EDUCATION: Bollinger Bands Hello, dear subscribers!

The next topic of our education is the Bollinger Band channel.

What is Bollinger Bands?

BB channel consists of three lines: the moving average of close price, the MA plus/minus 2 standard deviations. This channel defines the most likely price swings range.

How to trade with BB?

There are two different situations for the BB trading.

The first one is the trading during the consolidation phase.

You should open the long positions when the price broke the lower BB and close when it reached the centraline. The short position you can open when the price hits the higher BB and close on the centraline.

The second situation is the trend trading. According to theory the periods with low volatility are preceded by the high volatility periond. When the the volatility is low the BB channel is squeezed and it is a good time to searching for the potential trend beginning. You can use Money Flow Index or other volume-based indicators for the trend confirmation. For example, when the price hits the higher BB and the money flow index value rapidly increased it can be the evidence of potential uptrend beginning.

The most difficult and important problem of the BB trading is the trend direction definition. If the trend is defined correctly this strategy becomes very profitable.

Trade

How to take advantage of a trade multiple times? Check it out!Hi guys!

Just published my very first educational post, I hope you will like it!

This is a trade which I took yesterday and I thought it would be interesting to "dissect" it into 4 steps in order to understand why and when is the "best" moment to buy and/or to sell.

I have incorporated the explanations in my chart.

Please note that this is an "ideal" trade and it doesn't happen like that all the time... but it gives you an idea of how I analyze it.

Feel free to comment/like it if you find it valuable!

QLCBTC - It will surprise everyone with a great and fast growthHello friends,

Be sure to follow QLCBTC. We have a good opportunity for strong growth.

In the short time frame, we saw the MA200 cut off and exit the downward trend, and this is definitely not a message but a sharp rise.

Open: 0.00000205 - 0.00000208

Target 1: 0.000000225

Target 2: 0.000000243

Stop 1: 0.0000190

Please trade and sell at your discretion

.. Navid ..

Trading in a trend. ETH/USD trend. Past Trading Idea +70%Ethereum is currently moving in a strong uptrend. An ascending wedge formed. It is very necessary to be careful in trading now. In fact, holding the starting position while the trend continues. You can apply the pyramid trading strategy, about which I have an extensive article on how to work profitably and safely in two directions on one tool.

A break in the price of the trend line and fixing below it will indicate the weakness of the bulls as a result of a potential trend reversal. On the chart, for clarity, I showed the existing and past local uptrend, so that you understand the logic of work.

I will also set an example on my past trading ideas on how to work in similar situations. In order for you to better understand the essence of trading work. If you are not in a position on this instrument, then you can simply observe the development of events for the trading experience in the future.

My past trading idea for this ETH / USD pair. March 31, 2020

ETH / USD Triangle. The price is decreasing. Coming soon.

Profit already more than + 70%.

There has been no upward trend weakening since the triangle broke. The trend continues.

A similar situation on bitcoin in June 2019.

BTC is moving in an uptrend. Repeat 2014 or 2017?

An uptrend continues. Trend Trading and Important Areas Jun 27, 2019.

The trend stayed at the important zone and the price fixed under the trend line.

An attempt to return the price to an uptrend was unsuccessful.

What served as a signal of a reversal of the then upward trend on Bitcoin. And the formation of a bear measured move

BTC possible formation of a global triangle. Jun 28, 2019

Trading with the trend Option of forming a global triangle Jun 27, 2019

And a very similar situation was at one time on LTC a month before halving.

LTC trend trading. Crowd training before halting BTC Jun 25, 2019

Well, after a while (2 weeks). We saw a breakdown of the upward trend line.

As history showed that the breakdown before the halving served to reverse the current trend and the emergence of a downtrend.

I will continue the example of trend trading on the same coin.

LTC price uptrend is broken. Trading in a downward channel . Aug 14, 2019

As we see the downtrend continues.

Potentially work in a hypothetical downward channel that may form.

As we see from the history of the channel and formed. Work on this tool continues.

Trading idea + training. Nov 1, 2019.

TRAINING

Pyramiding money management. 2 part. Short LTC / USD.

In this training idea, I described how I worked on this LTC / USD pair long before the trend reversal.

Pyramiding money management. 1 part. Long LTC / USD

Also, I think this trading + training idea will be useful for you to familiarize yourself. The same pyramiding (trading in a trend), but on coins of average capitalization . The profit, as well as on the lightcoin, is impressive about + 200-350%. But the charm is that due to the fact that it is an altcoin of average capitalization, all the actions of the cycle occur many times faster.

Also, if a person worked in the algorithm that I described and defended my profit as shown in the idea of learning online, he would not be afraid of the margin focus of the Binance exchange that they scrolled on hamsters.

Pyramiding online on a pump coin. Matic. Whale Trading Nov 28, 2019

To all readers a lot of money in trading. Rock your mind and skills.

Why Price patterns work. Price patterns are patterns that were made by price based on the relationship between time and the movement of price on a price chart. They could be based on a single bar or candlestick, two or more, or even several bars or candlesticks. For now, I would be using just bars. They could be just for one session based on the timeframe or several sessions or days. The charts below illustrate some bars

Single bars

Multiple bars

Some of the reasons why price patterns work are:

1. Prices are determined solely by people’s changing attitudes towards the emerging fundamentals. That means, prices are determined by psychology. Garfield Drew is quoted as saying that: “Stocks don’t sell for what they worth, but for what people think they are worth.” One recent example of people’s changing attitude is the recent selloff in gold that was experienced at the heart of the Covid-19 pandemic. People thought gold being a safe haven could rise rapidly in prices, but for two weeks between March 9 and March 19, the price of gold fell by 14%.

2. Market prices are not random events. People’s changing attitudes towards the value of an asset moves in trends and trends tend to perpetuate. An uptrend is expected to keep going up until the market psychology changes and the same for a downtrend. The shifts in these attitudes are usually captured by price patterns. GBPUSD chart below showing how a shift in trend due to market sentiment is captured by the 123 pattern and trendline very perfectly. A huge rally ensued.

Notes on my observations:

1. Price patterns should not be used in isolation. When I trade price pattern I use confluence of the price pattern with support and resistance levels such as horizontal support and resistance, diagonal support and resistance from trendlines, and Fibonacci levels.

2. Also, you should take note of the underlying psychology that gave rise to the development of the price pattern. I generally trade pullbacks and reversal patterns because these give price actions that conform with the underlying psychology of the market in trends.

WHY IS MY TRADE STILL RED?? When will I see profits??!This a brief tutorial explaining pullbacks/retests/drawdowns in the market. I hope this helps put your mind at ease.

Example shown is of DAX30/GER30

Telegram @RichDadBre

Possible Trade Idea for GBP/USD! Hello Traders,

Here we have a possible Trade Idea for GBP/USD. We're looking at GU on the 1H here. REMEMBER Traders this is ONLY A POSSIBLE TRADE IDEA TO WATCH FOR!!! THIS IS NOT A SIGNAL, This trade is not confirmed yet. This is only something to watch for and a possible setup. Nothing is confirmed until we see the initial move to the upside and clean 3-4+ Confirmations. We might see a further push to the downside to the larger blue zone I have marked up. If the price does make a move to the downside this trade is canceled. The only thing we're looking for to make this trade happen is a breakout of the triangle I have drawn up. Once we see a breakout of the Triangle and a CLEAN retest and rejection and continuation to the upside this is where we could see a move to the upside. If all this plays out and we can find 3-4+ CLEAN confirmations we should be looking at a 200+ Pip move to the upside!

JUST A POSSIBLE TRADE IDEA!!! NOTHING IS CONFIRMED OR SET YET!!!

Please wait for the confirmations to activate this trade. If we see a break to the downside do not open a position on this trade. Please comment below or ask in the group chat if you have any questions!

Support And Resistance – The House! EICHERMOTOR.----------------------------------Support And Resistance – The House!----------------------------------

Support and Resistance explanation:

Imagine that you are looking at a vertical cross-section of an "Old fashioned dolls house " which is shown in the schematic. Now you can see all the floors and ceilings in the house, and as you can see here we have a ground floor, first floor, second floor, and roof.

The market then moves lower, having reversed, back to the floor, where it consolidates.

The concept of Support and resistance is important for a number of reasons.

--> First, as we have already seen, a breakout from a consolidation phase can be validated with volume , and if confirmed, provides excellent trading opportunities . The so-called breakout trade s.

It is a WIN/WIN. You have the comfort of knowing that once the market has broken through a ceiling of price resistance, not only does this become a floor of price support, it has also become a barrier of price protection in the event of any short term re-test of this area. Any stop loss, for example, could then be placed in the lower regions of the price congestion. This is why breakout trading is so popular.

EUR/USD Post Trade Breakdown Hello Traders,

Here I've got a Post Trade Analysis and breakdown on a trade I took for EUR/USD. Remember, this is a post-trade. Meaning this trade for me has ended so please do not take this trade as it is not current and I have closed my positions. This is just for educational purposes showing you what I did with this trade and what I saw.

To start off I was Looking at EUR/USD on the 4H & 1H. I found a Rising wedge formation indicating I could see a short on the pair. I put this pair on my watch list and was waiting for the breakout. As we know a rising wedge in a downtrend does suggest a continuation in the previous trend. I saw a decent Zone at the top of the wedge around the area of 1.09916. After seeing a clean rejection of this zone price was sent back to the downside and this is where we found our break of the wedge. As you can also see I found a trend line. It was a weaker trend line but it still played a role in my initial analysis helping me see a possible rejection. Below I have an image on the 4H what I was seeing and then I have a further breakdown of the trade on the 30 minutes showing my entry points.

Here I have a screenshot showing the 30 Minute time frame on my trade on EUR/USD. I knew I was looking for a trade and movement to the downside. My next step was finding entry points to enter this trade. As we know when looking at patterns we have to look for the breakouts of the pattern. We found our breakouts clearly on the 30 minute and 15-minute time frame. When I find trades on the 4H & 1H I find my entry points typically cleanly on the 30 Minute and 15 Minute time frames. Here I found my breakout of the pattern with two entry points. As you can see I have two zones marked up with Green. For my first entry on the trade, I found some Pin Bar candlesticks around my first green zone of 1.09370. As we also know when we see a pin bar at a resistance level it suggested to me a move to the downside. So this was my first entry on the trade. Now I quickly saw possible levels of support and resistance where we could see price slow down. (MY Second Green zone). My second entry point on this trade was at my green zone around the 1.09161 level. I once again saw a pin bar formation here at the resistance level showing a move down was in order. I made an additional trade entry at this point.

Overall I caught 70 + Pips from my first entry and roughly 50+ from my second entry.

Like I said this trade is now over and complete. If you have any questions on this trade breakdown and post-trade analysis please comment below or ask in the telegram!

DXY THEORY YOU HAVEN'T HEARD YET!THE DXY IS ONLY MADE UP OF 6 MAJOR CURRENCIES MEASURED AGAINST THE DOLLAR:

EUR (57.6% OF THE WEIGHTING),

JPY (13.6%),

GBP (11.9%),

CAD (9.1%),

SEK (4.2%),

CHF (3.6%)

A MISTAKE MANY PEOPLE MAKE WHEN PREDICTING THE DOLLAR'S STRENGTH IS USING THE DXY AS A GAUGE FOR ALL CURRENCIES' PERFORMANCES AGAINST THE DOLLAR!

EMERGING MARKET AND MANY OTHER MAJOR CURRENCIES ARE NOT INCLUDED IN THE DXY!

RECENTLY, PETER SCHIFF PLACED A BET WITH BRENT JOHNSON ON THE DIRECTION OF THE DXY, STATING THAT THE DXY WOULD BE WEAKER THAN 99 IN JANUARY 2021, WHILE BRENT JOHNSON PREDICTED IT WOULD BE HIGHER!

PETER'S THEORY CLAIMS THAT THE CURRENCIES OF PRODUCTIVE COUNTRIES WILL STRENGTHEN AGAINST THE DOLLAR FOR MANY OBVIOUS REASONS, WHILE BRENT CLAIMS THAT THE MASSIVE SHORTAGE OF U$Ds WORLDWIDE WILL ACT AS DEMAND ON THE DOLLAR, INCREASING IT'S VALUE AGAINST OTHER CURRENCIES!

I BELIEVE THEY COULD BE BOTH RIGHT, AND THAT PETER MAY HAVE MADE A MISTAKE IN USING THE DXY AS A BAROMETER:

BRENT JOHNSON IS RIGHT BECAUSE: THE WESTERN FINANCIAL SYSTEM WILL ABSORB ALL U$Ds CREATED, AND EUR, GBP, CHF AND CAD WILL ESPECIALLY SUFFER BECAUSE OF THE EURODOLLAR SYSTEM! WESTERN ECONOMIES COULD ALSO WEAKEN SEVERELY WHICH WOULD DEVALUE THEIR CURRENCIES IN ADDITION TO A EURODOLLAR SQUEEZE!

PETER SCHIFF IS RIGHT BECAUSE: AS COUNTRIES NOT INCLUDED IN THE DXY DIMINISH THEIR TRADE WITH THE U.S.A., AS THEY CEASE USING THE EURODOLLAR TO SETTLE FORMS OF TRADE NOT INVOLVING THE U.S.A. (MAINLY OIL), AND AS THE AMOUNT OF U$Ds' CREATED IN EXCESS OF THEIR DEMAND FOR DOLLARS INCREASES, PRODUCTIVE ASIAN AND EMERGING MARKET CURRENCIES WILL ABSOLUTELY STRENGTHEN AGAINST THE DOLLAR, BUT THIS WILL NOT APPEAR IN THE DXY!

IT IS ALSO POSSIBLE THAT THE FEDERAL RESERVE MEETS THE GLOBAL DEMAND FOR DOLLARS, AND THEN SOME, WHICH WOULD DEVALUE THE DOLLAR AGAINST ALL CURRENCIES, AND I BELIEVE THIS IS THE CASE, BUT I DO NOT DISCOUNT THE POSSIBILITY EXPLAINED ABOVE!

5-0 pattern. Bearish + 20% and bullish model + 51% Real tradingI must say almost all of this movement I took. Short + 8% (instead of 20%). At long + 55%, entry into the long was lower than shown in this example. I will attach the trading idea for which I worked below. She was published here on January 22. I used other methods of analysis and work, but I used this method that I want to talk about as evidence for my methods. The graph shows a bearish pattern, which immediately turns into a bullish 5-0 pattern, a very rare phenomenon. And that's why I decided to make this idea of training.

I want to say that the 5-0 harmonious pattern is very widely used in other markets, rarely in the cryptocurrency, due to the very low professional preparedness of the participants in this market.

Trading in this pattern can be either profitable or unprofitable, in the first place it depends not on the method itself, but on the person who uses this method. The 5-0 pattern is effective in areas of potential trend reversal. Just the pair ETH / BTC was in such a zone.

The profitability of trade largely depends not on the method of trading, but on the ability to use it.

________________________________________

A bit of history.

Harmonic patterns are the development of the idea of ordinary geometric patterns, using Fibonacci levels to more accurately determine pivot points. By the way, I almost never use the Fibonacci levels, as I see without them, what they show. For beginners in trading, it is better to use them.

By the way, who did not know initially in the father of harmonious trading Harold Gartley there were no Fibonacci levels. Only more than 80 years after the creation of the theory and the successful application of Larry Pesavento in practice, did Scott Kearney begin to pervert and sculpt exact numbers for each pattern that are far from real application on the market. It’s not customary to talk about this, but their main business is not real trading, but selling books, unlike Harold Gartley, who was a successful trader in the 20-30s during the Great Depression and became a millionaire! This is not an imaginary millionaire trader, a seller of courses and books, but a real trader who made all his fortune on real trading.

In mid-1935, Harold published his best work and the first book, which, translated into Russian, was called "Profit in the Stock Market."

The initial circulation of this book totaled only 1,000 copies. This book was very popular among traders, despite its very high cost. The book was worth 1,500 dollars, at that time it was possible to buy three new Ford cars for this amount. This is many times higher than $ 1,500 nowadays. One fact is that his books, which were being sold at the height of the Great Depression, let us understand how high authority he enjoyed among the people of the world of finance. The name of the pattern is Gartley Butterfly, which bears the name of its discoverer.

Already after the death of Harold, Billy Jones bought from Harold Gartley's wife the patent rights to the book “Profit in the Stock Market”, then continued to print it in large volumes. And a "perverse improvement" in working methods for making money on book sales started. That's why I have such a negative attitude towards such "specialists."

You have to be, not seem to be.

________________________________________________

5-0 pattern.

Pattern 5-0 is the youngest harmonious model (it is a variation of it with the Fibonacci grid thanks to traders of books on TA). The model usually represents the first pullback of a significant reversal trend. This is a relatively new model with 4 segments and specific Fibonacci measurements of each point in its structure, which excludes the possibility of a flexible interpretation.

Formation of the figure begins with a slight movement of the market, in the direction of a previously existing trend (segment AB), which was preceded by a comparable depth correction (XA). Point B, in this case, should not be higher than the level of 161.8% of point X. This is a fundamental point. If point B "goes" higher, then almost certainly the trader is dealing with short-term correction and the continuation of the existing trend.

The segment of the aircraft, in relation to the segment AB, is formed in the range between 161.8% and 224%.

The CD segment is a correction within the framework of an emerging trend. The correction depth (according to the classical pattern algorithm) should be 50% of the BC segment.

5-0 pattern template measurements:

The segment AB should be from 1,130 - 1,618. before the XA extension.

The segment BC should be a continuation of the segment AB from 1.618 to 2.240.

Point D should be formed at the level of 0.5 segment BC.

The segment AB must be equal to the segment CD, (AB = CD).

_______________________________________________

There are bullish and bearish formations of this pattern on the market. The graph shows both variants of the 5-0 pattern.

Bullish 5-0 pattern.

As you can see, the structure of the price movement at the time of the formation of the 5-0 pattern is generally very similar to the model of the Dragon figure with the development of goals. I made the ideas of training on this model of a figure and will fix it in ideas under the article.

Point 0 - the beginning of the downward movement, point X - the first correction upward, point A - the completion of the correction and the beginning of the fall down, point B - the end of the fall and the beginning of the strong upward movement, should be located at a level between 1.13-1.618 from XA, that the point C - the completion of a strong upward movement should be located between 1.618-2.24 from AB, point D is the end of the fall and the beginning of the upward movement, here we are trying to enter the market. The input should be at the level of 50% correction from the BC.

Bearish 5-0 pattern.

The structure of the bearish model of the 5-0 pattern is remotely similar to the model of an asymmetric head and shoulders or an inverted Dragon figure with a working out target.

Point O is the beginning of growth and the beginning of the formation of the model, point X is the beginning of correction down, point A is the beginning of growth and completion of correction, point B is the end of growth, should be located at the Fibonacci projection level between levels 1.13-1.618, point C is the end of a strong fall and the beginning of growth, point D - completion of growth, the place where we should open a deal for sale should be at the level of 50% correction from the BC.

Conservative traders are looking for additional confirmation before entering the trade. The 5-0 pattern can be either bullish or bearish. Goals can be set at the discretion of the trader, as the pivot point may be the beginning of a new trend. The common stop loss levels lie beyond the structure level beyond point D or the next important level for the Fibonacci sequence.

_______________________________________

Objectives for this pattern.

As it is a reversal pattern, which can act as a reversal pattern of the whole trend (the emergence of a new trend). You understand that there can be no clear goals, unlike simple figures. If you really get to the beginning of a new trend, the goals can be huge. It is important here not to exit the market prematurely. So that your profit does not turn into a loss, use the movement of stop-loss as the upward movement develops, but take into account the volatility of the instrument.

In this example, on the chart on the ETH / BTC pair, you can clearly see what the goals for this pattern can be.

The bearish model made a profit of + 20%

Channel support stopped a further drop in prices.

The bullish model made a profit of + 51%

The first goal is the resistance of the rising channel + 18%, as we see the price there was delayed for some time.

From this zone the reverse corrective movement to the support of the channel could take place. But, the price has successfully overcome this zone.

In total, the profit is + 51% of the entry point (point D).

In two models, the profit in theory was + 20 + 51% = + 70%.

But the reality is different, I have a profit of + 8% + 55% = + 60%

I rounded the interest for a better understanding, I will say one thing, there was no liquidity at the maximum to reset a significant position, and therefore the profit is much less than the theoretical one on the schedule.

______________________________________

Violations of the pattern 5-0.

More than any other pattern, the 5-0 structure presents a unique opportunity for decision making when the area of opening positions breaks through. In all 5-0 models, the best moment to enter depends on various ratios within the structure. When trying to make a deal while forming an unsuccessful 5-0 pattern, the trader still needs to look at the prevailing trend and at models at smaller time intervals.

Of course, the 5-0 pattern is not an ultra-precise model, and it may not work out even in the most correct situations on the market. What to do if the price has broken through all levels and left the channel, in such cases, the authors of harmonious trading offer quality ideas for opening positions. The first target in this case may be the area of correction 0.886 from the entire movement. Therefore, if prices fell outside the channel and broke through the 50% area, then we should expect continued decline.

______________________________________

Advantages and disadvantages of pattern 5.0

Despite the popularity of this pattern, I would like to first consider the disadvantages of the pattern. The main of its shortcomings should be called the poor "recognition" of the figure. After all, not all formations in the real market, exactly correspond to the ideal book example. In this example, I used exactly the ideal option for the ease of presenting information, and a person who is interested in adding this pattern to his arsenal of trading can also look for more complex formations for work. I would advise beginners to look for ideal models for work, as they are more predictable.

The developers and "popularizers" of the pattern emphasize its versatility. In their opinion, the pattern works with equal efficiency on any trading instruments and at any time intervals. If in the first part this statement is undeniable, then with regard to timeframes, the use of the pattern raises many questions.

On short timeframes, this pattern is not effective due to the high content of "white noise" and which does not allow to clearly identify and build the boundaries of the pattern.

Over long periods of time, the created corridor is so wide that, in fact, it can only indicate the direction of the trend (and even then in the long term). Thus, the efficiency of using this figure very much depends on the correctly selected timeframe. The ideal timeframe for work is 4 hours-1 day.

Remember the most important thing, this 5-0 pattern is effective in areas of potential trend reversal.

_____________________________________

I wrote above that I will attach trading ideas for this pair that I worked on. Which trading ideas made it possible to take profits in shorts + 8% and long + 55%.

1) This one worked in short when the head and shoulders formed. Published November 24th.

ETH / BTC Pivot Points. Ascending Triangle - Head and Shoulders

Result in short + 8%

2) The trading idea for which he worked in long. Published January 22.

ETH / BTC Coin operation. Reversal zones. Double bottom.

The result is now + 55%, the entrance was practically at the very minimum price when confirming support.

Perhaps we will see a reversal of the main trend by ETH18, if the price closes above the downtrend line (red line).

Also, in the idea of training on this graph, you probably all noticed which figure is being formed and how much you can earn from fulfilling its target.

Remember, trading is a game of probabilities.

Who trades from the situation created in the market - earns.

Who trades on the basis of what he wants - receives a loss.

The crowd trades out of their desires, not market probabilities. The crowd always loses.

From the pixels of thinking of individuals, a way of thinking of the crowd is created.

Thanks to the thinking and desires of the crowd, we earn.

The more stupid a society is, the higher the percentage of earnings in it is smart.

To earn, you need someone to lose money. No other way.

Under the article, I have fixed 31 learning ideas.

I didn’t even know that I already have so many of them.

Knowledge and experience are power!!!

CSIQ - Swing Trading Stocks with Two Indicators for 1 YearQuick Video swingtrading stocks journal for the CSIQ Stockover a 1 Year period.

During the last 1 year period we have used the tradethefift Roller Coaster and ElliottWave Indicator suites for TradingView to swing Trade the CSIQ Stock.

There were 7 trades in Total and only one loser! In this example we use $1000 risk per trade and the Result is a $7450 profit.

Please watch the short video to learn a little bit more about these strategies.....

Hypothetical UK Election Trade ...Election results come in...

(for which party will be in government). which results in a rise or fall in GBP

due to it's significance (in this instance it was seen as a good result and GBP rose).

-We know there is going to be volatility, so we can profit regardless of whether the

price goes up or down as when the price reaches certain points (A if price rises and

B if price falls) it will trigger a trade which will cancel the other one

-Can be executed on many pairs/ stocks if large results are due.

-Eliminates bias with OCO order.

--(DISCLAIMER) Set TP and Trigger point on major support resistance,

you don't want to trigger then go the opposite direction!!

Straddle Trades can be good for profiting regardless on where the price goes (in times of high volatility) and you could have made some good profits here, this could be replicated for trades such as EUR/GBP, Non farm payroll, US Elections etc... and are also known as OCO (One Cancels the Other) orders

THE TREND IS YOUR FRIEND... but don't trend trade!!As you have probably heard do not trade against the trend. I'm going to assume you know what this means but if you don't read the bottom paragraph first.

Trading with the trend is obviously much more beneficial to us, and its clear why we shouldn't go against it. But have you tried being a trend trader? Aka a person who tries to identify trends and rides these huge moves out and scales in along the way?

For starters markets range 90% of the time, so only in 10% of market conditions are you going to succeed. Assuming you don't miss the big move because of all the previous losers and break evens you had in ranging conditions which filled you full of self doubt.

There are people who successfully trend trade, and I ask myself why bother??? It is such a struggle, you have to go through so many loosing streaks and keep calm and collected until that big move comes and you're in on it. For me that is too much stress and too much of a strain on my brain.

Trade with the trend when there is one of course. Only buy if there is a clear uptrend and sell if there is a downtrend. But in my advice I would steer clear of trying to follow the trend orcatch these big moves; you'll get chopped up hard in between!

I like it simple. See where people just got wiped out by the banks and follow the big boys.

Do you want to join our gang Haha?

You stay classy San Diego.

***** Trading with the trend is only buying in an uptrend, and only selling in a downtrend, if you do not know what a trend is, message me or google "How to identify a trend in trading" *****

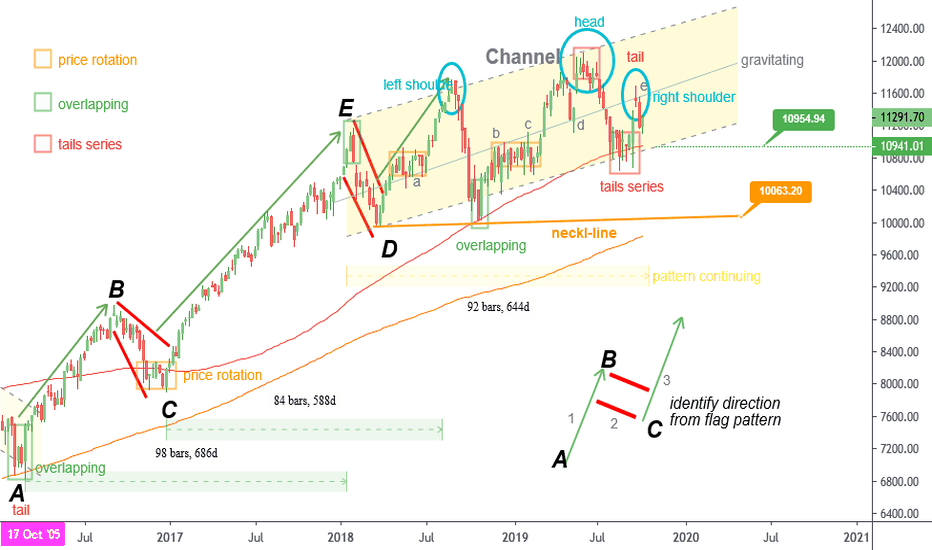

Nifty long-term chart analysis give a story from 2000 to 2020.Following patterns are found for data of 2015 to 2019 (5 years data) on weekly candle chart.

Channel pattern

Flag Patterns

Currently running Head and Shoulders pattern

Remarkable zone 1, 2 and 3

Head & Shoulders pattern is still uncompleted with right shoulder. The neckline target is 10063

At the remarkable zone, its has highly price rotatio n detected with tails

As per channel pattern , the range is 12600 to 10900. The gravitating target 12000 for nifty.

Conclusion, break 10900 below nifty can draw more downward.

History may not repeat itself, but Chart pattern gives you data points and insights to understand how the market can behave in the future.

Weekly candle chart for the spot NIFTY from 2000 to 2020 until the present. Patterns, uptrend, downtrend, or sideways trend, etc are drawn. We have divided this data in 5 years data chart. Comparing the four charts that We have generated, conclusions was written. There're many similarities and difference was found. We can get clear picture of NIFTY for next price move.

Case 1 (2000-2005)

Lot of time and brainpower attempting for technical analysis.

Case 2 (2005-2010)

Technical Chart patterns on nifty.

Case 3 (2010-2015)

Chart the weekly data for the NIFTY.

The constructor of your trading algorithmHi friends, today I want to share the constructor of your trading algorithm.

I want you to take a piece of paper and a pen and answer these for yourself

And this will be your individual trading algorithm

1. Trade style

Decide how you are going to trade

Choose your style

- Short term

- Swing trading

- Medium term

- Scalping

- Carrytrade

- News StraddleTrade

- Long term

- Other

2. Write more specifically here, what time will you work?

Indicate the hours of your work at the terminal

3. What's is stopping you from trading?

Here you should list ALL moments that can confuse you in trading.

I do not trade if:

- Bad mood

- I'm drunk (a), or fun)

- I'm sick

- Exceeded (a) the established level of risk for a day, week, month

- On the day of the release of important economic indicators

- Bank holiday period

- At the end of the fiscal year

- At the beginning of the fiscal year

- Other

4. Trade Details:

Describe in detail all the situational moments in the trade

I am analyzing yesterday's deals

Yes

Not

My instruments (what I trade)

__________

What type of analysis do you use

___________

What patterns do you trade

-add files

What important economic news do I see on the calendar

___________

I am doing a general market analysis on such timeframes

___________

What indicators do I use (indicate names and settings)

___________

Signals to enter the market, i.e. when I enter the market

___________

Pictures of situations

___________

I trade such a market model based on price levels

add files

For me, the signal to enter the market is a SELL order based on price levels

Price trading below the level after the breakdown of the level (breakdown of the level)

Price trading below the level without breakdown (reversal from the level)

In pictures it looks like this

_________

The signal to enter the market is a Buy order based on price levels for me

Price trading above the level after the breakdown of the level (breakdown of the level)

Price trading above the level without breakdown (reversal from the level)

In pictures it looks like this

_________

The signal for a false breakdown for me is

Maximum permissible risks for my deposit (in%) per transaction, per day, per month:

_________

The ratio of profit to loss is

1: 1

2: 1

3: 1

Your option:

Other

After entering the trade for each order, I set StopLoss

Yes

Not

After entering the trade for each order, I set TakeProfit

Yes

Not

In my trading, I practice partial fixation of the volume of the order (I close the profitable trade in parts) *

Yes

Not

What does it look like? Picture*

I make sure to work on the bugs *

Yes

Not