Wedge Pattern – Simple Explanation

📚 Wedge Pattern – Simple Explanation

A wedge pattern is a shape on the chart that looks like a triangle or cone. It tells us that the price is getting ready to break out — either up or down.

---

🔻 Falling Wedge (Bullish)

Looks like price is going down, but slowly.

Lines move closer together.

Usually means the price will go up soon.

It's a bullish signal (good for buying).

---

🔺 Rising Wedge (Bearish)

Price goes up, but losing strength.

Lines get closer together.

Usually means the price will go down soon.

It's a bearish signal (good for selling).

---

💡 Easy Tips:

Wait for breakout (big move out of the wedge).

Use a stop-loss below/above the pattern.

Target = height of the wedge.

---

📌 In Short:

Wedge = Squeeze pattern.

Falling wedge = Buy chance.

Rising wedge = Sell chance.

---

Let me know if you have sny doubt in comments

Wedge

What is a Bearish Breakaway and How To Spot One!This Educational Idea consists of:

- What a Bearish Breakaway Candlestick Pattern is

- How its Formed

- Added Confirmations

The example comes to us from EURGBP over the evening hours!

Since I was late to turn it into a Trade Idea, perfect opportunity for a Learning Curve!

Hope you enjoy and find value!

Real Success Rates of the Falling Wedge in TradingReal Success Rates of the Falling Wedge in Trading

The falling wedge is a chart pattern highly valued by traders for its potential for bullish reversals after a bearish or consolidation phase. Its effectiveness has been extensively studied and documented by various technical analysts and leading authors.

Key Statistics

Bullish Exit: In 82% of cases, the exit from the falling wedge is upward, making it one of the most reliable patterns for anticipating a positive reversal.

Price Target Achieved: The pattern's theoretical target (calculated by plotting the height of the wedge at the breakout point) is achieved in approximately 63% to 88% of cases, depending on the source, demonstrating a high success rate for profit-taking.

Trend Reversal: In 55% to 68% of cases, the falling wedge acts as a reversal pattern, signaling the end of a downtrend and the beginning of a new bullish phase.

Pullback: After the breakout, a pullback (return to the resistance line) occurs in approximately 53% to 56% of cases, which can provide a second entry opportunity but tends to reduce the pattern's overall performance.

False Breakouts: False exits represent between 10% and 27% of cases. However, a false bullish breakout only results in a true bearish breakout in 3% of cases, making the bullish signal particularly robust.

Performance and Context

Bull Market: The pattern performs particularly well when it appears during a corrective phase of an uptrend, with a profit target reached in 70% of cases within three months.

Gain Potential: The maximum gain potential can reach 32% in half of cases during a bullish breakout, according to statistical studies on equity markets.

Formation Time: The wider the wedge and the steeper the trend lines, the faster and more violent the post-breakout upward movement will be.

Comparative Summary of Success Rates:

Criteria Rate Observed Frequency

Bullish Exit 82%

Price Target Achieved 63% to 88%

Reversal Pattern 55% to 68%

Pullback After Breakout 53% to 56%

False Breakouts (False Exits) 10% to 27%

Bullish False Breakouts Leading to a Downside 3%

Points of Attention

The falling wedge is a rare and difficult pattern to correctly identify, requiring at least five contact points to be valid.

Performance is best when the breakout occurs around 60% of the pattern's length and when volume increases at the time of the breakout.

Pullbacks, although frequent, tend to weaken the initial bullish momentum.

Conclusion

The falling wedge has a remarkable success rate, with more than 8 out of 10 cases resulting in a bullish exit and a price target being reached in the majority of cases. However, it remains essential to validate the pattern with other technical signals (volume, momentum) and to remain vigilant against false breakouts, even if their rate is relatively low. When mastered, this pattern proves to be a valuable tool for traders looking for optimized entry points on bullish reversals.

Falling Wedge Trading Pattern: Unique Features and Trading RulesFalling Wedge Trading Pattern: Unique Features and Trading Rules

Various chart patterns give an indication of possible market direction. A falling wedge is one such formation that indicates a possible bullish reversal. This FXOpen article will help you understand whether the falling wedge pattern is bullish or bearish, what its formation signifies about the market direction, and how it can be used to spot trading opportunities.

What Is a Falling Wedge Pattern?

Also known as the descending wedge, the falling wedge technical analysis chart pattern is a bullish formation that typically occurs in the downtrend and signals a trend reversal. It forms when an asset's price drops, but the range of price movements starts to get narrower. As the formation contracts towards the end, the buyers completely absorb the selling pressure and consolidate their energy before beginning to push the market higher. A falling wedge pattern means the end of a market correction and an upside reversal.

How Can You Spot a Falling Wedge on a Price Chart?

This pattern is usually spotted in a downtrend, which would indicate a possible bullish reversal. However, it may appear in an uptrend and signal a trend continuation after a market correction. Either way, the falling wedge provides bullish signals. The descending formation generally has the following features.

- Price Action. The price trades lower, forming lower highs and lower lows.

- Trendlines. Traders draw two trendlines. One connects the lower highs, and the other connects the lower lows. Finally, they intersect towards a convergence point. Each line should connect at least two points. However, the greater the number, the higher the chance of the market reversal.

- Contraction. The contraction in the price range signals decreasing volatility in the market. As the formation matures, new lows contract as the selling pressure decreases. Thus, the lower trendline acts as support, and the price consolidating within the narrowing range creates a coiled spring effect, finally leading to a sharp move on the upside. The price breaks through the upper trendline resistance, indicating that sellers are losing control and buyers are gaining momentum, resulting in an upward move.

- Volume. The trading volume ideally decreases as the pattern forms, and the buying volume increases with the breakout above the upper trendline, reflecting a shift in momentum towards the buyers.

Falling and Rising Wedge: Differences

There are two types of wedge formation – rising (ascending) and falling (descending).

An ascending wedge occurs when the highs and lows rise, while a descending wedge pattern has lower highs and lows. In an ascending formation, the slope of the lows is steeper and converges with the upper trendline at some point, while in a descending formation, the slope of the highs is steeper and converges with the support trendline at some point.

Usually, a rising wedge indicates that sellers are taking control, resulting in a downside breakdown. Conversely, a descending wedge pattern indicates that buyers are gaining momentum after consolidation, generally resulting in an upside breakout.

The Falling Wedge: Trading Rules

Trading the falling wedge involves waiting for the price to break above the upper line, typically considered a bullish reversal. The pattern’s conformity increases when it is combined with other technical indicators.

- Entry

According to theory, the ideal entry point is after the price has broken above the wedge’s upper boundary, indicating a potential upside reversal. Furthermore, this descending wedge breakout should be accompanied by an increase in trading volume to confirm the validity of the signal.

The price may retest the resistance level before continuing its upward movement, providing another opportunity to enter a long position. However, the entry point should be based on the traders' risk management plan and trading strategy.

- Take Profit

It is essential to determine an appropriate target level. Traders typically set a profit target by measuring the height of the widest part of the formation and adding it to the breakout point. Another approach some traders use is to look for significant resistance levels above the breakout point, such as previous swing highs.

- Stop Loss

Traders typically place their stop-loss orders just below the lower boundary of the wedge. Also, the stop-loss level can be based on technical or psychological support levels, such as previous swing lows. In addition, the stop-loss level should be set according to the trader's risk tolerance and overall trading strategy.

Trading Example

In the chart above, there is a falling wedge. A trader opened a buy position on the close of the breakout candlestick. A stop loss was placed below the wedge’s lower boundary, while the take-profit target was equal to the pattern’s widest part.

Falling Wedge and Other Patterns

Here are chart patterns that can be confused with a falling wedge.

Falling Wedge vs Bullish Flag

These are two distinct chart formations used to identify potential buying opportunities in the market, but there are some differences between the two.

A descending wedge is a bullish setup, forming in a downtrend. It is characterised by two converging trendlines that slope downward, signalling decreasing selling pressure. A breakout above the upper trendline suggests a bullish move.

A bullish flag appears after a strong upward movement and forms a rectangular shape with parallel trendlines that slope slightly downward or move sideways. This formation represents a brief consolidation before the market resumes its upward trajectory.

While the falling wedge indicates a potential shift in a downtrend, the bullish flag suggests a continuation of an uptrend.

Falling Wedge vs Bearish Pennant

The falling wedge features two converging trendlines that slope downward, indicating decreasing selling pressure and often signalling a bullish reversal when the price breaks above the upper trendline.

Conversely, the bearish pennant forms after a significant downward movement and is characterised by converging trendlines that create a small symmetrical triangle. This pattern represents a consolidation phase before the market continues its downward trend upon breaking below the lower trendline.

While the falling wedge suggests a potential bullish move, the bearish pennant indicates a continuation of the bearish trend.

Falling Wedge vs Descending Triangle

The falling wedge consists of two downward-sloping converging trendlines, indicating decreasing selling pressure and often signalling a bullish reversal when the price breaks above the upper trendline. In contrast, the descending triangle features a flat lower trendline and a downward-sloping upper trendline, suggesting a buildup of selling pressure and typically signalling a bearish continuation when the price breaks below the flat lower trendline.

While the falling wedge is associated with a potential bullish move, the descending triangle generally indicates a bearish trend.

Falling Wedge: Advantages and Limitations

Like any technical pattern, the falling wedge has both limitations and advantages.

Advantages

- High Probability of a Reversal. The falling wedge is often seen as a strong, bullish signal, especially when it occurs after a downtrend. It suggests that selling pressure is subsiding, and a reversal to the upside may be imminent.

- Clear Entry and Exit Points. The pattern provides clear points for entering and exiting trades. Traders often enter when the price breaks out above the upper trendline and set stop-loss orders below a recent low within the formation.

- Versatility. The wedge can be used in various market conditions. It is effective in both continuation and reversal scenarios, though it is more commonly associated with bullish reversals.

- Widely Recognised. Since the falling wedge is a well-known formation, it is often self-fulfilling to some extent, as many traders recognise and act on it, further driving the market.

Limitations

- False Breakouts. Like many chart patterns, the falling wedge is prone to false breakouts. Prices may briefly move above the resistance line but then fall back below, trapping traders.

- Dependence on Market Context. The effectiveness of the falling wedge can vary depending on broader market conditions. In a strong downtrend, it might fail to result in a significant reversal.

- Requires Confirmation. The wedge should be confirmed with other technical indicators or analysis tools, such as volumes or moving averages, to increase the likelihood of an effective trade. Relying solely on the falling wedge can be risky.

- Limited Use in Low-Volatility Markets. In markets with low volatility, the falling wedge may not be as reliable, as price movements might not be strong enough to confirm the falling wedge's breakout.

The Bottom Line

The falling wedge is a powerful chart pattern that can offer valuable insights into potential trend reversals or continuations, depending on its context within the broader market. By understanding and effectively utilising the falling wedge in your strategy, you can enhance your ability to identify many trading opportunities. As with all trading tools, combining it with a comprehensive trading plan and proper risk management is crucial.

FAQ

Is a Falling Wedge Bullish?

Yes, the falling wedge is a bullish continuation pattern in an uptrend, and it acts as a bullish reversal formation in a bearish market.

What Does a Falling Wedge Pattern Indicate?

It indicates that the buyers are absorbing the selling pressure, which is reflected in the narrower price range and finally results in an upside breakout.

What Is the Falling Wedge Pattern Rule?

The falling wedge is a technical analysis formation that occurs when the price forms lower highs and lower lows within converging trendlines, sloping downward. Its rule is that a breakout above the upper trendline signals a potential reversal to the upside, often indicating the end of a downtrend or the continuation of a strong uptrend.

How to Trade Descending Wedge Patterns?

To trade descending wedges, traders first identify them by ensuring that the price is making lower highs and lows within converging trendlines. Then, they wait for the price to break out above the upper trendline, ideally accompanied by increased trading volume, which confirms the breakout. After the breakout, a common approach is to enter a long position, aiming to take advantage of the anticipated upward movement.

What Is the Target of the Descending Wedge Pattern?

The target for a descending wedge is typically set by measuring the maximum width of the wedge at its widest part and projecting that distance upwards from the breakout point. This projection gives a potential price target.

What Is the Entry Point for a Falling Wedge?

The entry point for a falling wedge is ideally just after the breakout above the upper trendline. Some traders prefer to wait for a retest of the broken trendline, which may act as a new support level, before entering a trade to confirm the breakout.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

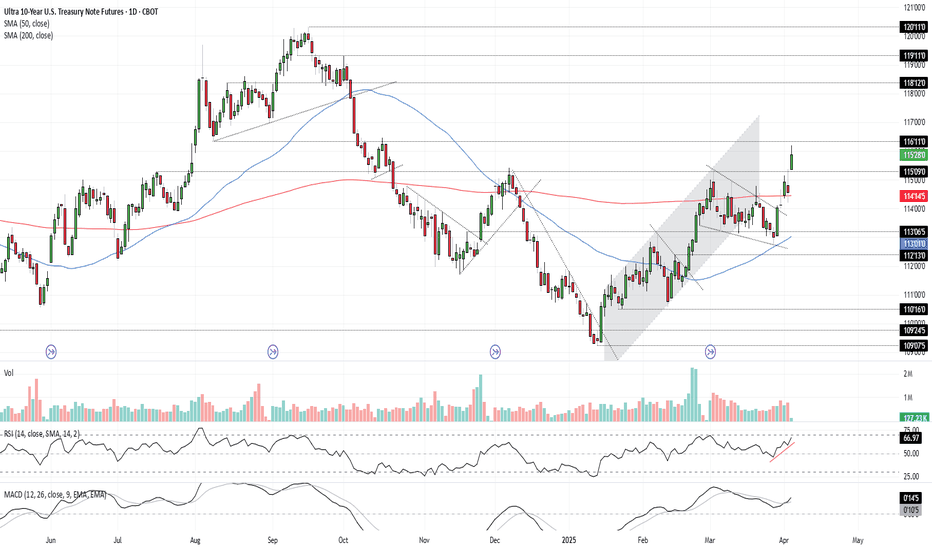

Bonds Don’t Lie: The Signal is ClearU.S. 10-year Treasuries are a crucial cog in the global financial machine, serving as a benchmark borrowing rate, a tool for asset valuation, and a gauge of the longer-term outlook for U.S. economic growth and inflation.

As such, I keep a close eye on 10-year note futures, as they can offer clues on directional risks for bond prices and yields. The price action over the past few days has sent a clear and obvious signal as to where the risks lie: prices higher, yields lower.

Futures had been grinding lower within a falling wedge for several weeks but broke higher last Friday on decent volumes following soft U.S. household spending data. It has since extended bullish the move, reclaiming the 200-day moving average before surging above key resistance at 115’09’0 after Trump’s reciprocal tariff announcement on Wednesday.

RSI (14) is trending higher but isn’t yet overbought, while MACD has crossed the signal line above 0, confirming the bullish momentum signal. That favours further upside, putting resistance at 116’11’0 and 118’12’0 on the immediate radar. For those who prefer it expressed in yield terms, that’s around 4% and 3.8% respectively.

Good luck!

DS

Best Chart Patterns to Buy Gold in Uptrend

One of the proven strategies to safely buy gold in uptrend is to look for THESE chart patterns.

In this article, I will teach 4 best bullish price action patterns for Gold trading.

All the patterns that we will discuss work perfectly on a daily, 4h, 1h time frames.

The first strong bullish pattern, that we will discuss, is a bullish flag pattern.

The pattern is based on 2 important elements:

a bullish impulse leg and a bearish correctional movement afterward.

The highs and lows of a correctional movement should respect 2 falling trend lines: one being a vertical resistance and one being a vertical support.

These 2 trend lines will compose a falling parallel channel.

Your strong bullish signal will be a breakout of the resistance of the flag - a candle close above that.

The trading strategy of this pattern is very straightforward .

After a violation of the resistance of the flag is confirmed , buy the market immediately or on a retest. Place stop loss order below the lowest low of the pattern, initial target - the high of the pattern with a potential bullish continuation to a new high.

Look at a bullish flag pattern on Gold on a 4H time frame. A bullish breakout of its upper boundary was a perfect signal to buy XAUUSD.

The variation of a bullish flag pattern is a falling wedge pattern.

In a wedge pattern, a correctional movement occurs within a contracting channel based on 2 converging trend lines.

The same strategy is applied for buying wedge pattern after a breakout .

Above, you can see a falling wedge on Gold chart on a daily that was formed after a completion of a sharp bullish wave. Bullish violation of the resistance line of the pattern was a strong call to open long position.

Trading hundreds of bullish flags and falling wedges, I noticed that the wedge patter has a little bit higher accuracy.

The next chart pattern for buying Gold is called Ascending Triangle.

After completing a bullish impulse and setting a higher high, the market should start consolidating .

A consolidation should have a specific shape: the price should start respecting a horizontal resistance based on the last high and drop from that, setting equal high and a consequent higher low after every bearish movement.

A reliable bullish signal will be a breakout - a candle close above a horizontal resistance line based on the equal highs.

Buy Gold immediately after a violation, or set a buy limit order on a retest of a broken resistance.

Safe stop loss will be at least below the last higher low.

If you are taking the trade on 1H time frame, set it below the first higher low.

Take profit will be the next potentially strong resistance.

With the absence of historic resistances, your goal can be the next psychological level based on round numbers.

That's a perfect example of the ascending triangle pattern that formed on Gold on a daily time frame. After a breakout of its resistance, a bullish rally initiated.

Usually, the pattern is considered to be completed when the price sets at least 3 higher lows and 3 highers highs.

If only 2 equals highs and 2 higher lows are set, such a pattern will be called Cup & Handle.

Entry, stop loss and target rules are the same as in ascending triangle trading.

That's a nice cup & handle pattern on Gold on a 4H. Violation of its resistance triggered a significant trend-following movement.

The last pattern for buying Gold is horizontal parallel channel.

It should form after a completion of a bullish wave and represent a consolidation and indecision.

The price should set equal highs and consequent equal lows, respecting horizontal support and resistance.

A strong bullish signal to buy Gold will be a breakout of a horizontal resistance of the channel and a candle close above.

The principles of its trading strategy are very similar.

Open long position on Gold immediately after a candle close above the resistance or on its retest.

Stop loss should be placed below the support of the channel.

Take profit will be the next historic or (if there is no) psychological level.

Check this horizontal channel that was spotted on a daily time frame on Gold chart. After quite an extended consolidation within, the price violated its upper boundary and went up.

All these chart patterns have a unique shape and structure and are very easy to recognize. Apply them for trend-trading Gold on any time frame and good luck in your journey.

❤️Please, support my work with like, thank you!❤️

Falling Wedge Pattern: Cocoa FuturesThis is the map of how to trade this rare chart pattern.

This is a textbook sample of Falling Wedge continuation pattern that played out with impressive accuracy.

We have a strong uptrend in 2024 that has been changed

by a large consolidation that took place for the rest of 2024

as it has built the large Falling Wedge (continuation) pattern.

One should focus on the following crucial points and measurements:

1. breakout point where price rises above trendline resistance

it acts as a buy entry trigger (green segment)

2. stop loss - it is located below the lowest valley preceding breakout (red segment)

3. widest part of the pattern - use it to measure the distance to the target adding it to breakout point (blue arc)

4. target (yellow dashed segment)

all of above key parameters are highlighted on the chart.

It's amazing how accurately the price grew towards the target booking over 60% profit.

Next time you can use this map as a guidance.

Uptrend & Downtrend Bullish Falling Wedge Pattern TutorialA bullish falling wedge is a charting pattern that signals a potential reversal from a downtrend to an uptrend. Here's a breakdown of its key characteristics:

Shape: The pattern forms a wedge that slopes downward, with the upper trendline connecting the highs and the lower trendline connecting the lows. The key is that the highs and lows get closer together as the pattern develops.

Trend: It typically forms during a downtrend, indicating that selling pressure is decreasing.

Breakout: The pattern is bullish when the price breaks above the upper trendline. This breakout suggests that the downward trend is losing momentum, and an upward trend may follow.

Volume: During the falling wedge formation, volume tends to decrease, which supports the idea that selling pressure is diminishing.

Retest: After the breakout, it's common for the price to retest the upper trendline, and if it holds, it provides further confirmation of the bullish reversal.

Example

Imagine a stock that has been falling for several months. The price forms lower highs and lower lows, creating a narrowing wedge. Suddenly, the price breaks above the upper trendline with increased volume, signaling a potential reversal and the start of an upward trend.

Learn Best Price Action Patterns For Trend-Following Trading

In this educational articles, I will teach you the best price action patterns for Trend-Following Trading Forex.

📍Ascending & Descending Triangles

The ascending triangle will be considered to be a trend-following pattern if the impulse leg preceding the formation of the pattern is bullish.

The pattern consist of 2 main elements:

a horizontal neckline based on the equal highs,

a rising trend line based on the higher lows.

❗️The trigger is a bullish breakout of a neckline of the pattern and candle close above.

📈The position is opened on a retest.

🔴Stop loss is lying at least below the level of the last higher low.

🎯Take profit is the next historical resistance.

Look at an ascending triangle formation on EURUSD on an hourly time frame.

On the left, you can see the structure of the pattern and on the right, the trading plan.

📍The descending triangle will be considered to be a trend-following pattern if the impulse leg preceding the formation of the pattern is bearish.

The pattern consist of 2 main elements:

a horizontal neckline based on the equal lows,

a falling trend line based on the lower highs.

❗️The trigger is a bearish breakout of a neckline of the pattern and candle close below.

📉The position is opened on a retest.

🔴Stop loss is lying at least above the level of the last lower high.

🎯Take profit is the next historical support.

Above is a perfect descending triangle pattern that I spotted on GBPUSD on a 4H time frame.

📍Bullish & Bearish Wedges

The bullish wedge pattern will be considered to be a trend-following pattern if the impulse leg preceding the formation of the pattern is bullish and the pattern is directed to the downside.

The pattern consist of 2 contracting falling trend lines based on the lower lows and lower highs.

❗️The trigger is a bullish breakout of a resistance of the pattern and candle close above.

📈The position is opened on a retest.

🔴Stop loss is lying below the low of the pattern.

🎯Take profit is the high of the pattern.

Above is a falling wedge pattern that I found on GBPUSD.

The pattern is formed after a strong bullish impulse.

A trigger to buy is a bullish breakout of its resistance.

——————

The bearish wedge pattern will be considered to be a trend-following pattern if the impulse leg preceding the formation of the pattern is bearish and the pattern is directed to the upside.

The pattern consist of 2 contracting rising trend lines based on the higher highs and higher lows.

❗️The trigger is a bearish breakout of a support of the pattern and candle close below.

📉The position is opened on a retest.

🔴Stop loss is lying above the high of the pattern.

🎯Take profit is the low of the pattern.

To correctly sell this rising wedge pattern on EURUSD, we should wait for a breakout of its horizontal support and then sell the market on its retest.

📍Bullish & Bearish Flags

The bullish flag pattern will be considered to be a trend-following pattern if the impulse leg preceding the formation of the pattern is bullish and the pattern is directed to the downside.

The pattern consist of 2 parallel falling trend lines based on the lower lows and lower highs.

❗️The trigger is a bullish breakout of a resistance of the pattern and candle close above.

📈The position is opened on a retest.

🔴Stop loss is lying below the low of the pattern.

🎯Take profit is the high of the pattern.

Above, you can see a perfect example of a bullish flag pattern on EURUSD on a 4H time frame and its trading strategy.

——————

The bearish flag pattern will be considered to be a trend-following pattern if the impulse leg preceding the formation of the pattern is bearish and the pattern is directed to the upside.

The pattern consist of 2 parallel rising trend lines based on the higher highs and higher lows.

❗️The trigger is a bearish breakout of a support of the pattern and candle close below.

📉The position is opened on a retest.

🔴Stop loss is lying above the high of the pattern.

🎯Take profit is the low of the pattern.

Above is a bearish flag pattern on GBPUSD and a full plan to sell the market based on it.

📍Bullish & Bearish Symmetrical Triangles

The bullish symmetrical triangle will be considered to be a trend-following pattern if the impulse leg preceding the formation of the pattern is bullish.

The pattern consist of 2 contracting symmetrical trend lines based on the higher lows and lower highs.

❗️The trigger is a bullish breakout of a resistance of the pattern and candle close above.

📈The position is opened on a retest.

🔴Stop loss is lying at least below the last higher low of the pattern.

🎯Take profit is the high of the pattern.

This bullish symmetrical triangle on EURUSD on an hourly time frame is a perfect example of a bullish trend-following pattern.

——————

The bearish symmetrical triangle will be considered to be a trend-following pattern if the impulse leg preceding the formation of the pattern is bearish.

The pattern consist of 2 contracting symmetrical trend lines based on the higher lows and lower highs.

❗️The trigger is a bearish breakout of a support of the pattern and candle close below.

📉The position is opened on a retest.

🔴Stop loss is lying at least above the last lower high of the pattern.

🎯Take profit is the low of the pattern.

On the left chart, you can see a structure of a valid symmetrical triangle.

On the right chart, you can see how to trade it properly.

The main difficulty related to trading these patterns is their recognition. You should train your eyes to recognize them on a price chart.

Once you learn to do that, I guarantee you that you will make tons of money trading them.

Real Success Rates of the "Rising Wedge" in TradingReal Success Rates of the "Rising Wedge" in Trading

Introduction

The rising wedge, also known as the "rising wedge" in English, is a chart pattern that has a remarkable success rate in trading. This analysis details its performance, reliability and complementary indicators to optimize its use.

Success Rate and Performance

-Key Statistics

Overall success rate: 81% in bull markets

Average potential profit: 38% in an existing uptrend

-Breakout Direction

Bearish: 60% of cases

Bullish: 40% of cases

Contextual Reliability

Bull market: 81% success, average gain of 38%

After a downtrend: 51% success, average decline of 9%

Important Considerations

The rising wedge is generally a bearish pattern, indicating a potential reversal.

Reliability increases with the duration of the pattern formation.

Confirmation of the breakout by other indicators, especially volume, is crucial.

Complementary Indicators

-Volume

Gradual decrease during formation

Significant increase during breakout

-Oscillators

RSI (Relative Strength Index): Identifies overbought/oversold conditions

Stochastics: Detects price/indicator divergences

-Moving Averages

Crossovers: Signal trend changes

-Dynamic Support/Resistance: Confirm the validity of the wedge

-Momentum Indicators

MACD: Identifies price/indicator divergences

Momentum: Assesses the exhaustion of the trend

-Other Elements

Fibonacci Levels: Identify potential support/resistance

Japanese Candlestick Analysis: Provides indications of reversals

Conclusion

The rising wedge is a powerful tool for traders, offering a high success rate and significant profit potential. The combined use of complementary indicators increases the reliability of the signal and improves the accuracy of trading decisions. It is essential to look for a convergence of signals from multiple sources to minimize false signals and optimize trading performance.

_______________________________________________

Here are the best times to enter a trade after a rising wedge, in a professional manner:

-The confirmed breakout

Wait for the candle to close below the support line of the wedge.

Look for a significant increase in volume during the breakout to confirm its validity.

-The retest

Look for a pullback on the broken support line, which has become resistance.

Enter when the price rebounds downward on this new resistance, confirming the downtrend.

-The post-breakout consolidation

Identify the formation of a flag or pennant after the initial breakout.

Enter when this mini-formation breaks in the direction of the main downtrend.

-The confirmed divergences

Spot bearish divergences on oscillators such as the RSI or the MACD.

Enter when price confirms divergence by breaking a nearby support.

-Timing with Japanese Candlesticks

Identify bearish formations such as the Evening Star, Bearish Harami, or Dark Cloud.

Enter as soon as the next candle confirms the bearish pattern.

-Important Considerations

Always place a stop-loss to manage risk effectively.

Be patient and wait for the setup to be confirmed before entering the trade

Check the trend on higher timeframes to ensure the consistency of the trade.

Integrate the analysis of the rising wedge with other technical indicators to improve the quality of decisions.

By following these recommendations, traders can optimize their entries on rising wedges while minimizing the risk of false signals.

A textbook reversal signal..And if you do not know what I mean then see the linked idea below ‘the study’. Now the market cap is way to small for my interest but it might appeal to someone or indeed someone who is interested in the long game.

The reversal pattern is one we see play out time and time again in all markets. Most recently on a crypto called CFX (see example below). The psychology between buyers and sellers is very specific and is told in great detail on this particular pattern. The last 6-day candle to print on this chart informed you of the great weakness amongst sellers. This crucial.. for the moment demand returns there practically no resistance until new buyers sell into the market.

Is it possible price action falls further? Sure.

It is probable? No

Ww

Type: trade

Risk: 1%

Timeframe: now

Return: At least 500%

The study

Example

Trading Diverging Chart PatternsContinuing our discussion on trading chart patterns, this is our next tutorial after Trading Converging Chart Patterns

This tutorial is based on our earlier articles on pattern identification and classification.

Algorithmic Identification of Chart Patterns

Flag and Pennant Chart Patterns

In this tutorial, we concentrate on diverging patterns and how to define rules to trade them systematically. The diverging patterns discussed in this tutorial are:

Rising Wedge (Diverging Type)

Falling Wedge (Diverging Type)

Diverging Triangle

Rising Triangle (Diverging Type)

Falling Triangle (Diverging Type)

🎲 Historical Bias and General Perception

Before we look into our method of systematic trading of patterns, let's have a glance at the general bias of trading diverging patterns.

🟡 The Dynamics of Diverging Wedge Patterns

Diverging Wedge patterns are typically indicative of the Elliott Wave Structure's diagonal waves, potentially marking the ending diagonal waves. That means that the patterns may signal the ending of a long term trend.

Hence, the diverging rising wedge is considered as bearish, whereas the diverging falling wedge is considered as bullish when it falls under Wave 5 of an impulse or Wave C of a zigzag or flat.

For an in-depth exploration, refer to our detailed analysis in Decoding Wedge Patterns

Both rising wedge and falling wedge of expanding type offers lower risk reward (High risk and low reward) in short term as the expanding nature of the pattern will lead to wider stop loss.

🎯 Rising Wedge (Expanding Type)

Expanding Rising Wedge pattern is historically viewed with bearish bias.

🎯 Falling Wedge (Expanding Type)

Expanding Falling Wedge pattern is historically viewed with bullish bias.

🟡 The Dynamics of Diverging Triangle Patterns

Diverging pattern in general means increased volatility. Increased volatility during the strong trends also mean reducing confidence that may signal reversal.

🎲 Alternate Approach towards trading diverging patterns

Lack of back testing data combined with subjectivity in Elliott wave interpretation and pattern interpretation makes it difficult to rely on the traditional approach. The alternative method involves treating all expanding patterns equally and define a systematic trading approach. This involves.

When the pattern is formed, define a breakout zone. One side of the breakout zone will act as breakout point and the other side will act as reversal point.

Depending on the breakout or reversal, trade direction is identified. Define the rules for entry, stop, target and invalidation range for both directions. This can be based on specific fib ratio based on pattern size.

Backtest and Forward test the strategy and collect data with respect to win ratio, risk reward and profit factor to understand the profitability of patterns and the methodology.

Breaking it down further.

🟡 Defining The Pattern Trade Conditions

Base can be calculated in the following ways.

Distance between max and min points of the pattern. (Vertical size of the pattern)

Last zigzag swing of the pattern (This is generally the largest zigzag swing of the pattern due to its expanding nature)

This Base is used for calculation of other criteria.

🎯 Breakout Zone - Entry Points

Breakout zone can be calculated based on the following.

Long Entry (top) = Last Pivot + Base * (Entry Ratio)

Short Entry (bottom) = Last Pivot - Base * (Entry Ratio)

If the direction of the last zigzag swing is downwards, then top will form the reversal confirmation and bottom will form the breakout confirmation. Similarly, if the direction of the last zigzag swing is upwards, then top will become the breakout confirmation point and bottom will act as reversal confirmation point.

🎯 Stops

Long entry can act as stop for short and vice versa. However, we can also apply different rule for calculation of stop - this includes using different fib ratio for stop calculation in the reverse direction.

Example.

Long Stop = Last Pivot - Base * (Stop Ratio)

Short Stop = Last Pivot + Base * (Entry Ratio)

🎯 Invalidation

Invalidation price is a level where the trade direction for a particular pattern needs to be ignored or invalidated. Invalidation price can be calculated based on specific fib ratios. It is recommended to use wider invalidation range. This is to protect ignoring the potential trades due to volatility.

Long Invalidation Price = Last Pivot - Base * (Invalidation Ratio)

Short Invalidation Price = Last Pivot + Base * (Invalidation Ratio)

🎯 Targets

Targets can either be set based on fib ratios, as explained for other parameters. However, the better way to set targets is based on expected risk reward.

Target Price = Entry + (Entry-Stop) X Risk Reward

🟡 Back Test and Forward Test and Measure the Profit Factor

It is important to perform sufficient testing to understand the profitability of the strategy before using them on the live trades. Use multiple timeframes and symbols to perform a series of back tests and forward tests, and collect as much data as possible on the historical outcomes of the strategy.

Profit Factor of the strategy can be calculated by using a simple formula

Profit Factor = (Wins/Losses) X Risk Reward

🟡 Use Filters and Different Combinations

Filters will help us in filtering out noise and trade only the selective patterns. The filters can include a simple logic such as trade long only if price is above 200 SMA and trade short only if price is below 200 SMA. Or it can be as complex as looking into the divergence signals or other complex variables.

Falling wedge aka continued patternThe formation of any triangle is a direction indication relevant to where you find it as some can be a warning if reversal.

The market moves in grids(zones). Relevant to sentiment of traders and news. It always moves in wave 🌊 and in those waves we have patterns like ABCD resumption. Failure swings💰👃, 🐂 bullish breakouts, traps ECT.

The thing is impulsive moves is where you want to be even though it may be a correction. The thing with that is only with rising wedge patterns that are confirmed by long wicked 🔨 that indicate a move to the downside and this is like I said the day being under pressure from all the wicks formed by sellers and buyers showing no strength or news keeping it suppressed. This is your classic break and retest strategy. Like I said the money is in the trend and the impulses is always where you want to be mostly breakouts from levels continuing with the direction of the day - down to MN if you that good.

The SL of the pattern invalidates the idea and if any near term trails can be hit we get even better low entries. Remember your idea is only invalid when it doesn't hold weekly and MN TF key levels. This can also be seen by the RSI as it shows the strength of candlesticks relevant to highs and lows of the sessions.

Risk management is key especially if you have an account from 2$-100$. We only increase size when the accounts over 250-500$ which will give you a chance at playing 0.05 not saying it isn't possible at 70$ but you risk blowing it faster than a single 0.01 that just loses 1-5$ depending how the setup looks. If you feel like it won't work the SL should be 100 pips of not 10-50 pips which is 0.30cents to 0.72c$

Entry will be a breakout. And anything playing and rejected in that area can be waited for a signal to go long. Obviously if you don't have money to blow on risk like a 0.01 and lose 20$ in one go than don't. You risk smaller that's why we wait for lows or zone to enter example 0.01 and a lose of 2-4$. You can always trade gold with a small amount and turn it to a lot thing is it will kick you out if you dont take profits or secure them in positive SL of 1_5$

The TP is usually the inside of the pattern or the impulse before. Remember wave move in 5-1-2-3-4 and five.

2-correction can't be a triangle so it's usually rectangle

4- correction Triangle 📐 and it moves up

3-the largest impulse bigger than wave1-&5, but never small than 1

1impulse can be an extension (1-2-3-4-5 wave in wave one ),

5 can be the same as ones length

Now the thing about waves is the counting that gets difficult especially if the complex corrections. Therefore for m30, you play the day and if it doesn't hit one target or the second you positive SL and wait for better entries.

Gold can make you bank if you play it right, I mean risk manage your account to small losses and close large ones you can always enter again another place a ladder positions.

Please like if this education is helpful 🙏

SPG - Trade analysis & Multi-time frame confluenceThis video is more of a tutorial on why I took a short trade on SPG today. We fell out of our strong buying continuation channels with a rejection of HTF tapered channels and selling channels. Confirmation was the support from our more tapered buying algo and rejected of the bottom of our stronger buying algo (in addition to it lining up with our strong magenta selling channel)

Happy Trading :)

Trading Converging Chart PatternsWe discussed identification and classification of different chart patterns and chart pattern extensions in our previous posts.

Algorithmic Identification of Chart Patterns

Flag and Pennant Chart Patterns

In this installment, we shift our focus towards the practical trading strategies applicable to a select group of these patterns. Acknowledging that a universal trading rule cannot apply to all patterns, we narrow our examination to those of the converging variety.

We will specifically address the following converging patterns:

Rising Wedge (Converging Type)

Falling Wedge (Converging Type)

Converging Triangle

Rising Triangle (Converging Type)

Falling Triangle (Converging Type)

This selection will guide our discussion on how to approach these patterns from a trading perspective.

🎲 Historical Bias and General Perception

Each pattern we've discussed carries a historical sentiment that is widely regarded as a guideline for trading. Before we delve into our specific trading strategies, it's crucial to understand these historical sentiments and the general market interpretations associated with them.

🟡 The Dynamics of Contracting Wedge Patterns

Contracting Wedge patterns are typically indicative of the Elliott Wave Structure's diagonal waves, potentially marking either the beginning or conclusion of these waves. A contracting wedge within a leading diagonal may experience a brief retracement before the trend resumes. Conversely, if found in an ending diagonal, it could signal the termination of wave 5 or C, possibly hinting at a significant trend reversal.

The prevailing view suggests that these patterns usually precede a short-term directional shift: Rising Wedges are seen as bearish signals, while Falling Wedges are interpreted as bullish. It's essential to consider the trend prior to the formation of these patterns, as it significantly aids in determining their context within the Elliott Wave cycles, specifically identifying them as part of waves 1, A, 5, or C.

For an in-depth exploration, refer to our detailed analysis in Decoding Wedge Patterns

🎯 Rising Wedge (Converging Type)

The Rising Wedge pattern, historically viewed with a bearish bias, suggests that a downward trend is more likely upon a breakout below its lower trend line. This perception positions the pattern as a signal for traders to consider bearish positions once the price breaks through this critical support.

🎯 Falling Wedge (Converging Type)

The Falling Wedge pattern is traditionally seen through a bullish lens, indicating potential upward momentum when the price surpasses its upper trend line. This established viewpoint suggests initiating long positions as a strategic response to such a breakout, aligning with the pattern's optimistic forecast.

🟡 Contracting Triangle Patterns

Contracting Triangles, encompassing Converging, Ascending, and Descending Triangles, are particularly noteworthy when they appear as part of the Elliott Wave's B or 2 waves. These patterns typically signal a continuation of the pre-existing trend that preceded the triangle's formation. This principle also underpins the Pennant Pattern, which emerges following an impulse wave, indicating a pause before the trend's resumption.

🎲 Alternate Way of Looking into Converging Patterns

Main issue with historical perception are:

There is no clear back testing data to prove whether the general perception is correct or more profitable.

Elliott Waves concepts are very much subjective and can be often difficult for beginners and misleading even for experts.

So, the alternative way is to treat all the converging patterns equally and devise a method to trade using a universal way. This allows us to back test our thesis and be definitive about the profitability of these patterns.

Here are our simple steps to devise and test a converging pattern based strategy.

Consider all converging patterns as bidirectional. Meaning, they can be traded on either side. Thus chose to trade based on the breakout. If the price beaks up, then trade long and if the price breaks down, then trade short.

For each direction, define criteria for entry, stop, target prices and also an invalidation price at which the trade is ignored even without entry.

Backtest and Forward test the strategy and collect data with respect to win ratio, risk reward and profit factor to understand the profitability of patterns and the methodology.

Now, let's break it further down.

🟡 Defining The Pattern Trade Conditions

Measure the ending distance between the trend line pairs and set breakout points above and beyond the convergence zone.

🎯 Entry Points - These can be formed on either side of the convergence zone. Adding a small buffer on top of the convergence zone is ideal for setting the entry points of converging patterns.

Formula for Entry can be:

Long Entry Price = Top + (Top - Bottom) X Entry Ratio

Short Entry Price = Bottom - (Top-Bottom) X Entry Ratio

Whereas Top refers to the upper side of the convergence zone and bottom refers to the lower side of the convergence zone. Entry Ratio is the buffer ratio to apply on top of the convergence zone to get entry points.

🎯 Stop Price - Long entry can act as stop for short orders and the short entry can act as stop price for long orders. However, this is not mandatory and different logic for stops can be applied for both sides.

Formula for Stop Can be

Long Stop Price = Bottom - (Top - Bottom) X Stop Ratio

Short Stop Price = Top + (Top - Bottom) X Stop Ratio

🎯 Target Price - It is always good to set targets based on desired risk reward ratio. That means, the target should always depend on the distance between entry and stop price.

The general formula for Target can be:

Target Price = Entry + (Entry-Stop) X Risk Reward

🎯 Invalidation Price - Invalidation price is a level where the trade direction for a particular pattern needs to be ignored or invalidated. This price need to be beyond stop price. In general, trade is closed when a pattern hits invalidation price.

Formula for Invalidation price is the same as that of Stop Price, but Invalidation Ratio is more than that of Stop Ratio

Long Invalidation Price = Bottom - (Top - Bottom) X Invalidation Ratio

Short Invalidation Price = Top + (Top - Bottom) X Invalidation Ratio

🟡 Back Test and Forward Test and Measure the Profit Factor

It is important to perform sufficient testing to understand the profitability of the strategy before using them on the live trades. Use multiple timeframes and symbols to perform a series of back tests and forward tests, and collect as much data as possible on the historical outcomes of the strategy.

Profit Factor of the strategy can be calculated by using a simple formula

Profit Factor = (Wins/Losses) X Risk Reward

🟡 Use Filters and Different Combinations

Filters will help us in filtering out noise and trade only the selective patterns. The filters can include a simple logic such as trade long only if price is above 200 SMA and trade short only if price is below 200 SMA. Or it can be as complex as looking into the divergence signals or other complex variables.

Turning Traps into Profitable Opportunities ! TOP 3 PATTERNSTrading traps are a common occurrence in the cryptocurrency market. They can be created by a variety of factors, including market manipulation, technical analysis, and psychological biases. While traps can be dangerous for traders who are not prepared, they can also be a source of profit for those who know how to trade them effectively.

In this article, we will discuss three common trading traps and how to trade them profitably. We will also discuss how traps are created and how they can be used to your advantage.

What Are Trading Traps?

Trading traps are false movements in the price of a cryptocurrency that are designed to trick traders into taking a position in the wrong direction. They can be created by a variety of factors, including:

Market manipulation: Market manipulators may create traps to trick traders into taking positions that are in their favor. For example, they may buy a large amount of a cryptocurrency to drive up the price, and then sell it off quickly to create a sell-off.

Technical analysis: Technical analysts may use traps to take advantage of traders who are following technical indicators. For example, they may create a false breakout of a support or resistance level to trigger stop-loss orders.

Psychological biases: Psychological biases, such as fear of missing out (FOMO) and fear of loss (FUD), can also lead traders to fall into traps. For example, a trader who is afraid of missing out on a potential bull run may be more likely to buy into a false breakout.

In the example above, LINK was trading in a horizontal range for several months. The price then broke below the lower range boundary, which was a sign of a potential bear trap. However, the price quickly reversed and re-tested the lower range boundary. This was a good opportunity to enter a long position, as it showed that the trend was still in place.

How to Identify Trading Traps

There are a few things you can look for to help you identify trading traps, including:

Volume: A sudden increase in volume can be a sign that a trap is being set. This is because market manipulators or technical analysts will often need to buy or sell a large amount of cryptocurrency to create a false movement in the price.

Price action: A false breakout or fakeout is often accompanied by a sharp reversal in price action. For example, a false breakout of a support level may be followed by a sharp sell-off.

Technical indicators: Some technical indicators, such as the Bollinger Bands, can help you identify potential traps. For example, the Bollinger Bands may widen before a false breakout, which can be a sign that a trap is being set.

How to Trade Trading Traps

Once you have identified a trap, you can trade it in one of two ways:

Long trap: If you believe that the trend will continue, you can enter a long position on the re-test of the breakout level.

Short trap: If you believe that the trend will reverse, you can enter a short position on

the break of the breakout level.

Examples of Trading Traps

3.1 Triangular Trap Unveiled:

Discuss the bearish implications of descending triangles in technical analysis and their potential use as manipulation tools.

Explore how market manipulators engineer these patterns to trigger artificial stop-losses.

Case Study: NEAR's Triangular Intricacies:

Analyze NEAR's descent within a descending triangle and its unexpected breakout.

Offer insights into the motives behind orchestrating such traps and how traders can leverage these market dynamics.

Here are some examples of how trading traps can be created and traded:

Shakeout trap

A shakeout trap is a false breakout that is designed to trick traders into taking a position in the wrong direction. For example, a cryptocurrency may be trading in a horizontal range for several months. The price then breaks below the lower range boundary, which is a sign of a potential bear trap. However, the price quickly reverses and re-tests the lower range boundary. This is a good opportunity to enter a long position, as it shows that the trend is still in place.

Fakeout trap

A fakeout trap is similar to a shakeout trap, but it occurs after a trend has already begun. For example, a cryptocurrency may be in a bull market. The price then breaks above a resistance level, which is a sign that the bull market is continuing. However, the price quickly reverses and re-tests the resistance level. This is a good opportunity to enter a short position, as it shows that the bull market may be coming to an end.

Reversal trap

A reversal trap is when the trend of a market changes direction. For example, a cryptocurrency may be in a bull market. The price then breaks below a support level, which is a sign that the bull market is ending. However, the price quickly reverses and re-tests the support level. This is a good opportunity to enter a long position, as it shows that the bull market may be resuming.

The Art of Spotting Fakeouts:

Define the concept of fakeouts and unveil their potential as precursors to bullish movements.

Offer insights into distinguishing genuine breakouts from manipulative traps set by

market actors.

Case Study: ZIL's Quick Turnaround:

Uncover the Zilliqa (ZIL) chart, examining the deceptive fakeout beneath a pivotal horizontal level.

Emphasize the strategic importance of waiting for a retest post-fakeout as a confirmation signal.

Conclusion

Trading traps can be a dangerous but profitable part of cryptocurrency trading. By understanding how traps are created and how to identify them, you can increase your chances of trading them successfully.

Additional Tips for Trading Trading Traps

Use stop losses: Stop losses can help you limit your losses if you are wrong about a trade.

Be patient: Do not rush into a trade just because you see a trap. Wait for the

Learn Best Price Action Patterns by Accuracy

Last year, I shared more than 1300 free signals and forecasts for Gold, Forex, Commodities and Indexes.

In my predictions, quite often I relied on classic price action patterns.

In this article, I will reveal the win rate of each pattern, the most accurate and the least accurate formations of the last year.

Please, note that all the predictions and forecasts that I shared this year are available on TradingView and you can back test any of the setup that I identified this year by your own. Just choose a relevant tag on my TradingView page.

Also, some forecasts & signals were based on a combination of multiple patterns.

Here is the list of the patterns that I personally trade:

🔘 Double Top or Bottom with Equal Highs

The pattern is considered to be valid when the highs or lows of the pattern are equal.

The pattern gives a bearish/bullish signal when its neckline is broken.

🔘 Double Top or Bottom with Lower High/Higher Low or Cup & Handle

The pattern is considered to be valid when the second top/bottom of the patterns is lower/higher than the first one.

The pattern gives a bearish/bullish signal when its neckline is broken.

🔘 Head & Shoulders and Inverted Head and Shoulders

The pattern gives a bearish/bullish signal when its neckline is broken.

🔘 Horizontal Range

The pattern is the extension of a classic double top/bottom with at least 3 equal highs/lows.

The pattern gives a bearish/bullish signal when its neckline is broken.

🔘 Bullish/Bearish Flag

The pattern represents a rising/falling parallel channel.

It gives a bullish/bearish signal when its upper/lower boundary is broken.

🔘 Rising/Falling Wedge Pattern

The pattern represents a contracting rising/falling channel.

It gives a bullish/bearish signal when its upper/lower boundary is broken.

🔘 Rising/Falling Expanding Wedge

The pattern represents an expanding rising/falling channel.

It gives a bullish/bearish signal when its upper/lower boundary is broken.

🔘 Descending/Ascending Triangle

The pattern is the extension of a cup & handle pattern with at least 2 lower highs/lows.

The pattern gives a bearish/bullish signal when its neckline is broken.

Please, also note that all the patterns that I identified and traded were formed on key horizontal or vertical structures.

Remember that the accuracy of any pattern drops dramatically if it is formed beyond key levels.

I consider the pattern to be a winning one if after a neckline breakout, it managed to reach the closest horizontal or vertical structure, not invalidating the pattern's highs/lows.

For example, if the price violated the high of the cup and handle pattern after its neckline breakout, such a pattern is losing one.

If it reached the closest structure without violation of the high, it is a winning pattern.

🔍 Double Top or Bottom with Equal Highs

I spotted 85 setups featuring these patterns.

Their accuracy is 62%.

🥉 Double Top or Bottom with Lower High/Higher Low or Cup & Handle

96 setups were spotted.

The performance turned out to be a little bit higher than a classic double top/bottom with 65% of the setups hitting the target.

🔍 Head & Shoulders and Inverted Head and Shoulders

58 formations spotted this year.

Average win rate is 64%

🏆 Horizontal Range

The most accurate pattern of this year.

More than 148 patterns were spotted and 74% among them gave accurate signal.

🔍 Bullish/Bearish Flag

38 setups identified this year.

The accuracy of the pattern is 57%

Rising/Falling Wedge

The pattern turned out to be a little bit more accurate.

Among 62 formations, 59% end up being profitable.

👎 Rising/Falling Expanding Wedge

The worst pattern of this year.

I recognized 24 patterns and their accuracy was just 51%.

🥈 Descending/Ascending Triangle

64 patterns were identified.

The win rate of the pattern is 66%.

The most important conclusion that we can make analyzing the performance of these patterns is that they all have an accuracy above 50%. If you properly combine these patterns with some other technical or fundamental tools, the accuracy of the setup will increase dramatically.

Good luck in your trading!

❤️Please, support my work with like, thank you!❤️

Algorithmic Identification and Classification of Chart PatternsWelcome to the world of technical analysis, where chart patterns play a pivotal role in shaping trading strategies. This is an ultimate guide designed to help users objectively identify the existence of patterns, define the characteristics and classify them. In this discussion, we will mainly concentrate on the patterns formed by trend line pairs. This includes wedges, triangles and channel type patterns.

🎲 Basic Principle of Identifying the Pattern

It is very important to apply definitely set of rules when identifying the patterns in order to avoid biases or fitting patterns to our opinions. The dangers of overfitting the patterns to our bias is documented in the idea

To identify the patterns objectively, we need to set some ground rules or follow a well-defined technique to derive the patterns. Here is the technique we follow to identify chart patterns.

🎲 Only Indicator Required - Zigzag

Tradingview has plenty of free community scripts for Zigzag indicator. For this demonstration, we are going to use our Multi Timeframe Recursive Zigzag implementation.

Once the indicator is loaded on the chart, go to indicator settings and perform these modifications.

Disable the Labels : The Labels contain information that is needed for this exercise.

Set the Highlight level to 1 or 0 : We can iteratively increase the level and check next levels on the go.

You can also adjust Zigzag Length and Depth Parameters.

🎲 Scanning and Identification of valid Pattern

We can either use 5 pivots or 6 pivots for pattern identification. 5-Pivot based scanning will generate more patterns than 6-Pivot based scanning. 6 pivot patterns are geometrically more accurate however, there is no proof that 6-Pivot based patterns produce better trading outcome.

🎯 Step 1 - On each level of zigzag, mark the last 5 or 6 zigzag pivots.

Since we are using Multi Timeframe Recursive Zigzag implementation, we can gradually increase the zigzag level from 0. This means that on every level, we can check if there are any patterns.

On each level - consider only the last 5 or 6 pivots and mark them on the chart.

Markings on Level 0 would look like this for 5 and 6 pivot scanning

🎯 Step 2: Draw Trend Lines

As part of this step, draw two trend lines.

The first trend line will join pivots 1 and 5 marked in the previous step.

The second trend line will join pivots 2 and 4 marked in the previous step for 5 pivot scanning. For 6 pivot scanning, the trend line joining pivots 2 and 6 will be marked.

🎯 Step 3: Inspect the validity of trend lines

A valid trend line is the one that confirm to below two points

Touches all the alternate pivots. For example, the trend line drawn from pivot 1 to 5 should also make contact with the candle of pivot 3. In case of 6 pivot scanning, the trend drawn from pivot 2 to 6 should also make contact with the candle of pivot 4.

All the candles from the starting pivot to ending pivot of the zigzag should be confined within the trend line pairs. Meaning, no candles should completely go above the upper trend line and no candle should completely go below the lower trend line.

Please note that while verifying the above points, minor adjustments in the alignment of the trend line can be made. Start and end of the trend line does not need to be on the high/low points of the candle, it can also be placed in any of the wick positions.

After adjusting the trend lines, in both type of scanning, we can see that the trend lines confirm to the above-mentioned rules. Hence, we have arrived with valid patterns in both types of scanning on the level 0 zigzag.

🎲 Classification of Patterns

Once the patterns are identified, they need to be classified into different types. We need to apply predetermined rules to objectively classify patterns into what they are. Everyone can build their own rules.

🎯 Properties of Derived Trend Lines

Before classifying the trend lines, we need to understand below properties of the derived trend lines.

▶ Direction of Individual Trend Lines

Both the trend lines needs to be individually classified among these categories

Rising - Trend Line is sharply rising up.

Falling - Trend Line is sharply falling down.

Flat - Trend Line is flat across the pivots.

Bi-Directional - Trend Lines are moving in opposite directions

Please note that, it is less probable for trend line to absolutely flat. Hence, allow angle to have certain degree of threshold to be considered as flat. For example, +- 10 degrees can be considered as flat.

Also, the angle of the trend line can further subjective based on how compressed the chart is. It is recommended to use either log/auto-scale or a specific formula based on ATR to identify the angle.

▶ Characteristic of the Trend Line Pairs

This parameter defines how both trend lines are aligned with respect to each other. Possible options are:

Converging - Trend Lines are converging and when extended towards the right will intersect at a visible distance.

Diverging - Trend Lines are diverging from each other and when extended towards the left will intersect at a visible distance.

Parallel - Trend Lines are almost parallel to each other and may not intersect to either right or to left at a visible distance.

To objectively identify the intersection distance, we further need to use some standard. Here are few options

Fixed Number of Bars : If the trend lines do not intersect to either left or right within X bars (Lets say 100), they can be considered as parallel. Otherwise, they can be classified as converging or diverging based on which side the intersection happens.

Relative to the Length of Pattern : If the length of longest trend line is X bars. The trend lines should converge within 1–2 times the X bars to be considered as converging or diverging. Or else, it can be termed as parallel channels.

🎯 Geometrical Shapes Classification

Following are the main geometrical classifications based on the characteristics of the trend lines and the pair.

Channels - Trend Lines are parallel to each other. And hence they both move in the same directions.

Wedges - Trend Lines are either converging or diverging from each other. However, both trend lines move in the same direction. Both trend lines will be either up or down.

Triangles - Trend Lines are either converging or diverging from each other. But, unlike wedges, upper and lower trend lines will have different direction.

🎲 Types of Patterns

Once we identify the direction and characteristics of trend lines, we can go on and classify the pattern in following categories.

Details below. Please note that examples are generated programmatically.

🎯 Rising Wedge (Contracting)

Rules for Contracting Rising Wedge are as follows:

Both Trend Lines are Rising

Trend Lines are converging.

🎯 Rising Wedge (Expanding)

Rules for the Expanding Rising Wedge are as follows:

Both Trend Lines are rising

Trend Lines are diverging.

🎯 Falling Wedge (Contracting)

Rules for the Contracting Falling Wedge are as follows:

Both Trend Lines are falling

Trend Lines are contracting.

🎯 Falling Wedge (Expanding)

Rules for the Expanding Falling Wedge are as follows:

Both Trend Lines are falling

Trend Lines are diverging.

🎯 Contracting/Converging Triangle

Rules for the Contracting Triangle are as follows

The upper trend line is falling

The lower trend line is rising

Naturally, the trend lines are converging.

🎯 Rising Triangle (Contracting)

The rules for the Contracting Rising Triangle are as follows

The upper trend line is flat

The lower trend line is rising

Naturally, the trend lines are converging towards each other

🎯 Falling Triangle (Contracting)

The rules for the Contracting Falling Triangle are as follows

The upper trend line is falling

The lower trend line is flat

Naturally, the trend lines are converging towards each other

🎯 Expanding/Diverging Triangle

Rules for the Expanding Triangle are as follows

The upper trend line is rising

The lower trend line is falling

Naturally, the trend lines are diverging from each other.

🎯 Rising Triangle (Expanding)

The rules for the Expanding Rising Triangle are as follows

The upper trend line is rising

The lower trend line is flat

Naturally, the trend lines are diverging from each other

🎯 Falling Triangle (Expanding)

The rules for the Expanding Falling Triangle are as follows

The upper trend line is flat

The lower trend line is falling

Naturally, the trend lines are diverging from each other

🎯 Rising/Uptrend Channel

Rules for the Uptrend Channel are as follows

Both trend lines are rising

Trend lines are parallel to each other

🎯 Falling/Downtrend Channel

Rules for the Downtrend Channel are as follows

Both trend lines are falling

Trend lines are parallel to each other

🎯 Ranging Channel

Rules for the Ranging Channel are as follows:

Both trend lines are flat

Naturally, the trend lines are parallel to each other.

Market structure, Right side of the marketMarket structure is one of the most important thing one can learn in trading. If you are day trading or investing staying on right side of the market is very important. Market structure help to identify the right side of the market. Lets say market is making HH (Higher high) and HL (higher low) that's bullish market structure. Meaning buyers are in control and its a bull trend. If market making LL (Lower low) and LH (Lower high) then seller are in control making it a bear trend.

Market are always in trend or trading range. In trend you are either in a bull trend or a bear trend. Market usually don't go from bull trend to bear trend. Often it will stay a trading range after a trend. If market breaks that trading range in trend direction then we call that flag pattern. If it was a bull tend a bull flag and on a bear trend a bear flag, but if price fails to continue going in earlier trend direction then its become a failed flag and then trader thinks we might get a trend reversal.

lets say market is in a bull trend so its making HH and HL . But if market fail to make a HH or HL and it ends up making LH then people start to think if this bull trend is still a strong bull trend which can cause market to shift from bull trend to trading range. And after a LL many bull will get out of their position which could create a LH and end up reversing a trend. In which case if price in a bull structure and market making HH and HL you should only be a buyer and after market structure change its direction then you can think if you should sell.

a rising wedgeA rising wedge is a pattern that forms on a fluctuating chart and is caused by a narrowing amplitude. If you draw lines along with the highs and lows, then the two lines will form an imaginary angle that will narrow over time. Moreover, this angle’s inclination must be positive; the resulting corner should be pointing upward, indicating an uptrend.

A rising wedge is a bearish reversal pattern. Typically, a rising wedge reverses an uptrend, but there are exceptions. It sometimes happens that the rising wedge continues the trend. If there was a downtrend before the rising wedge, then the price goes down after the wedge, and it turns out that the rising wedge continues the trend. But it is important to remember that in any case, after the rising wedge, there is a price decline.

The rising wedge is not a very common pattern and is not very easy to spot. Even though bulls and bears appear to be in relative equilibrium, the narrowing of the rising wedge corridor suggests that supply is winning. In the end, buyers break down, and sellers take control of the market. To determine how the price will behave further, it is necessary to further analyze this instrument.

Trading Advantages for Wedge Patterns

As a general rule, price pattern strategies for trading systems rarely yield returns that outperform buy-and-hold strategies over time, but some patterns do appear to be useful in forecasting general price trends nonetheless. Some studies suggest that a wedge pattern will breakout towards a reversal (a bullish breakout for falling wedges and a bearish breakout for rising wedges) more often than two-thirds of the time, with a falling wedge being a more reliable indicator than a rising wedge.

Because wedge patterns converge to a smaller price channel, the distance between the price on entry of the trade and the price for a stop loss, is relatively smaller than the start of the pattern. This means that a stop loss can be placed close by at the time the trade begins, and if the trade is successful, the outcome can yield a greater return than the amount risked on the trade to begin with.

Decoding Market Patterns:10 Essential Price Patterns Every TradeIn the intricate world of trading, price patterns are the footprints left by market sentiment. Understanding these patterns is like deciphering a complex code, revealing insights into potential market movements. Today we will explore 10 essential price patterns every trader should recognize. Each pattern is a chapter in the dynamic story of market behavior, offering opportunities to identify trends, reversals, and strategic entry or exit points.

1. Bull Flag: The Flagbearer of Continuation

A Bull Flag is a continuation pattern, often seen in strong uptrends. It resembles a flagpole (the initial price spike) followed by a rectangular flag (consolidation phase). When the price breaks above the upper boundary of the flag, it signals a potential continuation of the uptrend.

2. Bear Flag: The Bearish Counterpart

The Bear Flag is the opposite of the Bull Flag. It appears in downtrends, with a flagpole representing the initial price drop followed by a consolidation period. When the price breaches the lower boundary of the flag, it indicates a potential continuation of the downtrend.

3. Head and Shoulders: The Classic Trend Reversal

The Head and Shoulders pattern is a powerful reversal indicator. It consists of three peaks – the central peak (head) is higher than the surrounding peaks (shoulders). When the price drops below the neckline (a line drawn through the lowest points of the shoulders), it suggests a potential trend reversal from bullish to bearish.

4. Inverse Head and Shoulders: The Bullish Resurgence

The Inverse Head and Shoulders pattern is the bullish counterpart of the Head and Shoulders. It occurs after a downtrend and indicates a potential reversal to an uptrend. The pattern consists of three troughs – the central trough (head) is lower than the surrounding troughs (shoulders). When the price rises above the neckline, it signals a potential shift from bearish to bullish.

The cool thing about chat patterns is that they are everywhere. You often see many different chart patterns on a singular chart, or smaller patterns that are a part of a larger pattern. The tricky part is finding them and appropriately identifying them.

5. Double Top: The Bearish Reversal Duo

A Double Top pattern occurs after an uptrend and signals a potential reversal. It consists of two peaks at nearly the same price level, indicating a struggle to push the price higher. When the price falls below the trough between the peaks, it suggests a possible shift from bullish to bearish.

6. Double Bottom: The Bullish Reversal Duo

The Double Bottom is the bullish counterpart of the Double Top. It occurs after a downtrend and signals a potential reversal to an uptrend. It consists of two troughs at nearly the same price level, indicating a struggle to push the price lower. When the price rises above the peak between the troughs, it suggests a potential shift from bearish to bullish.

7. Rising Wedge: The Rising Price Constrictor