Trend

What to do when you do not have any good POIsWatch this video to learn how to adjust your thought process when the market does not give you any valid POIs to work with. I struggled with this for a long time.

How to understand the market movement?BINANCE:BTCUSDT

When you just open charts for the first time, the market movement seems chaotic: incomprehensible bars, lines, and so on remind us of a medical cardiogram. Here we have only one very important question: "How to understand the market movement?".

In fact, everything is simpler than it seems. Let's start with a classic trend move.

There are two camps on the market - "Bulls" and "Bears". Bulls - buy (raise the price values up), and bears - sell (lower the price values down).

Our task is to determine who is stronger in the market. This is the definition of the power of movement.

Market movement consists of a trend movement and a sideways movement. If the price lows and highs are higher than the previous ones, this may indicate the strength of the Bulls (uptrend), if the lows and highs are lower than the previous ones, the strength is on the side of the Bears (downtrend). When there are no clear higher/lower lows and highs then it is a sideways move.

Let's start from the most important.

There are two phases in a trend movement:

1) Main movement

2) Correction.

Let's take an upward movement as an example:

From the very beginning, you should have an understanding that the trend is your friend.

70-80% of trades should be opened strictly in the main direction of movement, and only 20-30% -

against it (trades that are opened in the direction of correction).

In the downward movement, everything is exactly the opposite.

In the case of lateral movement, the main factors for work are the boundaries of lateral movement.

Also, when working with trend movement, do not forget to look at the background timeframes.

What are timeframes in general and which ones are the main ones and which are the background ones?

Timeframe (tf) is a certain period of time for which a candle is formed.

The change of tf gives us the opportunity to look inside each candle.

So one daily candle (1D) contains six four-hour candles (4H), and one four-hour candle (4H) contains sixteen fifteen-minute candles (15M) and so on.

Each timeframe carries certain information for analysis. We can mark for ourselves the main timeframes:

1D 4H 1H 30m 15m 5m 1m

All other timeframes will act as intermediate (background) ones for us.

How to understand which timeframe is more important? 1D or all the same 1H?

In fact, there is no one important TF. As we pointed out earlier, each carries important information. Whether it is 5m or 1h, they are equally important for analysis.

There is only a sequence of analysis and trend definition.

From older to younger.

You must take into account all timeframes, carefully analyze each of them, not missing a single detail. Every factor you have should be "fractal" - displayed on lower TFs.

Do not rack your brains and do not look for “golden” information on the Internet “how to determine the trend”, just determine the highs and lows on the chart and everything will fall into place.

Also, the trend cannot be predicted. You can't think of yourself "Now the trend will begin" -

No! It is determined "by the fact" of its formation.

The optimal time for crypto trading is determined by the opening of stock trading sessions, as practice shows, this is a highly volatile time on the market. Within these trading sessions, there is a specific time that shows the main volatility at a distance. This time is the most successful for trading.

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

* Look at my ideas about interesting altcoins in the related section down below ↓

* For more ideas please hit "Like" and "Follow"!

What is a moving average and do they work?Moving average is an average of price closes over a certain amount of time, so at a base level they rise when price rises and fall when price falls, so why are they important? Because they give you a sense of the average direction of price over a certain amount of time, if you take the chart at face value you are not even witnessing one price close at that specific moment in time! unless you are then well done you lol, so the moving average is giving us data of maybe 89 or 50 or 200 ect, this overall analysis of the trend can defiantly aid your decision making, for example if you use two moving averages like the ma8 and ma89, what we can look at is the moving average MA8 reverting back to test the baseline which is the MA89 in this example, so price is now attempting to some extent to change trend, if it breaks lower than the baseline the line will start falling! MA89 will start declining as negative closes come in and alter the formula, that is why these areas can offer great buying opportunities or selling depending which side of the baseline you are, Price will test the baseline and bounce in strong trends before price will eventually break the baseline down the line. I will follow this post up with a post on moving averages being used on indicators now we have the first bit out the way.

Confluence example - 5 reasons to sellWe have trendline that connects highs and price is trending down. We also see resistance zone formation that price tested 3 times. On the 3rd

touch price also tested the trendline and formed bearish candlestick pattern. Stochastic indicator worked

well as it gave another confirmation so sell (red circle).

1. Downtrend

2. Trendline

3. Resistance

4. Bearish Candles

5. Stochastick Osc.

How To Make Your Trading Plan In 7 Steps !How To Make Your Trading Plan In 7 Steps !

➡️ Choose The Correct Time Frame

All traders know what time frames are, but few know that each time frame has a specific way of working. Time frames from 15 minutes to 60 minutes fall under the name of day trading, meaning that all deals will be closed on the same day, whether with profit or loss, and traders call it the name "Scalping"

On the other hand, there is a time frame from 4 hours to the daily frame, which are considered long deals and traders call them “swing”

Time frames higher than the daily are considered investment centers and are not suitable for small capitals

——————————————————

➡️ Risk Management

Most traders make a fatal mistake, which is not choosing a risk ratio for each trade, and this exposes the entire account to a loss. The best traders in the world believe that the reasonable risk ratio is between 1% to 3% for each trade.

——————————————————

➡️ Conditions

You Must Choose Between " Ranging " Or " Trending "

——————————————————

➡️ Markets

In Stock Markets We Have 4 Market ,,

- First One Is Option

Option or binary options is a currency, commodities and stock market that simulates the same conditions as the real markets, but you can set a time for the transaction and bet on the direction within a minute or two and you can win up to 90% of the bet amount, but in the event of a loss, you lose the entire bet amount and some believe that The option market has a lot of suspicions and scams

- Second Type Is Equity

- Third Type Is Futures

- Forth Type Is Forex

- Fifth Market Is Crypto Currency

——————————————————

➡️ Type Of Your Entries

- Pull Back

- Break Out

- Cross Over

——————————————————

➡️ How To Put Your Stop And Targets ?

——————————————————

Print It And Don't Forget Any One From The 7 Steps To Be Successful Trader ❤️❤️

Trade with the trend!Even if you might be new to trading or day trading you'll probably be familiar with the phrase "stay with the trend" or "the trend is your friend", well this blog post and supported video is all about that and how we are looking to trade the DAX during the London session.

The trend is your friend and trading with the trend will generally provide you with the easiest profits, and the smallest losses, as long as you base your trading strategy around this process.

We hope this short video helps you with your trading today!

Have yourself a fantastic trading day and all the best!

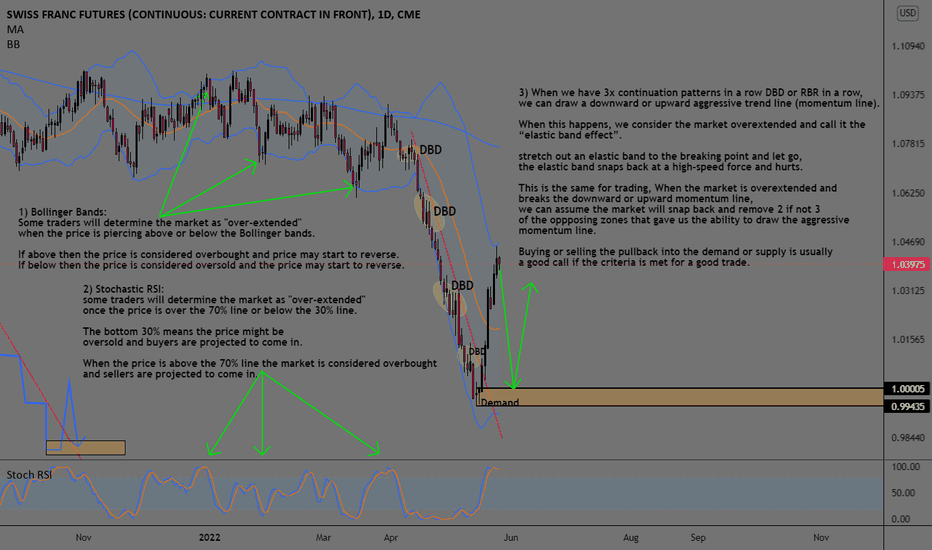

Overextended Markets (Overbought And Oversold)1) Bollinger Bands:

Some traders will determine the market as "over-extended"

when the price is piercing above or below the Bollinger bands.

If above then the price is considered overbought and price may start to reverse.

If below then the price is considered oversold and the price may start to reverse.

2) Stochastic RSI:

some traders will determine the market as "over-extended" once the price is over the 70% line or below the 30% line.

The bottom 30% means the price might be oversold and buyers are projected to come in.

When the price is above the 70% line the market is considered overbought and sellers are projected to come in.

3) Supply And demand

When we have 3x continuation patterns in a row DBD or RBR in a row, we can draw a downward or upward aggressive trend line (momentum line).

When this happens, we consider the market overextended and call it the “elastic band effect”.

stretch out an elastic band to the breaking point and let go, the elastic band snaps back at a high-speed force and hurts.

This is the same for trading, When the market is overextended and breaks the downward or upward momentum line, we can assume the market will snap back and remove 2 if not 3 of the opposing zones that gave us the ability to draw the aggressive momentum line.

Buying or selling the pullback into the demand or supply is usually a good call if the criteria are met for a good trade.

A Channel pattern - EducationalA channel is a chart pattern. And uses trendlines. A channel indicates an entry and a possible exit. It can also control the risk.

A channel consists of two parallel lines, between which the price moves.

Drawing a channel:

Ascending channel

- During an uptrend, draw the basic up trendline along the lows. Then you draw a line from the first peak which runs parallel to the basic up trendline, these lines now form a channel. If the 2nd peak reaches the upper line of the channel a channel can be said to exist, but a third test of the trendline is always needed to see if the trendline is really accepted.

Descending channel

- During a downtrend draw the basic down trendline along the highs. Then draw a line from the first bottom which runs parallel to the basic down trendline, these lines now form a channel. If the 2nd bottom reaches the bottom trendline a channel can be said to exist, but a third test of the trendline is always needed to see if the trendline is really accepted.

Horizontal channels are like rectangles, they are called trading ranges.

How to profit from this pattern?

Short term (uptrend)

A long position could be opened when the price is at or near the basic up trendline. One could even open a short position when the price is at the top of the channel, but beware! Going against the trend can have negative consequences.

Short term (downtrend)

A short position could be opened when the price is at or near the basic down trendline. A long position can even be opened when the price is at the bottom of the channel, but beware! Trading against the trend can have negative consequences.

Try to take profits the moment the price, comes close to the trendline on the other side, you could thus switch your position from Long to short and visa versa.

Remember, the higher the timeframe you use the more reliable the trendlines become, also a trendline is more reliable if the trendline has been tested often.

Trading the channel breakout

The failure to reach a channel line is often an early warning that the channel line on the other side will be broken. Once a channel is broken a move of around the width of the channel can be excepted. So a larger channel usually have bigger profit potential. You can use certain technical indicators with a channel, for example 'volume', pay attention to whether the volume increases the moment the price breaks out of the channel, if this is not the case it means that the channel is probably still intact.

Profit targets and a Stop-loss

As I already mentioned the intention is to take profit the moment the price is on the other side of the channel. Imagine this: There is an ascending channel, the price is moving around the basic up trendline (base line), then you can enter a long position. Then the price is moving towards the upper trendline of the channel and you can take your profit. If you like you can take a short position here, but beware! Trading against the trend can be dangerous.

But where is your stop-loss?

I already said it many times: always place a stop-loss before you forget it and before you start doing other things! In the preceding example you place this stop-loss just below the base line at the long position, keep a little space between the base line and your stop-loss! It could happen that the price breaks through the channel lines on an intra-day basis, but only when the price closes outside the channel line this could be a sign of a breakout. For the short position from the above example, place your stop-loss just above the upper trendline, with some distance in between.

Here are more examples:

I wish you all the best!

This is no financial advice.

BITSTAMP:BTCUSD

Price Action Ranges| Range High/Low| Deviations

In this segment we will discuss the concept behind Price Action Ranges; they are periods of oscillation in the market where supply and demand is balanced. Once this occurs, there is a high probability of a price expansion out of the range.

The basic concepts in price action ranges are the following:

- Range High Resistance

- Range Low Support

- Range –Mid

- Deviations

Range High Resistance

- This is an area on the chart where resistance is present, price action tests this area before reversing back down

Range Low Support

- This is an area on the chart where support is present, price action visits this area for a test before reversing back up

Deviations

- Deviations occur out of the region to generate liquidity, it is designed to trap trader before reversing in the opposite direction.

Emotional Responses are Dangerous in this EnvironmentMarkets across all asset classes hate uncertainty because it causes traders, investors, and all market participants more than a bit of indigestion. Fear and greed are emotions that drive impulsive behaviors. Effective decision-making depends on a rational, logical, and reasonable approach to problem-solving.

The Fed finally addresses inflation

Recessionary risks are rising

Stagflation creates the worst of both worlds

Tools impact the demand side- The supply side is a challenge

Tools and rules for keeping emotions in check during scary times

Reducing impulsive, emotional responses is a lot easier said than done. While it is easy to mitigate emotion during calm periods, they take over and trigger fear or greed-based actions in the heat of the moment.

In mid-May 2022, the markets face a crossroads. The current market correction is a function of rising interest rates, the potential for an economic decline, a rising dollar, the war in Europe, supply chain issues, geopolitical tensions between nuclear powers, and a host of other domestic and foreign factors.

It is now the most critical period in decades to take an emotional inventory that will avoid catastrophic, impulse-based mistakes. Wide price variance in all markets could accelerate, and those with a plan are the most likely to succeed and protect their hard-earned capital.

The Fed finally addresses inflation

The US central bank had an epiphany after mistakenly believing that rising inflationary pressures were “transitory” in 2021. The Fed woke up smelling the blooming inflationary environment late last year when CPI and PPI data showed the economic condition rose to the highest level in over four decades.

At the May 4 meeting, the central bank hiked the Fed Funds Rate by 50 basis points to 75 to 100 basis points. The central bank told markets to expect 25 or 50-basis point hikes at each meeting for the rest of 2022 and into 2023. The Fed also laid out its plans to reduce its swollen balance sheet, allowing government and debt securities to roll off at maturity. While the Fed has switched to a hawkish monetary approach, it remains behind the inflationary curve. Last week, April CPI came in at 8.3% with PPI at 11%, meaning real short-term interest rates remain negative, fueling inflation. While wages are rising, they are lagging behind inflation. Consumers may be earning more but spend even more on goods and services each month.

Recessionary risks are rising

The US first quarter 2022 GDP data showed a 1.4% decline or economic contraction. The war in Russia, sanctions and retaliation, supply chain bottlenecks, deteriorating relations with China, political divisiveness in the US, and many other issues weigh on the US economy. Meanwhile, rising US interest rates have put upward pressure on the US dollar, pushing the dollar index to a multi-year high.

As the chart shows, the dollar index rose to 105.065 last week, a two-decade high. A rising dollar is a function of increasing US rates, but it makes US multinational companies less competitive in foreign markets.

The falling GDP in Q1 2022 increases the threat of a recession, defined as a GDP decline in two successive quarters, putting pressure on the Q2 data this summer.

Stagflation creates the worst of both worlds

Recession and inflation create stagflation, the worst of all worlds for central bankers seeking stable markets and full employment. The most recent economic data has put the US economy on the road towards stagflation as rising prices and a sluggish economy require competing monetary policy tools.

The Fed is addressing inflation with higher interest rates and quantitative tightening, but recession requires stimulus, the opposite of the current hawkish monetary policy path. The central bank must decide on which economic condition threatens the economy more. The Fed seems to have chosen inflation, but it is more than a reluctant choice. Tightening credit treats the inflationary symptoms, but it can exacerbate recessionary pressures as higher rates choke economic growth. Stagflation is an ugly economic beast.

Tools impact the demand side- The supply side is a challenge

Meanwhile, the US and other central banks have deep toolboxes that address demand-side economic issues. While inflation and recession require different tools, the Fed faces other compelling factors from the global economy’s demand side.

The war in Ukraine is distorting prices as sanctions on Russia and Russian retaliation distort commodity prices. Moreover, the “no-limits” alliance between China and Russia creates a geopolitical bifurcation with the US and Europe. With nuclear powers on each side of the ideological divide, economic ramifications impact the economy’s supply side. China is the world’s leading commodity consumer, and Russia is an influential and dominant raw materials producer. Energy and food prices are the battlegrounds.

Central banks have few tools to deal with supply-side shocks and changes, which can create extreme volatility in the prices of goods and services. The Chinese-Russian alliance transforms globalism with a deep divide. Global dependence on Chinese demand and Russian supplies distorts raw material’s supply and demand fundamentals. While the US Fed faces a challenge balancing inflation and the potential for a recession, the supply side issues only complicate the economic landscape, increasing market volatility across all asset classes.

Tools and rules for keeping emotions in check during scary times

The best advice for dealing with anxiety came from US President Franklin Delano Roosevelt, who said, “the only thing to fear is fear itself.” Conquering fear requires a plan that mitigates emotions no matter the market conditions.

The Fed’s toolbox is bare in the current environment, creating a volatile landscape. Chasing inflation and dealing with a recession in the face of supply-side shocks is a potent cocktail for price variance. Investors and traders need to change their orientation to markets to adapt to the current conditions. The following tools and rules can assist in mitigating the human impulses that lead market participants to make significant financial mistakes:

Hedge portfolios using market tools to protect the downside and allow for upside participation. Hedging reduces the impulse to liquidate portfolios because of fear.

Since volatility creates opportunities, approach markets with a clear plan for risk versus reward.

Remember that the market price is always the correct price. A risk-reward plan only works when risk levels are respected. Markets are never wrong, while traders and investors are often wrong.

A long or short position should constantly be monitored at the current price, not the original execution price. Positions are long or short at the last tick.

Adjust risk and reward levels based on current market prices.

Follow trends, not news, “experts,” or pundits. Trends reflect the crowd’s wisdom, and collective wisdom reflects the sentiment that drives prices higher or lower.

Never attempt to pick the top or the bottom in a market, let the price trends do that for you.

The rules are simple, but emotions are tricky. The emotions that trigger impulsive behavior cause market participants to ignore the rules. The critical factor for success in markets is discipline, defined as “the practice of training people to obey rules or a code of behavior, using punishment to correct disobedience.” When it comes to our hard-earned savings and portfolios, the punishment is losses.

Tuck those emotions away and face the volatile market landscape with a plan. Hedge your nest egg, and you will sleep better each night. Remind yourself that fear is the only factor you should fear.

--

Trading advice given in this communication, if any, is based on information taken from trades and statistical services and other sources that we believe are reliable. The author does not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects the author’s good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice the author provides will result in profitable trades. There is risk of loss in all futures and options trading. Any investment involves substantial risks, including, but not limited to, pricing volatility , inadequate liquidity, and the potential complete loss of principal. This article does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.

📉How to stay calm during market crashes?🔋Hi friends! Have you saved your deposit to buy crypto? Markets are falling lower and lower every day. In this idea I will give you some tips on how to open successful trades when the market is bleeding and emotions are taking over.

At the crypto market, such massive dumps happen once in 3 years, but the price sometimes falls by 30% and rises by 500-700%. This is called volatility. Crypto market is still quite young, so it is very high here.

I think it`s an advantage because it`s give more opportunities to traders and investors to grow their deposit faster in compare to stock or forex markets. But if you don`t know what to do during market crashes and stay calm at any markets i`ll share with you some tips:

📈Follow the trend. First and foremost rule. You think you can reverse the price direction by yourself? Unless you have more than $1 trillion:) Why would you fight the market when it can help you? If you don`t know what is trend, please, check this idea. It helps you to identify it on lower (1m-1h), middle (1h-1d), higher (1d-1M) timeframes.

📣Join the trading community. Talk to different traders (scalpers, swingers), investors. Share ideas, keep an eye on other people's trading ideas. This way you'll faster understand your mistakes, raise your win rate and look at trading from different points of view. The human mind is built so that you calm down when you shares your thoughts. Do it!

💹Use the trading strategy. Open trades only when the strategy tells you to do so. If you don't know what a trading strategy is or how to make one, post in the comments I'll do an update for you. Simply put, you need to:

1. Create filters to help you identify future price movement.

2. Use risk and money management. To earn in trading you don`t need to open a trade using all your depo.

🚩Personally, I use: trend lines, squeeze under them, mark key levels, volume and horizontal volume indicators, track the market manipulation. There are many trading tools - find your own or borrow someone else's and adapt to yourself and your psychology.

👶If you are new to the market and this is your first experience, trade on a virtual account or try to start with 1% of your capital. If you can't make $200 from $100, how can you make $20,000 from $10,000?

🏁The statistics says that only 1% of traders make profit, 9% trade at breakeven and the other 90% lose money. Be the 1%, learn, read, develop and stay calm!

Friends, press the "like"👍 button, write comments and share with your friends - it will be the best THANK YOU.

P.S. Personally, I open an entry if the price shows it according to my strategy.

Always do your analysis before making a trade.

Wave personality (PART 1)Characteristic waves "1":

-Commonly,during the bottom start of waves "1"the accompanied news is generally bad, the period often exhibits the occurrences of recession (during intermediate wave degrees),or even depression and war(during large wave degrees).

-At this point and given that the input information on the current economic situation dos not look good,fundamental analysts continue to lower their earning estimates.

-Quite commonly, wave "1" are formed as a part of the bottoming phase or more generally, during periods of disbelief and thus, tend to demonstrate deeper corrective movement in wave "2"

-Wave"1",the rebound from a preceding bear trend, is constructive and offers a more structured rebound from undervalued price levels.this move often displays a subtle increase in volume and is relatively supported by market breadth.

-The short interest level peaks as the majorly of market participants believe that the overall trend is to the downside.investors view the rally as last chance to sell and get out.

-When waves"1" rise from either large base formed by the previous correction, or from extreme compression. They appear as dynamic and dramatic , and result is that only moderate retraced is seen in waves"2"

Characteristic waves "2":

-Waves"2"act so as interrupt the progress and the directional move of price.They tend to heavily retrace (but not extend) wave"1",especially, since they themselves occur mostly during the periods of disbelief,prior to the market-up phase.

-More often then not,news ans fundamentals tend to be worse during the end (bottom) of wave"2"when compared to the beginning(bottom) of wave"1".

-systematically,during wave"2",investors are convinced that the bear market is proceeding once more following the termination of wave"1"or what they had perceived to be another counter trend rally.

-Waves"2"are often associated with downside non-confirmations.This usually takes the shape of a wakening downside momentum and breadth.adding to this , waves "2" are often accompanied by low volume an volatility,indicating a drying up of selling pressure. It is not uncommon for waves"2"to take more time in formation compared to their preceding waves "1".

Characteristic waves "3":

-Waves"3"are strong and broad;the trend at this point is unmistakable.waves"3" occur are confirmed during the start of what the classic approach highlight as the 'mark-up' phase.

-Turnaround fundamentals stories begin to flow in the financial arena,causing an investor confidence re-build.

-Waves"3" usually generate the greatest volume and price movement,as they most often extended beyond their normal limits,with respect to both time and distance.

-During waves"3",successful classical pattern-breakouts are commonly observed;multi-continuation gaps,volume expansions,exceptional breadth(since almost all share price and market sectors participate),as well as major Dow Theory confirmations and runaway price movement,which create large gains in the market,depending on the wave degree.

-Corrections in waves"3' are usually weak and short-lived as those who bet on buying pull-backs suffer the likelihood of missing the move.

Characteristic waves "4":

-In principle,the occurrence of wave "4" implies that the best part of the growth phase which was evident in wave"3" has ended.

-More often then not, waves"4" appear as a form of a sideways interruption.they develop as part of the building of a base for the final fifth wave move.in part,wave "4"is seen as the "public participation phase" as termed by the classical approach(Dow Theory).

-Lagging stocks build their tops and begin declining during this wave,since only the strength of wave "3" is thought to have pulled them along for the upside participation.This initial deterioration in the market sets the stage for breadth divergences,non-confirmations and subtle signs of weakness during the fifth wave.

Characteristic waves "5":

-specifically,in stocks,waves"5"are always less dynamic than waves"3" in terms of breadth.With the exception fifth wave extensions,they usually display a weaker momentum as well.

-As a general feature, volumes in waves"5" tend to be less when compared to wave"3" volumes.

-during advancing waves"5",optimism runs extremely high as further public participation emerges, despite a narrowing of breadth. Nevertheless,market action dose improve relative to prior corrective wave rallies.

-Commonly,during the top (end) of waves"5",the accompanied news is positive,implying that prosperity and peace guaranteed forever as arrogant complacency becomes evident in the financial community and financial news.

Characteristic waves "A":

-During "A" waves of bear markets;the investment world is generally convinced that this reaction is just a pullback pursuant to the next leg of advance. the public surges to the buy side despite the first valid technically damaging cracks in trend patterns of individual stocks.

-The "A" waves set the tone for the waves that follow. A five-wave "A" indicates a start of a directional or trending mode,while a three-wave "A" indicates that a flat or sideways mode will likely follow.

Characteristic waves "B":

-"B" waves are phonies. They are sucker plays,bull traps , speculators paradise, orgies of oddlotter mentality or expressions of dumb institutional complacency (or both).

-They are often accompanied by an emotional advance of narrow list of stock,which would be evident through non-confirming signs of TA-breadth and momentum indications.

-"B" waves are often unconfirmed by all/broader market indices and are almost always expected to be completely retraced by the following wave "C".

Characteristic waves "C":

-"C"waves inherit most of characteristic and properties of third waves in the sense that they are persistent and broad .

-In the case of bearish "C"waves:

+They are usually devastating in their destruction .

+There is virtually no place to hide except cash

+The false impression that the bull trend is "back on track" which was held throughout its preceding waves "A" and "B" tend to fade away,as fear and occasionally multiple panic phase take over.

+Fundamentals ultimately collapse in response of the market action.

-In the case of bullish "C" waves:

+They are constructive and often render sizable gains or return in waves of large degrees.

+They usually give a fake indication that the bull trend is back to stay.

Source IFTA

BTCUSDT High Time Frame Oder Block In this section we will discuss what a price action order block is and how it is currently relevant to Bitcoin’s price action.

An Order Block is a trade location that has a cluster of price action, creating a liquidity pool. Once price action expands from the region, it automatically becomes support or resistance – hence a block,

This area once penetrated will act as a range, causing a period of price action oscillation. The Order Block can be dissected into three sections, the high (resistance), the low (support) and the middle (equilibrium). Whichever region price action breaks from will lead to a continuation or a reversal in the overall trend.

In essence, Bitcoin can remain trading in the Order Block before until decisive bottoming or continuation structures are developed.

Hope this educational peace helps!

great setup for swing trading on #btc🔥hi there traders all around the world👋

one of the great setups that we can count on it is breaking the trend line and it simple.

when a trend line breaks spatially if that trend was a pullback in previous(we had a good bear trend line here) we must wait for price to reach and touch the trend line then we can enter.

tip: if price touches 2or 3 times its much better.

I hoper you enjoy the lessen I just teaches you, wish you all a great day with good profit.

cheers 🥂.

Lines, trendlines and channelsLines are one-dimensional figures that extend endlessly into a future and which connect the price segments on a chart. They are often used to determine a trend and particular support and resistance levels. Lines are easy to draw and use as technical tools. Over time, lines became implemented into various trading systems such as Andrews' Pitchfork and Gann Fan Lines. However, lines have countless more uses. For example, lines can be used to section particular parts of a price pattern. Additionally, they can be used to draw horizontal support and resistance levels. Lines also find utility in measuring the speed of the price ascend or descend. Furthermore, they can be deployed in various trading strategies and used to identify a trend.

Illustration 1.01

The picture above shows the daily chart of Microsoft Corporation stock. A simple dashed line (white) measures the percentual decline between 22nd November 2021 and 8th March 2022.

Trendline

The trendline is a simple line that connects prices across a chart. It reflects a primary trend in the prices of stocks, commodities, etc. Trendlines can be used to construct channels and numerous different bodies. In addition to that, trendlines can also act as resistance or support.

Illustration 1.02

Illustration 1.02 shows Lockheed Martin stock on the daily chart. It also shows the trendline (white) pointed to the upside as it cuts through a substantial portion of lows.

Channels

Channel can be constructed by two parallel trendlines, which act as support and resistance levels. A channel can be sloped upward or downward depending on the general trend of prices. When a channel is correctly determined and drawn, the price often moves between the two boundaries. However, occasional breakouts occur. As a result, they establish a new trend or validate a current one once the price returns to a channel.

Illustration 1.03

The image above shows the daily chart of gold. The channel (white lines/boundaries) can be observed as well. False breakout took place on 27th January 2022. However, the price retraced back into the channel on 9th February 2022.

Resistance and support levels

Often, a line or trendline acts as a particular support or resistance level. The function of these two levels is to halt price rise or decline. Typically, it is considered bullish when resistance is penetrated to the upside. Contrarily, when support fails to hold selling pressure and breaks, it is usually a bearish sign. Resistance and support can be drawn by a simple horizontal line. However, resistance and support can be at a slope. That is common, for example, for channels in a strong uptrend or downtrend. Generally, the significance of support or resistance grows with an increasing number of successful halts being put to a price rise or decline.

Illustration 1.04

Illustration 1.04 portrays the daily chart of Bitcoin. Major support and resistance levels are indicated by white horizontal lines. The first top also acts as the resistance of utmost significance as the price previously halted its rise at this level.

Speed lines

Speed lines are three consecutive lines used to estimate future support and resistance levels. In an uptrend, speed lines are constructed by creating a box connecting a low point in the lower-left corner and a high point in the upper-right corner. Next, a vertical line connecting these two points is sectioned at each third and in the middle. Then a speed line is drawn from the actual low in the lower-left corner through the right side of a box where sections were marked. These speed lines are extended into the future and considered to estimate natural support and resistance levels. Modern techniques include creating speed lines, such as sectioning a box according to Fibonacci ratio numbers.

Illustration 1.05

The picture above shows Tesla stock on the daily chart. It also shows the unconventional construction of speed lines from a box cut into four equal sections.

Disclaimer: This content serves solely educational purposes.

Market Structure Tips Analyzing trends and price changes are two very important things traders focus on to gain profit. Trends allow traders to predict future prices and how they would change.

Two types of trends that exist in the market today are uptrends and downtrends.

Each type of trend tells a different story and has its own impact on a traders success in the market. While uptrends show a series of higher highs and higher lows, downtrends show lower highs and lower lows.

Sand and its recent pumpHey, we are going to talk about a pattern today, called falling wedge, as it happened few days ago in SAND I'm just gonna talk about it as a good example.

Basically a wedge is a shape looking like triangle, it causes to make lower highs and higher lows which are closer to each other as we go along. we have 4 types of wedges listed below :

1. Falling wedge ( in uptrend or downtrend )

2. Rising wedge ( in uptrend or downtrend )

well I'm not gonna tell you how to trade it as its explained in books or some youtube channels; what you'd normally find out there is that when you see Falling wedge in uptrend we are probably going to see another leg up ( what happened in SAND ) and rising wedge in an uptrend would probably cause trend reversal, but lets just say this is not true and market doesn't care about what we all think :D

what I'd suggest is to treat all these shapes as kind of channels, You can buy low sell high and when the break happens get in and ride with it ( DO NOT FOMO ).

But lets talk what is actually happening behind these formations, lets talk price action a bit; a wedge usually happens after a trend, we usually find it after a leg up or leg down, and basically that means market is probably going to play around the highs or lows it made for a while before making a second large move ( Correctional or not ), so it will start forming these shapes.

normally when we see the price making lower highs in an uptrend ( or higher highs in a down trend ) we'd suspect a trend reversal, but in this case , the highs are really close and we are also making higher lows, this tells us, market is not going anywhere yet, because there is a fight going on between bulls and bears. eventually one of these sides will give up, and the support or resistance will break, That's the moment for us to get in and ride along the market.

This is basically all you need to know about wedges. pretty simple but useful. check the price action on Sand as an example and let me know if there are any questions.