Flat, Quiet… and Full of Clues .Most traders only see the middle.

The acceleration. The “trend”. The movement.

But that’s just one-third of the story.

If you really want to understand the market’s rhythm,

you need to study how moves begin, evolve, and die.

Let’s break down the 3 key phases every market goes through —

again, and again, and again.

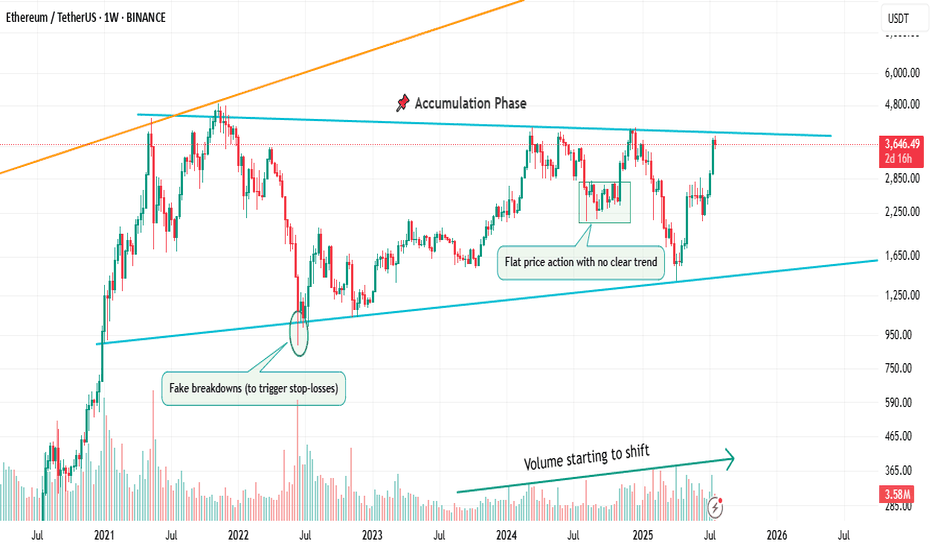

📌 1. Accumulation Phase

This is the part no one talks about.

Why? Because it’s boring. Choppy. Range-bound. Confusing.

Most traders get shaken out here.

But smart money? They’re quietly buying.

You’ll often see:

Flat price action with no clear trend

Fake breakdowns (to trigger stop-losses)

Volume starting to shift

Long wicks — both directions

This phase is a test of patience, not prediction.

And if you learn to read it well, you’ll start catching moves before they go parabolic.

🚀 2. Markup / Acceleration Phase

Here’s where everyone wakes up.

Momentum kicks in.

News gets bullish.

Breakouts start working.

Pullbacks are shallow.

And suddenly, everyone’s calling it a bull market.

But don’t be fooled.

This is not where smart money enters — this is where they ride the wave they already created.

Learn to:

Ride trends, not chase them

Add on pullbacks

Avoid FOMO entries

This is the fastest and most emotional part of the cycle — which means it rewards discipline, not excitement.

🧯 3. Distribution Phase

The party’s still on… but the hosts are quietly leaving.

Price starts to stall.

Breakouts stop working.

Volume gets heavy at the top.

And the same excitement that brought everyone in?

It’s now being used to sell into.

Distribution is sneaky.

It’s not an obvious top.

It’s a process — just like accumulation.

You’ll often see:

Lower highs forming quietly

False breakouts to trap buyers

Increasing volatility

Bullish news… with no follow-through

If you’re not paying attention, you’ll keep buying strength —

right before the rug gets pulled.

So what’s the lesson here?

Markets don’t just “go up or down.”

They prepare, move, then exhaust.

And if you learn to spot these transitions —

you’ll stop reacting late

and start positioning early.

That’s the real edge.

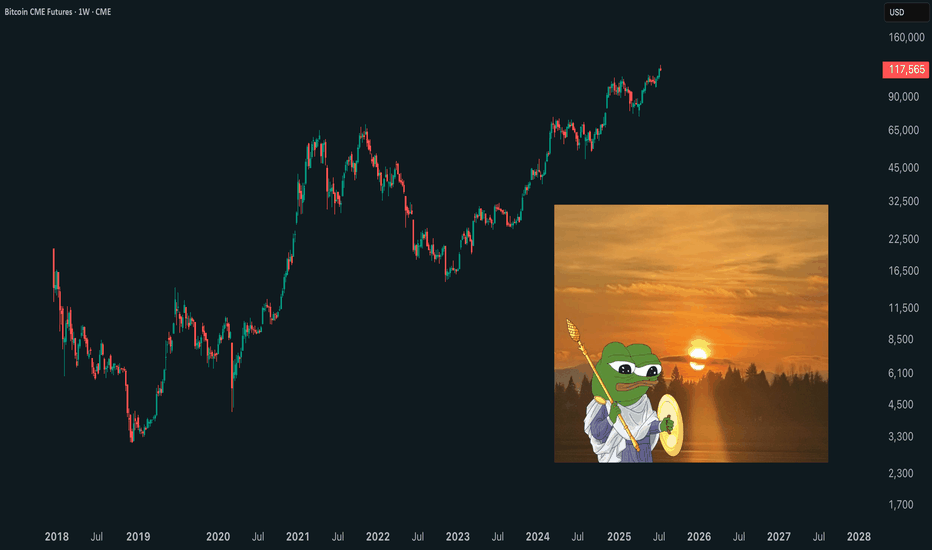

currently we are on the accumulation phase so in this idea I tried to show you the real story behind it and as well talk about the two others to beware of them also in the right moment I will talk about them , but for now let's focous on the current phase because we want to be part of the smart money and enjoy the next phase which is 🚀Markup / Acceleration Phase .

—

🧠 Save this post.

🔁 Revisit it when you’re confused.

📊 Because the chart isn’t random — it’s just cycling

And also remember our golden rule :

🐺 Discipline is rarely enjoyable , but almost always profitable. 🐺

🐺 KIU_COIN 🐺

Trading Plan

You Are NOT Your P<here was once a tree that stood alone at the edge of a cliff, overlooking the vast sea.

Some days, the sun shone bright, the winds gentle, the water below calm and peaceful. Other days brought heavy storms, fierce winds, crashing waves, rain so relentless it seemed the skies might never clear again. The seasons came and went. The skies changed again and again. But the tree never thought of itself differently because of the weather.

It did not feel more valuable on a sunny day. It did not feel broken or weak when storms battered its branches. The tree simply stayed rooted. It understood something quietly powerful - “ the weather was never personal. It wasn’t about the tree.”

The tree remained, growing slowly over years, not because the conditions were always perfect, but because it had learned to stand through all of it.

This is something most traders forget.

We step into the market with good intentions, hungry to learn, eager to succeed. But somewhere along the way, we make a mistake. We let our self-worth become tied to the numbers on the screen.

A green day makes us feel smart, in control, like we’ve cracked the code. A red day, on the other hand, shakes us to the core, makes us question our place, our skill, even our worth, like we never belonged here at all.

The danger isn’t just in the financial losses. It’s in how we let the market shape how we see ourselves.

But here’s the truth the market won’t tell you upfront: the market doesn’t know who you are, and it doesn’t care . It doesn’t remember what you did yesterday, how many hours you’ve spent learning, or how desperately you want this to work.

The market moves how it moves. Sometimes it moves with you, sometimes it moves against you. It’s neither a punishment, nor a reward. It’s just movement.

Your wins don’t make you superior. Your losses don’t make you dumb. Both are part of the same cycle, and part of the environment you’ve chosen to work in. If you build your self-image on the outcome of your last trade, you’ll forever live on a fragile edge. Every swing will shake you. Every drawdown will feel like a verdict on who you are.

But trading isn’t about who you are today. It’s about who you become over time.

Your job isn’t to seek approval from a system built on randomness and probability. Your job is to build yourself on steadier ground. To stay rooted, like a tree. To let your process define you, not your P&L.

The storms will come. They always do. Volatility, uncertainty, periods where nothing seems to work - these are all part of the environment. The traders who survive are NOT the ones who try to outmuscle the market. They are the ones who protect their capital, their energy, and their mindset through it all.

They understand that being steady is more important than being brilliant - that surviving is more valuable than being right.

Detach your self-worth from the swings. Build your identity on discipline, patience, humility - the quiet habits you control. These are your roots. And when the storm rolls in, they’re what keep you grounded.

When you stop tying your self-image to your short-term results, you begin to see the market more clearly. You stop forcing trades to make yourself feel better. You stop chasing moves to prove something. You start letting your process do its work, even when it feels slow.

You start to realise that progress in trading is quiet and unfolds slowly, almost invisibly, much like a tree growing through the seasons. Small shifts accumulate over time, often going unnoticed, until one day you look back and truly see how far you’ve come.

When you understand this, red days lose their sting. Green days lose their arrogance. Both just become part of the weather. You adapt, endure, and move forward.

You don’t measure yourself by how much you made this week, this month, or even this year. You measure yourself by how well you followed your process , how calmly you handled the volatility, and how patient you remained when there was nothing to do.

The market doesn’t ask for perfection - only consistency. And consistency comes from within, not from chasing highs or avoiding lows, but from standing firm through both.

Like the tree on the cliff, your strength is not in avoiding the weather. Your strength is in understanding that the weather will pass. It always does. Your roots - your process, your discipline, your patience, are what keep you standing until it does.

⦿ Learn to protect your energy.

⦿ Learn to lose without self-doubt.

⦿ Learn to win without ego.

⦿ Learn to wait without fear.

⦿ Learn to wait patiently

Your worth is not in your wins or losses. It’s in how you carry yourself through both.

Stay rooted.

The seasons will change.

And when they do, you’ll still be here, stronger than you were before.

Risk-to-Reward and Journaling : Track, analyze, and evolve

📈 Mastering the Markets: Why Risk-to-Reward and Journaling Are Every Trader’s Edge

In trading, profitability isn't just about making winning trades — it's about managing risk smartly and learning from every position. Two of the most underrated habits that separate amateurs from consistent traders are:

1. Understanding Risk-to-Reward (R:R)

The risk-to-reward ratio is the foundation of trade planning. It's a simple calculation of how much you're willing to risk versus how much you aim to gain. A ratio of 1:2 means you risk $1 to potentially make $2.

✅ Why it matters:

Even with a 40% win rate, a positive R:R can still yield profitability.

It disciplines your entries, stops, and targets — no more emotional exits.

It forces you to filter out trades that don’t offer enough upside.

📊 For example, if you take 10 trades risking $100 each with a 1:2 R:R:

Win 4 = $800 gain

Lose 6 = $600 loss

Net Profit = $200 despite winning less than half.

2. The Power of Journaling

Trading without a journal is like flying blind. Your memory fades, but data doesn’t lie. A trading journal helps you:

🧠 Improve strategy by analyzing what works (symbols, timeframes, setups)

📉 Spot patterns in losses — overtrading? wrong R:R? bad timing?

📈 Stay disciplined — journaling enforces accountability

📒 Capture emotions — was it fear or FOMO? A journal tracks mindset too.

In my experience, journaling alone can boost a trader’s edge more than tweaking indicators. It turns experience into insight.

🎯 Final Word

The market rewards preparation, not prediction. A solid risk-to-reward framework keeps you in the game. Journaling turns your trades into tuition. Together, they compound your growth.

Happy Trading

Pending Orders Are Not Set in Stone – Context Still MattersIn a previous educational article, I explained why I almost never trade breakouts on Gold.

Too many fakeouts. Too many emotional traps.

Instead, I stick to what works:

• ✅ Buying dips

• ✅ Selling rallies

But even these entries — placed with pending orders — are not automatic.

Because in real trading, price is not just a number — it’s a narrative.

And if the story changes, so should the trade.

________________________________________

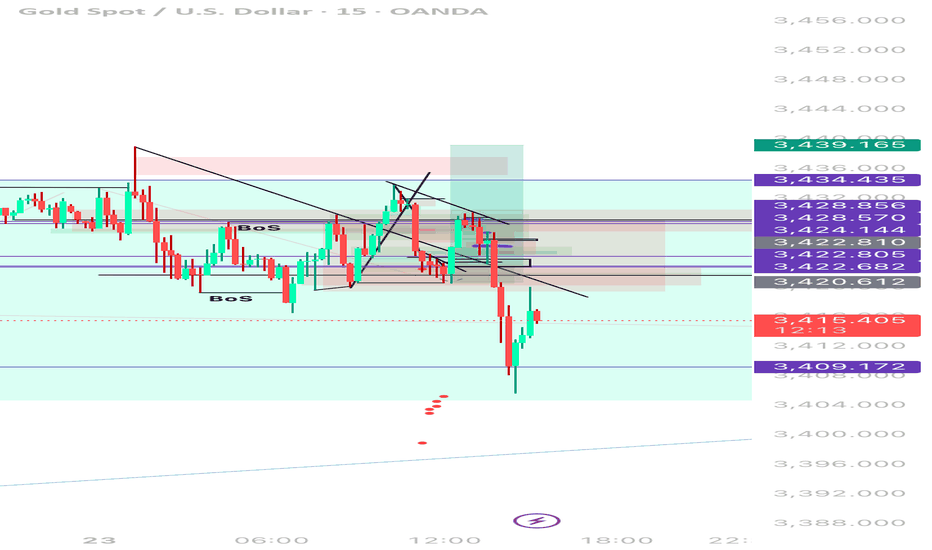

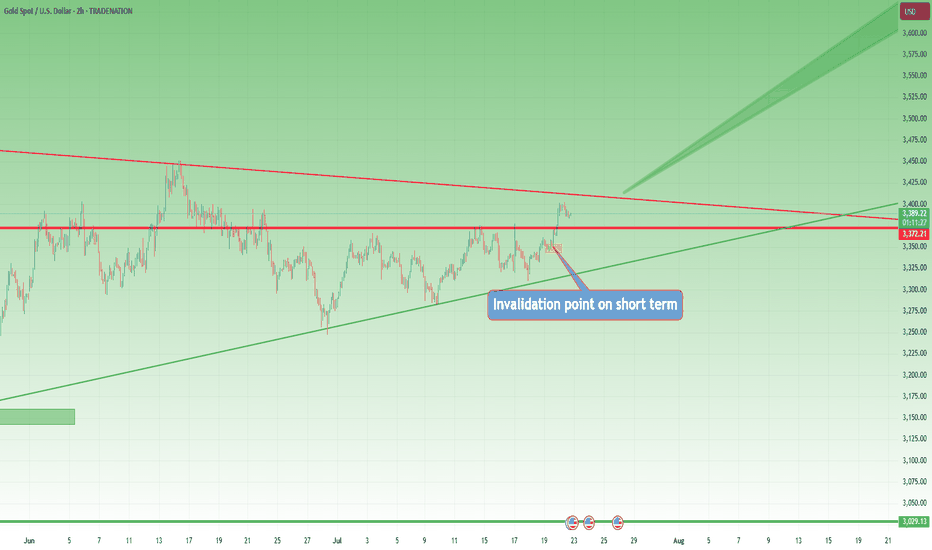

🎯 The Setup – Buy the Dip Around 3400

Let’s take a real example from yesterday.

In my analysis, I mentioned I would look to buy dips near 3400, a former resistance now acting as support.

Price dropped to 3405, just a few points above my pending buy at 3402.

We saw a clean initial bounce — confirming that short-term support was real.

But I missed the entry by 30 pips.

So far, so good.

But here’s the important part — what happened next changed everything.

________________________________________

🧠 The Rejection Shifted the Entire Story

The bounce from 3405 was immediately sold into at 3420, a newly formed short-term resistance (clearly visible on the 15-minute posted chart).

After that, price started falling again — heading back toward my pending order.

📌 At that point, I cancelled the order. Why?

Because the context had changed:

• Bulls had tried once — and failed at 3420

• Sellers were clearly active and waiting above

• A second drop into my level wouldn’t be a clean dip — it would be retest under pressure.

The market was no longer giving me a “buy the dip” setup.

It was showing me a failed recovery. That’s a very different trade.

________________________________________

💡 What If It Had Triggered?

Let’s imagine that price had hit 3402 first, triggering my order.

Then rebounded, failed at 3420, and started dropping again.

Even then, I wouldn’t hold blindly.

Once I saw the rejection at 3420, I would have understood:

The structure had shifted.

The bullish case is weakening.

Exit early — breakeven or small controlled loss.

________________________________________

🔁 Sequence > Level

This is the most important principle:

• ✅ First down, then up = healthy dip → shows buyers are still in control

• ❌ First up, then down = failed breakout → shows selling pressure is stronger

Two scenarios. Same price. Opposite meaning.

That’s why you should look for:

Not just where price goes — but how it gets there.

________________________________________

🔒 Pending Orders Are Conditional

Many traders treat pending orders like traps:

“Just let price come to my level, and I’m in.”, but you should refine a little

✅ Pending orders should be based on a conditional expectation

❌ Not a fixed belief that the zone must hold

If the market tells a different story, remove the order.

No ego. No drama. Just process.

________________________________________

📌 Final Thought

Trading isn’t just about catching a price.

It’s about understanding price behavior.

First down, then up = strength.

First up, then down = weakness.

Let the market show its hand — then decide if you want to play.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

XAUUSD | Flipped Long Too Early – Lessons From a £25k Drawdown 📝 Tutorial Description:

Today I flipped long after catching a clean short from 3,434.

The idea made sense: liquidity sweep, OB reaction, bullish BOS on 5m.

But the entry? Too early. Overleveraged. No HTF confirmation.

Ended up staring at a –£25,605 drawdown 😬

⸻

🔍 What Went Wrong:

• 🧠 Good Idea, Bad Timing:

Price did sweep lows and show signs of a reversal…

…but NY volume hadn’t kicked in yet, and the 5m BOS wasn’t locked in.

• 📉 No Higher Timeframe Confluence:

I didn’t wait for structure to shift on the 15m or 1H — just jumped in on a 5m bounce.

• 💥 Position Size WAY too heavy:

Even with a valid idea, risking £25k on one trade = recipe for disaster. I broke my own risk rules.

⸻

🎯 What I Learned:

1. Wait for full confirmation — not just a reaction wick

2. Scale in small first, add on confirmation

3. Stick to my risk % — don’t size up because I “feel confident”

⸻

🔖 Tags:

#XAUUSD #TradingMistake #SmartMoneyConcepts #Overleveraged #Drawdown #TradingLessons #5mTrap #EmotionalDiscipline

⸻

💬 Closing Note:

Flipping early isn’t the crime — flipping with no plan and too much size is.

This was a humbling one. Sharing so someone else doesn’t repeat it.

Look First, Then LeapIn trading, how you prepare matters more than how you react. The phrase “Look first, then leap” reminds traders to avoid impulsive decisions and instead focus on proper analysis, planning, and risk control. Whether you're trading stocks, forex, crypto, or commodities, this principle can save you from painful losses and build a foundation for long-term success.

Let’s break down what it really means to “look first,” and how applying this mindset can improve your trading discipline.

✅Preparation Beats Emotion

Before entering any trade, a trader should ask: What is this trade based on? Logic or emotion?

🔹 Control Impulsive Decisions

Most losing trades happen when people act on gut feelings, FOMO, or after seeing a sudden price spike. But excitement is not a strategy; analysis is.

🔹 Check the Basics First

-What is the market trend? (uptrend, downtrend, or sideways?)

-Are you trading with or against the trend?

-Are there any upcoming news events that might impact the market?

Taking a moment to “look first” gives clarity and filters out low-probability trades.

✅ Trade Only When There’s a Setup

The best trades often come from waiting for the right moment, not forcing entries.

🔹 Identify Clear Patterns

Before jumping in, confirm your strategy setup:

-Is it a breakout or a fakeout?

-Are key support/resistance levels respected?

-Is volume supporting the move?

🔹 Use Confirmation Tools

Indicators like RSI, MACD, and moving averages can support your decision. Price action and patterns like triangle, channel, and flag also provide valuable clues.

Look first means not reacting to the first move; wait for the follow-through.

✅ Always Define Risk and Reward

Entering a trade without a defined stop-loss or target is like jumping into water without checking its depth.

🔹 Use a Risk-Reward Ratio

Before leaping into a trade, ask yourself:

-What am I risking?

-What can I gain?

Aim for a minimum risk-reward ratio of 1:2 or 1:3 to stay profitable even with a lower win rate.

🔹 Position Sizing Matters

Know how much of your capital to allocate. Using 1-2% of your capital per trade helps manage losses and avoid emotional pressure.

✅ Adjust for Market Conditions

Just because you’ve seen success in one type of market doesn’t mean your strategy will always work.

🔹 Trending vs. Ranging Markets

-Trend-following strategies work well in strong trends.

-Mean-reversion or breakout-fade strategies work better in sideways markets.

🔹 Check for Major News or Events

Earnings reports, central bank meetings, or geopolitical events can change everything in seconds. Before entering a trade, look at the calendar.

Adapting to market conditions is part of looking first.

✅ Use a Trading Plan, Not Just a Feeling

Every trade should follow a plan, not just “I think this will go up.”

🔹 What Should Your Plan Include?

Entry and exit rules

-Stop-loss and take-profit levels

-Criteria for valid setups

-Timeframes and trading hours

A plan brings structure and consistency, reducing emotional decisions.

✅ Journaling and Reviewing Trades

Looking first also means learning from the past.

🔹 Keep a Trading Journal

Log every trade entry, exit, reason, emotion, and outcome. This helps you spot mistakes and patterns in your behavior.

🔹 Review Regularly

After a drawdown or losing streak, review your last 10–20 trades. Was your strategy sound? Were you disciplined? Did you look before you leaped?

Improvement comes from reflection and correction.

✅ Be Mentally Ready Before Every Trade

Looking first also means checking your internal state.

🔹 Ask Yourself Before Trading:

-Am I calm and focused?

-Am I trying to recover a loss?

-Am I trading because I’m bored or emotional?

If your mindset is off, step away. A bad state leads to bad decisions—even with a good strategy.

✅Backtest and Practice Before Going Live

Before risking real money, test your setup thoroughly.

🔹 Why Backtesting Helps

It lets you see how your system performs on historical data. This builds confidence and filters out weak strategies.

🔹 Demo Trading Is Smart, Not Weak

Trading in a demo account before going live helps you learn execution, order management, and emotional control—without financial damage.

✅ Protect Capital First, Trade Second

Your first goal isn’t to make money, it’s to stay in the game.

🔹 Survive First, Then Thrive

Big losses can take weeks or months to recover. That’s why looking first is critical—it prevents careless trades that damage your capital.

✅Final Word: Be the Trader Who Waits

The market rewards those who are patient, disciplined, and prepared. Anyone can open a trade, but only those who look first truly understand what they’re doing.

Before your next trade, ask yourself:

“Do I have a clear reason, a defined risk, and the right mindset? Or am I just reacting?”

Because in trading, it’s not how many trades you take, it’s how many good trades you wait for.

In trading, success doesn't come from speed; it comes from clarity, preparation, and discipline. The principle “Look first, then leap” serves as a constant reminder to slow down, observe, analyze, and plan before taking action. It’s a mindset that separates the disciplined trader from the emotional speculator.

Every trade you take should be backed by logic, not impulse. Whether it’s identifying the right setup, managing your risk, or simply being patient enough to wait for confirmation, looking first gives you control in a world that thrives on chaos.

In the end, trading isn’t about making quick money—it’s about making the right decisions consistently. So before your next trade, take a breath, do your research, and ask yourself:

“Am I truly ready to leap, or do I need to look one more time?”

That one extra moment of reflection could be the difference between a lesson and a profit.

Cheers

Hexa🧘♀️

Chart Image Credit: TradingView

Protect Capital First, Trade SecondIn the world of trading, mastering technical analysis or finding winning strategies is only part of the equation. One of the most overlooked but essential skills is money management. Even the best trading strategy can fail without a solid risk management plan.

Here’s a simple but powerful money management framework that helps you stay disciplined, protect your capital, and survive long enough to grow.

✅1. Risk Only 2% Per Trade

The 2% rule means you risk no more than 2% of your total capital on a single trade.

-Example: If your trading account has $10,000, your maximum loss per trade should not exceed $200.

-This protects you from large losses and gives you enough room to survive a losing streak without major damage.

A disciplined approach to risk keeps your emotions under control and prevents you from blowing your account.

✅2. Limit to 5 Trades at a Time

Keeping your number of open trades under control is essential to avoid overexposure and panic management.

-A maximum of 5 open trades allows you to monitor each position carefully.

-It also keeps your total account risk within acceptable limits (2% × 5 trades = 10% total exposure).

-This rule encourages you to be selective, focusing only on the highest quality setups.

Less is more. Focus on better trades, not more trades.

✅3. Use Minimum 1:2 or 1:3 Risk-Reward Ratio

Every trade must be worth the risk. The Risk-Reward Ratio (RRR) defines how much you stand to gain compared to how much you’re willing to lose.

-Minimum RRR: 1:2 or 1:3

Risk $100 to make $200 or $300

-This allows you to be profitable even with a win rate below 50%.

Example:

If you take 10 trades risking $100 per trade:

4 wins at $300 = $1,200

6 losses at $100 = $600

→ Net profit = $600, even with only 40% accuracy.

A poor RRR forces you to win frequently just to break even. A strong RRR gives you room for error and long-term consistency.

✅4. Stop and Review After 30% Drawdown

Drawdowns are a part of trading, but a 30% drawdown from your account's peak is a red alert.

When you hit this level:

-Stop trading immediately.

-Conduct a full review of your past trades:

-Were your losses due to poor strategy or poor execution?

-Did you follow your stop-loss and risk rules?

-Were there changes in the market that invalidated your setups?

You must identify the problem before you continue trading. Without review, you risk repeating the same mistakes and losing more.

This is not failure; it’s a checkpoint to reset and rebuild your edge.

Final Thoughts: Survive First, Thrive Later

In trading, capital protection is the first priority. Profits come after you've mastered control over risk. No trader wins all the time, but the ones who respect risk management survive the longest.

Here’s your survival framework:

📉 Risk max 2% per trade

🧠 Limit to 5 trades

⚖️ Maintain minimum 1:2 or 1:3 RRR

🛑 Pause and review after 30% drawdown

🧘 Avoid revenge trading and burnout

Follow these principles and you won't just trade, you'll trade with discipline, confidence, and longevity.

Cheers

Hexa

Feed Your Ego or Feed Your Account- Your Choise🧭 From Rookie to Realization

I’ve been trading since 2002. That’s nearly a quarter of a century in the markets.

I’ve lived through it all:

• The early days, when the internet was slow and information was scarce

• The forums, the books, the overanalyzing

• The obsession with finding “the perfect system”

• And later… the dangerous phase: needing to be right, because I have a few years of experience and I KNOW

At one point, I thought that being a good trader meant calling the market in advance — proving I was smarter than the rest.

But the truth is: the market doesn't pay for being right. It pays for managing risk, always adapting and executing cleanly.

________________________________________

😤 The Psychological Trap Most Traders Fall Into

There’s one thing I’ve seen consistently over the last 25 years:

Most traders don’t trade to make money.

They trade to feel right.

And this need — this psychological craving to validate an opinion — is exactly what keeps them from growing.

You’ve seen it too:

• The guy who’s been screaming “altcoin season” for 2 years

• Who first called it when EGLD was at 80, TIA, and others that kept dropping

• But now that something finally moves, he says:

“See? I was right all along, altcoin season is here”

He’s not trading.

He’s rehearsing an ego story, ignoring every failed call, every drawdown, every frozen position.

He doesn’t remember the trades that didn’t work — only the one that eventually did.

This is not strategy.

It’s delusion dressed up as conviction.

________________________________________

📉 The Market Doesn’t Care What You Think

Here’s the reality:

You can be right in your analysis — and still lose money.

You can be wrong — and still come out profitable.

Because the market doesn’t reward your opinion.

It rewards how well you manage risk, entries, exits, expectations, and flexibility

I’ve seen traders who were “right” on direction but blew their accounts by overleveraging.

And I’ve seen others who were wrong on their first two trades — but adjusted quickly, cut losses, and ended green overall in the end.

This is what separates pros from opinionated amateurs.

________________________________________

📍 A Real Example: Today’s Gold Analysis

Let’s take a real, current example — my own Gold analysis from this morning.

I said:

• Short-term, Gold could go to 3450

• Long-term, the breakout from the weekly triangle could take us to 3800

Sounds “right,” right? But let’s dissect it:

Short-term:

✅ I identified 3370 as support

If I buy there, I also have a clear invalidation level (below 3350)

If it breaks that and hits my stop?

👉 I reassess — because being “right” means nothing if the trade setup is invalidated

And no, it doesn’t help my PnL if Gold eventually reaches 3450 after taking me out.

Long-term:

✅ The weekly chart shows a symmetrical triangle

Yes — if we break above, the measured move targets 3800

But…

If Gold goes below 3300, that long-term scenario is invalidated too.

And even worse — if Gold trades sideways between 3000 and 3500 for the next 5 years and finally hits 3800 in 2030, that “correct call” is worth nothing.

You can't build a career on "eventually I was right."

You need precision, timing, risk management, and the ability to say:

“This setup is no longer valid. I’m out.”

________________________________________

💡 The Shift That Changed Everything

It took me years to realize this.

The day I stopped needing to be right was the day I started making consistent money.

I stopped arguing with the market.

I stopped holding losers out of pride.

I stopped needing to "prove" anything to anyone — especially not myself.

Now, my job is simple:

• Protect capital

• Execute with discipline

• Let the edge do its job

• And never fall in love with my opinion

________________________________________

✅ Final Thought – Let Go of Being Right

If you’re still stuck in the “I knew it” mindset — let it go.

It’s not helping you. It’s costing you.

The best traders lose small, admit mistakes fast, and stay emotionally neutral.

The worst traders hold on to “being right” while their account burns.

The market doesn’t owe you respect.

It doesn’t care if you called the top, bottom, or middle.

It pays the ones who trade objectively, flexibly, and without ego.

After almost 25 years, this is the one thing I wish I had learned sooner:

Don’t try to win an argument with the market.

Just get paid.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

How to Trade Doji Candles on TradingViewLearn to identify and trade doji candlestick patterns using TradingView's charting tools in this comprehensive tutorial from Optimus Futures. Doji candles are among the most significant candlestick formations because they signal market indecision and can help you spot potential trend reversal opportunities.

What You'll Learn:

• Understanding doji candlestick patterns and their significance in market analysis

• How to identify valid doji formations

• The psychology behind doji candles: when buyers and sellers fight to a draw

• Using volume analysis to confirm doji pattern validity

• Finding meaningful doji patterns at trend highs and lows for reversal setups

• Timeframe considerations for doji analysis on any chart period

• Step-by-step trading strategy for doji reversal setups

• How to set stop losses and profit targets

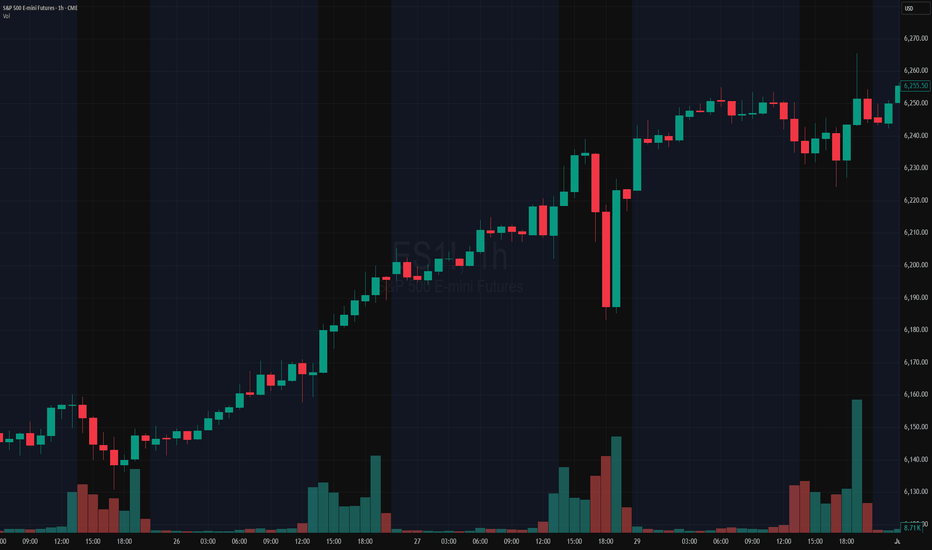

• Real example using E-Mini S&P 500 futures on 60-minute charts

This tutorial may help futures traders and technical analysts who want to use candlestick patterns to identify potential trend reversals. The strategies covered could assist you in creating straightforward reversal setups when market indecision appears at key price levels.

Learn more about futures trading with Tradingview: optimusfutures.com

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting instruments. Market conditions are constantly evolving, and all trading decisions should be made independently, with careful consideration of individual risk tolerance and financial objectives.

Why Swing Trading and Scalping Are Opposite Worlds"It's not about the strategy. It's about who you are when the market puts pressure on you."

Most traders fail not because they don’t learn “strategies” — but because they pick a style that doesn't match their temperament.

And nothing creates more damage than confusing swing trading with scalping/intraday trading.

Let’s break them down. For real...

________________________________________

🔵 1. Swing Trader – Chasing Direction, Not Noise

A swing trader does not touch choppy markets.

He’s not here for the sideways grind. He wants momentum.

If there’s no clear trend, he doesn’t trade.

He shifts between assets depending on where real movement is.

• USD weakens → he buys EUR/USD and waits

• Gold breaks → he enters and lets the move develop

Swing trading means positioning with the macro flow, not chasing bottoms and tops.

✅ He trades based on H4/Daily or even Weekly charts

✅ He holds for hundreds of pips.

✅ He accepts contrarian candles in the process.

________________________________________

🔴 2. Scalper/Intraday Trader – The Asset Specialist

A true scalper doesn’t chase trends.

He hunts inefficiencies — quick spikes, fakeouts, liquidity grabs.

✅ Loves range conditions

✅ Lives inside M5–M15

✅ Often trades only one asset he knows like the back of his hand

He doesn’t care what EUR/USD will do this week.

He cares what it does in the next 30 minutes after a breakout.

Scalping is not chaos. It's cold execution with a sniper mindset.

📡 He reacts to news in real time.

He doesn’t predict — he exploits.

________________________________________

🧾 Key Differences – Swing Trader vs. Scalper

________________________________________

🎯 Primary Objective

• Swing Trader: Captures large directional moves over several days.

• Scalper/Intraday: Exploits short-term volatility, aiming for quick, small gains.

________________________________________

🧭 Market Conditions Preference

• Swing Trader: Needs clean, trending markets with clear momentum.

• Scalper/Intraday: Feels comfortable in ranging markets with liquidity spikes and noise.

________________________________________

🔍 Number of Instruments Traded

• Swing Trader: Monitors and rotates through multiple assets (e.g. XAUUSD, EURUSD, indices, BTC, he's going where the money is).

• Scalper/Intraday: Specializes in 1–2 instruments only, knows their behavior in every session.

________________________________________

⏰ Time Spent in Front of the Charts

• Swing Trader: Waits for clean setups, may hold positions for days or weeks.

• Scalper/Intraday: Constant screen time, executes and manages trades actively.

________________________________________

📰 Reaction to News

• Swing Trader: Interprets the macro/fundamental impact and positions accordingly.

• Scalper/Intraday: Reacts live to data releases, wicks, and intraday volatility.

________________________________________

📉 When They Struggle

• Swing Trader: Fails in choppy or directionless markets.

• Scalper/Intraday: Loses edge when the market trends explosively.

________________________________________

🧠 Psychological Requirements

• Swing Trader: Needs patience, confidence in the big picture, and acceptance of drawdown.

• Scalper/Intraday: Needs absolute discipline, emotional detachment, and razor-sharp focus.

________________________________________

✅ Bottom line: They are two different games.

Don’t try to play both on the same chart with the same mindset.

________________________________________

✅ Final Thoughts – Your Edge Is in Alignment, Not Imitation

You don’t pick a trading style because it “sounds cool.”

You pick it because it aligns with:

• Your schedule

• Your attention span

• Your tolerance for uncertainty

If you hate watching candles all day – go swing.

If you hate waiting for days – go intraday.

If you keep switching between both – go journal your pain and come back later.

P.S. Recent Example:

I'm a swing trader. And this week, Gold has been stuck in a range.

What do I do? I wait. No rush, no overtrading. Just patience.

Once the range breaks, I’m ready — in either direction.

But I don’t close after a quick 50–100 pip move. That’s not my game.

I aim for 700+ pips whether it breaks up or down,because on both sides we have major support and resistance levels that matter.

That’s swing trading:

📍 Enter with structure, hold with confidence, exit at significance.

Not every move is worth trading — but the big ones are worth waiting for.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Survival First, Success LaterThere was once a stone that lay deep in the heart of a flowing river.

Every day, the water rushed past it, sometimes gently, sometimes with force. The stone wanted to stay strong, unmoved. It believed that by holding its ground, it could outlast the river.

For years, the stone resisted. It didn’t want to change. It believed that strength meant standing still, no matter how hard the current pulled.

But slowly, almost without noticing, the stone began to wear down. The river wasn’t trying to destroy it. The water wasn’t cruel. It was simply doing what rivers do - moving, shifting, carving its own path.

One day, the stone realised it wasn’t the same shape anymore. It was smoother now, smaller in places. It hadn’t won by resisting. It had survived by adapting. It had learned to let the river shape it without breaking it apart.

The stone couldn’t control the river. All it could do was endure without letting itself be shattered.

Trading is NOT so different.

The market moves like a river. It doesn’t care if you want it to go left or right. It doesn’t reward those who stand rigid against its flow. It rewards those who learn when to hold their ground, when to let go, and how to survive the constant pull of forces bigger than themselves.

This is NOT a story about rivers and stones. It’s a story about YOU.

About learning to endure without breaking. About understanding that survival comes not from fighting the current, but from learning how to live within it.

Much like the stone, every trader begins with the same illusion, that strength means control, that certainty can be conquered with enough knowledge or willpower.

But time in the markets teaches you otherwise. It shows you, again and again, that survival isn’t about resisting the flow. It’s about learning to move with it, to protect yourself from the inevitable storms without being broken by them.

And so, this is where the real story of trading begins.

Trading often appears simple from a distance. You buy, you sell, you make a profit, and then you repeat the process.

But anyone who has spent enough time in the markets will tell you the truth. This isn’t a game of certainty. This is a game of survival.

The market humbles you early. It doesn’t care how much you know, how brilliant you think you are, or how much confidence you bring. The market doesn’t reward ego; it breaks it down piece by piece.

Almost everyone starts with the same mindset. You want to win. You want to make money. You believe you can figure it out if you study hard enough, work smart enough, hustle more than the next person.

But eventually, reality steps in. You begin to understand this game isn’t about knowing where the price will go next. It’s about knowing where you will stop, where you will cut a loss, where you will step aside and wait.

The traders who survive are not the ones who chase perfection or seek to predict every move. They are the ones who learn how to lose properly - small losses, controlled losses. Losses that don’t bleed into something bigger, mentally or financially.

Most people can’t do that. They fight the market. They fight themselves. They refuse to accept small losses, believing they can somehow force a different outcome.

Those small losses eventually snowball. Blowups rarely come from one bad trade. They come from ignoring the small signs over and over again. The market isn’t cruel. It’s just indifferent. It’s your responsibility to protect yourself.

Good trading isn’t loud. It isn’t exciting. It isn’t full of adrenaline and big calls.

Good trading is quiet, repetitive, and frankly, a little boring. It’s built on discipline, not drama. Your job is to manage risk, protect your capital, and let time do its work.

There is no holy grail. There is only process. A process you can repeat with a clear head, day after day, year after year, without losing yourself in the noise.

Wins will come. Losses will come. Neither defines who you are. What defines you is how you respond.

⦿ Can you stay calm after a red day?

⦿ Can you follow your plan even after a mistake?

⦿ Can you sit on your hands when there’s nothing to do and trust the work you’ve already done?

Patience, in the end, is the real edge. Most won’t have it.

They’ll bounce between strategies, searching for certainty where none exists. They’ll burn out chasing shortcuts. They’ll forget that progress comes through small, steady steps taken over years, not through chasing big wins.

Trading is a mirror. It reflects your fear, your greed, your impatience. It shows you who you really are. Ignore what it reveals and you’ll keep paying for the same lesson until you finally learn it.

In the end, this game isn’t about the market. It’s about YOU.

⦿ Learn to protect yourself.

⦿ Learn to sit with boredom.

⦿ Learn to lose well.

⦿ Learn to wait without losing faith.

If you can do that, the market has a way of rewarding you in time.

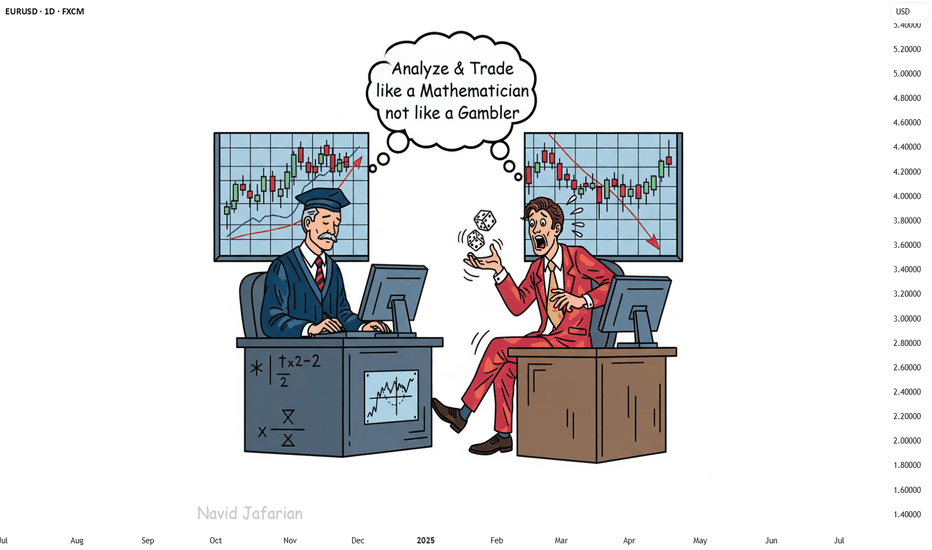

123 Quick Learn Trading Tips - Tip #7 - The Dual Power of Math123 Quick Learn Trading Tips - Tip #7

The Dual Power of Math: Logic for Analysis, Willpower for Victory

✅ An ideal trader is a mix of a sharp analyst and a tough fighter .

To succeed in the financial markets, you need both logical decision-making and the willpower to stay on track.

Mathematics is the perfect gym to develop both of these key skills at the same time.

From a logical standpoint, math turns your mind into a powerful analysis tool. It teaches you how to break down complex problems into smaller parts, recognize patterns, and build your trading strategies with step-by-step thinking.

This is the exact skill you need to deeply understand probabilities and accurately calculate risk-to-reward ratios. 🧠

But the power of math doesn't end with logic. Wrestling with a difficult problem and not giving up builds a steel-like fighting spirit. This mental strength helps you stay calm during drawdowns and stick to your trading plan.

"Analyze with the precision of a mathematician and trade with the fighting spirit of a mathematician 👨🏻🎓,

not with the excitement of a gambler 🎲. "

Navid Jafarian

Every tip is a step towards becoming a more disciplined trader.

Look forward to the next one! 🌟

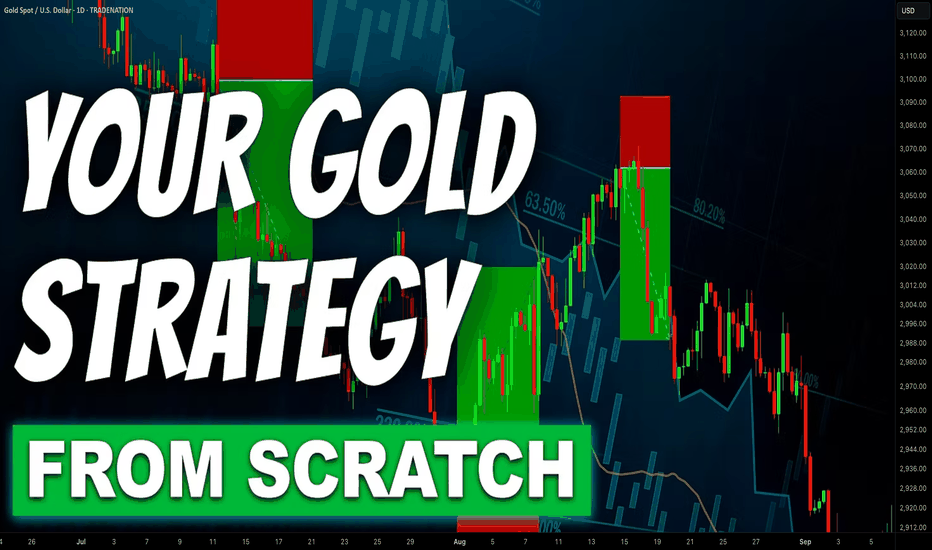

Step-By-Step Guide to Building a Winning Gold Trading Strategy

In the today's article, I will teach you how to create your first profitable gold trading strategy from scratch.

Step 1: Choose the type of analysis

The type of analysis defines your view on the market.

With technical analysis you rely on patterns, statistical data, technical indicators, etc. for making trading decisions.

Fundamental analysis focuses on factors that drive the prices of gold such as micro and macroeconomics, news and geopolitics.

A combination of technical and fundamental analysis implies the application of both methods.

For the sake of the example, we will choose pure technical approach.

Step 2: Specify the area of analysis

Technical and fundamental analysis are complex and multilayered subjects. That is why it is crucially important to choose the exact concepts and techniques that you will apply in gold trading.

For example, with a technical analysis, you can trade harmonic patterns, or apply a combination of key levels and technical indicators.

With fundamental analysis, you can build your trading strategy around trading the economic calendar or important news releases.

Here we will choose support & resistance levels and smart money concepts.

Step 3: Select a trading time frame

Your trading time frame will define your trading style. Focusing on hourly time frame, for example, you will primarily catch the intraday moves, while a daily time frame analysis will help you to spot the swing moves.

You can also apply the combination of several time frames.

We will choose the combination of a daily and an hourly time frames.

Step 4: Define your trading zones

By a trading zone, I mean an area or a level on a price chart from where you will look for trading opportunities.

For example, a technical indicator trader may apply moving average as the trading point.

For the sake of the example, we will choose support and resistance levels on a daily time frame as our trading areas.

Step 5: Choose confirmations

Confirmation is your entry reason . It is the set of conditions that indicates a highly probable projected outcome.

For an economic calendar traders, the increasing CPI (inflation) figures can be a solid reason to open a long position on Gold.

Our confirmation will be a local change of character on an hourly time frame.

Step 6: Define your stop loss placement, entry and target selection and desired reward to risk ratio

You should know exactly where should be your entry point, where will be your stop loss and where should be the target.

We will open a trading position immediately after a confirmed change of character, stop loss will lie below the lows if we buy or above the highs if we sell.

Target will be the next daily structure.

Minimal reward to risk ration should be 1.5.

Step 7: Define Your Lot Size and Risk Per Trade

You should have precise rules for the calculation of a lot size for each trade.

For our example, we will strictly risk 1% of our trading deposit per trade.

Step 8: Set trade management rules

When the trade is active, trade management rules define your action:

for example, whether you strictly wait for tp or sl, or you apply a trailing stop loss.

In our strategy, we will move stop loss to entry 10 minutes ahead of the release of the US news in the economic calendar.

Step 9: Back test your strategy

Study the historical data and back test at least 50 trading setups that meet your strategy criteria.

Make sure that the strategy has a positive win rate.

Step 10: Try a trading strategy on a demo account

Spend at least a month on demo account and make sure that you obtain positive overall results.

If you see consistent profits on a demo account, it is the signal for you that your strategy is ready , and it's time to start trading on a real account.

In case of negative results, modify your trading conditions and back test them again, or build a new strategy from scratch.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

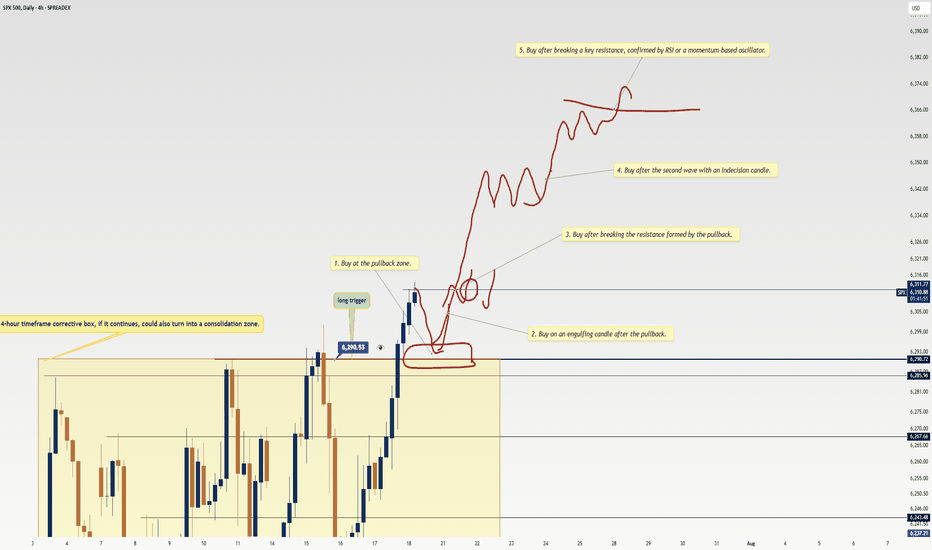

5 Proven Tricks to Trade Without FOMO After Missing Your TriggerYo traders! In this video, I’m breaking down what to do if you miss a trading trigger , so you can stay calm , avoid FOMO , and still catch the next move. We’re diving into five solid strategies to re-enter the market without losing your cool:

Buy on the pullback zone.

Buy with an engulfing candle after a pullback.

Buy after breaking the resistance formed by the pullback.

Buy after the second wave with an indecision candle.

Buy after breaking a major resistance post-second wave, confirmed by RSI or momentum oscillators.

These tips are all about keeping your trades smart and your head in the game. For more on indecision candles, check out this lesson . Wanna master breakout trading? Here’s the breakout trading guide . Drop your thoughts in the comments, boost if you vibe with it, and let’s grow together! 😎

In trading, the long way is the shortcut⚠️ The Shortcut Is an Illusion — And It Will Cost You

In trading, everyone wants to arrive without traveling.

They want the profits, the freedom, and the Instagram lifestyle — even if it’s fake.

What they don’t want is the process that actually gets you there.

So they chase shortcuts:

• Copy signals without understanding the reason behind them

• Over-leverage on “the perfect setup”

• Buy indicators they don’t know how to use

• Skip journaling and backtesting

• Trade real money without trading psychology

And then they wonder…

Why is my account bleeding?

Why does this feel like a cycle I can't break?

Because:

Every shortcut in trading is just a fast track to disaster.

You will lose. You will restart. And it will take even longer than if you just did it right the first time.

🤡 The TikTok Fantasy: “1-Minute Strategy That Will Make You Millions in 2025”

This is the new wave:

A 60-second video showing you a magical indicator combo.

No context. No testing. No risk management.

Just fake PnL screenshots and promises of millionaire status before next summer.

“This 1-minute scalping strategy made me $12,000 today!”

And people fall for it… because it’s easier to believe in shortcuts than to accept that real trading is boring, repetitive, and hard-earned.

If it fits in a TikTok video, it’s not a strategy. It’s clickbait.

________________________________________

❓ Looking for a System Without Knowing the Basics

Here’s the paradox:

Most people are desperate to find a “profitable strategy” — but they haven’t even mastered the basic math of trading.

• They don’t know how pip value is calculated

• They don’t understand how leverage works

• They confuse margin with risk

• They size positions emotionally, not based on their account

• They can’t define what 1% risk per trade actually means in dollars

But they’re out here, loading indicators, watching YouTube “hacks,” and flipping accounts with 1:500 leverage.

Imagine trying to perform surgery before learning anatomy.

That’s what trying to trade a strategy without knowing pip cost looks like.

________________________________________

🛠️ The Long Way Is the Fastest Way

You want the real shortcut?

Here it is:

• Learn price structure deeply

• Backtest like a scientist

• Journal like a professional

• Risk small while you're learning

• Stay on demo until your edge is proven

• Master basic math: leverage, margin, pip value, position sizing

This is the long way.

But it’s the only way that doesn’t end in regret.

________________________________________

⏳ Most Traders Waste 2–5 Years Looking for a Shortcut

And in the end?

They crawl back to the long path.

Broke, humbled, and wishing they had just started there from the beginning.

The shortcut is a scam.

The long way is the only path that leads to consistency.

You either take it now… or take it later — after your account pays the price.

________________________________________

✅ Final Thought

Don’t ask how fast you can get profitable.

Ask how solid you can build your foundation.

Because in trading:

❌ The shortcut costs you everything

✅ The long way gives you everything

And the longer you avoid it, the longer it takes.

Learn 2 Essential Elements of Forex Gold Trading

In the today's post, we will discuss how Forex Gold trading is structured, and I will share with you its 2 key milestones.

Trading with its nuances and complexities can be explained as the interconnections of two processes: trading rules creation and trading rules following.

1️⃣ With the trading rules, you define what you will trade and how exactly, classifying your entry and exist conditions, risk and trade management rules. Such a set of consistent trading rules compose a trading strategy.

For example, you can have a following trading plan:

you trade only gold, you analyze the market with technical analysis,

you buy from a key support and sell from a key resistance on a daily, your entry confirmation is a formation of a reversal candlestick pattern.

You set stop loss above the high/low of the pattern, and your target is the closest support/resistance level.

Here is how the trading setup would look like.

In the charts above, all the conditions for the trade are met, and the market nicely reached the take profit.

2️⃣ Trading strategy development is a very simple process. You can find hundreds of different ones on the internet and start using one immediately.

The main obstacle comes, however, with Following Trading Rules.

Following the rules is our second key milestone. It defines your ability to stay disciplined and to stick to your trading plan.

It implies the control of emotions, patience and avoidance of rationalization.

Once you open a trade, following your rules, challenges are just beginning. Imagine how happy you would feel yourself, seeing how nicely gold is moving to your target after position opening.

And how your mood would change, once the price quickly returns to your entry.

Watching how your profits evaporate and how the initially winning position turns into a losing one, emotions will constantly intervene.

In such situations, many traders break their rules , they start adjusting tp or stop loss or just close the trading, not being able to keep holding.

The ability to follow your system is a very hard skill to acquire. It requires many years of practicing. So if you believe that a good trading strategy is what you need to make money, please, realize the fact that even the best trading strategy in the world will lose without consistency and discipline.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

The Right Way to Manage Stop Loss: Dynamic Logic for Smart ExitsContext

In fast-moving markets, static stop losses often sabotage good trades by exiting too soon or too late. This approach uses dynamic, logic-driven stop loss adjustments that adapt to market context instead of sticking to a single fixed distance.

⸻

Key Principles of This Stop Loss Logic

Contextual Initial Placement

The stop is never just a fixed percentage below entry. It adapts based on recent swing lows/highs, ATR volatility, and trend confirmation signals.

Dynamic Extension in Favorable Conditions

If price retraces but shows bullish reversal evidence such as deep oversold signals, positive divergence, or compression breakouts, the stop loss is extended instead of closing immediately. This prevents cutting winners during normal pullbacks.

Tightening When Momentum Fades

If momentum weakens (for example, ADX drops, failed bounce, or resistance rejection), the stop is tightened dynamically. This reduces drawdown if the trend fails.

Clear Exit Triggers

The system can exit on consolidation breakdowns below support, confirmed bearish reversal patterns, or time-based exits if no continuation happens.

⸻

Examples and Visuals

Below, I’ve included chart examples with screenshots from my Multi Crossover Strategy . These images illustrate how dynamic stop loss management behaves in real conditions—showing entries, extensions during retracements, and exits triggered by different scenarios. You can see how the logic responds to changing volatility and trend strength in real time.

The "+" signs mark bars where the position would have closed using the default settings of 2.5 ATR Multiplier stop loss. A bullish reversal signal extended the stop, allowing the trade to close profitably instead of at a loss.

This example shows an early exit triggered by a consolidation breakdown. The system closed the position before the maximum stop loss was reached, limiting the loss as bearish momentum increased.

Example for lower high close to reduce loss. Here, the position was closed after a failed bounce and the formation of a lower high, signaling a likely continuation of the downtrend and helping to reduce the loss before a deeper move.

⸻

Advantages Over Simple Stop Losses

Adaptation

Stops react to volatility and price structure, not arbitrary distances.

Risk Mitigation

Dynamic tightening locks in gains faster when momentum fades.

Confidence to Stay In

Dynamic extension reduces the chance of premature exits during healthy retracements.

⸻

How to Use This Approach

When designing your strategy, start by defining a volatility-adjusted stop using an ATR multiplier as the base distance from entry. You can then set a maximum allowable loss in percentage terms to cap risk exposure to a fixed threshold.

After establishing your initial stop, consider adding layered adjustments that respond to different levels of reversal risk. For example:

ATR Multiplier: the factor used to calculate the initial stop distance based on market volatility.

Maximum Loss (%): the maximum risk per trade, defined as a percentage below the entry price.

Tight Stop Loss (%): a closer stop level that activates when early signs of a potential reversal appear, such as weakening momentum or minor bearish movement.

Bearish Stop Loss (%): a further tightening of the stop distance when stronger bearish reversal signals occur, including failed bounce attempts, lower highs, or clear resistance rejections. This level reduces the tolerance for further losses but still allows the trade to remain open if price stabilizes.

Extended Stop Loss Percentage Add-On: an additional percentage beyond the maximum loss cap, temporarily applied if strong bullish recovery signals appear.

In addition to these percentage-based stop adjustments, you can define instant exit rules that immediately close the position as soon as specific structural conditions are met. Unlike percentage-based stops, instant exits do not wait for further price movement or confirmation. They are typically used to react to decisive events such as a confirmed breakdown below support, a lower high after a failed bounce, or a sharp rejection at a resistance level. This combination of tightened stops and instant exit triggers allows for a flexible but disciplined approach to managing trades.

Pro Tip:

Most traders lose because their stops don’t evolve with the trade. Build a logic tree:

If trend = strong ➡ extend stop

If reversal risk ➡ tighten stop

If clear reversal signs ➡ exit

⸻

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Please do your own research before making trading decisions.

Two Brains, One Trade: Why You Freeze Under PressureBy MJTrading:

In trading, your biggest opponent isn’t volatility.

It’s your own neural wiring.

Every trader operates with two main systems:

🧠 System 2 – Rational, deliberate, planning (Prefrontal Cortex)

🧠 System 1 – Emotional, instinctive, fast (Amygdala & Limbic Brain)

Before entry, System 2 is in control. You feel calm, logical.

But the moment money is at risk—especially in drawdown or after a missed TP—System 1 takes over.

💥 Stress hormones spike

💥 Focus narrows

💥 Long-term thinking disappears

💥 You freeze, or act impulsively

You knew what to do.

But you didn’t do it.

Because in that moment, your rational mind wasn’t driving anymore.

⚖️ Set & Forget vs. Floating Managers

Different trading personalities react differently under pressure:

🔹 Set & Forget Traders

Rely on automation or predefined exits to bypass emotional hijack.

They reduce cognitive load, but often feel regret when price goes “a little more.”

🔹 Floating Management Traders

Rely on intuition and live feeling. They stay with the chart, adjusting based on flow.

When calm and trained, they shine.

But under pressure, they’re more vulnerable to emotional loops:

– hesitation

– premature exits

– revenge tweaks

– system betrayal

🧘♂️ What can you do?

✔️ Pre-plan decisions

Make the hard calls before emotions kick in.

✔️ Mental rehearsal

Visualize trade management scenarios—yes, like athletes do.

✔️ Create fallback protocols

So if you freeze, your system still knows what to do.

🧠 For Those Who Want to Go Deeper:

“Thinking, Fast and Slow” by Daniel Kahneman

Understand System 1 & 2 thinking—and how cognitive bias shapes all decisions, not just trades.

“The Hour Between Dog and Wolf” by John Coates

A stunning look at how biology, hormones, and risk-taking collide in traders' brains.

🔓 Final Thought:

If your strategy works in theory, but breaks in real-time—

It’s time to work on your neural execution layer.

Because in trading, you don’t rise to your level of analysis—

you fall to your level of emotional wiring.

— MJTrading

#NeuroTrading #TraderTypes #TradingPsychology #SetAndForget #FloatingManagement #MindOverMarkets #EURUSD #MJTrading

Previous psychology Ideas:

The Power of Confluence: Building Trade Setups Using 3 Indicator🔵 INTRODUCTION

Many traders fall into the trap of relying on a single indicator to make trading decisions. While one tool might work occasionally, it often leads to inconsistent results. The key to consistency lies in confluence — the strategic combination of multiple indicators that confirm each other.

In this article, you'll learn how to build high-probability trade setups by combining three essential components: trend , momentum , and volume .

🔵 WHY CONFLUENCE MATTERS

Confluence refers to multiple signals pointing in the same direction. When different indicators agree, your trade idea becomes much stronger. It helps reduce noise, avoid false signals, and increase confidence in your entries.

Think of it like crossing a busy road: you wait for the green light, check both sides, and make sure no cars are coming. The more confirmations you have, the safer your move.

🔵 WHAT IS CONFLUENCE IN TRADING?

Confluence means agreement. In trading, it’s when different methods, indicators, or tools all point toward the same outcome.

Think of it like this:

One green light? Maybe.

Two green lights? Worth watching.

Three green lights? That’s a trade worth considering.

Imagine you're planning a road trip. You check the weather forecast (trend), Google Maps traffic (momentum), and ask a local for advice (volume). If all three say “go,” you’re more confident in your decision. Trading works the same way — using multiple tools to validate a setup reduces risk and removes guesswork.

Important: Confluence is NOT about cramming 10 indicators onto your chart. It’s about using a few that each offer different types of information — and only acting when they align.

🔵 THE 3-STEP CONFLUENCE SETUP

1️⃣ Identify the Trend (Using EMAs)

Before entering any trade, you need to know the market direction. You can use:

Moving Averages (e.g., 21 EMA and 50 EMA crossover)

Structure-based analysis (e.g., higher highs = uptrend)

Trade only in the direction of the prevailing trend.

2️⃣ Check Momentum (Using RSI, MACD, or Stochastic)

Momentum tells you whether the market supports the current trend or if it's weakening.

RSI above 50 → Bullish momentum

MACD histogram rising → Acceleration

Stochastic crossing above 20 or 80 → Momentum shifts

Avoid entering when momentum is fading or diverging from price.

3️⃣ Confirm with Volume (To Validate Participation)

Volume reveals the strength behind the move. A breakout or trend continuation is more reliable when it's backed by volume.

Look for:

Volume spikes at breakout points

Increasing volume in the direction of the trend

Volume confirmation after pullbacks or retests

No volume = no conviction. Watch how the market "votes" with actual participation.

🔵 EXAMPLE TRADE SETUP

Let’s say you spot a bullish trend with 21 EMA above 50 EMA. RSI is above 50 and rising. A pullback forms, and volume picks up as price starts to push higher again.

That’s trend + momentum + volume lining up = a confluence-based opportunity.

🔵 BONUS: HOW TO ENHANCE CONFLUENCE

Add price action patterns (flags, wedges, breakouts)

Use support/resistance zones for cleaner entries

Combine with higher timeframe confirmation

Wait for retests after breakouts instead of chasing

Confluence doesn't mean complexity — it means clarity.

🔵 CONCLUSION

The best traders don’t guess. They wait for the market to align. By combining trend, momentum, and volume, you filter out weak setups and focus only on the highest-probability trades.

Start testing confluence-based setups in your strategy. You’ll likely find more consistency, fewer fakeouts, and greater confidence in your execution.

Do you trade with confluence? What’s your favorite trio of indicators? Let’s talk in the comments.

Let your winners run🧠 Fear | Hope | Growth – When Trading Meets Emotion

The message on the chart isn't just poetic — it's real psychology.

🔹 Fear wants to cut your winners short.

It sneaks in after a small move in your favor.

"What if it reverses? I better lock this in."

And just like that, a great trade turns into a missed opportunity.

🔹 Hope drags you into holding too long.

It dreams: "Maybe it doubles... maybe this time it'll be massive."

But it's not guided by data — it's driven by fantasy.

🔹 Discipline is what sits in the middle.

Quiet. Neutral.

It doesn’t scream or seduce — it just follows the plan.

And that’s where Growth lives — not just on the PnL, but in your psychology.

When Bitcoin pushes toward new ATHs, these emotions get amplified.

The real question becomes: Can you manage yourself, not just your trade?

📌 A Real Example from My Desk

In my earlier BTCUSD idea — “Another Edge – Decision Time” (shared above) —

I sent that setup to one of my managed clients.

He entered long exactly at the edge of the channel — a clean, strategic buy.

Price moved beautifully in our favor…

But he manually closed the trade at 106,600 — long before the move matured.

Why?

Because fear of giving back profit overwhelmed the original plan.

The chart was right. The timing was right.

But the exit was emotional, not tactical.

✅ The trade made money.

❌ But the lesson is clear: a profitable trade doesn’t always mean a disciplined one.

🎯 Final Takeaway:

“Fear kills your winners. Hope kills your timing. Discipline grows your equity and your character.”

🗣 What would you have done in that position?

Held longer? Closed at resistance? Let it run toward ATH?

Let’s talk psychology — drop your thoughts 👇

#MJTrading

#TradingPsychology #BTCUSD #FearHopeDiscipline #LetYourWinnersRun #PriceAction #BTCATH #ForexMindset #CryptoStrategy

The Market Rewards the PatientLast week was probably one of the slowest weeks I’ve ever had. I found two setups, but neither one truly materialized. They just didn’t meet all the conditions in my plan. It was tough. I won’t pretend it wasn’t tempting to drop my rules and chase other strategies just so I could be in the market.

But deep down, I knew exactly what I wanted. I want to be consistent . I want to trade like a professional . So I held back. All week, I watched and waited. No trades taken. It was boring, honestly . But that boredom protected my capital.

Instead of forcing trades, I spent the entire weekend backtesting , drilling into my strategy even more. I wanted to be sure that when my moment came, I’d recognize it without hesitation.

Then this week started. I didn’t know if it would be any different, but I trusted my process and stayed ready. Eventually, one clean setup appeared. I shared it here on TradingView. I managed my risk properly , took half my usual size at just 0.5%, and let the trade run. It almost hit my stop, but I didn’t touch it. It was simple: either TP or SL .

And this time, it hit TP. A clean 1:4.

This was a powerful lesson. Following my plan didn’t just lead to a winning trade. It protected my capital all of last week when the market wasn’t offering quality setups. That patience and discipline paid off.

That’s how you build consistency. That’s how you survive long enough to catch the trades that truly matter.

9 Essential TIPS For Newbie Traders (Learn from my Mistakes!)

In the today's article, I will reveal trading secrets I wish I knew when I started trading.

1️⃣ Forget about becoming a pro quickly

Most of the traders believe, that you can learn how to trade easily and that it takes a very short period of time in order to master a profitable trading strategy.

The truth is, however, that trading is a long journey.

I spent more than 3 years, trying different strategies and looking for a profitable technique to trade. Once I found that, it took more than a year to polish a trading strategy and to learn how to apply that properly.

Be prepared to spend YEARS before you find a way to trade profitably.

2️⃣ Focus on One Strategy

While you are learning how to trade you will try different techniques, tools and strategies. And the thing is that newbies are trying multiple things simultaneously. The more strategies you try at once, the more setups you have on your chart. The more setups you have on your chart, the more complex and difficult is your trading.

Remember that in this game, your attention is the key.

You should meticulously study each and every trading setup.

For that reason, I highly recommend you to focus on one strategy, one approach, one technique. Test it, try it and look for a new one only when you realize that it doesn't work.

Here is the example how the same price chart can provide absolutely different trading opportunities depending on a trading strategy.

Price action pattern trader would recognize a lot of a patterns, while indicator based trader could spot absolutely different bullish and bearish signals.

Now, try to imagine how hard it would be to follow both strategies simultaneously.

3️⃣ Start with small capital that you can afford to lose

You will lose your first trading deposit and, probably, the second one and potentially the third one as well.

Losses are the only way to learn real trading. While you are on a demo account, you feel like a king, but once you start risking your savings, the perspective completely changes .

For that reason, make sure that you trade with an account that you can afford to lose. The fact of blowing such an account should be unpleasant, but that should not affect your daily life.

4️⃣ Use stop loss

I am doing trading coaching for more than 4 years.

What pisses me off is that the main reason of the substantial losses of my mentees is the absence of stop loss. Why can it be if naturally everyone: from your broker to Instagram trading gurus repeat that day after day.

Set stop loss, know in advance how much you risk per trade, and know the exact level on a price chart where you become wrong.

Imagine what could be your loss, if you shorted USDJPY and hold the trade while the market kept going against you.

5️⃣ Forget about getting rich quick

That is the iconic fallacy. I believe that around 90% of people who come in this game want to get rich quick , want easy money.

And no surprise, when I share a trading setup in my free telegram channel, and it loses I receive dozens of messages that I am a scammer.

People truly believe that professional trading implies 100% win rate and quick and easy money.

The truth is, traders, that trading is a very tough game. And with a good trading strategy, you have just a little statistical edge that will give you the profits that would slightly overcome your losses.

6️⃣ Train your eyes

Professional trading implies pattern recognition: it can be some technical indicators pattern, the price action or candlestick formation, etc.

Your main goal as a trader is to learn to identify these patterns.

Pattern recognition is a hard skill to acquire.

You should spend dozens of hours in front of the screen in order to train your eyes to identify certain patterns.

Here is how many patterns you would spot on GBPUSD chart, paying close attention.

7️⃣ Track and analyze your trades

Study all the trades that you take, especially the losing ones.

Look for mistakes, look for the reasons why a certain setup played out and why a certain one didn't. Journal your trades and make notes.

8️⃣ Don't use technical indicators

Newbies believe that technical indicators should do the work for them.

They are constantly looking for one or a bunch that will accurately show where the market will go.

However, I always say to my mentees that technical indicators make the chart messy and distract.

If you just started trading, focus on a naked chart, learn to analyze the market trend, key levels, classic price action patterns.

Learn to make accurate predictions relying on a price chart alone.

Only then add some technical indicators on your chart.

They won't do the work for you, but will help you to slightly increase the accuracy of a certain setup.

Above is the classic chart of a newbie trader.

A lot of indicators and a complete mess

The same chart would look much better without technical indicators.

9️⃣ Find a Mentor

There are hundreds of trading mentors on Instagram, YouTube, TradingView. Find the one with a trading style that you like.

Follow him, learn from his trading experience, listen to his trading recommendations.

11 years ago I found a guy on YouTube, his name was Jason.

I really liked his free teachings, and they were meaningful to me.

I decided to purchase his premium coaching program.

It was 200$ monthly - a huge amount of money for me at that time.

However, with his knowledge I saved a lot, I learned a lot of profitable techniques and tricks that helped me to become a professional forex trader.

Of course, this list could be much bigger.

The more I think about different subjects in trading, the more important tips come to my mind. However, I believe that the tips above are essential and I truly wish I knew all that before I started.

I hope that info will help you in your trading journey!

Good luck to you.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

My Ideal Elliott Wave Entry ModelThe IMSETT 3/C Entry Model.

Every trader wants to catch the big moves the ones that pay quickly and decisively. In Elliott Wave, those moves often come during Wave 3. It's the strongest part of the trend, and when you're positioned early, the risk-to-reward is unmatched.

But not every opportunity hands you a clean Wave 3 on a silver platter. Sometimes you’re looking at a Wave C instead. That’s where the 3/C Entry Model comes in. It’s designed to get you aligned with high-conviction moves—whether the market is in a trend or a zig zag.

Here’s the edge: both Wave 3 and Wave C often start the same way—a strong, motive push off an AOI (area of interest), followed by a retracement. That shared structure gives us an anchor. Whether we’re labeling it a 3 or a C doesn’t change the fact that the initial impulse gives us clarity, direction, and a place to manage risk.

That’s what the IMSETT Model is built around:

Identify

Motive

Scout

Entry Plan

Track

Trade

Each step is focused, actionable, and repeatable. You're not trying to outguess the market—you’re reacting to structure, preparing for common behavior, and executing with intent.

I do have a video with a walk through.

This just the way I look for clarity in setups. As with everything in trading, nothing will work every time so do your own research this is not financial advice.

Cheers!

Trade Safe, Trade Clarity.