaying these VWAP levels can provide support and resistance levels to be aware of.

Daily – Weekly - Monthly – Yearly Levels

O = Open / H = High / L = Low

pO = Previous Open / pH = Previous High / pL = Previous Low / pEQ = Previous Equlibrium

Having previous Low/High levels makes you aware of Swing Failure Patterns (SFP). Also the daily/weekly/monthly opening and previous opening can assist with the trend.

Daily Open: Gives you an idea who is in control for the day. This level very often acts as strong support or resistance.

Weekly Open: Indicates where the price is within the higher timeframe.

Monthly Open & Yearly Levels: Overview of direction for the whole month without looking at a monthly chart and Yearly chart

Line Options

Within the line options you can choose to have a clean chart and display a “short line”. These line length can be adjusted by the user.

Line just to the right.

Line across the screen.

Disclaimer: The Monthly and Yealy VWAP will only show on higher timeframes this is due to restriction of how many candles can be shown on the chart. The candles displayed need to go back to either the start of the month of year to be able to calculate their VWAPs.

Multi TimeFrame (MTF) Trend StrengthCalculate and display simple multi timeframe (3 timeframe) trend strength using heikin ashi.

Papercuts Dual PSAR v01Dual PSAR is a trend following script that uses auto-higher timeframe calculation of the current timeframe to create a dual Parabolic Stop And Release.

This is useful because it can determine periods of transition or indecision and can flag those periods with which way it is learning even though it is undecided, what i call "Wait Zones".

When both PSARS are not in alignment, it uses the lower timeframe one to determine which way the wait zone is learning.

You can see below in the chart shows some good trends and some wait zones.

A wait zone can have bullish indication, but then still have a bearish continuation.

A wait zone can have bullish indication, and then enter a bull trend.

Typically I won't make trades in wait zones, and I will exit trades when entering one.

Just wanted to try this out and see how it did. Figured I'd share.

Tocorin_MTF_MA7 MAs (SMA or EMA) can be displayed in each period.

MTF display is performed only at 5m, 1h, and 4h.

The upper MAs to be displayed are as follows

5m: 1h, 4h, and 1D

1h: 4h and 1D

4h: 1D

The MA line style is stepline and circles to make it easier to see.

You can change it in the settings as you wish.

--

各時間足で 7本の MA(SMA or EMA) 表示が可能です。

5m, 1h, 4h の時だけ MTF 表示を行います。

表示する上位 MA は下記の通り

5m: 1h と 4h と 1D

1h: 4h と 1D

4h: 1D

見やすくするためにMA の線のスタイルを stepline と circles にしています。

設定で任意に変更してください。

Multi Time Frame (MTF) RSIThis script can display Multi time frame (MTF) Relative Strength Index (RSI) values. It works on any chart and appears at the top left of the screen.

1. It can plot values from 4 different time frames which can be customized.

2. Higher time frame indicates the main trend

3. Overbought and oversold levels are highlighted with different colours.

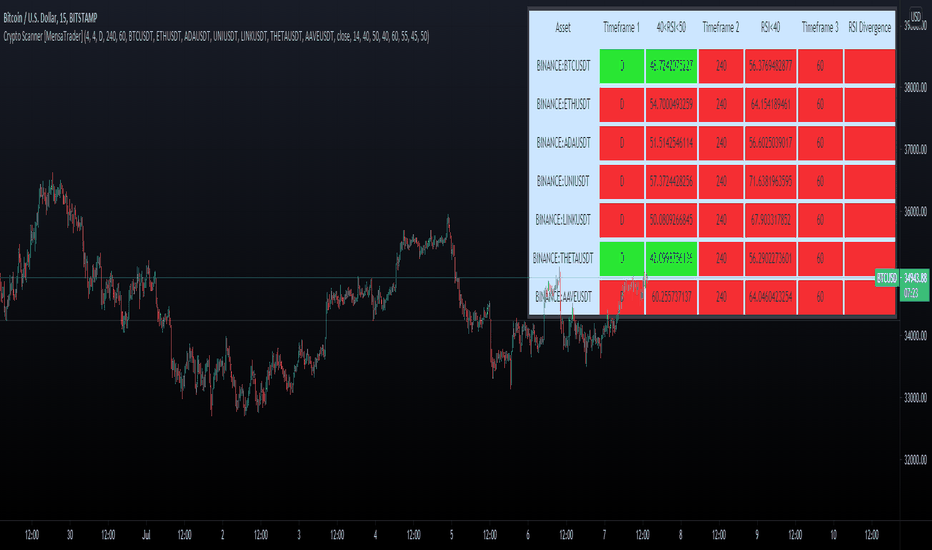

Crypto Scanner [MensaTrader]Market Scanner

By default set up to scan 7 Crypto Currencies on 3 different Time frames

Default assets are from Binance listing, but can be changed in settings.

First timeframe is set to Daily, (all timeframes can be changed in the settings), The RSI value for the Daily resolution is printed. The current conditions need it to be between the value of 40 and 50, If this condition is met then the box will light are green, if they are not they will stay red.

Second timeframe is set to 4 Hour, RSI for this timeframe and assset will also be printed here, the conditions for it are different though. Currently set up so if the RSI value is lower than 40 the box will light up green. This 40 value can be changed in the settings aswell.

Third timeframe is set to 1 Hour, This timeframe is looking for divergences. If a Divergence is found, the box will light up green and say "Bullish Divergence", This will stay green until either of the 2 invalidation conditions are met.

One condition is (For Bullish Divergence) to be cleared, If the recent Low where the divergence was formed gets taken out. Then the divergence sign will dissappear

Second condition is if the RSI Value climbs above 55, Then once again the Divergence sign will dissappear.

Use this to help scan multiple assets at once and find RSI values which suit your trading set ups.

I have tried to make as many options adjustable as possible including the Size of the Scanner, all in the settings.

Papercuts Super Trend MTF v02All my scripts are part of a suite called Papercuts .

This one uses one current timeframe supertrend and adds Four Automatic Higher Timeframe Supertrends based on those same parameters to help you determine larger trends while only needing a single chart. This works quite well on 5 and 15 minute charts and will look up in time. Confident trends can be identified by having two or more lines in the same direction.

When unified, the intensity of the glow should increase a trends confidence. Unify collapses the 3 highest timeframe supertrends into the first higher timeframe supertrend. Without Unify on, the overall trends are usually easier to see at just a glance. Higher timeframe supertrends can show support or resistance and act as stop loss limit ranges if you choose. Unify keeps things a bit cleaner and more compact.

V02 updated to fsecurity for no repainting and added a 3MA trend option as well.

Thanks to @Pinecoders for helping me better understand the security function!

Here is a view with Unify on....

Here is a view with Unify off...

MTF CandleLevelsIn the spirit of freedom from oppression on this day of July 4th, 2021 in the United States, I hereby release this flagship indicator "MTF CandleLevels" into the wild for any subscribing TV member on the planet to utilize. It's now one my few great gifts to the souls of humankind within the realm of trading on TV. TradingView continues to bless Pine Script by releasing supplemental upgrades, enough for me to develop this indicator beyond it's experimental phase to full potential, as I had always wished to design it from theory. Educationally while using it, you will witness how OHLC/HA candles are actually formed for charts. I like to think of it as a candle formation microscope anyone can learn from.

It is intended for any style of trading or skill level from newcomer to advanced. There are no requirements/prerequisites for you use it. Which means you don't have to wear a mouth muzzle, get multiple doses of the life endangering FrankenJabs, subserviently bow down to authoritarian demands of obedience, or learn the ancient mystical art of deception "Fau Chi" in order to employ it's inherent power. A little sprinkle of satire helps with a dry technical read :). You have the absolute freedom to utilize it any way you see fit! That's right, it's even your choice whether you use it or not. The unshackled empowerment of choice always equates to FREEDOM. I can't program these precious gems without it...

One thing you will have noticed is it's specifically published on a Heikin Ashi(HA) chart, while having immunity to the Heikin Ashi candle charts unique open/close behavior. This has been believed to be an impossibility until now. For members who don't know, HA candle charts have a different `open` and `close` from the `open` and `close` of the other ordinary OHLC candle charts. Regardless of "CandleLevels Mode" chosen in Settings, the indicator will display identical on either bar chart type, excluding Renko, Line Break, Kagi, Point&Figure, and Range candle charts of course. It's abilities supersede the simpler "Multi-Time Period Charts" built-in TV indicator with a completely different architecture. For those of you extremely curious about how I accomplished this indicators level of code complexity, it was immensely difficult taking over a year of effort for this one functional unit, and I will leave it at that...

This novel MTF technology displays OHLC/HA support and resistance levels that mimic the functionality of larger duration candle formations in real time. Basically explained, while charting on a shorter duration timeframe candle chart, you can see open, high, low, and close levels fluctuate in the larger duration timeframe. This reduces the need to jump back and forth to view price action on different chart sampling intervals. You may even use multiple sets of CandleLevels indicators over a wide variety of chosen timeframe options, along with everything else in between.

The CandleLevels behavior is chosen within the indicator "Settings" using a selection mode of either the standard OHLC candlestick formations or Heikin Ashi candlestick formations. Each mode has a multitude of uses depending on the users trading style or timeframe.

Visbility of CandleLevels will ONLY occur when it is set to a larger duration timeframe interval than the current chart sampling rate. For example, you may be using the 5 minute interval sampling rate on the chart, yet you can easily see the open, high, low, close ranges with a chosen 120 minute timeframe setting. The multiple time frame(MTF) settings are highly adjustable having intervals of seconds, minutes, days, a multiple of the chart interval, or the common input(type=input.resolution) function provided by Pine.

CandleLevels come with multiple color schemes to reduce color interference with other indicators in the overlay pane, including the intended use of multiple sets of CandleLevels. My basic color scheme selections can be overridden to choose any imaginable color you desire for your visual acuity. Also, there are additional controls available to fine tune a visually pleasing appearance depending on your preferences and viewable area. One last new hidden fine tune capability, not only for this indicator but all TV indicators, is the agility to use up/down arrow keys on the keyboard when an indicator setting is in focus after mouse selection. For example, when choosing line thickness, you can modify values/options by key stroke. Try it out, I'm sure you will find this useful for any indictor for eternity.

NOTICE: There is only 500 line drawings available, in total to display, at this current release. This equates to 83 sets of CandleLevels maximum.

Features List Includes:

Candle type selection

MTF controls for seconds, minutes, days, multiple-of, and TV input

Multiple color schemes with color overrides

Color opacity selector

Line thickness control

Enable/disable capable MTF interval display with positioning

When available time provides itself, I will consider your inquiries, thoughts, and concepts presented below in the comments section, should you have any questions or comments regarding this indicator. When my indicators achieve more prevalent use by TV members, I may implement more ideas when they present themselves as worthy additions. Have a profitable future everyone!

RISK DISCLAIMER:

My scripts, indicators, and studies are specifically intended for informational and educational use only. These use historical data points to perform calculations to derive real-time calculations. They do not infer, indicate, or guarantee future results or performance.

By utilizing this script/indicator/study or any portion of it, you agree to accept 100% responsibly and liability for your investment or financial decisions, and I will not be held liable for your subjective analytic interpretations incurring sustained monetary losses. The opinions and information visual or otherwise provided by this script/indicator is not investment advice, nor does it constitute recommendation.

MM MTF HeatmapThe MM Mtf HeatMap can scan multi symbol and multi timeframe on any given market

it detects trends with options on what type of trend detection moving average and smoothing type you prefer based on your backtest.

detects trends on four selectable timeframes

10 selectable symbols

Directions are simple

make sure you are using this on a lower timeframe your lowest selected timeframe is on. for example if your lowest timeframe is the 15min

make sure you are using current charts below the 15min like the 10 or 5min

selectable moving averages

are the

SMA

EMA

Tema

WMA

Hull

Variable

This HeatMap displays the trend overall market you are trading at one glance (Talk about top down analysis)

Enjoy happy Trading

Link below or PM us for access to this indicator Happy Trading

MTF VWAPA simple wavetrend oscillator based off WaveTrend Oscillator by @LazyBear to visualise 4 different timeframe vwap under 1 chart.

Timeframe can be changed in indicator settings in minutes. Unnecessary waves can be removed by unchecking said TF wave in Style settings.

RSI MTF TableRSI MTF covers the timeframes 1m, 5m, 15m, 1H, 4H and Daily

Works on any intraday chart and appears in bottom left of screen

Can customise colors and transparency

SMA 200 Ribbon MTF - Support and ResistanceThe SMA 200 is one of the most important and strongest support/resistance lines on any timeframe. This script pulls the SMA 200 line from multiple timeframes so traders can visually see price action bounce between support and resistance . The current timeframes SMA 200 is displayed in white and turns yellow to signify "pressure". Can be used on higher timeframes to find bull action. This indicator can also be used to filter out pumps and dumps as shown in example 3 and 4.

Example of indicator on 5 min timeframe. Candles bounce along SMA200 lines.

Example of indicator on daily timeframe . Lines turn green and price action pumps. Lines turn red and price action dumps.

Example 3: A clean crossover of lines usually signals a bullish pump.

Example 4: Tangled or messy lines tend to result in a dump as price action struggles to cross resistance. A pullback is required to "clean" the lines.

EMA Band can be turned on using "tickbox" in settings menu.

MTF GMMA with Display Timeframe ControlJapanese below / 日本語説明は下記

Multi time frame GMMA indicator that shows GMMA of the current timeframe and GMMA of upper time frame(MTF GMMA).

One of the GMMA’s advantages is to visualize trends showing multiple MAs of short term and long term. By providing both of MTF GMMA and the current timeframe’s GMMA, traders can grasp trends having upper timeframe’s perspectives.

How is it different from other MTF indicators?

Problems with other MTF GMMA indicators are;

-If you set higher timeframe GMMA , it will also be shown on further higher timeframes.

i.e. If you set 4hour GMMA on 1 hour or lower time frame charts, it will also appear on daily and weekly chart, which is not necessary.

To tackle these problems, this indicator has incorporated “display timeframe control” functions as follows.

-To show MTF GMMA on timeframe lower than the upper timeframe you set as MTF timeframe.

For example, if you select daily timeframe for MTF GMMA , the GMMA will be shown only on 4 hour or lower timeframes(1H, 30M, 15M, 5M, 1M).

Functions:

-One upper timeframe can be selected from monthly, weekly, daily, 4hour, 1hour, 30mins, 15mins and 5mins for MTF GMMA

-MA type can be selected from SMA/EMA

-MA period can be configured but common for current timeframe GMMA and MTF GMMA

-Both of current timeframe/MTF GMMA can be disabled when not necessary by ticking checkbox

How to use?

A suggested use of GMMA with MTF GMMA is trend following while price is above the current timeframe GMMA and MTF GMMA(buy the dips and sell the rips) and aim trend reversal when the current timeframe GMMA crosses MTF GMMA

Sample chart

1 hour chart with 1 hour GMMA(blue and yellow) and 4 hour GMMA(MTF GMMA, green)

——————————————————————————————

上位足のGMMA(MTF GMMA)と現在タイムフレームのGMMAの2つのGMMAを表示することのできるインジケーターです。

GMMAの一つのメリットは短期・長期のMAを複数表示することでトレンドを容易に可視化できることですが、上位足のGMMAを合わせて表示することで上位足の目線を保ったままトレンドを把握することができます。

他のマルチタイムフレームGMMAインジケーターとの違い

他のマルチタイムフレームGMMAのインジケーターでは、上位足のGMMAを表示すると、さらにその上位足でもそのGMMAが表示され、チャートが見にくくなるという問題に直面します。

例: 4時間足のGMMAを下位足で表示可能な様に設定すると、日足や週足でも表示されチャートが見にくくなる。

この問題に対して、このインジケーターでは、

・上位足のGMMAを表示する時間軸を制御することで上位足で不必要な情報を表示させない。

という機能を加えることでこの問題を解決しています。

具体的には、マルチタイムフレーム用に選択した上位足のタイムフレームより小さいタイムフレームでのみ上位足のGMMAが表示されるようになっています。

例えば、上位足として日足を選択した場合、日足のGMMAは4時間足、1時間足、30分足、15分足、5分足、1分足にのみ表示されます。

機能

-上位足のタイムフレートとして、月足、週足、日足、4時間足、1時間足、30分足、15分足、5分足を選択可能

-MAタイプはSMA/EMAから選択可能

-MAの期間は設定可能ですが、現在タイムフレームGMMAとMTF GMMAで共通

-現在タイムフレームGMMAとMTF GMMAは不要な時はチェックボックスで非表示可能

使い方

使い方の一つの例として、価格が現在タイムフレームGMMAとMTF GMMAの上にある間はトレンドフォロー(押し目買い/戻り売り)を、現在タイムフレームGMMAとMTF GMMAがクロスした時はトレンド転換を狙うということが挙げられます。

サンプルチャート

1時間足に4時間足のGMMA表示(青と黄色: 1HのGMMA, 緑: 4HのGMMA)

EMA 730 Ribbon MTF - Support and ReistanceThe EMA 730 line is a great way to show dynamic support and resistance . Price action travels "through" this line on each timeframe. This script pulls the EMA 730 Line from multiple timeframes so a trader can visually see price action bounce between support and resistance lines. Lower bands (white lines) can be turned off using "tickbox" in settings. EMA length can also be adjusted in settings. Some charts may work better with a length of 750.

Example of EMA Bands on lower timeframe.

[PX] MTF OverviewHello everyone,

the new table-functions came out, so I wanted to give it a try. With this indicator you can get an overview for your chart by looking at multiple timeframes and different type of indicators for each timeframe.

How does it work?

The indicator uses 3 different timeframes, which you can select in the settings-tab. For each timeframe it will look at the following indicators:

- Volume for the Volume column

- Relative Strength Index (RSI) for the Momentum column

- Average True Range (ATR) for the Volatility column

- Parabolic SAR (PSAR) for the Trend column

Increasing values will be shown in green, decreasing values in red. For the trend it prints a nice little symbol. I'm planning to add more indicators for each indicator category, so that you can choose, which indicators you want to use.

Hope that might be useful to some of you :)

Please click the "Like"-button and follow me for future open-source script publications.

If you are looking for help with your custom PineScript development, don't hesitate to contact me directly here on Tradingview or through the link in my signature :)