The 3-Method Framework: Simplifying Technical AnalysisMost traders get caught up in complex indicator setups, thinking that more tools equal better results. We rely on moving averages to tell us if prices are trending up or down, and we depend on support and resistance levels to predict market movement. But what if I told you there's a simpler, more powerful way to read the market using pure price action?

Today, I want to share my experience and understanding of bias and expectations for the next candle formation. This approach is refreshingly simple because we don't need to understand every single price movement - we just need to focus on what matters most.

Method 1: Opening Price Comparison

The first method is beautifully straightforward. For a bullish bias, the current opening price should be above the previous opening price. That's it. Sounds almost too simple, right? But simplicity often holds the greatest power in trading.

For Gold yesterday, we simply needed to compare the latest opening price on the Daily timeframe with the previous opening price. It's that simple.

Method 2: Mid-Level Analysis

The second approach involves comparing mid-levels between candles. We compare the mid-level of the previous candle with the mid-level of the candle before that. I know it might sound a bit complicated when explained this way, but once you visualize it on your chart, the concept becomes crystal clear.

Still on Gold, we just compare the 50% or mid-level of the previous candle with the candle two periods back from the latest candle on the daily chart.

Method 3: Expansion Expectations

The third method helps us anticipate expansion in price. Traditional complex methods require analyzing numerous factors, but this simplified approach only needs two candles before the current one. Here's how it works: we use the high and low of the candle two periods back, and the open and close (body) of the previous candle. If the previous candle's body sits within the high-low range of the two-candle-back formation, we can expect price expansion.

The beauty of this method is that we don't care whether the price is bullish or bearish - we simply expect expansion to occur. Think of it like a compressed spring: when price gets squeezed within a previous range, it often seeks to break out in either direction. We're not predicting the direction, just the likelihood of significant movement.

Still on Gold, I randomly selected all inside candles on the Daily timeframe. Remember, the purpose is only to expect expansion, not direction. If you want to use this for directional bias, make sure you apply the additional analysis required.

Remember, there are no guarantees in trading, but this method provides valuable insight into potential market expansion.

Advanced Combinations for Enhanced Analysis

Combining Methods 1 and 2 creates our most accessible approach since you only need two candles. When both the opening price and mid-point from two candles ago indicate bullish conditions, we can expect the current candle to follow an OLHC bullish pattern.

You can see the 3 examples I've provided in the image, and all of these are applicable across all timeframes, both daily and 4-hour.

Combining all three methods offers a more sophisticated analysis, particularly useful for anticipating market reversals. This involves marking the current and previous opening prices, comparing mid-levels from the last two candles, and identifying the high/low range from two to three candles back.

Now I'm adding Inside Candles from 2-3 periods back (My personal rule is maximum 3 candles before the current candle, or this analysis will lead to analysis paralysis).

The Bullish and Bearish Rules

Bullish Rule 1:

Opening price above the previous opening price

Mid-level of the previous candle above the mid-level of the previous candle before that.

Inside candle formation (optional)

Bearish Rule 1:

Opening price below the previous opening price

Mid-level of the previous candle below the mid-level of the previous candle before that.

Inside candle formation (optional)

The Secret Sauce: Timeframe Harmony

Here's where the "devil is in the details" comes into play. You might find perfect bullish conditions on your chart, but the market still reverses. The secret lies in using this method on Daily and 4-hour timeframes simultaneously.

Simply understand it from the chart.

Simply understand it from the chart.

If Rule 1 conditions are met on the daily chart, they must also align on the 4-hour chart. When the 4-hour contradicts the daily, follow the 4-hour signal as it might indicate a "sell on strength" or "buy on weakness" scenario.

The formula is simple: must align with

I've never tested this on 1-hour charts because the Daily and 4-hour combination provides sufficient accuracy for my trading approach.

Enhanced Rules for Precision

Rule 2 makes the inside candle formation mandatory rather than optional. Sometimes you'll encounter mixed signals where the mid-level suggests one direction while the opening price suggests another. The solution? Drop down to a lower timeframe for additional confirmation.

I don't recommend using this method below the 4-hour timeframe, but you can certainly apply it to Monthly or Weekly charts for long-term bias determination. The key is analyzing both Daily AND 4-hour timeframes together, not just one or the other.

When timeframes conflict, often just one key level provides the confirmation you need - typically a previous Monthly or Weekly high or low.

Final Thoughts

Pure price action mastery isn't about having the most sophisticated setup or the most indicators on your chart. It's about understanding the fundamental relationship between opening prices, mid-levels, and candle formations across meaningful timeframes.

This approach has served me well because it cuts through market noise and focuses on what price is actually telling us. Start with these three methods, practice identifying the patterns, and gradually build your confidence in reading pure price action.

Remember, consistent profitability comes from mastering simple, reliable methods rather than chasing complex strategies. Keep practicing, stay disciplined, and let price action guide your trading decisions.

Good Luck! :)

Priceaction

Understanding Market StructureIn this video, I break down market structure in a simple and easy-to-digest way, helping you understand how to identify whether the market is in an uptrend or downtrend.

Recognizing market direction is a key skill for any trader, it allows you to trade in alignment with price action and make more confident, higher-probability decisions.

✅ If you're new to trading or want to sharpen your edge, this video will give you the insights needed to read market trends more clearly.

📈 Hope you find value in this breakdown!

👉 Don’t forget to like, comment, and subscribe to support the channel and stay tuned for more educational content.

4 Profitable Bullish Patterns EVERY TRADER Must Know Forex, GOLD

In the today's post, we will discuss accurate bullish price action patterns that you can apply for trading any financial instrument.

1️⃣Bullish Flag Pattern

Such a pattern appears in a bullish trend after a completion of the bullish impulse. The flag represents a falling parallel channel. The market corrects itself within.

Bullish breakout of the resistance line of the channel is a strong bullish signal that can be applied for buying the market.

Best entries should be placed immediately after a breakout or on a retest.

Safest stop loss is below the lows of the flag.

Target - the next key resistance.

Here is the example of a bullish flag pattern that was formed on Gold on a 1H time frame. As you can see, after the breakout of the resistance of the flag, a strong bullish rally initiated.

2️⃣Ascending Triangle

Such a pattern forms in a bullish trend on the top of the bullish impulse. The market starts consolidation, respecting the same highs and setting higher lows simultaneously.

The equal highs compose a horizontal resistance that is called the neckline.

Its breakout is an important sign of strength of the buyers.

Buy the market aggressively after a violation, or set a buy limit order on a retest.

Stop loss should lie at least below the last higher low within a triangle.

Target - the next strong resistance.

Take a look at that ascending triangle formation on EURUSD.

Bullish breakout of its neckline was a perfect bullish signal.

3️⃣Falling Wedge

That formation is very similar to a bullish flag pattern.

The only difference is that the price action within the wedge is contracting so that the trend line of the wedge are getting closer to each other with time.

Your signal to buy is a bullish breakout of the resistance of the wedge.

Stop loss is strictly below its lows.

Target - the next key resistance.

GBPUSD formed a falling wedge on a 4H time frame, trading in a strong bullish trend.

You can behold how nicely the price bounced after a breakout of its upper boundary.

4️⃣Horizontal Range

Similarly to the ascending triangle, the horizontal range forms at the top of a bullish impulse in a bullish trend.

The price starts consolidation , then, setting equal highs and equal lows that compose a horizontal channel.

Breakout of the resistance of the range is a strong trend-following signal.

Buy the market aggressively after a breakout or conservatively on a retest.

Stop loss will lie below the lows of the range.

Target - the next strong resistance.

Dollar Index formed a horizontal range, trading in a strong bullish trend.

Breakout of the resistance of the range triggered a bullish rally.

The best part about these patterns is that they can be applied on any time frame. Whether you are a scalper, day trader or swing trader, you can rely on these formations and make consistent profits.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Golden Rejection Candle Strategy–Catch Explosive Intraday Moves!Hello Trader!

Are you tired of buying options and watching premiums die slowly?

Or chasing breakouts that reverse the moment you enter?

Here’s your solution – the Golden Rejection Candle Strategy , designed especially for option buyers who want timed entries, fast momentum, and defined risk .

What is a Golden Rejection Candle?

A special candlestick that forms when price hits a strong level (like VWAP, trendline, or demand/supply zone) and gets instantly rejected.

It leaves behind a long wick (shadow), showing that buyers or sellers stepped in with force .

This candle often marks the start of a sharp intraday reversal .

It's not just a random wick — it’s a smart money footprint .

Live Chart Example – Nifty Spot vs Option Premium (23950 CE)

Date: 9th May 2025

Timeframe: 1 min (Spot), 1 min (Options)

Spot Chart Setup: Nifty approached a marked green support zone and created a strong wick rejection with a small body candle — classic sign of buyers defending the level.

Confirmation Candle: The next candle broke above the rejection candle’s high, confirming the reversal setup.

Premium Reaction: On the 1-min ATM Option chart (23950 CE), premiums jumped from 270 to 344 – a clean 26% gain within few minutes.

Risk-Reward Snapshot: Entry was at breakout, SL just below rejection wick, and target hit in a single momentum burst — the kind of move option buyers live for.

How to Trade It as an Option Buyer

Choose the Right Strike: Use ATM or slightly ITM options to get faster movement when price reverses.

Entry Strategy: Wait for the next candle to break the rejection candle’s high/low. No break = No trade.

SL Placement: Keep it just beyond the wick. Small loss if wrong, big reward if right.

Exit Plan: Aim for intraday resistance/support or spike-based exits — option premiums often give quick moves post-rejection.

What NOT to Do:

Don’t enter on the rejection candle itself — wait for confirmation.

Avoid trading this pattern in low volume or middle of the range.

Don’t hold blindly — if premium spikes, take the money and run!

Rahul’s Tip:

“Sudden reversals are where option buyers make money — not slow trends. The rejection candle shows intent. The breakout shows confirmation. Combine both.”

Conclusion:

The Golden Rejection Candle Strategy gives you an edge that most random trades lack — timing, context, and structure.

If you're an option buyer, this can be your go-to setup to avoid traps and enter only when smart money steps in.

No more guessing. No more fear.

Just clean, price-action-based entries that make sense.

👇 Have you ever used rejection-based setups? Drop your favorite trade below! Let’s learn together.

If you found this post valuable, don't forget to LIKE and FOLLOW!

I regularly share real-world trading setups, actionable strategies, and learning-focused content — all from real trading experience , not theory . Stay connected if you're serious about growing as a trader!

Ultimate Guide to Master CISDCISD stands for Consolidation, Inducement, Stop Hunt, Displacement. It’s a simple, repeatable structure that shows how smart money sets up traps in the market to grab liquidity and then make a clean move in the opposite direction.

If you’re serious about trading the ICT style, this is one of the most useful frameworks to learn. It helps you avoid chasing bad breakouts and teaches you to wait for real setups that come after stop hunts and proper market structure shifts.

But there’s one rule that’s non-negotiable — a CISD setup is only valid after a liquidity sweep. If the market hasn’t taken out a clear high or low where stops are sitting, then the rest of the model doesn’t mean anything. No sweep, no trade.

1. Start With the Liquidity Sweep

Everything begins with the liquidity grab. If price hasn’t taken out a high or low where stops are stacked, you should walk away from the setup. Don’t try to front-run a move before smart money has done its job.

The liquidity sweep is what gives the rest of the move power. That’s when price runs through obvious levels, swing highs, swing lows, the Asian range, New York session highs or lows and hits stop losses. Those stops give smart money fuel to enter in the opposite direction.

When you’re watching the market, ask yourself this:

"Who just got stopped out?"

If you can’t answer that, then it’s not a sweep. And if it’s not a sweep, it’s not a CISD.

2. Consolidation — Where Liquidity Builds

This is the first part of the structure. Price starts to move sideways in a tight range, usually during Asian session or during parts of London where volume is low. It can last for hours or even across sessions.

The key here is to understand what’s happening. Traders are placing buys above the highs and sells below the lows. Liquidity is building on both sides. It’s a trap being set. Retail traders are expecting a breakout, but smart money is waiting to use that breakout to their advantage.

Your job in this phase is to identify the range and mark out the highs and lows. That’s where stops will be sitting. You’re not looking to trade during this phase. You’re watching and planning

3. Inducement (sweep)— Fake Break to Trap Traders

After the range is set, price gives a small push out of the range just enough to get people to commit. This is the inducement. It’s the bait.

Let’s say the range high is being tested. Price breaks just above it, traders think it’s a breakout, and they go long. Maybe it holds for a couple of minutes, even gives a small push in their favor. But then it rolls over. That’s the trap. Now those traders are caught, and their stops are sitting below.

Sometimes the inducement comes before the real sweep. Other times, the inducement is the sweep. What matters is that traders have been lured into bad positions and their stops are exposed.

As a trader, your job is not to take the bait. Watch how price reacts to these fake moves. Often, they come with weak volume or are followed by an immediate sharp reversal.

4. Stop Hunt — The Sweep That Validates the Setup

This is where the real move starts to form. Price aggressively runs through the level that holds liquidity, usually below the low or above the high you marked earlier.

This is when smart money takes out the traders who were induced during the fake move. Their stops get hit, and that gives institutions the volume they need to get into the opposite side.

You should be actively watching for a reaction here. Do you see rejection? Does the candle close with a strong wick? Are there signs of absorption or order flow flipping?

This is your validation point. Once price sweeps liquidity and starts to reject the level, that’s your cue to get ready for the next part, the actual shift.

5. Displacement — The Real Move Begins

Once the sweep happens, price doesn’t just drift, it snaps back hard. This is called displacement.

Displacement is a sharp, clean move in the opposite direction of the stop hunt. This is when market structure breaks, momentum shifts, and a fair value gap usually forms.

This is your confirmation that the setup is live. The sweep happened, smart money entered, and now the market is moving with intent.

You don’t want to chase the displacement candle itself. Instead, wait for the retrace. Look for price to come back into the fair value gap or an order block left behind by the impulse. That’s your entry point.

Make sure:

Structure is broken in your direction

The move away is impulsive, not choppy

You’re not forcing an entry on a weak pullback

This is the only part of CISD where you actually take the trade. Everything else is just setup.

How to Manage Risk and Entries

Once you’ve got a valid setup, here’s how to manage it:

Entry: Enter on the CISD or wait for the pullback into the fair value gap or order block. Enter on the reaction or confirmation.

Stop Loss: Place it just past the low or high that got swept. If you’re long, your stop goes below the stop hunt candle. If you’re short, it goes above.

Take Profit: Target the next liquidity level. That could be the other side of the range, a swing high or low, or an inefficiency in price.

You can scale out if price approaches a session high or low, or hold for a full range expansion depending on the session.

Final Thoughts

The CISD model works because it’s built on how the market actually moves, not indicators, not random patterns, but liquidity.

Don’t jump in early. Don’t guess. Wait for the sweep. Wait for the displacement. That’s where the edge is.

Once you get used to watching this play out in real time, you’ll start to see it everywhere. It’s in Forex, crypto, indices, any market that runs on liquidity.

Stick to the rules. Let the model do its job. And remember: no sweep, no setup!

___________________________________

Thanks for your support!

If you found this guide helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

Mastering Market Trends: Your Guide to Clearer Trading DecisionsTrends shape every decision you make in the markets, even if you’re unaware of it. Understanding how to identify and adapt to these market phases is your foundational skill - one that separates successful traders from the rest.

Today, let’s simplify and clarify the three essential types of market trends. By mastering this, you’ll approach trading decisions with more confidence and clarity.

⸻

📈 1. Uptrend – Riding the Bull

• What is it?

An uptrend is like climbing stairs upward. Each step (low) is higher than the previous one, and every leap (high) sets a new peak.

• What drives it?

Buyers dominate, optimism rules, and demand pushes prices upward.

• Trading tip:

Identify support levels and look for retracements as potential entry points. Be cautious about chasing prices that have moved too far without a pullback.

⸻

📉 2. Downtrend – Navigating the Bearish Territory

• What is it?

Visualize going down a staircase. Each step down (low) surpasses the previous one, and every upward bounce (high) falls short of the prior peak.

• What drives it?

Sellers control the market, bearish sentiment takes over, and supply outweighs demand.

• Trading tip:

Look for resistance areas to identify potential short entries or wait patiently for signs of a reversal if you’re bullish.

⸻

➡️ 3. Sideways Market – The Calm Before the Storm

• What is it?

Imagine a tug-of-war with evenly matched teams. The price moves back and forth in a narrow range without breaking decisively higher or lower.

• What drives it?

Uncertainty, indecision, or equilibrium between buyers and sellers.

• Trading tip:

Stay patient! Either look to trade range extremes (buying support and selling resistance) or wait for clear breakout signals to catch the next big move.

⸻

🔍 Pro Tip for Trend Analysis:

• Multi-timeframe analysis is key: Always check higher timeframes (weekly, daily, or hourly) to confirm the primary trend. Don’t let short-term noise mislead your trading decisions.

⸻

🚀 Why It Matters:

Aligning your strategies with the correct market trend significantly improves your odds. It’s like sailing with the wind at your back instead of battling against it.

Now, tell us in the comments: Which trend type do you find most challenging to trade?

Trade smarter. Trade clearer.

Mastering RSI Divergence: A Complete Guide to Trend ReversalsWhat Are Divergences?

In this guide, we will explore the concept of divergence and how it can be effectively utilized alongside the Relative Strength Index (RSI), one of the most popular momentum indicators in technical analysis. Divergence occurs when the price of an asset moves in the opposite direction of an indicator, such as the RSI. Understanding RSI divergence can be a powerful tool for identifying potential trend reversals or continuations. In this guide, we'll delve into the various types of divergence that can occur with the RSI and how to incorporate them into your trading strategy.

Types of Divergences?

There are three primary types of divergence: bullish, bearish, and hidden divergence. Each signals a distinct market condition and potential outcome, and understanding these nuances is key to using divergence effectively in your trading.

1. Bullish Divergence Bullish divergence happens when the price of an asset makes a lower low, while the RSI forms a higher low. This indicates that although the price is declining, momentum is weakening. The failure of the RSI to confirm the new low in price suggests that selling pressure is diminishing, potentially signaling that a reversal to the upside could occur. Essentially, the market is losing its downward momentum, setting the stage for a potential bullish move.

2. Bearish Divergence Bearish divergence occurs when the price forms a higher high, but the RSI forms a lower high. This indicates that although the price is rising, momentum is weakening. It suggests that the uptrend may be losing steam, signaling that a potential reversal to the downside could be on the horizon. As the price continues higher, but the RSI fails to confirm the new highs, it may indicate that the market is becoming overextended and ready for a correction.

3. Hidden Divergence Hidden divergence differs from regular divergence in that it signals a continuation of the existing trend, rather than a reversal. It typically occurs during pullbacks or retracements in a strong trend. Hidden divergence can appear in both uptrends and downtrends, providing traders with an indication that the prevailing trend is likely to continue after the short-term retracement is over. This type of divergence serves as a confirmation of trend strength and helps traders stay in profitable positions during market pullbacks.

Why Are RSI Divergences a Powerful Tool?

RSI divergence is a powerful tool in trading because it offers early insights into potential trend reversals or shifts in momentum before these changes are fully reflected in price movements. By recognizing divergence, traders can anticipate shifts in market sentiment and make timely decisions. One of the main reasons RSI divergence is so effective is that it serves as an early warning system. It signals when the momentum behind a price trend, whether up or down, is starting to weaken.

For example, in a strong uptrend, if prices continue to make new highs, but the RSI fails to reach new highs, this could signal that the buying momentum is losing strength, even though the price is still rising. This divergence indicates that a reversal or pullback might be imminent, allowing traders to exit their positions or prepare for a potential shift in market direction. Understanding this early warning can provide traders with an edge, helping them avoid being caught in the late stages of a trend and positioning themselves ahead of a change.

How to Trade RSI Divergences?

When the price makes a higher high but the RSI fails to confirm with a higher high, this is known as bearish divergence. While this situation suggests weakening momentum, it doesn’t necessarily mean a correction is imminent. The price may continue to rise for some time, and eventually, the RSI could catch up and make a higher high in line with the price action. Essentially, the market could remain in an uptrend, and the RSI could still align with the price over time.

This highlights the importance of not jumping to conclusions solely based on RSI divergence. Divergence can act as a useful warning, but it should not be relied upon as a definitive signal of a trend reversal. To increase the reliability of the signal, traders should wait for additional confirmation, such as a candlestick pattern indicating a potential trend reversal. Candlestick patterns like engulfing patterns, doji candles, or shooting stars at key support or resistance levels can provide stronger evidence that the trend may be about to change.

Therefore, it’s wise to wait for a more comprehensive confirmation from price action before making a move, rather than acting on divergence alone. Combining RSI divergence with other technical tools, such as candlestick patterns or chart patterns, can help increase the accuracy of your trade decisions.

Conclusion:

Divergence is a powerful tool that provides valuable insights into potential trend reversals or continuations. By understanding the different types of divergence and knowing how to identify them, traders can make more informed decisions. However, divergence should always be used in conjunction with other technical analysis tools to enhance the accuracy of your strategy. With practice, patience, and proper risk management, divergence trading can become a profitable strategy for identifying key market turning points. Whether you are seeking trend reversals or confirming ongoing trends, RSI divergence can be an essential component of your trading toolkit.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

Trend Changing Pattern (TCP) ExplainedIntroduction

One of the most important skills in forex trading is learning how to read price action and understand what the market is telling you. Price is not just numbers — it’s the collective perception of traders, making it the most reliable leading indicator available.

Today, I want to explain a powerful concept known as the Trend Changing Pattern (TCP) — a crucial tool for identifying potential market reversals and shifts in trend direction.

📈 What Is a Trend Changing Pattern?

In any trending market, whether it's an uptrend or downtrend, the trend won’t change easily. The strength of the trend and the timeframe you're trading on will determine how long it takes for a true reversal to occur.

One key signal of a trend change is a shift in momentum:

In an uptrend, when a momentum low forms during a pullback, it can be a sign that the trend is beginning to reverse.

In a downtrend, a momentum high during a pullback can signal a potential bullish reversal.

These are what we refer to as Trend Changing Patterns (TCPs) — moments where the structure of the market starts to shift.

⚠️ Watch for Manipulation After the TCP

After a TCP appears, it's common to see price manipulation before the new trend fully takes hold:

In an uptrend, price may return to manipulate the previous high before continuing down.

In a downtrend, price often dips to manipulate the previous low before reversing higher.

Being aware of this common liquidity grab helps traders avoid being trapped and instead position themselves in alignment with the new trend.

🧠 Final Thoughts

Understanding how to spot and interpret a Trend Changing Pattern gives you a major edge in forex trading. It helps you stay ahead of the market and make informed decisions based on price action, not emotion.

🎥 In the video, I go into more detail about momentum highs and lows, and how to recognize these key patterns in real time. Be sure to check it out if you want to sharpen your trend reversal strategy.

Wishing you success on your trading journey! 🚀

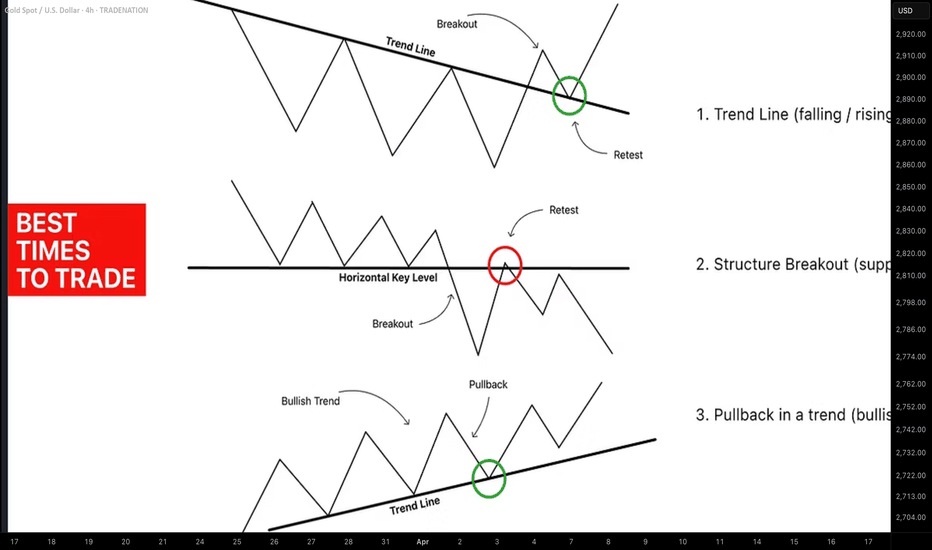

3 Best Trading Opportunities to Maximize Profit Potential

Hey traders,

In the today's article, we will discuss 3 types of incredibly accurate setups that you can apply for trading financial markets.

1. Trend Line Breakout and Retest

The first setup is a classic trend line breakout.

Please, note that such a setup will be accurate if the trend line is based on at least 3 consequent bullish or bearish moves.

If the market bounces from a trend line, it is a vertical support.

If the market drops from a trend line, it is a vertical resistance.

The breakout of the trend line - vertical support is a candle close below that. After a breakout, it turns into a safe point to sell the market from.

The breakout of the trend line - vertical resistance is a candle close above that. After a breakout, it turns into a safe point to buy the market from.

Take a look at the example. On GBPJPY, the market was growing steadily, respecting a rising trend line that was a vertical support.

A candle close below that confirmed its bearish violation.

It turned into a vertical resistance .

Its retest was a perfect point to sell the market from.

2. Horizontal Structure Breakout and Retest

The second setup is a breakout of a horizontal key level.

The breakout of a horizontal support and a candle close below that is a strong bearish signal. After a breakout, a support turns into a resistance.

Its retest is a safe point to sell the market from.

The breakout of a horizontal resistance and a candle close above that is a strong bullish signal. After a breakout, a resistance turns into a support.

Its retest if a safe point to buy the market from.

Here is the example. WTI Crude Oil broke a key daily structure resistance. A candle close above confirmed the violation.

After a breakout, the broken resistance turned into a support.

Its test was a perfect point to buy the market from.

3. Buying / Selling the Market After Pullbacks

The third option is to trade the market after pullbacks.

However, remember that the market should be strictly in a trend .

In a bullish trend, the market corrects itself after it sets new higher highs. The higher lows usually respect the rising trend lines.

Buying the market from such a trend line, you open a safe trend-following trade.

In a bearish trend, after the price sets lower lows, the correctional movements initiate. The lower highs quite often respect the falling trend lines.

Selling the market from such a trend line, you open a safe trend-following trade.

On the chart above, we can see EURAUD pair trading in a bullish trend.

After the price sets new highs, it retraces to a rising trend line.

Once the trend line is reached, trend-following movements initiate.

What I like about these 3 setups is the fact that they work on every market and on every time frame. So no matter what you trade and what is your trading style, you can apply them for making nice profits.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

What is a Swing Failure Pattern? - Basic explanation!A Swing Failure Pattern (SFP) is a technical chart pattern often used in price action trading to identify potential reversals in the market. It is typically seen on candlestick or bar charts in the context of trend analysis.

The basic idea behind a Swing Failure Pattern is that the price temporarily breaks above or below a previous swing high or low, but fails to sustain that move and reverses direction quickly. This indicates a potential shift in market sentiment, and it can be a signal for a trend reversal or breakdown.

When is it a SFP?

- In needs to sweep the previous low

- It has to close the candlestick above the previous low. So only a wick down When the price closes the body of a candle below the last low, it will not be considered an SFP. In this case, it is highly likely that the trend will continue in that direction.

The SFP can occur across various timeframes, from lower to higher timeframes.

Example on the daily timeframe

Here, we see two SFPs: one to the upside and one to the downside.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

Hidden Forces: Decoding Buyer & Seller Activity on ChartsTotal Volume vs. Volume Delta: The total volume on the chart includes both buys and sells, making it less useful for analysis. Volume Delta, however, shows whether buyers or sellers dominated within a candle.

A green Delta candle means more aggressive retail buying; a red one means more retail selling. This helps analyze market sentiment beyond price movement.

Price & Delta Relationships:

1. Price and Delta move together → Organic movement, likely driven by retail.

2. Delta moves, but price doesn’t → Retail is heavily biased in one direction, absorbing limit orders. Possible smart money trap.

3. Price moves, but Delta doesn’t → Retail didn’t participate in the move. Lack of belief or failed market-making attempt.

4. Price moves against Delta → Strong indication of market manipulation. Large players using aggressive strategies against retail.

Market Manipulation & Smart Money:

* Whales leverage retail psychology and order flow to position themselves.

* Retail often gets caught in fake moves, unknowingly providing liquidity to big players.

Final Thought: By analyzing Delta and price movement together, we can spot hidden large buyers and sellers and understand market dynamics beyond surface-level price action.

The Ultimate Guide to Price Action TradingIntroduction to Price Action

Price action trading is a powerful method that relies solely on analyzing price movements without using indicators. Instead of following lagging signals, traders use historical price movements to predict future market behavior. This approach helps in making informed decisions based on real market sentiment.

Why Use Price Action?

Many traders prefer price action because it simplifies trading by focusing only on the movement of price rather than complex technical indicators. Here are some key advantages:

Eliminates reliance on lagging indicators: Indicators often generate signals after the price has already moved significantly. Price action provides real-time insights.

Provides a clearer picture of market sentiment: By analyzing candlestick formations and key levels, traders can assess where the market is likely to move next.

Works across all timeframes and markets: Whether you trade stocks, forex, or crypto, price action techniques remain relevant.

Market Structure & Trend Analysis

Understanding market structure is key to recognising trends and making profitable trades. Price moves in patterns, forming trends, consolidations, and reversals.

Identifying Trends

A trend is a general direction in which the price is moving. Identifying trends early can give traders a significant edge.

Uptrend: Characterized by higher highs (HH) and higher lows (HL). This indicates strong buying pressure.

Downtrend: Identified by lower highs (LH) and lower lows (LL). This signals dominant selling pressure.

Ranging Market: Occurs when price moves sideways, forming equal highs and lows, showing indecision.

Using Market Structure to Trade

Follow the dominant trend for higher probability trades rather than trading against the market direction.

Look for breakouts from consolidation zones, which often lead to explosive moves in the market.

Identify trend reversals by observing changes in market structure, such as a break of previous highs or lows.

Key Support & Resistance Levels

Support and resistance levels help traders identify where price might react, leading to potential trade opportunities.

Types of Support & Resistance

Horizontal Levels: These are static price levels where the price has reversed multiple times, acting as strong barriers.

Trendlines: These dynamic levels move with price and act as diagonal support or resistance.

Psychological Levels: Round numbers like 100, 200, or 1.0000 in forex often act as key psychological barriers for traders.

How to Use Support & Resistance

Buying near support and selling near resistance is a classic strategy used by traders.

Breakout trading: If the price breaks a key level with strong momentum, it often continues in that direction.

Retest confirmation: After a breakout, the price may return to test the level before continuing its move. This offers a high-probability entry.

Candlestick Patterns & Their Meaning

Candlestick patterns provide insights into market sentiment and potential reversals or continuations.

Single Candlestick Patterns

Pin Bar (Rejection Candlestick): A pin bar has a long wick and a small body, showing strong rejection at a price level. It signals a potential reversal.

Doji: A candlestick with a small body and wicks on both sides, indicating indecision in the market.

Hammer & Shooting Star: The hammer forms at the bottom of a downtrend, signaling reversal, while the shooting star appears at the top, suggesting a potential sell-off.

Multi-Candlestick Patterns

Engulfing Pattern: A bullish engulfing pattern occurs when a large green candle completely engulfs the previous red candle, signaling a strong upward move. The opposite is true for bearish engulfing patterns.

Morning Star & Evening Star: These three-candle patterns indicate a shift in momentum, either bullish or bearish.

Head & Shoulders: A reversal pattern that suggests a shift from an uptrend to a downtrend or vice versa.

Price Action Strategies

Breakout Trading

Breakout trading involves identifying key price levels where a breakout is likely to occur. This can be from a range, a pattern like a triangle, or a resistance level.

Identify consolidation zones where price has been trading in a tight range.

Enter a trade when the price breaks above resistance or below support with strong volume.

Use stop-losses to avoid false breakouts, placing them just outside the consolidation zone.

Reversal Trading

Reversal trading focuses on identifying trend exhaustion and potential reversals.

Look for exhaustion at key levels, where price struggles to move further.

Confirm reversals with candlestick patterns such as pin bars, engulfing patterns, or head & shoulders formations.

Use risk-reward ratios of at least 1:2 to maximize profits on successful reversals.

Trend Continuation Trading

Enter on pullbacks within an established trend, rather than chasing breakouts.

Look for price bouncing off moving averages or trendlines as confirmation.

Ride trends until momentum weakens, using trailing stop-losses to lock in profits.

Trading Without Indicators

Analysing raw price action helps traders understand market movement without distractions.

Key Steps for Chart Analysis

Identify the overall market trend by checking higher highs or lower lows.

Mark key support and resistance levels to find potential trade areas.

Observe candlestick formations that provide confirmation for entries.

Wait for confirmation before entering a trade to avoid false signals.

Risk Management & Psychology in Price Action Trading

A strong mindset and risk management strategy are crucial for long-term success.

Risk Management Tips

Use stop-losses to limit risk and prevent large drawdowns.

Risk no more than 1-2% of capital per trade, ensuring longevity.

Always aim for a favorable risk-reward ratio, such as 1:2 or 1:3.

Psychological Tips

Stay disciplined and avoid emotional trading, as emotions can lead to impulsive decisions.

Accept losses as part of the process and learn from them.

Stick to a well-defined trading plan, reducing uncertainty in decision-making.

Final Thoughts & Next Steps

Mastering price action trading takes time, patience, and consistent practice. Here’s how you can improve:

Continuously analyze charts and refine your strategy by backtesting historical data.

Keep a trading journal to track progress and identify areas for improvement.

Stay updated with market conditions, as price action can behave differently in different market environments.

By applying these techniques, you can develop a strong foundation in price action trading and make more informed trading decisions. Stay disciplined, keep learning, and happy trading!

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

Soybean Futures Surge: ZS, ZL, and ZM Align for a Bullish MoveI. Introduction

Soybean futures are showing a potentially strong upcoming bullish momentum, with ZS (Soybean Futures), ZL (Soybean Oil Futures), and ZM (Soybean Meal Futures) aligning in favor of an upward move. The recent introduction of Micro Ag Futures by CME Group has further enhanced trading opportunities by allowing traders to manage risk more effectively while engaging with longer-term setups such as weekly timeframes.

Currently, all three soybean-related markets are displaying bullish candlestick patterns, accompanied by strengthening demand indicators. With RSI confirming upward momentum without entering overbought territory, traders are eyeing potential opportunities. Among the three, ZM appears to be the one which will potentially provide the greatest strength, showing resilience in price action and a favorable technical setup for a high reward-to-risk trade.

II. Technical Analysis of Soybean Markets

A closer look at the price action in ZS, ZL, and ZM reveals a confluence of bullish factors:

o Candlestick Patterns:

All three markets have printed bullish weekly candlestick formations, signaling increased buying interest.

o RSI Trends:

RSI is in an uptrend across all three contracts, reinforcing the bullish outlook.

Importantly, none of them are currently in overbought conditions, suggesting further upside potential.

o Volume Considerations:

Higher volume on up moves and decreasing volume on down-moves adds credibility to the bullish bias.

III. Comparative Price Action Analysis

While all three soybean-related markets are trending higher, their relative strength varies. By comparing recent weekly price action:

o ZM (Soybean Meal Futures) stands out as the one which will potentially become the strongest performer.

Last week, ZM closed above its prior weekly open, marking a +1.40% weekly gain.

RSI is not only trending higher but is also above its average, a sign of potential continued strength.

o ZS and ZL confirm bullishness but lag slightly in relative strength when compared to ZM.

This comparative analysis suggests that while all three markets are bullish, ZM presents the most compelling trade setup in terms of technical confirmation and momentum.

IV. Trade Setup & Forward-Looking Trade Idea

Given the strong technical signals, the trade idea focuses on ZM (Soybean Meal Futures) as the primary candidate.

Proposed Trade Plan:

Direction: Long (Buy)

Entry: Buy above last week’s high at 307.6

Target: UFO resistance at 352.0

Stop Loss: Below entry at approximately 292.8 (for a 3:1 reward-to-risk ratio)

Reward-to-Risk Ratio: 3:1

Additionally, with the introduction of Micro Ag Futures, traders can now fine-tune position sizing, making it easier to manage risk effectively on longer-term charts like the weekly timeframe. Given the novelty of such micro contracts, here is a CME resource that could be useful to understand their characteristics such as contracts specs .

V. Risk Management & Trade Discipline

Executing a trade plan is just one part of the equation—risk management is equally critical, especially when trading larger timeframes like the weekly chart. Here are key considerations for managing risk effectively:

1. Importance of Precise Entry and Exit Levels

Entering above last week’s high (307.6) ensures confirmation of bullish momentum before taking a position.

The target at 352.0 (UFO resistance) provides a well-defined profit objective, avoiding speculation.

A stop-loss at 292.8 is strategically placed to maintain a 3:1 reward-to-risk ratio, ensuring that potential losses remain controlled.

2. The Role of Stop Loss Orders & Hedging

A stop-loss prevents excessive drawdowns in case the market moves against the position.

Traders can also hedge using Micro Ag Futures to offset exposure while maintaining a bullish bias on the broader trend.

3. Avoiding Undefined Risk Exposure

The Micro Ag Futures contracts enable traders to scale into or out of positions without significantly increasing risk.

Position sizing should be adjusted based on account risk tolerance, ensuring no single trade overly impacts capital.

4. Adjusting for Market Volatility

Monitoring volatility using ATR (Average True Range) or other risk-adjusted indicators helps in adjusting stop-loss placement.

If volatility increases, a wider stop may be needed, but it should still align with a strong reward-to-risk structure.

Proper risk management ensures that trades are executed with discipline, preventing emotional decision-making and maximizing long-term trading consistency.

VI. Conclusion & Disclaimers

Soybean futures are showing bullishness, with ZS, ZL, and ZM aligning in favor of further upside. However, among them, ZM (Soybean Meal Futures) potentially exhibits the most reliable momentum, making it the prime candidate for a high-probability trade setup.

With bullish candlestick patterns, RSI trends confirming momentum, and volume supporting the move, traders have an opportunity to capitalize on this momentum while managing risk effectively using Micro Ag Futures.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Avoid Market Maker Traps: Liquidity Sweeps & FVG ExplainedUnderstanding Market Maker's Perspective: Liquidity Sweeps and Fair Value Gaps (FVG)

In this educational post, I'll dive into the smart money concepts (SMC) that help traders understand market behavior from a broker or market maker's perspective. This analysis will focus on liquidity sweeps, Fair Value Gaps (FVG), and how market makers use these strategies to manipulate price movements.

What is a Liquidity Sweep?

A liquidity sweep occurs when the market pushes through a known level of liquidity, such as stop losses or pending orders. This action often creates sharp wicks or sudden moves, typically engineered by smart money to gather liquidity for their positions.

Fair Value Gap (FVG) Explained

An FVG is a price gap between a consecutive bullish and bearish candle (or vice versa), leaving a void in the market. These gaps often act as magnets for price, as market makers seek to "fill" these gaps, using them as traps for retail traders.

The Retail Trader's Perspective

Many new traders view the FVG as a signal to enter the market, expecting price to move in their favor immediately. They often set stop losses below recent lows, providing market makers with a clear liquidity target.

How Market Makers Exploit Liquidity

Market makers often execute a classic trap strategy:

Push the price up slightly to create a false sense of security for retail buyers.

Execute a sharp move down to trigger stop losses and capture liquidity below key levels.

Finally, reverse the price direction sharply to the upside, aligning with their true market intent.

Practical Trading Strategy

For new traders, understanding this concept can help avoid common traps:

Avoid entering trades at the FVG without confirmation.

Look for signs of a liquidity sweep, such as long wicks or strong rejections.

Enter trades only after seeing a market structure shift (MSS) that confirms the true direction.

Conclusion

By thinking like a market maker, traders can align their strategies with smart money concepts, improving their chances of success. Always remain patient, seek confirmation, and avoid the traps set by market manipulation.

This post aims to educate traders on avoiding common pitfalls and developing a more strategic approach to trading using smart money concepts.

Leap Ahead with a Dynamic Setup: Trading with Andrew’s PitchforkThe Leap Trading Competition: A Chance to Trade Micro Euro Futures

TradingView’s "The Leap" Trading Competition provides an opportunity for traders to apply their futures trading strategies in a competitive environment. Participants can trade select CME Group futures contracts, including Micro Euro Futures (M6E).

This article presents a structured trade setup using Andrew’s Pitchfork, a technical tool that helps define potential trend direction and breakout levels. The setup involves two intersecting pitchforks near a key UFO support level, signaling the possibility of either an uptrend continuation or a confirmation of a new downtrend.

Understanding Andrew’s Pitchfork and Market Structure

Andrew’s Pitchfork is a technical analysis tool used to identify trend channels by plotting three parallel lines from a major price swing. The tool helps traders anticipate support, resistance, and breakout levels based on median lines.

In this setup, two pitchforks define opposing market structures. The green pitchfork represents an uptrend, suggesting that price could continue higher. The red pitchfork represents a developing downtrend, indicating a possible reversal. The intersection of these pitchforks at a key UFO support level marks an important decision point for the market.

The Dynamic Trade Setup: Long and Short Scenarios

In a long trade scenario, entry is confirmed if price breaks above the Upper Median Line (UML) of the red pitchfork. The target for the trade is the Median Line (ML) of the green pitchfork, representing trend continuation. A stop loss is placed below entry at a distance that ensures a minimum 3:1 reward-to-risk ratio.

In a short trade scenario, entry is confirmed if price breaks below the Lower Median Line (LML) of the green pitchfork. The target for the trade is the Median Line (ML) of the red pitchfork, confirming further downside movement. A stop loss is placed above entry at a distance that maintains a minimum 3:1 reward-to-risk ratio.

Because the UML, LML, and ML levels change dynamically with each bar, breakout levels and targets must be adjusted accordingly. If price remains inside the pitchfork structure, the setup remains neutral until confirmation occurs.

Contract Specifications and Margin Requirements

Euro FX Futures (6E) details:

Full contract specs: 6E Contract Specifications – CME Group

Contract size: €125,000

Tick size: 0.00005 per EUR/USD ($6.25 per tick)

Margin requirements depend on broker conditions and market volatility, currently around $2,600 per contract.

Micro EUR/USD Futures (M6E) details:

Full contract specs: M6E Contract Specifications – CME Group

Contract size: €12,500 (1/10th of 6E)

Tick size: 0.0001 per EUR/USD ($1.25 per tick)

Lower margin requirements provide access to traders with smaller accounts, currently around $260 per contract.

M6E offers a lower-cost alternative to 6E, making it a useful instrument for adjusting position sizes and managing risk effectively. Traders should consider market conditions and leverage when determining position sizes.

Execution and Trade Management

Before executing a trade, price must confirm a breakout by fully breaking above UML for long trades or below LML for short trades. Additional confirmation through volume trends, momentum indicators, or candlestick patterns may help validate the move.

If price does not confirm the breakout, the setup remains invalid. If price re-enters the pitchfork channel, traders should reassess market structure before taking a new position. Stop losses should be maintained at levels that align with a structured risk-reward plan.

Conclusion

Andrew’s Pitchfork provides a structured approach for trading trend continuation and reversals. This setup allows for both long and short breakout opportunities, depending on how price reacts at key pitchfork levels.

For traders in The Leap Trading Competition, this setup highlights the importance of disciplined execution, waiting for confirmation, and managing risk effectively when trading futures.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Leap Ahead with a Bearish Divergence on Gold FuturesThe Leap Trading Competition: A Chance to Trade Gold Futures

TradingView’s "The Leap" Trading Competition is an opportunity for traders to test their futures trading skills. Participants can trade select CME Group futures contracts, including Gold Futures (GC) and Micro Gold Futures (MGC).

Register and participate here: TradingView Competition Registration .

This article presents a structured short trade setup based on a bearish divergence identified using the Commodity Channel Index (CCI) and key pivot point levels for confirmation. The trade plan focuses on waiting for price to break below the pivot point at 2866.8 before executing the trade, with clear targets and risk management.

Identifying the Trade Setup

Bearish divergence occurs when price makes higher highs while an indicator, such as CCI, makes lower highs. This signals weakening momentum and a potential reversal. The Commodity Channel Index (CCI) measures price deviations from its average and helps traders identify overbought or oversold conditions.

Pivot points are calculated from previous price action and serve as key support and resistance levels. The pivot at 2866.8 is the reference level in this setup. A breakdown below this level may suggest further downside momentum, increasing the probability of a successful short trade.

The trade plan combines CCI divergence with pivot point confirmation. While divergence signals a potential shift, entry is only considered if price trades below 2866.8. This approach reduces false signals and improves trade accuracy. The first target is set at 2823.0, aligning with an intermediate support level (S1), while the final target is near S2 at 2776.2, just above a UFO support zone.

Trade Plan and Risk Management

The short trade is triggered only if price trades below 2866.8. The stop loss is placed above the entry at a level ensuring at least a 3:1 reward-to-risk ratio.

Profit targets are structured to lock in gains progressively:

The first exit is at 2823.0, where partial profits can be taken.

The final exit is near 2776.2, positioned just above a UFO support level.

Stop placement may vary based on the trader’s preferred risk-reward ratio. Position sizing should be adjusted according to account size and market volatility.

Contract Specifications and Margin Requirements

Gold Futures (GC) details:

Full contract specs: GC Contract Specifications – CME Group

Contract size: 100 troy ounces

Tick size: 0.10 per ounce ($10 per tick)

Margin requirements depend on broker conditions and market volatility. Currently around $12,500 per contract.

Micro Gold Futures (MGC) details:

Full contract specs: MGC Contract Specifications – CME Group

Contract size: 10 troy ounces (1/10th of GC)

Tick size: 0.10 per ounce ($1 per tick)

Lower margin requirements provide access to smaller traders. Currently around $1,250 per contract.

Leverage impacts both potential gains and losses. Traders should consider market conditions and margin requirements when adjusting position sizes.

Execution and Market Conditions

Before executing the trade, price must break below 2866.8. Additional confirmation can be sought through volume trends and price action signals.

If price does not break the pivot, the short setup is invalid. If price consolidates, traders should reassess momentum before committing to the trade.

Conclusion

Bearish CCI divergence signals potential market weakness, but confirmation from the pivot breakdown is key before executing a short trade. A structured approach with well-defined targets and risk management increases the probability of success.

For traders in The Leap Trading Competition, this setup highlights the importance of discipline, confirmation, and scaling out of trades to manage risk effectively.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

ETH | Alternative Chart Pattern | EducationJust a short update for my latest C&H post

Price is also forming an Ascending Triangle pattern with a liquidity zone of $2,800 - $3,000 for an average spot for buyer to step in

When trading chart patterns it's best to figure out how to jump in before the breakout similarly to the last touches highlighted in blue on the bottom trendline

You can see that price was forming a bottom-like pattern or what I also like to call price accumulation and then vice versa for the tops.

Learn What is Higher High, Higher Low, Lower Low, Lower High

In this educational article, we will discuss the foundation of price action analysis: the concepts of highs and lows.

In order to grasp that concept, you should learn to perceive the price chart as the sequence of zigzags .

Depending on the direction of the market and the shape of these zigzags, its peaks will be called differently. There are 6 types of them that you should learn to recognize.

1️⃣ Equal Highs (EH).

The peaks of bullish moves will be called equal highs, if they perfectly respect the same level (resistance), retracing from that and not managing to break above.

Above is the example of equal highs on Gold chart on a daily.

2️⃣ Equal Lows (EL).

The peaks of bearish moves will be called equal lows, if they perfectly respect the same level (support), bouncing from that and not managing to break below.

Find perfect equal lows on USDCAD on the chart above.

3️⃣ Higher High (HH).

The peak of a bullish move will be called Higher High, if the price manages to violate the previous high after a retracement.

Look at a perfect sequence of higher highs on NZDUSD.

4️⃣ Lower Low (LL).

The peak of a bearish move will be called Lower Low, if the price manages to violate the previous low after a pullback.

Trading in a strong bearish trend, NZDCAD keeps updating lower lows on a daily.

5️⃣ Higher Low (HL).

The peak of a bearish move will be called Higher Low if, after a retracement from the high, the price manages to set a low that is higher than the previous low.

Back to the example on NZDUSD. Not only the price updates the higher highs but also the higher lows.

6️⃣ Lower High (LH).

The peak of a bullish movement will be called Lower High if, after a pullback from the low, the price sets a high that is lower than the previous high.

That's how EURJPY acted on a daily, setting 2 nice lower highs.

Why these terms are so important?

Because, firstly, you can apply them to objectively identify the market trend.

Secondly, all the price action patterns are based on a combination of these highs and lows.

You should learn these terms by heart, and you should learn to perceive the price chart as the sequence of zigzags, with a strict designation of each peak.

❤️Please, support my work with like, thank you!❤️

How I Stopped Missing The Best Trade Entries!!I’ll be honest—when I started trading, I had no idea what I was doing. I’d open a 15-minute chart, see what looked like a good setup, and jump in. Sometimes I got lucky, but more often than not, the market turned against me.

I remember one trade in particular that still stings when I think about it. I was trading EUR/USD on the 15-minute chart, and I spotted what I thought was the perfect breakout. Without hesitating, I entered.

An hour later, the market completely reversed, and I was stopped out. Frustrated, I zoomed out to the daily chart, and there it was: I’d entered a buy trade right into a major resistance zone during a long-term downtrend.

That trade taught me a hard truth: if you don’t look at the bigger picture, you’re setting yourself up for failure.

How I Changed My Approach

After that trade, I knew I had to change how I looked at the market. I started using multiple timeframes, and it made all the difference. Here’s how I do it:

1️⃣ Start Big (Monthly and Weekly Charts):

I always start with the monthly or weekly chart to get the big picture. Is the market trending up, down, or just moving sideways? Are we approaching any major levels that could cause a reversal?

For example, if the monthly chart shows a strong downtrend, I know I’ll only be looking for sell setups. That keeps me from fighting the overall momentum.

2️⃣ Zoom In (Daily and 4-Hour Charts):

Once I’ve got the big picture, I move to the daily or 4-hour chart. This is where I refine my plan. I look for key levels like support and resistance or patterns like consolidations and pullbacks.

These timeframes help me figure out where the market is likely to go next, and they’re where I start building my trade idea.

3️⃣ Precision Entries (30-Minute and 5-Minute Charts):

Finally, I drop to the lower timeframes—30-minute and 5-minute charts—to time my entry. This is where I wait for confirmation. Maybe it’s a candlestick pattern, a breakout with volume, or a pullback to a key level I spotted earlier.

This part takes patience. There have been so many times I’ve almost jumped the gun, but waiting for that confirmation has saved me more times than I can count.

My Secret Sauce

Here’s the approach I stick to every single time:

1. Align with the bigger picture. If the monthly and weekly charts are trending down, I only look for sell setups. I don’t care what the smaller timeframes say—sticking to the big picture keeps me disciplined.

2.Identify key levels. On the daily and 4-hour charts, I mark the major support and resistance zones where the market is likely to react.

3.Wait for confirmation. When the price reaches one of my levels, I don’t jump in right away. I wait for the 30-minute or 5-minute chart to give me a clear entry signal.

Here’s the real kicker: I’ve learned to walk away if nothing aligns. No trade is better than a bad trade, and patience has become my best tool.

Switching to multiple timeframes has completely changed the way I trade. It taught me to be patient, to respect the market, and to stop forcing trades that don’t make sense.

If you’ve been struggling with timing your entries or feel like you’re always one step behind, I get it—I’ve been there. Try this approach. Start with the bigger picture, work your way down, and let the market come to you.

And if you’ve got questions or want to know more about how I trade, send me a DM or check out my profile. I’m happy to help—you don’t have to figure it all out alone.

Kris/Mindbloome Exchange

Trade What You See

Reversal Trading Strategy Using GOLDEN RSI Divergence Indicator Overview

Reversal trading strategies capitalize on identifying turning points in the market where a potential reversal from a downtrend to an uptrend, or vice versa, occurs. In this post, I will introduce a strategy based on divergence patterns spotted with a custom RSI (Relative Strength Index) indicator.

This method enhances traditional RSI analysis by making divergence detection clearer and actionable. By combining it with a strong understanding of price action, traders can gain an edge in timing market reversals effectively.

Key Features of This Strategy

Divergence Analysis: The core of this strategy is to identify bullish or bearish divergences between the RSI and price action.

Custom RSI Indicator: The custom RSI indicator simplifies divergence detection by highlighting critical levels and marking divergence points directly on the chart.

Confluence with Price Action: Reversals are validated using trendlines, support/resistance zones, and candlestick patterns.

Chart Example: S&P 500 Index

In the attached chart:

Bullish Divergence:

The price made lower lows, while the RSI made higher lows (indicated by green arrows).

This divergence signaled weakening bearish momentum and potential reversal.

Entry Point:

A clear breakout above the trendline validated the reversal.

Enter long positions near this breakout level.

Stop Loss:

Place the stop loss just below the recent swing low.

Target Profit:

Aim for the next major resistance zone or use a fixed risk-reward ratio (e.g., 1:2 or 1:3).

How to Spot Divergence

Bullish Divergence:

Price forms lower lows.

RSI forms higher lows.

This indicates waning bearish pressure and a potential upward reversal.

Bearish Divergence:

Price forms higher highs.

RSI forms lower highs.

This suggests weakening bullish pressure and a possible downward reversal.

Why This Strategy Works

Strength of RSI Divergence

RSI divergence reflects the loss of momentum in the current trend. By detecting it early, traders can position themselves ahead of major reversals.

Combining Confluence Factors

The success rate of this strategy increases when RSI divergence aligns with other technical factors like:

Horizontal support or resistance levels.

Trendline breaks.

Volume spikes.

Practical Tips for Using This Strategy

Use Multiple Timeframes: Confirm divergence signals on higher timeframes for stronger setups.

Avoid Overtrading: Only act on clear and validated divergence setups to minimize false signals.

Risk Management: Never risk more than 1-2% of your trading capital on a single trade.

Conclusion

This custom RSI-based divergence strategy is a powerful tool to identify high-probability reversal setups. When combined with proper risk management and confluence analysis, it can significantly improve trading outcomes.

Start experimenting with this strategy on your demo account and refine your approach before deploying it in live markets. If you have questions or want to discuss this further, feel free to comment below!

BDL - An update and a VSA Learning ExerciseThis is just a learning exercise. We had anticipated a good move from this stock. However, 1230 was the trigger point for the Up move Now let us do a bar to bar analysis.

Refer the box marked “A”. We can see there was a sideways move or a consolidation happening. We can see the prices clustering together and the volume became low. It Indicated accumulation going on.

Refer to the bar marked “B”. It is an up bar with increased volume. This bar was an indication that things are about to change.

Refer to the Bar marked “C”. The next bar is a wide spread bar going past the trigger point, ending near the top. Also, we can see the volume increased volume indicating a high probable Breakout.

And today's bar (marked “D’) opened up above the previous close. The bar did see some selling, but finally it overcame the selling and closed up. Of course, the spread was not, the spread was narrow indicating selling pressure still present.

We can see the stock has started its up move and it is all supported by increased volume and the momentum. The price action momentum is also driven by volume and we can see increased relative strength. All that support further up move and the first obstacle we could see would be 1365, where we may see some more consolidation before further up move. This whole exercise is just for learning purpose.

FACT(NSE) Stock - Applying Bullish Breaker Concept on TradingTrading is simple!

All you need to know is Premium / Discount Arrays to understand market dynamics.

Choose the Higher Time Frame (HTF) PD array and trade Lower Time Frame (LTF) PD array.

Time Frame Alignment

HTF - H4

LTF - M15

HTF PD ARRAY - Bullish Breaker

LTF PD Array - Bullish Breaker

Higher Time Frame gives you market direction.

Lower Time Frame gives you entry opportunity

7 Best Chart Patterns For Trading Forex and Gold

If you are studying chart parts, I prepared for you the list of 7 price action patterns you should never miss.

In this article, I will share with you powerful chart patterns for trading forex or any other financial market.

These patters work perfectly for day trading, swing trading and scalping.

We will study real market examples. I will explain the psychology and meaning of each pattern and explain to you how to trade them.

The first chart pattern that we will discuss is double top.

The pattern is formed on the edge of a bullish impulse.

It is based on 2 equal highs and a higher low between them.

A higher low composes a minor support.

A strong bearish signal is a breakout of a neckline and a candle close below that. Entry is on its retest. Stop loss is above the highs.

Target is the closest strong support.

The bullish version of a double top pattern is called double bottom

The pattern is formed on the edge of a bearish impulse.

It is based on 2 equal lows and a lower high between them.

A lower high composes a minor resistance.

A strong bullish signal is a breakout of a neckline and a candle close above that. Entry is on its retest. Stop loss is below the lows.

Target is the closest strong resistance.

The second powerful pattern is a descending triangle formation.

The pattern is formed on the edge of a bullish impulse.

It is based on at least 2 equal lows and 3 lower highs between them.

A falling trend line should respect the lower highs.

A strong bearish signal is a breakout of a neckline and a candle close below that. Entry is on its retest. Stop loss is above the highest high.

Target is the closest strong support.

A bullish variation of a triangle pattern is called an ascending triangle.

The pattern is formed on the edge of a bearish impulse.

It is based on at least 2 equal highs and 3 higher lows between them.

A rising trend line should respect the higher lows.

A strong bullish signal is a breakout of a neckline and a candle close above that. Entry is on its retest. Stop loss is below the lowest low.

Target is the closest strong resistance.

Chart pattern number 5 - Cup & Handle pattern.

Cup & handle pattern is the variation of a double bottom.

The only difference between 2 patterns is 1 lower low and a consequent higher low, instead of 2 equal lows.

Entry trigger and trade execution rules are absolutely the same as with a double bottom.

Stop loss is strictly below the lower low.

A bearish version of a cup & handle is called an inverted cup & handle.

Inverted cup & handle pattern is the variation of a double top.

The only difference between 2 patterns is 1 higher high and a consequent lower high, instead of 2 equal highs.

Entry trigger and trade execution rules are absolutely the same as with a double top.

Stop loss is strictly above the higher high.

The last and the most powerful chart pattern is the range .

Range is a strictly horizontal parallel channel where the price sets equal highs and equal lows, respecting the support and the resistance of the range.

This chart pattern signifies that the market found equilibrium, a fair value.

A strong bullish signal is a breakout of a resistance of the range and a candle close above that.

Target will be the next strong resistance, stop loss should lie below the lows of the range.

A strong bearish signal is a breakout of a support of the range and a candle close below that.

Target will be the next strong support, stop loss should lie above the highs of the range.

Of course, there are more patterns to study but these 7 are essential .

Your ability to recognize them is the key for accurate price action trading.

Learn to spot these patterns and good luck in your trading..

Let me know which patterns do you want to study in the next article.

❤️Please, support my work with like, thank you!❤️