Trading with WRONG Expectations #4... Trading is Easy Money...The above statement is true, but only from a certain point of view...

I only need to trade a few minutes every hour, I work from home, I have no daily commute and I have uncapped earnings. This is all correct. What people don't see is the amount of time and commitment involved in getting to this point. My trading journey has taken hours of study, practice, losses and frustrations - it has not been an easy journey.

Read the quote below from As a Man Thinketh...

'Seeing a man grow rich, they say, "How lucky he is!" Observing another become intellectual they exclaim, "How highly favoured he is!" And noting the saintly character and wide influence of another, they remark, "How chance aids him at every turn!" They don't see the trials and failures and the struggles which these men have voluntarily encountered in order to gain their experience; have no knowledge of the sacrifices they have made, of the undaunted efforts they have put forth, of the faith they have exercised'

Conclusion... Trading is not easy, nor will it ever be. Anything worth achieving is hard, whether that is success in trading, business, marriage or fitness! This is a universal principle of success.

Educational

BITCOIN OR ANY MARGIN TRADED COIN - HOW TO SCALP TRADE Dear Traders and Hopeaholics alike,

HOW TO SCALP LIKE A PRO - NO BOTS, NO SCRIPTS, JUST UNDERSTANDING HOW THE INDICATORS CAN BE USED.

As the self-proclaimed President and Founder of HOPEAHOLICS ANONYMOUS (or HA for short) , you are NOT going to laugh at this strategy... BECAUSE USING THIS... YOU... YES YOU... will be laughing all the way to the crypto bank!!! HA HA HA... I hear you... this works!

And the strategy is FREE, no paid course, and simple to use!

WHAT YOU NEED

9 AND 21 EMA (EXPONENTIAL MOVING AVERAGE)

100 AND 200 MA (MOVNG AVERAGE)

A MARGIN/LEVERAGE TRADED ACCOUNT.

PAID TRADINGVIEW PREMIUM VERSION ALLOWS YOU TO SET AN ALERT ON THE CROSSING OF 9/21 EMAs - I HIGHLY RECOMMEND AS IT WILL PAY ITSELF OFF IN NO TIME!!!!!

These trades are best on 15min chart as it gives stronger confirmation on the direction.

They are also best when 100/200MAs are situated above or below the wave formation.

When MAs are tight to wave formation there is a high risk of entering a scalp as the direction is uncertain.

Always wait for confirmation of the 15min EMA indicator cross.

YOU MUST USE A STOP LOSS!!!!!

Scalp trades at any time are high risk as the market direction is not confirmed in correction zones. It is a way to make DOLLARS in an uncertain market, as you can see on the chart, trades are flipped LONG and SHORT as the EMAs cross. As explained and you can see in the example it is a higher risk when MAs are crowding the waves.

Be careful of over-margining/over-leveraging your trade, as the margin for any error can be affected with any wave move.

FOR BEGINNERS - I recommend commencing paper trading your entries and exits to gain confidence without risking your capital to commence with, we want you to be successful and making $$$

************************************************

When trading, always know you are in control 100% as you are pushing the buttons, and it is YOUR money/cryptocurrency you are trading.

BUT let me tell you this... at HOPEAHOLICS ANONYMOUS and in my world... ANYTHING IS POSSIBLE!!!

SHOOT FOR THE MOON - EVEN IF YOU MISS YOU'LL LAND AMONG THE STARS, BUT AT THIS STAGE I AGREE WITH ELON AND THINK WE ARE ALL HEADED TO MARS!!!

**********************************************

If you are unsure of direction or feel you are over trading I have a moto. IF IN DOUBT SIT IT OUT! There is no shame in not being in a trade. Stick to your game plan, wait for a set up to be confirmed, and ONLY take a trade if it all aligns.

So please I welcome your comments and CONSTRUCTIVE FEEDBACK - ALL HATERS WILL BE FLAGGED AND REPORTED!

And remember, there is NO RIGHT OR WRONG in trading - just money management!

REMEMBER IF YOU ARE PRACTICING SAFE... TRADING ALWAYS USE PROTECTION

(minimize your risk, use a stop loss. Especially in Margin Trades) ALWAYS!!!!!!!!!!!!!!!!!!!

<3 Lisa

DISCLAIMER:

The Legal stuff - I'm not a financial adviser. Just a few quick thoughts - remember you sit at your computer, you push the buttons...

PS make sure you give me a like, that way you get updates as I post them.... :) <3

THE ONLY WAY TO MAKE MONEY - IS TO MAKE YOUR OWN!!!

Granolabar's Gap and Crap principles TESTED (2/26 Trade Recap)Introduction

In this post, I explain how I utilized the Gap and Crap principles to trade SPY on February 26th, 2021.

Recently, I made a post titled "Granolabar's Gap Down Guide (my own style)." The post is linked below. In it, I outlined my strategy for trading gap downs. I highly recommend you read that post before this one to understand the references I am making.

In the post, I detailed a specific way to trade gap downs using a system of candles and EMAs. The most important part of the strategy is not necessarily the gap down aspect but the conditions I used to determine entries. Specifically:

--------

"To know when to enter the trade, I watch the candle sticks. First, there must be a 5 minute candle that closes below the premarket low. Then there are two possible scenarios from here.

Scenario 1, the next candle immediately pushes below the low of the first candle. In this case, you would take puts or sell short as soon as the second candle breaks the low. My reasoning for this is that if the movement is strong, the second candle would not hesitate to make a new low. It is better to enter on the break than to wait for the candle to close and miss out on potential profits, which are often pretty sizable when things are moving quickly. Notice in the below example that had you waited for that candle to close, you basically would have missed half of the entire fall, which lasted 4 5 minute candles.

Scenario 2, the next candle does not immediately push below the low of the first candle. In this case, you would wait until there is a candle that closes below the low of the first, instead of merely making a new low. My reasoning is that if the momentum is not strong enough for the second candle to immediately make a new low, the confirmation candle to enter needs

to be more definitive. The play is not invalidated because the first candle closing below the premarket lows indicates that there is downwards pressure. In this way you minimize the likelihood of shorting a bear trap while also capitalizing on the fall."

--------

I will proceed by explaining my thoughts on exactly what was going as I was watching the market.

(Note: stops at entry means that I set a stop loss at the price I originally purchased the option for, meaning that it will sell for breakeven price. This is important later on.)

Trade 1:

After getting on Tradingview in the morning and opening up the 5 minute SPY chart, I quickly noticed that SPY did not move at all overnight. Despite the lack of a gap, we could still trade with similar principles. I first drew the resistance at premarket high (yellow) and premarket low (blue) as well as a minor support (white). Identifying these support and resistance levels, as well as any applicable trendiness, are an important part to trading successfully. Keep in mind that the cleaner these lines are, the better they will act as critical levels.

The first few candles after market-open were just chopping between the minor support line and the premarket high; nothing closed above or below either, so there was nothing to be done there. Do not force a play!!! You do not always have to be doing something in the market. Oftentimes sitting on your hands is the best thing to do.

The next candle is when I went on high alert mode. It ended up not only closing under the minor support from premarket (that happened to hold for the first 20 minutes of the trading day), but it also closed below the 50 EMA. At this point, I was just waiting for the next candle which immediately pushed below the low of the first candle, giving the entry signal (Scenario 1). For this play specifically, I kept my stop loss at the premarket high (good resistance) and my target was the premarket low since there wasn’t any major support until then. Once SPY hit the premarket low, I scaled out most of the position and left stops at entry for the rest.

Trade 2

The next play came immediately after when the following candle closed right below the premarket low. This candle was followed by a slight pullback, so my conditions for entry changed to a new candle closing below the previous low (Scenario 2). To remind myself, I marked the bottom of the break candle with a white line. This image was from that moment and shows exactly what I was thinking (I don't have the replay feature for any timeframe less than the daily).

A few candles later, a candle closed under the break low. This marked the entry of a short position, with the stop loss set at the premarket low (blue line) since it previously acted as a critical level.

I decided to start scaling out after seeing a small inside bar green candle, which is typically a reversal pattern. Since I took profit on part of the position, I made sure to set stops at entry for the remaining position. This ensured that the play finished green; it is not worth it to risk the remaining position going negative and cancelling out the gains. If the market takes another turn down from there, just consider reentering a new position. I will continue reiterating this concept since it is crucial for this fast paced trading style.

Trade 3

After exiting trade 2, I did not play the break of the premarket low from the bottom up, but it would have been a good scalp also. Theoretically speaking, this was how it would have played out if the rules were followed.

The play I did take, however, was the break of the premarket high a little later. Again similar principles: closed above the line, the next candle immediately pushed higher (Scenario 1), and the stop loss was a clean break of the 34/50 cloud on the 1 minute chart. In this play, I scaled out due to a red inside bar; again, I left stops at entry after scaling out the first time to ensure the play stayed profitable.

Trade 4

This trade was a slight change of pace; I ended up playing a falling wedge breakout with the same principles. I saw that SPY was forming a clean wedge with the top and bottom trend lines both having 3 solid touches each. The plan was to wait for a break of the 50 EMA (top of the blue cloud in this case) since it typically acts as a support/resistance. The stop loss was a clean break of the 34/50 ema cloud on the 1 minute chart, and the price targets were the white and yellow lines from premarket. As soon as it hit the first price target, I scaled out half the position and set stops at entry to lock in gains. The rest were sold at the second price target since the stops were not triggered beforehand.

Right at breakout view:

Nearing PT 2, premarket highs:

To play devil's advocate on my own plan, I am asking myself why I did not sell the position at the 2:44 PM ET 1 minute bar (the 13:44 bar on my chart above). The candle was fully below the 34/50 EMA cloud and had pushed below the previous "break" candle's low for a second. While those are valid points, it did not satisfy my stop loss conditions. I wait for the second candle after the “break candle” to close below the first candle's low on the 1 minute, which this candle did not. Additionally, it ended up closing as a hammer which is typically a bullish sign.

After that fourth play, I did not take any more positions for the day. Typically, the last 30-45 minutes of the day are very volatile, especially on a Friday, and it can be very risky trading in that environment. The options that I typically play expire within an hour of close; any misplay will lead to 50%+ losses instantly. However, if I am in a position that goes into the last 30-45 minutes of the day, I will not close it just because it hit that time of the day.

Conclusion:

I hope you enjoyed this post; it may have been a little lengthy again, but I wanted to detail exactly how I used the principles that I devised to trade.

There are 3 key takeaways:

1. The candle stick rules I use to decide when to enter a trade is a good way to catch breakouts while minimizing fakeout risk. It may mean that your entry is not exactly the first bar of the breakout, but the additional safety will help the majority of the time.

2. The rules I devised in scenario 1 and 2 are not limited to Gap and Crap setups. I will use them on whatever a clear breakout opportunity presents itself, including ascending triangles, bull flags, bull pennants, symmetrical triangles, falling wedges, cup and handle, inverse head and shoulders, etc.

3. Always make sure you set stops at entry if you reach a take profit level and sell a portion of your contracts.

If you have any questions, feel free to leave a comment. I will try to read all of them :)

Have a great day and I wish you well.

-Granolabar

You Would Be Profitable Trader After Master This Education PostClassic Chart Pattern's

-------------

Reversal Charts Pattern's

Double Bottom

--

A double bottom pattern is

a technical analysis charting pattern that

describes a change in trend

and a momentum reversal

from prior leading price action.

The double bottom looks like

the letter "W".

The twice-touched low

is considered a support level.

Inverse Head And Shoulder

--

Investors typically enter into a long

position when the price rises above

the resistance of the neckline.

This pattern is the opposite of the

popular head and shoulders pattern

but is used to predict shifts in

a downtrend rather than an uptrend

Falling Wedge

--

Falling Wedge is a bullish pattern

that begins wide at the top

and contracts as prices move lower.

This price action forms a cone

that slopes down as the reaction

highs and reaction lows converge.

However, this bullish bias cannot be

realized until a resistance breakout occurs.

Double Top

---

Double tops and bottoms are important

technical analysis patterns used by traders

A double top has an 'M' shape

and indicates a bearish reversal in trend

A double bottom has a 'W' shape

and is a signal for a bullish price movement.

Head And Shoulder

---

Investors typically enter into a long

position when the price rises above

the resistance of the neckline.

This pattern is the opposite of the

popular head and shoulders pattern

but is used to predict shifts in

a downtrend rather than an uptrend

Rising Wedge

---

A true head & shoulders pattern doesn't

occur very often, but when it does,

many technical traders believe

it's an indicator that a major trend

reversal has occurred. A standard Head &

Shoulders pattern is considered

to be a bearish setup and an "inverse"

head & shoulders pattern is

considered to be a bullish setup.

Falling Wedge

---

The Falling Wedge is a bullish pattern

that begins wide at the top and

contracts as prices move lower.

This price action forms a cone that slope

s down as the reaction highs and reaction

lows converge. However, this bullish

bias cannot be realized until

a resistance breakout occurs.

Bullish Rectangle

---

The bullish rectangle is a continuation

pattern that develops during

a strong uptrend. Once the pattern

is established, a break to the upside

would imply a continuation

of the bullish trend

Bullish Pennant

---

A bullish pennant is a technical trading

pattern that indicates the impending

continuation of a strong upward

price move .This makes the bullish

pennant pattern particularly sought

after, as it can offer an early indication

of significant upward price action

Rising Wedge

---

A true head & shoulders pattern doesn't

occur very often, but when it does,

many technical traders believe

it's an indicator that a major trend

reversal has occurred. A standard Head &

Shoulders pattern is considered

to be a bearish setup and an "inverse"

head & shoulders pattern is

considered to be a bullish setup.

Bearish Rectangle

---

The bearish rectangle is a continuation

pattern that occurs when a price pauses

during a strong downtrend and

temporarily bounces between two

parallel levels

before the trend continues.

Bearish Pennant

---

What is a bearish pennant?

A bearish pennant is a technical trading

pattern that indicates the impending

continuation of a downward price move

😱Types of Fears in Trading😱Hello! There are several types of fears at the market!

There are several main types of fear:

💡- fear of losing all capital in the account. One of the most common fears. The trader clearly understands that the numbers in the terminal are his money, and their reduction limits his financial capabilities in the future. Under fear of losing an even larger sum, a market participant does even more stupid things or even refuses to trade;

💡- fear of losing money in a losing position. Similar concerns arise during the transaction period under the influence of strong market volatility . This kind of fear is easily correctable;

💡- fear in time not to see a signal to enter or exit the market. More often it's faced by newcomers, who will not imagine what risks are in the trader’s deals and how to protect themselves from them;

💡- general fear of working on the market. It can act as a negative background and prevent you from making the right decision. Often, such fears are eliminated by gaining certain knowledge and experience on the exchange;

💡- fear of receiving another disadvantageous deal. Such fear leads to the appearance of excess fuss. As a result, the trader misses a really good deal;

💡- fear of early fixation of income (fear of loss profit). The position could still be kept open, but the trader reduces his risks, closes the deal and receives less profit. For many market participants, the fear of making such a “mistake” is even stronger than the fear of losing trades.

Guys, it's ok to feel all types of fears ! Especially for those , who new at the market !

Everyone went through that. Someone overcame own fears, someone is trying to overcome, but someone hasn't gotten along with emotions and left the market!

Remember, if you have a goal - go forward!💪🏻 Look only ahead and listen only yourself !🙏🏻

If you wanna become successful - you'll surely become that!!!🚀🚀🚀

Let's become better together ♥️

Stay tuned by Rocket Bomb 🚀💣

Maybe it's time to get out of comfort zone?🧐

Have you noticed, that one of the most comfortable sleeping positions is curled up in a ball. The legs are pulled up to the stomach, the head is lowered, the arms are hidden on the chest, the back is slightly arched. Cover yourself with a blanket and sleep. Warm, dark and calm. A sense of safety arises.

And the secret of this protective posture is in subconscious imitation of the fetus in the mother's womb.

There, in the warmth of the mother's womb, is the first comfort zone, that a person leaves when he is born. Subconscious memories of how comfortable, calm and good it was, remain with us for life.

If you wanna live, you have to be born.

For a baby, this jerk is extremely uncomfortable. You find yourself in a cold and unfamiliar place, and some monster slaps on your 🌰🌰 🤣🤣

After a while you want to eat and drink, and you have to do it yourself, and everything around is so huge, loud...really don't wanna repeat that.

Therefore, subconsciously, we always resist leaving our comfort zone. The experience has already been. Didn't like it!

But the stress mechanism, that is triggered during childbirth (and then every time you leave your comfort zone) is a protective function of the body. Stress activates the reserves of the body and brain, forces us to act more actively, to fight the aggressive world.

However, nature also took care of the reward.

If stress doesn't become constant, but is a one-time surge, that activates forces, relaxation and satisfaction follow.

So, we figured out the physiology of the comfort zone. Why going beyond it guarantees stress is understandable. Now the question is: <>

The birth of a trader

In fact, everything new, unknown and unusual is outside the comfort zone. Even if we go to the store in a new way - that's a mini-stress for our brain, forced to work out a different route instead of saving resources while the body is moving on autopilot. Any change of scenery, new job means going beyond the familiar world. And the higher the unknown, the more uncomfortable the path.

For most people, trading is terra incognita. Trading isn't taught at school, it's not taught at universities. Trading forces you to take responsibility. Most importantly, trading is always associated with risk.

Risk is danger and uncertainty, and the brain reacts accordingly. He begins to ask insistently: "Do you really need this? No, are you sure?"

Leaving the comfort zone and becoming a trader is also hindered by social stereotypes. First, society reacts negatively to any attempts to break the system, that is, to do something that goes beyond the standard life path: creativity, politics, business. Secondly, trading is one of the areas, that make most people wary (and statistics, according to which only 5% of traders achieve success, reinforce this feeling). So if you want to become a trader, you are already challenging society.

That's why the birth of a trader so often becomes a struggle with the usual way of life, basic attitudes, other people's opinions and yourself.

What happens, when you become a trader ?

Think your comfort zone problems will end? Nothing like this. Two ambushes await the trader. The first is the inability to cope with responsibility for your life.

The second ambush is stagnation. After overcoming difficulties, learning to trade and starting to receive a stable profit, the trader finds himself ... Right, in a new comfort zone!

After all, what is it? The comfort zone is above all stability.

But the calmness puts you to sleep. Periods of economic stability in history often turn into a stage of stagnation and stagnation. The same in human life. Psychologists Robert M. Yerkes and John D. Dodson established as early as 1908 that performance doesn't improve in a state of comfort. Motivation falls asleep.

In order to become a successful trader, it is not enough to leave your comfort zone. You may have to struggle with its attraction more than once.

Therefore, leaving your comfort zone, take care of your psyche:

✔️Pump up motivation. Be clear about why you are breaking the wall and whether you need it.

✔️Work through your fears so that the body does not engage in self-sabotage mode.

✔️Develop resistance to stress and brain flexibility. Choose non-standard routes more often - in the broadest sense of the word.

✔️Take care of insurance, think over different scenarios for the development of the situation.

If you feel that getting out of your comfort zone is difficult for you, do not take a running ram. Take small steps.

Have you ever tried to leave your comfort zone?

Stay tuned by Rocket Bomb🚀 💣

Tips And Tricks To Be A Pro TraderThis is an educational + analytic content that will teach why and how to enter a trade

Make sure you watch the price action closely in each analysis as this is a very important part of our method

Disclaimer : this analysis can change at anytime without notice and it is only for the purpose of assisting traders to make independent investments decisions

Harmonic Patterns With Advanced Explanations Check It Out Harmonic price patterns are those that take geometric price patterns to the next level by utilizing Fibonacci numbers to define precise turning points. Unlike other more common trading methods, harmonic trading attempts to predict future movements.

Let's look at some examples of how harmonic price patterns are used to trade currencies in the forex market.

-----------

KEY TAKEAWAYS

Harmonic trading refers to the idea that trends are harmonic phenomena, meaning they can subdivided into smaller or larger waves that may predict price direction.

Harmonic trading relies on Fibonacci numbers, which are used to create technical indicators.

The Fibonacci sequence of numbers, starting with zero and one, is created by adding the previous two numbers: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, etc.

This sequence can then be broken down into ratios which some believe provide clues as to where a given financial market will move to.

The Gartley , bat, and crab are among the most popular harmonic patterns available to technical traders.

----------

Geometry and Fibonacci Numbers

Harmonic trading combines patterns and math into a trading method that is precise and based on the premise that patterns repeat themselves. At the root of the methodology is the primary ratio, or some derivative of it (0.618 or 1.618). Complementing ratios include: 0.382, 0.50, 1.41, 2.0, 2.24, 2.618, 3.14 and 3.618. The primary ratio is found in almost all natural and environmental structures and events; it is also found in man-made structures. Since the pattern repeats throughout nature and within society, the ratio is also seen in the financial markets

By finding patterns of varying lengths and magnitudes, the trader can then apply Fibonacci ratios to the patterns and try to predict future movements. The trading method is largely attributed to Scott Carney

although others have contributed or found patterns and levels that enhance performance.

Issues with Harmonics

Harmonic price patterns are precise, requiring the pattern to show movements of a particular magnitude in order for the unfolding of the pattern to provide an accurate reversal point. A trader may often see a pattern that looks like a harmonic pattern , but the Fibonacci levels will not align in the pattern, thus rendering the pattern unreliable in terms of the harmonic approach. This can be an advantage, as it requires the trader to be patient and wait for ideal set-ups.

Harmonic patterns can gauge how long current moves will last, but they can also be used to isolate reversal points. The danger occurs when a trader takes a position in the reversal area and the pattern fails. When this happens, the trader can be caught in a trade where the trend rapidly extends against him. Therefore, as with all trading strategies, risk must be controlled.

It is important to note that patterns may exist within other patterns, and it is also possible that non-harmonic patterns may (and likely will) exist within the context of harmonic patterns . These can be used to aid in the effectiveness of the harmonic pattern and enhance entry and exit performance. Several price waves may also exist within a single harmonic wave (for instance, a CD wave or AB wave). Prices are constantly gyrating; therefore, it is important to focus on the bigger picture of the time frame being traded. The fractal nature of the markets allows the theory to be applied from the smallest to largest time frames.

To use the method, a trader will benefit from a chart platform that allows him to plot multiple Fibonacci retracements to measure each wave.

Types of Harmonic Patterns

There is quite an assortment of harmonic patterns , although there are four that seem most popular. These are the Gartley , butterfly , bat, and crab patterns.

Break support/Resistance , give confirmation?Break support/Resistance , give confirmation?

- We usually trade base on S/R to find the entry point, exit or to predict the trend.

- One of an effective and simple way in trading is to trade when price breakout from a S/R level

- However, to identify an area or a point of good S/R in trading is mostly based on trading style, knowledge and trading experiences from each individual.

Today I would like to talk about Breakout in trading. When it is breakout, when it is failed breakout.

Before talking about breakout, we need to identify price closes above a S/R level or below a S/R level . Examine the below chart:

However, in the chart we also find the situations that market didn't follow the mentioned rule.

In the above case, if we carefully examine, we would see a pair of candle close below a resistance zone and make price go down. And price is still following rule of breakout and give confirmation as usual.

There are a lot of S/R appear in trading market. So, we have to choose by our own which is the S/R zone to play in each situation depending on our own experiences. No situation is exactly the same with each other! In the same above situation, at the same S/R level that we identified and used before, prices move differently (at that points, mostly our stoploss is hunted)

Here, experienced traders would easily recognize failed breakout based on trend analysis, or the way prices breaks, or at least don't follow the breakout.

We can analyze in a simple way as follow:

And then price continues its trend

I have presented some simple cases of successful breakout, failed breakout or fake breakout in the above chart.

I would like to receive the contributions from the community to learn from each other. Noone is right or wrong all the time. Every wrong or right cases have its own price. Hope that people would not keep silence instread of telling what you know or learned. Nothing has its own value unless it spent some prices. I hope that people would give a way their knowledge, don't try to hide for your own if not we are all failed to this market.

More information

www.investopedia.com

Break support/Resistance , give confirmation?Break support/Resistance , give confirmation?

- We usually trade base on S/R to find the entry point, exit or to predict the trend.

- One of an effective and simple way in trading is to trade when price breakout from a S/R level

- However, to identify an area or a point of good S/R in trading is mostly based on trading style, knowledge and trading experiences from each individual.

Today I would like to talk about Breakout in trading. When it is breakout, when it is failed breakout.

Before talking about breakout, we need to identify price closes above a S/R level or below a S/R level . Examine the below chart:

However, in the chart we also find the situations that market didn't follow the mentioned rule.

In the above case, if we carefully examine, we would see a pair of candle close below a resistance zone and make price go down. And price is still following rule of breakout and give confirmation as usual.

There are a lot of S/R appear in trading market. So, we have to choose by our own which is the S/R zone to play in each situation depending on our own experiences. No situation is exactly the same with each other! In the same above situation, at the same S/R level that we identified and used before, prices move differently (at that points, mostly our stoploss is hunted)

Here, experienced traders would easily recognize failed breakout based on trend analysis, or the way prices breaks, or at least don't follow the breakout.

We can analyze in a simple way as follow:

And then price continues its trend

I have presented some simple cases of successful breakout, failed breakout or fake breakout in the above chart.

I would like to receive the contributions from the community to learn from each other. Noone is right or wrong all the time. Every wrong or right cases have its own price. Hope that people would not keep silence instread of telling what you know or learned. Nothing has its own value unless it spent some prices. I hope that people would give a way their knowledge, don't try to hide for your own if not we are all failed to this market.

More information

www.investopedia.com

Support and Resistance, A way to draw a horizontal line !Support and Resistance, A way to draw a horizontal line !

Support, S and Resistance, R

1. Definition

1.1. Support is a zone where price moves up.

1.2. Resistance is a zone where price moves down.

- Support and Resistance can interchange when that zone is overcome by price

2. Support and Resistance levels

2.1. Horizontal line

2.2. Trendline

2.3. Moving averages

2.4. A Fibonancci level that you often use (Fibo 61.8)

2.5. A ratio of pattern AB=CD , or a Fibo derived from Harmonic pattern

….

Support and Resistance level are mostly depending on the trading skills and experiences of individuals

You and me would discuss a way to draw a horizinteal line

- S1: Change the chart to Line chart (because I prefer Closed price)

- S2: Choose zones where price is mostly reacting to that zone, then draw a horizontal line at those zones

- S3: Change back chart to candle chart of bar chart and adjust the horizontal line to make it look approriate

Just only 3 steps for us to draw a support/resistance line

o Attention:

- I emphasis that Support/Resistance is a zone, not a line. We usually based on historical data to plot the horizontal support/resistance zone. There fore, the close of candle or the shadow of it getting over that zone are quite common

- Because we base on historical data to plot it, so it doesn't have significant value in some specific cases. Not every time that price approaches that zone and bounce back. And not all the bouncing back case meet our expectation.

- All should depend on the surrounding theme of market, we have to look careful on specific cases to consider applying the Support/Resistance zone logically.

- All market are freely traded so there is always a chance to form a brand new Support/Resistance .

Good luck !

Support and Resistance, A way to draw a horizontal line !Support and Resistance, A way to draw a horizontal line !

Support, S and Resistance, R

1. Definition

1.1. Support is a zone where price moves up.

1.2. Resistance is a zone where price moves down.

- Support and Resistance can interchange when that zone is overcome by price

2. Support and Resistance levels

2.1. Horizontal line

2.2. Trendline

2.3. Moving averages

2.4. A Fibonancci level that you often use (Fibo 61.8)

2.5. A ratio of pattern AB=CD , or a Fibo derived from Harmonic pattern

….

Support and Resistance level are mostly depending on the trading skills and experiences of individuals

You and me would discuss a way to draw a horizinteal line

- S1: Change the chart to Line chart (because I prefer Closed price)

- S2: Choose zones where price is mostly reacting to that zone, then draw a horizontal line at those zones

- S3: Change back chart to candle chart of bar chart and adjust the horizontal line to make it look approriate

Just only 3 steps for us to draw a support/resistance line

o Attention:

- I emphasis that Support/Resistance is a zone, not a line. We usually based on historical data to plot the horizontal support/resistance zone. There fore, the close of candle or the shadow of it getting over that zone are quite common

- Because we base on historical data to plot it, so it doesn't have significant value in some specific cases. Not every time that price approaches that zone and bounce back. And not all the bouncing back case meet our expectation.

- All should depend on the surrounding theme of market, we have to look careful on specific cases to consider applying the Support/Resistance zone logically.

- All market are freely traded so there is always a chance to form a brand new Support/Resistance .

Good luck !

The continuous feedback loop of a successful traderDo you know what’s more important than winning in trading? It is knowing exactly why you actually won . Why? So that you can do it constantly. Needless to say, it is equally important to know why you lost when you lost.

The successful trader is constantly winning money, no matter the conditions. The economy may be in recession … or not … Algorithmic trading may be accounted for most of the trading volume. The volatility may be over the edge or down to ridiculous levels due to the summer holidays. So what … these are all part of the job . You need to make money because this is your job and if you complain and blame external factors for your poor results then think about choosing another profession.

Many would ask how is that possible … to constantly make money in ever-changing markets? Among the other 999 little things, your overall strategy is built upon there is one directly linked to your consistency. That is the continuous feedback and adjustment loop of your trading approach . This is where your post-trade analysis takes place and where you should find out WHY you won or lost.

For a discretionary trader, this feedback loop is not an easy thing to put in place, but it’s crucially important to have it. Because, the more useful you want the feedback, the more accurate the analysis should be. The difficulty of building the whole feedback mechanism is finding a fine balance between the depth of the trading details you take into consideration and the time and effort needed for analyzing them. From personal experience, I can tell you that you may fail to have a useful mechanism if you are too superficial. You might as well get lost in “analysis paralysis” as well as if you go too deep. That level of needed compromise is somehow personal. You know you’ve reached it when it can answer the following questions:

1. Is your selection technique giving you enough opportunities per your time frame?

2. Are your entries able to give you the price moves you want?

3. Are your exit techniques able to cut your losers short and let the winners run?

If the answer is “No” to any of these questions then you need to ask the next question “Why?” and dissect the effectiveness of that particular technique. Be ready to do the required adjustments if necessary.

There is a point in a trader’s career when being able to answer these questions alone will be more useful than an advice from the mentor. From that point on you can be on your own.

How To Trade Bearish Pattern's like Professional🗒 Just browsing through my analysis means a lot to me.

➡️ Please follow the analysis very carefully and every detail of the chart means a lot. And always entry depends on many reasons carefully studied

Always enter into deals when there are more than 5 reasons

combined

-----------------------

How To Trade Bearish Pattern's like Professional

-------

1 ) Descending Triangle

What is Descending Triangle

---------

This Triangle Contain 3 lower Higher &

3 - 2 Same level - and that mean there is

Selling Pressure on this area

--------

Target will be The Same Distance From

B : C -

IF This Area 200 PIP Target will be

200 PIP --

Stop loss Above

Down Connected line B - D

------------------------------

2 ) Symmetrical Triangle

What is Symmetrical Triangle

---------

This Triangle Contain 3 Higher low's &

3 - 2 lower high - and that mean there is

buy'er & sell fight's in this area -

and the winner who will break that Triangle

Target will be The Same Distance From

B : C -

IF This Area 200 PIP Target will be

200 PIP --

Stop loss Above

Down Trend line B - D

-----------------

3 ) Triple Top Pattern

WHAT IS A TRIPLE TOP?

-------------------

The triple top pattern entails Three high points

within a market which signifies an impending

bearish reversal signal. A measured decline in

price will occur between the Three high points,

showing some resistance at the price highs

Stop loss Above

Half Distance From Top to Nick line

----------------

4 ) Head & Shoulder Pattern

Target Same Distance From

Head To Nick

---------

If The Distance From Head To Nick is

200 PIP -- So Our Target will be 200 PIP

-----------

And Stop loss Will be 32 %

Of the 200 PIP Distance

---

Or Will be above Down Trend

That Connected

From Head To Right Shoulder Line

Stop loss Above

Down Connected line

From Head To Shoulder

-----------------

5 ) Up Channel Pattern

Target Same Distance From

Upper line To lower line

-------------

IF The Distance From Upper line To

lower line 200 PIP -- So Our Target

will be 200 PIP

------

Stop loss will be 32 % of Our Target

or near From middle line Of Broken

Channel

Stop loss Will be Above

Broken Channel Lower Line

/ Near Fro Channel Middle line

Risk : Reward

1 : 2 / 1 : 3

--------------

6 ) Inverted

Cup & Handle Pattern

What is an ‘inverted cup and handle’?

If you look at the regular cup and handle

pattern, there is a distinct ‘u’ shape and

downward handle, which is followed by

a bullish continuation. This means the

inverted cup and handle is the opposite

of the regular cup and handle .

Instead of a ‘u’ shape,

it forms an ‘n’ shape, with the handle

bending slightly upwards on the chart.

Stop loss Will be Above

Broken Support

Near From Handle

Sell Here

-------

Risk : Reward

1 : 3 -

Same Distance From Cup

to nick

--------------------------

7) Bearish Flag Pattern

The bear flag formation is

------------

underlined from an initial strong directional

move down, followed by

a consolidation channel in an upwards

Target Will be same Distance From Upper

line of flag to lower line

Stop loss Above

Flag middle line ( Channel )

Sell Here

-------

Risk : Reward

1 : 3

--------------------

8 ) Double Top Pattern

WHAT IS A DOUBLE TOP?

-------------------

The double top pattern entails two high points

within a market which signifies an impending

bearish reversal signal. A measured decline in

price will occur between the two high points,

showing some resistance at the price highs

Stop loss Above

Half Distance From Top to Nick line

Sell Here

-------

Risk : Reward

1 : 3 - 1 : 2

--------------------

9 ) Bearish Rectangle Pattern

4. Bearish Rectangle

-------------

The bearish rectangle pattern

characterizes a

pause in trend whereby price

moves sideways

between a parallel support

and resistance

zone.

Stop loss Will be Above

Broken Rectangle

or Near to Middle line

Sell Here

-------

Risk : Reward

1 : 3 - 1 : 2

-----------------------------

Hope you Enjoy Guys with this content Tumps Up Please and Support me with like and Comment

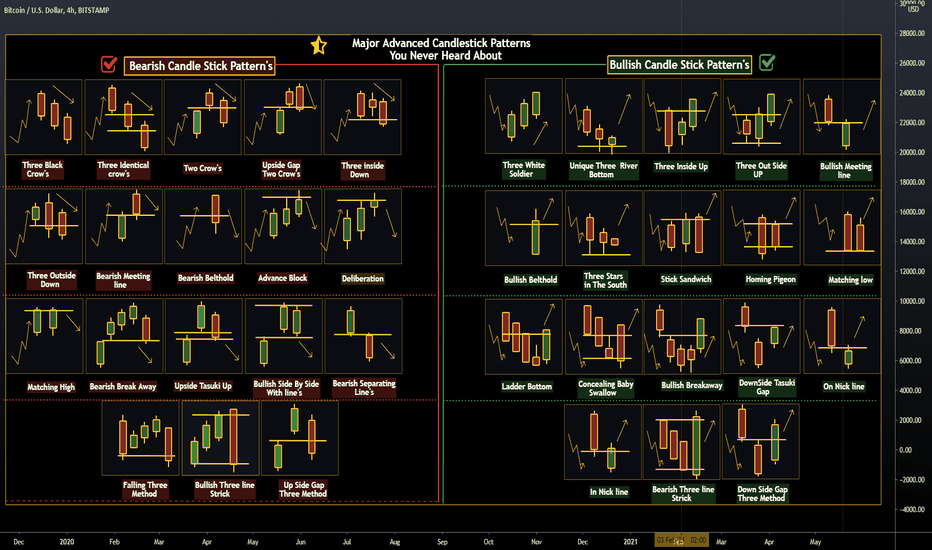

Major Advanced Candlestick Patterns You Never HeardCandlestick Definition

-----

What Is A Candlestick?

A candlestick is a type of price chart used in technical analysis that displays the high, low, open, and closing prices of a security for a specific period. It originated from Japanese rice merchants and traders to track market prices and daily momentum hundreds of years before becoming popularized in the United States. The wide part of the candlestick is called the "real body" and tells investors whether the closing price was higher or lower than the opening price (black/red if the stock closed lower, white/green if the stock closed higher).

KEY TAKEAWAYS

Candlestick charts display the high, low, open, and closing prices of a security for a specific period.

Candlesticks originated from Japanese rice merchants and traders to track market prices and daily momentum hundreds of years before becoming popularized in the United States.

Candlesticks can be used by traders looking for chart patterns.

The candlestick's shadows show the day's high and low and how they compare to the open and close. A candlestick's shape varies based on the relationship between the day's high, low, opening and closing prices.

Candlesticks reflect the impact of investor sentiment on security prices and are used by technical analysts to determine when to enter and exit trades. Candlestick charting is based on a technique developed in Japan in the 1700s for tracking the price of rice. Candlesticks are a suitable technique for trading any liquid financial asset such as stocks, foreign exchange and futures .

Long white/green candlesticks indicate there is strong buying pressure; this typically indicates price is bullish . However, they should be looked at in the context of the market structure as opposed to individually. For example, a long white candle is likely to have more significance if it forms at a major price support level . Long black/red candlesticks indicate there is significant selling pressure. This suggests the price is bearish . A common bullish candlestick reversal pattern, referred to as a hammer , forms when price moves substantially lower after the open, then rallies to close near the high. The equivalent bearish candlestick is known as a hanging man . These candlesticks have a similar appearance to a square lollipop, and are often used by traders attempting to pick a top or bottom in a market.

Traders can use candlestick signals to analyze any and all periods of trading including daily or hourly cycles—even for minute-long cycles of the trading day.

Two-Day Candlestick Trading Patterns

There are many short-term trading strategies based upon candlestick patterns. The engulfing pattern suggests a potential trend reversal; the first candlestick has a small body that is completely engulfed by the second candlestick . It is referred to as a bullish engulfing pattern when it appears at the end of a downtrend, and a bearish engulfing pattern at the conclusion of an uptrend. The harami is a reversal pattern where the second candlestick is entirely contained within the first candlestick and is opposite in color. A related pattern, the harami cross has a second candlestick that is a doji ; when the open and close are effectively equal.

Three-Day Candlestick Trading Patterns

An evening star is a bearish reversal pattern where the first candlestick continues the uptrend. The second candlestick gaps up and has a narrow body. The third candlestick closes below the midpoint of the first candlestick . A morning star is a bullish reversal pattern where the first candlestick is long and black/red-bodied, followed by short candlestick that has gapped lower; it is completed by a long-bodied white/green candlestick that closes above the midpoint of the first candlestick .

Manipulation Scenario :

1. Support was tested several times and finally (looks) a breakdown. Maybe some traders will sell on break support.

And put SL a little above the candle that breaks the support. But the price made a pinbar / hammer, went back up and touched SL.

2. After the SL is touched, the price finally breaks the trendline and closes above it.

Traders will think this is a false break with the trendline breakout confirmation and become a best time to buy with SL just below the previous low. However, prices fell back and touched SL for the second time.

3. After the SL has been touched, the price create a pinbar which is an indication of buyer's pressure.

Traders might think not to be fooled once again and think that the support is really broken and decide to sell in the SBR area with SL above the previous high. But again, the price was not friendly and touched SL once again.

4. The price finally made an upside impulse and formed a bullish pennant which became a continuation pattern.

With this pattern the trader should take a long position. However, due to doubt and don't want to become a victim of SL for another time, trader decided not to open a position. And the result is price actually goes up without being able to get some profit.

After being hit by SL several times it does disturb our emotions as traders, but if we have calculated each risk of SL before jump into trade and put SL which suitable with our risk tolerance, it shouldn't be a problem.

JUST ENJOY THIS PROCESS

Things I ask myself before a trade in cryptoThings I ask myself before a trade:

1 What's the market structure, range or trend?

2 Where are the major SR areas?

3 Can I lean my stops against SR?

4 Where would opposing pressure come in?

5 How is price moving, chop or clean?

6 Volatility expanding or decreasing?

Should You Quit Your Job To Trade Full-time in crypto?-be profitable

-Reasonable account size

-be prepared to be incomeless

-spouse that works full time

-Know the timeframe

-know what you want

if you are interested any crypto that you want analyze with me and any questions please do not hesitate and comment below the chart!

if u like it press like-comment and folow me.thx

Education: Why you should NOT buy or trade signals!" Give a Man a Fish, and You Feed Him for a Day. Teach a Man To Fish, and You Feed Him for a Lifetime " - unknown origin *

🔴 What does this quote mean, and how does it related to trading (signals)?

The quote means that you can indeed resolve an issue by providing a hungry man a fish, serving his immediate need, but if you really want to help him you should teach him to become self-sufficient.

Similarly, while providing a signal, you can provide the signal to a winning trade to someone, but if you really want to help him, you teach him how to analyze the market and become self-sufficient in trading.

🔴 DISCLAIMER

This post will probably get some backlash from users who provide signals, be it paid or not, because it goes against their "business model" and might reduce their revenues in one way or the other. But that is fine by me, this is my personal opinion, and I advise every single reader of this publication to draw his own conclusions.

🔴 What are trading signals?

Trading signals at a minimum constitute of an entry price and a direction. Example : buy $Gold at 1825 USD.

Some (but not all) signal providers also give you a Profit Target and/or a Stop Loss . They give you actionable information on where to open a trade, which direction you should trade and sometimes when you should close the trade.

🔴 That's easy! Nothing wrong with that, it can make me money, right! Right???

Yes, it can, you are absolutely right that you can make money off a trading signal.

However, there are a couple of questions that you need to ask yourself :

How many trades, what percentage, can you expect to win?

If not provided, where should you take profit or cut your losses?

What is the reason for entering the trade?

What confidence do you have in the trade if you're just following someone elses instructions?

What if you lose 10 trades in a row, was this expected?

Who is responsible for your losses? You, or the signal provider?

What do you learn from trading signals?

What are the emotions you have to go through during the trade?

What if your signal provider stops?

🤔 Additionally the question arises why the signals are provided.

Is it altruism? Or is it conceivable that the provider does not make enough by trading and wants to top-up his gains(?) by selling signals. Income from trading is not guaranteed, when you sell signal you make your profit the moment the transaction takes place, independent of the outcome of the trade. That's guaranteed 💰.

And yes, people will be unhappy and no longer order the providers' services, but there are always new "potential buyers" coming to the financial markets.

💡 " Trading signals does not guarantee your income, it guarantees the signal providers' income. "

🔴 OK, fair enough, but what should I do if I don't know how to trade?

Allow me to be blunt here, if you don't know how to trade, you should either learn how to trade, either keep your money in your pockets.

Ask yourself why you want to trade? What is the end goal?

► If you say that you just want to make some extra money, then taking up a 2nd job is a much more reliable source of income than throwing your money at the markets based on something someone else said, don't you agree?

Other than that, as said earlier, if you depend on a signal provider, that income (if any) will disappear the moment the signals do.

► If you want to become a trader, become financially independent, get rid of your daytime job, get out of that hamster wheel, I strongly suggest you invest the time and effort to learn how to trade for yourself.

🔴 MY ADVICE

Don't be lazy

Don't trade signals and

Learn how to trade

Hustle

Grind

Fail

Learn from your mistakes

Fail again

Don't give up

Don't expect to become rich overnight

Keep learning

Do your own research and analysis

Rinse and repeat until you succeed ....

That, imho is the only way you will achieve the financial goals you have set for yourself and feel good about it...

So, let's take our initial proverb and give it a trader twist:

👉🏻👉🏻👉🏻 " Give a Man a Signal, and You Could Feed Him for a Day. Teach a Man To Trade, and You Feed Him for a Lifetime " - Nico Muselle

💥The decision is all yours, if you want it bad enough, you can do it!💥

🔴 Useful information

This TradingView article gives you some additional information on the things you shouldn't do ... Give it a read before you hand out your hard earned money.

www.tradingview.com

Do you agree? What is your view on signals?

Let's open the discussion in the comments below ...

✌🏻 PEACE OUT

Liked this post ? "Smash that like button!" 👍 - follow for more educational posts and alerts 🔔 when a new one is published.

Oh, and maybe you'll like the related ideas linked below as well?

Thank you for your visit! 🙏

3 Simple Ways to Become a Better Forex TraderHey all!

Since many of you like our educational videos, here's another one for ya!

In this video we go over 3 excellent yet simple ways you can become a better trader!

They are:

1. Focus on price action, after all that's the markets language

2. Control your internal dialogue (mindset is king!)

3. Prepare a watchlist, then a trading plan and trade your plan!

Hope this helps! Give us likes and comments if you want more!

Trading Entries: Brutal Truths Nobody Tells You in crypto!

1.breakouts may fail

2.pullbacks may never come

3.pullbacks might become reversals

4.confirmation may be too late

5.you don’t need perfect entries

Hi guys..its the latest analyze chart .if you are interested any crypto that you want analyze with me and any questions please do not hesitate and comment below the chart!

if u like it press like-comment and folow me.thx