My profitable divergence trading strategy (INTRO)This is an intro to my divergence strategy with the basic rules. I may share more in the future so make sure to follow to stay up to date...

All of the indicators are listed on the chart except for the "LIXX DIVERGENCE LOADOUT", that is just my simplified version of VMC Market Cipher B. (THEY ARE ALL FREE)

Tradingstrategy

The way we day trade!In this video we go over the way we approach day trading via our trading strategy which is based purely on technical analysis.

Its a short video and we specifically go over WTI, even tough we have many tradings, but fixed range volume profile is explained and the way we use it.

We hope you enjoy the video and that it helps you with your trading!

Good luck!

ONE THOUSAND TO ONE MILLION IN CRYPTOCURRENCY TRADING STRATEGYDear Traders and Hopeaholics alike,

as the self-proclaimed President and Founder of HOPEAHOLICS ANONYMOUS (or HA for short), yes I know you are going to laugh at this strategy... many have, but it is me having the last laugh HA HA HA... I hear you...but this works! And the strategy is FREE, no paid course, and simple to use!

THE ONLY WAY TO MAKE MONEY - IS TO MAKE YOUR OWN!!!

Let me break it down, it is a COMPOUND TRADING STRATEGY , based on 3% minimum PROFITS with a strict 3% maximum STOP LOSS . The 3% stop loss is where some traders laugh, (HA HA but again I am the president of HOPEAHOLICS ANONYMOUS so please keep laughing it is good for the soul) When applied correctly at the cross support entry on bounce there should be a minimal loss. You MUST include the wicks when drawing your diagonal cross supports, it is again essential for this strategy to work in the high volatility cryptocurrency market.

I recommend setting an OCO order, this stands for ONE CANCELS THE OTHER. You have stop-loss protection and sell order and can go about living your life.

As you can see on the chart cross-supports are drawn from 2 intersecting diagonal supports crossing, this forms a stronger support zone and for this strategy to work, we need a minimum bounce of 3%, yes 3% compounded per day will give you ONE MILLION DOLLARS in around a year with the occasional 3% loss. This is not about winning every trade, it is about having the discipline and strong money management, not chasing trades midwave, having patience for the entries to come to you.

3% IS ACHIEVABLE IN ANY MARKET - BULL OR BEAR! The beauty of a bull market is we can target resistance regions, in the case study shown here this is a 50% move, broken down into dollar value, starting with $1,000, this trade would have gained you $500 in profits bringing your capital to $1,500 which would then be compounded into the next trade. This theory gets harder as your capital grows, as market liquidity can be an issue, and your funds will need to be divided into several trading positions. BUT with each minimum 3% trade you are one step closer to your MILLION DOLLAR GOAL.

It can be optimal to watch indicators such as the RSI and MACD, but not essential for this system to work, when both are as shown the chart patterns will give greater trading percentages, but as I said not necessary as we are only trying to achieve 3% per day.

FOR BEGINNERS - I recommend commencing paper trading your entries and exits to gain confidence without risking your capital to commence with, we want you to be successful and making $$$

************************************************

When trading, always know you are in control 100% as you are pushing the buttons, and it is YOUR money/cryptocurrency you are trading.

BUT let me tell you this... at HOPEAHOLICS ANONYMOUS and in my world... ANYTHING IS POSSIBLE!!!

SHOOT FOR THE MOON - EVEN IF YOU MISS YOU'LL LAND AMONG THE STARS, BUT AT THIS STAGE I AGREE WITH ELON AND THINK WE ARE ALL HEADED TO MARS!!!

**********************************************

If you are unsure of direction or feel you are over trading I have a moto. IF IN DOUBT SIT IT OUT! There is no shame in not being in a trade. Stick to your game plan, wait for a set up to be confirmed, and ONLY take a trade if it all aligns.

So please I welcome your comments and CONSTRUCTIVE FEEDBACK - ALL HATERS WILL BE FLAGGED AND REPORTED!

And remember, there is NO RIGHT OR WRONG in trading - just money management!

REMEMBER IF YOU ARE PRACTICING SAFE... TRADING ALWAYS USE PROTECTION

(minimize your risk, use a stop loss. Especially in Margin Trades) ALWAYS!!!!!!!!!!!!!!!!!!!

<3 Lisa

DISCLAIMER:

The Legal stuff - I'm not a financial adviser. Just a few quick thoughts - remember you sit at your computer, you push the buttons...

PS make sure you give me a like, that way you get updates as I post them.... :) <3

THE ONLY WAY TO MAKE MONEY - IS TO MAKE YOUR OWN!!!

How To Play The Markets To The DownsideI’m Markus Heitkoetter and I’ve been an active trader for over 20 years.

I often see people who start trading and expect their accounts to explode, based on promises and hype they see in ads and e-mails.

They start trading and realize it doesn’t work this way.

The purpose of these articles is to show you the trading strategies and tools that I personally use to trade my own account so that you can grow your own account systematically.

Real money…real trades.

How can you make money in a market that is going down? Today I want to show you two strategies on how to do this.

Shorting A Stock

The first strategy is shorting a stock. So what does this mean and how does it work?

Well, it means that you can sell a stock right now even if you don’t own it, and then buy it back later at a cheaper price.

This is how it works. So first there is your broker, then there’s you who wants to participate and make money in a falling market.

Let’s use Apple AAPL as an example.

Let us pretend AAPL is currently trading at $119 & we believe that AAPL actually might go down again to $110.

You can make money betting against AAPL in a falling market, and here’s how it works.

Now, you want to sell AAPL but you don’t have the shares just yet. So what you would do is you borrow shares from your broker.

So your broker is actually lending you 100 shares of Apple, or at least, we’ll use 100 shares for this example.

Now, the price at this point doesn’t matter. He’s just giving you the shares and says,

“OK, you need to give me back these shares later on.”

And he is actually reserving some money from your trading account to make sure that you really give it back to him.

Now, you have 100 shares, and you can do with these 100 shares pretty much whatever you want.

So in this example, you would sell them. So you sell AAPL , 100 shares of them, at the current price of $119 because you believe that AAPL will go down.

So how exactly do you make money?

Let’s say after a few days, AAPL , in fact, does drop down to $110.

Here’s what happens next. Now you are buying back AAPL at $110.

So how much money do you make? If you sold AAPL for $119 and you’re now buying it back at $110, you’re making $9 per share, multiplied by 100 shares.

This comes to $900 in profit.

Now that you have the shares back, you, of course, have to give them back to the broker.

Remember, the broker lent you the shares, so you have to give them back those 100 shares of AAPL , and when you do, the broker releases the money that they held, kind of in escrow, to make sure that you are getting the money back.

Now, the beautiful thing is this is all going on in the background.

This is what it would look like on a trading platform.

So now, I want to trade AAPL , and I want to just sell 100 shares of AAPL .

So all I do here is, it says already short minus 100 and I would sell them at the current price of $119.35. So I click review and send.

And the broker is requesting almost $6,000 from me. And this $6,000 is basically the money that he’s holding in escrow to say,

“All right, Markus, you have to give me back the shares.”

And it is that easy.

And now if I click on “Send Order,” I would sell the shares.

So this is the first way because I told you that I’ll give you two strategies of how to benefit from a falling market.

So this was strategy number one, shorting a stock.

Buying A Put Option

Now, let’s move on to strategy number two. You would buy a put option.

“Put” means that you have the right to sell a stock at the strike price.

So, again, we will be using the same example of AAPL that we used for the first strategy.

So as I just said, we’re pretending AAPL right now is trading at around $119 and we believe that AAPL will go down to $110.

This is how this would work.

So this is where we are looking at an AAPL put, let’s say here, AAPL put of 119, and it is trading at around $1.80.

So here is what exactly we would do.

We would buy a put for $1.80. Now, this put gives us the right to sell AAPL for $119.

Now, if AAPL really goes all the way down to $100, see same deal here, we actually would make $9 per stock.

However, we have to deduct the premium that we paid for the option, which is $1.80.

So this means here we are making $7.20 per share ($9 — $1.80).

If we would trade one option, one option controls 100 shares, so this means that we are making $720 total.

Which Strategy Should You Use?

Now, the main difference between these two strategies is that, for strategy number two buying a put, you don’t need as much money.

Remember when I went to my trading platform earlier and wanted to sell AAPL 100 shares, that my broker was reserving around $6,000 dollars in my account?

Now keep this in mind.

According to what my trading platform is telling me, if I want to buy this option, it would only cost me $180. So as you can see, huge difference.

In the one case, the broker is reserving $6,000 with the possibility of making $900.

For strategy two, buying a put, your broker is only requesting $180 and that is also the maximum amount that you can lose, and you can make possibly $720 here.

Summary

So this is how you can make money in a falling market.

Now, very important, strategy number one, where you’re just shorting the stock and where the broker is lending you the stock, you cannot do that in a retirement account.

But strategy number two, buying a put, you CAN do in a retirement account, and you can do this for any stock.

Now, you might actually be bullish on AAPL , but if you look at some other stocks right now that we're in a downtrend, for example, ZM , if you say,

“Oh my gosh, Zoom is crazy, during the pandemic here,”

it went from, what? $50 to $500? You could think,

“This is absolutely overvalued and I believe that Zoom will go down to $300”

you can use one of these strategies.

So you see that all these stocks that, during the pandemic benefited a lot, could actually move lower, this is how you can make money in a falling market.

So now you know two strategies how to make money in a falling market, how to bet on a stock that is going down.

RSI Trendline StrategyHello, traders!

Last time we considered the topic about the technical indicator's types combinations to increase your profit. I promised you to show in details some strategy which applies combination of the indicators.

Let's consider the TREND + OSCILLATOR strategy which uses the EMA and RSI indicators.

First of all we should define the direction of a market trend. The price is above 200 EMA means that the market is in global uptrend. So, we are going to search bullish signs for RSI indicator.

Today we are going to use RSI in a non-standard way. We will search the RSI downtrend lines breakouts. You can see such line on the chart. When the RSI breaks through this line during the price is in the uptrend it is a buy signal. It is great to have another one confirmation. Here we can see that the price bounced off the 200 EMA and exactly after that there was a massive growth.

Why does it work? During the uptrend we often have the consolidation or correction phases. If the RSI is in the downtrend it means that the asset's oversold zone is upcoming, but the market is in the uptrend and bulls dominate. Thus, the money reaccumulates here and when the bear's activity become weak the bulls push the price above rapidly.

DISCLAMER: Information is provided only for educational purposes. Do your own study before taking any actions or decisions.

What is a short squeeze? How to trade a short squeeze?What is a short squeeze?

A short squeeze is a short period when the price of a security increase rapidly due to the demand greater than the supply available for that security. A short squeeze is due to short-sellers covering their positions and long traders looking for a bargain.

How to trade a short squeeze?

A common shape of a short squeeze is an "inverted J" shape. The straight-line of the inverted J pattern is due to aggressive buying by the bargain hunters and short sellers covering. The hook shape of the inverted J is formed due to the profit-taking of the short-term traders. A trader can trade in the direction of the "inverted J" shape.

What are some of the reasons one may fail to trade this pattern?

Possibly due to failing to identify a correct bottom before placing a trade. Possibly a temporary bottom was identified, but the downtrend continued and trapped the traders.

Thank you for reading!

Greenfield

Remember to click "Like" and "Follow!"

Disclosure: Chart interpreted and article prepared by Greenfield. A market idea by Greenfield Analysis LLC for educational material only.

EDUCATION: Money Flow Index (MFI)Hello, dear subscribers!

The topic of this article is Money Flow Index Strategy (MFI).

Definition

This is the oscillator type indicator, which looks like RSI, but takes in account the volume.

Thus it demonsrates not only the price momentum, but also the money volume.

It is calculated as a ratio of the positive or negtative money volume divided by the total money flow. MFI indicates the overbought and oversold conditions. The asset is overbought when its value is above 80 and oversold, when below 20.

The strategy

Let's take a look at how to execute the long positions. Initially we should make sure that the market is in global uptrend now. For this purpose we will use the 200 period SMA. If the price is above the SMA, which has a positive slope the market is in uptrend now.

The second step is the bullish hidden divergence identification. As we told in the previous education article the hidden bullish divergence with the oscillators means the uptrend continuation.

The third point of this analysis is that the asset now is in oversold zone according to MFI.

Paper Trading on TradingView: 3 Simple StepsI’m Markus Heitkoetter and I’ve been an active trader for over 20 years.

I often see people who start trading and expect their accounts to explode, based on promises and hype they see in ads and e-mails.

They start trading and realize it doesn’t work this way.

The purpose of these articles is to show you the trading strategies and tools that I personally use to trade my own account so that you can grow your own account systematically.

Real money…real trades.

If you are brand new to trading and haven’t yet used a paper trading simulator, you should.

Some people won’t use a paper trading simulator when they are first getting started because they don’t feel like it’s an accurate representation of the real markets.

They’re right to an extent. You’re not risking real money, so you’re not going to experience the emotions that come along with it just trading in a simulator.

Even with that said, I’m still a huge fan of trading simulators. Think about it, when pilots are training, before they are able to actually fly, they spend hours and hours on the ground training in a simulator.

Why Should I Paper Trade?

There are two main reasons I want to show you how to use TradingView paper trading as a stock market simulator.

1) You want to test your trading strategy. A solid trading strategy has three elements to it:

- Knowing what to trade. Are you trading stocks or options?

- Knowing when to enter.

- Knowing when to exit, at either a profit or a loss.

These are the main elements of any solid trading strategy, and it doesn’t matter what strategy you’re trading.

It could be a strategy like the PowerX Strategy or The Wheel, it doesn’t really matter.

You want to make sure that the strategy actually works which is why you want to test it to make sure that you understand the rules so that you’re not making any mistakes.

If you are making mistakes, it’s better to find out when you’re not risking real money.

2) The second reason why you should trade on a simulator first? To gain confidence.

Whenever you have a new strategy, you might be wondering if it actually works right?

This is why when you use a simulator to test your strategy and you see that it works, you get more confidence because now you get some actual numbers.

So you will know your winning percentage, your average profit, your average loss, and other important numbers.

Setting Up TradingView To Paper Trade

TradingView is a free tool that you can use as a simulator, and you may already be familiar with it already. I use it a lot.

So here is a step by step walk-through for how you can use TradingView as a simulator.

1) Step one. You need to connect paper trading, and in order to do this, you go to the “Trading Panel” tab at the bottom.

Once you bring it up, you can choose your broker and log into your brokerage account.

On the very left side, you see “Paper Trading.” Click that.

2) Step two. You want to reset your account. You might be wondering,

“Why should I reset my account? I haven’t done anything yet.”

This is because your account will start you off with $100,000 by default.

This may be a fun fantasy, but maybe not exactly your trading account size.

It is very important that you mirror the size of your paper trading account with your real trading account.

So, therefore, you click on the gear icon that will show on the right-hand side, and then in the dropdown menu, you see “Reset Paper Trading Account.”

Once you click that, it will prompt you to input your desired starting balance.

So if you are planning to start with $10,000 in your real trading account, start with $10,000 in your paper trading account.

If you are starting out with an account of $20,000, enter that instead.

You get the idea. Then just hit “Reset.”

3) Step three. You will have to adjust a few settings and before I walk you through an actual order.

Right mouse click anywhere on the screen in your charts.

In the menu, you will see the fourth item down is “Trade.”

Go ahead and click on “Trade” then click on “Create New Order.”

When you click on Create New Order, you have an order ticket appearing on the right-hand side of your chart.

You will also see a gear icon.

Click the icon to change the settings, and these are the settings that I personally use, so I highly recommend these.

- Uncheck “Show Order Price In Ticks.”

- Check “Show Quantity In US Dollar Risk”

- Uncheck “Show Quantity In Percent Risk.”

- Check “Show TP/SL Inputs In USD,” (that’s Target Profit & Stop Loss).

- Uncheck “Show TP/SL Inputs In %.”

OK, so this is the basic settings in order to use the simulator.

Now let me show you exactly how to use it in conjunction with the PowerX Optimizer.

Using TradingView With The PowerX Optimizer

The PowerX Optimizer is a tool that I personally use to scan for stocks to trade.

When the stocks come up on the list I quickly go through the list and I’ll look for stocks that have no gaps, good upside/downside trend-ability, and I want to see a nice P&L chart.

Let’s pretend the PXO pulled up the stock PLUG as a recommended stock, and use it as an example.

Now, remember what I said about how a trading strategy should tell you three things.

It should tell you what to trade when to enter, and when to exit. This is exactly what PowerX Optimizer does.

Now here is how to use TradingView’s paper trading simulator in conjunction with PowerX Optimizer.

The PowerX Optimizer will show you how many stocks to trade based on your account size, when we want to enter, and when we want to exit.

What you want to do in TradingView to fill in the quantity and where exactly we want to enter.

And according to PowerX Optimizer, we want to buy, but we don’t want to buy it at the market price, we want to buy it when it reaches the “Buy To Open” price in the data window on the upper right.

Let’s just use the price of $18.89 as a place holder for this example.

Let’s also assume it suggests buying 55 shares based on the account size.

And then we can also specify our profit target and our stop loss.

Now PowerX Optimizer will give you a the profit target in the “Data Window,” lets say for $26.63.

We can then also specify a stop loss, and PowerX Optimizer tells us when to get out of this position with a loss.

For this let’s use $15.26.

So according to the PowerX Optimizer, with our $10,000 account, we would risk $199, almost $200 trying to make $425.

So our risk-reward ratio, as you can see here in PowerX Optimizer is 1:2.13, also seen in the “Data Window.”

So then all you need to do is click on “Buy Nasdaq” after you’ve entered all this in TradingView.

Remember, this is not being executed as your broker.

This is a simulator. So you don’t make and you don’t lose any money.

This is for testing your trading strategy and gaining confidence.

So let’s just say buy and you see the order is sent right now.

Once the order is placed you will now have one position and two orders in the market.

Those orders are a sell limit order for our profit target, and a sell stop order for our stop loss.

So as you can see, it is super easy to use this simulator here in conjunction with PowerX Optimizer.

You can now change the orders that you do have in the market here, so you can change them to a different price by clicking the little edit sign you will see on the right hand side.

So you see exactly what you have right now, what you bought, you have the working orders, you have the filled orders here and now, if you would change any working orders, for example, if you want to change your stop loss, you just click on the edit here and change it to any value that you want.

By the way, the right way to move your stop loss is always closer to your entry price, never away. Never, ever give a trade more room, it usually ends in disaster.

Summary

So this is how this trading simulator works. First of all, why do you need a simulator?

It is just to first test your trading strategy to see if you understand the rules, and to see if the trading strategy works.

Finding all this out will gain your confidence, all with no risk.

You can set up your TradingView account for paper trading in three easy steps:

1) You connect the paper trading account.

2) You reset it to the account size that you are planning to trade.

3) You modify the order settings.

Very simple. Then you just pick any stock that you want.

The best thing is, is it’s free.

I highly recommend that you do this. You literally have nothing to lose.

Power of Investing lies in your Individual Method Everything can be thought. But not everything can be learnt. Developing a risky instinct in investing is not something you learn. It’s something you are born with. Then you are given the power to share it. Agree? Probably not. It’s understandable. I went into stock trading not because I dig and sturdy deeply into companies’ financial and books at first hand, or mastering the art of options trading, rather I went into it simply because of self possessed gift of intuition to make risky calls that contradicts the majority, which often turn out favorably.

Investing is a game, not a gamble.

Contrary to the general method of investing, I buy a stock based on instinct then I start digging further in its books and financials to justify the instinctive decisions. Yes, I often lose. But yes, I often gain more. The reward comes from balances and checks that falls in favor of more profits at the end of the day. Take an example, on a 3 day stretch Oct 25th-28th, we all witnessed over 95% of stocks thrown downwards to a darkening red (nearing all time lows). Meanwhile, calls on Ford, GE, and Kodak (I made back in July when the market downgraded them to “Strong Sell”) kept a shiny bright green of blocks (upwards momentum). Now that was some risky calls that paid off.

So it begs to ask… What exactly is the rule in stock investing for winning profits? Are there standardized rules to follow? And are these rules created by the 10% of winners, and gets passed down for the mass to follow?

There’s the old saying: Read all that works, but never follow them, there’s a reason it only works for the less than 10%. (OK I made that up, but its true).

The power of investing lies in your individual method... not the market (standards).

What Is a Trading Strategy and Why Traders Must Use ItI think I won't be far from the truth if I say that novice traders think about trading signals and trading strategies as the main components of their profitable trading in the financial markets. They are wrong, but they will need time and enough knowledge to understand their mistakes.

It is obvious that novice traders think that if they know when to buy and when to sell in the market, they will make money. But the reality gives us about 90% failed traders who succeed only in destroying their capital. Trading signals won't make your rich if you know nothing about trading. If we talk about trading signals, we can say that they are useless for the majority of traders. But trading strategies, which produce trading signals, it is another tool which definitely worths your attention.

In this post, let's talk about trading strategies. What is a trading strategy? What type of trading strategies can you use? Why do you need to use trading strategies? How to pick the right trading strategies?

In simple words, a trading strategy is a list of rules which describe when to open a trade and when to close it. A trading strategy gives you a signal for buying or for selling. It tells you where to place stop and where to place profit targets.

Some trading strategies can include information about the risk level and how you can manage open positions. But I would like to talk about it in the context of money management strategies.

We can divide trading strategies into different groups using different criteria.

Trading strategies can be based on Fundamental analysis, Technical analysis, or they can combine both types.

We can divide trading strategies based on the duration of holding open positions, and we will get the following types:

- scalping strategies (very fast trades with very close profit targets)

- day trading strategies (trades which are opened and closed in the borders of a trading day)

- swing trading strategies (when we stay with open positions for more than one day)

- long term trading strategies (when we hold positions for weeks and months)

- investing strategies ( when we buy a financial asset and hold it for years)

We can trade in different market conditions, and for them, we need to use a different approach:

- trend-following strategies (when we trade in the direction of the main trend)

- countertrend strategies (when we trade against the main trend trying to catch pullbacks)

- trend reversal strategies (when we try to catch a trend reversal and join in a new trend in the best point)

- strategies for range markets (when a market moves sideways, and we buy from the support and sell from the resistance)

- volatility breakout strategies (when we try to catch a strong movement and a beginning of a new trend after a consolidation period).

All these strategies are based on different principles and must be used properly in order to avoid false signals. For example, if we use trend-following trading strategies in a range market, we will get tons of false signals. The same goes for using range strategies in markets with solid trends.

Trading strategies can be based on simple Technical tools like trend lines, levels, zones, chart patterns, and a wide range of different indicators and their combinations.

What is very important to note?

There are thousands of different trading strategies, which allow you to trade in any market, timeframe, and in any market conditions.

There are a lot of good trading strategies which can be profitable in the long run. But there are no trading strategies which will give you 100% profitable trades. You must understand that any profitable trading includes trades closed by stop orders. Drawdowns are a part of any profitable trading as well. When someone tells you that this trading strategy has 100% win rate, you are talking with a clown but not with a trader, and you shouldn't use such a trading strategy.

You should note that in order to succeed in trading, you must have at least one trading strategy. When you jump from one market into another market and you trade without the exact rules, you have very good chances to fail. You aren't consistent in your trading decisions and it leads to unpredictable trading results. Of course, you can expect that you will be so lucky and take part in only profitable trades. But the reality can be far from your expectations. Trading strategies allow a trader to be consistent. You have the trading strategy. You trade again and again, following the same rules. You pass through drawdowns. You pass through profitable periods. You are profitable in the long run because you use the proven trading strategy and realize its potential.

What else you should note?

A trading strategy must suit you like shoes. You don't wear shoes which don't match your size, right? The same goes for trading strategies! They must match traders' nature, lifestyle, goals. When you use the right trading strategies, you feel comfortable. It is a good way to avoid mistakes in trading. There are no perfect trading strategies if we talk about trading results. But there are trading strategies which perfectly suit you! You have to use such trading strategies!

Before using any trading strategy, even if you are sure of its profitability, you should backtest it. You will see all ups and downs of your equity curve. You will see the periods of drawdowns and how the strategy can manage it. You will see the weaknesses and strengths of the trading strategy. Based on the information from backtests, you will be much more confident in this strategy when you start real trading. It will also be good to start using a trading strategy in a demo account first.

And I guess you have a question, where you can get a trading strategy?

There are two ways. Of course, the simplest way, you can use trading strategies developed by other traders. Google search will help you with this task. Also, ask your favorite traders to share their trading strategies. Pick the most suitable variant for you among thousands of different strategies. Don't forget that you must feel comfortable using the trading strategy. The 2nd way is the best for any trader. It needs more knowledge, experience, and time, but it allows you to get the strategy which 100% suitable for you as a trader and it is oriented on reaching your goals. I'm talking about the way when you create a trading strategy for yourself.

Concluding, I want to say that there are a lot of variants of how to make money in the financial markets. There are a lot of trading strategies that work and they are profitable. You just need to pick the most suitable trading strategy for you and use it properly. Don't spend your time trying to find a strategy that will give you only profitable trades. There are no such trading strategies!

Also, please note that it is impossible to succeed in trading if you don't use a trading strategy or portfolio of trading strategies. I really advise you to stop searching for useless trading signals and focus on the tool which really can be helpful for you. Trading strategies give you what you need, and they make from you an independent trader. You trade in the markets you want and how you want. You follow your own trading plan, which helps you to reach your own goals in the financial world!

I wish you good luck!

How to Trade Bull & Bear Pennant Pattern | Pennant Tutorial !Pennant Chart Patterns Tutorial !

Pennant Pattern : Pennant Patterns are continuation chart pattern, forms when price of a security or asset makes strong upward or downward movemnt followed by a consolidation period with converging trendlines which forms a pennant before continuing to move in the same direction. Bullish pennant forms in a bullish trend market and Bearish pennant forms in a bearish trend market.

Bullish Pennant : Bullish Pennants are bullish continuation pattern that occurs in strong uptrends and it forms after a sharp climb in price then a consolidation period with converging trendlines. After formation of the pennant, price breaks above the upper trendline of the pennant and continues the bullish trend.

Bearish Pennant : Bearish Pennant is the opposite of a bullsish pennant. Bearish pennant forms after a sharp drop in price then a consolidation period with converging trendlines after that price makes a brekout below the lower trendline of the pennant and continues the bearish trend.

(* Key things to know : In a pennant pattern the period of consolidation should have low volume and the breakout should occur on higher volume like most pattern. Above average volume confirms the breakout. You can also use other indicators like MACD or RSI to know the strength of the breakout. Look at below detailed examples - )

Please Like & Comment and Stay Tuned ! 👍

Thank You-

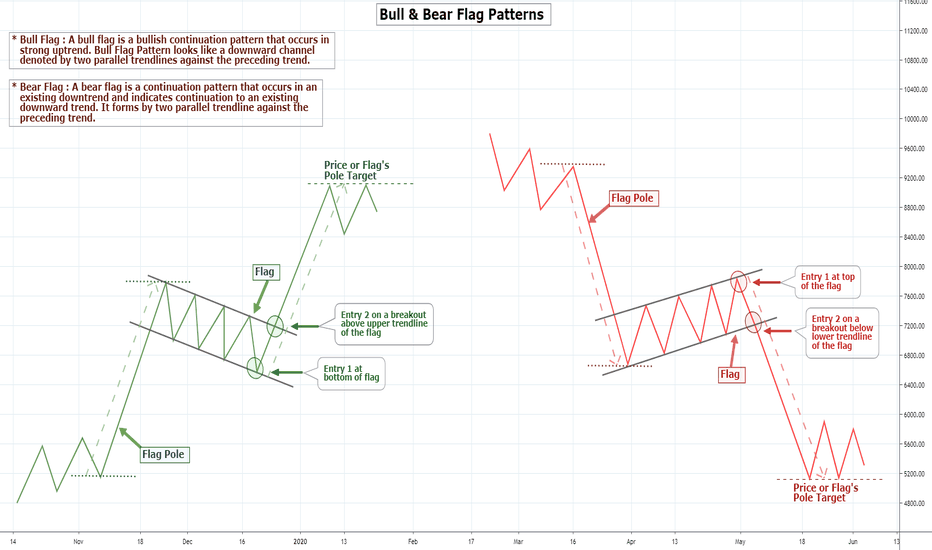

How to Trade Bull & Bear Flag Pattern | Flag Pattern Tutorial !Bull & Bear Flag chart patterns Tutorial!

Bull Flag : A bull flag forms in bullish trending market, After a strong bullish movement when this pattern forms it signals the market is likely to move more higher. Bull flag pattern much similarly looks like a horizontal parallel channel or downward parallel channel along with a strong bullish vertical rally; when we draw the pattern it looks like flag on a pole, that's why they are called bull flags.

How to identify and Trade Bull Flags : - It is easy to identify a bull flag you just need to look for a Bullish Vertical Rally or Trend which is Pole of the Flag then identify the consolidation which will look like either horizontal channel or downward channel which will be the Flag. After identifying the pattern you can enter at the bottom of the flag or you can enter when price breaks the upper trendline of the flag which is more safe.

The breakout may also be a fakeout that's why we will take help of Volume and RSI Indicator to confirm the breakout. As shown on the below example you can see when price breaked the uppper trend of the flag the Trend drawn on the RSI was also broke and the Volume was high.

()

( *Key things to know : If the retracement measured from the vertical rally or Flag Pole retrace more than 50% the pattern becomes weak and it may not be a Flag Pattern but sometimes it stays valid if it breakouts above the uppertrend of the flag.)

Bear Flag : Bear Flag is just the opposite of the Bull Flag Pattern. A bear Flag forms in bearish trending market. Bear Flag pattern signals the market is likely to drop more lower. You need to identify Bear Flag in bearish trend when the price of a financial asset drops then if the price forms a horizontal channel or upward channel which will look like a inverted flag whose flag pole will be upside and the flag will be downside.

Stay Tuned; 👍

Like this tutorial & share your comment below and also

check other tutorials with example linked below;

Thank You-

4H Support / Resistance with RSI Day Trading StrategyRSI = Blue, EMA of RSI = Red.

RSI 14, EMA 45

Long Rules:

1) RSI > EMA RSI = look for long setups

2) Resistance is broken ( a new high )

3) Price rejects (pulls away) from the previous resistance

4) RSI > EMA RSI >> 50

Short Rules:

1) RSI < EMA RSI = look for short setups

2) Support is broken ( a new low)

3) Price rejects (pulls away) from the previous support

4) RSI < EMA RSI << 50

I typically like to place a stop loss at the top of the closest resistance (if going short) and at the bottom of the closest support (if going long) and TP 1:1.

Another method is to go for partial profit at the closest support/resistance and move the stop to breakeven to catch longer trades.

3/4 trade setups in the past month on AUDUSD

FLAGS:

*the setup on the 20th of March was a working short position, but the strategy is looking long.

*the setup on the 31st of March was not validated as the RSI is not > EMA of RSI

Head and Shoulders the accurate price action patternHead and Shoulders Pattern Tutorial -

Head & Shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway; this reversal signals the end of an uptrend.

The formation of a H&S pattern resembles a baseline or neckline with three peaks where the middle peak is the highest between the two right and left peaks.

Head and Shoulders patterns are statistically the most accurate chart pattern, almost 85% of the time they reach their projected target.

The formation of a H&S pattern resembles a baseline with three peaks where the middle peak is the highest. The two left and right peak don't have to be at the same price, but the more closer they are to the same level the more stronger the pattern becomes. The pattern completes when price breaks through the neckline.

Stay Tuned, 👍;

The Power of a Momentum MoveNever underestimate the power of a momentum move... either up or down!

Because once the momentum train starts going its very hard to stop it and it will keep going much further than most have anticipated so don't be that trader that try to predict the reversal!

This video explains more!

The SMA cross strategy In this educational idea I’ll cover the SMA cross strategy. I’ll will cover how it works, what my peripheral values are and how it can work for you.

The Simple moving averages cross strategy is a strategy where you buy something on a buy-signal of the indicator and sell it on a target, for example if you had 5% profit.

What is a moving average? A moving average is an indicator which helps you smooth out “noise” in a graph. The indicator is based on a formula you can find the formula below. You can add values to the indicator, let’s say you want a MA of 9 candles you just add a value of 9. You usually use more than one MA, I prefer using a 7 candle MA and a 25 candle MA. The thing I like on moving averages is that you can use them in any time frame.

What is a buy signal? A buy signal is created when the long moving averages (in my case the 25 candle MA) gets underneath the short one (in my case the 7 candle MA). When that happens a buy signal is created. When the opposite occurs it’s a sell order.

How to determine a target. Your goal is to make money, but how can you make as much money as possible with this strategy. You have to determine a goal, so an exit-position. Your exit-position is the hardest thing of this strategy, but you can use an average of what happened before. If the average of positive “breakouts” is for example 5% profit you can use 5% profit as target.

How to use a SMA strategy to make you money. Not all the SMA crosses will lead to profit, most of them are even false “breakouts”. So before you buy something on a buy-signal you have to wait a few seconds and watch what the price will do, when it goes up you buy, when it does nothing of goes down you do nothing. If you want to make money using this strategy you have to set a stop-loss, I recommend to always set a stop-loss not only for this strategy. You can keep your stop-loss really close to your buy order.

www.investopedia.com():max_bytes(150000):strip_icc():format(webp)/latex_b8b977c06a4bf64591506c2bd9e918c6-5c474c25c9e77c0001d3b0e9.jpg

When to add to a trading set-up/plan and when to leave it alone.It can be a very daunting task to create a trading plan/strategy that fits you without conflict. There are a lot of obstacles that inhibit the average trader from leaving a profitable trading plan or strategy as it is. Even I struggle with this which is why I have decided to publish this article. After much reflection, I have come with a few metrics you can use to determine if you should change your trading plan or not.

Mental Capacity

Mental Capacity, to me, is perhaps the most important aspects of trading. It easily differentiates traders that are absolutely determined to become successful and traders that are bound to become scam traders and losers (no pun intended). Mental capacity resonates itself in a traders ability to deal with traumatic trading experienced such as drawdowns and losing trades. A lot of traders don’t understand that trading is a game of probability so you have to make a lot of money when you’re right and lose a little when you’re wrong. If you make 4X the money you lose, you’ll have to lose more than 80% of the time to not be profitable. Understanding and having mental capacity allows a trader the ability to ignore irrational phobia of thinking that their strategy is not working. If your trading plan/strategy fits you mentally then you should have the mental capacity to accept all the things that can happen to you trading wise. If not, then it’s time for you to change it. Trading is a mental game, always.

Objective

As much as I love the mental side of trading, I do have to admit that objectives are very important in trading as well. If you’re trading a strategy that is not fulfilling your objective (based on reasonable probabilities) then it’s time to switch components of your strategy. I hate to admit this as I am a big believer in having a “Mind like water.” When it comes to trading but if you have an ever burning passionate desire to make 4X what you risk and also to follow the trend then it’s not recommended to deny yourself of this desire as it will one day influence you to give in and break your trading plan. The solution to this, in my opinion, is to take your objective and create your plan/ strategy around it. For example, if I have a goal of making at least 100 pips per 25 pips that I risk then maybe I should trade on a higher time frame while using psychological support and resistance levels. The moral of this part of the article is to exemplify the fact that any undesired occurrence a traders mental capacity can’t handle can easily be resolved by having an objective ( not having a 30% DD) and a solution (maybe I should hedge my trades or buy options) that can help you acquire that objective. The solution in return will let you know that it’s time for you to change your strategy, but if it doesn’t resolve the objective then keep it as is.

Compatibility

I’m going to try to keep this part simple mostly because it’s somewhat related to the objective side of this article but at the same time is a very important part to keeping and tossing your trading plan. No matter how much money you are making in trading, if you aren’t compatible with your trading plan then it will all be in vain. It isn’t logical for a trader who loves waiting to be a scalper and vice versa because when this happens it makes the trader feel that they have to change instead of the trading strategy. It has to be the other way around! Trust me, I learned this the hard way because I always got jealous of high leveraged scalpers making 1k days while I was making 2% per month if I got lucky. When I tried copying them it forced me to change into timeframes/trading strategies that I was not compatible with. My advice to any trader struggling with this is to love yourself and you’re trading because it’s your decisions and perspective that determine profitability.

OANDA:EURUSD

How to find high probability trends on any currency pair.This is a very descriptive example on how a trader can find high probability trades that are very unlikely to reverse. The markets are full of fractals so this strategy should be good for any timeframe but I highly suggest you use these timeframes as follows. If you place trades using the 4hr, use the daily for trend (example on the chart). If you place trades using the daily time frame (recommended) use the weekly time frame for the trend by using the same exact method but on the open, high, low, and close, of the weekly charts. Please leave a lime and comment as this encourages me to create new content for you guys every Friday. Feel free to message me. FX:EURUSD

Three things Mark Douglas taught me. (Pt1)Psychology

Psychology, like anything in life, plays a big role on how humans function. It affects the way we think, act, talk, and so on but when it comes to trading it affects us, oddly enough, in only one way and that’s through our emotions. Any experienced (or shall I say inexperienced) trader knows and understands the waves of overwhelming emotions that resonates based off of a trade that’s a loser. These emotions range from sadness, depression, anger, and the list goes on. The reason for this, if I’m not mistaken, is because of the pure fact that the money we use to trade with is hard earned and even when it’s not it’s something that rightfully belongs to us. Human nature is something that’s extremely difficult to change because it's part of our genetic make-up that has allowed us to stay for so long by encouraging us to stay away from things that we don’t understand or that will hurt us. Trading psychology is definitely the hardest thing to master when it comes to trading because your psyche works against you when you're being hurt mentally (losing trades) and works for you when you're euphoric (winning trades). As if this couldn’t get any worse, a hurting mentality will tap you into a pool of past failures or misfortunes that have happened to you in life and convince you to think you're not any good as a trader and that your strategy is useless. This baffled me when I learned this from Mark Douglas because it wasn’t something that I realized. This fact is very important because it means you and only you alone are able to break this cycle of assuming a bad trade means a bad setup. A losing trade has absolutely no correlation to you as a person so you shouldn’t assume that you're the reason why you have a losing trade. According to Mark Douglas, it only takes one person around the world to negate your edge. This basically means that when you're buying, someone around the world is selling. When there are more bears (sellers) than buyers (bulls) you're long trade is no longer able to be profitable and stops you out depending on your risk. The markets are full of newcomers and unprofitable traders that agree on the wrong thing together and thus makes the impossible or improbable possible. This gets even more tricky because it makes you, the person on the other side of the trade, feel unsuccessful. This is not true! A losing trade does not represent a bad setup but because our phycology wants to protect us from losing money (what hurts us) it tricks us into thinking that we are unsuccessful as traders. The solution to this is to simply accept the risk of the trade by trading a strategy or setup that is profitable through backtesting. Mr Douglas implored that back testing should be done through 20 trade sample size to give accurate results. When I first started trading back in late 2016 I would always hear profitable traders talk about trading psychology and not trading strategies. I never knew why until I tool Mark Douglas’ principals into consideration and for that I am grateful.

(see pt2)