When To Take Profits on Options I’m Markus Heitkoetter and I’ve been an active trader for over 20 years.

I often see people who start trading and expect their accounts to explode, based on promises and hype they see in ads and e-mails.

They start trading and realize it doesn’t work this way.

The purpose of these articles is to show you the trading strategies and tools that I personally use to trade my own account so that you can grow your own account systematically.

Real money…real trades.

Options trading is really fascinating, and it’s a great way to make money, and I think it is very important to know when to take profits, especially if you like trading The Wheel as I do.

So the question is, when should you take profits when trading options?

How exactly do you figure this out, is there a formula for it?

In this article, I’ll share some guidelines for how and when you should take profits on an option trade.

We will answer the question of whether you should let options expire or take profits early.

I will show you some very specific examples of two trades that I have going on right now (at the time of this writing on March 17th, 2021).

One of them, I took profits today, and the other one I’m still holding on and I will show you exactly why.

]How To Calculate Profits On Options

Firstly, let’s talk about how to calculate profits on options. In order to address this, there are two types of options traders.

One type of options trader are ones that are buying options, and the other, which I feel is very lucrative, and this is what I’ve been doing for a long time, is selling options and collecting premium.

I want to actually talk about selling options and receiving premium, because this is, as I said, what I’ve been focusing on recently with trading The Wheel Strategy.

My year-to-date profits on this account so far are more than $54,000 selling premium on options, and I’ll show you exactly how to do this.

So when selling options, you’re receiving premium, and for me, the most important metric here is the so-called premium per day or PPD.

MARA Example

The first example that I want to give you is my position with MARA. Looking over my transactions with MARA over the last 30 days.

I sold puts at a strike price of 20, and for this, I received $0.28 in premium per option that I sold. Now options come in 100 packs, so this means that per option I made $28.

Now, in this specific example, I sold 50 options total, so this means that I’m receiving a premium of $1,400. I put this trade on March 10th, and these options expired on 3/19.

This is $1,400 in premium in 9 days. This comes to $155.55 in premium per day, or PPD.

Now this includes weekends.

My rule is I’m buying back the option when I can get 90% of the maximum profits, but there’s an exception to this rule.

First, let me tell you what that means.

So again, I sold each contract for $28, for $0.28. The idea is to buy back the option at $0.03, and this is exactly what I did today (March 17th).

So we have another two days to expiration.

So today, I bought back a total of 50 contracts at $0.03, and by doing so I made $0.25 in profits on MARA.

Now, this is where again, we’re looking at 50 contracts, times $25, so this is $1,250. I was in this position for 7 days.

So $1,250, divided by 7 days, means that I made $178.57 a day.

Let’s just round to $179 per day. As you can see, $179 is more than the $155.55 that I planned per day.

Now let’s think about it. If I would keep MARA right now, if I would keep this option until expiration, but what would happen?

I would make an additional $150 in three days. This means that now my premium per day is only $50 per day.

This doesn’t make sense to me because this here is actually bad, because my plan was to make $156 per day, and I was able to make $179 per day by buying the options back.

If I would hold on to this trade and let it expires worthless. So this is where here, and let it expire worthless, right?

This is what would happen. I would make an additional $150 in three days and the premium per day would only be $50. That does not make sense to me at all.

This is why here in MARA, it made sense to buy back the put option because by doing so, it frees up buying power meaning that now I can sell more puts.

So the idea here is that I’m selling more puts and making more money on the new puts than I would make holding on to MARA.

DKS Example

Let’s go over another example with a position I have right now with DKS .

I sold the 66 strike on March 10th. I sold 15 of them and I received $75 in premium. 15 contracts times $75 comes to $1,125.

So let’s do the math right now and see if it makes sense to close this trade today (March 17th) or if we should keep it, and we’re using very similar logic here.

So we sold the 66 put expiring March 19th, and we received $75 per contract for it, $1,125 total.

We then divide this by 9 days to get to our premium per day, which is $125.

So right now, on March 17th, let’s see how much DKS is still worth.

Right now, the bid/ask for DKS is $0. 05 over $0.10, and that’s really interesting because I want to buy it back at $0.07.

Let’s say right now, if I would place an order right now, I could buy it back at $0.10. Should I do it?

If I did this, I would make $75, minus $0.10 ($10 per contract), which is $65 per contract. For all 15 contracts, I would make $975.

We find our PPD by dividing $975 by 7 days, which comes to $139. So if I really wanted to, and if I needed to free up some buying power, I could do this.

But let’s see what happens if we hold this for a few more days. So if we hold DKS until expiration, we can make an additional $150.

It might actually make sense to close it out because $150 over the next three days does not make a lot of sense.

When I looked at the option earlier, DKS suddenly jumped from 78 to almost 79.

This is a 10% jump in 30 to 45 minutes.

When we opened this morning, first, we went down, and then we went a little bit up, and then we were hovering right around where we opened.

Earlier this morning, the DKS put was trading at $0.25.

So the question is earlier this morning, would it have made sense to close it? Earlier today on March 17th, I could have bought it back for $0.25.

So that wouldn’t have made sense, right? Because then if I’m buying it back for $0.25, I would only make $0.50.

So this here, $0.50, this is then $750 in seven days, and if we divide $750 by 7 days, this is $107 premium per day.

As you can see, the $107 premium per day is less than what I expected. If I would hold DKS to expiration, we can make an additional $0.25, $25 times 15 contracts is $375.

Now, if you take the $375 in 3 days, that would be $125 premium per day.

So when I’m getting $125 premium per day, this is when it does not make sense to sell it just yet.

Should You Take Profits Early?

So this is the important thing because the question always is, do you take profits early, or hold until expiration? Well here’s my formula for this.

So I want to give you a very specific formula that you can use if you want to.

If the current realized premium is a premium per day, PPD, is larger than the planned PPD, this means close it out early.

If the remaining premium per day is smaller than the planned premium per day, close it.

Only if the current realized premium per day is smaller than the planned premium per day, in this case, hold it.

If the remaining premium per day is larger than the planned PPD in this case, you want to hold it.

Summary

This is why today I wanted to show you my formula for when to take profits on options, especially when you are an options seller.

You see, selling options and receiving premium is what we do with The Wheel Strategy, and the most important metric here is the premium per day (PPD).

This where using the PPD, you can actually get down to a formula of when exactly you should buy or sell.

This is where it’s just a good rule of thumb if you don’t want to do all these calculations.

So the rule of thumb is I close a trade when I can realize 90% of the maximum profits.

Strategy!

Options Trading For A Living In this article, I’m going to show you how I made $52,138 in 8 weeks by trading options (at the time of writing this article March 12, 2021).

The key question that I’m always asked is, “Is trading for a living possible?” For me, this is a resounding YES!

I’ll break down all the steps from how to trade like a pro, where and how to find great trades, how patience is extremely important when making money, and more.

What Do You Need?

You might be thinking, “How the heck does anyone make that much money doing something so risky?” The answer is simple.

You need:

Number One a solid trading strategy, which we will discuss in this article. We will talk about the trading strategy that I personally used to make more than $50,000 in the past two months, and I’ll show you how to do this step by step.

Number Two you need the right tools. You will see why that is so important, and I’ll show you the tools that I’m using.

Number Three you need the right mindset. I know that mindset is probably the most boring thing to talk about it, so I will not spend a lot of time on this, but having the right mindset is important if you want to trade for a living.

Now, there’s one more thing that you need, and this is money. I hate to break the news to you, but if you don’t have any money you can’t put money into your account, and you won’t be able to make money.

And yes, I made more than $52,000.

Before we talk about the trading strategy, let me just add a very, very important disclaimer.

No, these results are not typical. Yes, I am very good at this, and I’ve been doing it for over 20 years. If you start trading this strategy, do not expect the same results. I will talk about this later, but it is super important that you start paper trading on a simulator first.

How Much Money Do You Need To Trade Options?

The key question that you might be wondering is, how much money did I need to put into this trading account to make this much?

For this account, I deposited $250,000 in cash. This is a margin account, so this gives me $500,000 in buying power.

Let’s dive in.

The Wheel Strategy

If you have been following me for a while, you know that I like to trade using The Wheel Options Trading Strategy.

There are three steps to this strategy.

Step Number One , what we are trying to do here is sell puts and collect premium. When selling options, I typically like to go with expiration dates 1 to 2 weeks out.

The idea here is to collect a “weekly paycheck.” I’m putting this in quotation marks because this is where some people say you can collect weekly paychecks with no risk, and that is simply not true. When trading there IS risk.

You want to make sure that you trade only the best stocks. What do I mean by this? Well, currently in my account I have positions with companies like AAPL, AMD, DBX, DKS, GDXJ, HAL, HAS, IBM, and JWN.

These are all super solid stocks. These are not fly-by-night stocks. You will not see any GME, AMC, BB, BBBY, or any of these meme stocks in my account.

We’re talking about super solid stocks, stocks that you have to be okay with owning if you’re assigned the shares.

So let’s look at DKS , which is Dick’s Sporting Goods. They are a solid retailer. The idea here is that we are selling puts at a strike price that is at support.

Here I looked at short-term support. You want to see at what price level did prices touch several times and then bounce back. They were at the 66 level, so I sold a 66 strike.

If DKS closes above then I keep the premium, if it closes below, we would get assigned.

Now, another stock that I am trading right now is SNAP , Snapchat. Here we are looking at a strike price of 49.

Again, this is where you want to pick super solid companies. I don’t know about you, but do you have kids? My kids live on Snapchat. They’re not on Facebook, Twitter, or Instagram, but they’re on Snapchat.

I believe SNAP it is a super solid company. We see that we had support four, almost five times. So this is where I sold a strike price at 49.

You want to make sure that you’re only trading the best stocks and that you always look for support. The support that I like to see is a support level that held at least over the past 8 weeks.

So, again, step number one is where we’re selling puts and collecting premium. The basic idea here is that we are buying stocks at a discount, or as many people would say right now, “buying the dip.”

This is something that has been working really, really well. It’s a tactic that Warren Buffett has been using for many, many years to scoop up stocks at a discount.

Step Number Two is where you may or may not get assigned. This means that if the price at expiration of the stock is below the strike price that you sold, then you have to buy the stock at the strike price you sold it.

In this case, if this is happening, then you would go to step number three, which I will share with you in just a moment.

Now, if the price is above the strike price at expiration, then you don’t get assigned.

You just keep the whole premium and you would go back to step number one.

This is why it’s called “The Wheel,” because we keep doing this, right?

Step Number Three is when we are assigned, we will sell covered calls and collect more premium.

This is the strategy in a nutshell. As you can see, it is not really complicated. The trick is to trade only the best stocks with solid support levels in case you are assigned.

Using The Right Tools

The second thing that you need is powerful tools. Let’s talk about the tools that I personally use.

If you have been following me for a while, you already know that the tool that I use is the PowerX Optimizer.

Now, here are the two things for me personally that are super important when we are picking the right tools.

First of all, I want to have a scanner built-in. A good scanner not only finds the best stocks to trade, but also tells me what strike price to trade, and at what expiration.

When it comes to expiration, I already told you in broad strokes, I’m only trading one to two weeks out.

But should I trade this week’s expiration or next week’s expiration? This is super important, and this is where a tool helps me.

The second thing, which for me is super important, is that the tool has a calculator.

With this calculator, it tells me exactly how much premium I should get, how much risk is involved in this trade, right?

These are the important things you need to know.

Then, of course, a calculator should tell you how many contracts should I trade based on my account size.

When trading options, you know the important things are, that you know what is the underlying stock, what is the strike price, what expiration, what is the minimum premium you want, and of course you want to know the risk.

So let me show you exactly how I am finding these stocks. So here we see the PowerX Optimizer.

The scanner actually gives us a bunch of symbols that are candidates to consider right now. Now, one of the things that we need to do is we need to make sure that we only pick the strong stocks, and that we only pick those that have a good support level.

So one of the examples of a stock that I’ve traded recently is NIO . The scanner actually shows me in the data window what strike prices I should consider right now.

It also shows me what premium I can get, and how much this would be annualized.

What PowerX Optimizer told me is that right now I could sell at a strike price of 36.

And I would get some decent premium for this. Now, we always want to go back over the past few weeks, and if we look over the past 6 to 8 weeks, we see the support see, it touched the level three times.

So it looked like there was strong support at 36.

Now, the next thing is, and this is where PowerX Optimizer helps you, that you see exactly here how much premium you can get, especially if we are looking at it annualized, right?

For me, the minimum option premium that I should get to get at least 30% annualized.

For me, that’s what I want to do. This is how I was able to make more than $50,000 thus far this year, and it is only March 12th, and I started on January 11th.

Now I also want to know how many options should I trade based on my account.

How much in premium would I collect, and what is the premium per day that I would make? So how much money per day do I make when trading this?

This is where we go back to why it is so important to have a tool that shows me all this because let me ask you, how else would you find all this out? I mean, if you tried to do this manually, I don’t know, I mean, for me, this is almost impossible to do it.

So and believe me, no professional trader does this with only a calculator or a cell phone in his hand.

You must know your numbers. Trading is a numbers game, and if you don’t know your numbers, it will be really, really difficult for you to make money.

Another key question is, if you don’t have a tool, how else would you find these trades?

I mean, every single trade that I did in this account here, that you see over the past eight weeks, that have yielded $52,000, has been taken from this scanner.

I mean, if you would force me right now to trade without this tool, I couldn’t do it.

This is where I believe that having powerful tools like the PowerX Optimizer is giving you an unfair advantage.

Think about it, when trading you are trading against other traders, but you don’t have to be the best trader in the world, you just have to be better than the other trader.

You just need to have an edge, and this is where I must say this tool is actually giving me an edge.

If you want, you can even say that it is not only an edge, you could call this if you want to, an unfair advantage, but when it comes to trading, you need to play every ace. You don’t want to show up with a knife to a gunfight, you’re trading against the smartest traders in the world.

Traders Mindset

Now, this brings me to the last point here of how to trade for a living, and this is having the right mindset. This is something that many traders underestimate because they think, “Hh, you know what, that’s fine, I just need a strategy and I need a tool and I will just be fine.”

Having the right mindset is important, especially if you want to trade for a living. You must be focused on what I call SRC profits. This stands for systematically, repeatable, and consistent.

So this is what SRC stands for, and this is why this so important. You see, as a trader, for me, at the end of the month, I’m wiring money out of my account, out of my trading account into my personal account.

I mean, it's great when you have windfall profits. If recently you participated in the GME hype, and you double, triple, quadruple many maybe 10x your account, then good for you. Congratulations, and I really mean this.

However, can you do this again this month? What is the next stock that is going crazy like this?

Or if you were able to capture the Tesla ride all the way up, good for you, but what happened when Tesla went from 800 to 500? Did you take a hit in your account? See, this where it is super important to have these SRC profits.

When it comes to trading for a living it is also important that you have patience, and here’s what I mean. You’ve got to grow your account systematically. So, and how do you grow your accounts systematically?

If you don’t have a trading strategy, this is why it’s so important to have a trading strategy that produces these SRC profits, the systematically, repeatable, and consistent profits.

So you see how it all comes together. I mean, this is why there’s these three pillars, the trading strategy, the tools that are supporting your trading strategy, and the mindset.

Now, the other thing is that when you are trading, patience means that you can’t panic. You see this is where recently, people started talking about these diamond hands, but I think the way how some people talk about diamond hands is just holding on to a losing trade.

No, this is not the case. It basically means you let the trade play out. How do you let the trade play out? You follow your plan, but to follow your plan, you must have a plan.

So this is where it goes back again to having a trading strategy.

Summary

To sum things up, first of all, is it, is it possible to trade for a living? The answer for me is yes because that’s what I’m doing. Now, does it mean that you can do it?

Again, this is why it’s so important that you practice on a paper trading account first. So you’ve got to have the right trading psychology.

For the trading psychology here is that you are aiming for SRC profits and not the YOLO-windfall every now and then profits.

To start trading for a living, what are the things that you need? You need to have a strategy, you need to have the right tools, you need to have the right mindset.

Now, if you are looking for a strategy, today I presented to you The Wheel Strategy, which I think is a great trading strategy because it’s simple to understand and it gives you an edge, right?

You also want to have the right tools, and for the right tools, I might be biased, but I think PowerX Optimizer is the best tool not only for trading this strategy but also for trading the PowerX Strategy here.

The Wheel Options Strategy: 29 Things You MUST KnowI’m Markus Heitkoetter and I’ve been an active trader for over 20 years.

I often see people who start trading and expect their accounts to explode, based on promises and hype they see in ads and e-mails.

They start trading and realize it doesn’t work this way.

The purpose of these articles is to show you the trading strategies and tools that I personally use to trade my own account so that you can grow your own account systematically.

Real money…real trades.

Those of you who have been following me know I love trading The Wheel Strategy, in fact, with my $500,000 trading account that I’ve been trading on since mid-January, I just $50,000 in REALIZED profits for the year.

The Wheel Options Trading Strategy is a powerful trading strategy that can be fairly low risk IF you know what you’re doing.

This is why, in this article, I wanted to give you a complete squad of trading tactics for trading The Wheel Strategy.

I look through all of the comments on my YouTube videos & the questions that I get in my live streams, and I have compiled a list of the questions I get most often.

So today we’re going to talk about the 29 things you must know when trading the Wheel Options Strategy.

The Wheel Strategy Overview

So let’s briefly talk about the basics, and the basics of the Wheel Strategy, are actually pretty simple.

So let me just tell you the three steps that we need to do when trading this strategy.

Step Number One: We want to sell put options and collect premium.

Step Number Two: Here, we may or may not get assigned.

Step Number Three: If we are getting assigned we will sell covered call options and collect more premium.

If we are not assigned, then we will just stay at Step Number One, and keep selling put options to collect more premium.

So as you can see, it’s really not that complicated. I mean, wouldn’t you agree?

Now I divided this into 3 sections: The Basics, then Picking The Right Stock, because there’s a lot of questions about this topic, and then we will also talk about Selling Calls After Getting Assigned, as well as What To Do When a Trade is in Trouble.

The Basics

1.) I have around $30,000 in my Interactive Brokers account. Is it enough to start trading the Wheel?

Here is my recommendation. You should have at least $10,000 in cash so that you can get $20,000 in margin.

I highly recommend that you are trading a margin account.

If you have less than $10,000 in cash, I do not recommend that you trade with the Wheel Strategy.

Now, if you have a smaller account, I recommend that you do a maximum of three positions in your account.

As your account grows, you can go up to five positions in the account.

2.) What is the best expiration date when selling options?

What I personally like to do is go 1 to 2 weeks out, so this also means that I like to trade weekly options.

So I’m looking for a really short fuze here because I believe that this is where you have the most control over the prices here.

The idea is actually to collect so-called “weekly paychecks,” and I put this in quotation marks because it always sounds so glamorous, right?

However, it’s really important that you know what you’re doing here.

Now, the next question that I receive all the time.

3.) Should I use margin to increase my buying power?

My answer to this is yes, absolutely. I highly recommend this, however, keep in mind that margin is a double-edged sword, which can work for you as well as against you.

4.) How do I know if I have enough capital if I get assigned?

It’s easy. So let’s say that you are selling a 100 put, which means a put with the strike price of 100.

This means that when you’re getting assigned you have to buy 100 shares at $100 each totaling $10,000, so this is how much capital you would need.

So all you need to do is basically just take the strike price that you are selling of the put, times 100 because options come in 100 packs, and multiply this number by the number of options that you’re selling.

Let me give you an example. I recently sold 8 put options of Apple at a 133 strike price. So how do you know whether you have enough money in your account?

Well, this is where we are taking the strike price, 133 times 100, times 8. This means you would need to have $106,400 in your account.

So please make sure that you are sizing your account appropriately. The good news is, if you do have the PowerX Optimizer, which is the tool that I’m using, it will show you exactly how many shares you can trade.

So what you need to do here is that you are actually filling in your buying power, and again, your buying power might be different.

How many positions you want to take, and this is where I said if you have a smaller account fill in three, if you have a larger account you want to fill in four or five.

Then based on the strike price that you are selling here, it will tell you exactly how many options you should trade, and based on how many options it also tells you how much money you need, and how much margin is required if you were to get assigned.

I highly, highly, highly recommend that you do use a tool, because you see, if you do all the math in your head, it can go horribly wrong.

The tool that I personally use is the PowerX Optimizer. Many of you already have the tool, many of you are familiar with it.

5.) Is there a certain percentage you buy to close at? Some people say 50% profit is best statistically to close.

I like to close a position at 90% of the max profits. So as an example, this morning (March 10, 2021) I sold puts on DKS, Dick’s Sporting Goods, and I sold them for $0.75.

So this is where right now I have a working order in there to buy this back at $0.07, which is 90% of $0.75. So, yes, if I can get 90% of the max profit here, this is when I want to exit.

6.) So is there a rule of thumb of what percentage this account is tied up with the strategy?

It really depends on how many trading strategies you use, right? So right now I trade two strategies. I trade the PowerX Strategy and The Wheel Strategy.

The PowerX Strategy is perfect for a trending market, but the markets right now, are far from trending. They are super choppy going up and down, so, therefore, right now I’m dedicating all of my money in the account to the Wheel Strategy.

Once I start trading the PowerX Strategy again, this is where I would just decrease the buying power here and say instead of using the $500,000, I might just use, let’s say 400K, and use 100k for the Wheel Strategy.

7.) What screening criteria does the PowerX Optimizer use for the Wheel Strategy?

The PowerX Optimizer has a built-in scanner to find the best candidates for the Wheel Strategy, and there’s a conservative scanner as well as an aggressive scanner.

For my criteria, we are looking for stocks between $5 and $300 here. We are also looking for stocks that have a down day because when you’re selling put to collect premium, you want to make sure that you’re selling when the market is going down.

We are also looking at the implied volatility because want to make sure that there’s enough premium there.

Then most importantly, we want to make sure that the annualized premium is actually at least above 30%.

There are a few other minor criteria. First of all, we only look for stocks that have weekly options. This is what I explained briefly a little bit earlier, I’m not interested in trading stocks that only have monthly options.

8.) What can I expect? 30% yearly annualized based on what capital?

The capital here this would be based on is the buying power. So in my account, I have a $500,000 buying power.

This means if I’m looking for 30% based on the buying power, so this would yield into 60% based on the cash that I put in the account because the cash that I put in the account was $250,000.

So when I’m talking about the 30% yearly annualized, it’s based on the buying power. If you don’t trade with margin, then this would be based on your cash.

Picking The Right Stock:

9.) Do you have a defined universe of stocks that are your “good list?”

Well, first of all, I want to make sure that I’m trading the stocks from the PowerX Optimizer Scanner, and then I just look for stocks that I like overall.

These are some of the stocks I've traded thus far this year:

There's been DBX, DKS, GDXJ, HAL, HAS, IBM, JWM, LL, MARA, MNST, NIO, RIDE, RIOT, SNAP, and many more others.

These are stocks that I really like to trade, and as you see, most of them are very well-known names so I’m not trading any exotic stocks.

You also will not find meme stocks like GME or AMC on this list here.

10.) Is there a certain level of IV, implied volatility, on a stock that you won’t go to? I’ve traded some 200% plus of IV is that too high?

Just as a rule of thumb, the higher the IV the higher the risk. This means that now stock can really swing back and forth. So for me, what I feel is a sweet spot, I like to see at least 40% IV, but no more than 100%.

Sometimes I do take trades that are higher than 100 but honestly, for me, the sweet spot where you find most trades that are fairly safe is anywhere between 60% to 80% implied volatility.

This is where I don’t have hard rules here, but I need to like the stock.

11.) Markus, have you changed from your “When I started I just wanted to know the symbol. I did not want to know anything about the company, as it might cloud my view. Trade what you see, not what you think” mentality?

My answer is NO, for the PowerX Strategy. I absolutely do not want to know anything about the symbol. However, for the Wheel Strategy, the answer is YES because when trading The Wheel Strategy I only want to trade super solid stocks.

12.) So I noticed that some of the stocks on your list for the Wheel have very illiquid weekly options. Do you watch for options liquidity or just the credit limit and hope to get filled?

For me, I don’t care about open interest and volume, and here’s why.

I am selling premium and I’m fine letting the option expire worthless, so I don’t need to buy it back.

If I can buy it back I will, otherwise no. So this is where here I don’t care about the open interest.

But again, it really depends on the strategy. I mean, if you’re trading a different strategy, open interest and volume might be very important to you. For me, it is not.

13.) Besides technical support/resistance levels, how do you objectively decide which are the best stocks? Do you take into account any fundamental analysis to filter out which underlying to trade?

No. So here is what I do, and this is it’s pretty subjective, so I don’t have objective criteria here.

I must like the company, because the point is, you must be OK owning this company, and I must like the story of the company. Yeah.

This is where I always use Peleton as an example because I know that many are trading Peleton and it has lots of premium in there.

But you see for me, Peleton, it’s a company that I believe can easily be ripped off, and at some point, a major competitor might swoop in.

So I must like the company and the story of the company. This is fairly subjective here because the key is that you must be OK owning that stock at the strike price.

14.) Since you are suggesting not to sell puts on leveraged ETFs, why are they then included in the Wheel Scanner?

You know what? This is a great question and we actually might exclude them in version PXO 2.0. So right now I thought you’re all adults, and as adults, you can do whatever you want.

I did not want to restrict you, so but we might exclude it or, we might add an asterisk as a warning sign.

It’s a good suggestion, and I know that some get blinded by premium on leveraged ETFs. So I do not trade leveraged ETFs, anything that has 2x or 3x in the description I stay away from this.

15.) Why do you select growth stocks only instead of a mix of value and growth stocks? Seems that growth is in trouble due to interest rates.

Growth stocks offer attractive premiums, but value stocks rarely do. I want to give you a very specific example here, and let’s actually go to IBM, because IBM is one of the value stocks that I have traded.

I traded IBM after a massive drop where I sold the 117 strike. Usually in IBM, you won’t find enough premium in there.

The implied volatility lately, is usually around 34 or 29. So this is the very simple reason why I’m going for growth stocks because I’m looking for a minimum of 30% annualized in premium.

Selling Calls After Getting Assigned

16.) If you sell a call lower than your original put strike price can you still make money?

This is actually super dangerous, and here’s why.

So when you sold a put you got assigned, and you had to buy stocks at the strike price.

I’m using an example of AAPL, and I was assigned Apple at $133 per share.

Now, if I’m now selling a call, it means that I have to sell stocks at the strike price, so if I’m selling, let’s say a 125 call, it means that I have to sell the shares for $125.

Now here’s the challenge with this. I bought them for $133 and now I’m selling them right now for $125.

This means that I’m losing $8 per share. Now when you’re trading options, they come in 100 packs.

So this means that you would lose $800 per option. So this is where you need to be careful when you’re selling a call lower than your original strike price.

If you do this, make sure that it is above your cost basis, and we’ll talk about the cost basis here in just a moment.

17.) Why are covered calls more profitable in your experience than cash-secured puts?

Are you targeting a different percentage return?

No, I do not. Here’s a rule of thumb for what I do. Let’s jump to PowerX Optimizer and go to the Wheel Income Calculator.

Here is something that I did today (March 10, 2021) where I sold calls on RIDE.

Yes, and let me, let me quickly double-check before I do this, what did I sell on RIDE?

So on RIDE I sold calls that expire March 19th, and I sold them for $0.35, and the calls that I sold were at 23.

So by doing this, this actually gave me an annualized return.

By default, I am not going as many strikes out, because all I need here right now is a rise in 7%.

So if you are rising seven percent here, then I will be able to make money not only on the premium that I collected, the 16.45, but also an additional $7,000 on the stock, right?

So this will be a total of $8,500.

It’s just the nature of the beast because when you are selling calls you’re usually closer to the strike price, and therefore, usually higher premium for a higher ROI.

This is why I keep telling you, I’m always looking forward to getting assigned because selling calls is actually more profitable.

18.) When you sell calls to reduce the cost basis, do you also include the premium received from selling first the put to reduce the cost basis?

Yes, I do include the premium.

19.) Is there a risk of the portfolio becoming nothing but stocks and not being able to sell covered calls out of the money (OTM) to hit your targets?

The answer to this is absolutely yes.

When trading there’s risk, and there is a possibility that you own a bunch of stocks and you cannot sell calls against.

So you have to hold on to these, and so for a few weeks, it could absolutely happen that you’re not making any money.

I was recently assigned shares of AAPL, and have not been making any money with them because I have not been able to sell calls.

But you see, even though I have one dud in my account, it’s only one of my positions, and I still have been able to make almost $51,000 in about 8 or 9 weeks.

So, therefore, it’ll even out. So is there a risk? Absolutely.

When trading there is always risk. If you are not willing to accept the risk when trading, do not trade, because there’s always the risk of losing money.

20.) Markus, if you haven’t sold a call against the Apple 103 strike price haven’t you been missing out on money?

Not really, and here’s why. Right now, if I would try to sell a 133 call on Apple, that is, for example, expiring this week, I would get $0.01.

I’m not missing out on any money, right? $0.01 translates into $1. So, no, I’m not missing out.

Even if I would go out next week and I’m looking at the 133, I would only get $0.14.

That’s $14. For me, it’s not worth it, and again, everybody’s different, so you might have different rules. For me, however, it’s not really worth it.

21.) When running a rescue mission on margin, how does one sell a covered call? My broker requires cash for any call that I sell.

If this is true, change the broker immediately, and here’s why.

So I own Apple shares, and if right now I want to sell calls against these Apple shares, let’s say 8 calls, it would not have any effect on my buying power.

It’s the opposite

So here I highly recommend you change the broker if this is true. Your margin requirements should be reduced when selling a covered call, this is how it works.

22.) Why not still sell calls at your cost basis after the stock drops?

Because sometimes there’s not enough premium.

If there is enough premium, I will do it, but sometimes there is simply not enough premium and then you are sitting on your hands.

This is why I said I have this, the one dud in my account, AAPL, is not making me any money, but everything else IS making me money.

I was able to sell calls against GDXJ and RIDE. With DKS, MARA, and SNAP, I sold puts.

So everything else is making me money. I mean can’t change the wind, I can only adjust my sails and this is what I’m doing here.

What To Do When A Trade Is In Trouble

23.) What do you mean by “rescue mission” for those who have not heard it before?

But a “rescue mission” is where you have been assigned shares, and now the trade is going against you. You sell more put options below the assigned strike price.

By doing this you collect more premium. If you are assigned, you lower your cost basis, making it easier to get out of that trade.

You only should consider flying a “rescue mission” if the stock is down at least 30% from your assigned price.

24.) Why not still sell calls after your stock drops?

Because there might not be enough premium in there.

So very simple, right? If there is, we will do it, if not like with AAPL for me right now, then it is what it is.

25.) What happens when you run out of buying power and can’t sell calls at your target?

So first of all, you can always sell covered calls, because you will not run out of buying power for selling covered calls.

What they probably meant is what about not being able to sell puts, and there are two things that you can do.

Number one, you can either wire more money into your account, which is probably not always feasible.

Number two, you can simply close some positions to free up some buying power.

26.) Is it possible to buy options rather than sell options because selling options is supposed to be very dangerous?

Well, of course, and that would be the PowerX Strategy.

So with the PowerX Strategy, you are buying options if this is what you prefer to do, and if you’re trading the Wheel Strategy, this is where you’re selling options.

So pick your poison. I mean, you got to do one thing, either you’re buying options or you’re selling options.

So I have a strategy for each of these.

27.) Any point in waiting to make sure that the market has stopped dropping before flying a rescue mission?

Yes! You don’t want to try to catch a falling knife.

Wait until you see that the market or the stock is stabilizing here.

28.) I understand starting the rescue mission when the stock drops 30%, how do you determine the new put strike price to enter? The next support level?

Yes, absolutely. This would be the next support level that you’re looking at.

I got assigned at 21.50, and the next possible support level is right around 12,13, so this here it would be a strike price of 12–13, so this is where I would do it.

If we go to Apple, which is another stock that I have, I did get assigned here at 133 and the next support level is around 108, right?

So I would probably be most interested in selling the 108 strike price.

29.) It’s hard to make money on a small account unless you get assigned.

Yes, it is hard to make money on a small account, period.

I know that many want to start with a smaller account, like $500 or $1,000, but honestly, it is super, super, super difficult to make money on such a small account.

In order to do this, you would have to trade this account way more aggressively, which means that you are basically risking a whole lot.

So if you want to try to double a $500 account, you basically have to risk the full $500.

This is what many Robinhood traders and these YOLO’ers do.

It’s all-in and maybe it doubles or you lose all of the money. So, yes, it is absolutely difficult.

So this is why the capital requirements, I highly recommend that for the PowerX Strategy if you want to trade it, that you have at least $5,000, and if you want to trade the Wheel Strategy, that you should have at least $10,000 in cash, which gives you $20,000 in buying power we talked about this at the beginning of the show here.

So this is super important.

If you do have smaller accounts, there might be trading strategies for you.

I want to be honest with you though if there are, I don’t know them.

When I started trading, I started with an $8,000 account and I saved until I had $8,000.

Now, I shredded that account into pieces, down to $1,600 and then I saved money up again.

Then the second account that I was trading was $16,000.

Now that one, I also lost more than half. So I lost, I traded this down to $8,000 and this is when I put some more money in, brought this up to $12,000, and this is when it finally clicked.

So again, if right now you have a smaller account, good luck, there might be strategies out there. I wish I had some for you.

I promise, if I knew how to grow a $500 account I would tell you.

If right now, if all I had to trade was with $500 to trade, I wouldn’t do it.

I would probably find a way to save money or make extra money with Door Dash, Insta Cart, or something like this until I have at least $5,000.

I wish that I could tell you something different, and unfortunately, I can’t.

I’m not saying that it is impossible. All I’m saying is that I’m not the right person to teach you these strategies because I don’t know them.

Summary

If I didn’t cover a question here in this article that you may have, I promise I’m reading through all of the questions that you have, and I will answer them in one of the upcoming Coffee with Markus episodes.

I hope that you enjoyed this article because I love talking about trading.

Anyhow. Have a fantastic rest of your day and I’ll see you on the next one.

Why trading with Pine script can give you an extra month a year!I've spent around 9/10 years trading with technical analysis.

I used to spend 2/3 hours on a weekend and easily 1/2 hours each day on the screen - that doesn't include the amount of times I'd be checking from my phones on and off throughout the day too!

So add that all up - its 620-700 hours per year.

Frightening.

We trade for freedom and time - not to spend that time looking at a chart.

Well, in my opinion anyway.

A month is 720 hours - so pretty much an extra month a year.

Crazy right?

Fed up, I created a systematic approach.

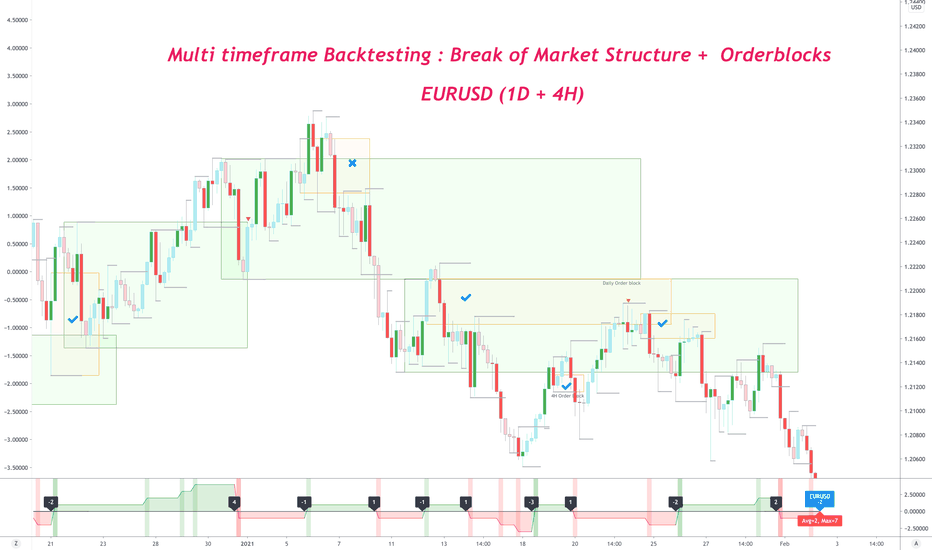

This video highlights how my systematic strategy works vs. how you would see the markets technically on the last GJ sell.

Pinescript makes all this easier too, I have data at the click of a button!

Any questions feel free to drop me a DM.

Thank you,

Darren.

How To Lose Money With CONFUSION (timeframe mixing) The issue for many new traders is understanding the correlation between timeframes. We often get caught up in indicators, news hype, chat room posts, and various other things.

One of the biggest challenges I see when talking to new traders is simply the lack of "experience" in reading multiple timeframes. This causes confusion and even self-doubt. The issue with the internet being so vast is there is a lot of info - but what do you go with & why?

In this post I have tried to "dumb it down" - the simple idea is to pick your timeframes based on your trading style.

Now if work gets in the way and you need to trade end of day or even swing (Longer-term) then really, you shouldn't stress so much about a 15 minute candle. A lot can happen throughout the day. But on the opposite side of the spectrum, if you are sat in front of your screen every minute the market is open. (scalping) then trying to work out what the monthly is doing whilst you hold a trade for an hour is not going to affect your trade (in general).

To give you a great example of this - I trade COT data as it's swing, with Monthly and weekly bias. I will have a mentee say something like "COT is a buy, but the price has dropped". Yes if you're looking at the 4-hour candle. If you think what institutional players can manage in terms of drawdown, especially using hedging techniques. It's far greater than the guy investing £5k of savings into Bitcoin.

If a hedge fund buys Bitcoin at 45k and the price drops to 22.5k - the likelihood is they have a hedged position & will be buying it all back at fair value. Whereas Mr £5k has lost some sleep & half of his capital - bailed, only to see the price shoot back up above his original entry.

You think of someone like Elon Musk - if his entry of a Billion Dollars was at 40k (example) and price drops to 20k, he has a paper loss of 500m for sure, it will hurt. But again if the Tesla share price drops from 800 to 700, he has a paper loss of (say 20 Billion) - a 500m loss on paper is less of a concern. *** You get the picture.

Investors & traders know that things don't just moon! they have dips, impulsive moves and so on.

So take the charts into account - You have an idea of what timeframes to pick based on your own personal availability or your style you have already identified. As a scalper it's easy to use 4 hour or even a 1 hour candle for your bias - a 15minute for a local area of interest & an entry on a 1m - 5m chart. (example only).

If you trade swing trades (depending on the overall time & expectations) a weekly bias, a daily interest and a 4hour trigger could be what you look for.

Here are some examples;

In these examples - all I have done is used 1 tool. This is only to show the idea - If stochastic is up then I want to be Bullish, if down I'll consider Bearish moves. Keep in mind this could be anything from above/below a moving average, a key price level or a magnitude of other things. Even other tools like RSI for example.

Example of step down

The idea is this gives you a directional bias.

Then we look at the area of interest.

And finally - we want to look down on the next timeframe for the trigger (entry)

Traders can easily get confused with one timeframe saying one thing and the next timeframe up or down saying something else. If you can treat it like a tick sheet, you can step down with confidence and work on a strategy favouring your directional bias & that's in confluence with the time period & your expectations.

This really is an oversimplified breakdown. Just to give a general idea.

Have a great week!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years’ experience in stocks, ETF’s, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

A Quick intro to Moving Averages (Beginners) I have recently had some questions on some of the basics such as moving averages. First of all, there is some great free content out there via sites such as Babypips

I wanted to share some simple info to at least explain what a moving average is. Where it is used and what are the types of.

Moving average is a simple, technical analysis tool. Moving averages are usually calculated to identify the trend direction of a stock or to determine its support and resistance levels. It is a trend-following—or lagging—indicator because it is based on past prices.

They also form the building blocks for many other technical indicators and overlays, such as Bollinger Bands, MACD and the McClellan Oscillator. The two most popular types of moving averages are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

Moving averages are a totally customizable indicator, which means you can freely choose whatever time frame they want when calculating an average. The most common time periods used in moving averages are 15, 20, 30, 50, 100, and 200 days. The shorter the time span used to create the average, the more sensitive it will be to price changes. The longer the time span, the less sensitive the average will be. @TradingView has many of these tools to use under the list of indicators.

A simple moving average is formed by computing the average price of a security over a specific number of periods. Most moving averages are based on closing prices; for example, a 5-day simple moving average is the five-day sum of closing prices divided by five. As its name implies, a moving average is an average that moves. Old data is dropped as new data becomes available, causing the average to move along the time scale.

Then you have an Exponential Moving Average (EMA).

reduce the lag by applying more weight to recent prices. The weighting applied to the most recent price depends on the number of periods in the moving average. EMAs differ from simple moving averages in that a given day's EMA calculation depends on the EMA calculations for all the days prior to that day. You need far more than 10 days of data to calculate a reasonably accurate 10-day EMA.

Highlighting the difference between an MA & an SMA - The Smoothed Moving Average (SMMA) is similar to the Simple Moving Average (SMA), in that it aims to reduce noise rather than reduce lag. The indicator takes all prices into account and uses a long lookback period.

Then how it can be used and applied, *** There are many strategies out there, the most basic starts with above or below a level (above = buy, below = sell) And then it steps into two moving averages crossing for example. Also as I mentioned above - other indicators use a form of moving average to calculate their plot.

Another simple strategy - Investopedia

This moving average trading strategy uses the EMA, because this type of average is designed to respond quickly to price changes. Here are the strategy steps.

🍒Plot three exponential moving averages—a five-period EMA, a 20-period EMA, and 50-period EMA—on a 15-minute chart.

🍒Buy when the five-period EMA crosses from below to above the 20-period EMA, and the price, five, and 20-period EMAs are above the 50 EMA.

🍒For a sell trade, sell when the five-period EMA crosses from above to below the 20-period EMA, and both EMAs and the price are below the 50-period EMA.

🍒Place the initial stop-loss order below the 20-period EMA (for a buy trade), or alternatively about 10 pips from the entry price.

🍒An optional step is to move the stop-loss to break even when the trade is 10 pips profitable.

🍒Consider placing a profit target of 20 pips, or alternatively exit when the five-period falls below the 20-period if long, or when the five moves above the 20 when short.

I hope this helps - Please feel free to add more info below. Any suggestions & comments to help new traders, always appreciated.

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years’ experience in stocks, ETF’s, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

❗ What to look for when I post an idea - Check the Trade Log! ❗A quick video running through how my ideas work and why they're different!

Trading for me is all in the detail and the planning now.

Know your numbers and your data and you can plan properly.

You know if your strategy or system works or not and you can ensure your risk management is in line with probability.

Rule number one is...

You cant run out of money, else you're out of business, right?

You can even run out of money with a profitable strategy, if you risk to much and hit a losing streak - even if the strategy is profitable!

Trading is a long game, not about retiring off that one lucky trade you might hit over the course of a week.

You'll also give the profits back with interest anyway.

Talking from experience!

Have a great weekend, any questions - feel free to reach out vis the DM.

------------------------------------------

I try and share as many ideas as I can as and when I have time. My trades are automated so I am not sat in front of a screen daily.

Jumping on random trade ideas 'willy-nilly' on Trading View trying to find that one trade that you can retire from is not a sustainable way to trade. You might get lucky, but it will always end one way.

------------------------------------------

Please hit the 👍 LIKE button if you like my ideas🙏

Also follow my profile, then you will receive a notification whenever I post a trading idea - so you don't miss them. 🙌

No one likes missing out, do they?

Also, see my 'related ideas' below to see more just like this.

Interested in access to my strategy so you can be in these trades the moment they're valid? Drop me a DM .

The stats for this pair are shown below too.

Thank you.

Darren

Why Most Traders Lose Money — Here Are The Top 3 ReasonsI’m Markus Heitkoetter and I’ve been an active trader for over 20 years.

I often see people who start trading and expect their accounts to explode, based on promises and hype they see in ads and e-mails.

They start trading and realize it doesn’t work this way.

The purpose of these articles is to show you the trading strategies and tools that I personally use to trade my own account so that you can grow your own account systematically.

Real money…real trades.

Anyone that has been around the markets and trading for any period of time has probably heard that most traders lose money.

In fact, there’s actually an old trading adage that says:

90% of new traders will lose 90% of their account within 90 days.

So after reading that, before you reach for your broker’s phone number to wire out all of your money… how about I let you in on a little secret:

If you follow some simple rules and avoid these 3 mistakes, you can be in that minority of traders that actually make money consistently in the markets.

And if you are currently making one or all of the mistakes, I’ll also show you exactly how to fix it.

So let’s dive in!

1) Most Traders Enter A Trade Too Late

The first thing on my top 3 reasons why traders lose money is: Most traders get into trades WAY too late!

There are a lot of reasons this happens, but most commonly it’s because new traders are basically gambling.

They’re buying stocks or options based on news, or a hot stock tip, which really isn’t what I would consider a strategy.

So let me give you a great example with a company I’m sure you’ve heard of: Uber Technologies (Yes, enemy #1 for taxi drivers worldwide.)

Last year UBER , known for its popular ride-sharing and food delivery services, IPO’d in May (2019).

With the disruption this company caused, their IPO had a lot of hype surrounding it, bringing a lot of investors to the table.

On the day of their IPO, UBER opened at $42/share and people poured into the stock.

For a few weeks, the stock had a turbulent, roller coaster of a ride all the way to as high as $47.08/share, a little over a 13% increase since its IPO.

And around this new high, more and more inexperienced retail traders piled in thinking that it would continue its bullish run with dollar signs in their eyes.

The mainstream media was continuing to hype it and more and more and investors and traders gobbled up more of the stock.

Looking at the image below, you’ll see after that high of $47 things got UGLY fast, with UBER falling day-after-day, week-after-week.

It wasn’t until November of 2019, about 7 months after their IPO that UBER found a temporary bottom at $25.58, down more than 45% from its high of $47.08… and I would bet there were a LOT of people who bought near or at the highs and were still holding at that point.

So what did retailer traders do when UBER made a bottom?

Yes, once again most (losing) retail traders didn’t get in at, or even around the bottom… once again, they piled as UBER neared its previous highs.

And as you’ll see yet again, UBER rolled over on its way to making another new all-time low this past March 2020 going all the way down to $13.71/share.

That’s more than a 70% decrease from its ATH and yes, I’m sure some investors rode it all the way to the bottom.

Now I want to share a second example with you, so let’s take a look at Amazon AMZN .

So as you know, AMZN is a HOT STOCK and last year it has a crazy move where it crossed $2000/share…. and yes, just like our example with UBER , inexperienced retail traders piled in at the very top.

Once again, in the weeks that followed, AMZN’s stock tanked leaving those who’d piled in dazed and confused, now holding onto sizable losses.

So as you can see, the first of my top 3 reasons most traders are losing money is simply because they’re piling in way too late in a stock’s move, generally near a high.

Now on to reason number 2:

2) Most Traders EXIT Too Late

Yes, as you can imagine if people are getting in too late, well, they’re also typically getting out too late as well.

So let’s talk about why this happens.

Why do retail traders tend to hold onto trades way too long, either turning a small loss into a BIG loss or sometimes even more painful, turning a winner into a loser?

Let’s take a look at another example with an UBER competitor, LYFT .

Like UBER, LYFT also had its IPO in 2019, opening up at $87.24/share… but that didn’t last long.

In less than two months, LYFT went as low as $47.17… and what do you think those who bought during the IPO are saying right about now:

“Oh, I’m holding it because IT WILL TURN AROUND!”

This is generally where I see traders get religious

Instead of ‘taking their medicine’ and getting out when the trade moved against them, they held on and are now pleading and praying the stock will turn around.

I hate to be the one to break it to you, but ‘hope’ is not a strategy… at least not one with a winning trading record.

Now on to number three in our list of top reasons why most traders lose money:

3) They Don’t Have A Trading Strategy

As you’ll see, I’ve saved the best for last as this one alone can help fix or eliminate the other two we just discussed.

So first, let’s answer this question: What Is A Trading Strategy?

Well, a trading strategy gives you three key pieces of information you need before ever entering a trade:

1) It tells you WHAT you are trading. Is it stocks, options, futures, cryptocurrencies? This is answered in your trading strategy.

2) It answers when you ENTER a trade.

3) It answers when you EXIT a trade and that’s exiting with a profit or loss.

Now, let’s take a look at an example here using TSLA on how I make trading decisions.

I like to look at three different indicators, that when in alignment, give me a clear signal to go long or short a stock or ETF.

As you can see on the charts, back in December of last year (2019) my indicators gave us a long signal on TSLA at around $370/share.

And the indicators told me we were good to go until around $850/share.

All I had to do is let the indicators tell me when to get in and when to get out… no guessing, hoping or praying.

Summary

So as you can see, there’s actually no big secret to why most traders are losing money.

It’s actually pretty simple to see and correct, but it takes a plan and a little bit of discipline.

If you’re brand new and not sure where to get started, I’ve written The PowerX Strategy, a book that outlines my EXACT trading strategy for trading stocks and options.

Why S and R works so good - Spring & Upthrust WyckoffWelcome Traders to a new Educational Posts.

Today we will have a deeper look at Support and Resistance. One of the most popular chart techniques out there, but the question?! Do they really work?

Absolutely YES. But probably not like most of the traders think they do. That simple Break and Retest Strategy. NOOO!

I would like to introduce you to the extended version of Support Resistance. The Wyckoff Spring and Upthrust.

Wyckoff Spring and Upthrust

In other words they are simply the Fake Outs at Support and Resistance Levels. The idea behind it is to get an entry exactly there where most of the trader will put their SL.

-> WHY?!

because of the LIQUIDITY

The whole market is based on Liquidity (Supply Demand). The bigger fish will always win. Those who have the bigger amount will always dominate here. Just FACTS . So how do you want to position yourself in the market. Exactly there were 95% of the Retail Traders will put there SL? Or do you want to change your perception on how you view the market.

This will completely change your view on the Forex Market.

Supply Demand

What I also do is I use my own style of Supply Demand to identify exactly those areas where most of the trader will put there SL and I will place exactly my Entry there with a very tight SL to get bigger Risk Reward. Of course I will not have that much of valid entries for my setups as they do not occur as often as Support Resistance Setups but the Total Risk Reward is a complete new Level. WHY?

Example Upthrust

Because you are rocking the market with the market movers. You are always clearing with these entries both sides.

#1 Sellers at Resistance because of Upthrust

#2 Breakout Trader(buy) because of Upthrust

Sell is the right decision in this case but most of the Traders will lose that Trade due to SL hit. Everybody is placing the Entry and SL different but the majority is losing this trade.

Spring Example

This was the bigger manipulation as the price did a strong move to the downside through the level of Support. This level was a very interesting level for Retail Traders to buy. Doji occured for Price Action Confirmation but the price dropped down to the level of Demand. Why? -> Liquidity. All SL were located there so Market Movers had there buy limit order placed exactly there.

Conclusion

With this Post I do not want to judge Retail Traders using Support Resistance. Maybe you found a nice Strategy with that and you are profitable. I am also using Support Resistance but simply in a different way as you can see. I just wanted to share with you my thoughts behind Support Resistance and how I use them to be profitable

Please leave a LIKE if you found this Post useful and share your thoughts below!

Trading The Wheel Options Strategy — 3 Reasons Why You’d Lose MoI’m Markus Heitkoetter and I’ve been an active trader for over 20 years.

I often see people who start trading and expect their accounts to explode, based on promises and hype they see in ads and e-mails.

They start trading and realize it doesn’t work this way.

The purpose of these articles is to show you the trading strategies and tools that I personally use to trade my own account so that you can grow your own account systematically.

Real money…real trades.

So, as you know, I love trading the wheel options trading strategy, and this past week was a roller coaster for this strategy.

Friday morning I woke up and my account was down $25,000. Now I’ve been trading a larger account.

It’s two hundred fifty thousand dollars in cash, five hundred thousand dollars in margin, so $25,000 is not that much, but still.

So in this article, we are going to talk about the Wheel Options Strategy.

We will talk about the three reasons why you would possibly lose money with this strategy and also how to avoid these mistakes.

So here we'll talk about my account.

As you know, this show is about real money and real trades, and at the time of this writing, I am still down about eighteen thousand dollars.

So it has gotten a little bit better since this morning, but down eighteen thousand dollars. So we’ll take a look at these trades in detail.

But first of all, let’s talk about the three reasons why you would lose money with this strategy and then also how to avoid them.

3 Reasons You Would Lose Money

So there are three big mistakes that you can make when trading The Wheel strategy.

So the first is panicking. If you are somehow trapped in a position and you say, what the heck do I do now?

I often see traders who say, “What do I do now?”

So solution number one is don’t panic. Easier said than done, right?

But not panicking is so important.

This is what one of our members posted in our community. “It’s not a loss if you don’t sell.” so the worst thing that you can do going back to this is panicking and closing your positions at a loss.

Don’t do this. Don’t close your positions, & evaluate what’s happening.

The second mistake is not having a plan.

Mistake number three is not having the right trading tools.

So, now I will go through my positions that I had and then I will show you how I handled them with my plan.

Then we will also talk about the third mistake in more detail, and then some more solutions.

My Positions

So five positions that I had in my account were (On February 26, 2021):

AAPL

AMD

DBX

GDXJ

RIDE

So let’s start with AMD first.

If AMD were to stay above 83.50 until the remainder of the trading session (at the close that day), I’d make money.

Everything that happens with my positions, I write this down, and I recommend you do the same thing so that you know of what’s happening to your positions.

You will know which ones are actually in trouble and which ones are good to go.

So if AMD closed above 83.50 nothing would happen, and I would keep the whole premium.

For this trade, this was $576 in premium for the week. Not bad at all.

The second position is DBX which is Dropbox.

So Dropbox needs to stay above 21.50 and it was trading at 22.85. So it seemed that we were pretty good there.

You might be wondering why I am talking about the positions that are OK?

You see, in order to stay calm and to make sure that you’re not panicking, focus on the positive first.

I know if you’re taking a hammer and you smack one of your fingers, what do you focus on? The finger that hurts. Right?

But you have four other fingers that are absolutely fine.

So it’s important to focus on what’s going right for us.

So if DBX stays above 21.50, which is very likely. So I sold 47 of these options for $13 totaling $611 in premium, so not bad at all.

So what’s happening with GDXJ?

So the week prior I got assigned because it expired below my strike price.

So I got assigned 2,100 shares at $48.

Now, here’s what I did with this. So let’s forget these shares for just a moment and let’s again focus on the positive of what’s working well for it.

I sold covered calls at the 49 strike price, and I collected premium.

So how much premium did I collect for these calls? I sold 21 contracts for $75 each.

So I collected for this trade, $1,575 in premium.

So we are OK there, and I still have the shares, because they expired worthless.

So the next position is RIDE.

So if it stays above 21.50 I just collect the premium and nothing else happened, but the price stayed below.

I got assigned 4,700 shares at $21.50 so this position is in trouble, we will deal with that at some point, but here’s the good news.

I still collected $1,974 in premium.

So the last position here is AAPL, and I did get assigned these shares a week prior.

So I have 800 shares and I’ve not been able to sell any calls against it.

So here I have 800 shares at 133, and also these shares are in trouble because Apple right now is trading at $124.

So I got assigned and now AAPL is down. Not good.

I still collected all this premium and it all added up.

So because overall, it was a pretty darn good week, collecting $4,736 overall.

I don’t know about you, but this is not bad at all.

And I know you might be saying, “oh my gosh, you’re talking about making some money here, but what about all of these red positions?”

Why You Shouldn’t Worry About Being Assigned

We’ll take a look at these starting with RIDE

This is where it goes back to what is the worst thing that you can do? Panicking.

Like if I were to sell for example.

If I would sell these shares instead of collecting the premium that I have here, I wouldn’t have made any money on RIDE, I would have lost $8,272 instead.

I don’t know about you, but I would rather keep the premium of $1,974 instead of losing $8,272.

For me personally, I will not worry about it.

So here is where it goes back to. What do we do? Follow your plan.

So you got to follow your plan, and this point I’m about to make is very important.

I’m actually excited to get assigned, and in a moment you will see why.

Your reaction should be, “Yes! I am assigned because I want to own the stock.”

I’m really, really happy about this. I’m happy about having stocks.

Or your reaction might be this where you say, “oh my gosh, what have I done?”

If this is your reaction, then you violated the number one rule of “The Wheel Club,” and here’s the number one rule of the wheel club:

"Don’t sell puts on stocks that you don’t want to own".

OK, wrong movie, but you get the idea right? So let’s take another look at my positions.

Am I happy to own AAPL stocks? Yes, I am. Am I happy to own GDXJ and RIDE? Yes! Would I have been happy to own AMD stocks if I was assigned? Of course! Absolutely!

OK, so let’s take a look here at the stocks that I’ve traded thus far year to date.

And as you can see, my profits year to date, around $43,000.

Take a look at all the stocks.

These are the stocks that I would not mind owning at all, and this is really the number one rule of The Whale Club. So Apple, AMD, DBX, GDXJ, HAS, IBM, LL, WYNN, ect. All of these are good, solid stocks that I wouldn’t mind owning.

So let’s talk about what do we do with RIDE.

Why am I so excited to own it? This is where it goes back to having a plan.

So my plan is just to follow The Wheel strategy, and this means that after assignment, I will sell covered calls and collect premium. Very, very easy.

This is where we go back to mistake number three, not having the right tools. I use the PowerX Optimizer and I will show you right now how to use it and why it is so important.

So PowerX Optimizer supports two separate strategies.

The PowerX strategy as well as The Wheel strategy and part of the PowerX Optimizer is the real income calculator.

I set my buying power to $500,000 because that is the buying power that I have in the account.

So the stock I want to use as an example is RIDE.

Let’s plug in some numbers and see what our premium is on this one for if I get assigned these shares, and start selling calls.

So getting assigned 4,700 shares at 21.50.

Now, the option strike price that I’d try to sell would have to be at the price that I bought at or above.

The last traded price was $0.43, so let’s assume we’re selling the shares at that same price.

So I’m using the strike price here of 21.50 and I’m selling calls for $0.43.

If I did this I would get $2,021 in premium! Wholly Cannoli, are you getting excited about this? I’m excited about this. Now you see why I’m excited to get assigned.

If you add this with the premium I’ve already collected on RIDE from selling puts, which was $1,974, that’s almost $4,000.

You get the idea right? So I would not make any money on the stock but that is OK. So is this stock really in trouble if I make 4000 dollars in two weeks? I don’t think so.

So one trade that I had last week that wasn’t doing so well was AAPL.

I got a signed AAPL at 133, so I need to see if I would get enough premium to sell calls.

This is why it is so important & I can’t even stress this enough, how important it is to have the right tools.

Having the right tools help you make the best decisions instead of panicking.

Back to AAPL, I was assigned 800 shares at $133.

How much premium could we get for selling calls?

So right now, if we sell calls with expiration for the end of this week, at the 133 strike price, we would only get about $0.13, and I would only make about $104 which is nothing.

So out of all these positions, Apple is the only one that right now is kind of in trouble because I not yet able to get enough premium when trying to sell calls, but that is OK.

All I need to do is just be patient and wait until AAPL goes up.

Summary

In the meantime, I do believe that Apple is a solid company, and I don’t mind owning the shares.

This is where we go back to rule number one of The Wheel Club.

“Don’t sell puts on stocks you don’t want to own”

because if you do this, then you probably sitting there today, like, what have I done?

But I hope this helps you see how to deal with being assigned and that you also see, how to handle things when a trade is in “trouble.”

Just sell covered calls, and collect premium. If there isn’t enough premium available to sell calls, just wait until it bounces back, it’s really not a big deal.

I am absolutely OK making $4,736 last week with the potential to make another $3,000 this week.

Not bad at all, as you know.

My goal is to make $15,000 per month. If I can make $7,000-$8,000 in two weeks. I’m well on my way.

Granolabar's Gap Down Guide (my own style)Introduction

Within the past week, AMEX:SPY has become increasingly volatile, with massive gap ups and downs

followed by all day runs extending more than 3% in either direction. This is apparent with a cursory glance at the following chart.

With this volatility comes uncertainty, especially for those who are swing trading on the timeframe of a few days to a few

months. However, we can use this increased volatility to our advantage. i am going to introduce my way of trading these days,

particularly the ones involving gap downs.

Identifying the Setup

Identifying the setup is relatively simple, but there are a variety of factors that can improve your chances of success.

Firstly, the stock needs to have gapped down overnight. This one is quite obvious and easy to identify; look for a literal gap in

the prices going from after hours to premarket, like those identified in the following chart of SPY.

Secondly, there are a few things that can improve the chances of this strategy playing out. For example, if the stock recently hit