EDUCATIONAL STRATEGY 21>50>250 BUY, 21<50<250 SELLHELLO,

HERE IS A BEAUTIFUL MA STRATEGY,

HOW TO SET IT UP?

1. LOAD MA 21, Linear Weighted, HL/2 (Colour WHITE)

2. LOAD MA 50, Linear Weighted, HL/2 (Colour RED)

3. LOAD MA 250, Linear Weighted, HL/2 (Colour YELLOW)

SIGNALS.

1. MA 21>MA50>250 WE BUY, WE CLOSE WHEN MA 21MA50

Extra,

1. MA 50> MA 250 CONFIRMED UP TREND. GOLDEN CROSS. ONLY TAKE BUY SIGNALS

2. MA 50< MA 250 CONFIRMED DOWN TREND. DEAD CROSS. ONLY TAKE SELL SIGNALS

EARLY SIGNAL.

1. SELL EARLY: MA21 < MA50 ( BUT WE ARE IN UP TREND WHERE MA 50 > MA250)

2. BUY EARLY: MA21 >MA50 ( BUT WE ARE IN DOWN TREND WHERE MA 50 < MA250)

WHAT TIME FRAME SHOULD I USE? H1, H4, M15,M5.

What DO I DO WHEN 21MA=50MA=200Ma? DON't ENTER, WHAIT CONFIRMED TREND AND CROSS THEN ENTER.

WHAT PAIR SHOULD I USE THIS? ALL CURRENCY AND STOCK.

CAN I ADD ANOTHER INDICATOR? YES, ADD PARABOLIC SAR TO GIVE YOU BUY OR SELL SIGNAL WITH THIS STRATEGY.

IS THE STRATEGY BEST FOR TREND OR RANGE? BEST FOR TREND, USE M5 TIME FRAME FOR RANGE.

THANK YOU ALL, PLEASE LIKE IF YOU BENEFIT SO WE ADD MORE EDUCATIONAL TIPS.

ACCOUNT MANAGEMENT SERVICE

0096594072143 WHATS UP.

Moving Averages

Comprehensive Trading Strategy - ConsensioDisclaimer: If you are primarily interested in copying other people’s trades then this is not for you. However, if you are willing to put in the work that it takes to learn how to trade for yourself then you have found the right place! Nevertheless please be advised that you can give 10 people a profitable trading strategy and only 1-2 of them will be able to succeed long term. If you fall into the majority that tries and fails then I assume no responsibility for your losses. What you do with your $ is your business, what I do with my $ is my business.

Identify Time Horizon

First and most important is identifying the time frame that you want to trade. I primarily trade the daily chart using Tyler Jenks’ Consensio. It was designed to capture long term trends. If followed it will ensure that you do not miss out on a trend and it will also get you out before it fully reverses.

“We want 90% of the cookie” -Tyler Jenks

There will be times when we cost ourselves a small amount of opportunity but that will be peanuts in comparison to the larger trends that will be captured.

Even though it was designed for higher time frames (TFs), specifically the weekly, it can still be used on smaller TFs based on your understanding and time availability. Decisions need to be made each time a candle closes, therefore you need to be available, or out of all positions, every time that happens.

I trade the daily chart because I know that I will be available every day for the candle close. I also like to trade the stock market, commodities, and FOREX as well as crypto because the daily closes are staggered throughout the afternoon and it gives me time to manage my positions.

If you prefer to day trade then this strategy can be used for the 1m - 1h candles. However it doesn’t seem to be too conducive to anything above 1h, if trading 24/7 markets.

For example: if trading the 4h then will not have enough time for position to develop before going to bed.

Regardless of what TF you select you can zoom out to determine longer term trends, however you should only use one TF for making decisions.

For example: I trade the daily chart and will zoom out to the weekly when I am looking for major reversals. However, if the price is signaling entries on the weekly then that is irrelevant because I make decisions based on the daily chart.

Identify Trend

“The purest form of Consensio is three Moving Averages without the price” -Tyler Jenks

Once you know what time frame you are going to trade then you need a reliable way to identify the trend. I have found Consensio to be the single most powerful tool for recognizing trends (as well as signaling entries, exits and reversals).

It is a system that seems very simple on the surface and potentially even unoriginal. However the deeper you dig the more you will uncover.

To start you need to go to the source directly:

Consensio - A New Trading System

Deep Dive Into Consensio

The notes that I have on it span well over 100 pages and I couldn’t possibly sum that all up in this post. Nevertheless I will attempt to cover the most important parts of the puzzle.

Important: Watch the videos above or else below will not make sense.

I have four subcategories for trending markets that are somewhat similar to Elliott Waves.

1) Short, medium and long term trend all in alignment. For bull trend: price > Short MA > Medium MA > Long MA (Strong trend)

2) Minor Correction (Small pullback moves against overall trend)

3) Major Correction (ABC type of correction that forms lower high but finds support at major boundary levels - Long MA, horizontal or trend line)

4) Potential Reversal (Price closes below long term MA and starts turning it over)

The moving averages should be dialed in to your specific time frame to help identify each subcategory above. When the asset is in a strong trend you want to see the Short Term MA act as support / resistance. A close above / below the Short Term MA indicates a minor correction. When there is a minor correction you want the Medium Term MA to act as support / resistance. A close above / below the Medium Term MA indicates a major correction taking place. When there is a major correction that doesn’t quite reverse the trend then you want the Long Term MA to act as support / resistance. A close above or below the Long Term MA indicates a potential reversal. If in a strong trend then expect price to quickly react from the Long Term MA and continue the trend.

For example: in a bull market the long term MA should act as strong support / provide a strong bounce. If it doesn't and the price closes below it instead then that is an indication that the bull market is getting exhausted.

When the Long Term MA starts to show signs of a reversal then I will add a Longer Term MA (default is 200) and / or I will zoom out to the weekly chart. This really helps me to understand if it is just a major correction within a market that is still trending or if a full on reversal is to be expected.

Being able to distinguish major corrections from reversals is the hardest part about consistently beating the market in the long run. Once you are comfortable with that then it mainly comes down to patience, discipline and diligence in regards to acting on signals and managing risk.

Entry & Exit Signals

5% when Price crosses Short Term MA (default is 4)

10% when Price crosses Medium Term MA (default is 9)

15% when Short Term MA crosses Medium Term MA

20% when Medium Term MA turns over (if it was trending down, then watch for it to turn up)

25% Price cross Long Term MA & Long Term MA flattens / turns over

25% Golden Cross with the Medium Term MA & Long Term MA

If multiple happens at once then sum the %’s.

For Example: P close < S & M MA then enter 15% .

If I am not in position then price crossing MA’s would trigger entries. If I am in a position then it would trigger exits. In rare cases I will flip my position by exiting a short and immediately entering a long, or vice-versa.

Entries and exits are done as soon as possible after the candle closes. I trade the daily chart so I will wait for the daily candle to close before making decisions and then I will try to make sure I get filled within 30 minutes (will take a market order if necessary). If you try to front run the candle close then you will make more mistakes than it is worth. It is very important to only make decisions after the candle closes. Everything else is noise and you cannot make decisions based on noise.

I may pass on signals if it would enter me against a longer term trend.

For Example: Price closes above Short Term and Medium Term MA’s and they cross over in a bullish manner. 30% - 50% long entry signaled. May choose to pass if Long Term MA is bearish.

I can completely pass on this entry in favor of waiting for a short if the price is below the Long Term MA and the Long Term MA is in a strong bear trend. In this case I will expect Long Term MA to act as strong resistance and will wait for price to close back below shorter term MA’s to trigger a short entry.

It takes time to reverse a trend. In the above example the Long Term MA is in a strong bear trend while price appears to be rallying through it after 50% long entry is signaled. I would pass on long entries and be very confident that the price isn’t going to blow right through my Long Term MA (due to the downward angle).

It very well might reverse the trend, however that will take time. If the price is above a Long Term MA that is angled down then the MA will act as a magnet for the price until it flattens / turns over.

Passing on the first long entries that are signaled does not mean that I will pass up on it all together, it just means that I think it is too early / risky. I would strongly prefer to wait for a golden cross with the Long Term MA flattened, or angled up, to go ahead and fully enter. In the example above I would wait for a pullback to the Long Term MA. If it supports above and gets a golden cross with the Medium Term MA then I would be much more inclined to take that entry.

It is very important to understand the difference between opportunity cost vs capitalizing on a loss. As traders we need to be completely comfortable with missing out on opportunity and extremely diligent about avoiding / minimizing losses. Therefore it is okay to pass on possible entries that are less than ideal however it is not okay to pass up on exits that feel similar.

Stop Losses & Risk Management

I determine my position size and leverage based on the amount of risk that I would be assuming. If an entry is triggered then I will use the Parabolic SAR or the Bill Williams Fractal to determine my risk.

If SAR is too tight then I will use the Fractal. I use the medium and long term MA’s to determine what is or is not too tight. Prefer stop to be above long term MA but has to be above medium MA.

I am trading Consensio, and it does not allow for stop losses in this manner. Instead it demands that you hold onto a position through the candle close and that you scale out in pieces (see above 'Entries & Exits'). This is best in 99%+ of the time.

However that really limits the leverage that can be used. If trading the daily chart 3X - 5X would be the absolute max. I tend to prefer 5X - 10X leverage for a number of reasons:

-Minimizes exchange risk

-Can minimize slippage

-Still gives me plenty of flexibility to place stop above prior Fractal / SAR

Below shows an example entry triggered and my thought process for where to place the stop along with a risk / leverage calculation.

Once I understand the risk, then I can calculate the position size. You should always think of risk as the amount you stand to lose opposed to exposure amount. I do not care about the exposure amount. I care about how much I stand to lose... how much I am risking. I care about controlling my downside and limiting it to less than 2% of my trading capital.

In the above example the risk is 7.10% and the max leverage is 14.08%. I never use the max leverage because getting liquidating comes with significantly higher fees. In this case I would use 10X or less leverage and I would make sure to set a market stop loss below the liquidation price.

If you get liquidated then it will likely be a ~22% fee. If you take a market stop before the liquidation triggers then it will be a ~2% fee.

I currently like to cap my risk at $500 per trade. $500 (USD I wish to risk) / 0.071 (calculated risk based on wick above Fractal) = $7,042 (exposure)

$7,042 is my maximum exposure. With 10X leverage $704.20 is the most I will need for margin. Once I understand my position size, leverage and margin requirements then the position size can be easily calculated based on the Entry & Exit Signals above.

Trailing Stop Losses

I consider myself 100% entered when I have $500 at risk. If the price moves in my favor then I will trail the stop loss. If I trail it to the point where it is at break even, or better, then I will not consider myself fully entered anymore.

Even though I still have the full original exposure, I am no longer assuming any risk and the latter is all that matters to me. Therefore I would feel comfortable adding to my exposure up until the point where I am risking another $500.

In the example above we get a great entry before a strong trend starts (also happened to follow descending triangle breakdown which provided great confirmation). The price quickly moves in our favor to the point where the stop is adjusted to break even, or very close to it.

With no risk I do not consider myself to be fully exposed anymore and I feel comfortable adding to my position up to an amount that would risk $500. Need to be very careful with this because adding to a profitable position after a big move can completely ruin your trade.

I will use the TD’ Sequential , RSI and Average Directional Index to confirm that the trend still has room to go. I will also check horizontals and trends to make sure I’m not selling support / buying resistance. In the example above I would really like adding because all of the above are in my favor.

This can be thought of as manual unbalancing which is the opposite of how most people approach allocating capital.

Automatic rebalancing will sell the most profitable positions and add to the lesser profitable positions in order to keep the same allocation percentages.

For example: if allocations are 50% Apple and 50% Amazon then Amazon outperforms. It will be something like 45% Apple and 55% Amazon. Rebalancing would sell Amazon and buy Apple so that it is 50:50 again.

I have always thought that is completely backwards. I want to allocate my capital to the best performing assets. If I am in a position that is really moving in my favor then I am thinking about adding to it. I would never take away from a more profitable position to add to a lesser profitable one just for the sake of balancing my portfolio.

Conclusion

What is outlined above is enough to ensure that you do not miss out on a trend and it also ensures that you will get out before it fully reverses. Don’t take me word for it, go do some backtesting yourself. That is when the power of Consensio will really come to life.

When trying out a new strategy I always recommend to start with an extremely small amount of money that is > $0 and I also recommend zooming in.

I think that it is very important to have some skin in the game so that you feel the pain and pleasure of losing and winning. However I think that is should be very nominal. If you have a $10,000 trading roll then I would take $100 and trade the 3m chart. Focus on learning the intricacies and making sound decisions. Also focus on ROI and how long it takes to generate 10%, 50% or 100%+ returns opposed the dollar amount being returned.

Regardless of what time frame you decide to trade I would always start with a very small TF. The reason is that the daily / weekly charts could take years to teach what the 3m and 5m charts can teach in days.

The decision making process should be exactly the same regardless of the TF. There are a ton of variables and intricate situations that you can put yourself into by trading small TF’s. Thinking your way through these situations is how you internalize and gain confidence in the trading system as well as the decision making process.

Facing these situations before you have significant money on the line is what I consider batting practice.

“We don't rise to the level of our expectations, we fall to the level of our training.” -Archilochos

After a couple weeks of trading the shorter TF’s I felt comfortable putting significant money to work on the Daily chart. However, I consider myself a fast learner and that process could take longer for others.

Moving averages explained for beginners (and 'experts')Moving averages are 'averages of historic price points'.

They are used to filter out "noise"(price fluctuations) and simplify price movements.

For example:

A moving average of 3 on a daily chart means: you take the previous 3 day-prices, add them up and divide by 3.

Day 1 = 10$

Day 2 = 20$

Day 3 = 15$

------------------

total = 45$

divided by 3 = 15$ averaged

So the price was 15$ on average for those 3 days

Easy right ?

Often two "moving averages" are used together.

Traders really should, get institutionalized "moving averages". Those being MA 50 and MA 200 (MA 200 of course being the average of four consecutive MA 50's)

Every now and then those two averages can cross each other.

If the shorter MA (50 in this case) goes under the longer term (200 in this case) we call that a Death Cross, that signifies a sharp drop in price (which of course already happened since you are using historic prices and thus you are too late to act on it accordingly)

If the opposite should happen, the longer MA goes over the shorter one, that is called a Golden Cross and is used as a buy-signal (which you should already have done and now should sell to the people seeing that delayed indicator)

Moving averages also can act as "resistance" and "support" (because its own delayed historic diluted data can do that).

First here is MA50 and MA200 on the daily chart.

We can clearly see that the price is under the MA50 and MA200 and that MA50 is acting as "resistance", which is of course NOT GOOD

But not to worry, if we change the timebase to 3 Hour (or 4Hr), we can now observe that MA50 is actually "support"

Or we could even change to 1 Hour and now MA200 is support, which is really a good sign. You can see how nice it bounced up there

One can without doubt recognize how important MA50 is as a resistance here, especially just before December 29, it really struggled there.

So, to conclude "moving averages" are really great and useful, for a tool.

HULL Moving Average StrategyThis is my strategy based off the Hull Moving Average, created by Alan Hull.

www.fidelity.com

The HMA is extremely fast and accurate in determining price reversals - I exploit this quality and add the ability to select a granular TimeFrame to use for the HMA calculations (ranging from 1m to 1D). The HMA can be painted on any TimeFrame. When the HMA indicates a price reversal, the strategy waits for the current candle to close before entering a trade.

Target profits and losses can easily be set, as well as: Leverage, % to risk per trade, trailing stop entry point, trailing stop offset, Spread, Commission, and more!

The indicator works on any currency pair (excluding metals) and as low as the 5m timeframe.

Simple Way to Read Oversold/Overbought Without RSIThis is how u can tell if a market is oversold (or overbought) by reading price and using our little 14EMA friend

After price has a large push down (or up) like you can see in the yellow circles, it retraces up to the green circles

In example 1, this yellow circle was right on the close of a huge bearish 4h engulfing. Perfect example to see how it is oversold by seeing the large gap between price and the 14 cyan coloured EMA

And the following day we see this happen again in example 2. price pushes fast away from the 14EMA and therefore it needs to breath and retrace a little. No body can continuously sprint, neither can markets! "After big drop, markets must chop"

Whether or not you have RSI on the charts, it is good to know when a market is oversold or overbought because nobody likes entering and seeing the trade go immediately negative, only to see it later where you thought after you closed in a loss

Another cool term for a temporary up trend in an overall down trend is a dead cat bounce! This is a very very short term version considering we are looking at the 15m tf here

~ The trend is your friend and so are retracements ~

The importance of the trend: Moving AveragesHello friends,

With how bitcoin has been so consistent in taking a dump the last few months (ETH even better!) I feel it is important to remind everyone the importance of being able to recognize the trend. There's a lot of things to consider when determining the outlook of the market and the trend of price is a biggie.

In this example, the moving averages are all bearish. How do you tell? It's whenever the average is lower when it is faster. When the 200ma > 100ma > 50ma, you have bearish posture. The reverse is true for bear markets. If you'll notice, during this bear market, we have been testing and failing the 200 average regularly. It is a key level in the markets.

Just a quick reminder/lesson for you all. The trend is very important to identify in trading because when you're neutral, it gives you a little favorable bias. And a little favorable bias can make a big favorable return :)

Hope you learned something.

-YoungShkreli

Using/Delaying McGinley Dynamic seeding to chart parabolicsc.mql5.com

In summary:

McGinley believed moving averages are not supposed to be used as a trading signal, and instead identify the main trend. The formula is designed to go slower when price is trending up, and faster when price is trending down, to mimic how investors react to market movements.

This does not work when an asset starts at a low price then rises astronomically. Unless Gann and friends are right about markets having full cycles, I don't believe bitcoin will be under $100 any time soon. Therefore x bars are ignored to give a usable McGinley Dynamic.

As a trend identification tool, the McGinley Dynamic will trail far behind during forceful uptrends. The utility created here is based on the assumptions that:

Less the extremely parabolic assets, an uptrend will retrace eventually to the McG, and the trader using McG understands that the moving average trails far away to keep a trader secured in position by slowing down for movement upwards

The trading strategy employed is not based solely on moving averages

Like all moving averages, McG will always suffer in terms of giving clear trading signals when the trend is too strong, too weak, too volatile, etc. vs a coincidental/leading indicator

Length chosen should be 60% of your chosen MA to account for lag. In this case, a McG of 15 is equal to a 25 EMA (as TradingView uses EMA as the base MA for McG).

Bars ignored should be before an uptrend, and only ignored up to where the MA is usable for the particular ticker.

Something I have noticed is to be cautious when publishing ideas or sharing charts with indicators that weren't intended for sharing, especially for those who do not have the ability to publish invite-only scripts.

While scripts are not meant to be copied straight off a chart, in rare cases there are ways to grab an indicator for self-use when the author did not intend such. As a first step preventive measure and self-incentive to keep scripts updated, it would be ideal to apply a 'expiration date' using the timenow function to published and nonpublished indicators that are accessible to the public. Although indicators are mostly derivatives of each other (except my stuff, I'm a real snowflake), there are many such cases in which seemingly 1:1 copies pop up, and there is no real way to identify who is in the right, if anyone even is. It is possible (and not uncommon) for indicators to be 'replicated' just by coincidence, so that should not be ruled out either.

Example of McGinley Dynamic outperforming an EMA in the whipsaw department:

Formula as described by Investopedia:

MD = MD-1 + (Index – MD-1) / (N * (Index / MD-1 )^4)

where MD-1 is the previous period's moving average, N is length, and index is price source. Adjustments can be made to the formula to optimize, but at what point do you scrap it and move on to other, more appealing methods? The wide berth that McG gives is not very useful over candlestick analysis for near instant reversal identification.

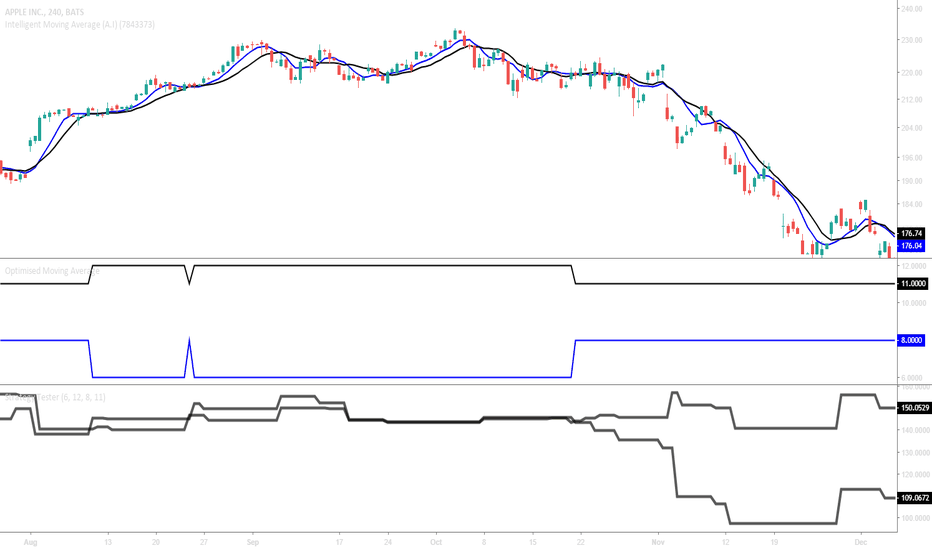

TradingView's First Intelligent Indicator!The Moving Average is the most used indicator on the planet, yet no one really knows what pair of moving average lengths works best in combination with each other.

A reason for this is because no two moving averages are always going to be the best on every instrument, time-frame, and at any given point in time.

This will no longer be a problem because this free to use indicator will plot only the most profitable pair of moving average on your chart

when it is applied and it will update when a different combination of moving average lengths becomes more profitable .

This will be the first of a series of indicators that self optimise in real-time called the "Intelligent Series (AI)".

If you like this concept, you will like the indicator.

Also, please like this if you wish to support my endeavours as a contributor and wish to see more intelligent indicators as it is a lot of work.

Comment down below your favourite technical indicator that you want to become intelligent!

A simple investing strategy.Here is a simple strategy, or at least something to help build a bias.

I have not looked that much into it but I checked charts and it worked ALL THE TIME FOREVER AND EVER.

I did not want to share anything lately, but seing how idiotic the cryptoers are, how there have been a new bubble every 5 years for the past 400 HOW ARE PEOPLE THAT STUPID HOW DO THEY KEEP FALLING FOR THIS MOOONKEYS!

My top strategies (short term) have worked forever (no one figured them out really? or?), I got some that are completely unrelated totally different strategy with different tools to feel completely safe, but ye I am not too worried now, so I can share (not my top strategies thought, these are top secret).

Got one with 70% winrate and a RR of 2 that's probably the best strategy ever invented by mankind or just made public lol. Oh it is my worse one.

You can check what MA200 daily gives, but EMA15 on monthly chart is so much better.

When price is clearly above it you could keep opening long swing trades for years and win right?

Or buy short term when it gets visited, perhaps.

You might have heard of the rule with the daily MA200

Works 60% of the time everytime.

But with EMA 15 it works 90% of the time everytime (I do not know actual numbers have not really tested this strategy).

Can be improved of course, just an example and something that might be useful. Stock market has a bull bias, so best to be more selective with short.

Or not short at all

Oh and if you are thinking "meh I want 50000% gains on my 15$ investment this is bad", this works with billions of dollars np.

Maybe I'll use this when I made huge GAINZ from short term trading FX & indices.

And the moment you've all been waiting for:

Hey, works even better with the 3 month chart:

Moving Average, MA Ribbon (Cloud)Rundown of the options for the moving average indicator.

Plot MAs of your choosing

Plot ribbon/cloud of MAs

MA options

Simple Moving Averages

Exponential Moving Averages

Double Exponential Moving Averages

Symmetrically Weighted Moving Average

Weighted Moving Averages

Volume-weighted Moving Averages

Moving average used in RSI

Arnaud Legoux Moving Averages

You can also plot an envelope around the MA cloud at a custom percentage.

MA lines can be colored by the slop of the line or its position relative to price.

10 MA Shaded ribbon colored by slope

10 MA Shaded "cloud" colored by its relative position to price with 4 MAs

Link to the indicators

Moving Averages

MA Ribbon

Referral Links

Bitmex 10% fee discount for 6 months

www.bitmex.com

TradingView (50% off after trial period ends)

tradingview.go2cloud.org

Tip Jar

BTC: 1FgEeDDMF7QKydQPJVCDjp7ypjREp8XG6c

LTC: LM9KsXz7GUxCN9g9EjTC8ayviDEmBK14rw

Story-Time!EMA-Trendfollowing-Strategy for beginners!=)Hey guys,

quick another Trendfollowing-Strategy with three EMA`S easily to remember. :-)

I hope you enjoy it and that this is going to inspire you!

Peace and happy learning

Irasor

Trading2ez

Wanna see more? Don`t forget to follow me.

Any questions? Need detailed saignals or education? PM me. :-)

HOW does a Moving Average work? #EZ-Learning by EXPLANATIONHey tradomaniacs and becoming traders,

here some more education for you and especially for those who started trading and heared about that weird thing called Moving Average.

I hope you enjoy it and learn something.

If you need more education just check my videos and posts tagged as education.

Peace and happy learning

Irasor

Trading2ez

Wanna see more? Don`t forget to follow me.

Any questions? Need more? PM me. :-)

ES 200 SMA LONG (2018) Part 5The entry of 2614.00 is based on the previous day close of the 200 SMA

Stop loss is 2 ATR from the entry.

Profit target #1 is 2 ATR from the entry, giving you a reward to risk ratio of 1:1.

Trading Plan:

1. Set Stop loss(2531.50)

2. Sell half at Profit target #1(2696.50)

3. Once Profit target #1 hit, shift stop loss to 1 ATR above your entry. (2655.25)

4. Sell the remaining half at the resistance.

closing of the red candle on 21 March 2018 (2716.25)

*Final Note:

Hello everyone!!

If you notice the 5 instances, the stop loss do not have to be 2 ATR.

With just 1 ATR, you will not get stopped out in any of the 5 trades.

Therefore it easily increases your Reward to Risk ratio by 2 fold.

I hope you managed to learn a pointer or two out of it.

Always trade with a plan and have your stop loss in place once you are in the trade.

Goodbye, take care and God Bless.

ES 200 SMA LONG (2018) Part 4We always wait patient for the trade to come to us rather than chasing the trade.

Previously on Part 3, we missed the trade by a thin margin of 2.25 points.

The market bounced back up and retrace back down.

Luckily it presented an opportunity for us to enter the trade.

The Profit target #2 is identical to Part 3 Profit target #2 as price action did not reach to that area previously. (2718.00)

The entry of 2588.50 is based on the previous day close of the 200 SMA

Stop loss is 2 ATR from the entry.

Profit target #1 is 2 ATR from the entry, giving you a reward to risk ratio of 1:1.

Trading Plan:

1. Set Stop loss (2482.00)

2. Sell half at Profit target #1(2695.00)

3. Once Profit target #1 hit, shift stop loss to 1 ATR above your entry. (2641.75)

4. Sell the remaining half at the resistance.

closing of the red candle on 21 March 2018 (2718.00)

Trading Strategy for Parabolic Markets [Part 1]I recently watched this podcast with Tone Vays. Tyler Jenks was the guest and he started out by saying:

"This is the greatest opportunity I have seen in financial markets."

It just so happens that I have been studying parabolic theory as it relates to hyperwaves. I am using that information to develop a trading strategy that is aimed towards capitalizing on parabolic moves. I will be using Tyler Jenks' hyperwave and consensio theories, Welles Wilder’s RSI, ADX and Parabolic SAR indicators, as well as Parabolic theory from Spyfrat’s Call. The TD' Sequential and Ichimoku Clouds will also be used to a much smaller degree. Below I have outlined the indicators/theories that are being used, my approach to entries, four options for a trailing stop loss in a parabolic market and a rudimentary price target calculation.

If you are not interested in the minutia of my approach then feel free to skip straight to part 2 where positions will be outline. I have identified 5 stocks that are currently in a parabolic state and one that is primed to start one. Entries, stop losses and risk:reward calculations are provided for each. Three strategies for implementing trailing stop losses have also been included.

Consensio

Used to identify bull and bear markets. If price is above the MA’s and the shorter term MA’s are all above the longer term MA’s then it is a bull market. If the price is below the MA’s and the shorter term MA’s are below the longer term then we are in a bear market.

Hyperwave

Parabolic Burst Continuation

30-prd RSI is used rather than the more commonly used 14-prd RSI

If 30-prd RSI reaches 70 level, stock is in parabolic status

The best setup is when both Weekly RSI and Daily RSI reach 70 with the weekly RSI > Daily.

If both weekly and daily RSI are in parabolicy state but the daily RSI overtakes the weekly RSI the asset is said to be in a ‘Parabolic High Risk’ (PSR') state. Indicates that asset is at a high risk of a major correction (paraburst)

If both weekly and daily RSI > 80 (regardless if w > d), the asset is said to be in ‘Extreme Parabolic High Risk’ (ePHR) state.

Source

ADX and DI

ADX measures the strength of the trend. If < 20 then no trend exists. If > 25 then strength of trend is building. Horizontal lines can be drawn on the ADX to indicate when the move is becoming exhausted.

Plus Directional Indicator (+DI) and Minus Directional Indicator (-DI), together these measure trend direction. If +DI > -DI then trend is bullish. If +DI < -DI then trend is bearish. Crossover in the -DI and +DI can indicate a change in the market trend.

Entries

I will always line out a minimum of three entries. That is because I believe in entering into positions in thirds or fourths, only adding when the price moves in my favor. This allows me to minimize risk and emotional decision making.

Trailing Stop Losses

Bill Williams Fractals - Set slightly under most recent down fractal (if long).

Parabolic SAR - Set slightly under most recent weekly SAR' or slightly under the previous 2 daily SARs.

ADX - If > 50 on weekly and/or > 60 on daily

RSI - If weekly and daily are > 80

Price Targets

This is still a work in progress. I have noticed that each phase tends to go +90% - +95% from prior phases high. That can be used to give us a rough idea in order to calculate the risk:reward, however there is a lot more backtesting that still needs to be done. If you have significant data about the % ROI' each phase will return on average then I would be very interested in collaborating!

Now that you understand the approach be sure to check out part 2 where 5 possible possible positions are outline

Anatomy of Price & MA's During Consolidation and Trend ReversalBefore price makes a true reversal, whether bearish or

bullish, price and SMA's have to make a series of cross overs

in the direction of the reversal. Once every new level of

support for price and SMA's has been made and confirmed,

price then has the base from which to rally.

Of course the easiest and safest way to profit from a trend

reversal is a candle that closes above the upper resistance

trend line, followed by a close above the the highs of the

consolidation zone. However, many of us want to profit

from price action in the lower time frames, too, but often

we get stopped out or lose out on profitable trades

because of the erratic whipsawing which is taking place

in the higher time frames.

Therefore, it is a good idea to analyze and observe what

price and SMA's (and/ or EMA's, which ever you prefer) are

doing on the larger time frames to understand why price

is so choppy on lower time frames.

Realize also that when price is consolidating or ranging as

in this example of GBP/JPY, any trend following indicator

like SMA's and EMA's are useless until price breaks out of

the consolidation zone and forms a trend. Another good

rule of thumb to follow and watch out for, is the 200SMA

and whether it is sloping upwards, downwards or moving

along horizontally. If at any stage on the daily time frame

it is moving horizontally, expect a lot of erratic and

almost illogical price action in the lower time frames,

thus an indication to not hold trades for a long time

until it starts to move up or down.

Moving averages as mentioned above are useless when

price is consolidating, however, they do reveal something

very significant during that process nonetheless, namely,

their levels when they cross over one another.

If after each time price drops as in the example I have shown,

the SMA's are higher than their previous levels than

very often price will have found support at precisely those

levels where the SMA's crossed over on another. This is

far more revealing and provides much more credibility

to price moving higher as opposed to just looking if

price bounces of or is rejected at a single SMA or EMA

level; incidentally, I have found that when one single

candle bounces of a 50SMA for example and then continues to rally

up from there, price tends to be in strong uptrend

already with the SMA also pointing in that direction.

Hence, it is crucial to understand the difference of

behaviour of MA's in relation to price action, i.e. ranging

or trending.

If you look at the candle that broke out above the

consolidation zone, note that below the 100 & 200SMA

made a final bullish crossover and all the SMA's were

sloping upwards, and this is quite interesting in that

we know MA's to be lagging indicators. But they do

indicate momentum building up so that we can be

prepared for a move to the upside, as in this example,

when price breaks out of the consolidation zone, thus,

it seems as if the SMA's are not lagging at all, but this

is due to the fact, as mentioned above, that price is now

trending and the SMA's start to indicate and support

the trending price action, hence changing their behaviour

to confirm price is no longer consolidating.

A brief look at the RSI indicator also is indicative of a

bullish trend reversal about to occur when observing

the divergence and convergence between price action

and the SMA movement. For those new to trading and

using momentum indicators such as the RSI, remember

that overbought or oversold conditions dont immediately

imply that price will drop or rise once it reaches those

levels, instead price usually enters overbought or oversold

levels after a breakout which indicates momentum in trend

in the direction of the breakout. Only after the RSI crosses

from above or below extreme levels can you start

anticipating a corrective move, but never necessarily a

reversal of the trend.

In summary: When price is consolidating look for SMA crossover levels as support.

4] How to use Traders Dynamic Index and Complementary OverlayThe basic function/use of HighPhaser:

How to use HighPhaser

Price trends steadily above HighPhaser,

then, crosses under HighPhaser but follows it.

Price attempts at making HighPhaser support for more moving up, but it then breaks it to fall more.

USDJPY Uptrend:

USDJPY Downtrend:

An Efficient Strategy Using RSIHi guys, This my first video and I wanted to share with you a simple strategy I use to find opportunities with RSI.

This strategy gives amazing results in scalping and daytrading in order to grab 15 to 25 pips per trades.

Hope you gonna like it. Do not hesitate to like it or give comments.

3] How to use Traders Dynamic Index and Complementary OverlayXtremePhaser = Thin Cyan line

HighPhaser = Thin Blue line

HighMBL = Thin Orange line

Phaser = Thick Blue line

Midline = Thick Black line

& others.

Just like the traditional use of moving averages, HighPhaser and XtremePhaser allows for higher time frame trend (by their nearness and crossover) to be seen and recognized by traders allowing them to respect market's condition to not imply what is not true and in the end 'lose it all'.

It (TDI-CO) allows of course to show support and resistance.

It also allows for support/resistance breakout to be evidenced as seen in 15 min chart with price being squeezed by Phaser (&Midline) and XtremePhaser.

How to to trade retracements: Retracements come with the expectation of a trend continuation, therefore the safest trade is to continue trend not countertrend-trading with the pullback.

Component lines aid in recognizing when the market is in a pullback as seen in image.

HighMBL overlay did not allow price to rise any higher. Phaser and HigherMBL formed a channel because of their slope downward, but the importance of their steepness is major, as it should determine how you should trade. In summary you should trade in same steepened direction as the thick blue and thin orange line, but a breakout of a flat highLine is more promising for the adept swing traders.

2] How to use Traders Dynamic Index and Complementary OverlayWe here learn to observe the higher time frame 360, and analyse 1D that RSIPL are crossed down parallel. So lower than daily time frame= 540, 360 allows for trend entry at a 360 RSIPL and 'TSL initial cross down for max profit.

On 180 as on 360 allowed for entry using the RSIPL/TSL crosses down. Also observing Phaser very near price as it 'pushed' priced down until price could breakout Phaser which had much importance.

Price breakout of black Midline meant clear reversal and price retraced to it for support with target being HighPhaser or Fibonacci retracement tool for extension target. Entry for this retracement was possible by means of the countertrendline cross.

__________

Promoting free and highly useful Indicators:

KK_Traders Dynamic Index_Bar Highlighting

Traders Dynamic Index Overlay

"Price Action Channel Master by JustUncleL Restored"

Backtesting EMA StrategyAn EMA-based strategy which involves the following

- Trend trading

- Price interaction with the EMA's

- Using EMAs for consolidating profit

Here are the rules

Step 1. Establish a trend

In this strategy if the fast moving EMA (20 or the blue line) is above the 50EMA (slow EMA - red line) then we're in an uptrend. If its the opposite we are in a downtrend.

Step 2. Two Cycles

We want to have seen at least two cycles of Higher Highs and Higher Lows in an uptrend or Lower Highs and Lower Lows in a downtrend

Step 3. Entry when price interacts with the 20 EMA after step 1 and 2 above with 30 pip Stop loss target and no Take profit

Step 4. If the trend goes in your favour, trail the stop loss by scaling in behind the 50EMA (red line)

These backtest show incredible results of over 50% on the GBPJPY pair in since September 2017, assuming absolutely all opportunities were taken.

1] How to use Traders Dynamic Index and Complementary OverlayTraders Dynamic Index serves for crossover signals and are essential for trade entries and most beneficial when identified on over 30-minute Time Frames as on hourly time frames.

I have made the options available of the oversold (green) 32 level line overlay which is useful in identifying potential buy zones/price.

In KK_Traders Dynamic Index_Bar Highlighting it is also good to note that in uptrends : RSI ranges between Upper Volatility Band, Lower Volatility Band and/or relatively "within" 68 and 50 level lines as it has been doing on hourly time frames on Bitcoin.

Direction and deviation of MBL overlay or Phaser from price is strong indicator of trend direction and price level/zone useful for those who are confused in knowing where price will have to average into.

Promoting free and highly useful Indicators:

KK_Traders Dynamic Index_Bar Highlighting

Traders Dynamic Index Overlay

"Price Action Channel Master by JustUncleL Restored"

_______________

I had not used these guides recently which I have currently published.

If anything (I ever do publish) varies contrary to these indicated guides and the coming guides to be published, the likelihood of failed forecast is augmented.