Moving Averages

Bitcoin | Bullish Flag Breakout Done, Now What's Next??BTC/USD (Update)

In 8h Chart, EMA200 (7332) & EMA100 (6950) Both Are Play Important Rule As Key Support & Resistance Level.

At the moment, Bulls holding the EMA100 (Support) & Pushing the Bitcoin price towards EMA200 (Resistance)

Now If Bulls Cleared the EMA200 (Resistance) & Weekly Candle Close Above it then Bitcoin Might PUMP Hard in Coming days (We Could See HALVING FOMO)

If Bitcoin Bulls Failed to Hold EMA100 (Support) Then It Might Retest the 6.4-6,6k Area Again.

BTW Bitcoin Bulls Already Broke the Bullish Flag & Now Forming Another tiny Bullish Flag.

In Case of Bullish Move, Target Will be Between 7340-7380 (CME gap Area)

Outline : At the Moment, I'm Bullish on BTC & It Might Test the 7340-7380 Area, & Also Waiting for Weekly Closing, It Will be Important for Halving FOMO.

Please like the idea for Support & Subscribe for More ideas like this and share your ideas and charts in Comments Section..!!

Thanks for Your Love & Support..!

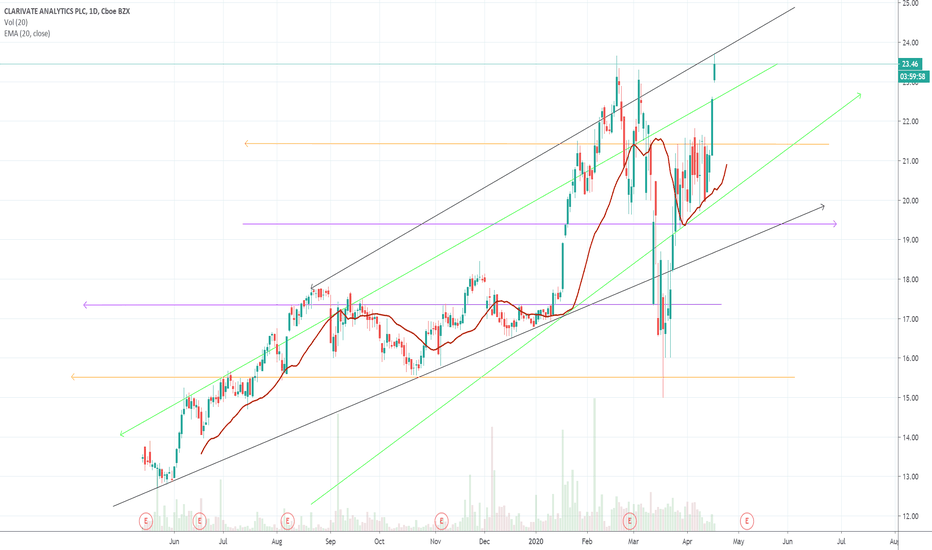

Fist Stock lookI am not trying to say buy nor sell. This is my first reading of the stock and I was also wondering other peoples thoughts on the chart. I am wanting feedback and tips to improve my skills to work on bettering my skills. Any tips are appreciated and tell me what i go wrong and how i could fix it.

Moving Average Trading SignalsMA Crossing MA is a common trading signal. When a short period MA crosses above a long period MA, you may want to go long. You may want to go short when the short-term MA crosses back below the long-term MA.

Here we can see MA50 crossing MA200 both ways, each resulting in a corresponding trend.

Death CrossThe death cross occurs when the short term average trends down and crosses the long-term average, basically going in the opposite direction of the golden cross, and is understood to signal a decisive downturn in a market.

Here we can see how the death cross triggered a year-long bear market.

The other perspective and Dollar Cost AveragingHappy Sunday, here I give you another perspective that may support my previous bearish bias of bitcoin.

The key of this analysis is the high period of moving average which I use to identify whether there is a down trend or the uptrend which hold current major trend in the market. Here in this example, I use the 1000 moving average on the daily time frame.

The 1000 moving average can be used as the benchmark to identify the dynamic support or resistance. In this current structure, we've found that based on the historical performance of bitcoin, there are only 3 period of times that the price trended below this 1000 MA on daily chart. The first period was between January - October 2015, The second period was between November 2018 - April 2019 and the third period is now. I might say with current price structure, the 1000 MA is acting as a dynamic resistance and the fact that the price is coming closer to this line makes me expecting a potential rejection toward this resistance and make the price goes lower.

On the other hand, The fact that the price is now trending slightly below the 1000 moving average is once again becoming a good area of doing the dollar cost averaging for a long term investment. At this rate below this dynamic support, the price of bitcoin is becoming undervalue. But, this doesn't mean the price can't goes even lower, but doing the dollar cost averaging at this rate is less risky than if we wait for the price to breaks out of current resistance to confirm the uptrend.

So, for short term, I will bet that the price will go even lower. But, for longer term maybe for the next 2 - 5 years, this time is a great time to start your dollar cost averaging on bitcoin as part of your portfolio.

Don’t miss MA opportunities this month Our analysis suggests that Moving Average Cross Over Trading strategies would likely be most successful at present. MA Cross Over is a particular form of trend trading. Moving averages "smooth" price data and represents the average price over a period of time. MA cross overs rely on faster moving averages crossing over longer period (slower) moving averages. For example, by plotting a 200-day and 50-day moving average, a buy signal occurs when the 50-day crosses above the 200-day and a sell signal occurs when the 50-day drops below the 200-day. The time frames can be altered to suit your individual trading time frames.This is in comparison to Support/Resistence Trading strategies which may have worked better last month.Conversely, our analysis suggests that Support/Resistence Trading strategies would most likely be unsuccessful at present.

BITCOIN | Ascending Channel & EMA100 Resistance..!!BTC/USD (Update)

Bitcoin Has been Moving Inside the Ascending Channel & Facing EMA100 In 8h Chart.

Now There Are Two Possible Scenarios!!

1- If Bulls Lost the MA50 & Channel Broken down, then It Might Crash Hard towards 4.8k Support.

2- if Bulls Clear the EMA100, then It Might Test 8k Area. (Major Resistance)

Please like the idea for Support & subscribe for More ideas like this and share your ideas and charts in Comments Section..!!

Thanks for Your Love & Support..!

Support/Resistance Long StrategyChart TF: 4H

Indicators: 14 EMA, 40 EMA, Vortex Indicator 30, RSI 22, TRIX 10

I have been tweaking this simple, yet profitable, system for a few weeks and wanted to share it with the public to receive feedback/opinions.

This post will go over the long entry conditions, look at my profile for the short conditions (they are simply flipped).

Long Conditions:

1) 14 EMA > 40 EMA.

2) A bullish candle must break above a resistance level.

3) The price must be above both EMAs.

4) VI(+) > VI(-) by at least .15

5) RSI > 50

6) TRIX > 0

If all conditions are met, enter long.

Stop Loss:

1) Set SL to the closest support.

Take Profit:

1) Set TP 1:1 R/R with the stop loss.

In this recent 21 day stretch, 02/26/20 - 03/18/20, this strategy gave 6 successful long entries and over 500 pips on EURGBP.

Support/Resistance Short StrategyChart TF: 4H

Indicators: 14 EMA, 40 EMA, Vortex Indicator 30, RSI 22, TRIX 10

I have been tweaking this simple, yet profitable, system for a few weeks and wanted to share it with the public to receive feedback/opinions.

Short Entry Conditions:

1) 40 EMA > 14 EMA.

2) A bearish candle must break below a support level.

3) The price must be under both EMAs.

4) VI(-) > VI(+) by at least .15

5) RSI < 50

6) TRIX < 0

If all conditions are met, enter short.

Stop Loss:

1) Set SL to the closest resistance.

Take Profit:

1) Set TP 1:1 R/R with the stop loss.

In this recent 28 day stretch, 02/19/20 - 03/18/20, this strategy gave 5 successful short entries and over 300 pips on NZDCHF.

S&P 500 😷 Coronavirus Panic Selling, but should you worry? 😱🚨PANIC SELLING of stocks due to Coronavirus...😷 in fear that earnings for top companies will drop as productivity comes to a halt. 😩

⚠️ Historically, the SARS outbreak did not cause the stock market to dump farther as we were in the tail end of the Recession.

Coronavirus appears to be coincidentally at the top of a market rally and is just a social trigger to inspire fear, uncertainty, and doubt. FUD 😱

This will allow institutional players to take your money and buy back at cheaper prices. 👿

(The 200 Week Moving Average.)

Ask yourself this... 🤔 because of Coronavirus will you stop logging onto Facebook, will you discard your Apple Macbook, will you stop buying goods from Amazon, will you stop watching Netflix, will your office stop using Microsoft Office?

If the answer is no... DO NOT PANIC SELL your retirement account, please. 🙅♀️

Since 1977, which direction is the stock market moving?

Answer: Up.

☝️☝️☝️

RSI Bearish Divergence playing out:

(Indicator below the chart with squiggly blue lines)

Price makes higher tops, while magnitude of price (RSI) makes lower tops. Warren Buffet and Jeff Bezos already sold their stocks for cash.

No one cares until now... Who do you think will buy the stocks you are panic selling?

Open close EMAsSimple indicator which paints the same EMA twice (default to 20), one set to open one set to close. The idea being the when the price is closing > the open on average number goes up.

Green on top trends up, red on top trends down. Only really backtested this on HTFs, works well on daily, interesting on weekly but you lose a lot of wicks.

Try it with the candles hidden.

200 EMA - best use for entries!I don't use indicators, they're not my style, they lag, they repaint; and in my opinion they don't work.

The 200 EMA on DAILY can be useful because of how slow it is. We can use it to filter the direction of which way we trade.

Price ABOVE 200 ema = ONLY BUY

Price BELOW 200 ema = ONLY SELL

Then drop timeframes for your entries via your strategy whatever that may be. If your strategy says go long but price is below EMA, don't take the trade etc...

Ignore the EMA on other timeframes lower than the daily. You want a slow daily direction indicator.

Don't blindly trade this, wait until price is clearly past the EMA and maintaining a good distance from it.

Use it as a guideline if you struggle working out fundamentals to help you filter a direction to trade.

NOT TO REPLACE FUNDAMENTAL ANALYSIS!!!

BTCUSDT 4H DOUBLE DEATH CROSS LONG TRADE STRATEGYThe double death cross strategy employs one more moving average that will help you anticipate when the death cross signal will occur. The third moving average is the 100-day MA, which is a medium-term MA situated between the other two moving averages.

Step #1: Wait for the 50-day EMA to cross below the 100-day EMA. The two moving averages also need to converge with the price action. You can read more about day trading price action here.

If we get the crossover of the 50-day MA (blue line) and 100-day MA (orange line) at the same time the price is testing those moving averages like it’s doing on the GBP/USD chart below, that’s the best-case situation for trade because we can define the risk.

The rule you need to keep in mind is that when the MAs converge with the price you have to get ready for the ride because it is going to get BUMPY!

Step #2: Multiple entry strategy: Sell1 when we close below 50-day MA and 100-day MA. Sell2 when we break and close below 200-day MA.

Using multiple entries to improve your average entry price can be the best way to approach the death cross signal. Scaling into a position is our preferred trading method when looking to capture a large price move in a currency pair.

The fact that the price was near the death cross signal, it created tension in the market that eventually will lead to a sharp move to the downside.

We pull the trigger on the first half of the trade once we close below the 50-day and 100-day moving averages.

If at the moment when the death cross developed we’re already trading slightly below the two moving averages, sell at the market the moment we close below.

The second half of our position is entered once we break and close below the 200-day moving average.

**Note: It’s important to remember that the success of the death cross signal relays on this simple trade secret that price and the two moving averages need to converge.

Keep it 'simple stupid' is not just a simple aphorism, but it’s an old truth that can make the difference between losing and making money trading.

Step #3: Hide your protective Stop Loss above 50-day MA and 100-day MA

The most important thing we need to define when trading is our risk. If you want to be a profitable trader you really need a limited risk. This is the type of death cross trades that we want to pull the trigger on.

If the price were to move back above those moving averages, we can safely assume this is yet another false trade signal. In this trade case scenario, we’re risking a little and our reward is potentially much bigger.

So, the best place to hide your protective stop loss is above the 50-day MA and 100-day MA.

Step #4: Choose your own Take Profit strategy or use this Two-step process for the take profit strategy: Mark on your chart the high of the candle when the 50-day MA crossed below 200-day EMA. Take profit when this high is broken.

Our take profit strategy might seem a little bit complex, but once we break down the steps you need to follow, it will make more sense why we’ve chosen this approach.

The first thing you have to do is to remember what we said at the beginning of the article which is that when the price doesn’t converge with the two MAs this is a death cross false signal.

In the example below, we can observe this type of price action.

Now all you have to do is to mark the high of the candle when the death cross happened and take profit as soon as the high gets broken.

**Note: The above was an example of a SELL trade using the death cross strategy. Use the same rules for a BUY trade – but in reverse, in which case we have the golden cross trading strategy.

Conclusion - Death Cross Stocks

Following the death cross trade signal can be a very efficient approach to identify bearish sentiment in the market. If you want to switch from short-term trading and try capturing larger trends the double death cross trading strategy can help you achieve your goals.

You must know that the death cross definition is universally applicable to any other asset classes. We can have a death cross crypto or a death cross gold the same way we can have a death cross S&P 500. Capturing and detecting bearish trends can be a hard task because downtrends are typically different than bullish trends. However, the double death cross strategy gives you a systematic way to tackle bearish trends.