The 90-90-90 rule - Why do traders fail?"Many are called, but few are chosen". Ever heard this proverb?

This is certainly true for trading, in fact, there is even a rule in trading about this, the 90-90-90 rule. So what does this rule say?

"90% of traders lose 90% of their money in 90 days"

😱😱😱

That's right, statistics show that 90% of people who start trading lose the majority of their money in less than 3 months. But why is that so? In this post I will try to lay out the reasons for failure, if you are a new or struggling trader, I'm sure you'll find this useful. Let's get into it ...

🤯 EXPECTATIONS

Many start trading because they've seen or read about success stories, people becoming rich overnight, they might even have a friend who has been successful in trading and they think (to say it in Jeremy Clarckson's famous words) "How hard can it be?. With this approach, failure is imminent...

📐 NOT HAVING A PLAN

"If you fail to plan, you are planning to fail - Benjamin Franklin . Trading without a plan results almost certainly in failure. Your trading plan should include the definition of your setup, entry, stop loss, profit taking, trade management, risk management and money management.

🔄 NOT TESTING YOUR PLAN

OK, you have determined how you will trade, what defines your entries and exits, how much of your capital you will risk and how you will manage your trades. But do you know what is the expectancy of that plan? Do you know how much trades you will win on average, and how many you will lose? How much money can you expect to make?

Backtesting your plan, executing it flawlessly time after time on historical data will give you that information and the confidence to execute your plan time and time again without hesitation.

😱 EMOTIONS - THIS IS THE BIG ONE!

If did not take the time to create a trading plan and backtest it, you don't really know what you are doing and emotions will have the best of you.

Fear, greed, hope, excitement, anxiousness, boredom and frustration will drive your hard earned capital away from you.

Results of these emotions are : trading too much, letting your losers run and cutting winners short, revenge trading, overleveraging etc...

I could write an entire post about each of the emotions and how they can affect you while trading, but it would make this post too lengthy. Just know that emotions are your biggest enemy when trading, for best results you should be in a stoic state when trading.

🕺 EGO

"The market can remain irrational longer than you can remain solvent.". If you want to prove the market that you are right, you are doomed to fail. The market is always right, no matter what happens, so you better learn to accept that your analysis or prediction of what would happen was wrong and cut your losses. Fast!

📚 LACK OF EDUCATION

It takes many years to learn a skill or a profession, trading is no different. If you think about making lots of money without putting the time in to learn and test, you pretty much guarantee yourself to fail.

You wouldn't want a lawyer without education to defend you in court, or a self-proclaimed surgeon who learned on YouTube to operate on you, would you?

💰 STARTING CAPITAL TOO LOW

If you're starting with a low capital, you will tend to try and make it grow fast, resulting in taking too many trades, too high of a risk, too high leverage. If you start with a low capital, you'll have to be OK with the fact that it will grow slowly and that it will take (a lot of) time to build up a sizeable account.

🚦 BUYING OR FOLLOWING SIGNALS

"There is no such thing as easy money." You might think that you don't have the time to learn about trading, making and backtesting a trading plan. So why not follow signals?

Ask yourself what you know about this service? How profitable is it (and don't just go from the claims they make)? Do you know anything about the reason for a signal, why was it triggered?

Have you talked to other users who used the service, what do they think about it? Why is this person/company selling signals if they are so successful as they claim? Philanthropy ? 🤔

📉 INDICATORS OVERLOAD

Indicators can help you make decisions for trading, but too many indicators can and will lead to opposite signals or "analysis paralysis.

Most indicators are derived from price, so it makes sense to learn how to read price action and discover the story behind the candles.

🆕 THE NEXT SHINY OBJECT SYNDROME

You took the time to develop a trading plan and even tested it, but you run into a drawdown... Rather than counting on your experience and the expectancy that you know is there, you look for a new shiny method of trading, until the same thing happens again with this new method ... Rinse & repeat, never giving the chance for your original method, which you know was working when you tested it, to prove its worth ...

Alright, I think I have provided the main reasons why new or inexperienced traders fail. Knowing why they (or you) fail is one thing, doing something about it is not a small feat. But with enough dedication, persistance and the right mindset, you can prove these statistics wrong!

Feel like reasons are missing, let me know in the comments below.

So what is your story?

Are you a successful trader now but recognize these reasons for failure?

Are you a new trader? Was this helpful?

What did/will you do to overcome this?

What did/do you struggle most with?

Help the TradingView community by commenting below.

"Trading is a ruthless business that does not take any hostages, so you better come prepared." - Nico Muselle

Liked this post ? "Smash that like button!" 👍 - follow for more educational posts and alerts 🔔 when a new one is published.

Thank you for your visit! 🙏

Educational

Why Most Traders Lose Money #Scalping The Market in #crypto1-caught by news

2-don’t have what it takes

3-cant read price action

4-wrong expectations

5-get killed by commissions

if you are interested any crypto that you want analyze with me and any questions please do not hesitate and comment below the chart!

if u like it press like-comment and folow me.thx

An insight into becoming a better trader!Hey all!

Happy weekend and I hope this week has been good for you, in profits or lessons!

In this video we go over 4 insights that if followed can and will make you a better forex trader!

We hope the video helps you in one way or another, and if it does our job will be counted as a success!

Have a great weekend!

PS: We go over our BTCUSD long trade too!

#RSI indicator cheat sheet in #cryptoRSI indicator cheat sheet

-Relative strength index

-Momentum indicator

-Measures how fast price moves

Important level(30-70)

Rsi 30:oversold

Rsi70:overbought

Price is above rsi 50=uptrend

Price is below rsi 50=downtrend

-depends on the timeframe

if you are interested any crypto that you want analyze with me and any questions please do not hesitate and comment below the chart!

if u like it press like-comment and folow me.thx

Implementing Heiken Ashi CandlesKEY POINTS:

Heikin-Ashi is a candlestick pattern technique that aims to reduce some of the market noise, creating a chart that highlights trend direction better than typical candlestick charts.

The downside to Heikin-Ashi is that some price data is lost with averaging, which could affect risk.

Long down candles with little upper shadow represent strong selling pressure. Long up candles with small or no lower shadows signal strong buying pressure.

-----------------------------------------------------------------

When paired with risk management tools, trading indicators can give you a clear insight into price movements. Heiken Ashi candlesticks resemble a typical Japanese candlestick, but several details differ from the traditional candlestick chart.

Every Heiken Ashi candlestick has an upper candlewick, a shadow (lower candlewick) and a body – much like the Japanese candlesticks.

However, a bar in the Heiken Ashi starts from the middle of the one before it and not where the previous one closed-a significant distinction.

Each candle has a high, low, open and close, and thus the Heiken Ashi formula has four segments.The opening level is the midpoint of the previous bar; the Close of each bar is the average of high, low, open and close.

If you’re aiming to catch persistent trends, then Heiken Ashi will be valuable.

NOTE:

However, day traders who need to exploit quick price moves may find Heikin-Ashi charts are not responsive enough to be useful. Also, due to no price gaps within Heikin-Ashi candlestick charts, risk management is harder to monitor. Using additional methods to watch risk is advised.

The formula for calculating Heikin-Ashi candlesticks is as follows:

Open= (Open of previous bar+ Close of previous bar)/2

Close = (Open + Close + High + Low)/4

High = the Maximum Price Reached

Low = Minimum Price Reached

*Hope this helped refresh your knowledge of Heikin-Ashi candlesticks or showed you a new trading strategy to use.

Bollinger Bands - Contraception for your Price ActionSo i thought i’d do another educational post, this time on the Bollinger Bands. I’ll try and keep this as a brief introduction to the basics of Bollinger Bands so you can do your own research to fully understand what the indicator is doing and showing, there is no point putting a fancy indicator on your chart if you have no idea what it is showing you. Bollinger Bands measure, Price & Volatility, potential Support and Resistance, & it can also give you a sense of if an asset is Overbought or Oversold, although its best practice to use another indicator to get confirmation of being Oversold or Overbought because the price can walk the Upper and Lower Bands for extended Periods. The Standard Bollinger Bands is composed of a 20-period Simple Moving Average (SMA) which is its Middle Band, it also has an Upper Band & a Lower Band which envelopes the SMA. The outer bands are a +/- 2 Standard Deviation (StdDev) of the 20-period SMA in whatever timeframe you are in. A Simple Moving Average (SMA) is an unweighted average of the Previous 20-period Values in whatever timeframe you are in, so for the 1min chart, the SMA period will be an unweighted average of the previous 20 mins, for the 1hr chart, the SMA period will be an unweighted average of the previous 20 hours, for the Daily chart, the SMA period will be an unweighted average of the Previous 20 days and so on and so on. You are able to change the SMA to any period you want, some trading sites also allow you to change the SMA into an Exponential Moving Average (EMA). Changing the timeframe from the standard 20-period SMA to a faster SMA like a 10-period, will allow faster entry into possible buy & sell points but could be prone to false signals, because of this, most people keep the SMA at the Default of 20-periods to avoid possible false buy/sell signals. You can change the StdDev settings, but you must know what you are doing as you cannot just add any number for shits and giggles, for example, a 20-period SMA is 2 StdDev, a 10-period SMA is 1.5 StdDev and a 50-period SMA is 2.5 StdDev as default. For those interested, & from my understanding of it, the Population Standard Deviation used in the Bollinger Bands system is a measure of the +/- dispersion/variation of the mean or the sum of a collection of values, the values being the 20 periods, so a +/- deviation value away from its Midpoint Basis in whatever timeframe you are in. I won’t go into the calculations because everyone will stop reading & it’ll also hurt my head because i cannot even count. So the + is the Upper Band and the - is the Lower Band. So looking at the Bollinger Bands, we now know that the Middle Band is the basis & the Upper and Lower Bands are +/- Standard Deviations of that Middle Band Basis in whatever timeframe you are in. With Low Volatility, the closer the Upper and Lower Bands are to its Price & Middle Band Basis. The more volatile the Price action is in either direction, the further away the Price will move from its Middle Band and move closer to its Upper or Lower Bands depending on if it’s Bullish or Bearish. Along with the Price, the Upper and Lower Bands will also expand outwards and move away from its Middle Band. With extreme volatility the Price may even wick out or close a candle out of its Upper or Lower Bands. If there has been a period of Volatility which has come to an end, then you will see the Upper and Lower Bands start to contract inwards. You can use the Middle Band as potential Support and Resistance Levels depending on if the Price is above or below it. You can also use the Upper and Lower Bands as potential Resistance Levels, and also as potential entry levels for longs or shorts respectively. The Lower and Upper bands will point outwards and inwards depending on if the Price is contracting or expanding respectively. With normal volatility, if you use the default 20-period SMA & 2 StdDev settings, then the price action will possibly remain within the bands for roughly about 90% of the time. The Price will eventually move back in to the Upper or Lower Bands if there has been a period that the Price has been outside of the Upper or Lower Bands. What is great about the Bollinger Bands is that you can apply it to any chart and timeframe that has enough previous trading data, and use it to get a feel for the assets volatility over time. A key thing to look out for is the Bollinger Bands Squeeze, this happens when you buy latex contraception that’s too tigh……… sorry…… this happens when volatility has slowed & the Upper and Lower Bands contract, envelope and stay close to the Price & Middle Band so essentially Price action is trading sideways within a channel made up of the Lower and Upper Bands. The Bollinger Bands Squeeze Pattern can potentially end in a big breakout upwards or downwards. Bollinger Bands can also be used to see Bullish W-Bottoms or Bearish M-Top signals in the Price. These signals have 4 steps that need to happen for it to be considered valid but i’ll let you do your own research on that. The Price can also walk along the Upper and Lower Bands for an extended period of time depending on if the Price is Bullish or Bearish. It’s best practice to use complementary indicators like Volume, RSI, ADX, STOCH or MACD to try and get confirmation or any potential breakout. I actually use the Bollinger Bands on my charts in conjunction with the Ichimoku Cloud.

On a side note, having a grasp of the basics of the original Bollinger Bands crated by John Bollinger is the first step to really understanding it and properly using it to enable you to make wise decisions with your money/investments. If you have an understand of the original Bollinger Bands, then that can help you with understanding other price enveloping indicators like what David ‘WycoffMode’ Ward has created. David has created his own genius take on the Bollinger Bands called Bad Ass Bollinger Bands, which is quite fascinating because it shows multiple +/- Standard Deviations for whatever timeframe you are in. You could potentially use these as multiple Support and Resistance Levels for whatever timeframe you are in and also look for any potential cascading effect from lower to higher timeframes using these multiple +/- StdDev levels, he does state however that to get the best out of it, you have to use it with his Phoenix Ascending indictor, which from what I’ve seen, i think it complements his Bad Ass Bollinger Bands by showing Momentum, Upwards and Downwards Pressure & potential Trend Crossover, this agrees with what i have said above, about using other complimentary indicators with your Bollinger Bands like RSI or MACD. From what I have seen of David’s Bad Ass Bollinger Bands, one of the many benefits of having multiple +/- Standard Deviations, 8 in total, 4+ & 4-, is that you end up with a closer to 95-99% of the Price action staying within the Bollinger Bands for more accuracy. 99% because if there is extreme volatility, that may still cause a Candle Wick to poke its head out. This new indicator is potentially a real game changer. This is just my opinion from what i have seen of it, so i could be completely wrong & David could say it doesn’t mean anything that i've typed and he’s gonna hunt me down for typing complete bollox. Below is a pic to show you the differences between the original Bollinger Bands and the Bad Ass Bollinger Bands.

In any case, it’s best practice that when using your charts, you should have a range of indicators to complement each other, an indicator for Momentum, Volatility, Trend, Price, Volume ect. You do not need to add 4 indicators on your chart that show the same thing. If your using RSI then you don’t really need the STOCH, If you’re using MACD then you don’t really need ADX or Parabolic SAR.

If you’re interested in learning more about the Ichimoku Cloud System, please click on the below pic which will take you to an educational post i did about it.

I hope you have found this brief intro helpful & i hope it encourages you to do your own research to find the best trading strategy for you. Cheers 👍

I LOST 70% OF MY CAPITAL WITH THE SAME MISTAKE => OVERTRADINGHello Traders,

today I want show you a point of my live, that I constantly overlooked. I want sensitize you for it and also make me so a reminder for the future!

1. OVERTRADING

It's the truth: In the past I lost 70% of my capital with overtrading. If you find yourself there then I would be sensitize you to rethink your approach of trading.

On the chart above you can see how I take at the beginning all rules what I learned before:

Only 1% of my capital I choose for risk with using StoppLoss

Support and Resistance are STOPPLOSS and TAKEPROFIT, depence on trading direction

I choose a Takeprofit more then 2 times of my risk

=> I lost the most time with this rules

But the rules are not the problem!

The problem was my overtrading. I see only "ONE" signal to take action => then it overcomes to reaction buy, no no, sell... dame, better buy and so on => always if I was in loss I tried to rethink my trade 24/7 hours in front of the screen.

2. SUPPORT AND RESISTANCE: THE WORST ENTRY POINTS EVER, BUT GOOD STOPLOSS AND TAKEPROFIT AREAS

Another thing is, that support and resistance areas are good reverse moments. Every greedy trader like I used to be, try to catch the early trade to make more money than anyone can imagine. Then back to reality: you get stopped. The market takes your money and you don't realize why!

On this moment, you have your own opinion of the market and this your mistake to believe you are right. You hadn't wait enough!

3. BE PATIENCE - TRADE LATE AND RIGHT THEN EARLY AND WRONG (MULTIPLE)

The headline above in point 3. is since my realizing the importast rule. Trade late and right!

Because the other thing of trading you can: the right risk, the winning opportunity.

Sometimes it helps to look in deeper timeframes, to get enough win-risk-ratio.

Hopefully it helps you!

Kind regards

NXT2017

5 trading lessons from 5 years of losing1-consistent set actions

-Your action must be consistent

-inconsistency leads to inconsistent results

-what are your goals from trading

2-money management

3-model success

4- Emotion management

5- Trader Psychology

if you are interested any crypto that you want analyze with me and any questions please do not hesitate and comment below the chart!

if u like it press like-comment and folow me.thx

Different Between Break Out / Fake Out Hi Pro Trader's .. Hope You Be Fine ♥️

Today We Have New Education Lesson .. About Different Between Break Out / Fake Out

1- Fake Out : After Break Out The Next Candle Close Below The Resistance

2- Break Out : After Break Out Wait For Next Candle To Close Above Resistance And Enter Trade >>

Be Safe - Trade Safe ✔️✔️

5 Trading Habits Which Keep You Poor (Without You Realizing) 1-don’t chase the market

2-don’t use a fixed position size

3-don’t trade without plan

4-don’t adjust your stoploss

5-avoid having itchy fingers

if you are interested any crypto that you want analyze with me and any questions please do not hesitate and comment below the chart!

if u like it press like-comment and folow me.thx

5 Things You Should Stop Doing As A Trader1-listening to others

-you don’t know their trading plan

2-strategy hopping

-focus on one trading method

-learn more about the trading method

3-tweaking one strategy

-develop new strategies instead

4-thinking in terms of absolute

5-comparing yourself to others

if you are interested any crypto that you want analyze with me and any questions please do not hesitate and comment below the chart!

if u like it press like-comment and folow me.thx

5 Brutal Trading Truths Nobody Tells You1-you need money to make money

2-steep learning curve

3-in a drawdown most of the time

4-don’t have what it takes

-trading takes time,energy and resources

-few people stay

5-must have an edge

if you are interested any crypto that you want analyze with me and any questions please do not hesitate and comment below the chart!

if u like it press like-comment and folow me.thx

4 Things To Look For Before You Place A Trade4 Things To Look For Before You Place A Trade

1-do scalable things

2-find favorable risk to reward opportunities

3-anything can go wrong

4-never go all in

if you are interested any crypto that you want analyze with me and any questions please do not hesitate and comment below the chart!

if u like it press like-comment and folow me.thx

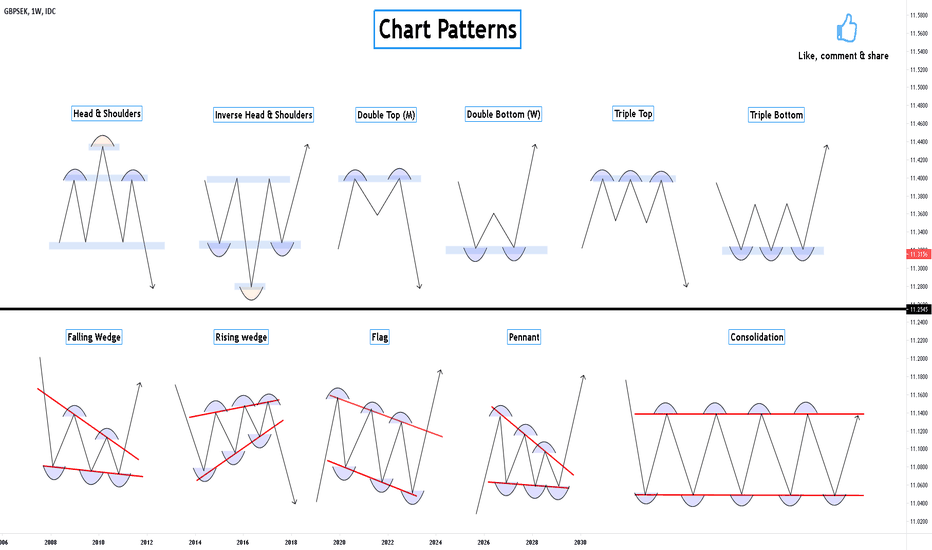

11 Chart Patterns you need to know in 2021Hello Traders,

Here is some Educational Chart Patterns that you should know in 2021.

Most of these patterns are seen daily in Stocks, Forex and different markets across the globe.

I hope you will find this information educational & informative.

Your support is appreciated with a like & Comment

Head and Shoulders Pattern

A head and shoulders pattern is a chart formation that appears as a baseline with three peaks, the outside two are close in height and the middle is highest.

In technical analysis, a head and shoulders pattern describes a specific chart formation that predicts a bullish-to-bearish trend reversal.

Inverse Head and Shoulders Pattern

An inverse head and shoulders is similar to the standard head and shoulders pattern, but inverted: with the head and shoulders top used to predict reversals in downtrends

An inverse head and shoulders pattern, upon completion, signals a bull market

Investors typically enter into a long position when the price rises above the resistance of the neckline.

Double Top (M) Pattern

A double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate decline between the two highs.

It is confirmed once the asset's price falls below a support level equal to the low between the two prior highs.

Double Bottom (W) Pattern

The double bottom looks like the letter "W". The twice-touched low is considered a support level.

The advance of the first bottom should be a drop of 10% to 20%, then the second bottom should form within 3% to 4% of the previous low, and volume on the ensuing advance should increase.

The double bottom pattern always follows a major or minor downtrend in a particular security, and signals the reversal and the beginning of a potential uptrend.

Tripple Top Pattern

A triple top is formed by three peaks moving into the same area, with pullbacks in between.

A triple top is considered complete, indicating a further price slide, once the price moves below pattern support.

A trader exits longs or enters shorts when the triple top completes.

If trading the pattern, a stop loss can be placed above resistance (peaks).

The estimated downside target for the pattern is the height of the pattern subtracted from the breakout point.

Triple Bottom Pattern

A triple bottom is a visual pattern that shows the buyers (bulls) taking control of the price action from the sellers (bears).

A triple bottom is generally seen as three roughly equal lows bouncing off support followed by the price action breaching resistance.

The formation of triple bottom is seen as an opportunity to enter a bullish position.

Falling Wedge Pattern

When a security's price has been falling over time, a wedge pattern can occur just as the trend makes its final downward move.

The trend lines drawn above the highs and below the lows on the price chart pattern can converge as the price slide loses momentum and buyers step in to slow the rate of decline.

Before the lines converge, price may breakout above the upper trend line. When price breaks the upper trend line the security is expected to reverse and trend higher.

Traders identifying bullish reversal signals would want to look for trades that benefit from the security’s rise in price.

Rising Wedge Pattern

This usually occurs when a security’s price has been rising over time, but it can also occur in the midst of a downward trend as well.

The trend lines drawn above and below the price chart pattern can converge to help a trader or analyst anticipate a breakout reversal.

While price can be out of either trend line, wedge patterns have a tendency to break in the opposite direction from the trend lines.

Therefore, rising wedge patterns indicate the more likely potential of falling prices after a breakout of the lower trend line.

Traders can make bearish trades after the breakout by selling the security short or using derivatives such as futures or options, depending on the security being charted.

These trades would seek to profit on the potential that prices will fall.

Flag Pattern

A flag pattern, in technical analysis, is a price chart characterized by a sharp countertrend (the flag) succeeding a short-lived trend (the flag pole).

Flag patterns are accompanied by representative volume indicators as well as price action.

Flag patterns signify trend reversals or breakouts after a period of consolidation.

Pennant Pattern

Pennants are continuation patterns where a period of consolidation is followed by a breakout used in technical analysis.

It's important to look at the volume in a pennant—the period of consolidation should have lower volume and the breakouts should occur on higher volume.

Most traders use pennants in conjunction with other forms of technical analysis that act as confirmation.

Consolidation Pattern

Consolidation is a technical analysis term used to describe a stock's price movement within a given support and resistance range for a period of time. It is generally caused due to trader indecisiveness.

Consolidated financial statements are used by analysts to evaluate parent and subsidiary companies as a single company.

Thanks for Reading, ill see you in the next Educational Post

Global Fx Education

" INTRA-DAY PATTERNES " To Get 50-100 Pips Daily Hi Pro Trader's .. Hope You Be Fine ♥️

Today We Have New Education Lesson .. About INTRA-DAY PATTERNES

1- Ascending Triangle

2- Descending Triangle

3- Channel

4- Trends On 5 Minutes Frame

If you follow Those Pattern You Will Get Daily 50-100 Pips ✔️

Best Pairs : GBPUSD / EURAUD / EURNZD / Gold / Dawjones

Be Safe - Trade Safe ✔️✔️

What kind of Trader are YOU?🟢 A scalper , is a kind of trader that usually buys and sells an individual stock multiple times throughout the same day.

They hold a position for few seconds or few minutes, trading during the busiest and most liquid market hours.

Scalpers aim for very small profits on each trade, the large number of trades they open during a day can easily return significant profits by the end of the day.

Be a scalper is not that easy, if you can't keep focusing on your screen for hours each day, it probably won't suit your life style.

🟢 A day trader open and close substantially less setups compared with scalpers, normally one or few setup every day.

Although they both trade intraday, the day trader's strategy is to focus on the best opportunities of the day, and to hold on for a larger profit target.

Therefore, a day trader usually holds on to a trade for several hours but not more than one full trading day. Ultimately the goal of a day trader is to aim for a larger piece of the expected daily price movement within one trade

🟢 Swing traders normally trade on higher time frames, from H4 to daily charts, holding a position for few hours, days or sometimes weeks!

They always are looking for great opportunities that could give them more profits and large targets

Swing traders must familiarise themselves with technical analysis, using these techniques as a set of guiding principles for their decisions and also have an understanding of fundamental analysis, examining the asset’s fundamentals to support their technical evaluation.

🟢 Position traders usually hold a stock for an extended period of time, typically several weeks or years. A position trader generally does not let daily price motion or market news influence their trading strategies. Instead, they are focused on long-term outcomes and allow their particular holdings to fluctuate in sync with general market trends over the short-term.

They usually need to be really patient and wait several weeks before getting the perfect opportunity to get into a trade!

What kind of Trader are you?

Trade Safe and Responsibly ,

Gianni

Trading Errors / Trading Success In Market - 10 Golden Tips -Hi Trader's .. Hope You Be Fine .

Today We Have A New Education Lesson To How To Success In Trading --- And Golden Tips .

-- Golden Tips To Continue In Market --

1-Don't Start Within 500$

2-Learn And Choose Good Strategy First

3-Traning On Demo Account For 1-3 Months With One Strategy

4-Foucs On 4-5 Pairs Only To Understand There How To Move

5-Don't Trade In High Spread

6-Don't Trade With High News

7-For Every 500$ Only USE 0.01 And Just 5 Open Trades In Same Time

8-Use Stop Lose

9-Don't Use Hedge

10-Don't Forget 1/2/3/4/5/6/7/8/9 Tips ♥

Be Safe -- Trade Safe

Risk management using Alpha and BetaAlpha measures excess return. Anything with alpha over 1.0 is considered favorable.

Beta measures volatility and market risk. Anything with beta below 1.0 is considered favorable.

These cannot be the only metrics you make your trades or investments on, but they are extremely helpful when comparing funds or stocks. Chasing high alpha will usually result in higher beta. Chasing low beta will usually result in lower alpha, meaning muted returns but a more stable, safe investment.

||HERE'S WHY YOU ARE FAILING IN TRADING (EXPLANATION)If your reading this your one of 3 people , you have been trading for more than 1-3 years without any success whatsoever that you can be proud of ,you are just in your beginning phase and you just can't understand why you can't get the hang of it(trading) yet you had a few good months in the start , you are unknowingly addicted to the idea of yourself being this top trader but keep making the same mistakes and are wondering whether you made the right choice joining trading to begin with!. Well to you, all are in luck because pretty much everyone in the industry has lived or come close to those same ideas and thoughts ,asked those same questions over and over until you come to a certain realisation which am going to relay down below .

How does it start ? (the losing consistently) you might wonder;

well when the analysis and trades you takes aren’t rewarded 100% of the time, nor do they cause a negative outcome 100% of the time, this keeps you trying: You the trader realise that you have a chance of profitability anywhere between 0% and 100% to win. In your mind, a loss or a string of losses are just part of the process and you need to keep going to eventually win. You expect to be rewarded some of the time, and this expectation motivates you to keep trading.

And to make things more interesting you overestimate the probability that something will happen because your mind can produce immediate examples of when it did happen(I know you recall your last winning trade you took how nice it felt) It might even be because you can recall a time when you had a lucky string of wins yourself. Thus, you think your chances of winning are larger than they actually are.

As a trader you commonly think that the chances of winning increase with each loss, but this is completely untrue(learn from the loses they say).

The chance of winning neither ‘increases’ nor ‘decreases’ when trading. Chance does not work by shuffling through a pre-determined number of losses or wins. Each trade is a new, isolated event and has the exact same chance of winning or losing as the previous one.

Think of it like flipping a coin. If it comes up with tails 7 times in a row, that doesn’t suddenly make the chance of getting heads higher than 50%. Each new flip is always 50%. Our brains just try to rationalise the unlikeliness of getting 7 tails in a row by saying it’ll ‘balance’ out with a heads next.

Chance has no methodology, but traders often think it does. We believe that our next trade is ‘due’ to be good because all our previous ones have been so lousy or that the pair/stock/metal we’re trading on is ‘due’ to pay out, and this flawed mentality urges us to keep trading.

Many traders also falsely believe that they have some influence over markets. This might be reinforced depending on the type of strategy we’re trading – one where there is some level of control due to choices , but in the markets primarily the driving force is whether someone wins or loses

we want to feel in control – it’s within our nature – so the frustration of how unpredictable trading is can lead to a person convincing themselves that they can gain some control over it. (am sure you felt like you had some control, who hasn't ).

We as traders are also more sensitive to losses than gains of equal value. For example, losing a 100$ to the markets generates a more prominent emotional reaction than finding 100$ in your wallet. This is why many traders endlessly invest time and money to try ‘win’ back previous losses or alleviate the feeling of disappointment or frustration by gaining a win. At this point, winning becomes less about excitement and more about ‘making up’ for losses, so we get stuck in a vicious cycle.

These psychological factors, combined with genetic predispositions, mean a trader can very easily fall down a slippery slope leading to failing in trading.

Some times you can have trades running in positive but fail to close them and come back finding them in negative then you decide to close them, reluctancy to make emotionless decisions to cut trades when in profit but rather in negative has something to do with how you react to handling risk in your mind and you need to fix the gap, Gap( is you thinking that any increment you get in an environment of pure risk isn't worth but then react when it goes against you.)

It also makes it incredibly difficult for a trader to know when they have a problem. Failing at trading is often accompanied with denial and an unrealistic views of things.fortunately there's lots of information out there to help you set yourself on the right journey but it ends with you asking yourself this question!

ARE YOU PROFITABLE (REALLY PROFITABLE) OR ARE YOU IN DENIAL AND LYING TO YOURSELF?

if the answer is (NO!)

You can do the following;

-weekly trade reviews

-strategy reviews

-risk management review

-money psychological review

among other things

leave a comment if you have experienced any of these situations in your trading and how you overcame them to help everyone better there trading

thank you ps-dabag.

Highlighter and signpost - new toolsJust a quick post to show off these two new tools. I've been waiting FOREVER for these. My goodness they are fantastic. The signpost tool is AMAZING.

Tradingview continues to separate itself as the best trading and charting platform on the planet. Great job guys!

Link to the original post by Tradingview below-

Understanding the difference between market pending orders !!Hello traders

Today our btcusd chart will show you the differences of market pending orders. These order types will help you to avoid getting into the market early.

Please read the chart carefully and adopt it into your trading entry rules.

Thank you and trade safely.