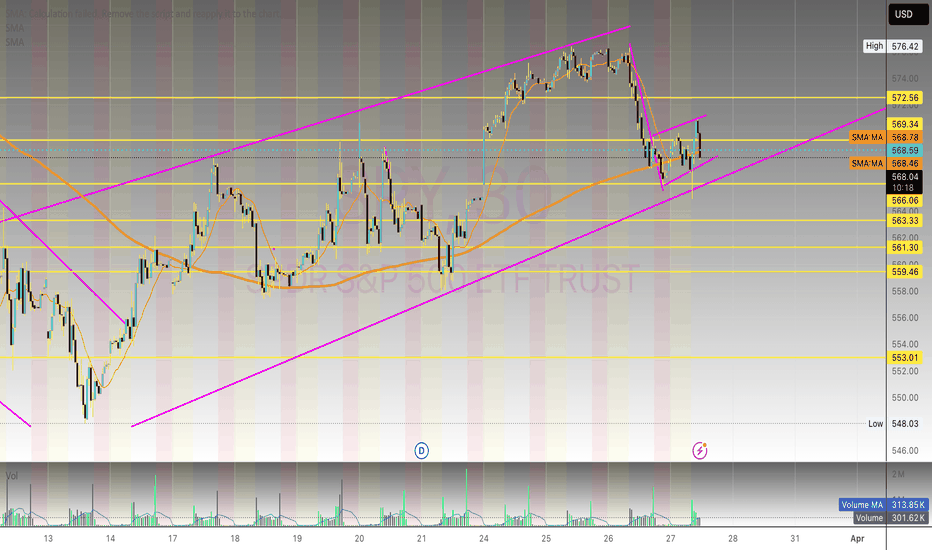

SPX500 & Nasdaq: Confluence! Confluence! Confluence!With consumer confidence off at circuit breaking levels, the market, technically, has reached extreme levels of support. Let's look at it:

Technicals:

(1) Horizontal Levels of support

(2) 50%/61.8% fib confluence

(3) exDiv1

(4) extreme indicators

(5) Chikou span testing cloud support

(6) 28% drop is SPX

All of these levels are lining up around the same location. And just like in real estate "Location! Location! Location!" is the adage; in markets, "Confluence! Confluence! Confluence!" is the adage!

Community ideas

EDUCATION: The $5 Drop: How Trump’s Tariffs Sent Oil TumblingOil markets don’t move in a vacuum. Politics, trade wars, and global economic shifts all play a role in price action. Case in point: the recent $5 drop in oil prices following Trump’s latest tariff announcement.

What Happened?

Markets reacted swiftly to Trump’s renewed push for tariffs, targeting key trading partners. The result? A ripple effect that sent oil prices tumbling as traders anticipated lower global demand. The logic is simple—higher tariffs slow trade, slowing trade weakens economies, and weaker economies use less oil.

Why It Matters to Traders

For traders, this kind of volatility is both an opportunity and a risk. Sharp price drops like this shake out weak hands while rewarding those who position themselves with clear strategies. If you trade crude oil, understanding the macro picture—beyond just supply and demand—can make or break your positions.

The Next Move

Is this just a knee-jerk reaction, or the start of a larger trend? Smart traders are watching key levels, tracking institutional order flow, and looking for confirmation before making their next move.

How do you react when headlines move the market? Do you panic, or do you position yourself with a plan? Drop a comment and let’s talk strategy.

Alibaba - Don't Forget Chinese Stocks Now!Alibaba ( NYSE:BABA ) still remains super interesting:

Click chart above to see the detailed analysis👆🏻

After we saw the very expected parabolic rally on Alibaba about four months ago, Alibaba is now perfectly retesting major previous structure. Yes, we could see a short term pullback in the near future but this just offers a perfect break and retest after the rounding bottom pattern.

Levels to watch: $110, $140

Keep your long term vision,

Philip (BasicTrading)

BRBR Power Bar and Protein Shakes Shakin' It UP!Fundamentals:

Meets my parameters for investing long-term.

Technicals:

Daily:

ExDiv1

Triples

161 extension, equal legs and weekly key fib meeting at the same spot (confluence)

New Crown high formed on the daily

Weekly:

uHd+hammerw/ d3 volume @ key fib pullback

morning star

Met monthly average range

Kijun signal

extreme indicator

Target 140 (tentatively), but will hold forever if I possible

Tentative rethinking point to buy more investment if it falls is about 48.

BTC- Weekly Analysis: Elliott Wave ProjectionThis analysis applies Elliott Wave Theory using ghost candles to project potential future price movement for BTC/USDT Perpetual on Pionex.

Wave Structure: Completed (W)-(X)-(Y) correction followed by a speculative (A)-(B)-(C) correction using ghost candles.

Key Levels: Support at $110,791.5 (trendline), Resistance at $140,454.5.

Volume Confirmation: Low volume (154.4K) confirms the projected wave is speculative.

Forecast: If price respects the trendline, the next impulse wave could reach $140,454.5. A breakdown could target $73,238.2.

Be the Choosy trader on Gold!Price is dragging on dropping. being very indecisive. Looks like the entire market is waiting on News to help give it a push. I need to see price break out of value before I can get a read on a sold move. in the mean time this is sclaping conditions. You can hold trades. Have to cut them short quick with this price action. Since we have some USD news tomorrow that indicates that the market might be waiting for that before proceeding on any decisions. Patience is key!

NFLX & chilling until...Earnings. I have been bearish on this stock technically. Currently it is floating within the Bollinger Bands. Today (3/26) was pretty bearish on the market overall. I read that NFLX will be raising rates or creating alleged value within its ad tiers. I like commercials, so I'll keep watching them lol. Anyways... I just know that people will be affected by loss of jobs/income. NFLXing may not be top of mind for many. I also hear rumors of a stock split. That would be great. & if it happens, I'll still be looking for pullbacks. Will see how week and month close. Earnings 4/17.

***Side note... I remember when the original CD business launched during my college days. Oh how I wish that I was investor savy at the time. Sigh... Looking forward to earning some moolah on my trade ideas now.

AUDUSD triangle pattern suggests a big move is comingAUDUSD has been consolidating in a triangle pattern, suggesting a breakout is near—likely within weeks. A bullish breakout could target 0.6393, with potential for a 229-pip move. A bearish break is also possible but less clear. The setup offers strong risk-reward, with examples showing a 5.6x ratio.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

Tips for Corrections & Dips with TradeStation: TradingView ShowJoin us for an insightful TradingView live stream with David Russell, Head of Global Market Strategy, as we dive deep into the latest market developments, including potential crashes, corrections, and the upcoming Federal Reserve announcement. We'll cover it all, LIVE!

In today’s session, we’ll explore the critical factors shaping the market landscape and how you can leverage the TradingView platform to stay ahead. Plus, we’re excited to share a major update to our broker integration with TradeStation, which opens up new trading opportunities and provides expanded options for your portfolio strategy.

TradeStation, a fintech leader since 1982, has built a reputation for providing institutional-grade tools, personalized services, and competitive pricing to active traders and long-term investors alike. Known for their innovation and reliability, TradeStation remains a trusted partner in navigating volatile market conditions.

For the first time, we've expanded our integration with TradeStation to include equity options trading directly on TradingView. This new feature complements our recently launched options trading suite, featuring tools like the strategy builder, chain sheet, and volatility analysis, helping you make informed decisions, especially in light of potential market corrections.

This session is sponsored by TradeStation, whose vision is to provide the ultimate online trading platform for self-directed traders and investors across equities, equity index options, futures, and futures options markets. Equities, equity options, and commodity futures services are offered by TradeStation Securities Inc., member NYSE, FINRA, CME, and SIPC.

www.tradestation.com

www.tradestation.com

AMD stock up over 20% off the lows- outperform NVidia?AMD is still cheap relative to its growth and still way down from all time highs.

Seeking alpha analysts expect 25-30% annual growth in earnings yearly. The stock is still in the low 20s PE. Stock can double and still be a good business worth owning for the long term and let compounding earnings work.

Low rsi and bollinger bands gave us the signal to buy, we bought with leverage, now we are in the shares unlevered.

Target would be all time highs over the next 2-3 years.

Trading isn't Rocket Science!!! - BUY NAS100 All the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

Trading Is Not Gambling : Become A Better Trade Part IOver the last few weeks/months, I've tried to help hundreds of traders learn the difference between trading and gambling.

Trading is where you take measured (risk-restricted) attempts to profit from market moves.

Gambling is where you let your emotions and GREED overtake your risk management decisions - going to BIG WINS on every trade.

I think of gambling in the stock market as a person who continually looks for the big 50% to 150%++ gains on options every day. Someone who will pass up the 20%, 30%, and 40% profits and "let it ride to HERO or ZERO" on most trades.

That's not trading. That's flat-out GAMBLING.

I'm going to start a new series of training videos to try to help you understand how trading operates and how you need to learn to protect capital while taking strategic opportunities for profits and growth.

This is not going to be some dumbed-down example of how to trade. I'm going to try to explain the DOs and DO N'Ts of trading vs. gambling.

If you want to be a gambler - then get used to being broke most of the time.

I'll work on this video's subsequent parts later today and this week.

I hope this helps. At least it is a starting point for what I want to teach all of you.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Quick Simple ReturnsQSR baby! That's what that stands for to me. Anyway, it took a ton of searching, high and low to find this stock. The markets just haven't really turned from their bearish sentiment even after a strong day yesterday. I need to add some long delta to my portfolio and think this stock is just the one. Check out my market overview for why it has been so hard to find a bullish stock.

How to use ETFs instead of Indexes to know how to trade that dayMost Traders use the indexes to try to understand whether they should buy long or sell short. However, the ETFs impact the index components prices not the other way around. Most traders do not realize that they should be studying the ETF of an index rather than the index to determine how to trade the next day. Also ETF trading can be highly lucrative. Using the chart layouts that I have designed to trade Dark Pool activity, HFT and Hedge Fund activity and Sell Side activity helps you understand who is on control of price for the ETF and thus is created the value changes of the indexes.

When you study the ETF rather than the index, you will find you have far more information in the chart, indicators and price changes.

EURUSD - How Long Will The Bullish Gravy Train Last?German Chancellor-in-waiting Friedrich Merz announced he had secured the crucial backing of the Greens for a massive increase in state borrowing.

The deal will likely be approved by the outgoing parliament next week. It includes a 500 billion euro ($544.30 billion) fund for infrastructure and sweeping changes to borrowing rules.

Due to this, the dollar weakened against the euro but rose against the Swiss franc and the yen, underpinned by the likelihood the U.S. government will avert a shutdown over the weekend.

Will this weeks high impact events lead to the weakening of EURUSD?

AAPL and MSFT Reading Charts For Better Entries and ExitsOptions Trading Strategy Using Ichimoku Cloud, 200 SMA & Monthly Contracts

(Following Your 3 Trading Rules)

This strategy adapts the Ichimoku Cloud & 200 SMA trend-following method for trading monthly options contracts with a focus on high-probability setups. It leverages time decay (theta), trend strength, and proper timing to maximize gains while reducing risk.

🔹 Strategy Overview

We will trade monthly options contracts using:

Trend confirmation via Ichimoku Cloud & 200 SMA

Directional bias based on price positioning

Entry timing rules to avoid low-probability setups

Theta-friendly positioning (avoiding weeklies to reduce time decay risks)

📈 Trading Rules & Setup

(My 3 Golden Rules)

🚫 No trading on Mondays → Avoids choppy market structure from weekend gaps.

🚫 No trading on Fridays → Avoids gamma risk and weekend time decay.

⏳ No trades before the first 15-minute candle closes → Ensures market direction is established.

📊 Selecting the Right Option Contract

For monthly expiration contracts, select options that:

Expire within 30 to 60 days (avoid weekly contracts to minimize rapid time decay).

Are slightly in-the-money (ITM) or at-the-money (ATM) for higher delta (0.55–0.70).

Have open interest >1,000 and a tight bid-ask spread to ensure liquidity.

Example: If today is June 11, trade the July monthly contract (third Friday of the month).

📉 Bearish Put Play (Short Trade)

200 SMA Bias: Price is below the 200 SMA

Ichimoku Cloud Confirmation:

Price is below the cloud

Tenkan-sen is below Kijun-sen (bearish momentum)

Chikou Span is below price from 26 candles ago

Future cloud is red

Entry Trigger (After First 15 Min Candle):

Price pulls back into the Kijun-sen but rejects it

OR price breaks below the cloud after a weak consolidation

Enter PUT contract (monthly expiration)

Stop Loss & Take Profit:

SL: Above Kijun-sen or recent swing high

TP: First at the cloud’s lower edge, second at a key support level

Exit before Theta decay accelerates (last 14 days before expiry)

📈 Bullish Call Play (Long Trade)

200 SMA Bias: Price is above the 200 SMA

Ichimoku Cloud Confirmation:

Price is above the cloud

Tenkan-sen is above Kijun-sen (bullish momentum)

Chikou Span is above price from 26 candles ago

Future cloud is green

Entry Trigger (After First 15 Min Candle):

Price pulls back into the Kijun-sen but holds

OR price breaks out above the cloud

Enter CALL contract (monthly expiration)

Stop Loss & Take Profit:

SL: Below Kijun-sen or recent swing low

TP: First at the cloud’s upper edge, second at a key resistance level

📊 Trade Management & Adjustments

Rolling: If trade is profitable near expiry but not at the full target, roll to the next monthly contract.

Closing Early: If the trade is at 70-80% max profit, close early to avoid decay risk.

Cutting Losses: If price closes inside the Ichimoku Cloud, consider exiting early (trend loss warning).

🛠 Why This Works for Monthly Options?

✅ Avoids time decay risks of weekly options by trading monthly contracts.

✅ Uses strong trend confirmation from Ichimoku & 200 SMA.

✅ Only trades at high-probability times, avoiding choppy Monday & Friday moves.

✅ Allows scaling into strong trends rather than short-term noise.

Why DCA Does Not Work For Short-Term TradersIn this video I go through why DCA (Dollar Cost Averaging) does not work for short-term traders and is more suitable for investors. I go through the pitfalls than come through such techniques, as well as explain how trading should really be approached. Which at it's cost should be based on having a positive edge and using the power of compounding to grow your wealth.

I hope this video was insightful, and gives hope to those trying to make it as a trader. Believe me, it's possible.

- R2F Trading