Special Analysis for Bitcoin: Is Bitcoin prepare for bull run?Hello guys, in this technical analysis I want to talk you about why Bitcoin is so prepare for bull run soon? Now, I selected the Weekly and Daily timeframe.

Now, in weekly we see a Bitcoin bearish for MACD and price action, but there are a lot doubts that respald that a drop what a much traders hope, it's can be fake drop and the price is can to prepare to go to break up the simetric triangle from 2017.

But for this information we need to see in Daily timeframe, that is the key what Bitcoin do.

But in Daily timeframe, we see a reality so different than Weekly, because Bitcoin is now into this bullish rising wedge in formation and find up the Elliot Wave D, to later go to drop for the E to find down, and later we proyect for Bitcoin so bullish scenario reaching at $11,500 USD. That is a possible target to see in few weeks. Also the MACD is show us a possible buy!!! Now, if I asking you about if this scenario it's could be to pass. Are you prepare for there? Now, in that case that this rising wedge fail and broke down, we can see a Bitcoin so bearish until the $7,000 USD again. But, the key is in Daily timeframe how we see the trend key, structure and condition for midterm.

Centered Oscillators

EUDUSD 2 Hr Potential for Long with CCI diver, Fib. retr.The EURUSD upleg from May 25 to Jun 10 as retraced 38.2% of that price change, which is often a turning point for resumption of uptrend. During this price drop, 13 CCI has diverged, giving higher low, another checkpoint before price resumes any uptrend. If 100 CCI is > -100, that also allows upside to price. When the green trendline on 13 CCI is broken to the upside, That's the Long entry, whenever the other criteria have also been met. One more criterion, below, is necessary most of the time. (The exception is when a long explosive upmove happens, and takes 13 CCI above zeroline on the first move up)

After a CCI divergence forms higher low, the price generally then needs to drop back to retest the low or go even some lower, but then the door is open for price to resume uptrend if it wants. You can watch the retest of price low, then all the checkpoints are in to be ready to go Long if price moves up, and both CCI's move up

1ST - MACD TREND FOLLOWING STRATEGYQUESTION - WHAT ARE THE BEST FOREX TRADING STRATEGIES?

1ST - MACD TREND FOLLOWING STRATEGY

Step #1: Wait for the MACD lines to develop a higher high followed by a lower high swing point.

This is an unorthodox approach to technical analysis. But, we at Trading Strategy Guides.com are different. We don’t mind doing uncomfortable things if that’s what it takes to succeed in this business.

First, let’s visualize how an authentic swing point really looks on the MACD indicator:

The first rule of thumb to recognize a swing high on the MACD indicator is to look at the price chart if the respective currency pair is doing a swing high the same as the MACD indicator does. A higher high is the highest swing price point on a chart and must be higher than all previous swing high points. While a lower high happens when the swing point is lower than the previous swing high point.

Step #2: Connect the MACD line swing points that you have identified in Step #1 with a trendline.

At this point, we really ignored the MACD histogram because much of the information contained by the histogram is already showing up by the moving averages. Look at the price action now and compare it to our MACD trendline we drew early. We can clearly notice that the MACD contains the price action much better and reflects the trend much clear.

But, at this point, we’re still not done with the MACD indicator, which brings us to the critical part of our MACD Trend Following Strategy.

Step #3: Wait for the MACD line to break above the trendline. (Entry at the market price as soon as the MACD line breaks above).

When the MACD line (the blue line) crosses the signal line (the orange line) it’s an early signal that a bullish trend might start. However, if trading would be that easy we would all be millionaires, right? And that’s the reason why our MACD Trend Following Strategy is so unique. We’re not only waiting for the MACD moving averages to cross over but we also have our other criteria for the price action to break aka the trend line we drew early.

This is a clever way to filter out the false MACD signals, but you have to be equipped with the right mindset and have patience until all the piece of the puzzle come together. If you were to trade just based on the MACD crossover over time you’ll lose money because that’s not a reliable strategy. But if you use the MACD indicator along with other criteria such what this strategy tells you to do, you will find great trade entries on a consistent basis.

Step #4: Use Protective Stop Loss Order. (Place the SL below the most recent swing low).

Now, that you already know how to enter a trade at this point you have to learn how to manage risk and where to place the SL. After all, a trader is basically a risk manager.

You want to place your stop loss below the most recent low, like in the figure below. But make sure you add a buffer of 5-10 pips away from the low, to protect yourself from possible false breakouts.

Did you notice?

The MACD Trend Following Strategy triggered the buy signal right at the start of a new trend and what is most important the timing is more than perfection. We bought EUR/USD the same day the bullish divergence trend started.

Now, what this has to do with the SL?

Basically, a good entry price means a smaller stop loss and ultimately it means you’ll lose a lot less comparing it with the profit potential, so a positive risk to reward ratio.

Step #5: Take Profit when the MACD crossover happens in the opposite direction of our entry.

Knowing when to take profit is as important as knowing when to enter a trade. However, we want to make sure we don’t use the same trading technique as for our entry order. When the MACD line (the blue line) produces signal line crossovers (the orange line) we want to close the position and take full profits.

Before taking profits, it’s important to wait for the candle close – either the 4h or the daily candle – depending on the time frame you trade so you make sure the MACD crossover actually happens.

Note** The above was an example of a buy trade using the MACD Trend Following Strategy. Use the exact same rules – but in reverse – for a sell trade.

Conclusion:

The MACD Trend Following Strategy is a very simple trend following strategy and yet a very profitable strategy at the same time. As the saying goes, “The trend is your friend” and no matter if you’re just starting as a Forex trader or you’re already an established trader life is much easier when trading in the direction of the line of least resistance rather than fighting the trend which is a loser’s game.

The success behind the MACD Trend Following Strategy is derived from one simple principle: momentum precedes price.

ETHUSD 30M CAMARILLA PIVOT TRADING STRATEGYDay Trading Camarilla Pivot Trading Strategy

Mean reversion day trading inherently has lower profit margins with Camarilla pivots. The reason behind this is very simple due to the proximity of the Camarilla points with the price action you’re left with lower profit margins.

So, from the start, you have a handicap that as a trade you need to overcome.

Trading is all about finding those situations where we maximize our profits and minimize the risk.

That’s the reason why we prefer trading breakouts of the Camarilla pivot points. The profit potential is far greater. However, in order to confirm our breakout trade, we’re going to throw in another indicator.

So, what’s the best combination with the Camarilla pivot points?

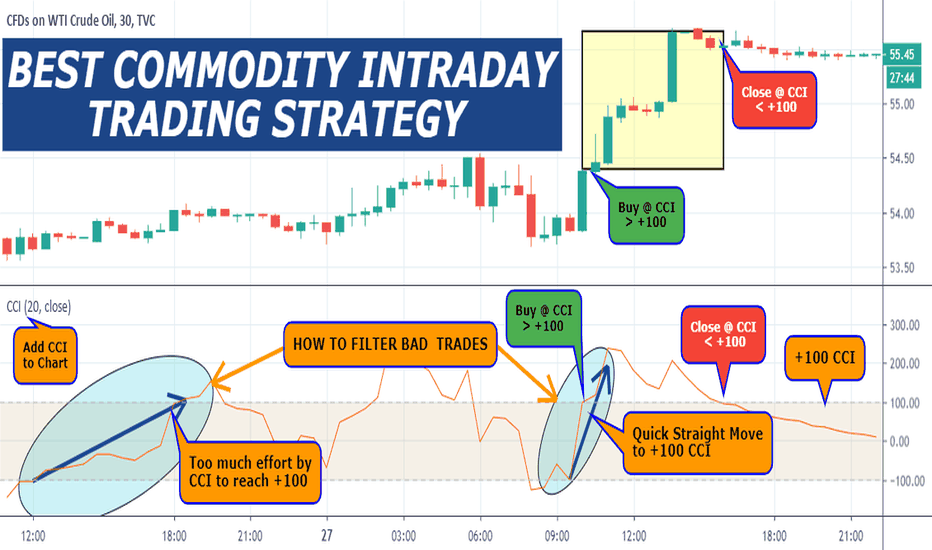

The CCI or Commodity Channel Index can be used in combination with Camarilla points to confirm breakouts.

Learn more about how the pro’s trade using the CCI trading system HERE.

So, what are the rules to confirm the Camarilla pivot point breakouts?

There are two rules:

For bullish breakout trades above the resistance R4, we need to see a CCI reading of +100 at the moment the breakout happens.

For bearish breakout trades below the support S3, we need to see a CCI reading of -100 to confirm the breakout.

Note* an effective way to hide your protective stop loss would be below (above) the resistance R3 (support S3).

You determine your own TP.

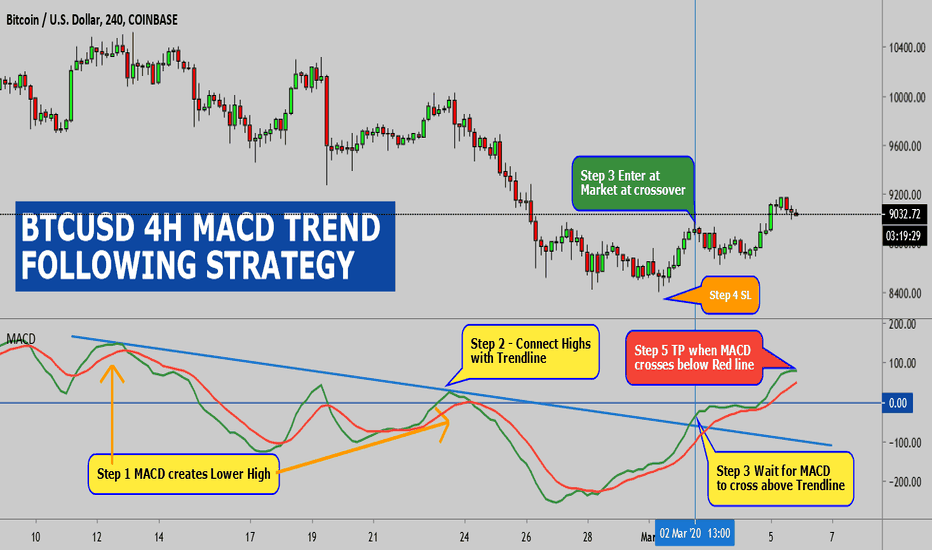

BTCUSD 4H MACD TREND FOLLOWING STRATEGY(Rules for A Buy Trade)

Step #1: Wait for the MACD lines to develop a higher high followed by a lower high swing point.

The first rule of thumb to recognize a swing high on the MACD indicator is to look at the price chart if the respective currency pair is doing a swing high the same as the MACD indicator does. A higher high is the highest swing price point on a chart and must be higher than all previous swing high points. While a lower high happens when the swing point is lower than the previous swing high point.

Step #2: Connect the MACD line swing points that you have identified in Step #1 with a trendline.

At this point, we really ignored the MACD histogram because much of the information contained by the histogram is already showing up by the moving averages. Look at the price action now and compare it to our MACD trendline we drew early. We can clearly notice that the MACD contains the price action much better and reflects the trend much clear.

But, at this point, we’re still not done with the MACD indicator, which brings us to the critical part of our MACD Trend Following Strategy.

Step #3: Wait for the MACD line to break above the trendline. (Entry at the market price as soon as the MACD line breaks above).

When the MACD line (the blue line) crosses the signal line (the orange line) it’s an early signal that a bullish trend might start. However, if trading would be that easy we would all be millionaires, right? And that’s the reason why our MACD Trend Following Strategy is so unique. We’re not only waiting for the MACD moving averages to cross over but we also have our other criteria for the price action to break aka the trend line we drew early.

This is a clever way to filter out the false MACD signals, but you have to be equipped with the right mindset and have patience until all the piece of the puzzle come together. If you were to trade just based on the MACD crossover over time you’ll lose money because that’s not a reliable strategy. But if you use the MACD indicator along with other criteria such what this strategy tells you to do, you will find great trade entries on a consistent basis.

Step #4: Use Protective Stop Loss Order. (Place the SL below the most recent swing low).

Now, that you already know how to enter a trade at this point you have to learn how to manage risk and where to place the SL. After all, a trader is basically a risk manager.

You want to place your stop loss below the most recent low, like in the figure below. But make sure you add a buffer of 5-10 pips away from the low, to protect yourself from possible false breakouts.

Basically, a good entry price means a smaller stop loss and ultimately it means you’ll lose a lot less comparing it with the profit potential, so a positive risk to reward ratio.

Step #5: Take Profit when the MACD crossover happens in the opposite direction of our entry.

Knowing when to take profit is as important as knowing when to enter a trade. However, we want to make sure we don’t use the same trading technique as for our entry order. When the MACD line (the blue line) produces signal line crossovers (the orange line) we want to close the position and take full profits.

Before taking profits, it’s important to wait for the candle close – either the 4h or the daily candle – depending on the time frame you trade so you make sure the MACD crossover actually happens.

Note** The above was an example of a buy trade using the MACD Trend Following Strategy. Use the exact same rules – but in reverse – for a sell trade.

Introduction to the BEST All-In-One Oscillators with divergencesHello traders,

A unique indicator displaying many oscillators with a multi-timeframes and regular/hidden divergences options for all oscillators below

1. MACD

2. MACD ZERO LAG

3. RSI

4. DMI/ADX

5. ATR

6. STOCHASTIC RSI

7. TRUE STRENGTH INDEX

8. CANDLE MOMENTUM OSCILLATOR

9. VORTEX INDICATOR

10. COMMODITY CHANNEL INDEX

11. RATE OF CHANGE

☔ Safe crossing mode for RSI/STOCH RSI/CMO: Choose to get alerted whenever the oscillator enters or exits the Overbought/Oversold zone.

Wishing you all the BEST for your trading using it.

Dave

Indicators: My Issues with BoPI guess it's the same story with many traders, few years ago, when i first got introduced to the world of technical analysis and indicators, i was fascinated. trading is such an easy thing, just follow the indicator signals, right? then i started to dig deeper only to learn, each indicator shows something specific - and you need to know what is it that you need to see for your trading style, then choose the right indicator and the right values.. etc. my trading setup started changing from there endlessly.

then came the other lesson, indicators alone do not make a successful trader - nothing can predict the future, and an indicator only shows specific "signs" at a specific time - what happens next is subject to so many variables, and some of these variables are even sometimes influenced by big players who may not be all playing in the same direction .. however, indicators still help - but in that case, less is more, and a cleaner chart setup with less indicators would then be the right way to go. so take your pick, MACD, RSI, Stoc, ...etc - and throw in couple of moving averages on the top chart, and you're good to go.

that's where BoP comes into play. the Balance of Power is a very interesting indicator that has the potential to show "leading signs" - BoP has been around since the '70's and there are various stories about who is the original "father" of BoP - in all cases, the BoP formula is not a secret anymore - BoP simply divides the "body" by the "range" of a bar - so take (close - open) and divide it by the (high - low). since (high - low) is always a positive value, if it's a down bar (closes lower than the open), you will get a negative result - if it's an up bar, positive. now the Bulls get the positive value (and for that bar, the bears get a zero), and bears get the negative value (and again, the bulls get a zero) - so BoP shows who is in control of price movement (bulls vs bears), and if we know that - then we can expect, for example, a trend up to continue or dissipate, right?

i will post further analysis on this if there's interest, and dive into each of the "issues" i highlighted here - but i thought to share initially those "issues with BoP" here in this community - and why i think that the Balance of Power comes short of delivering on the premise - and it's time for an upgrade - leveraging the available computing power and scripting languages we now have available at our fingertips.

the attached chart shows 6 issues that the BoP indicator doesn't address in its classic calculation - for my own education, i decided i wanted to "see BoP" for each bar - so the "value cards" we see here are the classic BoP values for each bar - then these values are taken and smoothed using a moving average to produce the green line in the lower panel. i modified the calculation slightly to make it oscillate between +/- 100 , then smoothed with a WMA(3) .. on the value card, we can see that modified "BoPx" value for each bar. my thoughts are "if BoP is right and reliable, why would a well-known bearish chart pattern like a shooting star not have a negative value" - right?

those who are like me, curious about technical indicators and like to create their own, may find this analysis as interesting as i did. Let's here from you folks. if you have the chance to re-develop or improve "the BoP", how would you approach that to ensure that it really brings the accurate insights that it should ?

Let me know your thoughts. feel free to post here or PM.

(the code i use here is open and available, but it's really not an indicator - it's more of a research code)

----------------------------------------------------------------------------

//@version=4

study("BoP Lower #1")

// This source code is subject to the terms of the Mozilla Public License 2.0 at mozilla.org

// © RedKTrader

// this is a research study - it plots the value of the Balance of Power on each bar

length = input(title="Length", type=input.integer, defval=7, minval=3, step=1)

body = close - open

range = high - low

score = body / range * 100

bulls = if score > 0

score

else

0

bears = if score < 0

-score

else

0

//create an index scaled from +100 to -100

dx = wma(bulls, length) / wma(bears,length)

dxi = 2 * (100 - 100 / (1+dx)) - 100

// -----------------------------------------------------------------------------------

//print values on top chart

//alternate labels once above and once below

//c = bar_index % 2 == 0

//T = "Bulls = " + tostring(round(bulls)) + " Bears = " + tostring(round(bears)) + " ----------" + " BoP = " + tostring(round(dxi))

//label.new (bar_index, c ? low : high , text = T, size = size.normal, textalign = text.align_left , style = c ? label.style_labelup : label.style_labeldown, color = color.white, textcolor = color.black )

// ==================================================================================================================================

// lower plot --

hline(0, color = color.yellow, linestyle = hline.style_solid)

plot (wma(score, length), title = 'Classic BoP', color = color.green)

plot(dxi, title='BoPx',style=plot.style_line , color = color.gray , linewidth=1)

plot(wma(dxi,3), title='BoP II',style=plot.style_line , color= dxi >=0 ? color.aqua : color.orange , linewidth=2)

Big secret - when to buy & sell bitcoin (you decide)Using USDCNY (Caveat- LINE BREAK CHART & small sample size) See what happens when MACD signal line drops into negative territory. Significant support line for bitcoin price. See Oil and Gold price effect on support line. Will coronavirus shut down bitcoin mining in China? What will happen when Chinese market reopen. Is bitcoin about to explode? Bahhhhhh........ Hmm.............. NOT ADVICE. DYOR.

Bitcoin facing the abyss - need a daily close above....OMGNOT ADVICE DYOR. Caveat - small sample size.

Here's the construction. You need BB %B indicator. Then do MACD on that indicator. Mark all instances signal line turns positive (yellow). Mark (white) first instance histogram turns red. If both these cross month end then mark that month end (blue). Box both months in white. Bulls need to push daily close above $7933.4. Come on! If not will first lines of defence hold. NOT ADVICE. DYOR.

A More Efficient Calculation Of The Relative Strength IndexIntroduction

I explained in my post on indicators settings how computation time might affect your strategy. Therefore efficiency is an important factor that must be taken into account when making an indicator. If i'am known for something on tradingview its certainly not from making huge codes nor fancy plots, but for my short and efficient estimations/indicators, the first estimation i made being the least squares moving average using the rolling z-score method, then came the rolling correlation, and finally the recursive bands that allow to make extremely efficient and smooth extremities.

Today i propose a more efficient version of the relative strength index, one of the most popular technical indicators of all times. This post will also briefly introduce the concept of system linearity/additive superposition.

Breaking Down The Relative Strength Index

The relative strength index (rsi) is a technical indicator that is classified as a momentum oscillator. This technical indicator allow the user to know when an asset is overvalued and thus interesting to sell, or under evaluated, thus interesting to buy. However its many properties, such as constant scale (0,100) and stationarity allowed him to find multiple uses.

The calculation of the relative strength index take into account the direction of the price changes, its pretty straightforward. First we calculate the average price absolute changes based on their sign :

UP = close - previous close if close > previous close else 0

DN = previous close - close if close < previous close else 0

Then the relative strength factor is calculated :

RS = RMA(UP,P)/RMA(DN,P)

Where RMA is the Wilder moving average of period P . The relative strength index is then calculated as follows :

RSI = 100 - 100/(1 + RS)

As a reminder, the Wilder moving average is an exponential filter with the form :

y(t) = a*x+(1-a)*y(t-1) where a = 1/length . The smoothing constant being equal to 1/length allow to get a smoother result than the exponential moving average who use a smoothing constant of 2/(length+1).

Simple Efficient Changes

As we can see the calculation is not that complicated, the use of an exponential filter make the indicator extremely efficient. However there is room for improvement. First we can skip the if else or any conditional operator by using the max function.

change = close - previous close

UP = max(change,0)

DN = max(change*-1,0)

This is easy to understand, when the closing price is greater than the previous one the change will be positive, therefore the maximum value between the change and 0 will be the change since change > 0 , values of change lower than 0 mean that the closing price is lower than the previous one, in this case max(change,0) = 0 .

For Dn we do the same except that we reverse the sign of the change, this allow us to get a positive results when the closing price is lower than the previous one, then we reuse the trick with max , and we therefore get the positive price change during a downward price change.

Then come the calculation of the relative strength index : 100 - 100/(1 + RS) . We can simplify it easily, first lets forget about the scale of (0,100) and focus on a scale of (0,1), a simple scaling solution is done using : a/(a+b) , where (a,b) > 0 , we then are sure to get a value in a scale of (0,1), because a+b >= a . We have two elements, UP and DN , we only need to apply the Wilder Moving Average, and we get :

RMA(UP,P)/(RMA(UP,P) + RMA(DN,P))

In order to scale it in a range of (0,100) we can simply use :

100*RMA(UP,P)/(RMA(UP,P) + RMA(DN,P))

= 100*RMA(max(change,0),P)/(RMA(max(change,0),P) + RMA(max(change*-1,0),P))

And "voila"

Superposition Principle and Linear Filters

A function is said to be linear if : f(a + b) = f(a) + f(b) . If you have studied signal processing a little bit, you must have encountered the term "Linear Filter", its just the same, simply put, a filter is said to be linear if :

filter(a+b) = filter(a) + filter(b)

Simple right ? Lot of filters are linear, the simple moving average is, the wma, lsma, ema...etc. One of most famous non linear filters is the median filter, therefore :

median(a+b) ≠ median(a) + median(b)

When a filter is linear we say that he satisfies the superposition principle. So how can this help us ? Well lets see back our formula :

100*RMA(UP,P)/(RMA(UP,P) + RMA(DN,P))

We use the wilder moving average 3 times, however we can take advantage of the superposition principle by using instead :

100*RMA(UP,P)/RMA(UP + DN,P)

Reducing the number of filters used is always great, even if they recursion.

Final Touch

Thanks to the superposition principle we where able to have RMA(UP + DN,P) , which allow us to only average UP and DN togethers instead of separately, however we can see something odd. We have UP + DN , but UP and DN are only the positive changes of their associated price sign, therefore :

UP + DN = abs(change)

Lets use pinescript, we end up with the following estimation :

a = change(close)

rsi = 100*rma(max(a,0),length)/rma(abs(a),length)

compared to a basic calculation :

up = max(x - x , 0)

dn = max(x - x, 0)

rs = rma(up, length) / rma(dn, length)

rsi = 100 - 100 / (1 + rs)

Here is the difference between our estimate and the rsi function of both length = 14 :

with an average value of 0.000000..., those are certainly due to rounding errors.

In a chart we can see that the difference is not significant.

In our orange our estimate, in blue the classic rsi of both length = 14.

Conclusion

In this post i proposed a simplification of the relative strength index indicator calculation. I introduced the concept of linearity, this is a must have when we have to think efficiently. I also highlighted simple tricks using the max function and some basic calculus related to rescaling. I had a lot of fun while simplifying the relative strength index, its an indicator everyone use. I hope this post was enjoyable to read, with the hope that it was useful to you. If this calculation was already proposed please pm me the reference.

You can check my last paper about this calculation if you want more details, the link to my papers is in the signature. Thanks for reading !

Fisher Transform - BTCDisclaimer; This analysis for educational purposes, its not a financial advise. Please do your own research

What is Fisher Transform?

How is it work?

How probability of distribution calculated? And why it works?

FTransform ; The accuracy of calling tops and bottoms almost to perfect ratio when Fisher & trigger line crosses. Best buys /sells are clearly at OS/OB region when they are very close to Bollinger Bands.

I just marked some of the buy (blue) - sell (red) signals (vertical lines) along with TD sequential.

Lets dive in. Following paragraph from the genius J.Ehler who created this solid indicator

"The input values are constrained to be within the range -1 < X < 1. When the input data is near the mean, the gain is approximately unity. By contrast, when the input approaches either limit within the range the output is greatly amplified. This amplification accentuates the largest deviations from the mean, providing the “tail” of the Gaussian PDF. The transformed output Probability Density Function is nearly Gaussian, a radical change in the PDF.

So what does this mean to trading? If the prices are normalized to fall within the range from –1 to +1 and subjected to the Fisher Transform, the extreme price movements are relatively rare events. This means the turning points can be clearly and unambiguously identified. Value1 is a function to normalize price within its last 10 day range. The period for the range is adjustable as an input. Value1 is centered on its midpoint and then doubled so that Value1 will swing between the –1 and +1 limits. Value1 is also smoothed with an EMA whose alpha is 0.33. The smoothing may allow Value1 to exceed the ten day price range, so limits are introduced to preclude the Fisher Transform from blowing up by having an input value larger than unity. The Fisher Transform is computed which is delayed by one bar are plotted to provide a crossover system that identifies the cyclic turning points.

How probabilities are measured by (-/+) deviations on Fisher Transform?

A) -If Fisher transformed indicator has a value of −1, it has a value of negative one standard deviation and therefore there is a 32 percent chance prices will go lower.

B) -If the transformed indicator has a value of −2, it has a value of negative two standard deviations, and therefore there is only an 8 percent chance prices will go lower.

This is a high-probability buying opportunity.

C) At a level of −3, the negative 3 standard deviations means there is only a 2 percent chance of the prices going lower.

FT values are symmetrical, so positive deviations are high-probability indications to exit a long position or to sell short. If the prices are normalized to fall within the range from –1 to +1 and subjected to the TF, the extreme price movements are relatively rare events. This means the turning points can be clearly and unambiguously identified"

For detailed trading concept of join us. t.me

USDCAD 120min CCI turn signals diver retest hi TLBThis could have been posted 2-3 hr ago but trading comes first. There are still pips available, but more importantly the turn signals were so clear that the value is in the tutorial.

The first warning that uptrend was waning came with strong CCI divergence from price

Second, there was an abc down which corrected back up to retest the high (following divergence)

at the CCI high of the price hi retest, the CCI had a short signal with slanted rooftop. Together, those were a

first signal short.

Third, CCI crossed down thru an up-trendline giving a later signal short.

Reversal signal would be when CCI crosses back up thru a down-trendline on CCI (not shown)

Comparison of PRISM and FG-DIVERGENCE generated Buy/Sell SignalsPRISM Signals (Lime/Red)

Buy/Sell signals based on filtered pSAR-based Monemtum/Acceleration/Jerk oscillator.

[ p.Doji ] marks points of market-indecisiveness, and where typically, significant volatility and movement is about to occur ahead.

FG-DIVERGENCE V4 {50/15-Series} (Light-Blue/Orange)

Buy/Sell signals based on Momentum/Acceleration hybridized FUSIONGAPS oscillator.

Seems to have a high hit-rate for local tops and bottoms at different time-frames.

~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~

~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~

The above are based on the following two respective Indicators

PRISM Signals

FG-DIVERGENCE V4 {50/15-Series}

~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~

Related Indicators

PRISM {PSAR+RSI/STOCH/MAJ Oscillator Set}

FUSIONGAPS V4 {50/15-Series}

FG-DIVERGENCE V4 {50/15-Series}

~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~

~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~

Note:

In no way is this intended as a financial/investment/trading advice. You are responsible for your own investment decisions and trades.

Please exercise your own judgement for your own trades base on your own risk-aversion level and goals as an investor or a trader. The use of OTHER indicators and analysis in conjunction (tailored to your own style of investing/trading) will help improve confidence of your analysis, for you to determine your own trade decisions.

~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~

~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~

Please check out my other indicators sets and series, e.g.

LIVIDITIUM (dynamic levels),

AEONDRIFT (multi-levels standard deviation bands),

FUSIONGAPS (MA based oscillators),

MAJESTIC (Momentum/Acceleration/Jerk Oscillators),

PRISM (pSAR based oscillator, with RSI/StochRSI as well as Momentum/Acceleration/Jerk indicators),

PDF (parabolic SAR /w HighLow Trends Indicator/Bar-color-marking + Dynamic Fib Retrace and Extension Level)

and more to come.

Constructive feedback and suggestions are welcome.

If you like any of my set of indicators, and it has benefited you in some ways, please consider tipping a little to my HRT fund. =D

cybernetwork @ EOS

37DzRVwodp5UZBYjCKvVoZ5bDdDqhr7798 @ BTC

MPr8Zhmpsx2uh3F5R4WD98MRJJpwuLBhA3 @ LTC

1Je6c1vvSCW7V2vA6RYDt6CEvqGYgT44F4 @ BCH

AS259bXGthuj4VZ1QPzD39W3ut4fQV5giC @ NEO

rDonew8fRDkZFv7dZYe5w3L1vJSE51zFAx @ Ripple XRP

0xc0161d27201914FC0bAe5e350a193c8658fc4742 @ ETH

GAX6UDAJ52OGZW4FVVG3WLGIOJLGG2C7CTO5ZDUK2P6M6QMYBJMSJTDL @ Stellar XLM

xrb_16s8cj8eoangfa96shsnkir3wctdzy76ajui4zexek6xmqssweu85rdjxrt4 @ Nano

~ JuniAiko

(=^~^=)v~

BEST COMMODITY INTRADAY TRADING STRATEGY Before we outline the best commodity intraday trading strategy, it’s important to understand that trading commodities are different from trading Forex or stocks. Every financial asset has its own set of unique characteristics. The commodity market has its own behavior, that’s why some strategies are more suitable than others to generate profits from commodity trading.

We’re going to reveal some of the most well-kept commodity trading secrets only known by successful commodity traders.

Let’s now see what commodity trading strategy you can use to buy and sell products in the commodity market.

Here is the link to "Best Commodity Intraday Trading Strategy" pdf.

tradingstrategyguides.com