RSI Overbought & Oversold Strategy

What Is the Relative Strength Index (RSI)?

1. The relative strength index (RSI) is a popular momentum oscillator introduced in 1978.

2. The RSI is displayed as an oscillator (a line graph) on a scale of zero to 100.

3. An asset is usually considered overbought when the RSI is above 70 and oversold when it is below 30.

4. The RSI line crossing below the overbought line or above the oversold line is often seen by traders as a signal to buy or sell.

5. The RSI works best in trading ranges rather than trending markets.

Strategy!

Martingale Strategy

Martingale Strategy

1. The Martingale Strategy is a strategy of investing or betting introduced by French mathematician Paul Pierre Levy.

2. It is considered a risky method of investing.

3. It is based on the theory of increasing the amount allocated for investments, even if its value is falling, in expectation of a future increase.

4. When the Martingale Strategy is used in trading, the trader must double the position size when faced with a loss.

5. The Martingale system is a methodology to amplify the chance of recovering from losing streaks.

6. The amount spent on trading can reach huge proportions after just a few transactions.

7. If the trader runs out of funds and exits the trade while using the strategy, the losses faced can be disastrous.

8. The risk-to-reward ratio of the Martingale Strategy is not reasonable.

Calculating the Breakeven Point (BEP)

1. Current Total Investment = (1*BTC@49348.17) + (2*BTC@39342.32) + (4*BTC@21117.39) = 212502.25

2. Breakeven Point = Current Total Investment / (Total Number of BTC) = 212502.25 / 7 = 30357.48

50 Day Moving Average Strategy

TRADE ENTRY

1. To enter a 50-day moving average trade, you should wait for a breakout.

2. Whenever the price breaks the 50-day SMA, you should open a trade in the direction of the breakout.

3. In most cases, the price action will continue in the direction of the breakout.

STOP LOSS

1. If the price breaks the 50 SMA upwards, we need to go long, placing a stop below a bottom prior to the breakout. The opposite is true for bearish trades.

2. If the price breaks the 50 SMA downwards, we need to short the stock placing a stop below the bottom prior to the breakout.

PROFIT TARGETS

1. Hold your trades until the price action breaks your 50-day moving average in the direction opposite to your trade.

2. If you are long, you close the trade when the price breaks the 50-day SMA downwards.

3. If you are short, you close the trade when the price breaks the 50-day SMA upwards.

CONCLUSION

1. Stock price above the 50-day moving average is usually considered bullish.

2. Stock price below the 50-day moving average is usually considered bearish.

3. If the price meets the 50 day SMA as support and bounces upwards, consider a long entry.

4. Stock price meets the 50-day SMA as resistance and bounces downwards, consider a short entry.

5. If the price breaks the 50-day SMA downwards, you should switch your opinion to bearish.

6. If the price breaks the 50-day SMA upward, you should switch your opinion to bullish.

An Idiot's Guide to EURUSD: 5 Steps to Success 💲💲💲Synopsis

If you trade Forex then you know the weekends are the best time to analyse the market. Everybody likes to talk about how volatile EURUSD is, but what they don't tell you is that the market is ranging a good 80%-90% of the time; good deals do NOT last long. In fact, half of a days price movement can play out in 15-45 minutes, It's that fast. The best entries are usually snatched up in a matter of minutes, meaning that slow momentum oscillators and lagging trend following indicators don't perform well in these conditions. EURUSD in my opinion trades a lot like CL (crude WTI), where trading decisions need to be made while volatility is low to mitigate risk. Translation: if you can't win in a range, you're going to blow your account in this market, trust me.

I see so many people on here setting targets 2-3 times the daily atr with the expectation that they'll be paid by the end of the day or the next day. Don't do that, please. It's not a sprint, it's a marathon. Long term gains depend on practical consistent returns, not 10:1 RRs. It's actually a lot more realistic to take ZERO to two 20-40 pip trades per day. Over the course of a week it adds up.

The chart:

This week we came off of a really strong bullish surge away from parity, and the market then did what it does best, range. And the way that prices are moving right now is just classic EURUSD, I love it...I get so nostalgic, because ranges like these are how I learned to trade; the way that the market recycles over and over makes it so fun to trade, it never gets stale. Since it's the weekend and the markets are closed, I wanted to take this opportunity to share with anyone who might be wondering what it's like to day trade this market.

How to trade ranges:

Step 1: Find your levels...

The easiest way is to map out support and resistance zones. On the chart, I use my own variation of the Williams fractals indicator (I call them Neo fractals 😎) for every prominent swing high or swing low, the indicator draws a horizontal ray from the highest, lowest close and projects it out into the future. You can see the spots where lines start stacking up in a certain price range act as stronger support or resistance than the areas with only one dotted line. It only takes about 5-10 minutes per day to do this by hand though, so an indicator definitely isn't necessary. It's really important to be able to eyeball pivot points yourself anyways.

Step 2: Determine market phase...

After you've mapped everything out, it becomes a lot clearer what's happening in the market, and if the market is ranging or trending. If the market's ranging, you will see far more s/r lines on your chart especially once you start seeing s/r lines stacking up close to one another. A clear giveaway that the market is ranging is when price makes strong moves in one direction, only to return back from where it came, later in the day. Once you've determined what phase of the market you're even closer to spotting high quality trades.

Step 3: The next step is to find areas of value...

In general you want to find the areas within the range which provide the most exclusive prices, And steer away from price ranges that hold 80-90% of the activity on the cart. Being 5-10 pips in profit before a big move will completely change the way you feel about a trade when it starts to go against you (plenty winning trades will go against you, especially if you're trading reversals). On the chart you can see that the supply and demand zones only produced 2-4 trades this week, but all of them were for over 50 pips. These aren't the only trades you can take, but they're definitely the highest RR trades, you can get in a ranging market.

Step 4: What for confirmation...

There are so many ways to confirm a move, but my favorite for this market is a phenomena that I like to call a spike. (There's probably an actual name for it, but I'm self taught so I just make stuff up as I go 😅) Find a hammer or star candle on a higher chart like the daily or 4hr and it look at that time period again on a lower timeframe, what you'll see is that the hammer or star is actually just a large price movement in one direction followed by an equally large movement in the other direction. What might appear as a spike on a lower timeframe will appear as a hammer or star on a higher time frame, and the larger and longer the chart pattern takes to complete, the larger and longer the move will be in the opposite direction. These are the Rolls Royce of signals. When you realize that a head and shoulders pattern is really just a series of spikes, it will completely change the way that you trade. In my experience, trading price spikes alone out performs every other chart pattern there is, because most candlestick and chart patterns are made up of a series of spikes anyways. Most consolidation periods end in a large spike followed by a 1-200 pip surge in the opposite direction. They appear most often on higher timeframes as hammers and stars, or large engulfment. but on the lower time frames you can watch these things play out over 5 ,10 or even 100 periods sometimes. The key is to have very strict rules for what you consider a spike to be, how many pips? What kind of ratio are you looking for? is it happening in an area of value? etc.

Step 5: The range leads to the trend...

The reason that trend following strategies under perform in this market is because strong trends don't last long on EU AND getting good value is insanely competitive. The key is to spot these trends early, you have to be looking when nobody else is looking. That means waking up earlier than everyone else and having a plan in place before the move happens...Not seeing a big candle and just hopping in. I try to have a daily strategy in place before the Asian session ends, that way, I''m ready for London and NY. I live in the US, so that means I'm waking up everyday around midnight to 1 in the morning. But most of the time, if my trade starts well, I go back to bed and check back in around 7. If you want to trade EURUSD, that's what it takes though. There might have to be lifestyle changes that you have to make (especially for North and South American traders) in order to really commit yourself to this market and give your trading it the attention that it needs.

EXIT STRATEGIES: Money ManagementHey traders,

Today I wanted to dive into exit strategies. A lot of you will already have a very clear understanding of what an exit strategy is and how you usually go about it. Most of you are probably automatically thinking of stop losses and take profits, which is fair enough. Today however, I wanted to dive into some more advanced techniques. I want to have a look at what you need to be thinking about prior to entering a trade, during the trade, and then finally when it's time to get out. Yes, we use stop losses. Yes, we use take profits. But I know from my experience personally, it's very rare that I actually get my full stop loss hit. I'm usually out of the position prior to those levels.

This all falls under money management, which is by far the most important aspect of your trading ability that you need to understand. We are money managers as traders. When we are risk on, we have money live in the markets. It is our job to manage it accordingly. Win or lose, the success comes down to if we are managing position and risk correctly.

Now, this blog is a little bit more directed to our day traders or people who are constantly having positions with the whole idea of set stop losses and take profits. For investors, it does differ a little bit and I'll touch on that now. When it comes to buying a stuck or an asset, it is very easy come up with a trade idea. You find the idea, you buy, simple. What makes it really difficult is actually finding the appropriate time to sell. That's what actually makes the good investors. Because equity, yes, it is still extra cash in your pocket, but you don't get that cash actually in your pocket until you have hit that sold button and realized your profits. My biggest outlay to anyone in any type of investing is have an exit plan prior to entry. Have a minimum requirement, have a maximum requirement, and what to do in those scenarios. I've seen it many many times before, especially with the recent cryptocurrency boom that people just get in expecting it to go up with no exit strategy, so they never exit because it's constantly moving up. Then, Unsurprisingly, the market pulls it back in and they lose all of their equity profit. They find themselves trying to close out of their position before it's a big loss. Always have an exit plan.

Now lets dive back into more of the day trading market. When it comes down to exits of the market. Most people use stop loss orders or take profit orders. These are orders you can set on your brokerage platform, which essentially, when that asset reaches a certain price, the server will read that and automatically pull your position at your requested price. These are the most common ways to manage risk. It's a very beginner friendly. It's very easy to find an area where to put your stop loss, put your stop loss, put your take profit, walk away and let the trade unfold. However, today, let's get a little bit more advanced.

There are a few questions you need to ask yourself prior to entering a position. Regardless of looking at the profit potential (which is the biggest pull). Start associating yourself with the risk you are taking in order to open this position.

The first question I want you to ask yourself is, how much are you willing to risk on this trade?

Risk is an important factor when investing right to determine your risk level. You need to understand what is not going to affect or hurt you, but still generate enough profits to make it worthwhile in your eyes. Finding that medium balance of what you can handle when you go and drawdowns is going to be highly beneficial to risk the right amount and not go emotionally insane every time you're in a position. Once you understand what dollar value you're willing to risk, then you just position size accordingly and have a stop loss on your chart and there you will know your maximum risk. That is what you are going to lose if all goes against you on this position.

Once you have the basic understanding of how much you're risking per position, you want to try and avoid hitting that stop loss at all costs. So while you're managing your position (this is something I like to do personally) if everything is going against you, it's usually a sign that it's going to continue that way. Yes, statistically, there's going to be sometimes it may be reverses. That's the beauty in backtesting your strategy so you have an in-depth understanding on what it is capable of. I look to start scaling out of my position, which means selling off my position size as we move towards the stop loss. As I mentioned above, it's very rare that I actually hit my Max loss stop loss statistically. Looking back at my journal, I've actually scaled more than 75% of my position out prior to hitting a full stop loss if not all of the position. This is giving me an incredible advantage when it comes down to statistics, because while I can still hit a full take profit and a full position in profits. But I am not hitting a full loss, so my risk to reward has actually rapidly increased, even though it's still very similar when I'm entering the trade.

The second question I want you to ask yourself is, where do you want to get out?

Where is your take profit? Where is your stop loss? But also look within those areas where realistically are key indications on where this price is going to move. Do you have to get through four or five support levels to reach your take profit? Should you start looking at scaling out some of the position in the profits around those levels? The more you have to go through, the harder it is going to be to actually achieve the profit. Have an exit plan. Where are the levels you want out?

And finally, and this is probably the biggest one, how long you are planning on being in the trade?

If you're trading down on the five minute chart, do you really want to hold this trade for two days? If it takes that long, do you only want to be trading during this market hours? Where do you want to cut this trade? This is really important because most people, especially the set and forget traders, they don't have a time limit on their trades. They allow it to just run over multiple sessions. But The thing is, the longer it runs, the less than analysis becomes true. Have a look at the time frame you're trading. If you're investing, look at the yearly outlook. How long do you really want to be holding this stock before it actually does something? I know we're not options traders. Some of you, maybe, but it is a good idea to have kind of a time scheme that you don't want to be holding any longer than. I personally look to start scaling out of the position, taking risk off the longer the trade takes, especially if I'm trying to trade on volatility.

These are three questions to ask yourself and a little bit of tips and tricks when it comes down to scaling an managing risk on a more advanced level. Remember, as traders and investors, we are risk managers. We are money management specialists. Our job is to not lose money. When we stop losing money, profits will come in. Focus on your risk, focus on what you can afford to lose, and then focus on your positions and try and stop yourself from ever hitting that Max stop loss that you give yourself.

I wish you all success!

-Jordon Mellor

Candles continued.So here I am following on from the previous post, we have moved to the 4H chart, and I have taken a deeper delve into how to filter the candles out to find optimal ones, and look here, all the Bullish engulfing under the moving average... very poor performance, but the Bearish engulfing that is rejecting the moving average, remember previous post we talked about what price is attempting on pullbacks to the moving average? also has an orderblock rejecting as the moving average is down, remember what that tells us?? I will post the links to them under this post so you can go back over it. The Bollinger band squeezed just before aswell before the expansion. What to take away... Patience and optimisation! make the rules to your system click! do not react to every candle, find where price has action!

How to use EMA8 and EMA89 in your trading.Here I have shown how the EMA8 and EMA89 can lead to good results by using the EMA89 as a baseline and applying the rule, buys above the average and sells below. To find entries look for pullbacks to the average of breakdown and breakout of order blocks, things like inside bar to find momentum should also find results, you could experiment with oscillators in order to find these pullbacks easier. However most of the entries will usually give some good price action and this is important to keep an eye when using this strategy, you want likely reversals so use candles to enter that typically have a higher % chance of changing direction, things like engulfing candles and pinbars, not only will this keep the risk low, it will enable better rewards and consistency. Hope someone out there can find some use of this post :)

Education: Why your trading strategy win rate doesn't matter!What makes a profitable automated strategy?

Probably the biggest misconception for trading perpetuated in the mainstream is that you need to have a greater than 50% win rate to be profitable.

This is followed by a close second, of constantly assuming you need to have a risk-reward ratio of greater than 1:1 (e.g. 1:2, 1:3 etc). This one is perpetuated mostly by forex and stock market gurus.

By the end of this article, I hope to dispel these myths and aim to shed some truths on how to assess a profitable strategy.

Why your win rate doesn't matter:

Let's simplify this down using an example. Consider the following two strategies. Which one would you rather trade?

Strategy A: 50% win rate - When you win you make 2 dollars, but when you lose, you lose 1 dollar

Strategy B: 50% win rate - When you win you make 5 dollars, but when you lose, you lose 1 dollar

This one was a very obvious case of choosing Strategy B. In this case, both strategies have the same win rate, but Strategy B nets you 5 dollars per win, whereas Strategy A only makes you 2.

Let's take another example. A little less obvious this time. Which one would you rather trade here?

Strategy A: 90% win rate - When you win you make 1 dollar, but when you lose you lose 50 dollars

Strategy B: 10% win rate - When you win you make 200 dollars, but when you lose, you lose 1 dollar

Now the 90% win rate strategy may look attractive on the surface, but when you dig into it, you realise that you could get a massive 50 dollar loss in the 10% of times you do lose! For those of you who chose strategy B, this is the correct answer.

One way we can assess the above strategies is using Expectancy . The formula for Expectancy is as follows:

(Win % x Average Win Size) – (Loss % x Average Loss Size)

We can calculate the expectancies of the strategy below:

Strategy A:

(0.9 * 1) - (0.1 * 50) = -4.1

Meaning you are expected to lose an average of $4.10 per trade using strategy A. Not a good sign.

Strategy B:

(0.1 * 200) - (0.9*1) = 19.1

Meaning you are expected to win an average of $19.10 per trade using strategy B. This is a major winner here!

As you've probably realised. It is possible to have a profitable strategy using a low win rate. Many trend trading/breakout strategies tend to have lower win rates, but with larger rewards to risk, whilst mean-reversion strategies tend to have higher win rates with less frequent but larger drawdowns.

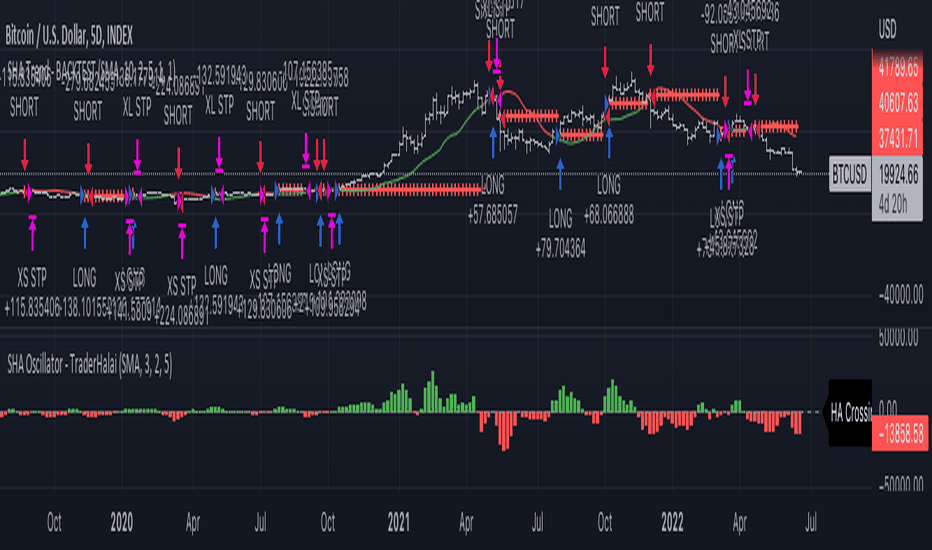

The backtest shown in this post shows an example of a low win rate, and high win amount strategy using the Smoothed Heikin Ashi Trend on Chart indicator which I have developed, with an overall positive expectancy, backtest (note, no strategy is perfect, should not just blindly trust backtest data).

Why you may still choose to define a risk/reward

Better consistency of your strategy

Psychological factor of knowing that you can be expected to lose only x amount (assuming no slippage etc)

As an aside, note that defining a fixed risk-reward may hurt your win rate (which could impact your expectancy) so it's important to backtest to see if you get better results with defined risk-reward parameters. This is beyond the scope of the current article, but an important consideration.

Why do traders gravitate toward a higher win rate?

The simple answer here is that everyone wants to be a winner! It's human nature to want to be right, whether this be about a market direction or when to open or close a trade. It's often easier to brag about how much you win whether that be on social media or just feeling good about yourself.

For algorithmic traders, having a higher win rate may also provide psychological benefits, as losing 20 times in a row can sometimes be very daunting for traders and can throw doubt into the efficacy of your system.

I hope that through this article, I have managed to convey that it may be prudent consider strategies with low win rates also, as these can be very profitable in their own right.

Digging further:

This article is only just scratching the surface of how to create and validate if a strategy is something that you should consider trading. There are many aspects of backtesting including Monte Carlo simulation, understanding standard deviation of returns and risk, Sharpe ratio, Sortino ratio, walk-forward analysis, and out-of-sample analysis to name a few that you should conduct before you evaluate a strategy as suitable for live trading.

If you've made it this far, thanks for reading. If you like the content, feel free to like and share, as well as check out some of the free scripts, strategies and indicators that I have published under the scripts tab.

Thank you!

Disclaimer: Not to be taken as financial advice, anything published by me is purely for education and entertainment purposes

IS IT TIME TO CHANGE THE STRATEGY?In order for your strategy to start making a profit, it takes time, patience and discipline, no matter if you bought it or developed it yourself.

To see the weaknesses and strengths of the strategy, you need to test it, and this means strict adherence to the rules for a long time.

At some point, there may come a situation when it is worth abandoning the strategy in order to develop further.

But when should it be done?

That's what I want to talk about today.

How to understand that the strategy is outdated and it's time to get rid of it?

I present to you four signs that it's time to get rid of the strategy:

1. Inability to follow the rules

Any strategy implies rules to be followed.

Take a look at the list below:

• It is too specific;

• It is extremely uncertain;

• It's too complicated;

• Contains a large number of items/rules.

If your strategy contains these items, it's probably time to get rid of it.

The strategy should not be too complicated, otherwise you will not be able to use it. At the same time, it should be understandable.

If you don't understand your strategy and can't change it, make it easier, then it's time to throw it away.

2. You spend a lot of effort and end up getting nothing

Do you sit in front of a monitor screen all day all week?

Do you compare a large number of indicators to confirm the signal?

Does your strategy require you to turn to the sun and recite the alphabet in reverse order at exactly 5:30 in the morning?

If it is inconvenient for you to use your system consistently for long periods of time, or if you believe that it brings plus or minus the same number of points of profit in comparison with not using it at all, then it's probably time to look at other options.

3. You lose more than you gain

This applies to those who prefer to buy ready-made strategies from other people.

Although not all strategies available on the market are "divorce", the chances that you have chosen one of them are very high. If your signal provider generates more various signals for entering and exiting the market every month than real profits, then it's time to admit your mistake.

The same applies if you use your own system, but pay a lot of money for subscribing to some data - you should also think about replacing your strategy with another one.

4. It just doesn't make a profit

There is not much to say here.

If you have shown due diligence and tested your strategy, tried to revise it, adjust it and launch it in various market conditions.

If it still won't bring you profit, then obviously it's time to move on in search of a new strategy.

Thank you for your time – I hope this will help you and your trading.

📊How to make a trading strategy?What helps the traders to be successful? That's right, their trading strategies. A trading strategy is a trader's plan for deciding whether or not to open a trade. The purpose of the strategy is to help the trader to make more successful trades, to analyze the mistakes and successes. At a time of uncertainty, these rules help to keep calm and make the right decision. Simply put, it's a set of filters that remove unnecessary noise from the charts and help you make right decision.

💹How to develop a trading strategy? Figure out what you want to trade and what you're best at. Do you like trading false breakouts? Let`s do it! Like to trade patterns? Perfect! Pick your best 20-30 possible trades from the past on the chart, and look for those patterns to repeat on the chart.

As soon as you get a chance to make a trade, remember the rules of your strategy, and if they all match, then do it.

💹What does a trading strategy consist of? This set of rules includes:

1️⃣ The tool you use (patterns, levels, indicators, waves, candlestick analysis, etc.). For example, a squeeze under the trend line, a false breakout of a level, the exit of the indicator into the oversold or overbought zone - all these trading tools can be used in your strategy.

2️⃣ Risk Management. How much money to use in 1 trade, risk per trade. This is a mandatory ingredient of any trading strategy. You can't be 100% right on every trade, so risking all of your capital is not advisable. The average win rate of traders is 50-60%. That means that 5-6 out of 10 trades will be successful - an excellent result. The other 4 trades will be either loss-making or break-even, so it is better to start with a small amount or virtual account on the crypto exchange. In the picture below, you can see what the risk-to-reward ratio and winrate should be.

If you have 50% of successful trades, then at least in each trade you should have RR 1:2 (for 1 risk you receive 2 rewards). To calculate your RR in TradingView, use the "Date and Price Range" section on the left side of the screen and choose "Long Positions" or "Short Position".

✅Example of a trading strategy.

Tools:

🔶false breakout of the key level;

🔶volume indicator.

Description: you marked a key level of $30420 on the chart. After the false breakout you noticed that a large volume appeared on the chart.

Target: the level of highs of $42K.

Risk to reward (RR) 1:5. Good for us? Let's look at the table! The win rate of this strategy is 50% and so RR profitable.

🚩Summary: by opening a trade with a risk of $10, you got $50.

💹Advice for beginners:

1. the trading strategy does not have to be yours. You can take the rules from another strategy and adapt them to you, make your own risk management, rules of entering the trade, in the end, how many trades you make per week or month.

2. start with something simple, like a channel trade and a volume indicator that will show you the reaction of a buyer or seller when it touches the channel boundary. Gradually add filters to remove noise from your charts and increase your win rate. For example, do not open a long on altcoins if Bitcoin is falling. Statistically, 99% of cryptocurrencies repeat Bitcoin's movements, so it is unlikely to be a good trade. Unless you know the secret information, or you have more than 8 years in trading, and you have enough experience.

3. make screenshots of your best and unsuccessful trades, analyze problems and fix them, and try to repeat the best trades more often. A trading journal is best for keeping statistics.

🏁Follow your plan and you will succeed. If you still have questions about how to create your trading strategy, write in the comments. Experienced traders, how did you create your own trading strategy? Share it with the beginners!

💻Friends, press the "like"👍 button, write comments and share with your friends - it will be the best THANK YOU.

P.S. Personally, I open an entry if the price shows it according to my strategy.

Always do your analysis before making a trade.

SETTING REALISTIC GOALSHey Traders,

Traders whether they are new to the world of finance or have been involved for a while can benefit greatly from setting specific goals in correlation to what it is they actually want to achieve. There's a million different ways on focusing and goal setting in trading and a lot of people get it wrong straight out of the gates. To this day I still see some professional traders still setting their goals wrong. Traders need to get to focusing on the process of trading, including strategies, structures, journaling, whatever it may be. You have to focus on these processes set in place for yourself regardless of results. This can be so much more effective with getting to an area of consistency compared to just focusing on returns.

One key takeaway I want you to get from this post is all traders, whether novice or whether you're experienced, you should be basing your trading results off of how well thought out the trading plan was, which includes how the trades will be entered, exited, how the money will be managed. That right there is how you measure performance, not the Profit and Loss that comes from the trades.

Process Goal Setting -

Initially, when getting into trading, most traders look for some kind of goal surrounding numbers. We are all here to make money, to make percentage gains. So we tend to gravitate towards setting our goals based on what we want to return, what type of money we want to make, what time are percentage yield we want to bring in. This is damaging in its own right. It's very easy for people to say, OK, I'm going to try an make 1% per day and I'm going to do all my trading to make 1% per day. Then all of a sudden they start planning in the future. "Okay, I make 1% per day everyday for the rest of the year," and then all of a sudden they start calculating what they're expected to return and they give themselves these high hopes in achieving that. But The thing is, what they're not understanding is given their strategy, 1% per day might not be possible. We can't say yes. I'm going to make 1% per day and our strategy not allow that to happen. We may only find one opportunity per week given our strategy, we might only find three opportunities, but we have a 33% win rate. So having these unrealistic, number focused goals are really damaging because no matter how much work you put into it, it may not be possible.

Just like any other business, we need to develop a process. Anna system and our goals need to be set on doing that process an working that system correctly and consistently. So rather setting goals for, I want to make 5% this month. Set goals like I want to only take trades which are an A-Grade set-up in accordance to my strategy. I want to journal every trade for the next 4 weeks. Goals like these make you focus on the process, and I don't know a single business that is successful without a good process. Most businesses don't get profitable for a set period of time. Some even just fail. Without a process and without setting goals aligning with those processes will make your results be based on chance and not based on skill.

Aim for consistency -

When it's early on and you may still be demo trading or trading with a small amount of money, I want you to start aiming for consistency. Now I know that can be hard when running in drawdowns or perhaps even trading a strategy that isn't profitable, but what you can do is aim to be consistent in your process aim to be consistent in your decision making. Aim to be consistent in your risk management. What you will learn is whether your strategy is profitable or not. You will learn a lot about the market. What you will notice after a long period of consistency (Trade for at-least three months) is your areas that need improvement. let's stay consistent and every single day you do the same thing, you trade the same setups, you trade exactly the same way, which a lot of people don't have the self discipline to do. You will notice areas where you can improve on based off of those results. Most people give up and fail because they're not disciplined enough to remain consistent in a strategy which isn't providing them with the unrealistic returns that they're aiming for. If you sit down and you take it seriously for three months, win or lose, I guarantee you will take about 18 steps forward in the right direction compared to just sitting on the balance rope jumping from strategy to strategy.

It is okay to not trade -

This is where consistency and discipline delivers the reality check. The market is constantly moving, sometimes slow, sometimes fast, and that gives people the impression that their strategy is always valid and they always have to be risk on and always have to be trading. This isn't the case. Trading during slow times or making impulsive trades outside of the scope of your plan is such a common issue that I feel the need to point it out in today's message. So many people will try and force their strategy or force themselves to get in and make money when the opportunity isn't there. Have a plan. Understand what it is you want to see. Understand what it is you want to trade and wait patiently until that opportunity arises. Do not try and force trading. It will only result in one way and it will not result in you achieving the goals that you want to achieve.

Start small, then grow -

I witness day in day out, traders just trying to get onto big accounts because they believe if they had more money they would achieve better results. They build the most complex strategies and trade four different strategies across 12 different assets straight out of the gates. This is not an easy game. This is not an easy money grab. It can generate thousands and thousands of dollars if done right. But it has to be done right. The learning process is the exact same. Start small, be a niche trader focused on a few manageable goals. Results will come in time. If you trade according to your trading plan you've remained disciplined and you do everything I spoke about today, you will see improvements and progress. Set goals, realistic goals that have nothing to do with profit and loss, but have everything to do with being a consistent, self disciplined trader and you will see returns come in the long run. If you develop the foundations to being a profitable trader, the profits will be delivered once you get a greater understanding of what needs to be done.

I wish you all great success and cannot wait to hear about your consistency in trading!

Trading the bleeding markets with a winning mindset ;)There's a great struggle going from profit to loss.

A burst of a bubble, which in it's essence is hope.

But this is false.

The odds are, that your profits were on paper, so how does a loss on paper differ from a profit on paper?

Truth is - It doesn't.

But what it does do is play with your emotion.

Our mind has a tendency of expecting the worst once things start rolling in that direction.

Take a step back and think about what life threw at you so many times in the past, think about the times you thought things are going to end up the worst but actually didn't.

It could be you planned a nice day outside with your partner in the park but it started to rain.

But instead of crying about the day wasted and how this is just awful, you ended up cooking together a nice lunch and drinking wine while finding a new great TV show to watch, ending up being one of the best days in a while.

Not let's roll back to trading.

And let's cut out negative thinking completely just for 3 minutes and look only at the positive.

Positive points -

1) Cheap instruments all around to invest in

2) Great practice of mental skills while trading, which truly is the most influential aspect of mastering trading

3) It reminds you the very basics of trading that we lose track of once markets start flying up - Buy low, sell high.

4) Opportunity, opportunity, opportunity - Every time you would have bought into the stock market, over a few year period you would make great returns, same thing goes even for people who bought Bitcoin after the decline of 2018 and pretty much any other pop financial instrument.

5) You're a day trader? Great! Volatility is amazing if you have a strategy which is disciplined and consistent as well as based on risk management.

See how bright the light shines at this very moment?

Keep it. Be positive. Be hopeful. Be practical.

The negative quotes such as -

I can lose everything!

It's never going to rally back!

This is taking too long!

I don't have patience for this!

This is turning out to be so not fun!

I didn't expect to hold this trade this long!

How will any of this benefit you in any way? Where's the logic? Where's the gain? Where's the analysis? Where's the market view? Where's the money management?

Only look at what is relevant to your success. Block the negative, ignore it completely as much as you can and eventually always.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Thank you so much for reading! I hope you found my idea useful, if you did, please like and follow! It would mean the world to me.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

EURUSD : Scalping 30m chart strategy , simple!Think you are the master of discipline?

Here's your potential way to make it big trading!

Extremely straight forward is this RSI 14 , 30 minute chart strategy.

When RSI goes to around 70+ it's time to short and aim for 10-15 pip

When RSI goes to around 30 and below , it's time to long and aim for 10-15 pip.

You can place your SL with 10 pip lower/higher and your TP with 15 pip higher/lower.

Money management is critical and discipline is critical.

You are not to aim for bigger profit, further SL, trade when RSI is not overbought/oversold and so on.

Money management should be almost minimal lot size with every trade like this you take.

Split it with 4-5 currencies and you have yourself a strategy to follow and test.

Good luck!

----------------------------------------------------------------------------------------------------------------------

If you found my idea useful, please like and follow! It would mean a lot to me.

Thank you so much for listening and let me know what I can do to help , with questions/comments on the post.

Obviously I am not a financial advisor and I encourage you to do your own research and be cautious when day trading!

----------------------------------------------------------------------------------------------------------------------

❌ What not to do in Heavy dumps! ❌Please observe the mentioned items. The market is terrible, but that does not mean that trading is not profitable!

You can also make a profit in shorts if you want. Use profitable methods, follow experts with sufficient knowledge and follow a few simple rules that I have explained to you.

Respectfully.

How To Backtest Further In The Past On Low TimeframesQuick video to show this little trick using the Replay mode that allows us to load more historical bars than real time, and thus get a better picture at how a strategy can perform over time.

The Strategy Tester re-calculate the results everytime we load new bars, as the indicator strategy is correctly applied to these new bars.

I got the confirmation from the awesome TradingView Support Team that the extra data that you get this way is real and relevant, and can be used to test your strategies.

That means we are no more limited to 15/30 days backtest data in the 5min timeframe for example.

How I trade BA This video covers my BA trading strategy.

I get many requests on what my trading style looks like (as a quant trader), so I figured I would show how I trade BA, as this particular strategy is replicable and the tools I use are publicly available (linked below).

NOTE:

This isn't financial advice.

As well, my signal to long BA is always a Z Score of -2.6.

However, my signal to short BA changes based on the market sentiment. Currently, it is -1, however for the most part of 2021 and up until last month it was set at -0.5 to 0. In general, I DO NOT recommend shorting a stock with a Z-Score of -1. It is high risk.

Its important when you are applying any strategy to back-test it first!

As well, this strategy is applicable to other stocks; however, its important to get a feel for how the Z-Score behaves as each stock is unique. For example, TSLA I have seen go as low as a -4 Z Score and as high as a +4.4 Z Score. The parameters I share in this video are my current parameters for BA but are subject to change as the sentiment changes.

Let me know your questions/comments and criticisms below!

Thanks for watching

What Does Consistency Mean In Trading ? Hello traders:

Today let's talk about “consistency” in trading.

Many traders understand they need to be consistent, but what exactly is consistent in trading ?

To me, it's not just making consistent “profit”, rather it's being consistent with your trading strategy, risk management, trading psychology, mindset and emotion.

Let's take a look at a few examples of consistency in trading:

Consistency in profits:

More often traders think about hitting a set amount of % return in consistency.

This is certainly one way to look at it, but I would say to challenge ourselves to do more.

Each and every month, the market will develop differently, hence our profits are not gonna always be the “same” each and every month.

Some month with more profits, some month with more losses. We need to have the ability to stay “consistent” no matter what the market condition is.

Consistency in strategy and Trading Plan:

Remember, there are many different trading strategies out there.

The ability to stay “consistent” with your current trading strategy, and not jump from strategy to strategy.

Even if your strategy right now isn't getting any entries available in the current market condition, while others are entering trade, you need to stay consistent with your strategy and let the probability play out.

Understand no strategy can catch every move in the market. Some will catch this particular run, while others will catch other developments.

Consistency in risk management:

When you are at a series of drawdowns and losses, the ability to stay “consistent” with your risk management.

Not risking more than 1%, not entering more than 2-3 trades at a time. No revenge trade, and/or over leverage trade.

Respect your SL and honour the SL. More often traders fall into this stage while they take a number of losses and throw their risk management out the window.

Consistency in mindset and emotion:

When your strategy isn't playing out on a short term, the ability to stay “consistent” and not to start randomly taking trades based on FOMO, Greed and emotion.

Sometimes traders get impatient and feel like waiting for setups to happen is a hassle and they don't want to wait.

This is when they start to rush their trading journey and backfires on them.

Consistency in your goal:

Set goals for your result and progress. The ability to stay “consistent” with yourself and don't let external factors like social media, fake guru, scammers affect you and your goal.

If you plan to have 5% per month profit, then don't let other people affect you in a negative way.

Everyone trades differently, and with different strategy, method and approach. No need to compare and compete with others, rather, with yourself each and every year.

Below I will forward some good educational videos on the above topics that we have discussed:

Trading Psychology: Revenge Trading

Trading Psychology: Fear Of Missing Out

Trading Psychology: Over Leveraged Trading

Risk Management: Combine everything you learn to prevent blowing a trading account

High Accuracy VIX trading strategyThis is a strategy that uses a strategy that normally sucks with range markets, which by inverting the conditions, makes a highly profitable strategy.

Leave feedback for me!

Keep in mind that the source code that I used is just an edit of someone else's. The strategy itself is not specifically associated with the code used, and was just meant to give a visual of the strategy.

This is not financial advice.

The myth of risk management - Hack it :) I speak to a lot of traders, new and veteran.

It's surprising to see how so many are not sure how risk is calculated and what the exposure really means in terms of P&L.

This obviously is a major block in the road on the way to gaining confidence necessary to avoid losses.

So let's break it down -

*P&L is calculated by lot size * movement.

Example: If you have 100 ounces of Gold (1 lot) - That's $100 in P&L (Profit/loss) for each $1 Gold moves in value, so if the price 1890 and you are buying 1 lot , price moves by $5 higher - That's a $500 profit ($100*$) , same thing in reverse, if it would drop by $5 that's a negative of -$500 in open P&L.

Leverage decides what you are technically able to open in terms of margin used.

So if your leverage on Gold is 1:100 - The value of a 1 lot trade is the price of Gold multiplied by the amount of ounces , so let's say 1890*100 = $189,000 value trade, but your leverage is 1:100, so you would only need $1,890 of used margin (189,000:100) to open the trade.

But if you have 1:20 as leverage, you would need 5 times more used margin to open the trade.

So a common misconception is that your risk is your leverage.

That's not true.

Your risk is your lot size.

But if you have very high leverage , than you can open very high lot size with a small account - Which is extremely dangerous and not advised.

So what does an experienced , smart trader do? No matter what his leverage is, he understands the short-term and the long-term range of movement, and opens a lot size that fits the size of his account considering the range of movement.

If the account size is $100,000 , and you are buying 1 lot of Gold:

The weekly range is 1840-2,000 , the short-term range is 1880-1910 - Price is 1890

So the exposure is ~$1,000 in the short-term (1%) back to the short-term support 1880 , compared to $2,000 on the short-term resistance (2%) of 1910.

The long-term exposure is to 1840, meaning a $5,000 exposure 5% ($100*$50) from 1890 - but 2,000 is the top of the weekly range, meaning - $110 up ($110*100) = $11,000 (11%).

So didn't really matter what the leverage is 1:20 or 1:100, what matters here is the range and the lot size.

Thank you for reading!

-----------------------------------------------------------------------------------------------------------------------------------

If you liked my educational idea please like and follow! It would mean the world to me!

I promise to answer all comments/questions - I encourage you to communicate :)

Thank you so much for reading - Looking forward to reaching as many of you guys as I can :D

-----------------------------------------------------------------------------------------------------------------------------------

Why do traders mostly lose? Point of viewFor 3-5 minutes while going through this forget what you know about trading.

First thing is : Let's remember our goal, every successful action/plan started with a clear goal that led the way:

In our case it's profit

When starting to trade seeing the numbers go up and down plays with your head and emotion quickly tempting you with the unlimited potential at your fingertips.

Even experienced traders that had some lucky streaks forget that the wanted end result is simple - to be in the money, meaning, making profits consistently.

In order to secure our goal of making profit we need to first start with remembering this is not a 'get rich quick' scheme and there is no magic - A big bunch of money won't fall on your head out of nowhere, at least not consistently.

Now - remember this : It's a lot better to be consistently profitable than to have a series of a few winning streaks .

With this in mind, it's great if you would put up a sticky note on your screen reminding this - As at times it gets hard keeping sight when numbers run wild.

I see many traders look at between 5-10 crypto currencies, 3 commodities and 10 currency pairs - Deciding based on a variety of different things what to trade on every time.

This way of action has no structure at all - Which makes it very hard to reach a certain target: profit.

It is necessary to have focus, structure and a plan with a single minded mission: PROFIT.

But not just any profit - smart profit, a profit that was a result of planned action.

So how do you make a plan?

The easiest way to effectively craft a well thought out plan is to focus on between 2 to max 3 instruments

Learning the range, price action and tendencies of 2-3 instruments can be done within a few weeks going through 1h, 4h and weekly time-frames and determining the short-term and long-term projections of each of the 2-3 instruments.

Once you start seeing the patterns and understanding the price action continue by implementing what you learned on the instruments on a demo account testing a possible strategy that relies on clear idea of what to do with every possible scenario.

You may not get it right with the first strategy, so try others until you find one that shows consistent results - while mastering the 2-3 instruments you have chosen and continuing to following up on a daily basis on relevant news, changes in trends on short-term and long-term projections.

For me - Because I've dedicated years trading and following Gold and WTI , learning how and why it moves - I prefer trading a swing trading strategy, keeping trades open between 3 days to 2 weeks usually, this puts my bigger picture understanding of the instruments into true effect

The difficulties you will find while searching for your strategy are -

*Greed

*Fear

*Lack of patience

*Lack of discipline in plan

Don't let them in - Remember your plan and one and only goal : consistent profit!

Thank you for reading,

Let me know what you think and what you would like to hear more about :D

The basics of back-testing (HOW TO)Hey Traders,

Today I wanted to follow on from the fantastic amount of comments that we are receiving from the previous video, "stop strategy jumping." It seems that so many of you took a whole heap of value from that video and for that I am very thankful and to everyone who reached out and told their story or let me know that it really touched them.

As highly requested, I wanted to run through a basic way to start getting the grips with strategy back-testing. How can we go about back-testing our strategies to ensure that they are profitable for us in the long run? Take a look, have a listen and tune in. Set up an excel sheet the way I do and get back testing. There's only one way to do this, and it is to do the hard work.

Let me know what you guys find. I can go more in depth in the future, but for now. It seems like most people wanted to get to grips with the absolute basics, which is what I'm going to show you today.

If you have any questions at all, please the comment section is the place to be. As always, have a fantastic trading week and a fantastic weekend traders. I'll see you very soon.

The PIK Trading Strategy & Key Lessons for Day Traders!Hey Traders!

Happy Sunday!

In this video, which ends a little earlier as I didn't know videos have a limit, we go over a few key points, starting from the PIK trading strategy which you guys will hear about much more over the next few days, mindset, motivation and guidance is covered too!

When it comes to the PIK trading strategy, we go over the indicators that are used, price action and key levels!

The video isn't our best one, but it does have plenty of value and we hope you enjoy it!

Thanks and all the best!