KOG - JACKSON HOLE Part 1Jackson Hole Symposium:

What is the Jackson Hole Symposium?

The Jackson Hole symposium (Economic Policy Symposium) is held in Jackson Hole, Wyoming USA. It is an event attended by the worlds top financial professionals including ministers, bankers and academics. It is a closed event so no press are allowed access to the meetings or talks. Instead, press conferences are held throughout the event where any comments from financial professionals usually move the markets and cause extreme volatility.

This is not the usual analysis we provide. Instead, what we wanted to show you is the last 3-4yrs of market data illustrated on the charts, giving you an idea of what this event can do and cause on the markets. In this example, on Gold.

So, lets start with last year, 2021. We can see the price was at a similar price point to where we are today, just slightly higher at around the 1780 level. The early sessions were quiet, however, after a retest of the low look at the aggressive move to the upside! Price started at 1780 and the move completed at 1836. 500+ pip move in a matter of days.

Lets look at the top right chart, 2020. Again, look at the choppy price action, the whipsaw up and down, then the rested of the low before an aggressive move to the upside. Price started at 1904 and the move completed at 1994. 900pip movement in a matter of days.

Now 2019, a slow start in the early sessions, all of a sudden, a rested on the low and then another aggressive move to the upside. Price started at 1491 and completed the move 1557. Over 500pip movement in a matter of days!

What we’re trying to show you here is that its going to be a very difficult event to trade for new traders. Its going to be choppy, its going to be volatile, its going to whipsaw and its likely to move. If you’re caught the wrong side of it its going to kill your account. Best practice here is to let the market make the moves it wants to, wait for the price to settle in whatever level they want to drive it to, once this has happened then look for the setup to get in to the trade.

Hope this helps.

As always, trade safe.

KOG

Fractal

Understanding the Learning CurveWelcome to @Vestinda new article about Learning Curve! We are delighted to share this insightful piece with our valued community on @TradingView !

At Vestinda, we believe in empowering traders with knowledge and tools to navigate the cryptocurrencies and futures trading. In this article, we will explore the concept of the learning curve and its relevance to the trading journey. Whether you are a novice trader or a seasoned professional, understanding the learning curve can be instrumental in your path to success.

If you focus and invest time into a subject, you will eventually reach a level of mastery.

The actual level clearly depends on the amount of invested time and to a significant extent on your inherent abilities to acquire the specific knowledge. I could probably spend a decade on quantum physics and not progress beyond the level of ‘enthusiastic beginner'. However, attaining mastery is seldom a smooth and linear journey. It is more like a curve in the mathematical sense, characterized by uneven ups and downs, reflecting the usual 'bumps in the road' that we all experience when dealing with challenging topics.

There is a pattern in the process of learning something new (knowledge, skills, etc.), which was formulated by the American psychologist Albert Bandura. This pattern is depicted in the form of a graph known as the Bandura curve.

The graph demonstrates the relationship between time (number of attempts), the level of human competence in what they are studying, and their expectations.

If you have ever enthusiastically started a new training, holding high hopes for it, and then quietly gave up, blaming others or anything else, then you are not alone. To avoid repeating this in the future, it's important to understand how human psychology and the system work, and that each of us is part of this system. Below, we will provide recommendations on what to pay attention to.

So, the Bandura curve shows the stages a person goes through when beginning to learn something new.

1. Clueless (You don't know what you don't know)

When you first venture into trading cryptocurrencies and futures, you are essentially clueless about the intricacies of the market. The concepts, strategies, and tools may seem foreign and overwhelming. It's like staring at a vast landscape without a map, unsure of where to even begin.

2. Naively confident (You think you know, but still don't know what you don't know)

As you begin your learning journey, you might gain some basic knowledge and techniques. This newfound understanding might lead to a sense of naively confident. You believe you have a handle on things, but in reality, there's a lot you're still unaware of, and the market can surprise you with unexpected turns.

3. Discouragingly realistic (You know what you don't know)

With more experience, you come to a point of realization that there is much more to learn. The challenges and complexities of trading become evident, and you may face setbacks that test your resolve. It can be a discouraging phase as you grapple with the reality of how much you still need to learn.

4. Mastery achieved (You know it)

Through persistence and a commitment to learning, you gradually achieve mastery in trading cryptocurrencies and futures. You've gained a comprehensive understanding of the market dynamics, developed effective strategies, and learned how to manage risks. You can now navigate the market with confidence and consistently make informed decisions.

Remember: The learning curve in trading is a natural part of the process, and each stage brings its own valuable lessons. Don't be disheartened by challenges or setbacks; they are opportunities to grow and improve your trading skills.

WHAT TO DO?

✅ Embrace the journey of learning and growth, recognizing that mastery takes time.

✅ Stay humble and open-minded, acknowledging that there is always more to learn.

✅ Be patient with yourself during the challenging phases and use them as motivation to improve.

✅ Keep refining your strategies and adapting to the ever-changing market conditions.

Can you identify which stage you are currently in your cryptocurrency and futures trading journey? Remember, each stage brings you closer to becoming a proficient trader.

We hope you found this article on understanding the learning curve in trading cryptocurrencies and futures helpful!

If you have any thoughts, questions, or personal experiences related to the topic, we'd love to hear from you. Please share your feedback in the comments below.

Your input is valuable to us and can help us create more content that resonates with your interests and needs.

Thank you for being part of our community!

Market Makers Buy And Sell ModelThe market Makers' Buy and Sell Model is a strategy that reveals the market maker algorithm model for price delivery.

Basically, there are 3 things market makers' algorithms do with price in every trading session, day, week, and month

Those 3 things are; Accumulation, Manipulation, and Distribution.

AMD:

A: Accumulation

M: Manipulation

D: Distribution

1. Accumulation: They accumulate liquidity through the delivery of a ranging market.

The purpose of delivering a ranging market is to induce both buyers and sellers to enter the market thinking that price will go in their direction.

How to Identify a Ranging Market: You know price is in a ranging market when you see obvious relative equal highs and lows price range.

In a ranging market, price swing points have relatively equal highs and lows, that is, the price is neither delivering a higher high nor a higher low.

2. Manipulation: After accumulating both buy and sell orders, they then manipulate the market to further induce another set of traders which are breakout traders.

But, that particular manipulation move is not their intended direction for the day. They only use it to gather liquidity, Which will then lead them to the next action which is to move and distribute prices in their real direction for the day.

Usually, when price breaks out of a ranging market, the break-out is a manipulation to further induce a new set of traders to enter the market, further proving liquidity for market makers' real intended direction.

3. Distribution: After manipulating the price to a particular direction different from their plan, they then distribute the price to their original intended direction.

e.g to buy, they will first sell the market and then buy at the discount price level.

You know a price distribution through clean candles that left imbalances behind and then break market structure away from the previous manipulation move structure high or low to form a new structure.

Example of Market Makers Buy and Sell Model as described on the chart.

AMD:

A: Accumulation

M: Manipulation

D: Distribution

Accumulation: Price range for some time, accumulating liquidity on both sides of long and shorts.

Manipulation: Price broke the high of the accumulation to take out Buyside liquidity and then create a new higher high and higher low. But it's a manipulation move.

Distribution: Price moves away from the FVG leading to a shift in market structure, plus a short pullback, follow by a massive move to the downside to take out sell-side liquidity below.

Entry: Your entry should be inside the FVG created by price before the shift in market structure, you can set a limit order inside the fvg and place your stop loss at the high of the swing high created prior to the fvg and shift in market structure.

The same thing applies to a bullish market.

Basically, Marker makers push prices higher so they can sell the market at a premium, while they sell the market to lower prices so they can buy that market at very discount prices

This strategy can be used in any time frame and all markets including forex, crypto, stocks, future etc.

Follow me for more updates.

Feel free to ask me any questions in the comment.

ELLIOTT WAVE STRUCTURE BASICShere is some basic principles to discern between Corrective and Impulse. For corrective waves, it helps contextually to have a wave prior to measure the timing and retracement to. A simple way to tell the two apart is their retracements either do or do not intersect each other. A trending impulse wave will never have wave 4 enter wave 1's territory, and never surpasses 2. Otherwise the wave count is incorrect.

The left-most corrective waves (ABC) are generally classed as 2nd wave structures, and the corrective waves on the right (ABCDE) are generally wave 4s. important to actually do the homework and chart the waves, and the waves within the waves. With many revisions, will notice that waves in whole are congruent within the structures within, and so forth. aka fractals.

USDJPY Order Flow: Let The Structure Be The North StarHey traders,

Once again we are letting the power of the OFA script dictate the dominant structure.

Let me showcase a neat example in the USDJPY.

As one can observe, the daily chart has been predominantly buyers as per the circles outline. For position buyers, it is as easy as to go long or short when the structure suggets so. For those wanting to engage in swing or scalps, then keep reading...

How can you find an entry if you fall under the category of 'swing' or 'scalp' trading?

By reading the market structures and the subsequent entry signals (diamonds and circles) that the OFA script fires in the lower timeframes in line with this daily chart.

Remember the two key main features of the OFA indicator:

Magnitude: A major clue that will help determine the health of a trend is the type of progress by the dominant side in control of the trend. We need to ask the following question: Are the new legs in the active buy-sell side campaign as identified by the script increasing or decreasing in magnitude?

Velocity: When it comes to the distance the price moves, the magnitude is only ½ the equation. The other ½ has to do with the velocity of the move or the speed. Was the new leg created after a fast and impulsive move? Or did price make a new low or high with the movement being sluggish, compressive and taking too long to form? A good rule of thumb is to count the number of candles it took to achieve a new leg.

DISCLAIMER: This post contains commentary published solely for educational and informational purposes. This post's content (and any content available through links in this post) and its views do not constitute financial advice or an investment or trading recommendation, and they do not account for readers' personal financial circumstances, or their investing or trading objectives, time frame, and risk tolerance. Readers should perform their own due diligence, and consult a qualified financial adviser or other investment / financial professional before entering any trade, investment or other transaction.

The Ultimate Guide To Fractal TradingIn the seemingly chaotic world of the financial markets, a beacon of structure and predictability shines through in the form of fractal patterns.

Bill Williams, the godfather of fractal theory, elegantly stated, "The market's chaotic nature can be first tamed and then mastered by understanding its underlying structure, revealed by Fractals, which are the building blocks of the market, highlighting key turning points and potential opportunities."

Understanding Fractals

Fractals are repetitive, self-similar patterns that can be observed across nature and, quite remarkably, within the realms of finance as well. In trading, a fractal is a pattern that can be split into parts, each of which is a reduced-scale copy of the whole. They are typically composed of five consecutive bars or candles and can provide insightful information regarding market direction and potential turning points.

Power of Fractals in Trading

Fractals allow traders to comprehend the complicated, chaotic nature of the markets. By identifying key patterns in market data, they help to predict potential price movements and enhance trading strategies. Using fractals, traders can spot emerging trends, identify trend reversal points, and highlight potential market opportunities.

Magnitude and Velocity: The Two Pillars of Fractal Trading

When utilizing fractals in trading, it's crucial to understand two fundamental aspects: Magnitude and Velocity.

Magnitude refers to the degree of progress by the dominant side in control of the trend. The question to be asked is, "Are the new legs in the ongoing buy-sell side campaign increasing or decreasing in magnitude?" This gives an insight into the health of the trend and its potential longevity.

Velocity, meanwhile, represents the speed of the price movement. It's about how quickly a new leg is formed after a price shift. Is the movement fast and impulsive? Or is it sluggish and slow to form? Counting the number of candles it took to achieve a new leg can provide a deeper understanding of the market's direction.

Mastering the Market with Fractals

Despite its seemingly chaotic behavior, the market hides within its fluctuations a rich and decipherable fractal structure. Fractal trading empowers traders to harness the hidden order within this chaos, transforming apparent randomness into tangible trading opportunities.

By integrating fractal patterns into their trading strategies, traders can recognize and exploit recurrent patterns in the market, predict potential price movements, and subsequently enhance the effectiveness of their strategies. It's a potent approach that adds a layer of precision and structure to trading, tempering the market's inherent volatility.

To quote Bill Williams once more, the market's chaos can indeed be tamed and mastered through understanding its fractal nature. Through the lens of fractal trading, the market's complexity becomes its own roadmap, revealing pathways to strategic decisions and profitable opportunities.

Basic Understanding of Market StructureWelcome to the Game Of Resilience .. Structure is the King structure tells everything that you can go for buy or sell trades . sometimes structure will confuse you too so understanding the structure is some what tricky point all over the internet because everyone have a different perspective so coming to the point just this post is to understand the basics of what is market structure and what strong highs and low .

QQQ Order Flow - Selling Exhaustion Leads To Explosive GainsHey traders,

QQQ is in an explosive uptrend as the AI narrative reaches fever pitch.

However, as traders, all we care about is to look for long opportunities each and every time there is exhaustion by the sell-side.

These exhaustions, signaled via the DIAMOND pattern, offer an incredible risk-reward... (10% gains on the first print and 5% so far).

With the bullish structure in our favor as indicated via the OFA script, all we need is to wait for the entry trigger as new structures are formed.

Be reminded, when using the OFA script, it comes with highly accurate signals that, at its core, apply 2 main areas of study:

Magnitude: A major clue that will help determine the health of a trend is the type of progress by the dominant side in control of the trend. We need to ask the following question: Are the new legs in the active buy-sell side campaign as identified by the script increasing or decreasing in magnitude?

Velocity: When it comes to the distance the price moves, the magnitude is only ½ the equation. The other ½ has to do with the velocity of the move or the speed. Was the new leg created after a fast and impulsive move? Or did price make a new low or high with the movement being sluggish, compressive and taking too long to form? A good rule of thumb is to count the number of candles it took to achieve a new leg.

DISCLAIMER: This post contains commentary published solely for educational and informational purposes. This post's content (and any content available through links in this post) and its views do not constitute financial advice or an investment or trading recommendation, and they do not account for readers' personal financial circumstances, or their investing or trading objectives, time frame, and risk tolerance. Readers should perform their own due diligence, and consult a qualified financial adviser or other investment / financial professional before entering any trade, investment or other transaction.

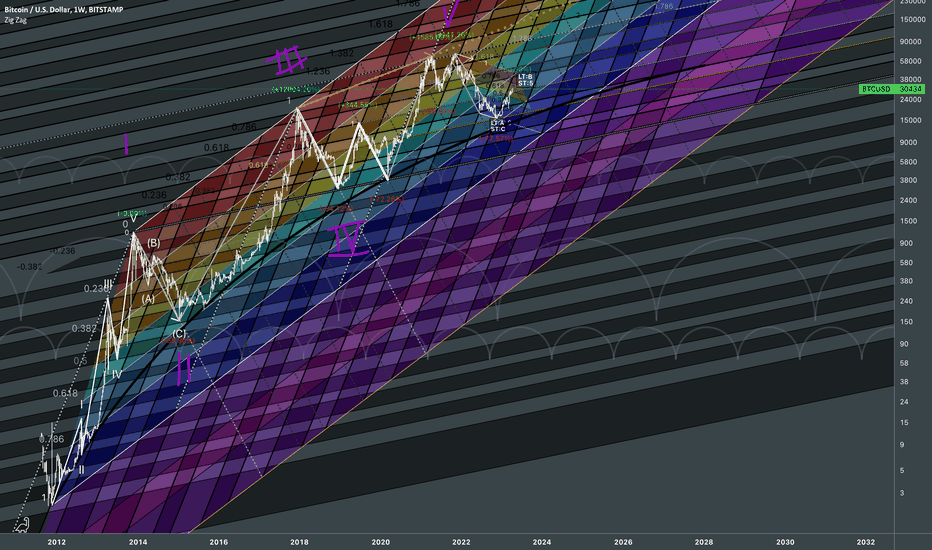

Bitcoin Fractal Dimensions II% 🕘 Fibonacci Reversal Zones give awareness about interconnectedness of historic patterns all the way to current candle. Projecting how one wave can be relative to the other using various Golden Ratios derived from waves of notable cycles.

Application of chaos theory behind the nature of the market in Fractal Geometry.

Long-term alertness for Violet Area:

Why? Because Bitstamp doesn't show candles before 2012. those crucial fluctuations when price was encountering levels.

BLX shows data before 2012 and covered with violet fib area from 1 to 1.618

Fractal Spit Up (Timing):

General Fibonacci Channel responsible for LT Reversals (Price+Time related fib line)

Vertical axis of Critical points of the Wavelength = Price related line

Since market has its own way despite of our perception on price formation, this way we keep neutrality for Long-term strategic aspect.

FREMA Levels:

Curve mimicking lows of price expansion against time scale. Mind 2024 bitcoin halving period.

If it really falls after reaching those hot short-term angled levels, that would be pre "assumed bullrun" period fueled by 2024 halving narrative. That's why relevant to our case fib levels are shown short length. Just like in quantum world particles arrear and disappear or be both, here the levels have their own limited time for the price to be reaching them. The sooner the price reaches them the more crucial reason for presence they have. Since wave frequency right there is high, it applies also to corrective waves. And Since corrective waves would have relatively same momentum measured as angles forming quantum world of possibilities - multi-universe fractal's critical points scaled in unfolding the market. Pretty much all opinions people do classical TA are summarized in terms of the market itself without without actually caring about the news background. Market has its own way and we know that external variable such as news, reports have positive or negative fundamentals already priced in as unfolding pattern to current candles. Odd chaotic movements of the market can be explained through this system of Fibonacci Channels. That's why subjective opinion is way too overrated since market as fractal system of unfolding patterns is more objective than opinions backed by classic TA at specific point of time. After all we care about reversal targets which can be justified by golden ratio rule governing the limits of waves and cycles.

Angles are important because they have time cycle properties within it because market is nothing but a curvature in PriceTime blocks covering variable rates of change of fluctuations.

S&P 500 ETF Multi-FractalTheory of multi-universe rhymes with idea that entangled market can go either way and we're not quite sure which. Since nobody can predict market in the future, we'd ignore news and stick with markets distinctive reaction to reports and news. Positive and Negative fundamentals pushes market to their causing path anyway, we just need to know which extent the targets - endpoints of me. So It's about points of reversals that really matter and are self-evident and very distinctive for any observer .

The term " observer " has second meaning which is also backbone of my own perception of %/TIME based collective consciousness observing the market causing this "matrix glitch" and proves that market has it's own path.

Read role of the term observer

Market's reaction on fundamentals already has been captured in history, so instead of using Elliott Waves why not use the interconnected market patterns itself DESPITE OF different scales.

Black fractal path feels more natural for my subjective perception.

White fractal might play out UNLESS price crosses pattern's violet uptrend line, which will cause at least parts of black pattern to play out, simply because it can cross earlier.

Fractal Scales:

Decade:

/2:

CloseUp FROM DECLINE:

Grateful to @jdehorty for this calendar which I've just used to align events into my fractals such way.

Events can cause HL points of fractal iside future bigger cycled fractal.

Along side with indicators it's always good to look back into making sense out of consequent patterns and their collective relationship with zeroed in and zoomed out" versions of the entity itself.

IF the slope of the fall would be steeper:

SP500 Fib Modeling IIn physics, when charged particles are fired at double slit, chances are they will leave 2 marks as they would go through 2 slits. Those waves of uncertainty crash into each other and interfere, merging and canceling each other out just like any other waves. Then, when an electron's wave hits the back screen, the particle finally has to decide where to land. Slowly, electron by electron, the wave pattern builds up. Our expectations can be evaluated by checking the results. But results can change by simply witnessing the process closeup. An intervention of consciousness can alter reality. Particle as we know started behaving like wave as if they were aware of being watched. So each time particle is fired, it becomes a wave of potential as it approaches the slits and through the quantum world of infinite possibilities finds its final destination. As a result we get interference pattern , the mark that commonly shared by targets of particles after going through such chaotic journey. The electron can go through both slits as wave of potential, then it collides back forming particle hitting the layer! Act of additional measuring by repeating experiment can make the particle act normal again with two stripes pattern. From this I'd outline the sharp changes in behavior as well as shift in entity itself. The collapse of wave function caused by particle's awareness of ongoing surveillance can in some way mean that matter is a derivative from consciousness. And these are the building blocks of universe, where things can simply appear and vanish without evident reason.

Removed irrelevant fibs:

Fibonacci Ratios found in regular Retracement as well as TimeFibs fit the parameters of Wave Function. The overlap of Golden Ratio with real life example of interference pattern formed by two slits using regular white light as a source.

I was pleased to acknowledge that Fibonacci numbers with its known features are also applicable in Quantum Mechanics, when we're dealing with the odds, probabilities and forecasting. This observation actually adds more credibility to FIBS and explains my long fascination over price behaving differently near fibs in one way or the other.

Wave-particle duality is an example of superposition. That is a quantum object existing in multiple states at once. An electron, for example, is both ‘here’ and ‘there’ simultaneously. It’s only once we do an experiment to find out where it is that it settles down into one or the other.

Today we know that this ‘quantum entanglement’ is real, but we still don’t fully understand what’s going on. Let’s say that we bring two particles together in such a way that their quantum states are inexorably bound, or entangled. One is in state A, and the other in state B.

The Pauli exclusion principle says that they can’t both be in the same state. If we change one, the other instantly changes to compensate. This happens even if we separate the two particles from each other on opposite sides of the universe. It’s as if information about the change we’ve made has traveled between them faster than the speed of light.

This makes quantum physics all about probabilities. We can only say which state an object is most likely to be in once we look. These odds are encapsulated into a mathematical entity called the wave function. Making an observation is said to ‘collapse’ the wave function, destroying the superposition and forcing the object into just one of its many possible states.

Arranging the fractal by phases with fibonacci on both price and time scales is an alternative approach to the known quantum mechanical solutions to finance, thus relying on a postulate that quantum mechanics applies to finance unchanged. For market prices, it is important to note that nowadays we are looking at a lot of noise when handling them. In financial markets we are dealing with infinite possibilities emerging patterns which also creates chaotic process just like in subatomic levels. On molecular scale, we know that elements don't just react without a reason. It can bond with other elements if it shares corresponding properties of valence. When it matches the electron configuration, it bonds into new compound generating geometric shapes like hexagon of new chemical structure, like shapes of puzzles unite to resemble a bigger picture.

Similarly, as market makes a move, it determines next candle's dimensions. If previous candle hypothetically had different properties, then the current candle wouldn't be the same it's forming right now. I'd say even the slightest change can significantly delay or change targets and outcomes. Price action also rhymes with time cycles. Sometimes these cycles of different wavelengths overlap resulting in breakout with short-term rapid growth rate.

To get an approximate idea of where price is heading to, we must carry out a thought process. Let's assume market is heading up. We know that chances of a rapid pump to establish new ATH in one day is very low. We assume it's rather going to start with gradual growth when breaking from cyclic entangled side trend. Imagine the candles are made out of metal string so you could touch it and play with it according to all laws of physics just like with a regular piece of metal wire in real life. Now imagine just grabbing the right end of it and pulling upwards to simulate shape unfolding into direction of your target... Nevertheless, various fragments of final structure would still carry its systematic shapes which were originally determined by the market.

In both cases these is a psychological effect, almost convincing me, that the market path is predetermined by trajectories of EMA with intermediate arguments rather than by short-term direction of a wave a spike and collapses. And it's not about the overall performance of the economy or any other factors, market simply derives the path on the go like in multi-universe concept.

The fact that >90% of people are losing is a result of sticking to the current market information noise and news. chances are market simply would have already reacted to the narrative even long before entries were placed. That's how fast things are happening. This happens when market is correcting to other "upcoming" more dominant arising fundamentals whether they are positive or negative. The curve of information distribution speed is vital concept which contributes to ignoring the naive need for information backup behind price moves. Many serious participants of the market are deaf to news. Whatever we receive, we must acknowledge that by the time we receive the news, millions of people already digested those them provided by some media company with their own angle in it. News trading is a very hysterical thing to do, unless you are among the first wave of investors possessing the information from real insiders. The lots and billions of entries in favor for the narrative are already locked in and they are waiting for the last remaining crowd to jump in to be kill them at 5th wave. Considering an accumulation should be after completing a fall. We must feel comfortable at places where the rest still feel fear in order to be able to beat them off due to averaging trades without blind faith.

Modern approaches to stock pricing in quantitative finance are typically founded on the Black-Scholes model and the underlying random walk hypothesis. Empirical data indicate that this hypothesis works well in stable situations but, in abrupt transitions such as during an economical crisis, the random walk model fails and alternative descriptions are needed. For this reason, several proposals have been recently forwarded which are based on the formalism of quantum mechanics. In this paper we apply the SCoP formalism, elaborated to provide an operational foundation of quantum mechanics, to the stock market. We argue that a stock market is an intrinsically contextual system where agents' decisions globally influence the market system and stocks prices, determining a nonclassical behavior. More specifically, we maintain that a given stock does not generally have a definite value, e.g., a price, but its value is actualized as a consequence of the contextual interactions in the trading process. This contextual influence is responsible of the non-Kolmogorovian quantum-like behavior of the market at a statistical level. Then, we propose a sphere model within our hidden measurement formalism that describes a buying/selling process of a stock and shows that it is intuitively reasonable to assume that the stock has not a definite price until it is traded. This result is relevant in my opinion since it provides a theoretical support to the use of quantum models in finance. Fibonacci ratios are another way of exposing the probability of future prices in respect to timing.

Even when overwhelming majority of people expect growth after good news with obvious positive factors, price can fall and expectations of millions can easily be shattered by market in an action. Identifying patterns is a part of making sense of out of randomness. There is a logical parallel: If an observer can collapse wave function, same way the collective consciousness of market crashed the wave function of uptrend. This happens and quite often.

Some people incorporate prime numbers to their trading systems. But of course I'd stick with fibonacci, because golden ratio governs chaos behind price swings as well as its time cycles derived from coordinates of fractal peaks and bottoms. I put tremendous amount of accent on raw data of candles. It doesn't just stop where it does, it is predestined to do it due to chain of cause and effect loop. New formed candles of particular metrics is a direct result of nearest historic candles and mathematical relationship shared between all of them. The way things are curved in nature and space, even exponential growth can be perfectly simulated with fibonacci sequence. Fib ratios are credible as they share and fit into concepts from fractal geometry and chaos theory as well as describing behavior of complex processes. A line simple line can be used to link of some recent buildup of systematic patterns to similar historic fractal echoing back into present.

A properly observed shape can tell more words than any news article, as it passes through the phases of cycle. By documenting nature of short-term swings we can evaluate how market is determining the most efficient price having continuous stream of information, different opinions, events and other factors on the background can directly or indirectly shape the value of an asset. Patterns can tell whether collective psyche of the market feels distrust or approval of ongoing narrative and world trends are unfolding.

It's quite easy to say "buy the dip" or "buy at the finishing stage of falling". It sure takes a good combination of decisiveness, discipline and being able to stick to your plan. But how can we be so sure that price will follow the direction after entry. To answer that question, I'd monitor the security with BSP - "Buying & Selling Pressure".

During selloff SP is obviously over BP. We wait till SP loses momentum and declines while BP begins grow. This way we got ourselves interested.

Then we examine the hypothetical entry by chain of logical confirmations.

We actually need to wait for Buying Pressure to cross over Selling Pressure.

IF bpma > spma is true, confirm with:

volume > ta.ema(volume, 20) or ta.atr(10) > ta.atr(10)

ta.ema(ohlc4, 13) >= ta.ema(ohlc4, 13) and ta.ema(ohlc4, 5) >= ta.ema(ohlc4, 8) and ta.ema(ohlc4, 5) < ta.ema(ohlc4, 8)

bpma > bpma and ta.crossover(close, ta.vwma(close, 13))

stoploss = close - average(bpma, spma)

If all of the conditions are met in a row, wait for correction to complete, see the Selling Pressure falling and enter with the next green candle. Meeting just 1 of these conditions would technically push me into placing a long order. However, I wouldn't do it without fabric of PriceTime scales interconnected with candle data by fibonacci ratios. Refracted EMA can also be a tool of choice to determine the levels support and resistance. Personally I'd go with fibonacci, because they are based on raw chart data instead of averaging with MA's and its derivatives.

Gold Order Flow - Bears Rule The MarketHey traders,

Yet again, the OFA script clearly show we should not be meddling with the affairs of the bears, side fully in control of the price action in the Gold market.

Let the flows, identified via the formation of fractal-based structures, determine the path of least resistance. As usual, credit where is due (Bill Williams). The script simply makes it visually easier to call these trend, which otherwise would be seemingly hard to continuously identify through manual analysis.

Be reminded, when applying the OFA script , it has 2 main components to study:

Magnitude: A major clue that will help determine the health of a trend is the type of progress by the dominant side in control of the trend. We need to ask the following question: Are the new legs in the active buy-sell side campaign as identified by the script increasing or decreasing in magnitude?

Velocity: When it comes to the distance the price moves, the magnitude is only ½ the equation. The other ½ has to do with the velocity of the move or the speed. Was the new leg created after a fast and impulsive move? Or did price make a new low or high with the movement being sluggish, compressive and taking too long to form? A good rule of thumb is to count the number of candles it took to achieve a new leg.

DISCLAIMER: This post contains commentary published solely for educational and informational purposes. This post's content (and any content available through links in this post) and its views do not constitute financial advice or an investment or trading recommendation, and they do not account for readers' personal financial circumstances, or their investing or trading objectives, time frame, and risk tolerance. Readers should perform their own due diligence, and consult a qualified financial adviser or other investment / financial professional before entering any trade, investment or other transaction.

Silver Explodes - A Lesson To Track Shifts In Order FlowHey traders,

In today’s analysis, it’s hard to ignore Silver following the 🚀explosive🚀 8%+ move up.

Let’s unpack the action as of late via the OFA script :

To do so, I am not going to apply any subjective type of analysis such as drawing trendlines, counting waves based on what way the wind blows, or any other form of guessing game…

Instead, we let the formation of fractal structures (objective measure of moves) create the pathway from which we can all make decisions. Fortunately, there is no need to engage in laborious manual work?

Why? The OFA script has all of us covered. So, with that in mind, what can we observe in the silver market?

What recurring pattern do you notice? Clue - Pay attention to the visual Ms and Ws type pattern forming…

These patterns entail, as stated in the chart, “dynamic fractal-based order flow cycles where a decreasing involvement in one direction (depicted by cycle/wave/line counts leads to a predictable move in the opposite direction seeking out the next equilibrium area, in most instance, with potential profits as a by-product…”

If you are into disseminating order flow, nothing I’ve seen beats the objectivity in analysis one can carry out via the formation of structures derived off fractal structures. Note, the chart ignores the dominant trend and simply focuses on the M and W patterns. Can you imagine if you start to align trading in the direction of just simply the dominant trend in the higher timeframes + proper risk management? Let you fantasise with that!

Remember the two key main features of the OFA script:

Magnitude: A major clue that will help determine the health of a trend is the type of progress by the dominant side in control of the trend. We need to ask the following question: Are the new legs in the active buy-sell side campaign as identified by the script increasing or decreasing in magnitude?

Velocity: When it comes to the distance the price moves, the magnitude is only ½ the equation. The other ½ has to do with the velocity of the move or the speed. Was the new leg created after a fast and impulsive move? Or did price make a new low or high with the movement being sluggish, compressive and taking too long to form? A good rule of thumb is to count the number of candles it took to achieve a new leg.

DISCLAIMER: This post contains commentary published solely for educational and informational purposes. This post's content (and any content available through links in this post) and its views do not constitute financial advice or an investment or trading recommendation, and they do not account for readers' personal financial circumstances, or their investing or trading objectives, time frame, and risk tolerance. Readers should perform their own due diligence, and consult a qualified financial adviser or other investment / financial professional before entering any trade, investment or other transaction.

TLT: Order Flow, Auction Process & Failures To RotateHey traders,

If we zoom out to check the price action in TLT from a daily perspective, what do you notice?

Every single time there is a failure to rotate (hinted via diamond labels), the new expansionary wave leads the market towards a new equilibrium point that so far has been found at much lower prices.

I’ve circled each and every instance where these failures to rotate back up occurred. Each market is an auction process, and via the OFA script , we are able to get a pristine read of the constant ebbs and flows.

The structure depicted via the script should also be a clear red flag that in this type of well-anchored bear market, being a hero typically gets you in trouble, so stay with the trend.

Remember the two key main features of the OFA indicator:

Magnitude: A major clue that will help determine the health of a trend is the type of progress by the dominant side in control of the trend. We need to ask the following question: Are the new legs in the active buy-sell side campaign as identified by the script increasing or decreasing in magnitude?

Velocity: When it comes to the distance the price moves, the magnitude is only ½ the equation. The other ½ has to do with the velocity of the move or the speed. Was the new leg created after a fast and impulsive move? Or did price make a new low or high with the movement being sluggish, compressive and taking too long to form? A good rule of thumb is to count the number of candles it took to achieve a new leg.

DISCLAIMER: This post contains commentary published solely for educational and informational purposes. This post's content (and any content available through links in this post) and its views do not constitute financial advice or an investment or trading recommendation, and they do not account for readers' personal financial circumstances, or their investing or trading objectives, time frame, and risk tolerance. Readers should perform their own due diligence, and consult a qualified financial adviser or other investment / financial professional before entering any trade, investment or other transaction.

GBP Collapses - The Power Of Order Flow & The M Pattern Hey traders,

Remember that the market is a mechanism that transfer wealth from the patient to the impatient.

If you wish to stay on the side on the patient practioners, few things beat letting the price behavior and the swings that form in the process dictate your entries.

The OFA script applied to the chart of GBPUSD speaks a thousands words.

While there are a number of setups that it identifies, with the circles and diamond triggers, today I want to touch on a recurring pattern that when taken under the right context becomes a great application of the OFA properties.

So, lets talk about the M pattern in the pound.. check the video to find out all the insights...

Remember the two key main features of the OFA indicator :

Magnitude: A major clue that will help determine the health of a trend is the type of progress by the dominant side in control of the trend. We need to ask the following question: Are the new legs in the active buy-sell side campaign as identified by the script increasing or decreasing in magnitude?

Velocity: When it comes to the distance the price moves, the magnitude is only ½ the equation. The other ½ has to do with the velocity of the move or the speed. Was the new leg created after a fast and impulsive move? Or did price make a new low or high with the movement being sluggish, compressive and taking too long to form? A good rule of thumb is to count the number of candles it took to achieve a new leg.

The Truth About Trade AccuracyA critical component relating to trading success is the relationship between your win percentage and your bottom line. Many new traders hold some extremely inaccurate views when it comes to what kind of win percentage is required to generate net profit, including the notion they need a 70% or higher win percentage to achieve success. This notion is wrong and misleading. The relationship between your win percentage, your risk management, and the profit you generate from each trade are intricately related.

The beauty of this post is that the backtest logic in our Olympus Cloud indicator showcases the concepts covered with real trades, which is shown under this post in the data section.

The Positive Win Percentage

A win percentage over 50% is regarded as a probable edge or edge. Yet, even with a 60% win rate, you can generate a net loss. How? If your average loss is $100, but you are in the habit of falling prey to your emotions and prematurely selling your winners so you only generate an average of $50 when you win, you will lose money regardless of your 60% win rate.

No trader goes into a trade thinking, “Hey, I’ll lose $100 if I’m wrong and I’ll make $50 if I’m correct.” Nevertheless, random wins of $75, $25, $60, $40, $90, and $10 will average out to $50 per win. No one purposely tries to win half of what they lose, but random trading combined with random emotions produces random results.

We all desire winning and making good profits when we take a trade, but as emotions come into play, things quickly change. You may take a trade that reaches $75 in profit and then decide the move looks gassed out, so you sell. On another trade, you might get scared by some volatility, or notice a resistance you neglected to spot initially and sell for $25 of profit. It is all too common to fall prey to your emotions and behave in a way you didn’t plan to. The irony is, that you will regard the $25 trade as a winner, and it will raise your trade accuracy.

Let’s look at a simple example:

Example: 100 total trades with 60% trade accuracy

60 winning trades at an average of $50 per win = $3,000

40 losing trades at an average of $100 per loss = $4,000

Net loss of $1,000

In the example above, your break-even point is a 67% win percentage for a whopping $50 in profit. With this type of random risk and profit management, any meaningful net profit requires a win percentage upwards of 75-80%.

The psychological damage of having a higher average loss than an average win is hard to quantify, but it’s easy to feel frustration when one loss wipes out two wins. While this sounds like common sense, many, many new traders fall into the habit of random profit management and find themselves in this undesirable situation. The same theory holds true even if you let your winners play out, but you also let your losses escalate and take a few big hits to your account. In either scenario, your 60% win rate means nothing.

The Negative Win Percentage

In the case of a negative win percentage, you can produce a net profit even if you are correct less than 50% of the time. In this scenario, your advantage over the market is getting into trades that consistently provide large gains when you win, and by letting those winners play out fully. Furthermore, you can’t hesitate to cut your losses and keep your drawdown controlled. With this kind of win rate, you must not sell early or your entire business model falls apart. You must understand that the big winners will make up for any profit you leave on the table.

Let’s look at what happens if you are correct 40% of the time, but your average win is $100 and your average loss is $50:

Example: 100 total trades with 40% trade accuracy

40 winning trades at an average of $100 per win = $4,000

60 losing trades at an average of $50 per loss = $3,000

Net gain of $1,000

It is now clear that win percentage is not everything. You can make money even if you are correct on 40% of your trades as long as your average win is double your average loss. The smaller your average win compared to your average loss, the higher your accuracy must be to make a net profit.

Of course, if you can maintain a win percentage over 50% while also having proper risk and profit management you will end up far ahead.

Putting It Together

Clearly, the best approach is to combine a reasonable win percentage of over 50% with proper risk and profit management. You must consistently let your winners play out regardless of the emotions you feel in the moment and ensure you don’t take losses beyond a certain threshold. Furthermore, scaling out of trades – selling portions of your position as the market moves in your favor – will increase your accuracy and ease your mind. By dividing your position into two or three tranches you can lock in a certain amount of profit at predefined targets and then let the final portion ride out the trend with a trailing stop-loss.

Revisiting our example, let’s put these concepts together with a reasonable win percentage:

Example: 100 total trades with 55% trade accuracy

55 winning trades at an average of $100 per win = $5,500

45 losing trades at an average of $50 per loss = $2,250

Net gain of $3,250

Now, that’s what you want to see!

It’s more important you behave in a consistent manner and follow a predefined game plan than it is to have 80% trade accuracy. It is wise to strive for reasonable trade accuracy – 50% to 65% – and remain consistent in order to fulfill your trading potential.

After you have mastered your emotions with a consistent strategy, perhaps you can raise your win percentage to mythical values like 80%. As we have covered, though, such accuracy is not required for great trading results.

Quantum Mechanics in Financial MarketsWave–particle duality is the concept in quantum mechanics that every particle or quantum entity may be described as either a particle or a wave.

Basically has 2 types of behavior.

Duality concept is present in Financial Markets

We have 2 directions of outcomes of the market activity.

UP and Down assumed as Bulls and Bears

Whatever we see on a chart is nothing but outcome of Interference of Bulls and Bears in a given TIME.

Indeed at given price we have certain confrontation of 2 forces. Like a spin of a particle, it has 2 CHARGES when MEASURED at given point of TIME: Positive and Negative.

Wave dualism are applied to fractal with fibonacci ratios.

These ratios are used irregularly in my analyses not by a chance.

Just like the alternation of the dim and contrasting bright colors are used to simulate the Quantum Phenomena.

The steeper the angle of incline of fibonacci channels the more it is related to TIMING of the Fractal.

We witnessed in my number of ideas how Fibonacci ratios work well with reversals.

The direction of fib channels covers the MOMENTUM of the market representing the dualism of the market inside ratios.

Behavior of masses rhymes on lines of Fibonacci Channels which shows interconnectedness of critical points of the market activity.

Peaks and Bottoms must be indexed with fibonacci ratios and adjusted to golden ratio to make sense out of bits waves.

Crossing means a takeover of either of participants of the market activity.

shake-n-bake fractalThis is just your typical head and shoulders pattern, but when a range is so tight, you'll just see one after the other after the other. It's pretty bizarre. I'm declaring this fractal as a "shake-n-bake" pattern where h&s leads right into another h&s of equal size and volatility

THERE ARE SO MANY DIFFERENT KINDS OF PULLBACK/REVERSALAs you've seen in the chart. Both are on the Resistance Level. So the key here is to plot fibb retracement from high to low.

The first trend on the resistance level are seen the trend creating a 2 bullish candles before touches our 618 level.

And the second trend on the resistance level different before you'll never see the retracement when you stick to 1hr TF. but you will also see this chart same on 15mins tf.

My Analysis on this are, Next time I'll explain because Its too hard to explain in English. HAHAHAHAHAHAA