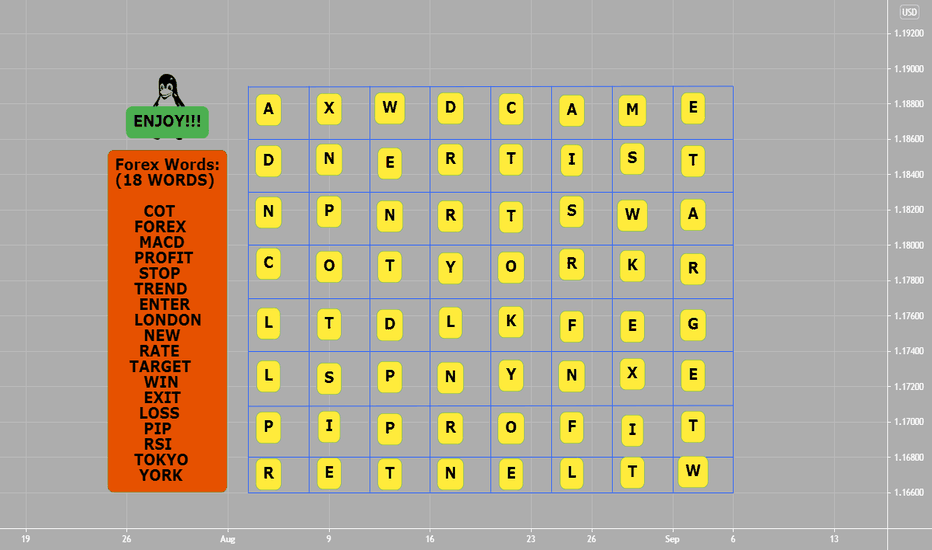

Forex Related Word Find (18 Words)E Enjoy and Have Fun. Balance is key in everything you do, life is short- balance of body, mind & spirit what humans should strive to be.

Find a way to have Forex trading be part of your life, but not the only thing in your life. Forex trading should give you time freedom.

Trading Psychology

The Hard Truth About Trading 😅

Well, that is just a joke.

Or not a joke?

In every good joke, there's a sliver of truth...

So many people blew their trading accounts in a blink of an idea chasing the profits, so many people went bankrupt practicing leverage trading...

Do not be that guy in a picture.

Be a true trader!

Never forget about risk management and don't be greedy.

Never let your emotions control you.

Stay calm and humble while you trade.

Have a great weekend!

❤️Please, support these drawings with like! It really helps!

The Hard Truth About Trading 😅

Well, that is just a joke.

Or not a joke?

In every good joke, there's a sliver of truth...

So many people blew their trading accounts in a blink of an idea chasing the profits, so many people went bankrupt practicing leverage trading...

Do not be that guy in a picture.

Be a true trader!

Never forget about risk management and don't be greedy.

Never let your emotions control you.

Stay calm and humble while you trade.

Have a great weekend!

❤️Please, support these drawings with like! It really helps!

🔋 Live to trade another day 🔋As the weekend has come we have lost many fellow traders in the days that have passed and we will lose many more in the next week and the week after that... but if they only knew the basic principles of what this video goes over, they (their accounts) would still be here with us!

Our mission is to help other traders become successful and in an effort to achieve our goals we come up with simple yet effective tips and tricks on achieving our goals, by helping you achieve your goals!

This video goes over some ideas and tips on how you can survive as a trader, the tips we go over are:

LIVE TO TRADE ANOTHER DAY:

- Use position sizing

- Have a definite exit area

- Prepare properly before starting to trade

- Review your trades daily or weekly (always seek improvement)

- Always follow your process & system

- Don't listen to others, find your own trades daily

- Cut your losers when the market tells you the trade is done, you

can always re-enter

We hope this video helps you achieve consistency! If you like it check out the other related videos on our channel!

Happy Weekend Traders!

How To Trade With The Big Banks (Price Cycle Trade Setup)Elements To The Trade Set Up: Price Cycle Of Institutions.

1) Expansion= Order block/Zone

Is when price moves quickly from a level of equilibrium in other words when price breaks out of consolidation. This will leave an order block or zone behind.

2) Retracement= PA Fills In Any Imbalance

Is when price pulls back inside the recently created price range or close to breakout of expansion area. Look for imbalance to be filled on retracement.

3) Reversal= Seek To Pick UP Liquidity

Is when price moves in the opposite direction from the current market direction was moving in. (from up trend to a downtrend).

4) Consolidation= Equilibrium In PA

Is a period of ranging or sideways price action, before expansion in price action area.

Trading Style? High Win Rate? High Risk Reward? Can't Have BothWin Rate, Risk/Reward, and Finding the Profitable Balance

You generally need to make a choice in your trading Forex: either have a high win rate % and low risk reward (hedge traders or scalp traders) or low win rate % and high risk reward. (day traders and swing traders).

Either can be successful, but it is a personal choice and different style of trading. Sometimes you can change depending on: pair, price, time & session that you are trading. End of Tokyo to end of London is high volume and liquidity daily time, so day trading might work and swing trading mid week. Hedging is mostly a high end money way of trading related to taking positions on both sides of a pair and scalping is going for many trades in same session, but make little pips per trade, but having high leverage per trade. These are great anytime of session, but do pretty good during low liquidity and volume times.

Win-rate is how many trades you win, usually given as a percentage. Such as 50%, 5 out of 10, or 50 out of 100. Means 50% of trades placed result in a profit.

Win rate is what many people focus on. They want to be right, often! Yet reward:risk (R:R) is just as important. R:R is how much a trader wins on winning trades versus how much they lose on a losing trade.

Most day traders focus on the win rate or win/loss ratio. The allure is to eventually reach that stage where nearly all their trades are winners. While this appears to make sense, having a high win rate doesn't mean you'll be a successful trader or even a profitable one. Your win rate is how many trades you win out of all your trades. For example, if you make five trades a day and win three, your daily win rate is three of five or 60%. If there are 20 trading days in the month, and you win 60 out of 100 trades, your monthly win rate is 60%.

What Is Leverage?Leverage is the use of borrowed money (called capital) to invest in a currency, stock, or security. The concept of leverage is very common in Forex trading.

By borrowing money from a broker, investors can trade larger positions in a currency. As a result, leverage magnifies the returns from favorable movements in a currency's exchange rate. However, leverage is a double-edged sword, meaning it can also magnify losses. It's important that Forex traders learn how to manage leverage and employ risk management strategies to mitigate Forex losses.

KEY TAKEAWAYS:

Leverage, which is the use of borrowed money to invest, is very common in Forex trading.

By borrowing money from a broker, investors can trade larger positions in a currency.

However, leverage is a double-edged sword, meaning it can also magnify losses.

Many brokers require a percentage of a trade to be held in cash as collateral, and that requirement can be higher for certain currencies.

Leverage simply allows traders to control larger positions with a smaller amount of actual trading funds. In the case of 50:1 leverage (or 2% margin required), for example, $1 in a trading account can control a position worth $50. As a result, leveraged trading can be a "double-edged sword" in that both potential profits as well as potential losses are magnified according to the degree of leverage used.

Example: USD/CAD at 50:1 or 2% leverage ( in this example, if you place a 100,000 USD/CAD trade with 50:1 leverage, your margin requirement will be $2000. Trade Size: 100,000 Margin: $2,000 Trade Size: 10,000 Margin $200 and Trade Size 1,000 Trade Size $20. *Required Margin. Required margin is the minimum account balance needed to hold a position.

Leverage 50:1 (maximum Reward Risk)Should you use 50:1 leverage or maximum Reward Risk on any one trade? Is that using proper risk management?

Per chart example:

1) You could either lose on chart one trade 10% of your account or

2) You could win on chart one trade 25% of your account

Using Leverage is a double edged sword, which can be used or abused in the context of risk management, lot size, margin and leverage.

Bad risk management is number #1 reason why traders blow accounts.

Use 2% of account on one single trade, adjust lot size accordingly, stop losses and targets- this is a marathon not a sprint.

Leverage Trading (Example)What is leverage in Forex?

Leverage is a facility that enables you to get a much larger exposure to the market you’re trading than the amount you deposited to open the trade. Leveraged products, such as Forex trading, magnify your potential profit - but also increase your potential loss.

Leverage works by using a deposit, known as margin, to provide you with increased exposure to an underlying asset. Essentially, you’re putting down a fraction of the full value of your trade – and your provider is loaning you the rest.

Leverage and risk management

Leveraged trading can be risky as losses may exceed your initial outlay, but there are risk-management tools that you can use to reduce your potential loss. Using stop-losses is a popular way to reduce the risk of leverage. Attaching a stop-loss to your position can restrict your losses if a price moves against you. However, markets move quickly and certain conditions may result in your stop not being triggered at the price you’ve set.

The basics: Higher Highs and Higher LowsMarkets trend. There are impulses, and in those the price consistantly makes several higher highs and lows, or lower highs and lows in the case of a downtrend impulse, or leg. The majority that try to compete in this activity fail, and from what I have seen they either don't know the basics, or have loss phobia. Or are dense, that's also a possibility.

It is basic. Do not go against the trend. Especially when it is diagonal. The market goes up in impulses. Forget elliott or dow waves, there can be any number of impulses within the impulse. 5 higher highs and lows, 6, 7, 8. Of course I am not used to seing something like 25 in a row. People would become instant billionaires if that happened. I wish...

I can't prove the market behaves in that way but I can use some empirical evidence. In here I will present a couple of examples. 2, 3 or 4 examples can be a coincidence. But when something repeats itself over and over it is unlikely it is a coincidence. It's basic and easy to play around the fact that currency pairs make successive higher highs and lows. For example it might be pointless to hold a long once the price has reached a lower low (but it's a bad idea to have a stop at the very low or just below it).

Eurodollar downtrend from the 20 April to the 10 May:

Put into context:

And then the new low:

Another example:

Forex charts look noisy and random, but they are obviously not random. The price does not randomly make a higher high in a downtrend then continues down. It keeps making lower highs without fail, and once there is a higher high well, most of the time it does not go just slighlty higher then drop.

How embarassing is it that PHD economists can't see this?

Sometimes a higher high in a downtrend is a trap

Here is what individual investors can be seen doing:

Retail positions have no predictive abilities that I know of.

Their entries are basically random. And don't matter.

I am not contrarian to retail positions when I enter, sometimes I buy with 80% of them.

I see 0 correlation with my entries.

But where is there a difference? Each time I have a big winners going past 5R I look at retail positions, and what I see is 80-90% are in the opposite direction (and have been for a while).

Them sucking and being on the wrong side could either be due to entering at stupid moments, or closing winners quickly and holding losers which leads to an aggregate of "80% long" at the bottom of long downtrends.

Are they dumb or afraid? By afraid I mean loss aversion.

I do not think personally they are all idiots that just go against the trend, but I do think there are a lot of individual investors that do just that. I can imagine them being all nervous while I'm just chilling.

I would say at least 90% got to be afraid, let's simply call it what it is: weak.

There are plenty of idiots. Who gets into this? People that have money and went to school right?

Engineers and doctors? There has to be some gamblers too.

In investing in general I know the vast majority is "educated" as well as IQ > 100 but short term like this might not have the same distribution.

How basic is it? Price makes lower lows and highs it is going down, and once there is a higher high the trend takes a break or reverses.

Trade like a pro, not another statistic.

COT Report (How To Find Information & USDJPY Bullish)Commodity Futures Trading Commission (Commission or CFTC) publishes Commitments of Traders (COT) reports to help public understand market dynamics.

------------------- I used website called: Tradingster to get COT Report but you can see information directly from CFTC.gov too.

How To Find Official Information:

1) Google or DuckDuck go: cftc.gov 2) Left side under Market Data & Economic Analysis

3) Click On Commitments Of Traders 4) Scroll down to section called Current Legacy Reports

5) See 2nd one, which says Chicago Mercantile Exchange----> under Futures Only----> see Long Format or Short Format 6) Click on Short Format

7) You now see a lot of both commodity and/or Currency Futures (Forex) information---> scroll down to like Example Japanese Yen (chart example)

Why Was USDJPY Bullish During Last Cot Report Of Date 08/10/2021 (Tuesday)? (BELOW IS CUT/PASTE of Japanese Yen Information)

JAPANESE YEN - CHICAGO MERCANTILE EXCHANGE Code-097741

FUTURES ONLY POSITIONS AS OF 08/10/21 |

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL | COMMERCIAL | TOTAL | POSITIONS

--------------------------|-----------------|-----------------|-----------------

LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

--------------------------------------------------------------------------------

(CONTRACTS OF JPY 12,500,000) OPEN INTEREST: 206,131

COMMITMENTS

36,684 97,341 461 151,720 68,459 188,865 166,261 17,266 39,870<------ THIS IS INFORMATION YOU NEED TO KNOW!!!

FYI: From above information we can see total contracts of JPY of 12,500,000. Open Interest is 206,131. Non Commercial Traders have 33,000 more short contracts and Commercials have 83,000 more short contracts outstanding. What does that mean? JPY is Weak & USD is Strong- verified on chart.

The Art of Swing TradingHey, family, we are wishing you all a pleasant weekend and coming at you with another educational post. The topic of our article for today is the following: The Art of Swing Trading. As you all may know, Swing Trading refers to the practice of trying to profit from market swings of a minimum of one day and as long as several weeks. But what is it that makes this type of market trading so unique? Let’s follow through and find out!

To start with, Swing Trading is safer than other types of trading such as day trading and scalping. This is due to the fact that with Swing Trading, you are less likely to overtrade, there is less stress and there is a reduced chance of making mistakes. Secondly, with Swing Trading, you are likely to spend much less time on the charts in front of monitors. You don’t have to open many positions within a day as opposed to intraday trading and scalping, which gives you plenty of free time in your hands. You can simply open your positions and then forget about those positions for days or weeks to come. You can go for a walk with your partner, grab a cup of coffee with your best friend, spend a quality time with your family, and do it all without being anxious about your trades. As the golden rule states: “Set (Your TP and SL) and forget”. Last but not least, financial news do not have a huge impact on your positions, as your SL is relatively higher than the Stops of day traders and scalpers. Therefore, you do not need to worry about some random spikes taking you out of the trades.

However, as the famous proverb cites, every advantage has its disadvantage. When it comes to Swing Trading, he or she needs to have patience, patience and some more patience. Swing trades are meant to be held open for a few days of even few weeks (Well, at least till the price hits your Target Profit). And while the trade is running open, you should know how to remain calm, control your emotions, and not to stress out. Once again, set and forget. Do not monitor your positions every 10-15 minutes. Further to that, this type of trading generally requires a huge trading capital, or otherwise, the profits are gonna be minuscule.

When it comes to the timeframes that need to be used, the Weekly and the Monthly are the best for identifying the direction of the trend, the Daily is the best for drawing the key zones and identifying the needed patterns, and lastly, H4 should be utilised for entering and exiting the market.

As for the recommendations part, the utilised risk fully depends on the trading capital. The 1-1.5% risk would be the standard normal. As for the risk-to-reward ratio, 1:3 would be an appropriate one to go with. But remember not to be greedy in the markets. Take your profits and enjoy the fruits of your labor.

The COT Report (How To Use/Strategies) BonusHow To Use The COT Report In Your Forex Trading

Before we discuss how to trade the Forex market using the COT Report, you should know why the COT Report is important for Forex traders.

Forex trades are executed over-the-counter (OTC). There is no central body, like NYSE, where all trades are recorded. It is difficult to accurately track volumes behind all Forex trades. It is also harder to know what big banks, large speculators, and other market drivers, are doing. But with the COT report, Forex traders can have an insight into these pieces of info. Which brings us to first use of the COT report in FX.

Trading Strategy 1: COT Report as a Forex volume indicator

The COT report can serve as a powerful Forex volume indicator when you use it rightly. Since CFTC releases the weekly report every Friday for all trades recorded before Tuesday, you can only use it for long-term trades. To use the COT Report as a volume indicator, keep your eyes on the open interest numbers of an asset. When there is a rise in the open interest of an asset, it means more people are trading the futures contract of the asset.

Trading Strategy 2: Using the COT Report to predict reversals

There are two ways to use the COT report to spot potential reversals in the Forex market. The first method is the use of the spreads data on the report. A reversal may occur when the spread between commercial and non-commercial traders is wide. If the commercial traders are going heavily bullish while the non-commercials are heavily bearish, the market could experience a reversal to the uptrend. And if commercials are going short while non-commercials are going long, a reversal to the downtrend may occur. The other method involves noting where the non-commercial traders are accumulating their positions. Remember that non-commercial traders are the big money guys that are interested in making more money. They are the ones you want to mimic.

So, when you find that their positions on a certain futures contract are reversing, and a reversal might be imminent on the underlying asset. This use of the COT report is similar to how you might use a sentiment indicator, such as the Current Ratio FXSSI indicator, in a Forex sentiment analysis. To get better results, you can use the data from the COT report to complement your technical analysis from other Forex trading tools. good luck.

The COT Report (Why Did EurUSD Fall?) Part 3 of 3C.O.T. is an acronym for Commitment of Traders. It is a report that contains a weekly overview of how participants of the futures markets in the U.S. have traded. The report contains all the positions of the main market factors in the United States. Why Did EurUSD fall during the latest COT Report from 8/3/21 to 8/10/21 (date period)- came out Friday on 8/13/21. Yes, data is historical in nature, but has great future value in trading FX for long and short term traders.

EURO FX - CHICAGO MERCANTILE EXCHANGE Code-099741

FUTURES ONLY POSITIONS AS OF 08/10/21 |

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL | COMMERCIAL | TOTAL | POSITIONS

--------------------------|-----------------|-----------------|-----------------

LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

--------------------------------------------------------------------------------

(CONTRACTS OF EUR 125,000) OPEN INTEREST: 702,098

COMMITMENTS

212,809 178,952 8,072 388,866 458,925 609,747 645,949 92,351 56,149

Above is part of 8/13/21 cftc.gov latest COT report.. The Difference in total longs and shorts (of both non commercial/commercials) equals 36,202 more short contacts. Contracts of EUR 125,000 (total) divided by 36,000 (more shorts) equals around 29% more of short contracts outstanding. This is why I believe that EURUSD dropped during the last COT report period of around 180 pips. Note: The COT keeps you on right side of trading with smart money.

Yes, using both commercial and non commercials are way to go for looking to where a particular market might go related to the COT report.

The COT Report (Trade Like Banks) Part 2 of 3C.O.T. is an acronym for Commitment of Traders. It is a report that contains a weekly overview of how participants of the futures markets in the U.S. have traded. The report contains all the positions of the main market factors in the United States.

These major market drivers include institutional traders, hedge funds, big banks, and more. And the weight these traders pull on the markets can sometimes be staggering enough to drive trends. As retail Forex traders, our best bet is to trade like big financial institutions or Big Banks, Central Banks, Hedge Funds.

They are the non-commerical traders. Non-commercial traders are large speculators who already have a lot of money in the bank, but want to make some more by trading the futures market. Examples of these non-commercial traders include hedge funds, trading advisors, and other huge financial institutions. These institutions follow the trend religiously. They buy in an uptrend and sell in a downtrend.

The majority of Forex traders are you and I; retail traders. We make up over 90% of all traders. The remaining 10% (or less) are smart money traders, such as banks. Smart money traders make the largest and most consistent profits between these two categories of traders. They are profitable 90% of the time. But retail traders lose money over 90% of the time.You may then wonder how banks make so much money and many retail traders lose so much money. The answer lies in how the banks trade Forex. FYI: There phases are: Accumulation then Manipulation then Distribution, then rinse and repeat over and over.

Now that you know who the smart money traders are, you want to know how they are different from you.

Firstly, smart monies have much more money to trade than you. I'm not talking about thousands or hundreds of thousands. Smart monies have tens and hundreds of millions to trade. And the sheer volume of their trades gives them the power to drive the market.

Secondly, they don’t trade on small time frames. Smart monies trade daily, weekly, or even monthly time frames. Traders that trade on small time frames are usually looking to get in and out of the market in a short time. But the smart money is usually in the market for a long time.