XAUUSD Market Maker Playbook – Learn How the Game Is Rigged🎓 XAUUSD Market Maker Playbook – Learn How the Game Is Rigged

Traders—if you think this market is some pure, fair supply/demand mechanism, you’re getting played.

Market makers run sophisticated pump and dump cycles designed to trap you.

Today, I’m going to break down exactly how they do it, so you can start trading like a sniper, not a sheep.

🔍 Understanding the 3 Manipulation Zones

🟢 GREEN ZONE: Accumulation Range (3286–3300)

Purpose:

Market makers quietly build positions.

They create an illusion of neutrality—small candles, tight ranges.

Signs:

Repeated tests of the same level.

Volume stays steady (not exploding).

Wicks in both directions (so nobody knows who’s in control).

🟡 YELLOW ZONE: The Pump Phase (3300–3330)

Purpose:

Trigger breakout traders.

Induce FOMO buying.

Clear out short stops above the range.

Signs:

Quick impulsive candles with LOW RELATIVE VOLUME.

Price blows through resistance but struggles to hold.

Social media and news start calling “Bull Run.”

🔴 RED ZONE: Distribution & Dump (3330–3350)

Purpose:

Offload large positions into retail buying.

Leave traders trapped at the highs.

Signs:

Spikes of huge volume as price stalls.

Rejection candles (long upper wicks).

Big delta shifts negative (sellers hitting bids hard).

⚔️ How the Market Maker Sequence Works

Here’s how the trap gets set:

1️⃣ Accumulate in Green Zone

Build inventory while convincing everyone “nothing is happening.”

2️⃣ Pump into Yellow Zone

Push price up just enough to trigger momentum traders.

Keep volume deceptively low—so it looks sustainable.

3️⃣ Sell in the Red Zone

Dump big positions into the buying frenzy.

Flip the tape bearish—fast.

Watch as the herd gets stopped out or bag-held.

🎯 Tomorrow’s Possible Plays

✅ Scenario 1 – Classic Pump & Dump

Phase 1: Grind in 3286–3300.

Phase 2: Spike to 3335.

Phase 3: Dump back to 3260.

✅ Scenario 2 – Fake Breakdown Reversal

Phase 1: Slam price to 3250, triggering panic selling.

Phase 2: Accumulate aggressively.

Phase 3: Rip price back to 3320, trapping shorts.

✅ Scenario 3 – Slow Grind Liquidation

Phase 1: Drift up in low volume toward 3330.

Phase 2: Distribute over several hours.

Phase 3: Liquidate longs into NY close.

📚 How YOU Can Spot This Manipulation

Here’s your checklist—save this:

✅ Volume vs. Price Analysis

Big price moves WITHOUT proportionate volume = FAKEOUT.

Big volume at tops/bottoms = Institutional distribution or accumulation.

✅ Delta Confirmation

Positive delta = buyers aggressive.

Negative delta = sellers slamming bids.

Watch for divergence (price up but delta down = hidden selling).

✅ Candlestick Clues

Rejection wicks.

Engulfing candles at key zones.

Multiple failures to break past a level.

✅ Timing

London open and NY open are prime manipulation hours.

Thin liquidity in Asia can exaggerate moves.

💡 Pro Tip:

“The crowd chases price. The professionals track volume, delta, and timing.”

— Technical Analysis and Stock Market Profits

🚀 Stay sharp. Think like a market maker. Trade like a predator.

#XAUUSD #MarketMakerEducation #ForexTrading #PriceAction #LearnT

Beyond Technical Analysis

Overfitting Will Break Your Strategy — Here’s Why█ Why Your Backtest Lies: A Quant’s Warning to Retail Traders

As a quant coder, I’ve seen it time and again: strategies that look flawless in backtests but fall apart in live markets.

Why? One word: overfitting.

Compare the signals in the images below. They’re from the same system, but one is overfitted, showing how misleading results can look when tuned too perfectly to the past.

⚪ Overfitting is what happens when you push a strategy to perform too well on historical data. You tweak it, optimize it, and tune every rule until it fits the past perfectly, including every random wiggle and fluke.

To retail traders, the result looks like genius. But to a quant, it’s a red flag .

█ Trading strategy developers have long known that “curve-fitting” a strategy to historical data (overfitting) creates an illusion of success that rarely holds up in live markets. Over-optimizing parameters to perfectly fit past price patterns may produce stellar backtest results, but it typically does not translate into real profits going forward.

In fact, extensive research and industry experience show that strategies tuned to past noise almost inevitably disappoint out-of-sample.

The bottom line: No one succeeds in markets by relying on a strategy that merely memorized the past — such “perfect” backtests are fool’s gold, not a future edge.

█ The Illusion of a Perfect Backtest

Overfitted strategies produce high Sharpe ratios, beautiful equity curves, and stellar win rates — in backtests. But they almost never hold up in the real world.

Because what you’ve really done is this:

You built a system that memorized the past, instead of learning anything meaningful about how markets work.

Live market data is messy, evolving, and unpredictable. An overfit system, tuned to every quirk of history, simply can’t adapt.

█ A Warning About Optimization Tools

There are many tools out there today — no-code platforms, signal builders, optimization dashboards — designed to help retail traders fine-tune and "optimize" their strategies.

⚪ But here’s the truth:

I can't stress this enough — do not rely on these tools to build or validate your strategy.

They make it easy to overfit.

They encourage curve-fitting.

They give false hope and lead to false expectations about how markets actually work.

⚪ The evidence is overwhelming:

Decades of academic research and real-world results confirm that over-optimized strategies fail in live trading. What looks good in backtests is often just noise, not edge.

This isn’t something I’ve made up or a personal theory.

It’s a well-documented, widely accepted fact in quantitative finance, supported by decades of peer-reviewed research and real-world results. The evidence is overwhelming. It’s not a controversial claim — it’s one of the most agreed-upon truths in the field.

█ Why Overfitting Fails

Let me explain it like I do to newer coders:

Random patterns don’t repeat: The patterns your strategy "learned" were noise. They won't show up again.

Overfitting kills the signal: Markets have a low signal-to-noise ratio. Fitting the noise means you've buried the signal.

Markets change: That strategy optimized for low-volatility or bull markets? It breaks in new regimes.

You tested too many ideas: Try enough combinations, and something will look good by accident. That doesn’t make it predictive.

█ The Research Backs It Up

Quantopian’s 888-strategy study:

Sharpe ratios from backtests had almost zero predictive power for live returns.

The more a quant optimized a strategy, the worse it performed live.

Bailey & López de Prado’s work:

After testing enough variations, you’re guaranteed to find something that performs well by chance, even if it has no edge.

█ My Advice to Retail Traders

If your strategy only looks great after a dozen tweaks… It’s probably overfit.

If you don’t validate on out-of-sample data… you’re fooling yourself.

If your equity curve is “too good” to be true… it probably is.

Real strategies don’t look perfect — they look robust. They perform decently across timeframes, markets, and conditions. They don’t rely on lucky parameter combos or obscure filters.

█ What to Do Instead

Use out-of-sample and walk-forward testing

Stick to simpler logic with fewer parameters

Ground your system in market rationale, not just stats

Risk management over performance maximization

Expect drawdowns and variability

Treat backtest performance as a rough guide, not a promise

Overfitting is one of the biggest traps in strategy development.

If you want your trading strategy to survive live markets, stop optimizing for the past. Start building for uncertainty. Because the market doesn’t care how well your model memorized history. It cares how well it adapts to reality.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Embracing Uncertainty

In trading, the illusion of certainty is often our biggest enemy.

Even the cleanest setups—like a MTR (Major Trend Reversal)—can fail.

Mark Douglas said it best:

“Anything can happen.”

This simple truth is what keeps professional traders humble and disciplined.

Respect the market, manage your risk, and never assume you know what comes next.

Stay sharp.

#MJTrading

#GoldTrading #XAUUSD #TradingPsychology #AnythingCanHappen #MarkDouglas #ForexMindset #TradingQuotes #PriceAction #RiskManagement #MindOverMarkets #ChartOfTheDay #MJTrading

Skeptic| Cycle Mastery Part 1: HWC, MWC, LWC for Smarter TradingUnderstanding Higher Wave Cycle ( HWC ), Minor Wave Cycle ( MWC ), and Low Wave Cycle ( LWC ) is the key to making informed trading decisions, simplifying when to go long , short , or stay out . This Part 1 masterclass introduces these cycles, their relative nature, and how to align them with your strategy for precise entries and effective risk management . Let’s break it down. 📊

The Three Cycles: HWC, MWC, LWC

We trade across three market cycles:

HWC (Higher Wave Cycle) : The big-picture trend, like Bitcoin’s yearly uptrend.

MWC (Minor Wave Cycle): A medium-term trend, often an uptrend or corrective phase within the HWC.

LWC (Low Wave Cycle): The short-term daily trend, which can be range-bound, uptrend, or downtrend.

Knowing these cycles helps you decide when to e nter long, short, or avoid trading altogether, ensuring you align with the market’s rhythm.

Defining Your Cycles: It’s Relative

The main question before diving in: What timeframes are HWC, MWC, and LWC? The answer is relative—it depends on your strategy. Think of it like a temperature scale: 0°C isn’t “no heat” but a reference point (water’s freezing point). Similarly, your cycles are defined by the largest timeframe you analyze:

HWC: Your highest timeframe (e.g., Weekly for long-term traders).

MWC: The next level down (e.g., Daily).

LWC: Your shortest timeframe (e.g., 4-Hour or 1-Hour).

Ask yourself: What’s the largest timeframe I check? Set your HWC there, then scale down for MWC and LWC based on your trading style. This relativity ensures your cycles fit your unique approach.

While shorter cycles (LWC, MWC) form the HWC, the HWC’s power dominates, influencing smaller cycles. Let’s explore how to trade based on these relationships.

Trading Scenarios: When to Act

Scenario 1: HWC Uptrend, MWC Range

When the HWC is in an uptrend and the MWC is range-bound:

Action: Enter a long position on the first MWC wave when the LWC breaks the ceiling of the MWC range (e.g., a box breakout).

Why? The HWC’s bullish power supports the move, likely triggering an MWC uptrend. This makes the first wave a strong, low-risk entry.

Example: If the LWC (e.g., 4-hour) breaks the MWC range ceiling with a strong candle, you can confidently go long, backed by the HWC uptrend.

Scenario 2: HWC Downtrend, MWC Range

When the HWC is in a downtrend and the MWC is range-bound:

Action: Skip the first MWC wave. If the LWC breaks the MWC range ceiling, avoid going long—the bearish HWC could reject the move, resuming its downtrend.

Wait for the Second Wave: Let the MWC return to a range after the first wave. If the LWC breaks the range ceiling again, go long with confidence—the HWC’s influence is less likely to disrupt this second wave.

Risk Management Tips (if you trade the first wave against the HWC):

Reduce Risk: Lower your position size to minimize exposure.

Take Profits Early: Close the position or secure most profits (e.g., scale out) once you hit your R/R target, as volatility is high.

Wider Stop-Loss: Set a larger stop-loss to account for potential HWC-driven reversals, as stop-loss hunts are common in this scenario.

Adjusting Stop-Loss Size Based on Cycles

Aligned Cycles (HWC, MWC, LWC in Same Direction): When all three cycles align (e.g., all uptrend), set a tighter stop-loss relative to market conditions. Gradually scale out profits instead of closing the position, as the trend’s strength supports higher R/R (e.g., 5 or 10).

HWC Against MWC/LWC: If the HWC opposes the other cycles (e.g., HWC downtrend, MWC/LWC uptrend), use a wider stop-loss. The HWC’s power could reverse the LWC, lowering your win rate if stops are too tight. Expect volatility and plan accordingly.

Final Vibe Check

This Cycle Mastery Part 1 equips you to time MWC waves with precision, aligning HWC, MWC, and LWC for smarter entries. By mastering when to trade the first or second wave, you’ll avoid traps and maximize your edge. Part 2 will dive deeper with examples—stay tuned! At Skeptic Lab, we trade with no FOMO, no hype, just reason. Protect your capital—stick to 1%–2% risk per trade. Want Part 2 or another topic? Drop it in the comments! If this guide sharpened your game, hit that boost—it fuels my mission! 😊 Stay disciplined, fam! ✌️

💬 Let’s Talk!

How will you time your MWC waves? Share your thoughts in the comments, and let’s crush it together!

Weather and Corn: Understanding the Precipitation Factor1. Introduction: Rain, Grain, and Market Chain Reactions

In the world of agricultural commodities, few forces carry as much weight as weather — and when it comes to corn, precipitation is paramount. Unlike temperature, which can have nuanced and sometimes ambiguous effects depending on the growth stage, rainfall exerts a more direct and consistent influence on crop performance. For traders, understanding the role of rainfall in shaping market sentiment and price behavior isn't just an agricultural curiosity — it's a trading edge.

This article unpacks the relationship between weekly rainfall levels and corn futures prices. By leveraging normalized weather data and historical returns from Corn Futures (ZC), we aim to translate weather signals into actionable market insights. Whether you're managing large agricultural positions or exploring micro futures like MZC, precipitation patterns can provide vital context for your trades.

2. Corn’s Moisture Dependency

Corn is not just sensitive to water — it thrives or suffers because of it. From the moment seeds are planted, the crop enters a delicate dance with precipitation. Too little moisture during the early stages can impair root development. Too much during germination may lead to rot. And during pollination — particularly the tasseling and silking stages — insufficient rainfall can cause the plant to abort kernels, drastically reducing yield.

On the other hand, excessive rainfall isn't necessarily beneficial either. Prolonged wet periods can saturate soil, hinder nutrient uptake, and encourage fungal diseases. Farmers in the U.S. Corn Belt — particularly in states like Iowa, Illinois, and Nebraska — know this well. A single unexpected weather shift in these regions can send ripple effects across global markets, causing speculators to reassess their positions.

For traders, these weather events aren’t just environmental footnotes — they are catalysts that influence prices, volatility, and risk sentiment. And while annual production is important, it's the week-to-week rhythm of the growing season where short-term trades are born.

3. Our Data-Driven Approach: Weekly Rainfall and Corn Returns

To understand how rainfall impacts price, we collected and analyzed decades of historical weather and futures data, aligning weekly precipitation totals from major corn-growing regions with weekly returns from Corn Futures (ZC).

The weather data was normalized using percentiles for each location and week of the year. We then assigned each weekly observation to one of three precipitation categories:

Low rainfall (<25th percentile)

Normal rainfall (25th–75th percentile)

High rainfall (>75th percentile)

We then calculated the weekly percent change in corn futures prices and matched each return to the rainfall category for that week. The result was a dataset that let us measure not just general trends but statistically significant shifts in market behavior based on weather. One key finding stood out: the difference in returns between low-rainfall and high-rainfall weeks was highly significant, with a p-value of approximately 0.0006.

4. What the Numbers Tell Us

The results are striking. During low-rainfall weeks, corn futures often posted higher average returns, suggesting that the market responds to early signs of drought with anticipatory price rallies. Traders and institutions appear to adjust positions quickly when weather models hint at below-normal moisture during key growth stages.

In contrast, high-rainfall weeks displayed lower returns on average — and greater variability. While rain is essential, excess moisture raises fears of waterlogging, planting delays, and quality issues at harvest. The futures market, ever forward-looking, seems to price in both optimism and concern depending on the volume of rain.

Boxplots of these weekly returns reinforce the pattern: drier-than-usual weeks tend to tilt bullish, while wetter periods introduce uncertainty. For discretionary and algorithmic traders alike, this insight opens the door to strategies that incorporate weather forecasts into entry, exit, and risk models.

📊 Boxplot Chart: Weekly corn futures returns plotted against precipitation category (low, normal, high). This visual helps traders grasp how price behavior shifts under varying rainfall conditions.

5. Strategy: How Traders Can Position Themselves

With the clear statistical link between rainfall extremes and price behavior in corn futures, the logical next step is applying this insight to real-world trading. One straightforward approach is to incorporate weather forecast models into your weekly market prep. If a key growing region is expected to receive below-normal rainfall, that could serve as a signal for a potential bullish bias in the upcoming trading sessions.

This doesn’t mean blindly buying futures on dry weeks, but rather layering this data into a broader trading thesis. For example, traders could combine weather signals with volume surges, technical breakouts, or news sentiment to form confluence-based setups. On the risk management side, understanding how price behaves during extreme weather periods can inform smarter stop-loss placements, position sizing, or even the use of option strategies to protect against unexpected reversals.

Additionally, this information becomes particularly valuable during the planting and pollination seasons, when the corn crop is most vulnerable and the market reacts most strongly. Knowing the historical patterns of price behavior in those weeks — and aligning them with current forecast data — offers a clear edge that fundamental and technical analysis alone may not reveal.

🗺️ Global Corn Map Screenshot: A world map highlighting major corn-growing regions with weather overlay. This helps illustrate the geographic variability in rainfall and how it intersects with key production zones.

6. Corn Futures Contracts: Speculating with Flexibility

For traders looking to act on this kind of seasonal weather intelligence, CME Group provides two practical tools: the standard-size Corn Futures contract (ZC) and the Micro Corn Futures contract (MZC).

Here are some quick key points to remember:

Tick size for ZC is ¼ cent (0.0025) per bushel, equating to $12.50 per tick.

For MZC, each tick is 0.0050 equating to $2.50 per tick.

Standard ZC initial margin is approximately $1,000 and MZC margins are around $100 per contract, though this can vary by broker.

Micro contracts are ideal for those who want exposure to corn prices without the capital intensity of full-size contracts. They’re especially helpful for weather-based trades, where your thesis may rely on shorter holding periods, rapid scaling, or position hedging.

7. Conclusion: Rain’s Role in the Corn Trade

Precipitation isn’t just a farmer’s concern — it’s a trader’s opportunity. Our analysis shows that weather data, especially rainfall, has a statistically significant relationship with corn futures prices. By normalizing historical precipitation data and matching it to weekly returns, we uncovered a clear pattern: drought stress tends to lift prices, while excessive moisture creates volatility and downside risk.

For futures traders, understanding this dynamic adds another layer to market analysis.

As part of a broader series, this article is just one piece of a puzzle that spans multiple commodities and weather variables. Stay tuned for our upcoming releases, where we’ll continue exploring how nature’s forces shape the futures markets.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

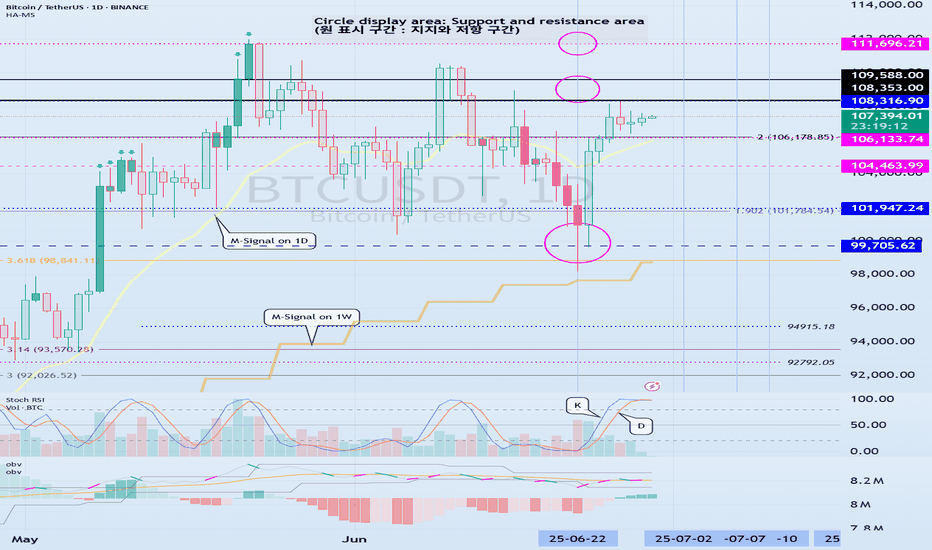

Example of how to draw a trend line using the StochRSI indicator

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

We use the StochRSI indicator to draw a trend line.

We draw a trend line by connecting the peaks of the StochRSI indicator, i.e. the K line, when they are created in the overbought area or when they are created in the overbought area.

That is, when the K line of the StochRSI indicator forms a peak in the overbought area, the trend line is drawn by connecting the Open values of the falling candles.

If the candle corresponding to the peak of the StochRSI indicator is a rising candle, move to the right and use the Open value of the first falling candle.

When drawing the first trend line, draw it from the latest candle.

Since the third trend line indicates a new trend, do not draw anything after the third trend line.

The currently drawn trend line corresponds to the high-point trend line.

-

Therefore, you should also draw the low-point trend line.

The low-point trend line is drawn by connecting the K line of the StochRSI indicator when the top is formed in the oversold zone.

The low-point trend line uses the low value of the candle when the K line of the StochRSI indicator forms the top in the oversold zone.

That is, it doesn't matter whether the candle is a bearish candle or a bullish candle.

The drawing method is the same as when drawing the high-point trend line, drawing from the latest candle.

The top of the best K line of the StochRSI indicator was not formed within the oversold zone.

(The top is indicated by the section marked with a circle.)

Since the trend line was not formed, the principle is not to draw it.

If you want to draw it and see it, it is better to display it differently from the existing trend line so that it is intuitively different from the existing trend line.

-

The chart below is a chart that displays the trend line drawn separately above as a whole.

It is also good to distinguish which trend line it is by changing the color of the high-point trend line and the low-point trend line.

The chart below is a chart that distinguishes the high-point trend line in blue (#5b9cf6) and the low-point trend line in light green (#00ff00).

The low-point trend line is a line drawn when the trend has changed, so it does not have much meaning, but it still provides good information for calculating the volatility period.

-

To calculate the volatility period, support and resistance points drawn on the 1M, 1W, and 1D charts are required.

However, since I am currently explaining how to draw a trend line, it is only drawn on the 1M chart.

-

I use the indicators used in my chart to indicate support and resistance points.

That is, I use the DOM(60), DOM(-60), HA-Low, HA-High, and OBV indicators to indicate support and resistance points.

Since the DOM(-60) and HA-Low indicators are not displayed on the 1M chart, I have shown the 1W chart as an example.

The indicators displayed up to the current candle correspond to the main support and resistance points.

Although it is not displayed up to the current candle, the point where the horizontal line is long is drawn as the sub-support and resistance point.

It is recommended to mark them separately to distinguish the main support and resistance point and the sub-support and resistance point.

The trend line drawn in this way and the support and resistance points are correlated on the 1D chart and the volatility period is calculated.

(For example, it was drawn on the 1M chart.)

The sections marked as circles are the points that serve as the basis for calculating the volatility period.

That is,

- The point where multiple trend lines intersect

- The point where the trend line and the support and resistance points intersect

Select the point that satisfies the above cases at the same time to display the volatility period.

When the point of calculating the volatility period is ambiguous, move to the left and select the first candle.

This is because it is meaningless to display it after the volatility period has passed.

If possible, the more points that are satisfied at the same time, the stronger the volatility period.

If the K-line peak of the StochRSI indicator is formed outside the overbought or oversold zone, it is better to exclude it when calculating the volatility period.

-

The chart below is a chart drawn on a 1D chart by summarizing the above contents.

The reason why there are so many lines is because of this reason.

For those who are not familiar with my charts, I have been simplifying the charts as much as possible these days.

However, when explaining, I have shown all the indicators to help you understand the explanation.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

War , Bitcoin , and the Myth of Safe Havens...Hello Traders 🐺

"You think Bitcoin is digital gold? Wait until the bombs drop."

Everyone talks about Bitcoin as a hedge. A hedge against inflation. Against fiat. Against banking failures.

But let me ask you this:

Is Bitcoin a hedge against war?

I’m not here to give you a yes or no. I’m here to make you uncomfortable —

Because if you think BTC always pumps when chaos hits,

you're trading dreams, not reality.

Let’s dissect this. No fluff.

⚔️ 1. Real Wars. Real Charts.

Let’s test your assumptions against actual history:

Feb 2022 (Ukraine invaded):

BTC dumps hard. Then... recovers.

Was it a hedge? Or just the market gasping for liquidity?

Oct 2023 (Middle East escalates):

BTC spikes. Why?

Was it fear of fiat instability? Or just algo-driven momentum?

April 2024 (Hormuz Strait tensions):

Whipsaws. No clear direction.

So again: what exactly is BTC reacting to?

👉 Are you reading price? Or just feeding a narrative you want to believe?

🧠 2. Bitcoin = Fear Thermometer?

In war, people flee. Banks freeze. Censorship rises. Panic spreads.

Some run to gold.

Some run to the dollar.

A few... run to BTC.

But don’t forget:

Most retail investors panic sell. Institutions vanish. Liquidity dies.

So here’s the punchline:

BTC isn't a safe haven.

It's a sentiment mirror — brutally honest and totally unstable.

Still wanna call it "digital gold"?

💣 3. War Doesn’t Create Trends. It Exposes Bias.

Most of you are trying to fit BTC’s price into a geopolitical event.

Wrong approach.

You should be asking:

What kind of war is this?

Does it shake the dollar?

Does it cause capital controls?

Does it threaten global liquidity?

BTC doesn’t care about explosions.

It cares about trust.

Break trust in fiat? BTC might thrive.

Spike short-term fear? BTC might collapse.

Simple enough?

📉 4. The Hard Truth: Most of You Can’t Read War

No offense — but most retail traders don’t understand geopolitics.

They just look at headlines and wait for a green candle.

So here’s your challenge:

Next time war breaks out, ask yourself:

“Is this bullish for BTC — or just loud?”

Be honest. Don’t just copy Twitter takes.

🔍 5. If You're Long BTC Because of War — You Better Know Why.

BTC might go up.

BTC might tank.

But if your reason is just “the world is collapsing” —

you’re gambling, not investing.

Ask the deeper questions:

Are people losing faith in centralized systems?

Are borders tightening?

Are currencies being weaponized?

BTC shines only when sovereignty collapses.

Not just when missiles fly.

🧠 Final Thoughts

War doesn't pump BTC.

Distrust does.

Learn the difference — or keep trading headlines.

💬 Your move.

Would you hold Bitcoin during a war?

Why?

Drop the cliché answers. Give me logic.

👇 Let’s debate.

Master Your Edge: It’s Not About Just Being Right

Most traders obsess over being right on every trade. But the truth is, consistent profitability doesn’t come from perfect predictions—it comes from disciplined risk management.

Mark Douglas reminds us:

“Trading is not about being right or wrong. It’s about how much you make when you’re right and how much you lose when you’re wrong.”

Focus less on proving yourself right, and more on protecting your capital when you’re wrong. That’s how professionals thrive in uncertain markets.

#MJTrading

#TradingPsychology #MarkDouglas #ForexMindset #TraderMindset #EURUSD #TradingQuotes #ForexLife #RiskManagement #TradingDiscipline #ForexEducation #ChartOfTheDay #PriceAction #MindOverMarkets

StochRSI indicator and support and resistance levels

Hello, traders.

If you "follow" me, you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

The StochRSI indicator on the left chart is slightly different from the StochRSI indicator on the right.

The StochRSI indicator on the left chart is the StochRSI indicator provided by default in TradingView, and the StochRSI indicator on the right chart is an indicator with a modified formula.

The StochRSI indicator is a leading indicator that is reflected almost in real time.

Therefore, it reacts sensitively to price changes.

Although it is advantageous because it reacts sensitively, it also increases the possibility of being caught in a fake, so I thought that a slight delay(?) was necessary, and so I created the StochRSI indicator on the left chart.

If you look at the relationship between the K and D of the StochRSI indicators on the two charts, you can see that there is a big difference.

In the end, you can predict the movement by checking whether the movement of the K line has escaped the overbought or oversold section.

However, I think that you will receive information that can determine the sustainability of the trend depending on the positional relationship between K and D.

Therefore, it is important to distinguish the inflection points that occur in the StochRSI indicator.

This is because these inflection points provide important information for drawing trend lines.

Therefore, the StochRSI indicator on the left chart, which better expresses the inflection point, is being used to draw the trend line.

(Unfortunately, this indicator was not registered on TradingView because I did not explain it well.)

-

As a new candle was created, the StochRSI indicator on the left chart is showing an inflection point on the K line.

The StochRSI indicator on the right chart is showing a transition to a state where K < D.

We will have to check whether the inflection point was created only when today's candle closes, but I think that the fact that it is showing this pattern means that there is a high possibility of a change in the future trend.

Since the next volatility period is expected to start around July 2nd (July 1st-3rd), I think it has started to show meaningful movements.

-

It is true that you want to buy at the lowest price possible and sell at the highest price.

However, because of this greed, one mistake can lead to a loss that can overturn nine victories, so you should always be careful.

Therefore, if possible, it is better to check for support and respond.

In that sense, I think it is worth referring to the relationship between K and D of the StochRSI indicator on the left chart.

This is because the actual downtrend is likely to start when K < D.

-

In order to check for support, you definitely need support and resistance points drawn on the 1M, 1W, and 1D charts.

Ignoring this and checking for support at the drawn support and resistance points can result in not being able to apply the chart you drew to actual trading.

Therefore, you should draw support and resistance points first before starting a trade.

Otherwise, if you draw support and resistance points after starting a trade, you are more likely to set support and resistance points that reflect your subjective thoughts, so as I mentioned earlier, you are more likely to lose faith in the chart you drew.

If this phenomenon continues, it will eventually lead to leaving the investment market.

-

It is important to determine whether there is support by checking the correlation between the StochRSI indicator and other indicators at the support and resistance points drawn on the 1M, 1W, and 1D charts.

Even if the inflection point of the StochRSI indicator or other indicators occurs at a point other than the support and resistance points you drew, you should consider it as something that occurred beyond your ability to handle.

In other words, you should observe the price movement but not actually trade.

As I mentioned earlier, if you start to violate this, you will become less and less able to trust the chart you drew.

-

Accordingly, the basic trading strategy I suggest is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, since the HA-Low and HA-High indicators are expressed as average values, they may move in the opposite direction to the basic trading strategy.

In other words, if the HA-Low indicator is resisted and falls, there is a possibility of a stepwise downward trend, and if the HA-High indicator is supported and rises, there is a possibility of a stepwise upward trend.

Therefore, the basic trading strategy mentioned above can be considered a trading strategy in the box section.

In the case of deviating from this box section, it is highly likely to occur before and after the volatility period indicated by the relationship between the trend line using the StochRSI indicator mentioned above and the support and resistance points drawn on the 1M, 1W, and 1D charts.

Therefore, special care is required when conducting new transactions during the volatility period.

This is because there is a high possibility of being caught in a fake when trading during the volatility period.

-

The DOM(60) and DOM(-60) indicators are good indicators to look at together with the HA-Low and HA-High indicators.

The DOM indicator is an indicator that comprehensively evaluates the DMI, OBV, and MOMENTUM indicators.

Therefore, the DOM(60) indicator is likely to be at the end of the high point range, and the DOM(060) indicator is likely to be at the end of the low point range.

In the explanation of the HA-Low and HA-High indicators,

- I said that if the HA-Low indicator receives resistance and falls, there is a possibility that a stepwise downtrend will begin,

- and if the HA-High indicator receives support and rises, there is a possibility that a stepwise uptrend will begin.

In order for an actual stepwise downtrend to begin, the price must fall below DOM(-60), and in order for a stepwise uptrend to begin, it must rise above DOM(60).

In other words, the DOM(-60) ~ HA-Low section and the HA-High ~ DOM(60) section can be seen as support and resistance sections.

-

If these correlations start to appear, I think you will be able to create a trading strategy that fits your investment style without being swayed by price volatility and proceed with trading.

The reason for analyzing charts is to trade.

Therefore, the shorter the time for chart analysis, the better, and you should increase the start of creating a trading strategy.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

FX quarter end : a high-probability recurring patternAs we approach the end of June, a well-known phenomenon among FX traders is once again coming into focus: when currencies have diverged significantly over the course of a month or quarter, we often see a technical correction into the final trading session, with partial pullbacks in the pairs that had previously moved the most.

This end-of-month or quarter pattern is not random. It is the predictable result of recurring institutional flows. Recently, the US dollar has notably weakened against most major currencies. As a result, we could anticipate a modest bounce in the dollar to close out the month and start the new week, as various participants are likely to adjust their positions accordingly.

Performance of FX futures contracts from Sunday, June 1 to Friday, June 27:

Swiss Franc +3.71%

Euro +3.61%

British Pound +1.95%

New Zealand Dollar +1.58%

Australian Dollar +1.50%

Canadian Dollar +0.67%

Japanese Yen +0.16%

Performance of FX futures contracts from Tuesday, April 1 to Friday, June 27:

Swiss Franc +10.73%

Euro +8.40%

New Zealand Dollar +6.90%

British Pound +6.26%

Canadian Dollar +5.23%

Australian Dollar +4.80%

Japanese Yen +3.68%

These figures illustrate a broad-based decline in the dollar during June and over the entire second quarter. Historically, such imbalances open the door to late-stage adjustments, with currencies that have risen sharply often seeing modest technical pullbacks. This is a setup closely monitored by FX traders, who view it as a high-probability opportunity based on a pattern that is rare, but remarkably consistent.

FX rebalancing: mechanics and market players

At the heart of these adjustments lies one key concept: rebalancing. This is the process by which institutional players, pension funds, insurers, central banks, passive managers, bond funds, corporates adjust their FX exposures to stay in line with the targets defined in their mandates.

Every month, the value of their assets (equities, bonds, alternatives) and currency holdings fluctuate. If a currency appreciates sharply, its weight in the portfolio may become too high. Conversely, if a currency weakens, exposure might fall below target. Rebalancing involves buying or selling FX to return to those target allocations.

This process is recurring, predictable, and usually concentrated in a narrow window, the final hours of the trading month, just before the London 4pm fix. Quarter-ends tend to be even more pronounced, as many investors revisit long-term strategic allocations at that time.

Many of these adjustments are driven by systematic models using fixed thresholds, which adds to the consistency and timing of these flows.

Ideal setup: low volatility, high impact

June 2025 ends in a particularly calm environment: equity markets are stable or even rising, and the VIX is trading near its yearly lows, signs of a quiet and balanced market that favors more technical trading. This context is favorable for strategies aiming to take advantage of rebalancing effects, as in the absence of new announcements or unexpected events, these adjustments are likely to have a tangible impact on prices.

Conversely, in a more volatile market environment, such adjustments could be drowned out by larger flows (such as a flight to quality), thus having a reduced or even negligible impact.

FX options: another layer of flows

Another important factor on Monday, June 30: a large number of FX options expire at 10am New York (3pm London). These expiries cover several major pairs, with significant notional amounts concentrated near current spot levels.

According to what is currently being whispered on trading desk chat rooms, we expect the following large expiries:

EUR/USD: €3.0bn at 1.1650 (below spot)

USD/JPY: $1.6bn at 145.50 (above spot)

USD/CHF: $1.8bn at 0.8000 (above spot)

GBP/USD: £1.0bn at 1.3600 (below spot)

AUD/USD: A$1.1bn at 0.6425 (below spot)

When spot approaches these strikes, option holders or sellers may intervene to "pin" prices, based on their delta exposure. This behavior can amplify technical price movements in the hours before expiration.

When these heavy expirations align with month/quarter end rebalancing flows in a quiet, low-volatility market, it creates a strong potential cocktail for tactical moves, conducive to a dollar rebound into the fix.

How to trade the pattern effectively

Here’s a simplified roadmap to navigate this recurring pattern:

Identify monthly or quarterly extremes: look for the currencies that gained or lost the most over the period;

Assess the market environment: a low VIX, no major data or central bank events, meaningful trends, and significant options expiries are ideal conditions;

Use liquid and transparent instruments: Sep 2025 FX futures (standard, e-mini or micro) are currently the most suitable products for active positioning

Set realistic expectations: aim for a 0.5% to 1.0% pullback, not a full-blown trend reversal

Manage risk properly: as with any strategy, always use a stop-loss. This is quantitative trading, not fortune-telling. If the USD continues to weaken despite the setup, be ready to exit swiftly.

In short...

Quarter/month end FX rebalancing is one of the few market events where anticipated institutional flows can create repeatable, high-probability trading opportunities. These flows stem from real portfolio needs and systematic re-hedging, and are often amplified by option expiries and technical positioning.

This setup provides a great educational case study for any trader seeking to better understand hidden FX dynamics. There’s no secret indicator or crystal ball here, just a solid grasp of structural flows and timing.

From a personal standpoint, after over 20 years trading currencies, this strategy remains one of my favorites: simple, effective, and highly instructive. I encourage you to study it closely, and observe its behavior during upcoming month-end windows.

---

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/ .

This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Mastering Delta–Volume Divergence

🎓 Mastering Delta–Volume Divergence: How to Read Institutional Absorption and Trap Setups

⸻

1️⃣ What Is Delta?

Delta measures the net aggression between buyers and sellers:

• Market Buys: traders lifting the ask

• minus

• Market Sells: traders hitting the bid

✅ Positive Delta indicates stronger buying pressure.

✅ Negative Delta indicates stronger selling pressure.

Delta shows who is initiating trades, not just that trading is occurring.

⸻

2️⃣ What Is Volume?

Volume measures the total number of contracts traded, regardless of who initiated them.

Every matched buy and sell contributes equally to volume.

Volume reveals activity, but not who controls the move.

⸻

3️⃣ What Is Delta–Volume Divergence?

Delta–Volume Divergence occurs when:

✅ Volume is high (lots of trades happening),

✅ But Delta is near zero (neither side dominates).

This signals:

• Intense two-sided activity between buyers and sellers,

• Strong participation on both sides,

• Passive absorption—institutions quietly filling large orders without moving price significantly.

⸻

4️⃣ Chart Breakdown – Bar by Bar

Below is a clear example of this concept in practice, reviewing each daily bar from your footprint chart:

⸻

🔴 June 24

• Delta: -8,240 (strong net selling)

• Volume: 575,720 (very high)

• Interpretation:

• Heavy, aggressive selling.

• Clear trend-confirming action.

• No divergence.

⸻

🟢 June 25

• Delta: +4,650 (net buying)

• Volume: 343,990 (moderate)

• Interpretation:

• Counter-trend buying or short covering.

• Less volume and less conviction.

⸻

🟢 June 26

• Delta: +2,690 (mild net buying)

• Volume: 416,820 (higher)

• Interpretation:

• Rising volume but weaker delta.

• Early sign of balance developing.

• Possible absorption beginning.

⸻

🟨 June 27 (Critical Bar)

• Delta: +272 (near zero)

• Volume: 540,310 (very high)

• Interpretation:

• Huge volume churn.

• Neither buyers nor sellers in control.

• Likely institutional absorption of aggressive orders.

✅ This is a textbook example of Delta–Volume Divergence.

⸻

5️⃣ Why This Matters

Professional Insight:

• Sellers had been aggressive for several sessions.

• Suddenly, volume remained elevated, but delta flatlined.

• This suggests:

• Exhaustion of selling aggression, or

• Institutional accumulation and passive positioning.

This often sets the stage for:

• A trap reversal (short squeeze), or

• A continuation flush if sellers regroup and push lower.

⸻

6️⃣ Confirmation Scenarios

Scenario A: Bearish Continuation

• Watch for renewed strong negative delta (e.g., -5,000 or worse).

• Price remains below the last support (~3,250).

• Confirms absorption failed and sellers remain dominant.

Scenario B: Short Squeeze Reversal

• Price reclaims the VAL (~3,285–3,300).

• Delta flips strongly positive (+5,000 or more).

• Trapped shorts begin covering, driving price back toward supply.

⸻

7️⃣ Common Misinterpretation

⚠️ High volume alone does NOT mean momentum.

Key Point:

If delta is flat, high volume simply means churn, not directional energy.

This is why inexperienced traders often get caught:

• They see heavy volume and assume a breakout is underway.

• In reality, the market is absorbing liquidity to trap both sides.

⸻

8️⃣ Professional Tips for Trading Divergence

✅ Wait for confirmation before entering:

• Clear delta shifts, and

• Price reclaiming or rejecting key levels.

✅ Be aware of stop zones:

• Under recent lows if buyers fail,

• Above recent range if sellers get exhausted.

✅ Avoid trading during pure churn without clear follow-through.

⸻

9️⃣ Quick Recap

✅ Delta–Volume Divergence: High volume, flat delta, no clear directional control.

✅ Typically signals absorption and position buildup.

✅ Requires confirmation before committing to trades.

✅ Recognizing it helps you avoid traps and false breakouts.

⸻

🔟 Final Thought

Learning to read divergence is what separates professional traders from retail:

“Volume tells you how hard the market is working. Delta tells you who’s winning.”

Combine both to see the hidden game behind every price bar.

⸻

⚠️ Disclaimer: This lesson is for educational purposes only. Nothing here constitutes financial advice.

When Charts Lie: How Fundamentals Rescued My Forex TradingEvery trader knows the frustration: your analysis is technically flawless, but the market moves against you. I learned this brutally in Q1 2024 when my USD/CAD short—backed by textbook bearish divergence and order block rejection—got steamrolled by a 190-pip rally after Canada’s surprise oil export announcement.

The Blind Spot in Pure Technicals

Price action traders often dismiss fundamentals as "noise," but three scenarios consistently break chart-based systems:

Policy Surprises (SNB removing EUR/CHF floor)

Geopolitical Shocks (Rubles during Ukraine invasion)

Structural Shifts (BOJ abandoning YCC)

These events share one trait: they change the market’s fundamental DNA, invalidating historical patterns.

A Practical Filter

I need to train myself to do something like this: To overlay two fundamental checks before technical entries:

Central Bank Calendar

No trades 12 hours before scheduled meetings

Monitor yield spreads (10YR US vs. DE)

Commodity Links

AUD/USD: Iron ore inventories

USD/CAD: WTI backwardation

Case Study: April 2024 GBP/USD

Technicals suggested continuation above 1.2700

Fundamental red flag: UK real wages shrinking

Outcome: False breakout, 140-pip drop

Your Turn

Try this today: On your next trade, ask:

Is there scheduled event risk?

Does this align with rate expectations?

Are commodities/equities confirming?

The goal isn’t perfection—it’s avoiding obvious mismatches.

For me, I read my own words on what should be done, and most probably, I won't do it. I think the above is too much. I believe there must be an easier way to merge Technical and Fundamental Analysis.

Middle East peace/war = Bitcoin’s Explosive Price CoilDo you know why every time tensions rise in the Middle East, Bitcoin springs upward like a compressed coil?

This market reaction isn’t just a coincidence it’s the result of a mix of psychological and economic factors we’ll explore today.

Get ready to understand how these crises can create golden opportunities for the world’s favorite digital currency.

Hello✌

Spend 3 minutes ⏰ reading this educational material.

🎯 Analytical Insight on Bitcoin:

Price is approaching a significant support level that has held strong historically. A potential rebound from this zone could lead to at least a 7% upside move 📈, with the primary target set around $115,000—near a key descending trendline on the daily chart. Watching this level closely for confirmation 🔍.

Now , let's dive into the educational section,

Market Psychology: When War Plays with Fear and Greed 🧠

Middle East crises act like a spring: when released, they trigger intense fear in the market. Many traders react emotionally and start selling their holdings. The key point: this fear often flips into greed.

When Bitcoin’s price drops due to war fears, savvy traders seize the opportunity and enter the market. This cycle of fear and greed causes Bitcoin’s price to surge faster than usual just like a compressed spring suddenly releasing.

If you understand these market emotions and trade without bias, you can maximize gains from such volatility.

Key TradingView Tools for Bitcoin Analysis 📊

When the Middle East conflict heats up, market volatility spikes, affecting Bitcoin as a high-risk asset.

Using essential indicators like RSI , Fibonacci retracements , and volume on TradingView helps you pinpoint precise entry and exit points and better understand market reactions.

Practical Tips for Better Tool Usage ⚙️

To get the most out of TradingView:

Activate several indicators simultaneously and compare price movements with volume.

Draw Fibonacci retracements on previous trends to find key support and resistance levels.

Check RSI to see if Bitcoin is overbought or oversold.

Monitor trading volume to confirm momentum shifts.

This approach turns your analysis from guesswork into a logical, actionable strategy.

How Middle East War Drives Bitcoin Growth: Final Analysis 🚀

As tensions escalate, investors seek safe-haven assets, and Bitcoin, known as digital gold, attracts massive attention. Also, banking restrictions and sanctions push liquidity toward cryptocurrencies.

These condition s, combined with market psychology and the analytical tools we covered, make Bitcoin behave like a compressed spring that suddenly leaps upward, driving significant growth. Traders aware of these trends and skilled in using indicators and sentiment can find better profit opportunities.

Recommendations 📌

Geopolitical tensions in the Middle East act as a powerful trigger for Bitcoin volatility. Understanding market psychology, smart use of TradingView tools, and having a solid risk management strategy are key to success in such times. I recommend keeping an eye not just on technical analysis but also on market sentiment and political news to make the best timely decisions.

✨ Need a little love!

We put so much love and time into bringing you useful content & your support truly keeps us going. don’t be shy—drop a comment below. We’d love to hear from you! 💛

Big thanks,

Mad Whale 🐋

📜 Please remember to do your own research before making any investment decisions. Also, don’t forget to check the disclaimer at the bottom of each post for more details.

#AN011: NATO Summit, 5% for Defense

Hello, I am Forex Trader Andrea Russo and after the NATO Summit meeting, I want to analyze the situation a bit. Remember that my opinions are strictly personal and what I say may not reflect your thoughts. I do not write with a political or personal ideology. I analyze the situation objectively.

I thank in advance our Official Partner Broker PEPPERSTONE for the support in creating this article.

🔍 Key points of the NATO Summit

Yesterday's NATO Summit in The Hague attracted global attention, with the 32 member countries committing to a strong increase in defense spending, with the goal of 5% of GDP by 2035, of which 3.5% for basic military spending and 1.5% for broader security measures, such as strengthening cybersecurity and infrastructure.

US President Trump praised the outcome as a "major victory" and stressed that increased spending would likely benefit US defense contractors, while reaffirming NATO's commitment to Article 5.

However, countries such as Spain have expressed concern, indicating that it could include military aid rather than pure budget increases.

📈 Financial Market Reaction

🔹 Defense & Aerospace Stocks

Major defense companies across Europe posted immediate gains:

Babcock (UK) +10.7%,

Rheinmetall (Germany) +3.1%,

Thales (France) +2%+,

Leonardo (Italy) +2.6%

🔹 Bond & Currency Action

According to KBC Bank market commentary:

The bond market steepened bearishly, particularly in Europe, as governments are reassessing their fiscal balances to accommodate defense budgets.

The US dollar remained strong, supported by dovish Fed expectations, countering the spike in bond yields.

🌍 Currency Market Implications

EUR/USD:

The momentum of a dovish Fed and US fiscal pressure could support the dollar. However, divergence in bond yields could support moderate euro strength if the ECB remains cautious.

EUR-linked currencies (e.g. SEK, NOK):

These could come under pressure from rising risk premia and possible increase in government bond issuance.

JPY and CHF:

Likely to benefit from high volatility and safe-haven flows amid geopolitical tensions.

🧭 Strategic Outlook

Theme Market Impact

Increased defense spending Supports government bonds, increases government bond yields.

Fiscal tightening Increases credit risk premia.

US defense dominance Strengthens the USD in the short to medium term.

Geopolitical unity Strengthens investor confidence, mitigates risk-off tendencies.

📝 Conclusion

NATO summit signals a geopolitical shift that extends to currency and credit markets. Forex traders should pay attention to:

Yield changes in the US versus Europe due to increased deficit financing.

Currency inflows into the US dollar on defense and risk themes.

Safe-haven demand if tensions in Russia-Ukraine or the Middle East flare up again.

Thanks a lot for making it this far. Stay tuned for more analysis.

Skeptic | RSI Masterclass: Unlock Pro-Level Trading Secrets!Hey traders, it’s Skeptic ! 😎 Ready to transform your trading? 95% of you are using the Relative Strength Index wrong , and I’m here to fix that with a game-changing strategy I’ve backtested across 200+ trades. This isn’t a generic RSI tutorial—it’s packed with real-world setups, myth-busting insights, and precise rules to trade with confidence. Join me to master the art of RSI and trade with clarity, discipline, and reason. Big shoutout to TradingView for this epic free tool! 🙌 Let’s dive in! 🚖

What Is RSI? The Core Breakdown

The Relative Strength Index (RSI) , crafted by Welles Wilder, is a momentum oscillator that measures a market’s strength by comparing average gains to average losses over a set period. Here’s the formula:

G = average gains over n periods, L = average losses.

Relative Strength (RS) = | G / L |.

RSI = 100 - (100 / (1 + RS)).

Wilder used a 14-period lookback , and I stick with it—it’s smooth, filters noise, and gives a crystal-clear read on buyer or seller momentum. Let’s get to the good stuff—how I use RSI to stack profits! 📊

My RSI Strategy: Flipping the Script

Forget what you’ve read in books like The Handbook of Technical Analysis by Mark Andrew Lim— overbought (70) and oversold (30) aren’t just for shorting or buying. I go long when RSI hits overbought, and it’s been a goldmine. I’ve backtested over 200 trades with this approach, and it’s my go-to confirmation for daily setups. Why does it work? When RSI hits overbought on my 15-minute entry chart, it signals explosive buyer momentum. Here’s what you get:

Lightning-Fast R/R: I hit risk/reward targets in 30 minutes to 2 hours on 15-minute entries (longer for 1-hour entries, depending on your timeframe).

Massive R/R Potential: An overbought RSI on 15-minute can push 1-hour and 4-hour RSI into overbought, driving bigger moves. I hold for R/Rs of 5 or even 10, not bailing early. 🚀

Rock-Solid Confirmation: RSI confirms my entry trigger. Take BTC/USD:

BTC bounces off a key support at 76,000, sparking an uptrend.

It forms a 4-hour box range, but price tests the ceiling more than the floor, hinting at a breakout.

Trigger: Break above the box ceiling at 85,853.57.

On 15-minute, a powerful candle breaks the ceiling, and RSI hits overbought—that’s my green light. I open a long.

Soon, 1-hour and 4-hour RSI go overbought, signaling stronger momentum. I hold, and BTC pumps hard, hitting high R/R in a short window.

This keeps trades fast and efficient—quick wins or quick stops mean better capital management and less stress. Slow trades? They’re a mental grind, pushing you to close early for tiny R/Rs. 😴

Pro Rules for RSI Success

Here’s how to wield RSI like a trading weapon:

Stick to the Trend : Use RSI in the direction of the main trend (e.g., uptrend = focus on longs).

Confirmation Only: Never use RSI solo for buy/sell signals. Pair it with breakouts or support/resistance triggers.

Fresh Momentum: RSI is strongest when it just hits overbought/oversold. If the move’s already rolling, skip it—no FOMO, walk away!

Customize Zones: Overbought (70) and oversold (30) can shift—it might show reactions at 65 or 75. Adjust to your market’s behavior.

Backtesting RSI: Your Path to Mastery

To make RSI yours, backtest it across at least 30 trades in every market cycle— uptrend, downtrend, and range. Test in volatile markets for extra edge. 😏 Key takeaways:

Range Markets Kill RSI: Momentum oscillators like RSI (or SMA) are useless in ranges—no momentum, no signal. Switch to ROC (Rate of Change) for ranges—I use it, and it’s a beast. Want an ROC guide? Hit the comments!

Overextended RSI Zones: On your entry timeframe (e.g., 15-minute), check higher timeframes (e.g., 4-hour) for past RSI highs/lows. These are overextended zones—price often rejects or triggers a range. Use them to take profits.

Final Vibe Check

This RSI masterclass is your key to trading like a pro—fast R/Rs, big wins, and unshakable confidence . At Skeptic Lab, we live by No FOMO, no hype, just reason. Guard your capital— max 1% risk per trade, no excuses. Want an ROC masterclass or more tools? Drop a comment! If this fired you up, smash that boost—it means everything! 😊 Got a setup or question? Hit me in the comments. Stay sharp, fam! ✌️

Is every fall an opportunity?Is every fall an opportunity?

Of course not! Because sometimes, the lower you get, the lower you get. You need to know 2 things here:

1- Why did we buy?

2- How long is our maturity?

➡️ Example:

I believe that Bitcoin CRYPTOCAP:BTC will continuously increase in value in the long run. Because I know why I bought it. It's simple math (fixed in my article profile). But is there no risk?

Of course, there is risk.

❌ For example, if the US bans it?

This is unlikely today, but of course it can happen. As a matter of fact, the US banned gold investment between 1933-1974. Such a thing would not end Bitcoin, but it would make the road very long.

✅ So?

1- If you believe that what you are buying will appreciate in the long run and you have a long maturity, declines are opportunities.

2- But if you've only heard about your investment from someone, then you're more likely to get scared and sell at every drop.

Thanks for reading 🙏

Timeframes in Trading: Which Chart Tells You WhatHello, traders! 👋🏻 Why can the same chart tell a different story on 1D, 4H, or 15M? You’ve probably been there. BTC looks bullish on the daily… bearish on the 4-hour… and totally sideways on the 15-minute. So, which one is right?

The truth is: none of them is wrong. They’re just telling different parts of the story. Understanding timeframes in trading isn’t just a technical skill. It’s how you decode what the market is actually doing.

Every Timeframe Has a Role

Think of timeframes like zooming in and out on a map: The 1W chart tells you where the mountain ranges are, the macro trend. The 1D chart shows the highways and the current direction within that macro. The 4H chart reveals city streets, the local trend swings. And the 15M chart? That’s the back alleys, where the noise and micro moves live. BTC, for example, doesn't behave the same way across these views, and it shouldn't.

What Happens If You Ignore Timeframes?

You try to short a "breakdown" on the 15M, only to realize you just sold into 4H support.

You enter a 1D bullish breakout, only to panic when price pulls back aggressively on the 4H… forgetting that the 4H was just doing a retest. Or worse, you start trading against the macro trend, thinking the 15M chart holds more weight than it actually does.

How Professionals Read Timeframes (BTC Example)

Example:

You can start high, work down: 1W → 1D → 4H → 1H/15M. Check the macro first. Is BTC bullish, bearish, or ranging on the 1D or 1W? Then, you can map key levels: Support/resistance from higher timeframes is 10x more meaningful on lower timeframes. For example, BTC’s $30K, a weekly level, creates reactions even down on 5-minute charts. And, align context: A bullish setup on 15M is excellent, but check if it aligns with the 4H trend direction. If the 4H is also bullish, your setup has context. If not, expect chop.

🔗 BTC Right Now: Timeframe Confusion in Action

Just look at the current BTC structure. On the 1W, BTC is still trending higher, higher highs and higher lows from the $15K bottom in 2023. On the 1D, BTC trades inside a broad consolidation range after a strong uptrend. The price has repeatedly tested the $107K–$112K zone, acting as a key resistance cluster, while forming a series of higher lows. It's not a breakdown but a correction inside a bullish structure, testing previous supply zones. The 4H? Chaos. The price bounces between $105K and $112K, which is pure range behavior. The 15M? Traders are getting whipped trying to catch fake breakouts that mean nothing in the daily or weekly context.

Which Chart Tells You What?

All of them. But differently.

THE 1W TELLS YOU THE NARRATIVE.

THE 1D SHOWS YOU THE CURRENT DIRECTION.

THE 4H REVEALS TRADEABLE SWINGS WITHIN THAT DIRECTION.

THE 15M CAPTURES THE NOISE, THE TRAPS, AND THE MICRO OPPORTUNITIES.

If you’re only looking at one timeframe, you’re only seeing part of the picture. So, timeframes aren’t about right or wrong. They’re about perspective. If you’re a day trader, you probably live on the 5-minute to 15-minute charts, while still peeking at the 1H or 4H for structure.

If you’re a swing trader, the 4H and 1D are your home base, with the weekly chart guiding the bigger story. And if you’re thinking in months or quarters, the 1W and 1M are what actually matter – everything else is just noise.

So next time BTC feels “confusing”… zoom out. Or zoom in. The answer is probably hiding in the chart, just not the one you were looking at. Which timeframe do you trust the most when trading crypto? Drop it in the comments!

Anatomy of a Breakout: How to Spot It Before It Fakes You OutFew things in trading are as appealing as a breakout. The chart tightens, volume starts to stir, headlines align, your alerts start going off , and suddenly — boom! Price explodes above resistance. Your adrenaline spikes and you pop open that long.

But just as often, that breakout turns out to be nothing more than an expensive head fake. Price stalls. Sellers swoop in. Your stop gets clipped. And now you’re sitting there, blinking at your screen, “Welp… that was quick.”

Welcome to the bittersweet world of breakouts — where opportunity and deception dance like partners at a high-stakes poker table.

📢 What Is a Breakout, Really?

Let’s get the basics out of the way: A breakout happens when price pushes beyond a key support or resistance level that’s been holding for a while.

That level could be a previous high, a consolidation range, a trendline, or a psychological number that traders obsess over because humans love round numbers (did someone say Bitcoin BITSTAMP:BTCUSD at $120,000 ?).

The logic is simple: Once price clears a well-watched level, trapped shorts have to cover, new longs pile in, and momentum feeds on itself. That’s the dream scenario.

But markets aren’t always that generous. For every clean breakout, there are a few fakeouts lurking — luring in overeager traders with the promise of easy money before slamming the door shut.

⚠️ Why Breakouts May Fail

If breakouts were easy, we’d all be rich. The problem is that breakouts attract a special kind of crowd: late-to-the-party momentum chasers, breakout algorithm bots, and retail traders who read one blog post about technical analysis.

The moment price nudges above resistance, FOMO kicks in. Volume surges. But if the move isn’t backed by genuine institutional buying (you need lots of billions to move the needle nowadays), it quickly becomes what seasoned traders call a “liquidity vacuum” — thin air where the only participants are you, a few equally optimistic Reddit threads, and market makers more than happy to take the other side.

Sometimes breakouts fail because:

The move lacked volume confirmation.

Macro headlines shifted mid-breakout.

A key level was front-run, and the real buyers have already taken profit.

It was a deliberate trap set by larger players to hunt stops before reversing.

Or — more often — the market just needed an excuse to shake out weak hands before resuming the actual move later.

🍸 Volume: The Truth Serum

Let’s be very clear: Breakouts without volume are like dating profiles without photos — you should be suspicious.

When real breakouts occur, you’ll usually see strong accompanying volume. That’s your proof that big players — funds, institutions, serious money — are committing to the move. No volume? Maybe the summer vibes are already here .

Smart traders wait for confirmation:

Is volume above average relative to recent sessions?

Is price holding above the breakout level after the initial pop?

Are follow-through candles printing convincingly?

Are we seeing continuation across related sectors or instruments?

Without these signs, that breakout candle may just be a cruel joke.

🤯 Breakout Psychology

Breakouts prey on two of the most dangerous emotions in trading: greed and urgency. The market whispers, “If you don’t get in now, you’ll miss it.”

This is where breakout psychology becomes more dangerous than the chart itself. Once a breakout happens, most traders are no longer analyzing — they’re reacting. They buy late, set tight stops below the breakout level, and become easy prey for stop-hunting algorithms.

✨ Types of Breakouts

Not all breakouts are created equal. Here’s the lineup you should be watching for:

Clean Breakouts:

The rarest and most beautiful. Strong move, high volume, sustained momentum. You’ll know it when you see it — or after you’ve hesitated and missed it.

Fakeouts (a.k.a. False Breakouts):

Price nudges just past resistance, triggers breakout orders, then swiftly reverses. Designed to shake out breakout traders before resuming the original trend.

Break-and-Retest Setups:

Often the highest-probability trades. Price breaks out, then pulls back to retest the former resistance (now support). If buyers defend this retest, you’ve got confirmation.

News-Driven Breakouts:

Triggered by earnings, economic data, or political events. Volatile, fast, and often unsustainable unless backed by real fundamental shifts.

📈 The “Pre-Breakout Tell”: Reading the Tape

Good breakout traders aren’t just watching levels — they’re watching how price behaves near those levels in advance.

Tight consolidation? Lower volatility into resistance? Declining volume as price grinds higher? That often signals an impending breakout as supply dries up.

Conversely, choppy action with large wicks and erratic volume often signals indecision — ripe conditions for failed breakouts and fakeouts.

Tape-reading matters. The cleaner the structure before the breakout, the better your odds.

💰 Breakout Traders Need Thick Skin

Even with perfect analysis, breakout trading requires accepting that many will fail. That’s the game. Your job isn’t to nail every breakout — it’s to size your positions properly , keep losses small when faked out, and let the clean breakouts run when you catch one.

Stop-loss discipline is everything. Breakouts are binary events: you’re either right quickly, or you’re cutting the trade quickly. There’s no room for “maybe it’ll come back.”

The most painful breakouts are the ones that fake out, stop you, then continue in your original direction. Every breakout trader has lived that nightmare. Accept it. Build it into your risk plan.

👉 Takeaway: Prepare the Setup, Anticipate the Fakeout

Breakouts will always be part of every trader’s playbook. But they require discipline, experience, and an iron stomach. The market loves to tempt you with early signals — your job is to separate signal from noise.

Pro tip: Start your day by checking the Economic calendar and browsing the latest news — staying informed (and witty) helps you build better context for smarter decisions.

So before you chase that next breakout candle, ask yourself:

Is volume there?

Is the broader market supportive?

Have I managed my risk before clicking buy?

Because in trading, the only thing worse than missing a breakout… is getting faked out and blowing up your account chasing it.

Now over to you : Are you a breakout trader or a fakeout victim? Share your best (or worst) breakout stories — we’ve all been there.

FED, rate cut possible on July 30? With the US Federal Reserve (FED) meeting on July 30 fast approaching, the markets are scrutinizing the slightest signals likely to indicate an inflexion in monetary policy. While a rate cut seems unlikely in the short term, it cannot be ruled out altogether. Despite Chairman Jerome Powell's firm stance, some influential members of the Monetary Policy Committee (FOMC) are actively pushing for monetary easing this summer.

1) Jerome Powell is not the only decision-maker on the FOMC, and there is pressure for a rate cut in July

Jerome Powell adopts a very cautious stance, making any monetary easing conditional on clear convergence towards the 2% inflation target. His main concern is the potentially inflationary impact of the tariffs currently under negotiation. However, Powell does not have absolute power. The FOMC has 12 voting members, including 7 permanent governors, the president of the New York Fed and 4 rotating regional bank presidents.

Although each vote is worth as much, the Chairman largely shapes the agenda and guides the discussions. Some members, such as Michelle Bowman and Christopher Waller, appointed under the Trump presidency, are pushing for a cut as early as July. Donald Trump's implicit support for this option adds political pressure, even if his direct influence is limited.

Below is a table showing the current balance of power between the voting members of the FOMC.

2) There will be a rate cut on July 30 if and only if the unemployment rate becomes worrying

On the fundamentals side, inflation measured by the PCE index, the FED's benchmark, remains slightly above target, but several key components are showing signs of normalization. Oil, which accounts for around 11% of the basket, is not showing any alarming technical signals with the geopolitical calm in the Middle East. The real estate sector and healthcare spending, also heavily weighted, are showing positive indications in favor of further disinflation. Moreover, tariffs are only marginally affecting services, which account for 67% of the PCE.

Despite this, Powell remains concerned about the risk of exogenous inflationary resurgence, especially if the universal 10% tariff were to apply to all US trading partners, with an expected impact on core PCE of +0.2% to +0.3%.

Markets are anticipating a first decline in September, but a July changeover cannot be ruled out if employment data, notably the NFP report of July 3, show a marked weakening of the labor market.

3) The S&P 500 index will need the FED's pivot to go higher, as it has returned to its all-time high