How to connect a brokerage and join the Broker AwardsIn this video we show you how to connect a brokerage to your account. We also talk about rating your favorite brokerage and participating in our upcoming Broker Awards. 🏆

When you connect a brokerage you can trade, invest, and follow markets with advanced tools built directly into our platform. To get started, find and click the Trading Panel button at the bottom of your chart. Once your brokerage is connected, you can use the Order Panel to create orders and manage risk including take profit targets and stop losses. When you place an order, it will appear on your chart. This is one of the biggest advantages of trading with a connected brokerage - see your trades directly on the chart. Make a plan and then visualize the risk and reward.

As a TradingView member with a connected brokerage you are allowed to rate and review your favorite brokerage. Your reviews will help others find the perfect brokerage for their needs. Together, we can build a transparent marketplace with real reviews by real traders. Get started by visiting our Top Brokers page.

Remember, your reviews are important because they will determine our first-ever Broker Awards. Here are the awards we will be giving out based on what you say:

• Broker of the year

• Most popular broker

• Social champion

• Most innovative tech

• Best multi-asset broker

• Best futures broker

• Best forex broker

• Best crypto broker

If you have any questions or comments, please leave them below. We look forward to seeing your reviews and announcing the awards on Jan 20, 2021.

Trading Tools

Weekly Institutional COT Analysis (Majors 1) 🎥🎯 This is weekly overview to the institutional positions of the commercials and non-commercials which is big part of the decision making for my strategies next to the technicals.

Subscribe, this video is released every saturday.

📌 GET COT INDICATOR HERE

⏬add this script to your charts

✅ Unfortunately due to data limitation I cant import my complete indicator to trading view so this is just limited for last 10 weeks.

Wish you good hunt in next week !!

Dave FX Hunter ⚔

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

❗❗ This is Pre-plan

That means my view can change, depends on how the price will arrive to the level and what will be happening on the M30 in my level of interest for entry. Then I will decide if I will enter or not. So please don't just blindly follow this. FX market is quickly changing environment and it requires full focus on the levels for the precise entry with low risk.

❗❗ DISCLAIMER

We are the only one person who is responsible for our health, relationships, success and money in our life's. So taking a risk on the markets based on this idea is only and only your decision. You deserve the profit and you are responsible for your potential loss. Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice. Author of the analysis does not accept liability for any loss or damage.

❗❗ Legal Risk Disclosure

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

Using the new SignPost ToolI love the new Signpost tool that was released this week... i was all set to put in a feature suggestion when I realized I could already do it: make the signpost go DOWN as well as up!

I am a stickler for documenting your trades - EVERY single trade: the winners but ESPECIALLY the losers - so you can learn, reinforce, and EMBED your trading system into your subconscious. (See link to a previous article on that very subject below!)

Hope you enjoy this video... let me know what you think!

Trade well...

-Anthony

How To Download Divergence+ I get a lot of private messages about divergence+, a divergence indicator that also gives insanely accurate buy and sell signals. It is so accurate the creator charges a monthly subscription for the indicator.

It cost $15 a month and for me personally, with the gains I have made... It is has already paid itself off for the remainder of my life and I am young!

Here are instructions on how to download

1. View my account [Myantman101}

2. View who I am following and click on Market Scriptors

3. Send them a private message requesting access to D+

4. Follow their instructions and use as desired

Hope this indicator helps everyone in their analysis/trading decision making

We've added 100+ years of price history for gold and silverThe team at TradingView is committed to building a platform that gives you the best charts, data, and visualizations for better decision making. Today, we're happy to show you two new data feeds that we've expanded for those who want to see the history of gold and silver.

You can now chart over 100 years of price history for gold and silver. As two of the oldest precious metals and essential to the evolution of currencies and trade, we believe these additional years will be invaluable for long-term precious metal traders and enthusiasts. See gold or silver in short-term time frames or long-term time frames going back as far as 1915.

To get started, type GOLD or SILVER into your search box. You can also use the two links we've included below for quick viewing:

• See a live gold chart

• See a live silver chart

We hope you enjoy these expanded datasets and if you want us to add even more data for a specific ticker, please write it in the comments. Our team will do their best to add it for you. Thanks for reading!

The Ace Spectrum as a Template for Support ProjectionDemonstrating the big idea: That straight lines in log-space form exponential curves.

This property of the log chart is useful for examining assets with exponential growth (like high-growth stocks, cryptos, etc).

Because the log scale asymptotically approaches the absolute scale as y slice decreases, this indicator is really applicable to any time scale.

This indicator samples a distribution of lines from the past and projects them into the future, these projected lines form indicators of prior support.

The idea is longer support at those specific lines is indicative of support strength, which this indicator approximately captures.

My initial goal was to capture this intuition about exponential growth in log spaces by applying a monte-carlo style sampling approach to visualize the latent support lines.

After I had captured that in a slightly more complex version of this indicator, my goal was to distill the concept into the simplest possible implementation.

How to create chart art, infographics, and custom visualsThere are two things you have to master to create the best chart art:

1. The drawing tools available to you

2. Your chart settings

In this video, we show you how to create a blank canvas for chart art, infographics, and custom visuals. The first step to getting started is understanding how you can turn your chart into a blank canvas. Open your chart settings to get started. In your chart settings you can control the look and feel of your chart including the ability to hide everything, even the price line, and draw on an open canvas. You can also control the background, scales, and color of the price line to create something totally unique to you.

The simplest way to create a blank canvas is to uncheck each box in the chart settings and adjust the background color of the chart including the vertical and horizontal grid lines. Once you've created your blank canvas, you have the freedom to create and draw anything you want. You can use this canvas to make flow diagrams, pictures, and more. It's really up to you and your level of creativity. Here are some recent examples that convey interesting educational lessons or trading concepts:

How to manage risk

What is growth investing

How to think about the long term

The trader's journey

The final step to creating the best chart art and custom visuals, is to make sure you master your drawing tools, which are located on the left-side of your chart. You can use them to draw anything that comes to mind. It could be a flow chart, a cartoon or even a picture. You will want to make make the brush tool your best friend. It's how you draw freely across your chart as if you were holding a pen or a paint brush in your hand.

We hope this video tutorial helps you get started and we look forward to seeing the work you create.

Please leave any questions or comments below. In addition you can ask for product features or product requests and we will share them with the team.

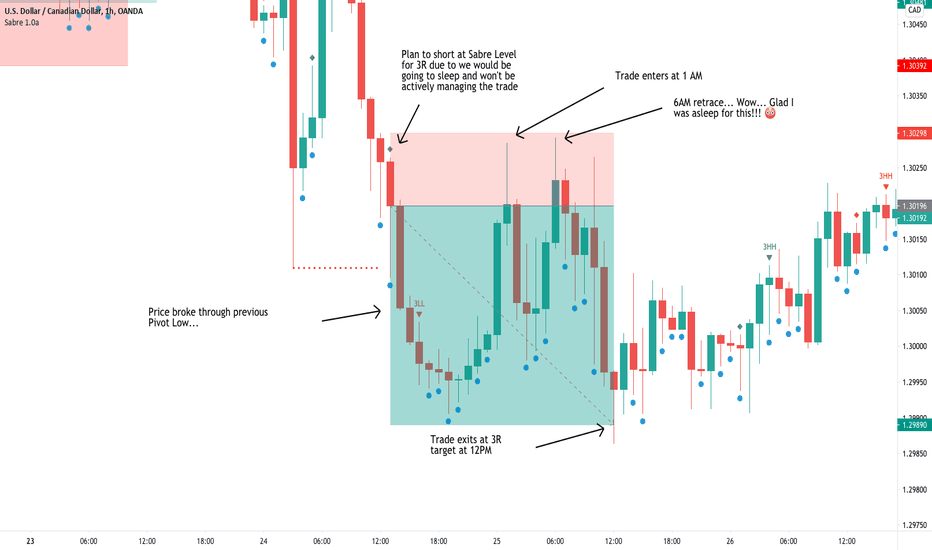

Documenting Your Trades (For Fun and Profit)How do you document your trades? In a spreadsheet? In a trading journal? Directly on the chart? How much is too much? How little is not enough?

I say you need to document enough to tell the story properly. Every trade tells a story. As with all good stories you have a protagonist and an antagonist. Good guys and bad guys. The hero and the villain. And then, there's the journey.

In the markets you are the hero and the market is the villain. One way I make trading "fun" and what helps me "tell the story of the trade" is to "Trade Like a Pirate" and use the vocabulary of Jack Sparrow. I have already written on this topic when it comes to analyzing profit targets (seizing treasure and plunder) but let's look at how we learn what we did on a trade by trade basis.

When you do an after-the-trade analysis (what I call a postmortem) you should be able to see what you did right, what you could have done better, but most importantly, what you may have done wrong; not to beat yourself up, but to make sure that you *never* make that mistake or repeat that behavior again. (Fool me once, shame on you... fool me twice, shame on me!)

For instance, I once lost three trades in a row and asked "How the heck did that happen?" and later when I looked at the actual trade screenshots I realized that both my trading timeframe and trend timeframe was the same! Somehow instead of having my charts on the 60-15 minute charts they were *both* 15 and I realized if I had my chart timeframes right I would have never entered those particular trades, saving me from experiencing those losing positions. Thanks to those trades, though, and thanks to my post-mortem analysis, the first item on my "pre-flight checklist" is now "Verify Trade Timeframes." Thanks to journaling and the postmortem process I'm *never* going to make *that* mistake again.

But what about the *psychology* of the trade? *Why* did you enter it, *what* were you thinking once you were in it, *why* did you adjust your stop, *why* did you choose your target, *what* might you have done out of fear that got you out of the trade early or prevented you from realizing as much profit as you could have?

Journaling your trade, or documenting the trade *properly* will help you with that.

In the example above you can see a recent trade that presented itself to me and my pirate "Crew" in the Gasoline Futures market. I talk about the "weather conditions" before getting into the trade (the wind and the tide), other environmental factors like the "shark feeding frenzy area" helping me decide where I will target my profit (there be treasure *here*), what was going on when the trade actually entered, and finally, managing the trade to my target. In addition, during the postmortem I found an opportunity where if I had used a trailing stop, I could have gotten an additional 42% profit, or 'treasure'.

As I mentioned in my Backtesting series, one of the reasons you backtest is that through repetition, you can often find patterns in your system that will prompt you to tweak it to either *improve* results or *eliminate* inefficiencies. In this same manner, through repetition in documenting your trades you may very well find a pattern of behavior that is holding you back from your full potential.

For example, In the trade above, after securing 3R, (the minimum I am willing to take in a trade), if I followed price using my trailing stop strategy instead of a target, I found that I could have made an additional 2-3R profit. What if after documenting 20, 30, 40+ trades I find a similar pattern, that I am often "leaving money on the table"? I can then test several exit strategies to see which ones would give me the biggest bang for my buck and increase my R per trade.

The other big benefit of having your trade journal "tell a story" rather than "state facts" is you begin to *personify* the market and see it as someone who exhibits certain behavior patterns, and that is what the markets present to us every day: PATTERNS. And if you can determine someone's patterns, you can predict their behavior.

If I know that whenever my wife is browsing through a jewelry catalog and consistently goes "ooh" or "aah" over earrings with blue stones in them, I can guess with a high degree of accuracy that if I buy her a set of sapphire earrings she (and consequently*I*) will be a happy person. Likewise, if I can predict with a high degree what "Mister Market" is going to do based on certain patterns, I can keep setting sail, with confidence, day after day and see gains in my trading account (which makes me, my crew, and most importantly the missus, HAPPY! (Because when momma's happy, everybody's happy!).

Trade well! (And Journal Well!)

PS: Let me know how your journaling journey goes in the comments! I'd love to know how it "upped your trading game!" You can only improve what you analyze!

-Anthony

Is it cheap? Why "dilution" is a concept you NEED to understandMany newbie investors get in trouble because they don't understand the relationship between share price and share count. If you're new to investing and you've never heard of "dilution," it's very important that you keep reading this post.

If I look at a standard chart of Spirit Airlines's share price, such as a upper chart above, I might conclude that the stock is cheap right now. Spirit shares are trading well below the price they've traded at for the last five years.

This is an illusion. The valuation of a company is its share price times the number of shares outstanding. When a company runs low on cash, it sometimes issues and sells new shares. This "dilutes" the ownership percentage of existing shares.

Imagine I have a pie, and I've invited you and two other people over for a piece. We're each going to get a quarter of a pie-- a really big slice! But then you decide to invite a friend. The size of the pie doesn't change, so now we have to cut it in fifths so your friend can have a slice. Each of us will get a smaller piece.

Issuing new shares works the same way. Since the beginning of the Covid-19 pandemic, Spirit Airlines has issued 29.14 million new shares, increasing its share count by 42.5%. That means that each share now represents a much smaller proportion of the company than it used to. The shares have been "diluted."

Because of dilution, looking at a chart of the price of a single share doesn't tell you how "cheap" or "expensive" a company is compared to its historical valuations. Fortunately, there's a quick and easy way to chart a company's actual valuation.

Share price multiplied by shares outstanding equals the company's total price tag, its "market capitalization" or "market cap." To chart market cap on TradingView, find and click the button labeled "fundamental metrics for stocks" at the top of the chart. Type "market" in the search box, and TradingView will narrow the list of metrics down to the one you want. Clicking on "market capitalization" will add a time series of the stock's market cap to your chart.

When we look at market cap for Spirit Airlines, it doesn't look cheap anymore. Spirit is trading within its price range of the last four years, even though the company is now financially worse off in every way. With earnings negative and sales nearly cut in half, Spirit is priced as if the pandemic had never happened. By charting market cap, you've adjusted for dilution and gained a much better understanding of the asking price.

HOW-TO: Backtest Your Forex Strategy & Increase Your Win-RateIn my earlier article, " Proving Your Trading System with Backtesting ", I demonstrated how, in the Futures market, you could backtest your trading system, see what works and what doesn't, change your variables, and rinse & repeat until you have a winning trading formula.

You GET this winning formula by torture-testing (ahem, *back*testing) your system under every market condition.

My last video backtested Futures as an example and I received dozens of requests to demonstrate and develop a similar system using Forex, so here it is! This video will show you HOW you can backtest your own Forex Trading system over time, determine its results, and refine it until it is bulletproof (or marketproof!).

All you need is a Trading System, a Spreadsheet, and a great trading platform (ahem, like TradingView) :-)

Trading can be the most rewarding of careers, but only after putting in the hours of hard work. And like everything else in life, if you don't put in the work, you won't get the results. And if you put in the work AHEAD of time, you won't have to put a DIME of your hard-earned capital into the market until you are CONFIDENT that your system will multiply that money in your account rather than feed the market monster.

I hope you enjoy the video... but more importantly I hope it will help you become a better trader. If this was beneficial to you please feel free to leave a like, a follow, or a comment... I'd love to hear from you and stay in touch as we all move forward in our trading journeys!

Trade hard, and trade well!

-Anthony

How to Spot Blow-off Tops - ES1!Here are 3 blow-off tops and 1 failed attempt which all occurred in the last 7 months. Successful completions are marked in solid black. The failed attempt is shown in dotted black.

On all 4 attempts, the price accelerated upwards to different degrees. Each target can be roughly measured based on the price move.

Notice how the failed blow-off begins closer to a price bottom than the successful ones did.

Volume was either steadily increasing or declining during successful blow-offs, compared to the unsuccessful attempt when volume was not clearly trending.

ROC (momentum) was increasing with all 4 attempts. The blow-offs were successful when momentum was at 0 or positive at the start of each blow-off.

Disclaimer: This is my opinion. This is not advice. Trading involves risk.

Forex Pairs Correlation: Avoiding Contradictory TradesHello, in this post I will be talking about Forex Pair Correlations. A problem new traders frequently find themselves in is opening/having positions that are contradictory. I will elaborate on that but for now, let's understand first what correlation is. A correlation is a statistical relationship which means that when A moves a certain way, B will move a certain way. The stronger the correlation, the more likely that the price will move along with each other/opposite of each other. There are 2 types of correlation; Positive correlation which is A and B will move together, and negative correlation which is A and B will move opposite of each other. Now that we understand what correlations are, I can address the problem that new traders have. Contradictory positions: For example, having a long position in GPBUSD and a short position in GBPJPY is contradictory since these 2 pair has a 87.5% correlation which means 87.5% of the time, it will move together. As you can see in the graph, when the GPBUSD (Blue) moves up, GBPJPY (Orange) moves up and vice versa. This applies to moving down as well. GBPUSD (Blue) and AUDNZD (Yellow) is an example of a negative correlation (-69.7%). My recommendation to avoid having these problems is if you do not yet have an understanding of which pairs will move up and down together, check this website: www.myfxbook.com This website will show you every pair and its correlation. Of course, there are some exceptions to when contradictory trades are fine like when hedging against each other or when 1 trade is short-term/intraday/scalping, looking at the smaller trends and the other one is swing trading/position trading looking at the bigger trend. However, I do not recommend new traders to hold/open contradictory trades until they have some confidence in what they are doing.

Main points:

1. A correlation is a statistical relationship which means that when A moves a certain way, B will move a certain way.

2. Positive relationship = Pairs will move the same way.

3. Negative relationship = Pairs will move the opposite way.

4. New traders should avoid contradictory trades.

5. Website for checking correlations: www.myfxbook.com

Please give a thumbs up if you agree with the educational post and if there are any questions, feel free to comment down below.

How to use Fibonacci correction levelsHello, Traders!

Most of you have heard about Fibonacci Retracement, some of you saw it and some even tried to use it on their own charts. So today I am going to explain how to use this instrument correcly.

Traders use the Fib Retracement tool in order to determine the nearest correction levels on the chart,.

If your task is to find out the nearest correction levels of upward movement, the level of 1.0 Fib Retracement. should be at the beginning of the movement and the level of 0 Fib Retracement at the end of it.

In simple words: if you are looking for upward motion correction, then 1.0 should be at the bottom and 0 at the top. If you are looking for a downward correction, then the opposite is 1.0 at the top (start of movement) and 0 at the bottom (end of the movement).

There are three types of correction by Fibonacci levels :

1. Bullish to levels 0,236 and 0,382.

2. Normal correction to the levels 0.50 and 0.618.

3. Bearish correction to 0.786 and 0.860.

When the movement is sharp, most often the correction will be minimal and will end at levels 0.236-0.382.

When the movement is corrected for a longer time, the correction comes to the levels of 0.50-0.618.

If the movement breaks down, the correction ends at levels 0.786-0.860.

In other words, in order to continue upward movement, as in the current BAND chart, we will be interested in levels of at least 0.236-0.318 and 0.50-0.618.

Near level 0.618, it is beneficial to catch the sharp impulses that occur due to the stops of market participants.

If the price movement comes to the level 0.786-0.860, then most often it is already its conclusion and it is dangerous to buy at such levels.

At the current bullish rally, the use of correctional Fibonacci levels will bring good results.

Share your setups in the comments and I would help you understand if you used it correctly!

Backtesting Part 2: Testing Your Trading System in 3 Easy StepsIn my earlier article, " Proving Your Trading System with Backtesting ", I outlined the HOWs and WHYs of backtesting. Does your trading system work under all conditions? Under what conditions might it *not* work? Can you remove those instances from your plan? Under what conditions might you *improve* your win rate? In another article, " The Unexamined Trader ", Just as an unexamined life is not worth living, the unexamined trader should not be trading a system that has not been tested under every market condition (and I mean TORTURE tested under HUNDREDS of trades).

This video will show you HOW you can backtest your own system over time, determine its results, and refine it until it is bulletproof (or marketproof!).

All you need is a Trading System, a Spreadsheet, and a great trading platform (ahem, like TradingView) :-)

It will take some time and effort, but like everything else in life, if you don't put in the work, you won't get the results. And if you put in the work, you won't have to put a DIME of your precious capital into the market until you are CONFIDENT that your system will multiply that money in your account rather than feed the market monster.

I hope you enjoy the video... but more importantly I hope it will help you become a better trader. If this was beneficial to you please feel free to leave a like, a follow, or a comment... I'd love to hear from you and stay in touch as we all move forward in our trading journeys!

Trade hard, and trade well!

-Anthony

Proving Your Trading System with BacktestingWouldn’t it be great to see the future? To see where turning points in price will occur with a high degree of accuracy? To see if a trading system that you developed or bought or learned actually works? Well, you can, with a method called BACKTESTING.

Backtesting performs three important functions:

1: It helps you IDENTIFY the reliability / win rate of your trading system over time.

2: It helps develop and reinforce the muscle memory you need to EXECUTE opportunities in your trading strategy

3: It helps you continually REFINE / improve your strategy as you observe it work against price action, ultimately increasing your "hit rate" as a professional trader.

The first requirement of a trading system is that it works via RULES. There are no 'hunches' in the market... the market has *specific* behavior patterns and our job as traders is to recognize those patterns and *capitalize* on them.

Backtesting has three important requirements:

The first requirement is that your trading platform supports backtesting. Can you go back "x" amount of time and look at the timeframe(s) you need to make the decisions you would have made if you were "in the moment" in an efficient manner in order for you to simulate hundreds of trade setups?

The second requirement is that *you* are willing to put the energy and work into testing your trading system within an inch of its life before you risk a single penny of your trading capital. You need to know WHEN the system works, WHERE the system fails, and WHY the system worked and failed when it did, and that takes hundreds (if not thousands!) of simulated trades to do so.

As you are observing the system in action you will begin to "see" the patterns in a new light. It will become more and more intuitive and you will find opportunities to 'tweak' the system as you go along. You will identify patterns when trades fail and stop trading that pattern. You will see opportunities that got away and you can 'tweak' your system to take advantage of those opportunities. Most importantly, you will see whether the system even works reliably at all and ditch it if it doesn't. It may be frustrating to decide to do so, but the good news is you will not have lost a single penny trading a faulty system to begin with!

TRACKING YOUR TRADING SYSTEM

To track the accuracy of your trading system you will need to setup a spreadsheet that will record the important variables you want to track. For example, you may want to include the headers,

Asset / Date / Time In / Time Out / Long or Short / Reward to Risk Ratio / Gain or Loss / Account Balance

The "Reward to Risk Ratio" column is the most important. If you read my previous column, "Trade Like a Pirate" ...

... I discuss that you need to think in terms of Percent Risk per trade ("R") and not Dollars. This will show you how well your strategy works. For Example, if after tracking 100 trades you find out that your system has a 33% success rate, your account will grow by 1% for every three trades if you follow a minimum 3:1 Reward to Risk Ratio (3 -1 -1 = +1). If you find on average 6 trades per day, your account can potentially grow by 2% per day. Under the "Account Balance" column, if you add the trade's win/loss to your previous account balance you can determine how long it would take to get 'x' amount of money from where you started (or how long it will take and inferior system to lose it all as well!)

Testing your trading system also shows you how many opportunities present themselves per day / per hour and when the best time is to go 'fishing' for trades. Backtesting might tell you that you need to wake up 2 hours earlier (and go to bed 2 hours earlier) if you want to achieve the goal of replacing your car in 6 months. Or fire your boss in 24 months. Or pay off the mortgage in 3 years. Having a plan to *make* money should also include your plans on how and when you want to *spend* that money - how you will 'pay yourself'.

Socrates famously said “The unexamined life is not worth living.” Likewise the unexamined trading system is not worth putting your hard earned money into. The more you backtest your system, the more you will gain (or lose) confidence in the system which will ultimately determine the actions you will take.

Another happy by-product is that not only will you be able to refine your trading system, but you yourself will be continually refined in the fire of the market, exercising your mental muscles looking for opportunities that meet your particular trading system. For instance, by analyzing all my losing trades in my first batch of 100, I was able to identity a pattern in the formations common to all failing trades but not winning trades. I then modified my trading system to exclude trades which showed that pattern, increasing my success rate by 30% in the next 100 trades I tested with the new system. Not happy with that, I went through my losing trades from Round 2 and found another common pattern among them. Eliminating those, I modified my system and increased my success rate by yet another 20%.

Finding what works is often a product of finding out what doesn't work, and just stop doing that!

If you need advice on how to stop a bad habit, just listen to Bob Newhart:

www.youtube.com

Finally, just as any athlete will you tell you that you should "Warm Up" before performing any strenuous exercise, one thing my backtesting system has taught me is that I need to spend the first 30 minutes of my trading day "warming up" by finding all the opportunities that presented themselves in the Futures market during the overnight session and log them in my spreadsheet. Likewise at the end of the day I look at all opportunities I might have missed so I can reduce the likelihood of missing them again. The original title of this article was "Backtesting to the Future" which reflected this habit: by 'warming up' before actually trading I got my mind prepared to "see the opportunities" for the future day ahead, and I identified these patterns a lot better than I would have if I entered the pool cold and experienced the 'cramp' of a losing trade.

Admittedly, backtesting a highly visual concept, so I will be following up this article with a video showing an example of my backtesting strategy and how you can model my system to meet the needs of *your* system. As I love to say, "Good artists copy, great artists steal." Likewise, "Good traders copy... Great traders steal." I hope you can steal some of these ideas and have them help improve your trading game!

Share your thoughts and success below! As always, I'd love to hear if this has helped you become more confident and profitable in your trading. Like and Follow if you haven't already and you will be alerted to when I post the followup video!

Trade hard and trade well!

4 simple steps to create your perfect strategyHello traders,

Introduction

How many times did you find a perfect strategy giving great results in backtest but wasn't working for LIVE trading?

This effect is due to "overfitting" your past signals giving great historical results in a past environment.

Overfitting means you're forcing the results to look great; hence not realistic; knowing the historical price action.

Unfortunately, new traders don't know how random financial markets could be.

Then, a backtest with very controlled and precised conditions is often irrelevant for real/live trading.

Building a trading system is like solving a puzzle.

We don't define the entries and exits separately - entries are defined relative to the exits and vice-versa.

Imagine a RubixCube where solving one face of the cube could mess up with the other faces of that cube.

Step 1 - Define your entries

Finding entries is the easiest step.

Most indicators on a big timeframes give great entries but poor exits.

I appreciate low timeframes a lot as it gives me a better control of my RISK.

Thinking that low timeframes require more reactivity is a myth...

If we use the standard values from our trading indicators - yes sure, we often enter/exit dozen of times before the real move happens - and when it happens we're too exhausted to trade it well.

This is weird that many traders use common indicators with their standard values regardless of the timeframe.

Think about using the MACD with the 12/26/9 or RSI with a 14 period for example.

Using indicators with low values doesn't work neither for manual or automated trading.

The new traders wreck themselves either via exhaustion (manual trading) or with paying too many fees (both manual and automated trading).

If your high timeframes trades get invalidated/stopped-out, the drawdown is painful - and you really feel the pain if you use a big position size or a too high leverage... (please don't).

What I'm going to say is going to shock a lot of our readers I know.

Entries don't matter by themselves.

If your exits are not well-thought, you're guaranteed to lose regardless of how great your entries are.

Step 2 - Define your exits

A strategy without exits (Stop-Loss for example), gives a win-rate by design of 100%.

This is the most-common mistake apprentice quant traders make: they think first about PROFIT when actually they must think about the RISK first.

How much you can lose is more important than how much you can win (by far).

If you don't think about your RISK first, I tell you what's going to happen

Maybe you would have predicted the correct directions, but the unrealized drawdown + trading fees + funding will get you bankrupt before the move.

Anyone else already experienced this?

Step 3 - Backtest

From here, you don't even need to use a backtest system.

What I do is setting my chart days/weeks before the current date and then scrolling-right from there until the current date.

The goal is visually checking a few crucial things (in that order exactly):

A) Are my entries early enough?

B) If stopped-out how much do I lose in average?

C) What's the average profit I can make per trade? per day? per week?

You probably noticed that I don't mind the statistical data like win-rate, profit-factor, etc - I don't mind them because they're not relevant.

A backtest with a high win-rate, high profit-factor, high EVERYTHING could still not perform well for LIVE trading if the system is "overfitted".

Let's dig-in quickly into those 3 steps.

A) Are my entries early enough?

There is nothing worse than entering too late - this is obvious because it increases your drawdown if any and reduces your potential profit.

B) If stopped-out how much do I lose in average?

The most important item of the list If your entries are late, we get now that your stops are painful for your capital and psychology.

Even early entries could have terrible exits - and you may still lose

I don't use a price/percentage level stop-loss.

This is too subjective and to speak frankly... not working.

There is a great chance to get filled because of slippage even if the candles never hit your stop-loss order level and then we .... cry and rage because we predicted the correct direction but not the correct potential drawdown.

I'm 100% convinced it happens too often (to be profitable) for all traders using those stop-losses.

I won't say it enough...

Use a hard-exit for your stop-loss - it could be an indicator or multiple indicators giving an opposite signal.

Of course, it should be based on candle close - not candle high/low to remove almost completely the slippage risk .

For the take-profits, that's exactly the same concept.

I don't use price/percentage levels but a combination of Simple Moving Average(s), Traditional Pivots and Fibonacci Pivots

C) What's the average profit I can make per trade? per day? per week?

The goal of any trader: making money and quitting their jobs... I know.

That's why we shall not forget about the average profit we can make per trade and per period (day, week, month, ...).

Here it's important to have written goals and stick to them.

Assuming I want to make 500 USD a day, then I build a system giving me in average 500 USD a day with the lowest risk possible.

Step 4 - Rinse and Repeat

Creating your strategy is a continuous process - not a one step and you're "done".

After the previous step, you may notice some irregularities, some errors, some disturbing elements.

If my entries are late, or exits are late/too big then I go back to the first step and repeat the whole process.

With some experience, building a successful model for the asset and timeframe you want to trade shall take you no more than a few hours.

This is quite fast by the way and you'll already be ahead of most traders out there.

Conclusion

Building your perfect strategy becomes easier with experience and after a lot of trials.

There is no shortcut for becoming rich - you have to put up the work and be/stay focused.

Dave

Trading strategy using the DeMarker indicatorThe DeMarker indicator, also known as DeM, is a technical analysis tool that compares the most recent maximum and minimum prices to the previous period's equivalent price to measure the demand of the underlying asset. From this comparison, it aims to assess the directional bias of the market. It is a member of the oscillator family of technical indicators and based on principles promoted by technical analyst Thomas DeMark.

The DeMarker indicator helps traders determine when to enter a market, or when to buy or sell an asset, to capitalize on probable imminent price trends. It is considered a “leading” indicator because its signals forecast an imminent change in price trend. This indicator is often used in combination with other signals and is generally used to determine price exhaustion, identify market tops and bottoms and assess risk levels. Although the DeMarker indicator was originally created with daily price bars in mind, it can be applied to any time frame, since it is based on relative price data.

Unlike the Relative Strength Index (RSI), which is perhaps the best-known oscillator, the DeMarker indicator focuses on intra-period highs and lows rather than closing levels. One of its main benefits is that, like the RSI, it is less prone to distortions like those seen in indicators like the Rate of Change (ROC), in which erratic price movements at the start of the analysis window can cause sudden shifts in the momentum line, even if the current price has barely changed.

How does the indicator itself work? When the curve line moves below 0.7 from top to bottom it means that we are in a overbought zone and we have a potential sell scenario. When the curve line moves trough the minimum 0.3 level from bottom to top it means we are in oversold zone and we may have a potential buy opportunity. But! There is a catch.

It is not recommended to short or buy aggressively when the curve crosses both of the levels for the first time. Usually when the curve crosses from the top the 0.3 level, indeed, it means we are heading to oversold zone, but there is going to be additional sell impulse. That's why the curve can have readings above 0.7 or below 0.3.

I personally use DeM on the daily chart and this is my only oscillator. Usually Demarker indicators are payed and are very expensive. The free versions of the indicator which are massively distributed are not truly mathematically perfect, but they do fine job.

Here with USD/CAD example I have placed my DeM on the daily chart for the pair. I will highlight the period from September till now with the latest signals.

Using Customer Indicators to find SuperPerformance StocksOne of the BEST parts of TradingView is ALL the thousands of free and paid indicators you can add to your charts to try and find your own unique style and what works best for you.

I made a video a couple of days ago where I showed how you can use the built-in TradingView stock screener to find stocks in a nice steady uptrend using moving averages and some filters.

One of the disadvantages of that approach is while it shows you stocks in a steady uptrend, it doesn't tell you anything about how volatile they are or have been while they are making their move up.

This is where custom indicators can come in and add to the story. With help I created one called the SuperTrail which is a percentage based ATR indicator which simply means it looks at the "average true range" of a stock over time. It is super simple, intuitive and highly visual and by setting it to a default value like 20% I can quickly skim through a list of stocks and find ones where I can buy and in theory hold them longer term because they are less volatile than other similar stocks in the same market - but still making the same or even better gains. Once I have created a short list of these stocks I can then go through them and choose which ones I want to buy, and what the correct "range" is I want to apply as a stop loss to help protect my profits when the trend changes or eventually ends.

In this video I show you how I can find stocks that have made 100%+ type gains over the last 12 months without too much volatility and might be worth keeping an eye on.

You can find more information and videos on the SuperTrail and what else it can do via the link in my signature. It's pretty cool (I think).

If you ever wanted to create your own indicator, this is the place to do it!

The major Exchange Traded DerivativesChina continues to privatize companies, open its markets to foreign investors, and develop relations around the future silk road.

In 1 month China is launching its international Copper future. It sounds interesting but I do not know if individual investors care enough for this future to be available with my broker, maybe IG will have it.

As the USA declines (and perhaps Europe), China might become the "hub" for commodity derivatives (thinking of industrial metals and agri),

if this is the case I expect retail traders and their brokers to catch up in only a decade or two (seriously).

For this occasion let's look at the most traded derivatives around the world.

1- Agriculture

*It is a non-profit, self-regulating and membership legal entity established on February 28, 1993 (when China opened itself to the free markets and emerged out of poverty). Non-profit because that's evil capitalism. Nothing is free though. So who pays? The average chinese factory worker? Haha!

Back in 2018 they started opening up to foreign investors (Iron Ore, a little after their Oil contract that was the first one ever open to foreigners), the exchange also has an english website:

www.chinadaily.com.cn

**The Zhengzhou Commodity Exchange (ZCE) is China's first futures exchange,

Zhengzhou Airport Economy Zone is China's first Airport Economy Zone.

Zhengzhou is not a SPECIAL economic zone, it is only an economic zone.

Unsurprisingly China is not big on "financial" products (interest rates & equity index) but they are big on more basic things: Agriculture & Mining.

2- Energy

So ye Moscow, NYMEX (CME), and London ICE mostly.

3- Metals

4- Equity Index

How many contracts would you want? Yes.

India and Brazil are at the top of the list.

India is famous for its overvaluations and many gambling bagholders, and Brazil for its large numbers of gambling day traders.

Stocks and stock indexes (and ETFs) have by far the most individual investors, as those are supposed to be more noob friendly due to having a much lower skill floor.

Think of it (lol players) as Yasuo, Master Yi and Volibear mains. For HOMM the equivalent is 3 months afk farm Necro on a giant map.

They have been convinced that it was a positive sum game where everyone can make easy money.

There are 2 major categories of retail investors: bagholders & day gamblers. They both consistently lose.

Due to the power of compounding day gamblers lose money much faster than bagholders, which is why people advise individual investors to stick to bagholding.

Bagholding also gives people more time to think it through and quit with some of their money left, while day gamblers will have lost most of their money before the initial excitement has waned off.

5- FX

6- Rates

7- Other

No idea what all of this mess is.

For my part I only trade a couple of those: 3 grains, 2 metals (Gold Copper), Texas Oil & NatGas, all on the CME (7 total, with some correlations).

Sometimes I look at softs on the ICE and Nickel on the LME but I don't really touch them much.

Rarely will get into indices, I do follow where they are going from far away.

I actually am active in the smallest derivatives that make 7.4%, 5%, 4.9%, 1.6% and 1% while avoiding equities that make 50% :D

But I do Forex alot, got around 10 currencies in my watchlist. With correlations and everything I would say FX is about twice to thrice as big as commodities for me.

There is already plenty to do and plenty of good uncorrelated opportunities to go for. With on top of that the occasional Bitcoin or major indice or stock bet, I'd say that's about as far as someone can push it with just being coinflipping.

I know that professionals hold stocks for quarters or years, Forex for a few days or a few weeks, retail just day trades everything, and I do not know for indices and commodities and rates. But I know commodities sort of behave much more like FX than equities and open interest fluctuates similarly so I would say we are looking at weeks to month in my opinion, for professionals of course, retail just day trades everything they'd day trade overnight swaps and EOD indexes if they found a way.

There are alot of those futures. More than enough to have your hands full. Might have some bubbles in China in the future and if this is the case I'll be the first to know way before mainstreet gets all excited and rushes in at the top (and push it higher) as they often do.

In July 2019 ZCE Apples (bigger than CME Corn) gapped down by 40%. I am not ready for this. Unless they have some "fair and profit-free" options :D

I wouldn't mind getting some surprise 40% infinite gains with tiny limited losses. I guess they are not big on "evil profit driven too abstract for me to understand" speculation.

Haha so how are their behinds after that 40% gap with no speculator to absorb the risk? 😉

There HAS to be broken flaws to exploit in the future. Maybe when that happens they will rollback all trades "for fairness" silly commies.

Well too early to tell, we will see.

Book Review: Price Action Breakdown by Laurentiu DamirWhen I started trading I was extremely excited about the possibilities that lay before me… The dream of changing your work ethic from “working for your money” to “putting your money to work for you” was intoxicating. I took every class, read every book, followed every “guru” I thought would help me get that ‘edge’, that secret sauce, to make me a great trader. Once I discovered what actually worked, and actually *did* the work of putting that knowledge into practice, I found that trading, like so many other things, follows an 80/20 rule, where 80% of your results come from 20% of your actions. I asked myself what was really important in trading, and I distilled it down to 2 points: Psychology, and Price Action.

Notice, I put Psychology first.

After reading about, backtesting, sim trading, and live trading so many techniques by so may experts I have distilled (culled?) the instruments in my trading toolbox to a select few. Like that scene in Gran Torino when Clint Eastwood is teaching his young asian friend how to “be a man” and learn to fix things, he gives him Duct Tape, WD-40, a pair of pliers, and said “This will help you fix half of your problems.”

www.youtube.com

Similarly, I now only have 2 books that I read or listen to a LEAST once per quarter. This advice in them takes care of 90% of my trading needs. This also helps me stick to the basics. Repetition is the mother of skill and we need to constantly be reminded of (and practice) those basics.

Today I wanted to share with you one of those two books: Price Action Breakdown, by Laurentiu Damir.

This book is going to put you to work. Trading, like any other skill, is something you learn by DOING. You can’t learn carpentry by simply reading a book. You can’t learn painting by only reading a book… you have to take a chisel to wood or a brush to canvas to put that theory into PRACTICE. Likewise, Laurentiu puts you to work trading, lesson by lesson, concept by concept.

He simply and demonstrably shows the aspiring trader that all the information we need to decide to buy or sell is right there on the chart. No indicator, oscillator, or other doo-dads are needed. As he puts it,

"The best indicator you can have is your brain analyzing the raw price movements.”

He breaks down the specific patterns that we as traders need to look at to “see the opportunity” on the screen, notably value areas, excess price, control prices, and rejection areas. There is no mention of chart patterns (head and shoulders, triple bottom, cup and handle, ascending triangle, blah, blah, blah…) or candlestick patterns (bearish engulfing, dojo, shooting star, hammer…) - It’s all about price action. When you look at a chart and see who is buying what and where, you can make an educated decision on where to buy and sell right alongside the institutional market makers who are moving price.

Quote: "Throughout this book, whenever I will discuss about buyer and seller behavior, I am talking about the long term traders. They are the ones who move the markets, it makes all the sense in the world to study their behavior, observe how price moves as a result of their actions, and formulate concepts, rules and strategies to follow what they do, to be in the same boat as them. We have to discover their footsteps and follow them."

I’m a Kindle guy, and my trading partner bought the hardcopy on my recommendation. The hardcopy is a unique piece of work in terms of its layout, font choice, and stark coloring. I don’t know if it was intentional, but the fact that it is so physically *different* from other books almost makes you give what you are reading that extra bit of attention. My friend, too, owes much of his success to the techniques in this book so I never hesitate to recommend it.

I hope if you decide to get this book that you will put all the necessary WORK in that is required to put concepts into practice… to imbed it into your nervous system so you can “see the money” on the chart just like Neo could see The Matrix and easily defeat what was previously an undefeatable opponent.

youtu.be

In a later article I will talk about backtesting - something that every trader needs to do to build up his skill, to test a trading methodology (such as price action!), and to help keep you “in the zone” (teaser for my next book review!) so as you develop and hone your trading skills, that you will keep that skill and sharpen your trading saw day by day and enjoy the benefits of being a professional financial trader.

I would say 'good luck', but luck has nothing to do with developing the skill of trading just as it wasn't 'luck' that made Michael Jordan the best basketball player or Tiger Woods the golfer in the world. It was perseverance, grit, and repetition.

Happy trading!

smile.amazon.com