Fundamental analysis in cryptoThrough fundamental analysis , we can try to detect the authentic and objective value of cryptocurrencies in spite of their market price.

Through these techniques, we can assess whether a cryptocurrency is undervalued or overvalued, and we can detect a trading opportunity.

With fundamental analysis , traders evaluate and study what can affect the price of a security, such as external factors or events. This type of analysis takes advantage of tools like periodic financial statements, financial ratios, economic forecasts and other types

of additional information that can affect the value of a security.

There are different approaches to fundamental analysis that analyse micro and macroeconomic variables in different ways:

1. Top-down approach: through this approach, the trader analyses macroeconomic variables first and then microeconomic variables. Global information is taken in first, followed by more detailed and specific values and variables addressed. With this approach, the trader looks at the world economic situation, and then looks more at the most economically attractive countries, along with the sectors with the most potential, and within them, chooses which ones are most convenient to invest in.

2. Bottom-Up approach: this approach is the opposite of the previous one: first the trader chooses companies with growth potential, analyses the sector they operate in and then the economic situation of their countries; the overall global economic situation is the last thing to be analysed.

THE ADVANTAGES:

This approach allows the investor to collect and analyse information external to the markets but that might still influence prices. This way, the investor has a clearer vision of the reality of the market.

THE DISADVANTAGES:

The trader using fundamental analysis needs more thorough knowledge and experience of accounting, business and, in the specific, the sector of interest.

Moreover, investment terms with a fundamental analysis are longer because it requires more studying and background with respect to other analytical tools, like technical one.

It can also be outweighed by chance factors, such as physical disasters affecting commodity prices and companies in general. In general, markets can also be surprised by unexpected changes in economic and political scenarios.

In the specific case of crypto markets, fundamental analysis can be used to analyse the exterior components that can affect cryptocurrencies.

Fundamental analysis can be carried out by looking at its use cases or community, but also at the team behind every specific crypto project, something that tells a lot about its

overvaluation or undervaluation.

Indeed, in the case of crypto markets, there are no financial statements, and therefore they cannot be evaluated as normal financial assets. Most cryptocurrencies are still in the

developing stage and they do not have a lot of real-world applications; they rely mostly on miners, users and, of course, developers.

It can be of great importance given that crypto markets are relatively more volatile and less stable than others, and due to their irregular situation investors react quickly to exogenous factors. These factors can vary and go from regulatory pressures to simple tweets - take Elon Musk as an example.

Fundamental analysis can indeed help comprehend the fair value of crypto assets - data about this can be found on different websites, such as Reddit or Telegram. The use of technology is of utter importance.

The investor can assess the usability of the adoption of the cryptocurrency he's interested in, but this tool can also be used to study how governments value cryptocurrencies and whether they want to implement new regulatory policies about it. We can also identify the progress that it's being made in terms of technology, such as how the activity of cryptocurrency is developing, along with its software or media coverage - all these factors contribute to

increasing the crypto asset's value.

From a psychological point of view, it can also help the investor trade with more confidence, knowing that a thorough analysis has been carried out. When the analysis is done daily, it

can help you develop a finer investment strategy.

In terms of financial metrics, what can be used is:

Market capitalisation: the investor can look at the total market worth of cryptocurrency, which indicates whether there is space for growth. To get that, you multiply the current price per coin by its supply.

Liquidity, or how easy it is to buy or sell the asset. A liquid market is a competitive market and is usually favoured by investors, also because it entails a lower bid-ask spread.

Volume:

it spurs liquidity because it is telling of how much money has been exchanged for a certain asset.

Fundamental analysis usually prioritises the assessment of transaction values. If the transaction value is consistently high, it means that the cryptocurrency is in steady circulation.

Fees:

they reflect the demand on the blockchain. Every cryptocurrency can have its own transaction fee.

The assessment of the fees paid over various periods gives the

trader an idea of how secure the crypto asset is.

Supply mechanisms:

general microeconomics state that when supply is low and demand is high, price rises. A general belief for cryptocurrencies is that when supply runs out, the price will rise (this is, for example, a general prediction of Bitcoin holders). On the other hand, investors can also use project metrics for their fundamental analysis:

Whitepaper:

it is a technical document outlining the purpose and operation of the

project. It should comprise the blockchain technology solutions, the use cases for the currency, the planned features and upgrades, sale and team information, and tokenomics (the factors that impact the tokens' use and value).

The team:

crypto teams are easily accessible to assess nowadays so that the investor can learn more about them and their credibility.

The competitors:

the investor can conduct an analysis of the crypto assets; competitors. If there are other cryptos which are more widely adopted or valuable, maybe it is best to back off from the item of interest.

Last but not least, important instruments when evaluating cryptos through fundamental analysis are Blockchain metrics or On-chain metrics. The rising popularity of blockchain

has made sure that lots of different types of information could become extremely popular, such as the number of active users, total transactions and transaction value.

There are three fundamental metrics in this case:

1. Hash Rate :

this is a measure of the mining machine's ability to conduct hashing computations in an efficient way.

The hash rate also determines the profitability of the miner, as it indicates the likelihood that a block will be mined, and, indirectly, the chance of receiving the block reward. An investor should look at cryptos with a more extensive network because they are more resistant to attacks or data manipulation.

2. Status and Active Addresses:

active addresses measure the number of dynamic blockchain addresses over a period of time. They are helpful in comparing the growth or decline of the activity or interest in the coin or token. The investor can also get to

the active address through the computation of the total number of unique addresses over time (and a comparison of the results).

3. Transaction values : they can be determined for the assessment of the regular circulation of the crypto asset. It indicates how much money was exchanged on a given period, and therefore, the number of transactions.

Harmonic Patterns

Mastering and Understanding Candlesticks Patterns

An overview of Candlesticks

A candle represents the changes in price over an interval of time, such as 1 day or 1 minute. The main body of the candle illustrates the opening price at the start of the time interval and the price when the market closed at the end of the interval. The length of the shadows shows how much the price has moved up and down with respect to a candlestick within a specific duration.

The candlestick body describes the difference between the opening and closing prices for the corresponding time period.

THe market is a battleftield between buyers and sellers. If one side is stronger than the other, the financial markets will see the following trends emerging:

If there are more buyers than sellers, or more buying interest than selling interest, the buyers do not have anyone they can buy from. The prices then increase until the price becomes so high that the sellers once again find it attractive to get involved. At the same time, the price is eventually too high for the buyers to keep buying.

However, if there are more sellers than buyers, prices will fall until a balance is restored and more buyers enter the market.

The greater the imbalance between these two market players, the faster the movement of the market in one direction. However, if there is only a slight overhang, prices tend to change more slowly.

When the buying and selling interests are in equilibrium, there is no reason for the price to change. Both parties are satisfied with the current price and there is a market balance.

Analysis aims at comparing the strength ratio of the two sides to evaluate which market players are stronger and in which direction the price is, therefore, more likely to move.

CYPHER Harmonic Pattern - Made Easy For Everyone !The Cypher harmonic pattern is a technical analysis indicator used by traders to identify valuable support and resistance levels based on the Fibonacci sequence of numbers and detect trend reversals.

Here, in this article, we explain how the Cypher harmonic pattern works, identify it, and trade it.

What is the Cypher Harmonic Candlestick Pattern?

The Cypher harmonic pattern is a technical analysis formation indicating a price-action reversal.

The pattern was discovered by D. Oglesbee and is known as a relatively advanced pattern formation. In structure, the Cypher pattern is similar to the butterfly harmonic pattern; however, the Cypher is not a very common chart pattern due to its unique Fibonacci ratios.

The Cypher pattern, which can be either bullish or bearish, has five points (X, A, B, C, and D) and four legs (XA, AB, BC, and CD). Like any other harmonic pattern, the theory behind the Cypher chart pattern is that there is a strong correlation between Fibonacci ratios and price movements.

Eventually, the market is expected to reverse from point D after the four market swing wave movements

How to Identify and Use the Cypher Harmonic Pattern in Forex Trading?

Much like any other harmonic chart pattern, several conditions must occur so you can identify the Cypher pattern:

B point retracement of the primary XA leg ranges between 38.2% to 61.8% Fibonacci levels

C point is an extension leg with a Fibonacci ratio that should be between 127.2% to 141.4% of the primary XA leg

D point should break the 78.6 retracement level of XC

Let’s see what the Cypher harmonic pattern looks like on a trading chart.

Cypher Pattern – Set a Stop Loss

A reasonable stop-loss level when trading the Cypher pattern is simple and does not necessarily require the combination of Fibonacci retracement.

All you need to do is to place the stop loss somewhere below the D level because if this level breaks, the entire Cypher pattern is invalidated. So, the stop would be placed at the next support or resistance level, which is the X-point

Cypher Pattern – Set a Take Profit Target

The simple Cypher pattern trading method is using its points as profit targets, meaning the A and C levels.

How accurate is the Cypher harmonic chart pattern?

The Cypher harmonic pattern has been historically proven to be a fairly reliable and accurate chart pattern. According to various studies, the pattern has an accuracy rate of around 70%.

TRADING FOR BEGINEERS! USING SUPPORT AND RESISTANCE IN 2022!!!This tutorial video discusses how to find KEY support and resistance within trading on any timeframe or market including FOREX, STOCKS or CRYPTO. DROP A LIKE AND SHARE WITH OTHER PEOPLE.

P.S NOT A FINANCIAL ADVISOR... JUST FOR EDUCATIONAL AND LEARNING PURPOSES ONLY...

GBJPY Blending Smart Money Concepts with Long Money ConceptsSmart Money Concepts since its inception with ICT have polarized the trading community mostly in a positive way, and I think said concepts are more handy for traders who have experienced many cycles in the market and are looking to refine their edge

with the advancing technology and the transaction basis of today's exchanges based on a liquidity perspective.

ICT has pioneered a new way of understanding liquidity especially on the granular side of trading, but most traders, including myself, that don't have the edge which is tenure and experience, these concepts are too simple for a complex sport, and the play book of course

is tailored to the team's strength and weaknesses.

One thing I have noticed in the trading community is that since there is no barrier to entry, like any entry level job, without the experience you cannot expect to make much off trading in the beginning phases as a trader. You have to study theory, history, psychology, and just the environment around the ticker

and tape to really grasp the notion of the science. Yes, trading is a zero sum game, but let us not get lost in that saying because mostly everything in life is zero sum. Ying and Yang.

As of recently I stopped annotating things like break of structures to define trends, chochs, and unnecessary order blocks. Think about it. What really is a break of structure?

What is really a change of character?

Liquidity Sweep?

Imbalance?

Think about it all these terms coincide with events that in reality define a certain market personality. To my perspective, none of these terms actually exist on the chart.

If you go by the assumption that pricing has already accounted for the events in the then to now, then in reality, there is no real imbalance, liquidity sweep are just market fluctuations, and a choch is literally price curb tailing itself in the other direction, simply put.

But then you have to ask yourself the famous SMC question.

Where am I in structure?

That's where the SMC free trial ends, and the error begins, now you have to buy the course from your mentor.

One thing I'm learning is that in today's timeline, instant gratification is the reason why most traders give up.

This takes time. Trading isn't a game like they say. It's not a job either. It's an understanding.

It's a language.

SMC is very powerful yes, especially for intraday traders, but for me, it's not enough to draw an actual framework that can be fractalized, besides the order blocks, which are subjective.

The market moves with intentions, and regulated prices stop on the weekend, because guess what, it's the weekend and the market makers, liquidity providers, and large speculators have lives too.

But that doesn't the intentions aren't still there.

Frequency, tonality, personality, and modes are codified in the market just as any word coming out of your mouth. It's a language. And no fluent speaker learned to speak what they speak overnight.

It takes time. Fall in love with learning this new language.

Bat Harmonic Pattern - Made Easy For Everyone !The BAT pattern gets its name from the bat-shaped end product. Identified by Scott Carney in 2001, the BAT pattern is made up of precise elements that identify PRZs.

The bat harmonic pattern follows different Fibonacci ratios. One of the major ways to differentiate it from a Cypher pattern is the B point which, if it doesn’t go above the 50 percent Fibonacci retracement of the XA leg then it is a bat, otherwise it can turn into a cypher structure.

The market strategy of the pattern is suitable for all time frames and all markets types. Traders have to keep in mind that on lower time frames using the bat pattern market strategy has some challenges because the pattern tends to appear on less frequent on lower time frames.

How to Draw a Bat Pattern :

As mentioned earlier, the bat harmonic pattern looks very similar to the Gartley pattern . It has four different legs marked as X-A, A-B, B-C, and C-D.

X-A: In its bullish version, the first leg appears when the price sharply increases from point X to point A. This is the longest leg of the pattern.

A-B: The A-B leg then sees the price switching direction and retracing 38.2 to 50 percent using the Fibonacci retracement of the distance covered by the X-A leg. Have it in mind that the A-B leg can never retrace beyond point X. But if it does, the pattern is considered invalid. As you can see, if the price with a spike reaches a point under 50% but with the body above, this will be Valid. The candle Body's important.

B-C: Here, the price changes direction for a second time and moves back up, retracing anything from 38.2 to 88.6 percent of the distance covered by the A-B leg. If it retraces up above the high of point A, the pattern is considered invalid.As you can see, if the price with a spike reaches a point above 88.6% but with the body is below, this will be Valid. The candle Body's important.

C-D: This is the last and most significant aspect of the pattern. As with the Gartley pattern , this is where the bat harmonic pattern ends and traders place their long (buy) trade at point D. ( PRZ Potential Reversal Zone )

The 88.6% percent retracement of the X-A leg is our Entry Point. D POINT or PRZ

Before trying and trading the pattern, confirm from this checklist that the pattern is real. It should include these vital elements:

A-B : 38.2 to 50% max percent using the Fibonacci retracement

B-C : An 38.2 to 88.6% max percent Fibonacci retracement of the X-A leg

C-D : The 88.6% percent retracement of the X-A

Market strategy:

Step 1: Drawing the pattern

Begin by clicking on the XABCD pattern indicator that is found on the right-hand side toolbar of Tradingview

Identify the beginning point X, which can be any swing high or low point on the chart.

You should get 4 points or 4 swings high/low points that join and form the harmonic bat pattern strategy as explained Above

Step 2: Trading the pattern

The 88.6 percent Fibonacci ratio provides traders a more reliable risk/reward ratio which is why the market strategy of the bat pattern is such a very popular as a market strategy. The best entry point is the 88.6 percent Fibonacci retracement which is a very accurate market turning point.

It is recommended that traders should enter as soon as they touch the 88.6 percent figure. Oftentimes the harmonic bat pattern strategy doesn’t go much above this level.

Step 3: Placing a stop-loss

Usually, traders should place their protective stop-loss lower than the point X of a harmonic bat pattern . That is the only logical location to hide the stop-loss because any break below will automatically invalidate the pattern.We use as manual the 113% Fibo of X-A as a picture below.

Step 4: Take-profits

There can be several ways to manage your trades, but the best target for this pattern should be to use a multiple-take profit formula. For this pattern strategy, take the first partial profit once you hit wave-B level and the remaining half wave-C.

Once the price reaches the first target you should move the Stop Loss at BE ( breakeven - entry point ) or close the position in profit.

By doing this you will accomplish two things:

first, you’ll ensure that you accumulate profits and secondly, if the markets reverse, you ensure you’re stopped at BE and don’t lose any money.

There are many ways to calculate the Take profits Target, this is one of the most used and we suggest starting in this way.

Identical rules to draw and set parameters like stop loss and take profits are for the Bearish version. Nothing changed.

Please note this is an introduction to the BAT pattern , for beginners. I tried to make it more easy and simple as I can.

We're figuring it out. False Breakdown or breakdownFalse breakout and breakdown.

How to distinguish these trading instruments of price movement and how to use them in trading

The mechanism of a false-break involves taking out the stop-losses of most traders, which increases the probability of a rebound, i.e. the profit of the trader who caught the reversal. In this case the aggressive trading method is more appropriate.

I should say at once that statistically false-breaks and bounces occur more often than breakouts.

The actions of all traders, speculators and investors form their own traces in the market, such as various strong or weak movements, the so-called patterns, complex situations, traps, reversal zones, and so on.

The important thing in all of this for us will be the price levels on the chart.

These levels and zones are visible to most traders placing pending buy orders, sell orders, protective orders and lock orders behind them. These orders and orders are activated as price approaches to test the level and zone.

Behind levels there is a large accumulation of orders, so called liquidity zones. At the moment when the price comes into this zone, it tests the density and thus at this moment the volume can increase, which can provoke the activation of all orders at all and provoke a strong distributive movement towards the breakdown.

You should pay attention to how the price approaches this zone

1) If price reached a level or a zone during a strong and fast movement, which exceeds the average daily rate, then the probability of a break-out is high and amounts to 75-85%.

2) If price approached a zone or a level by consolidating movements, short impulses and price shaking to the level, the chance of a breakout increases and is 55-75%.

Prices do pass beyond the level where they "reach" the pending orders of all traders waiting for the trend to accelerate. But then the price reverses and returns to the range.

All markets - stocks, cryptocurrency, forex, indices, futures are at the mercy of big players and market makers who buy and sell large volumes of currency and maintain the necessary level of liquidity. An attempt by an investment fund or a bank to conduct such trades with market Buy/Sell orders would result in a strong price change, especially at the boundary of an important level, so this large market component mainly uses limit orders.

Big players and market makers use limit levels for consolidations when they need to accumulate energy for further moves. It is important to understand that big players usually do not take part in the distributive movements, because they have accumulated the necessary volume in consolidations and then they remove the limit order and let the market go, at such times the price flies in long candles in one direction or another.

How to predict whether the breakout will be a false one?

The prediction of a false or true breakdown is complicated by the fact that the currency rate takes into account everything. The release of news or any unforeseen events, such as force majeure or insider information, can make large traders give up their intentions to reverse quotes or breakout levels.

In most cases, the behavior of exchange rates near important levels will tell us whether it will be a false or true breakout.

The high volatility is related to the behavior of a large player, who "pushes" the currency rate in order to collect stop-losses and turn over the quotes - in this way they gain the necessary volume.

High volatility and large candles on the approach to the level is a sign of an impending false breakout.

A breakout is defined by the reduced volatility, especially in case of an abrupt move to consolidation after a strong trend and sticking of the price to the level (most often it is a consolidation, prices squeezed to the level, a pre-breakout set-up).

Fast breakdowns with high momentum usually occur when market volatility is low. Namely the phase of pre-breakdown consolidation is formed by small candles, after the end of such consolidation we see the breakdown and the subsequent distribution

Regards R. Linda!

The ABC pattern: One of the Traders’ FavoritesTrading ABC pattern is one of the most frequently used trading strategies by Forex/financial traders. The chart is a Bearish ABC Pattern.

Once the price makes a breakout, makes a correction, and produces a reversal candle upon finding point C, traders trigger their entry. It is a favorite pattern among all kinds of financial traders. It brings profit at least on 80% occasions. Demonstrate an example of an ABC pattern trading.

The chart shows that the price after being bullish has a double bounce at a level of resistance. It produces a bearish engulfing candle followed by another bearish candle. However, the price starts having consolidation. Since it is double top support, the sellers may keep their eyes on the chart.

The chart produces another bearish candle followed by a long bearish one. The price usually makes a correction after such a move. The sellers are to wait for the price to make a bullish correction and produce a bearish reversal candle to go short in the pair below the last lowest low.

As expected, the price starts having the correction. It produces two bullish candles. The sellers hope that the chart produces a bearish engulfing candle closing below the last lowest low to trigger a short entry. This is what pushes the price with more momentum. Let us find out what happens next.

The chart produces an inside bar. This is not a strong bearish reversal candle. However, the price finds its resistance. This is called the C point. If the price makes a breakout at the last lowest low, the ABC pattern traders trigger a short entry.

The price makes a breakout closing well below the last lowest low. The sellers may trigger a short entry right after the candle closes by setting stop loss above the last support (C point). Take Profit is to be set with 1R. Let us look at the chart and find out how the trade goes.

The price heads towards the South with good bearish momentum. It produces two consecutive bearish candles and hits the target (1R). Here is an important point to remember. The ABC pattern is a widely used trading strategy. Thus, the price often reverses once it hits the target. Thus, the traders are recommended that they close the whole trade and enjoy the profit.

Trailing Stop Loss and partial profit-taking do not work well in this pattern. Do some back testing and get well acquainted with this pattern. It may bring you a handful of pips. Keep retail Forex trading as simple as possible, it is the best way to trade. Risk management always. Have Plan & Trade Plan.

Bullish AB=CD alternate patternAB=CD pattern

The regular AB=CD pattern, both the AB and CD are exactly the same length and/or pips on a forex chart- BUT- the alternate AB=CD is where the CD is longer then the AB leg/length- there can be a range of fib retracements and/or extensions which are part of this simple AB=CD pattern but that is OKAY.

Scott Carney - creator of harmonic pattern rules and Harmonic Trading -- shows the essentials in minutes. He outlines the foundation of the AB=CD pattern in harmonic patterns in this effective presentation. If you like to further under this whole subject, please subscribe to his youtube channel: Harmonic Trading.

His wisdom and insights about this subject will clarify everything you need to know about all harmonic patterns. You might even trade better and make more profits with your forex trading too. Which is what we strive to do is work less & play more in life.

Bullish Butterfly PatternYes, you can scalp or day trade harmonic patterns in real live time, If you know what to look for. All harmonic patterns have their own fib retracement and/or extension ranges- which need to happen- for them to be called certain names.

When a PRZ happens, instead of just jumping on a trade, get a confirmation move out of PRZ and then reversal back to it with an engulfing, harami and/or pin bar candlestick setup to then do a trade. This will prevent you from getting into a move too early and help with risk management on the trade too.

Be Patience equals to Be Profitable- with a strategy and/or a plan.

Risk management in your priority on each trade that you do, in this Forex trading and with the high liquidity and volatility that is happening at this time with many currency's, their is no place for either fear and/or greed. Lock in profits on all winning trades. Concentrate on getting a little piece of pip pie, not getting the whole pip pie in trading.

Bullish Crab patternOn AJ 1 hour chart, did you notice that the example bullish crab pattern ended on Friday? On the AJ 4 hour time frame (refer to another article done today by myself) it showed another harmonic bullish pattern- see two time frames show that this pair when they open up on Sunday/Monday will be bullish when it starts out trading. Just wait for an Engulfing, Harami and/or Pin bar candlestick set up on this 1 hour and/or 15 minute timeframe to do any buy trades with.

Different time frames give you another perception of candlesticks and shows you more probable's that you are trading in the right trend and with the current big banks, which you always need to be doing.

All harmonic patterns have a bearish and/or bullish one, which you can find on your charts, if you chose to trade them and make money off of them too.

Please do your own research of exact ranges of fib retracements and extensions which are needed for each individual harmonic patterns- Wish you best.

Bullish Cypher PatternOn the AudJpy 4 hour chart example of a bullish cypher pattern. Yes, all harmonic patterns have their own Fib. Ret and extension percentages you need to look up and know, if you use harmonic patterns in your trading.

Higher timeframes of 1 hour, 4 hour and daily work the best when using harmonic patterns, but can work on smaller timeframes- just less time for you to set up trades and react to candlesticks in real live time. Always wait for all harmonic patterns to 100% complete before you make a trade in opposite direction.

Number one rule is wait for all harmonic patterns to complete before entering in any trades, related to being the safest times to get in and having the best risk reward setups with highest win percentages in trading, then to jump in too early because you are not patience, but have a need to trade rather then wait.

Risk management is always #1, control what is in your hands to do like: What pair you trade, what price you get in, what session you trade and what time you are trading a certain pair. Also, entries, exits and/or targets, stop losses, etc...

Stay healthy & get wealthy-

Note: I will be looking at 1 hour charts on AJ for bullish trades to start this coming week off- r/t the completion of the bullish cypher pattern on example chart of 4 hours- there is around 70 pips to the upside to the target area of at least 50% on the fib. retracement tool (here on TV).

Gartley Pattern (Bearish)With any harmonic pattern you want to let them completely finish before you make a trade at the PRZ (potential reverse zone) area. All harmonic patterns have there own Fib. retracement and extension range percentages, which you need to look up and know to verify that they what you think they are.

This Bearish Gartley pattern stick out very easily, on this EurJpy daily chart, you can trade all harmonic patterns on any time frames, but higher the time frames the easier to recognize them and the easier you will be able to predict their key XABCD points, and PRZ areas to set up trades. They are fun to do on your charts, but harder to do in live/real times when scalping and/or day trading on smaller time frames.

Do not only relay on harmonic patterns, but other confirming indicators, like RSI, angle trend lines, round psychological numbers and/or quarter numbers on chart you are trading on (.000, .250, .500 and/or .750).

Big deal on charts is for the best Risk Reward set ups, always trade when the PRZ (potential reversal zone) is hit and you see Engulfing, Harami and/or Pinbars candlestick patterns reversing in the other way then the bullish CD leg, so look for bearish trading and/or bearish CD leg, so look for bullish trading.

Wish all the best in forex trading and life. Always control risk management on all trades you do (lot sizes, stops, entry, exits/targets) you can do it.

Bat Harmonic Pattern - Made Easy For EveryoneThe BAT pattern gets its name from the bat-shaped end product. Identified by Scott Carney in 2001, the BAT pattern is made up of precise elements that identify PRZs.

The bat harmonic pattern follows different Fibonacci ratios. One of the major ways to differentiate it from a Cypher pattern is the B point which, if it doesn’t go above the 50 percent Fibonacci retracement of the XA leg then it is a bat, otherwise it can turn into a cypher structure.

The market strategy of the pattern is suitable for all time frames and all markets types. Traders have to keep in mind that on lower time frames using the bat pattern market strategy has some challenges because the pattern tends to appear on less frequent on lower time frames.

How to Draw a Bat Pattern :

As mentioned earlier, the bat harmonic pattern looks very similar to the Gartley pattern. It has four different legs marked as X-A, A-B, B-C, and C-D.

X-A: In its bullish version, the first leg appears when the price sharply increases from point X to point A. This is the longest leg of the pattern.

A-B: The A-B leg then sees the price switching direction and retracing 38.2 to 50 percent using the Fibonacci retracement of the distance covered by the X-A leg. Have it in mind that the A-B leg can never retrace beyond point X. But if it does, the pattern is considered invalid. As you can see, if the price with a spike reaches a point under 50% but with the body above, this will be Valid. The candle Body's important.

B-C: Here, the price changes direction for a second time and moves back up, retracing anything from 38.2 to 88.6 percent of the distance covered by the A-B leg. If it retraces up above the high of point A, the pattern is considered invalid.As you can see, if the price with a spike reaches a point above 88.6% but with the body is below, this will be Valid. The candle Body's important.

C-D: This is the last and most significant aspect of the pattern. As with the Gartley pattern, this is where the bat harmonic pattern ends and traders place their long (buy) trade at point D. ( PRZ Potential Reversal Zone )

The 88.6% percent retracement of the X-A leg is our Entry Point. D POINT or PRZ

Before trying and trading the pattern, confirm from this checklist that the pattern is real. It should include these vital elements:

A-B : 38.2 to 50% max percent using the Fibonacci retracement

B-C : An 38.2 to 88.6% max percent Fibonacci retracement of the X-A leg

C-D : The 88.6% percent retracement of the X-A

Market strategy:

Step 1: Drawing the pattern

Begin by clicking on the XABCD pattern indicator that is found on the right-hand side toolbar of Tradingview

Identify the beginning point X, which can be any swing high or low point on the chart.

You should get 4 points or 4 swings high/low points that join and form the harmonic bat pattern strategy as explained Above

Step 2: Trading the pattern

The 88.6 percent Fibonacci ratio provides traders a more reliable risk/reward ratio which is why the market strategy of the bat pattern is such a very popular as a market strategy. The best entry point is the 88.6 percent Fibonacci retracement which is a very accurate market turning point.

It is recommended that traders should enter as soon as they touch the 88.6 percent figure. Oftentimes the harmonic bat pattern strategy doesn’t go much above this level.

Step 3: Placing a stop-loss

Usually, traders should place their protective stop-loss lower than the point X of a harmonic bat pattern. That is the only logical location to hide the stop-loss because any break below will automatically invalidate the pattern.We use as manual the 113% Fibo of X-A as a picture below.

Step 4: Take-profits

There can be several ways to manage your trades, but the best target for this pattern should be to use a multiple-take profit formula. For this pattern strategy, take the first partial profit once you hit wave-B level and the remaining half wave-C.

Once the price reaches the first target you should move the Stop Loss at BE ( breakeven - entry point ) or close the position in profit.

By doing this you will accomplish two things:

first, you’ll ensure that you accumulate profits and secondly, if the markets reverse, you ensure you’re stopped at BE and don’t lose any money.

There are many ways to calculate the Take profits Target, this is one of the most used and we suggest starting in this way.

Identical rules to draw and set parameters like stop loss and take profits are for the Bearish version. Nothing changed.

Please note this is an introduction to the BAT pattern, for beginners. I tried to make it more easy and simple as I can.

Lesson 2: Support & Resistance ZonesSupport an resistance zones are critical in the market. These are the juicy spots from which market-makers get to feed themselves immensely. Many traders get trapped in these zones. Buyers are trapped when the market-maker's intention is to SELL and sellers are trapped when the intention is to BUY.

It very important for ordinary retail traders like you and I to be able to play the game the market-makers plays at SUPPORT AND RESISTANCE levels. This is how one can truly profit from the market. There's a lot of price manipulation going on at the S&R levels.

Market-makers are also in this business to make money. Unfortunately it is the retail trader who fattens their pockets. The good news is that this can be avoided through PATIENCE, PROPER RISK MANAGEMENT ANN HIGH LEVEL OF TRADING PSYCHOLOGY.

Things to avoid doing at SUPPORT & RESISTANCE levels:

1. Trading BREAK-OUTS instantly (a sure way to be caught in the opposite side)

2. Placing STOP LOSSES right on the zone (whipsaws will destroy you)

--------------------------------------------------------------------------------------------------------------------------------------

I hope this bit of education will help you trade carefully at critical SUPPORT AND RESISTANCE ZONES.

HAPPY TRADING!!

BTC/USDT :: Descending, but in what way !?BTC/USDT :::

<<< The general trend is downward >>>

First mode :

for a while the upward trend and hitting the resistance range of 34,000$ to 40,000$ and finally the downward trend .

The second mode :

The downward trend is integrated with short-term corrections .

In general, it depends on the direction of the triangle break .

<<<< Top ? Or Down ? >>>>

PRICE CHANNELS: A simple but very important trading tool1. WHAT IS A PRICE CHANNEL?

On any chart, you can see that the price is moving in a trading range bounded from above and below, and this range is a price channel. They can be ascending, descending or sideways (ranges). Ascending channels are formed with an uptrend, Descending channels are formed with a downtrend, Lateral channels are formed at intervals when the price moves in a horizontal range.

2. WHICH CHANNELS ARE MORE RELIABLE AND EFFICIENT?

If the price has touched the channel boundaries more than two or three times, it is considered confirmed. If he touched it up to two or three times, the channel is unconfirmed and weak.

In fact, the channel is a derivative of the trend line. The channel boundaries are drawn based on the upper and lower maximum price values (extremes).

To create a connecting price channel, both lines must be parallel, and the number of points must not be less than indicated above. The more often the price touches the channel boundaries, the stronger and more effective the channel will be.

3. WHAT TO DO WITH THE PRICE CHANNEL? HOW TO TRADE IN IT?

Use the bottom line of the uptrend channel to open long positions (to buy) - these are the most profitable signals. The resistance of the ascending channel in this case is the most important point of reference for short-term trades against the trend - from the upper limit of the ascending channel, you can open short positions (sales).

In a falling market, the channel is descending, so a deal against the trend from its lower border will be a long position (buy), and from the upper border in the direction of a downward trend - short positions (sell).

Crossing the channel boundaries may be a signal that the trend continues. This happens when the price breaks through and settles outside the channel boundaries, under or above the channel resistance. When it breaks through the upper limit of the ascending channel, it indicates that the trend is accelerating, and it may make sense for traders to activate purchases or open long positions. If it breaks through the lower boundary of the uptrend channel, it is a signal of a trend reversal, and it is better to open short positions.

The approximate size of the falling price most often corresponds to the width of the range. The situation will be the opposite for a falling market with a descending corridor.

4. HOW TO BUILD A PRICE CHANNEL?

To do this, you need at least three points on the chart.

Two of them define a line of resistance or support, the third should be opposite to the first two.

To build an uptrend channel, we need to understand where the trend movement begins.

Determine from two local gradually ascending minimum points where the trend line should be drawn. These two local points will be the reference points, and the constructed line will be the base support line for the channel.

Then draw another line parallel to the obtained line, which should pass through the highest point of the maximum - the very point opposite to the first two, which is located between the polls.

We do the same for descending price channels - only in this case we draw resistance instead of support, the main line should pass through the highs, and the second trend line should pass through the minimum.

The way to determine if you are dealing with a range is to allow the price to touch both levels, resistance and support, at least twice, and the levels should be horizontal.

5. HOW TO TRADE IN THE PRICE CHANNEL

Trading in a price channel reveals a variety of strategies - trade either inside the channel, buy or sell from resistance or support. Or a breakout of the price channel.

Intra-Channel Trading:

Traders are pushed away from the channel boundaries. There is too high a probability that the price will move inside the channel and push off from its borders. Therefore, it makes sense to sell when the price reaches the upper limit, and buy when it reaches the lower limit.

Trading on breakouts

You need to understand that any channel, depending on the time, will be broken - and at this time there will be a strong price movement, on which the trader can make a big profit.

It is convenient to use pending orders placed above the channel border for trading on a breakout. As soon as the price breaks through the channel boundary and reaches the pending order, it is triggered automatically.

Let's summarize:

Price channels are an excellent basis for trading strategies, as they are based on support and resistance lines.

All channels end with a breakdown depending on the time, so you should not trade without a stop loss when trading inside the channel.

You should not perceive the boundaries of the channel as something indestructible.

The price can easily skip the channel boundary or, conversely, make a false breakthrough.

You can trade inside or outside the channel, and both strategies can be combined.

And most importantly : technical analysis will allow you to always stay on the right side of the market!

Regards! R.Linda!

Lesson 1: The Market-Maker's GameLet's look at how market-makers succeed in trapping you and I in the market to make billions. These techniques, when grasped, can have an immense positive influence in your trading. Market-Makers use areas of support and resistance to accumulate/distribute order blocks. This creates massive liquidity for them to be able extract big profits, leaving the ordinary retail trader holding an empty bag.

----------------------------------------------------------------------------------------------------------------------------------

1. Support was broken at the 0.79000 zone. They break support zones like this to trap all the SELLERS. those who placed STOP LOSSES at 0.77400 anticipating price to go down are kicked out of the market before price starts to climb higher and higher. This is the biggest reason why traders wonder why the market kicks them out before it moves in their desired direction. It's as if someone is watching your trades. Well, market-maker can see where most STOP LOSS orders are placed. They push the price to those levels to wipe traders' positions.

2. The maker-maker's intention is to take the price up without being too transparent. Their intention is to make you believe that price is headed downwards when in fact it's going up. Their first target in this case is the 0.98000 zone. When price gets to that zone both BUYERS and SELLERS will be shaken off the market so that they can take the price up some more to the 1.2500 zone (3).

3. At 1.25000 more manipulation will take place. At that price level a lot of amateur retail traders will be thinking that price is still going up. What ensues then is a big drop. Maker-makers would have now trapped BUYERS to create liquidity for taking the price down.

This is critical to understand. If you can trade how MARKET-MAKERS are trading you'd be able to extract profits off the markets on a consistent basis.

---------------------------------------------------------------------------------------------------------------------------------------

Do drop questions in the comments section. I will be ready to answer.

FCXA Continuation Wedge (Bullish) represents a temporary interruption to an uptrend, taking the shape of two converging trendlines both slanted downward against the trend. During this time the bears attempt to win over the bulls, but in the end the bulls triumph as the break above the upper trendline signals a continuation of the prior uptrend.

This bullish pattern can be seen on the following chart

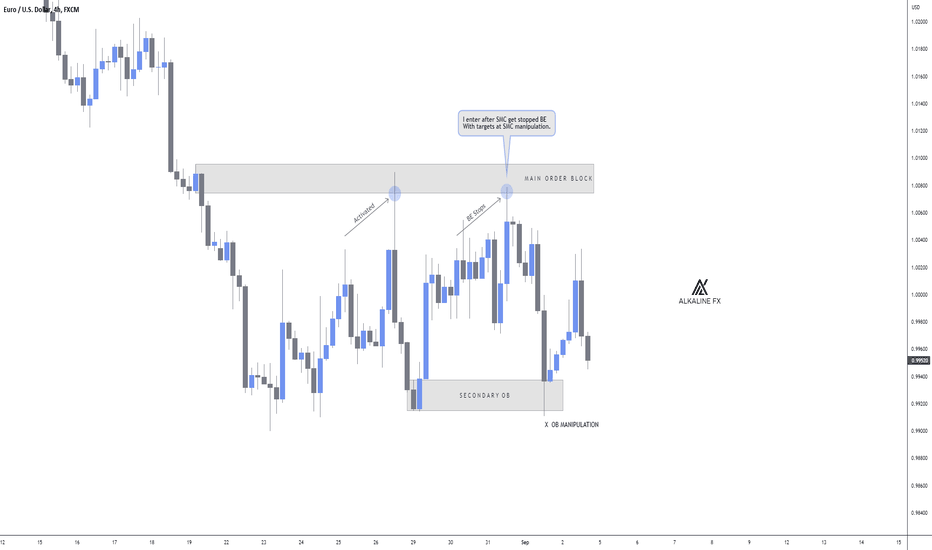

Smart Money Manipulation 🥊Alkaline is back baby! 💣

As smart money concepts gain popularity, liquidity increases.

I have taken a month away from trading to study the new forms of market manipulation and have been pleasantly surprised by what I have found.

Here is my discovery:

1) The market is currently focusing on taking liquidity from breakeven positions over fixed stop losses.

This is because emotional traders put their stops to BE quickly to avoid pain, especially during indecisive markets.

2) Order blocks are the perfect manipulation areas.

If you take time out to backtest significant order blocks, you will notice price will tap and lure or simply sweep above/below the zone before going in the intended direction.

3) That tight stop loss you are using is doing more damage than good.

Scale into your positions, trust me when I say this will reduce your emotions and give you a more relaxed trading style.

4) Use your brain, even if you are in denial.

If the majority of traders lose money, and the majority of traders now use smart money concepts, do the maths.

It feels good to be back after a long month of studying, I have lots of new things to teach and share.

I will be taking on new students shortly, have a great weekend everyone 👋

MarketMaking and MarketMaker. What is it and who is it?All participants in financial exchanges can be divided into two categories - market makers, who set the mood in the market, and market makers, private investors with small capital.

Market makers ( they are in minority ) will always manipulate market makers ( they are in majority ).

What is a market maker, who he is, what he does at the exchange and why he is needed?

WHO IS A MARKET MAKER AT THE STOCK EXCHANGE?

This is a professional in the market with very large money, without whom trading is impossible - because this figure is considered a key player in the market and moves the price. Most often, this is the whole financial organization.

MARKETMAKER is the one who creates and maintains the liquidity level of exchange , currency , cryptocurrency , futures instruments , etc.

It is only possible to make transactions on the market through the market maker, who regulates the processes so that the exchange is not dominated by only sellers or buyers.

The MARKETMAKER is obliged to buy even if the market is dominated by sellers and even if it leads to losses. And when the market is dominated by buyers, the market maker must sell in order to balance the market. The main purpose of the market maker is not to make money, but to regulate supply and demand, to maintain liquidity.

CATEGORIES OF MARKETMAKERS

Large commercial banks, but not by themselves, but united in groups: they are called institutional market makers.

Brokerage companies

Dealing centers

Investment funds

Private investors with significant capital.

WHY DO WE NEED A MARKETMAKER?

It stabilizes the market, controls price movements, satisfies traders' demand. And since large financial institutions take on this role, they can be both sellers and buyers.

The market maker makes a huge number of deals every day and ensures the liquidity of assets.

The peculiarity of their work is that market makers can support the quote both in the buy and sell direction simultaneously on the same financial instrument, which makes the price move more smoothly and price gaps disappear.

TASKS OF MARKET MAKERS

Ensure profitable deals for all participants

To maintain sufficient liquidity for any instrument throughout the trading session

To accumulate orders within the instrument being traded

Find and consolidate the best price offers and record them in the price book

Provide all participants with information on current quotes as soon as possible

WHAT AND HOW DO MARKET MAKERS MAKE MONEY?

The best way to make money on the exchange is to be able to correctly predict large price movements and timely open positions in this direction.

No market maker can do it on a large scale, but a small impulse is enough to start the process of a large price movement. And for this market maker first forms a trend in the direction he needs, after which he acts in the opposite direction. Thus, the market maker makes a profit, while other participants lose more or less.

Since market makers are the first to review current orders, they are the first to find out about the emergence of a trend in one direction or another and do everything necessary to balance the market and not allow a large surge of volatility. For the fact that he keeps the market price of the instrument in the predetermined limits, the market maker receives a significant discount on the commissions. And his profit is the difference between the bid and ask prices, which is called the dealing spread.

Because the exchange is interested in maintaining the liquidity of assets, it encourages healthy competition and advocates the presence of several market makers on one floor. It reduces the cost of transactions, increases the speed of transactions and makes pricing transparent. Even the exchange rules often contain a clause that a deal is legal if a market maker is involved, i.e. it is quite a significant and influential market player.

HOW DOES THE MARKET MAKER WORK?

He establishes a connection with his clients through a program, analyzes the market and executes orders of his broker's clients. Often he prefers to work with mid-sized brokers to have the necessary volume of transactions to make money.

Marketmaking. Order-Making and Order-Making.

The function of Order-Making is to watch a particular company's stock and make predictions. Order-taking is to execute traders' orders and take additional profits.

HOW DOES PROFIT TAKING TAKE PLACE?

Like other market participants, market makers can also incur losses, which occurs if a position is chosen incorrectly. But due to the fact that market makers work with large volumes of trades and a large number of clients, they always have an opportunity to cover their losses.

Regards! R.Linda!