Dont be a D#@K.... its DUCK.. honestly ;p Here we have some really strong support and resistance levels drawn on the chart ( green lines ) They are classed as strong because price touched them and then bounce a number of times ( I will let you figure these out for yourselves... I'm not spoon feeding you ) ;p

You can also see a lovely trend line TL that has been touched more than once, so this is also classed as strong.

Now because these levels an TL are strong a break of any of these could see a big move, again you can see all this on the charts.

When price is these key levels in NO MANS LAND we tend not to take a trade, we will wait for price to retest these levels and wait for a break or a bounce before jumping in a trade. I keep saying it and I will keep saying it until you get p#@sed off with me...... but patients is key!!!!!!!

Get the larger timeframe charts up ( we like to use 1 day and 4H charts ) and zoom all the way out... this will make spotting these levels so much easier.

So don't be a D@#k and practise this... it will make you a more profitable trader.

I hope this has helped you.

Educational

Dont be a D#@k... its DUCK honestly ;p Here we have some really strong support and resistance levels drawn on the chart ( green lines ) They are classed as strong because price touched them and then bounce a number of times ( I will let you figure these out for yourselves... I'm not spoon feeding you ) ;p

You can also see a lovely trend line TL that has been touched more than once, so this is also classed as strong.

Now because these levels an TL are strong a break of any of these could see a big move, again you can see all this on the charts.

When price is these key levels in NO MANS LAND we tend not to take a trade, we will wait for price to retest these levels and wait for a break or a bounce before jumping in a trade. I keep saying it and I will keep saying it until you get p#@sed off with me...... but patients is key!!!!!!!

Get the larger timeframe charts up ( we like to use 1 day and 4H charts ) and zoom all the way out... this will make spotting these levels so much easier.

So don't be a D@#k and practise this... it will make you a more profitable trader.

I hope this has helped you.

'

Coolio Gangstas Paradise, Support and ResistanceIf you can find a good support and resistance level or zone it will keep your bank account fed well for years.

As you can see the 1st purple arrow marks where price 1st tested this zone as resistance in 1995 when Coolio was at number 1 with "Gangstas Paradise" ( sorry if I've just made you feel old ) :p Then the price passed through this zone for the next few years eventually using it as resistance again in 2010, 2013 and 2017, Now price is currently in this zone again and has used it as resistance many times in 2018 and 2019, So 14 years ago this zone was 1st used and is still been used today, See why zones and levels are so important?

The same can be said about our bottom support and resistance zone but I'm sure your not that stupid you need that explaining also! Actually it is 2019 and there are a lot of brainwashed zombies about courtesy of the government, media and failing school system ;p

Anyway stop using your laptop to watch naughty adult movies and use it to find these key levels... you will also have a happy ending if you find them :p haha.

GBP USD Look at the bigger picture Purple arrows = resistance

Orange arrows = support

support/resistance level 1.28889

4H CHART - We can see resistance has been used and respected many times and price is currently at resistance level, So most traders would SELL rite?

1D CHART - Price is also at resistance level after respecting it on numerous times, so another SELL rite?

1W CHART - Price is respecting this level again... but as support, hmmmmm I can tell you are now confused and your thinking a SELL signal?

If you said BUY signal then give yourself a pat on the back ( if you are in a field full of cows ) ;p

This is the importance of looking at multiple timeframes on a pairing so you can piece all the bits of the puzzle together and you get an overall clearer picture.

Now then our reasoning for the BUY signal,

4H CHART - The last 2 candles formed were big bullish candles indicating a lot of buying power, enough to smash through this resistance level.

1D CHART - The last daily candle was a big bullish candle that also engulfed ( covered ) the bodies of the previous 2 daily candles BIG BUY SIGNAL, this also indicates that price will smash through resistance.

1W CHART - Last weeks candle closed as bearish but look how big its lower shadow was, price tried to break through our support level and failed to do so, closing above our level, this also is an indication that buying power is strong.

If price manages to break this support then we could see a further push higher and collect some nice pips from this trade.

So all roads lead to a BUY, we will see how this plays out at market open.

Trading Plan February 2019This is my trading plan for February 2019.

Will be working this plan for the rest of the year, and review December 31 2019.

This is based on:

- 2 years of crypto trading

- realisation that I suck at daytrading

- suspicion I could be good at macro swing trading

- recent education on Babypips and other trusted sources

The focus of the year is on:

- learning

- refining a system that plays to my strengths

- understanding risk management and R:R

- becoming effective at pulling the trigger on entries/exits

Profit is really not a concern for this year. Profit will come when I'm competent as a trader and can consistently show a meaningful, non-negligible winrate, net of fees.

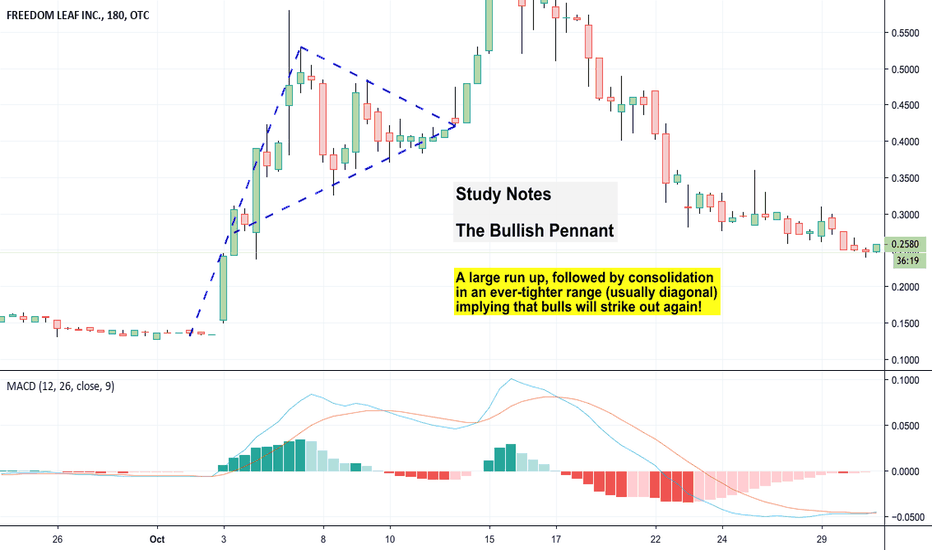

Study Notes - The Bullish PennantStudy notes based on the Babypips course.

Based on this article:

www.babypips.com

Bullish pennants are formed in an uptrend and imply that the bulls are about to charge again!

- Uptrend

- Breather, consolidation into a tight range

- Breakout to the upside

Flagpole can be used to measure size of the breakout upside potential

Bitcoin - Moving Average ZoneNot financial advise. Do your own research. The ideas shared here are the personal opinions of the BitDoctor team. Trade at your risk.

A slightly different perspective and not really looking at market formations but focusing on moving averages. There are a couple moving averages I want to focus on:

1. 200 Week Moving Average (Red) - ~$3175

2. 25 Day Moving Average (Green) - ~$3542

3. 50 Day Moving Average (Orange) - ~$3674

We are currently stuck between these 25 and 50 day moving averages but what I want to focus on is historical price action. We've been rejected at the 50 day moving average many times. I'm not sure I'd include Dec 24 as a front run rejection of the 50 but definitely Jan 8 and Feb 8.

If you take a loser look at the October- November timeframe, you'll notice we were suppressed below the 25 day moving average for quite a while and we were controlled by the 25 / 50 / 75 day moving average. We're close to being back there depending on what happens here at the 25/50. If we are able to break $3675 cleanly, I will be looking at the next target at $3850 but you have to be watching that resistance channel as well (in yellow).

All in all we are being controlled by the 200 weekly moving average and the 50 day moving average. These moving averages are converging on each other and I'm keeping my eye on the 75 / 100 day moving averages which is also creeping closer as days go by.

It will be interesting to see in the upcoming 2-3 days what happens. I am surprised we've stayed in this zone as long as we have.

Trade safely friends

<3 -CE-

Old Friends Meet AgainHere we have 3 different timeframes open ( 1D, 1W and 1M ) On the same pairing EUR USD, each chart has the same trend line ( TL ) and same support level marked on them, You can see how important it is to put these level on your chart and keep them there because if you look at the 1W chart you can see that price respected our support line in 2003 then fast-forward a few years price came back down and used this same level as really strong support in 2015, 2016 + 2017.

Also you can see our blue TL on the 1W chart, Price respected this in 2008, 2009, 2011, 2013, 2014 and 2018.... Come on tell me I'm talking s#it.

So go away and locate these important levels and TLs and I promise you will make money.

Keep charts simple... Dont let them fool youORANGE ARROWS - SUPPORT

PURPLE ARROWS - RESISTANCE

Look at the chart and tell me that support and resistance and supply and demand zones are not the way to trade, then I will tell you to folk off ;p

As you can see that every time price entered into one of our zones it bounced or if it did break it made a big move, the same happened with our support/resistance line... Come on people it really doesn't take a genius to work this stuff out!

Find a strong area/zone of support and resistance, place them on your charts and price will respect them time and time again for years to come, this gives you a head start over the market, you see peoples charts that look like an artist has thrown up over them, charts with more lines on than a table at a wall street office party :p.... These indicators only confuse you and stop you seeing what's going on, look at our charts they are nice and clean and you can spot setups easy.

Keep it simple and you will succeed, confuse things and the market will destroy you.

MARKET PSYCHOLOGY & CYCLEYou will often come across the term market psychology. This is different from your personal psychology. Market psychology is the same as market sentiment we just discussed. Market psychology is the overall feeling that the financial market is experiencing at any given particular time. There are several factors that contribute to this market psychology and include economic circumstances, expectations, fear, greed etc. All these factors taken together actually contribute to the trading patterns of the investors. There is nothing much you can do about this because, apart from hardcore economic circumstances, human psychology also plays a very vital role in determining the overall market sentiment.

The problem is that all humans cannot be rational. Many of the traders will be driven by emotions like fear and greed. As an individual trader, no matter how rational you are, the moment you see that majority of people thinking that market will move in a particular direction, your rational mind will face a revolt from your emotional side and even if you know that majority of the people are thinking wrong, you may still end up trading in the direction they are trading.

It is because of this weird conflict between rational mind and emotional side that you cannot really depend solely on fundamental analysis of market. Often times, it is very important to go for technical analysis too because it will tell you, without taking account of emotions, the direction or the pattern that the market is following. Technical analysis is based on historical price data. This is crude data we are dealing. They are numbers that are brutally true. The numbers don’t speak emotions. But again, technical analysis cannot alone give you the true picture and you will have to use fundamental analysis at times. So, market psychology can be like a dreadful nightmare but that is what you need to deal with by balancing between your fundamental analysis and technical analysis. Knowledge and education is key to success in binary options market. You cannot afford to be irrational but you cannot even ignore those irrational traders who can and do affect the market as a whole.

Inspirational Quotes that will change your life by Ben WrightSELF DEVELOPMENT/METHODOLOGY/PSYCHOLOGY

Here is a collection of inspirational trading/investing quotes that i live by;

1. “investing in yourself will be the best investment you make in your life” – Warren Buffet

2. “Trade small because that’s when you are as bad as you are ever going to be. Learn from your mistakes.”-Richard Dennis

1. “The goal of a successful trader is to make the best trade money is secondary” – Alexander Elder

2. “ Everybody gets what they want out of the market” – Ed Seykota

3. “Time is your friend: impulse is your enemy” – Jack Bogle

4. “Don’t focus on making money: focus on protecting what you have” – Paul Tudor Jones

5. “There is only one side to the stock market: and it is not the bull side or the bear side, but the right side” – Jesse Lauriston Livermore

6. “The best traders have no ego. You have to swallow your pride and get out of the losses” – Tom Baldwin

7. “ An investment in knowledge pays the best interest” – Benjamin Franklin

8. “ The key to making money in stocks is not to get scared out of them” – Peter Lynch

What are your favourites?

Happy trading :)

Follow your Trading plan, remained disciplined and keep learning !!

Ben Wright's 3 Essential Trading Routines!! MUST SEE!!SELF DEVELOPMENT/METHODOLOGY/PSYCHOLOGY

Below are 3 essential trading routines that i follow on a daily basis. This has been a critical component to my success.

Morning Routine

1. Meditation (10 Mins)

2. Gratitude

3. Trading Affirmations (2 Mins)

• I am a successful trader

• I have a very strict risk management plan

• I use a trading journal

• I am unemotional about profits or losses

• I am patient and let high probability trades present themselves to me

• I am happy to take a profit and will not be greedy

• I have an edge and I trade it effectively and decisively

• Losses are a part of my trading

• I am relaxed and confident about my trading at all times

• I do whatever is necessary to win at trading

• Discipline means I follow my trading rules and manage my risk

• I am highly focused

• I am in total control at all times with my trading

• I am a master trader

• I am not stressed about relying on trading money to provide for the family

4. Visualization (Goals & Perfect Trading Day) (10 Mins)

5. Priming – (30 – 60 Sec cold shower)

Shocks your body system and activates endorphins

6. Motivation & Stretching (10 Mins)

Pre-Trading Routine

1. 3 Deep breaths

2. Gratitude

Night Routine

1. Read (30 Mins)

2. Affirmations (2 Mins)

3. Gratitude

4. Visualization (Goals & Perfect Trading Day) (10 Mins)

Happy trading :)

Follow your Trading plan, remained disciplined and keep learning !!

(Review) Definition trend and change of trend ( Trend reversal)(Review) Definition trend and change of trend ( Trend reversal)

EX:

Discussion:

Downtrend - Definition

A downtrend comprises a repeating sequence of:

1) A downward extension

2) A swing low

3) An upward pullback

4) A swing high

A downtrend ends when price breaks the swing high which leads to the lowest swing low of the trend

Uptrend - Definition

An uptrend comprises a repeating sequence of:

1) An upward extension

2) A swing high

3) A downward pullback

4) A swing low

An uptrend ends when price breaks the swing low which leads to the highest swing high of the trend

EX: Prior analysis ( Downtrend)

- Countertrend

- Reversal trend:

- Downtrend forming=> Sell

- Continuous downtrend

Please support the setup with your likes, comments and by following on TradingView.

Thanks

MUST READ!! Best Trading/Investing books to Read!!SELF DEVELOPMENT/METHODOLOGY/PSYCHOLOGY

Brett Steenbarger “Routine is necessary for efficiency; breaking routine is necessary for adaptation.”

Trading/Investing books that I highly recommend. Some of them are listed below;

1. Brett Steenbarger's books

2 . Van Tharp's books

3. Pit bull

4. Millionaire Traders

5. Think and Grow rich

6. Trade mindfully

7. Emotional Intelligence

8. The power of habit

9. The art and science of TA

10. Alexander Elder's books

11. Mark Douglas Books

12. The way to trade

13. Mean market and lizard brains

14. When markets collide

15. When genius fail

16. As you think

17. The power of your subconscious mind

18. Dark pools

19. Way of the turtle

This is a just a handful of books to get your started :)

Happy Trading :)

Follow your Trading plan, remain disciplined and keep learning !!

Please Follow, Like,Comment & Follow

Thank you for your support :)

[DAX] HOW TO TRADE THIS MARKETWhy consider this chart only as "education"? The answer is very simple, at the moment we do not yet know the corrective structure (ABC) levels, but we only know that the nearest support is around 11,000 and Target around 11.500. That said, the potential setup is very simple: Long on wave (B) breakout and stop loss below wave (c) . Unfortunately we can not always use this strategy, but in this case, yes! ;)

The most important thing for a Trader is not the setup, but it's Money Management : Volume Size and R/R Ratio .

The size depends on your balance, while R/R Ratio is shown on the chart, in this case we have a good ratio (>1:3) ... but this is just an example!

NOTE: Each setup can lose no more than 2% of your Capital.

If there are many traders interested in this market, we can follow this index together from Monday, and try some setups in real time, here on TradingView!

If you want to support us, click on Like bottom and stay connected on tradingView!

Thank you for your support!

*** "... your best friend is not the market, but the stop loss!" (C.R.)